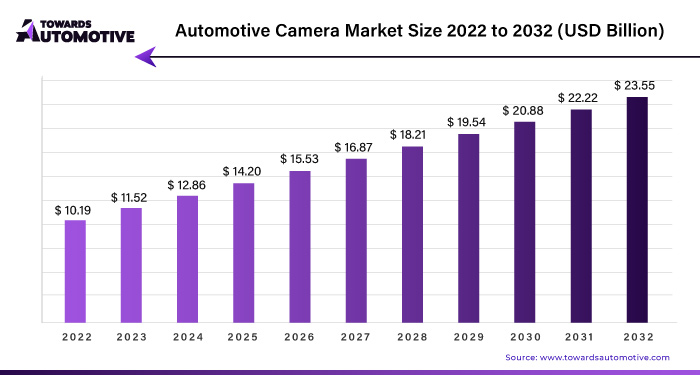

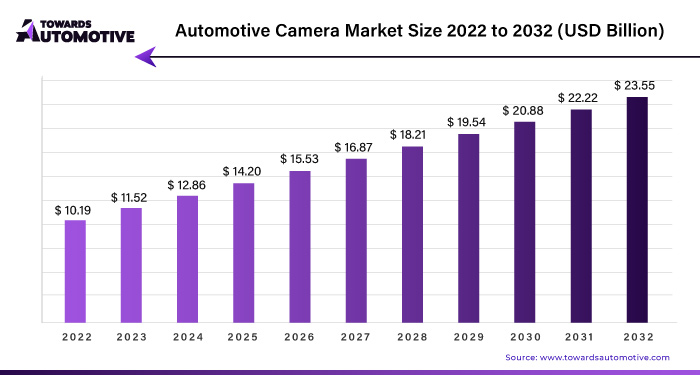

The automotive camera market was valued at USD 10.19 billion in the year 2022 and is expected to reach USD 23.55 billion by 2032, growing at a double digit CAGR of 11.49% during the forecast period.

Unlock Infinite Advantages: Subscribe to Annual Membership

The COVID-19 pandemic has slowed business growth due to vehicle production restrictions and supply disruptions. However, with the law's implementation in the country, the car camera industry recovered. In addition, the development of new technologies such as night vision and cruise control and the growth of electric vehicles have also caused a boom in the sector.

In addition, factors such as the increasing use of vehicle security systems and fierce competition among vendors to provide valuable services and products to users are goods needed to support economic growth. However, challenges such as high installation costs and potential failures in camera components such as sensors and modules will hinder growth over the forecast period.

