Automotive Lane Warning System Market Size, Share and Strategic Insights

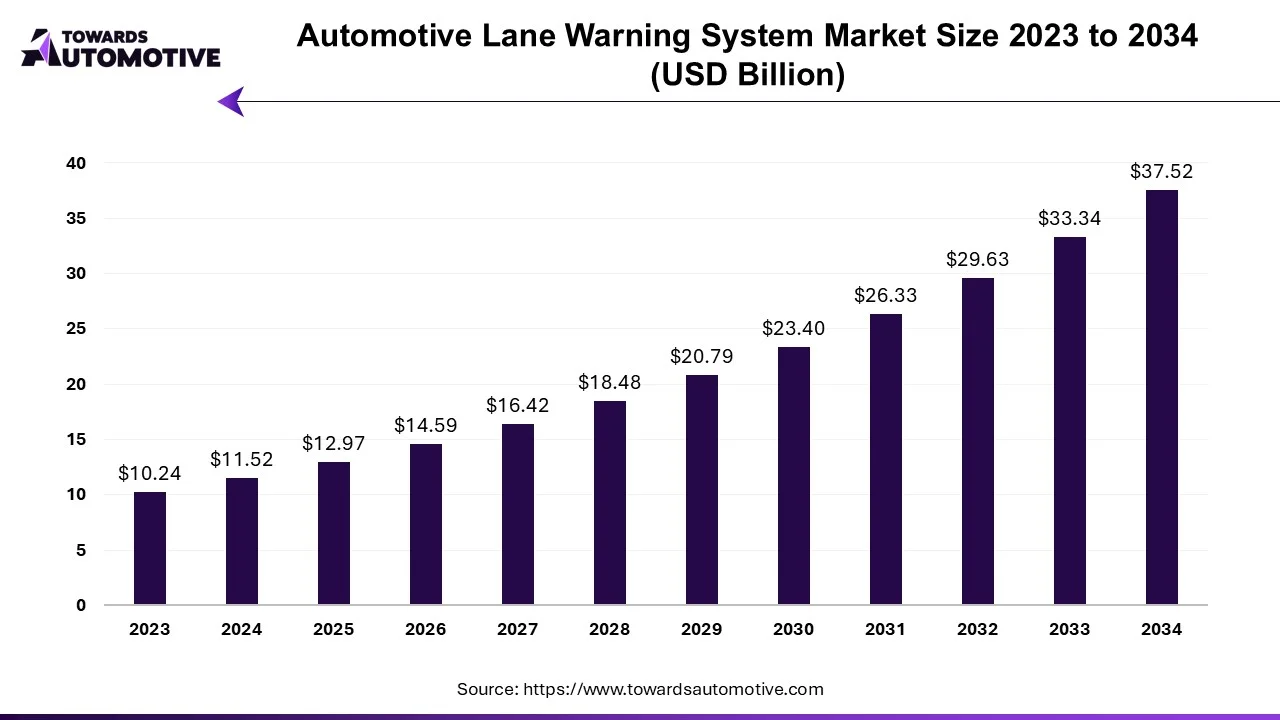

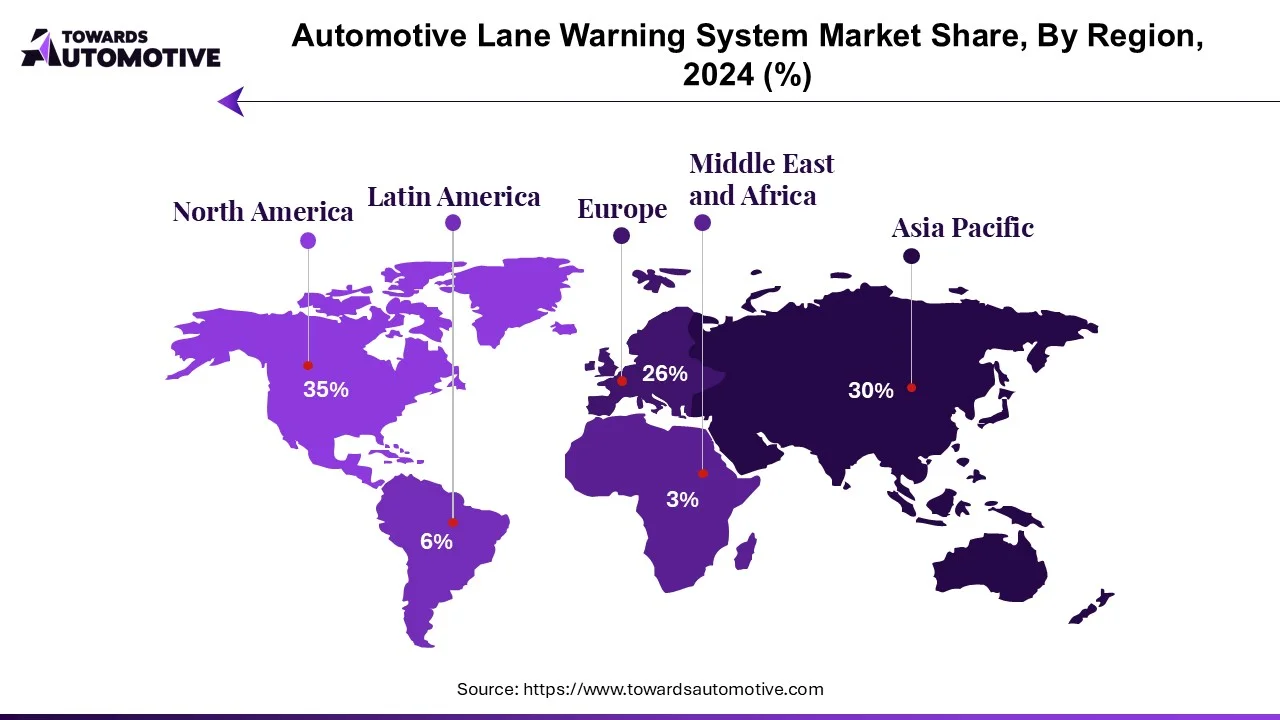

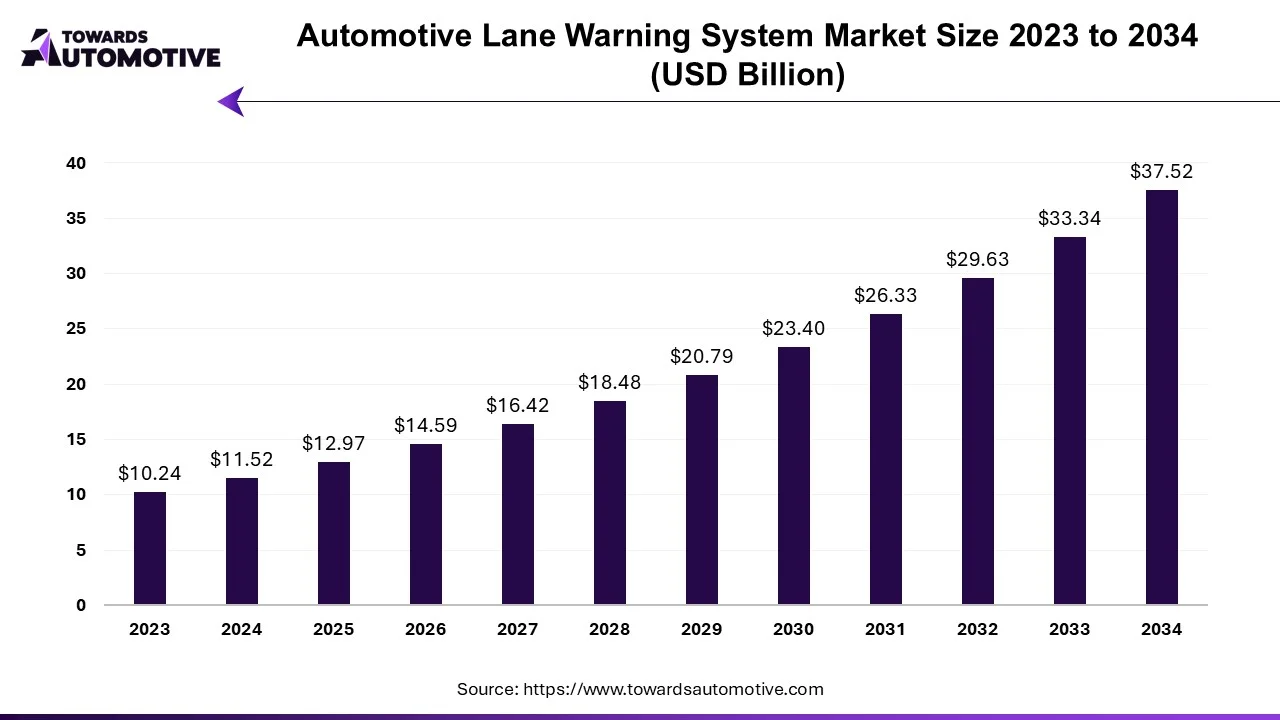

The automotive lane warning system market is projected to reach USD 37.52 billion by 2034, fueled by stringent road safety regulations, ADAS standardization, and growing integration in BEVs and connected vehicles. Segment data highlight lane departure warning (LDW) as the largest and most mature category, while lane keeping systems (LKS) exhibit faster growth. Video sensors dominate due to superior image processing and AI-based object recognition. Regional dynamics show North America leading by regulation, Europe aligning with EC 661/2009, and Asia Pacific growing on rising consumer safety awareness. Competitive profiling covers Continental, Bosch, ZF, DENSO, Mobileye, Delphi, Hitachi, Magna, Iteris, and Volkswagen AG, evaluating strategic acquisitions, software development, and OEM collaboration. Value-chain diagnostics analyze sensor module fabrication, ECU assembly, software integration, and distribution channels, while trade intelligence details imports/exports of camera-based ADAS systems and semiconductor supply dependencies.

- During the COVID-19 era, the equipment of the traffic alert line disappeared as the infection continued to increase, and the government strictly controlled it. In addition, there is also a shortage of sawdust, which causes a decrease in the production of warning lines.

