December 2025

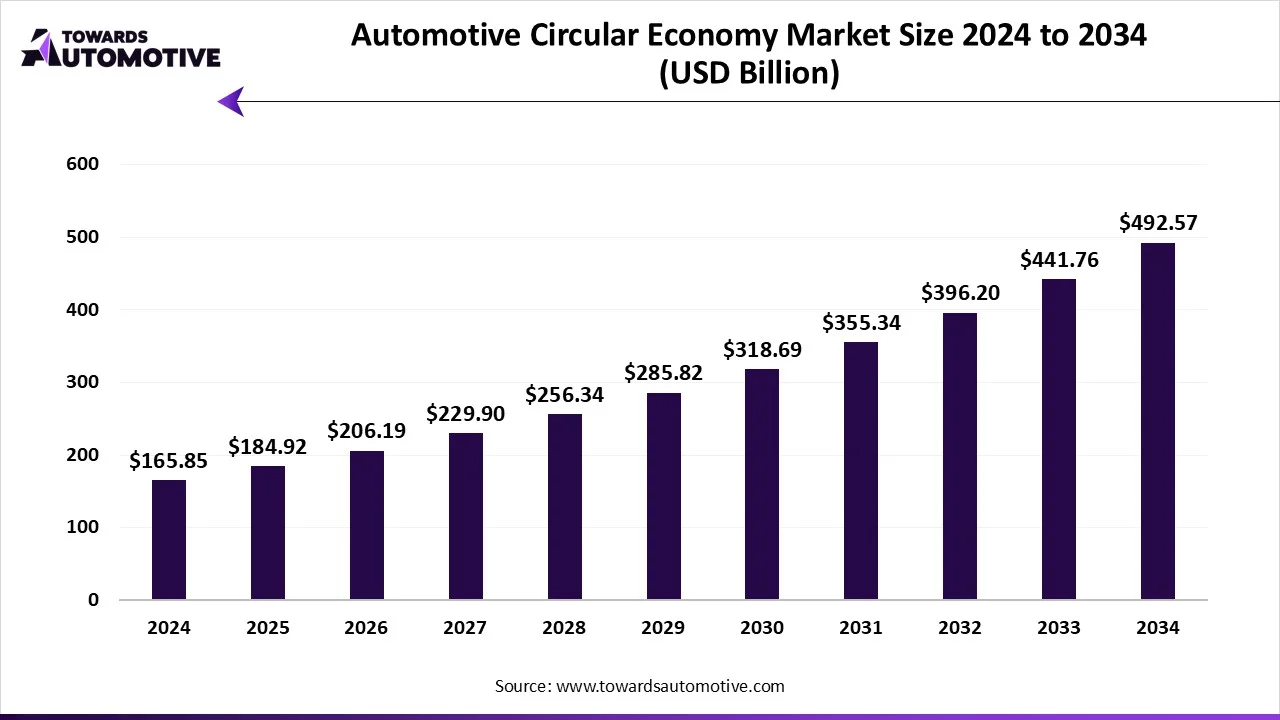

The automotive circular economy market is forecast to grow from USD 184.92 billion in 2025 to USD 492.57 billion by 2034, driven by a CAGR of 11.50% from 2025 to 2034. The increasing sales of commercial vehicles in various nations such as China, Germany, France, Italy and some others coupled with integration of generative AI in the automotive centers is playing a crucial role in shaping the industrial landscape.

Moreover, numerous government initiatives aimed at developing the EV sector along with rising focus of automotive brands to use high-quality safety materials in vehicles has driven the market expansion. The growing use of eco-friendly materials in modern cars to meet the sustainability goals is expected to create ample growth opportunities for the market players in the upcoming years.

The automotive circular economy market is driven by the growing demand for high-quality automotive components along with increasing disposable income of the people. The automotive circular economy redesigns the car lifecycle to move from a "take-make-throw away" model to a system that prioritizes resource efficiency by extending product life through reuse, re-manufacturing, and repair along with ensuring that materials are recovered and recycled at regular intervals of time. It deals in different types of vehicles such as passenger vehicles, commercial vehicles, electric vehicles and some others. There are several types of materials used in the production of automotive components including metals (steel, aluminum, copper), plastics & polymers, composites & alloys, rare/electronic materials and some others. This market is engaged in recycliGng of various automotive parts such as batteries, powertrains & drivetrain, body & structural components, interior components and some others. The end-users of these components consists of OEMs, aftermarket suppliers, recycling facilities and others. This industry is expected to rise significantly with the growth of the EV sector in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 165.85 Billion |

| Projected Market Size in 2034 | USD 492.57 Billion |

| CAGR (2025 - 2034) | 11.50% |

| Leading Region | Europe |

| Market Segmentation | By Process Type, By Material Type, By Vehicle Type, By Distribution Channel, By Component, By End-Use/ Application and By Region |

| Top Key Players | General Motors, Stellantis N.V., Toyota Motor Corporation, Volkswagen Group, Denso Corporation, ZF Friedrichshafen, Valeo, Call2Recycle, Gopher Resource |

The major trends in this market consists of partnerships, business expansions and government initiatives.

