December 2025

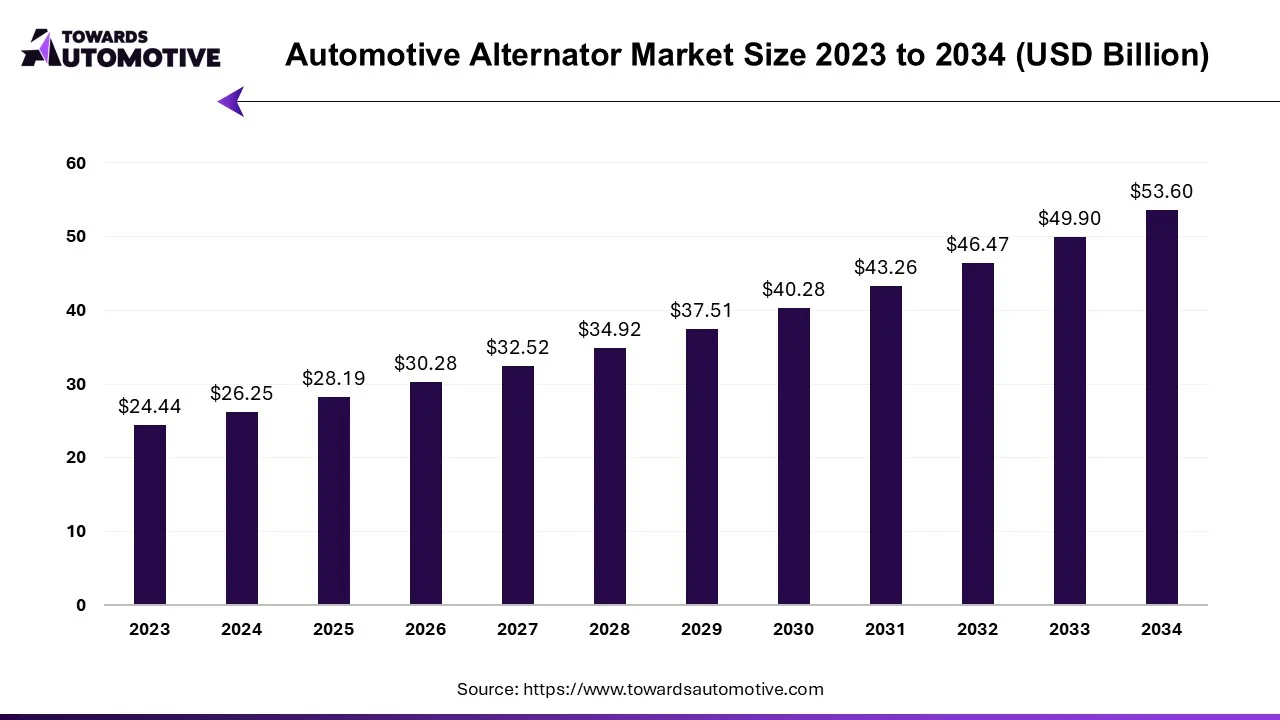

The automotive alternator market is projected to reach USD 53.60 billion by 2034, growing from USD 28.19 billion in 2025, at a CAGR of 7.40% during the forecast period from 2025 to 2034.

The automotive industry encountered a significant downturn amidst the COVID-19 pandemic, marked by temporary closures and reduced capacity in many factories. However, as restrictions eased and consumer demand rebounded, automobile production commenced its recovery trajectory, subsequently impacting the demand for automotive alternators positively.

The alternator plays a pivotal role in a vehicle's functionality, serving as a critical component of its charging system alongside the battery and voltage regulator. Functionally, an alternator converts mechanical energy into electrical energy through electromagnetism, thereby generating electricity that is transmitted to the battery to power various electronic devices within the vehicle. Alternators come in two primary types: three-phase alternators and single-phase alternators, with the specific type utilized dependent on the design of the passenger vehicles.

The COVID-19 pandemic has notably spurred increased interest in electric vehicles (EVs), driven by heightened awareness of sustainability and environmental concerns. Consequently, as the adoption of EVs continues to rise, it is expected to bring about shifts in the requirements of the automotive alternator industry. EVs typically incorporate different charging systems, such as electric generators or systems reliant on electricity, thereby reducing reliance on traditional alternators.