- The increasing number of traffic accidents worldwide has led governments and international organizations to implement stricter safety regulations, prompting automakers to develop new technologies such as Automotive Lane Warning Systems (ALWS). Lane departure warnings can prevent about 7 percent of fatal crashes.

- Strengthening policies and regulations regarding passenger safety has led to the growth of the lane departure warning business. In Europe, Regulation (EC) 661/2009 covers the installation of lane departure warning in the vehicle industry. Rising incomes in emerging markets such as India and China have led consumers to prefer expensive vehicles in the luxury sedan and SUV segments. This problem has led to the growth of the vehicle lane warning market.

- Automotive OEMs have partnered with technology companies to develop ADAS systems such as pillar alerts.

Nvidia provides technical, software, and hardware support for self-driving cars and virtual reality with DRIVE AP2X, DRIVE, and DRIVE AGX.

- In addition, after the second quarter of 2021, government products and simple products enable the economy to return to growth.

- With the continuous development of better and more advanced product lines, the market is expected to grow significantly during the forecast period.

Trends in the Automotive Lane Warning Systems Market

Rising Demand for Lane Departure Warning Systems

Automotive Lane Warning System Market Size, By Function Type, (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Lane Departure Warning System |

6.34 |

7.00 |

7.73 |

8.54 |

9.42 |

10.39 |

11.46 |

12.63 |

13.92 |

15.33 |

16.88 |

| Lane Keeping System |

5.18 |

5.96 |

6.86 |

7.88 |

9.05 |

10.39 |

11.93 |

13.69 |

15.70 |

18.00 |

20.63 |

- Lane Departure Warning Systems is a group of safety technologies designed to prevent high speeds on highways, freeways, and expressways. They warn drivers and sometimes take corrective measures to avoid accidents and road accidents.

- Increasing traffic risk, mainly due to rapidly changing roads, is causing concerns among consumers and governments worldwide. Therefore, technological development is essential in the automobile industry to reduce traffic accidents and increase passenger and driver safety.

- In addition, increasing consumer concerns about safety issues also increase the demand for advanced driver assistance systems (ADAS). Nowadays, autonomous and connected vehicles attract consumers' attention and are expected to gain wider acceptance during the forecast period.

- Advanced driver assistance systems (ADAS) should bridge the gap between old and future cars. Additionally, as technology in the automotive industry continues to advance, end users are increasingly willing to invest in new technology, improving driving and increasing driver and passenger safety.