The recycling segment dominated the market with a share of around 40%. The growing focus of automotive brands to use recycled components in modern vehicles for lowering emission has boosted the market expansion. Also, rapid investment by automotive brands for opening up new automotive recycling centers is contributing to the industry in a positive manner. Additionally, rising emphasis of recycling startups to integrate AI-based technologies to enhance the recycling capabilities has driven the industrial growth. Moreover, collaborations among recycling companies and automakers to deploy advanced equipment for automotive component recycling is expected to propel the growth of the automotive circular economy market.

The battery recycling & repurposing segment is expected to grow with a CAGR of around 18% during the forecast period. The rapid expansion of the battery industry in several countries such as China, South Korea, Japan and some others has boosted the market growth. Also, rapid investment by battery companies for establishing a wide network of EV battery recycling in different parts of the globe has driven the industrial expansion. Additionally, the increasing emphasis of automakers to use of recycled batteries in modern vehicles for reducing emission is playing a vital role in shaping the industrial landscape. Moreover, joint ventures among EV companies and battery brands to establish numerous EV recycling centers is expected to drive the growth of the automotive circular economy market.

The passenger vehicles segment led the market with a share of around 50%. The increasing sales and production of passenger cars in various countries such as India, the U.S., France and some others has boosted the market growth. Also, the growing emphasis of automotive brands for using recycled plastics in passenger cars is contributing to the industry in a positive manner. Additionally, rapid investment by automakers for opening up passenger car scrappage centers has driven the industrial expansion. Moreover, joint ventures among passenger car manufacturers and metal recycling brands is expected to foster the growth of the automotive circular economy market.

The electric vehicles segment is expected to rise with a CAGR of 25% during the forecast period. The growing adoption of electric vehicles in several countries such as the U.S., UK, Germany, China and some others has driven the industrial growth. Also, the rising focus of automotive manufacturers for using recycled parts in EVs for lowering emission is playing a prominent role in shaping the industry in a positive manner. Additionally, numerous government initiatives aimed at providing subsidies for purchasing EVs has boosted the market expansion. Moreover, rapid investment by battery companies for opening new EV battery recycling centers is expected to boost the growth of the automotive circular economy market.

The metals segment led the market with a share of around 45%. The growing use of high-quality metals for the production of vehicles has driven the market growth. Also, rapid investment by market players for opening up new metal recycling centers is contributing to the industry in a positive direction. Additionally, integration of advanced technologies such as AI and IoT in metal recycling centers has boosted the industrial expansion. Moreover, partnerships among metal refining companies and automotive brands is expected to boost the growth of the automotive circular economy market.

The batteries & rare/ electronic materials segment is expected to expand with a CAGR of around 25% during the forecast period. The growing demand for recycled batteries from the EV sector to reduce emission has boosted the market expansion. Also, numerous government initiatives aimed at rising awareness about battery recycling is playing a prominent role in shaping the industrial landscape. In addition, rapid investment by electronic recycling companies for opening up new recycling centers has driven the industrial growth. Moreover, collaborations battery manufacturers and automotive brands is expected to drive the growth of the automotive circular economy market.

The metals segment led the market with a share of around 50%. The growing use of high-quality steel and aluminum in modern cars has boosted the market growth. Additionally, the rising focus of metal companies to integrate advanced technologies to enhance the metal recycling capabilities is playing a prominent role in shaping the industrial landscape. Moreover, the increasing emphasis of automotive manufacturers to use recycled metals in vehicles for lowering emission has driven the industrial expansion. Furthermore, rapid investment by steel companies to open new recycling plants in various countries such as China, India, the U.S., Canada, France and some others is expected to propel the growth of the automotive circular economy market.

The plastics & polymers segment is expected to grow with a CAGR of around 18% during the forecast period. The growing demand for hard plastics from automotive companies to manufacture several parts such as interior trim, seating, bumpers, dashboards, cable insulation and some others has boosted the market expansion. Also, rapid investment by plastic companies for opening new recycling centers in numerous countries such as China, India, Germany and some others has further driven the industrial growth. In addition, numerous government initiatives aimed at increasing awareness about plastic and polymer recycling is playing a vital role in shaping the industrial landscape. Moreover, collaborations among plastic recycling startups and automotive brands is expected to drive the growth of the automotive circular economy market.