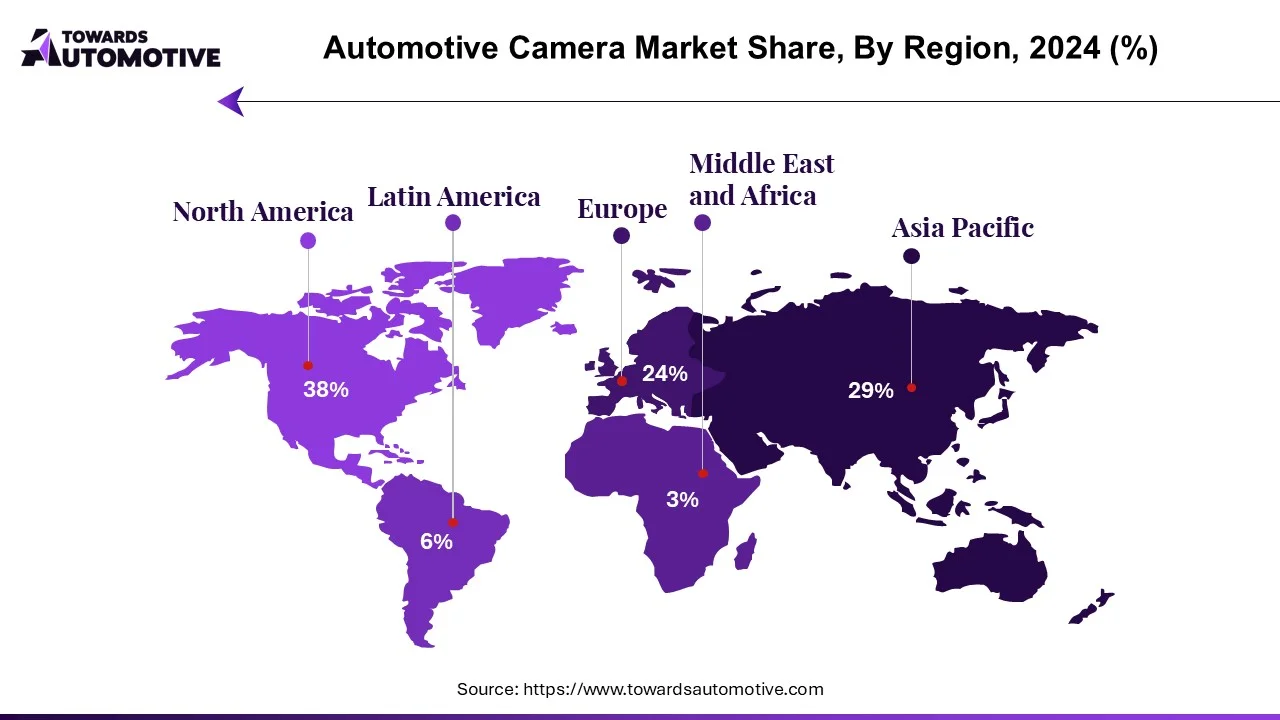

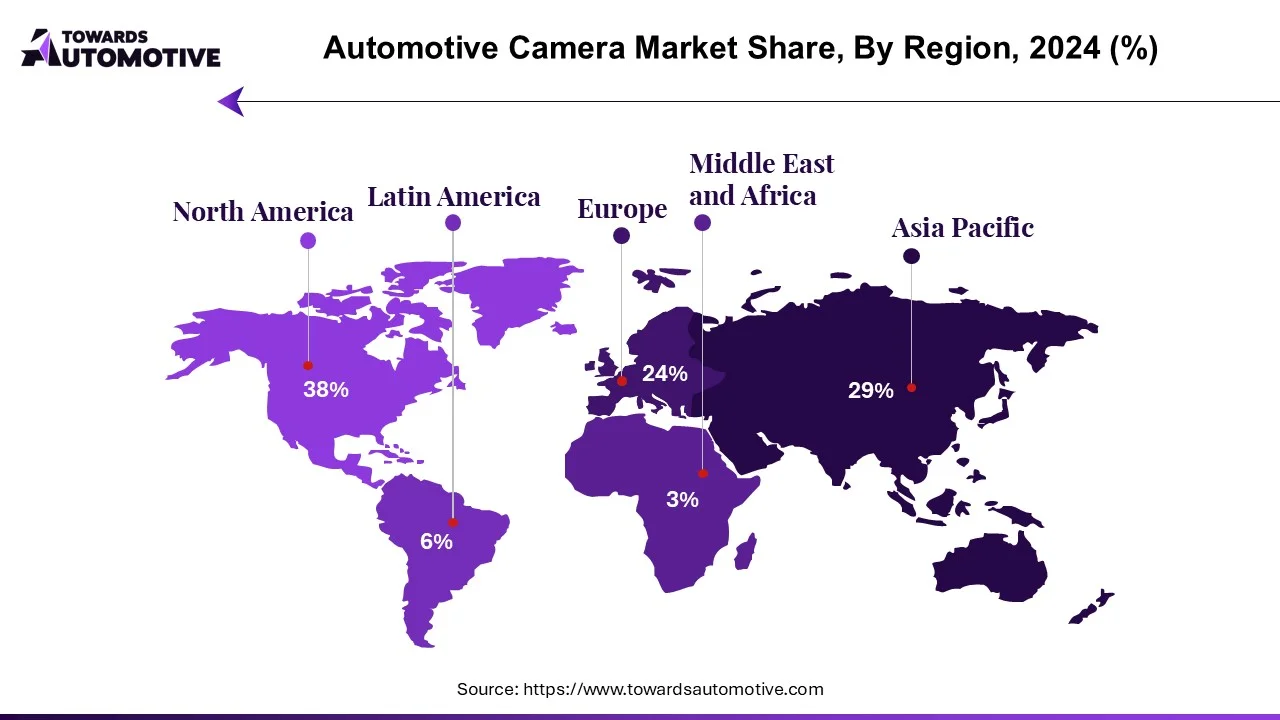

North America is expected to lead the car camera market due to the increasing demand for car cameras in luxury cars, especially in the United States and Canada. The growing development of advanced driver assistance systems (ADAS) is expected to increase the demand for dash cameras in the region. On the other hand, Europe and Asia-Pacific are expected to be essential markets as they host many automobile manufacturers.

Automotive Camera Market Trends

This section outlines the key trends influencing the Automotive Camera Market, as identified by our research experts:

Innovations Driving Market Development:

- Sensing cameras are emerging as essential components of active safety systems in vehicles. Heightened passenger safety concerns and stringent government regulations fuel this growth.

- Sensing cameras offer superior performance to general-purpose driving cameras, meeting automotive quality standards while remaining cost-effective.

- These intelligent safety systems comprise two main components: remote sensors, which collect real-world data through radar, ultrasonic sensors, and cameras, and processing computers, which analyze this data to make decisions and send commands to vehicle subsystems.

- Example: In March 2019, Garmin Ltd introduced an updated version of its backup camera solution, the BC 40. This wireless backup camera, compatible with Wi-Fi-enabled Garmin GPS navigators, provides drivers with a comprehensive view of the navigation display, enhancing overall driving safety.

Increased Adoption of ADAS Features:

- The rising adoption of Advanced Driver Assistance Systems (ADAS) in vehicles drives significant demand for automotive cameras.