- ADAS features such as collision warning, lane departure warning, and blind spot monitoring can impress customers and improve vehicle performance by alerting owners of faulty vehicles to reduce vehicle time. This increases the demand for Lane Departure Warning Systems (LDWS).

- Accidents in commercial vehicles often have serious consequences for the driver and other people on the road. As of November 2015, all new commercial vehicles weighing more than 3.5 tonnes and buses weighing more than 5 tonnes must be fitted with a lane departure warning. Approximately 38.9% of car accidents are mostly due to not wanting to swerve. Using an exit warning line can prevent such situations.

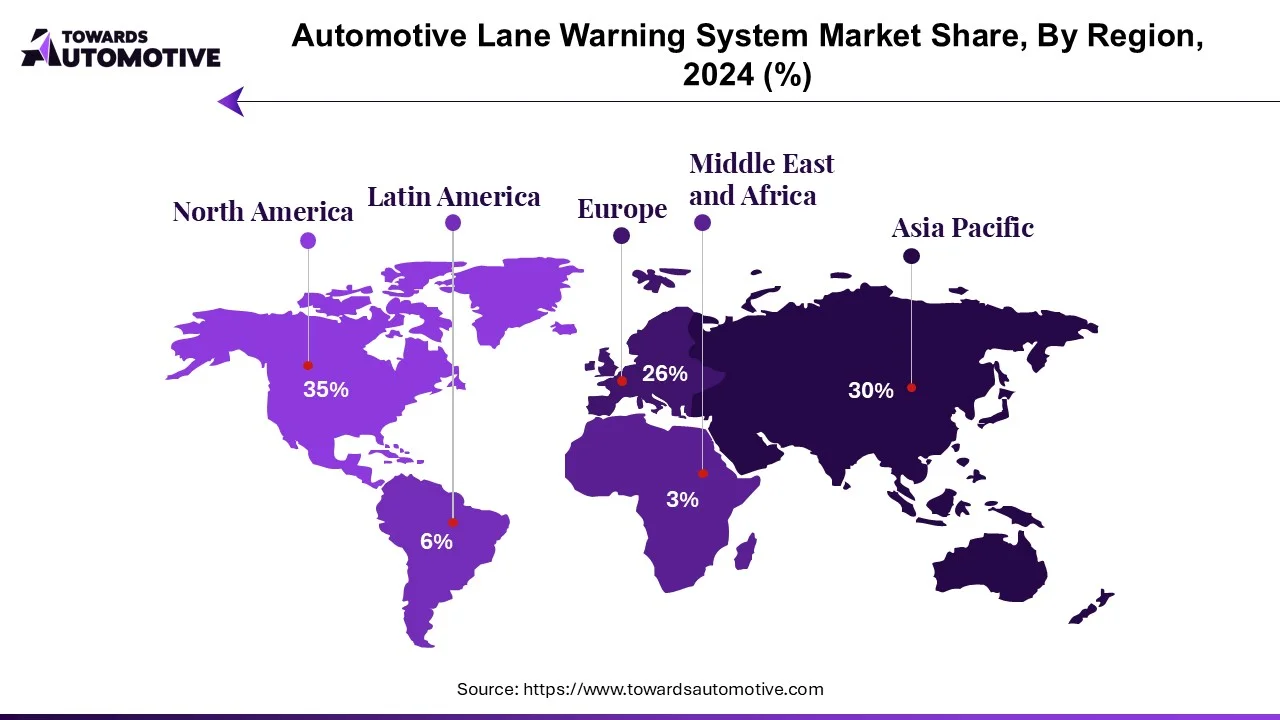

North America Leads the Automotive Lane Warning System Market

- It is one of the pillars of the North American automotive industry. The United States is the anchor of the North American automotive hub and contributes at least 3% to the country's gross domestic product (GDP). In addition, the government is one of the largest companies in the luxury automobile industry, with a revenue of $ 5 billion in 2021. More than 336,600 cars were sold in 2021.