A significant driver of the automotive alternator market is the growth in sales of passenger vehicles, given that all passenger vehicles are equipped with alternators. The passenger vehicles segment constitutes a substantial portion of the market, with SUVs and crossovers comprising a considerable share of sales in regions like China and Europe. The preference for fuel efficiency and travel comfort, particularly with the popularity of three-row seating configurations in crossovers and SUVs, is a primary growth driver in numerous global markets. Moreover, the decline in auto loans observed in countries such as the USA and Canada is anticipated to further bolster the convertible vehicles market during the forecast period.

However, the automotive alternator market is also influenced by factors such as increasing demand for automotive hybrid powertrains and stringent emission standards. The pursuit of advanced technology and enhanced energy efficiency may lead original equipment manufacturers (OEMs) to transition towards electric vehicles in the future, potentially limiting the market's growth trajectory.

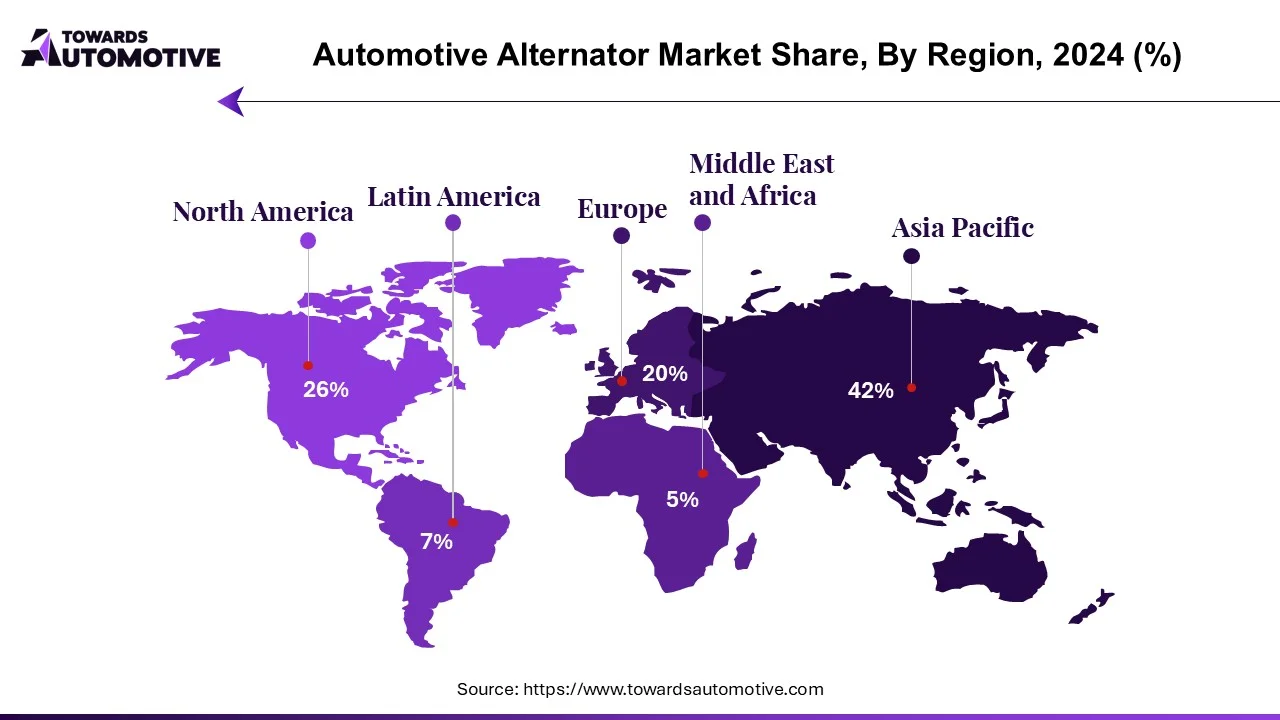

The Asia Pacific region is poised to maintain a significant market share throughout the forecast period, driven by burgeoning automobile sales in key markets like China, Japan, and India. Major automotive manufacturers have established production facilities in the region to cater to the escalating demand within this dynamic market landscape.