- Example: In March 2020, BMW launched the plug-in hybrid 330e and 330e xDrive models, equipped with ADAS features such as active cruise control with stop-and-go functionality. These systems automatically adjust speed to maintain the driver's desired speed and include standard safety features like frontal collision warning, city collision mitigation, and lane departure warning.

Overall, sensing cameras are witnessing increased adoption due to their enhanced performance and cost-effectiveness, driven by the growing integration of ADAS features in modern vehicles.

North America is Expected to Experience the Fastest Growth

North America will dominate the market during the forecast period, followed by Europe and Asia-Pacific. Demand for luxury vehicles in the United States, Canada, and Mexico, combined with the increasing use of advanced driver assistance systems (ADAS) in the commercial and passenger sectors, is expected to lead to job growth.

In addition, the popularity of the camera as a convenient feature in luxury cars and the involvement of businesspeople are essential factors influencing the expansion of the car camera industry. Additionally, increasing consumer demand for security systems is causing the market to grow, increasing demand for dashcams in the region. For example, in August 2019, Magna opened a new $50 million manufacturing facility near Flint, Michigan, to meet growing customer demand for digital cameras.

Europe is also expected to have a large market due to the widespread adoption of ADAS in countries such as Germany, the UK, France, and Italy and the regulations regarding the installation of passenger safety technology. The growth of initiatives such as the New Vehicle Assessment Program (NCAP) is another driving force for developing the global dashcam market.

The Asia-Pacific region, especially countries such as China, India, Japan, Thailand, Malaysia, and South Korea, is expected to show good growth due to rapid economic growth and increasing automobile production.