Automotive Lane Warning System Market Size, By Region, (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

4.03 |

4.51 |

5.05 |

5.65 |

6.32 |

7.07 |

7.91 |

8.84 |

9.89 |

11.07 |

12.38 |

| Europe |

3.11 |

3.46 |

3.85 |

4.28 |

4.77 |

5.30 |

5.89 |

6.55 |

7.29 |

8.10 |

9.00 |

| Asia-Pacific |

2.88 |

3.32 |

3.82 |

4.40 |

5.06 |

5.82 |

6.69 |

7.69 |

8.83 |

10.13 |

11.63 |

| Latin America |

0.81 |

0.91 |

1.04 |

1.17 |

1.33 |

1.51 |

1.71 |

1.93 |

2.19 |

2.48 |

2.81 |

| Middle East & Africa |

0.69 |

0.76 |

0.83 |

0.91 |

1.00 |

1.09 |

1.19 |

1.30 |

1.42 |

1.55 |

1.69 |

- All car accidents are caused mainly by human error. According to the U.S. Department of Transportation's National Highway Traffic Safety Administration (NHTSA), nearly a third of

- In recent years, governments, businesses, and other interest groups have responded to these statistics by promoting improvements in driving safety, primarily to reduce car crashes and deaths.

- Automakers and governments are working to ensure and encourage safe driving, especially for passengers.

- Additionally, the government and automakers are striking a delicate balance by prioritizing safety. For example, the Canadian government announced that safety checks will be carried out on all vehicles, and autonomous and connected vehicles will be operated while launching driver support services.

- In May 2022, General Motors and INRIX Inc. announced their partnership. Safety integration through cloud-based analytics solutions is delivered directly to the U.S. Department of Transportation to provide safety insight based on GM's future and Inrix plans.

- In May 2022, Toyota announced that it would use computer-based vision technology from Austin, Texas-based start-up Invisible AI for its assembly plants in North America. To improve quality, safety, and efficiency, the machine must be able to process physical motion data.

- Due to the abovementioned factors, the demand for vehicle security solutions will increase. This should enable the education business to grow over the forecast period.

Overview of the Automotive Lane Warning Systems Industry

- The vehicle alert line industry is dominated by various players such as Continental AG, Delphi Technologies, Mobileye, Hitachi Ltd., ZF Friedrichshafen AG, Robert Bosch GmbH, Denso Corporation and Magna International Corporation.

- These companies have entered joint ventures, including acquisitions, to create new products and expand their businesses.

- For example, Magna International Inc. in July 2021. Acquired Veoneer to strengthen advanced driver assistance services (ADAS), including blind spot stereo and lane alert, Veoneer technology Product, Customer, and Geographic Footprint.

- In September 2021, Continental entered into a joint venture with Horizon Robotics and signed the agreement. Autonomous driving systems integrated software and hardware solutions for vehicle pressure and driving. They also signed an investment agreement with Shanghai Jiading Industrial Zone, and the new joint venture will be located in Shanghai Jiading District.

Automotive Lane Warning Systems Market Leaders

- Continental AG

- Delphi Technologies

- Mobileye

- DENSO Corporation

- Robert Bosch GmbH

- The Bendix Corporation

- Hitachi Ltd

- Iteris Inc.

- Nissan Motor Co. Ltd

- Volkswagen AG

- ZF TRW

Automotive Lane Warning Systems Market News

- In January 2022, Bosch announced the provision of a lane departure warning system (LDWS) for the Chinese version of the BYD Qin Pro DM 2022.

- In April 2021, ZF revealed that its fastest automatic emergency braking technology, OnGuardMAX, would be manufactured in China. Starting this year, two major Chinese automakers will integrate OnGuardMAX into their new car models. OnGuardMAX also features safety functionalities such as Lane Departure Warning (LDW) and Adaptive Cruise Control (ACC).

- In April 2021, Denso Corporation enhanced the advanced driver assistance systems in the Lexus LS and Toyota Mirai. The system includes LiDAR sensors and the Advanced Driving System Electronic Control System (ADS ECS), enabling object recognition and distance determination.

Automotive Lane Warning Systems Industry Segmentation

The warning system is sensors located near the vehicle's air vents. This sensor detects the vehicle's path and keeps it in its lane. Governments worldwide are trying to use this technology in vehicle safety programs.

Market Segmentation

By Function Type

- Lane Departure Warning System

- Lane Keeping System

By Sensor Type

- Video Sensors

- Laser Sensors

- Infrared Sensors

By Sales Channel

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Geography

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle-East and Africa

- United Arab Emirates

- Saudi Arabia

- Rest of Middle-East and Africa