The increasing demand for vehicles, spanning passenger vehicles, commercial vehicles, and electric vehicles (EVs), has been a primary catalyst for market evolution. As global vehicle production escalates, so does the demand for alternators, driving market growth.

However, the automotive industry faced challenges due to the financial crisis in 2019 and the onset of the coronavirus pandemic in the first quarter of 2020. These events precipitated a significant decline in sales across major automobile markets such as China, the USA, India, and Japan, prompting companies to curtail production. Consequently, the downturn in sales hindered the growth of the automotive alternator market.

Nevertheless, 2021 marked a transition year with sales gradually rebounding. This trend is anticipated to fuel the growth of the automotive alternator market in the forthcoming years.

For instance,

Despite governmental efforts worldwide to stimulate passenger numbers, challenges persist. The increasing demand for high-performance motorcycles is propelling the demand for advanced traffic. Additionally, the rising popularity of personalization among motorcycle enthusiasts serves as a further market driver. Moreover, stringent emission regulations for motorcycles necessitate the development and utilization of automotive alternators to meet regulatory requirements. Continued advancements in technology and materials in automotive alternator production also contribute to increased demand.

However, external factors such as epidemics and geopolitical tensions can impede market growth. Political and economic instability resulting from ongoing conflicts, coupled with the adverse effects of epidemics on the supply chain, create challenges for manufacturers and exporters, leading to a slowdown in market growth.

Nonetheless, automotive alternators remain essential products, with demand expected to increase steadily over time. In this context, large companies with diverse customer bases, adaptability to market changes, and robust financial capabilities are poised to achieve significant results, navigating the uncertain weather prevailing in the market landscape.

The automotive alternator market is being propelled by the surging demand for passenger vehicles and commercial vehicles globally. Emerging markets, particularly in the Asia-Pacific region like China and India, have witnessed substantial growth in both vehicle production and sales, presenting lucrative opportunities for the automotive alternator market.

It is projected that Asia will dominate the alternator market, holding the largest market share by 2022, a trend expected to persist beyond 2023. Countries such as India, China, and South Korea have emerged as major hubs for automobile production, attracting investments from Western automotive manufacturers.

Asia presents an ideal landscape for the automotive industry, with India's automotive sector poised for significant growth to become the largest manufacturing market. The South Asian market, characterized by low labour costs, is poised to become a key traffic destination in the future.

In Europe, the automotive industry has invested approximately 59 billion Euros in research and development (R&D) activities. The proliferation of automotive electronics with the modernization of automotive equipment has fuelled the demand for alternators.

Consumer health awareness is emerging as a significant driver in the automotive alternator industry, fostering demand for alternative energy products perceived as healthier and more efficient. Technological advancements in the automotive alternator sector further bolster the industry by ensuring the emergence of robust production processes and stability.

Major industry players are making substantial investments aimed at fostering innovation and expanding the distribution network, thereby supporting future demand. These investments are geared towards developing new products and enhancing market reach, fostering an environment conducive to market expansion.

The automotive alternator market is primarily dominated by four key players: Power Products, Valeo, Mitsubishi Electric, and Hitachi Motors. Collectively, these companies command approximately 80% of the global market share. Denso has established itself as a market leader in refurbishment since 1988. However, the "other" segment of the market is characterized by fragmentation due to the presence of both local and international players.

Competition within the market remains intense, even amidst industry consolidation, with numerous smaller companies manufacturing similar products. The advent of e-selling and e-commerce has further empowered businesses, leading to significant sales growth.

Moreover, major market players engage in strategic pricing and product differentiation strategies to safeguard their market positions in specific regions. This strategic manoeuvring ensures that smaller competitors are unable to seize substantial market shares in these regions, effectively establishing a monopoly market environment for these industry giants.

Automotive alternators serve the crucial function of supplying electrical current to the vehicle, charging the battery, and powering the electric motor while the engine is in operation.

The convertible vehicle market is segmented based on powertrain type, including internal combustion engine vehicles and hybrid and electric vehicles. It is further categorized by vehicle type, encompassing both passenger vehicles and commercial vehicles. Geographically, the market is divided into regions such as North America, Europe, Asia Pacific, and other regions.

By Powertrain Type

By Vehicle Type

By Geography

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us