Automotive Camera Industry Overview

The automotive camera industry is characterized by a high level of fragmentation, with many regional players in the industry. However, several key players, such as Garmin Ltd, Panasonic Corporation, Continental AG, Autoliv Inc., Bosch Mobility Solutions, and Magna International, have significant market share. They are involved in joint ventures to expand their business and gain potential.

For example:

- In September 2020, OMNIVISION Technologies, Inc. and GEO Semiconductor Inc. announced the integrated rearview camera (RVC) and Surround View System solution to ensure good image quality. (SVS) and electric mirrors. The solution includes OmniVision's OXO3C10. This sensor is the world's only automotive image sensor that combines large 3.0-micron pixels, 140 dB high dynamic range to reduce image artifacts, and the highest LED Flicker Reduction (LFM) performance.

- In July 2020, ZF, a leading camera supplier, launched S-Cam4.8 in the United States, which uses Intel's Mobileye technology to improve the vision technology of the new Nissan Rogue. ZF is focusing on Level 2/2+ advanced camera systems such as S-Cam4.8 and Tri-Cam4 for global automakers and plans to cooperate with major Asian manufacturers by the end of 2022. The company announced coAssist. The Level2+ system is the least expensive, priced well over $1,000.

- In September 2019, Bosch launched the MPC3 monochrome camera suitable for applications such as advanced driver assistance systems (ADAS) and autonomous driving. The new camera uses multiple methods and artificial intelligence (AI) to provide better identification.

- In August 2019, Continental announced a new solution for safer driving, including a combined camera consisting of an inside-view infrared camera and a needle outside photo. The system monitors the driver and surrounding vehicles simultaneously.

Automotive Camera Market Leaders

- Gentex Corporation

- Continental AG

- Autoliv Inc.

- Hella KGaA Hueck & Co.

- Bosch Mobility Solutions

- Valeo SA

- Magna International Inc.

- ZF Friedrichshafen AG

- Panasonic corporation

- Garmin Ltd.

Automotive Camera Market News

- In January 2022, DTS, a global leader in music, video, and audio technology and a wholly owned subsidiary of Xperi Holding Corporation, announced the launch of the single-camera DTS AutoSense driver and passenger monitoring system at CES 2022.

- In July 2021, Continental acquired a minority stake in the German-American company. Startup Recogni is developing a new chip architecture for AI-based object recognition that can process high-speed data for driving.

- In February 2020, Continental announced the construction of a new American factory in New Braunfels, Texas, to expand the production capacity of radar sensors used in advanced driver assistance systems (ADAS).

- In June 2020, Omnivision developed the world's first image sensor for a car camera. STEREO has features like Flicker Reduction (LFM), 3-micron pixel size, 140dB HDR, and lens and pixel correction.

Automotive Camera Industry Segmentation

Car cameras are usually installed in the front, back, or inside of the car for security purposes. These camera modules contain image sensors with electronic components in the vehicle. The Automotive Camera Market report provides an in-depth understanding of the latest trends, the impact of COVID-19, and industry developments.

Market Segmentation

By Product Type

- Side-mirror Cameras

- Interior-view Cameras

- Forward-view Cameras

- Rear-view Enhancement

- Corner-view Cameras

By Vehicle Type

- Compact Passenger Cars

- Mid-sized Passenger Cars

- Premium Passenger Cars

- Luxury Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Application

- Blind Spot

- Drive Recorders

- 360 Surround View

- Lane Departure Warning System (LDWS)

- Night Vision

- Parking Surround View

- Drowsiness

- Distance

- Adaptive Frontlight System (AFS)

- Others

By Technology

- Mono Cameras

- Stereo Cameras

- Infrared Cameras

- Other Cameras

By Level of Automation

- Level 1: Driver Assistance

- Level 2: Partial Automation

- Level 3: Conditional Automation

- Level 4: High Automation

- Level 5: Full Automation

By Sales Channel

By Type

- Viewing Camera

- Sensing Camera

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle-East and Africa

- South Africa

- Rest of Middle-East and Africa