The OEMs segment led the market with a share of around 50%. The growing focus of automotive OEMs to use recycled components in new vehicles for lowering their dependency on non-degradable substances has boosted the market growth. Also, rapid investment by automotive brands for opening new recycling plants for developing high-grade automotive components is playing a vital role in shaping the industrial landscape. In addition, the battery OEMs are increasing their focus on adopting new recycling technologies for enhancing EV battery recycling capabilities has driven the industrial expansion. Moreover, partnerships among automotive OEMs and battery startups to establish a wide network of battery recycling is expected to boost the growth of the automotive circular economy market.

The aftermarket / remanufacturing segment is expected to rise with a CAGR of around 15% during the forecast period. The growing adoption of recycled parts by automotive aftermarket brands for gaining maximum profits has driven the market expansion. Also, rapid investment by aftermarket companies for opening up new automotive workshops has also boosted the market growth. Additionally, increasing emphasis of aftermarket brands for using advanced technologies to enhance the recycling process is contributing to the industry in a positive manner. Moreover, collaborations among automotive aftermarket companies and plastic recycling brands is expected to foster the growth of the automotive circular economy market.

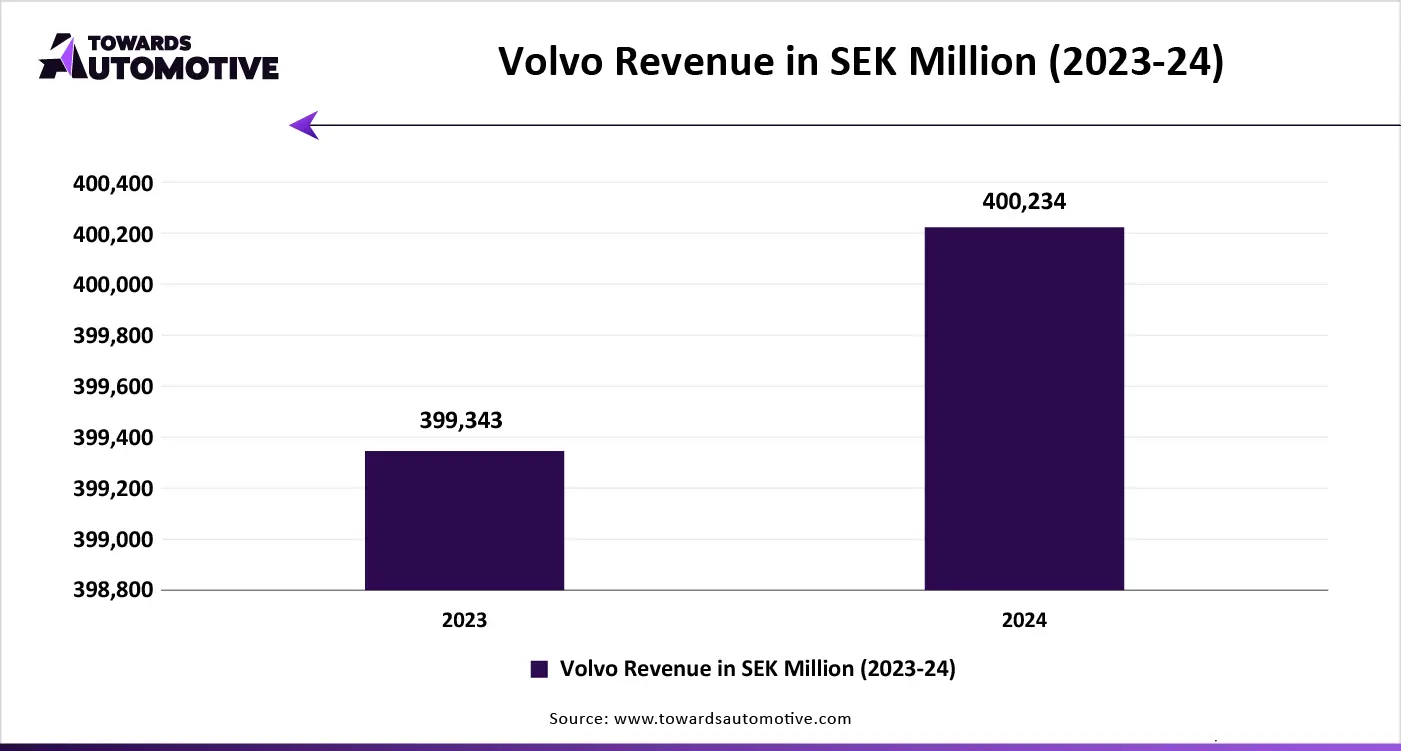

Europe dominated the automotive circular economy market. The increasing demand for commercial vehicles in several countries such as UK, Germany, France, Italy, Denmark and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at rising awareness about recycling along with rise in number of startup companies dealing in battery recycling activities is playing a vital role in shaping the industry in a positive manner. Moreover, the presence of various market players such as Volvo, BMW, Volkswagen and some others is expected to drive the growth of the automotive circular economy market in this region.

Germany and UK are the prominent contributors in this region. In Germany, the market is generally driven by the rapid expansion of the automotive sector coupled with advancements in recycling technologies. In UK, the increase in number of recycling facilities along with presence of various automotive brands has boosted the market growth.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The growing sales of passenger cars in various nations such as India, China, Japan, South Korea and some others has boosted the market growth. Additionally, rapid investment by government for launching various recycling policies along with technological advancements in the battery recycling sector is contributing to the industry in a positive direction. Moreover, the presence of numerous market players such as Hyundai, Toyota, Tata Motors and some others is expected to boost the growth of the automotive circular economy market in this region.

China and Japan are the major contributors in this region. In China, the market is generally driven by the increasing demand for passenger vehicles coupled with the growing trend of battery recycling. In Japan, the rising emphasis of automotive brands for opening up new recycling facilities along with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape.

| September 2025 | Announcement |

| Masood Mallick, Managing Director and Chief Executive Officer of Re Sustainability Limited | India’s growing fleet of end-of-life vehicles represented both a challenge and an opportunity. He added that the Re Carma network was contributing to large-scale resource recovery by channelling metals, plastics and other materials back into the economy, reducing dependence on virgin extraction. |

| October 2025 | Announcement |

| Tony Gu, PPG product engineering director, Automotive Coatings Asia | PPG continues to lead the industry with innovations such as precision application, 4-Wet sealants process technology, expanded bake electrocoats and heavy-metal-free solutions. “These technologies help automakers reduce carbon emissions, minimize waste and improve efficiency while meeting stringent environmental standards. By collaborating with partners across the value chain. PPG is accelerating the transition to a circular economy, driving the future of mobility toward greater sustainability. |

| September 2025 | Announcement |

| Dr. Cengiz Balkas, Chief Business Officer at Wolfspeed | Wolfspeed’s 200 mm SiC wafers are more than an expansion of wafer diameter it represents a materials innovation that empowers our customers to accelerate their device roadmaps with confidence.By delivering quality at scale, Wolfspeed is enabling power electronics manufacturers to meet growing demand for higher-performing, more efficient silicon carbide solutions. |

| June 2025 | Announcement |

| Giuseppe Crisci, General Manager at Lapo Compound | We believe in creating products that not only meet strict quality standards but also help contribute to a circular economy by keeping valuable materials in use. Our product innovation has successfully met this technical challenge for Fiat, which is testament to our dedication to sustainable innovation that supports a journey toward a more circular, responsible future. |

| September 2025 | Announcement |

| Philippe Beauchamp, the President of UgoWork | Scaling up our assembly operations to the US was the next logical step for UgoWork. We’re building serious traction with fleet operations across the country, and this move allows us to raise production capacity, stay closer to our clients, and comply with US manufacturing guidelines. We’ve always planned for this, but recent market conditions simply accelerated our timeline. |

| October 2025 | Announcement |

| Arun Murugappan, the Chairman of Montra Electric | With innovations like battery swapping for heavy-duty trucks and purpose-built platforms across segments, we are making clean mobility seamless, reliable and economically viable for fleet operators. Each step accelerates India’s shift towards cleaner logistics and a sustainable mobility ecosystem. |

| July 2025 | Announcement |

| Kazuo Tadanobu, the CEO of Panasonic Energy | The opening of our Kansas Factory marks a major milestone in our journey to scale advanced battery production in the United States in the release. This facility represents not only our commitment to the region but also a foundation for long-term collaboration and innovation in the U.S. |

The automotive circular economy market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Ford Motor Company, Volkswagen Group, Renault Group, BMW Group, Toyota Motor Corporation, Volvo Cars, Hyundai Motor Group, General Motors, Stellantis N.V., Northvolt AB, Li-Cycle Corp., Redwood Materials, Umicore, Duesenfeld, ECOBAT Technologies and some others. These companies are constantly engaged in providing automotive-related services and adopting numerous strategies such as launches, partnerships, acquisitions, collaborations, business expansions, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Process Type

By Material Type

By Vehicle Type

By Distribution Channel

By Component

By End-Use/ Application

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us