December 2025

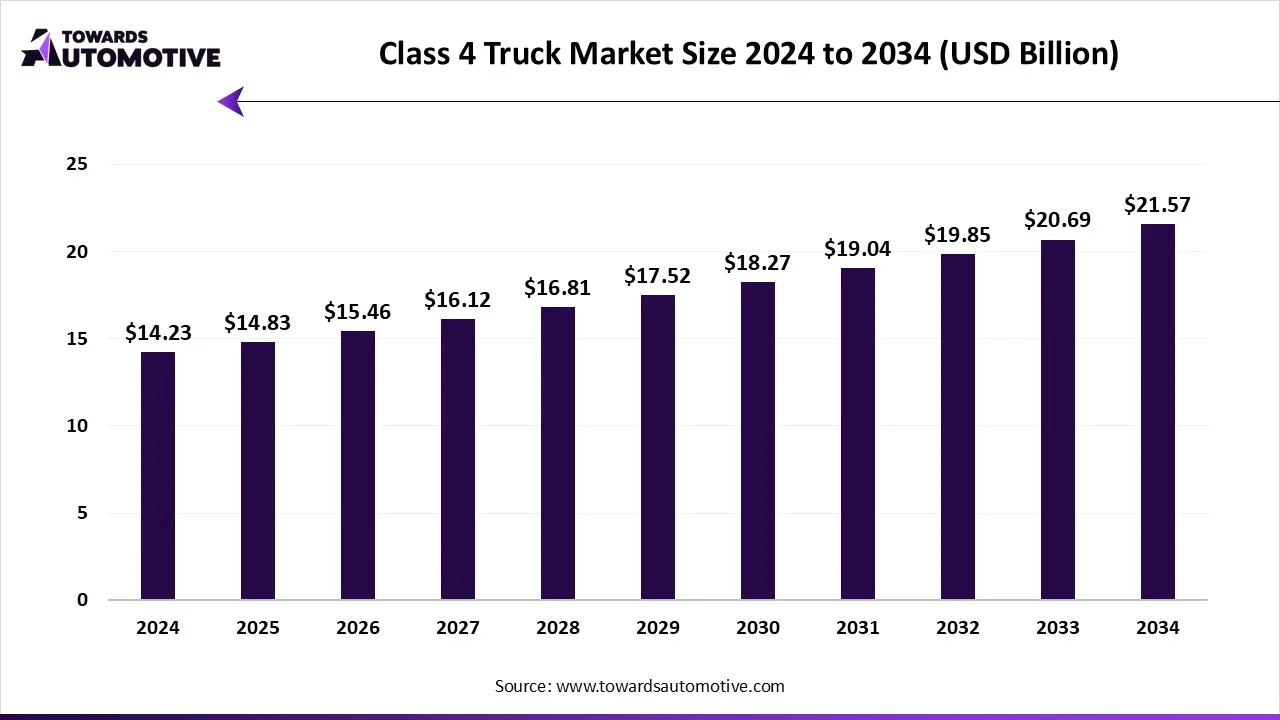

The class 4 truck market is projected to reach USD 21.57 billion by 2034, growing from USD 14.83 billion in 2025, at a CAGR of 4.25% during the forecast period from 2025 to 2034. The growing application of class 4 trucks for transporting a wide range of materials and equipment from one place to another coupled with continuous development in the mining sector has driven the market expansion.

Additionally, the rise in number of truck-based fleet operators in different regions along with technological advancements in hybrid powertrains is further adding to the industrial growth. The integration of ADAS and DMS in class 4 trucks is expected to create ample growth opportunities for the market players in the upcoming years.

The class 4 truck market is a crucial branch of the automotive industry. This industry deals in manufacturing and distribution of class 4 trucks in different parts of the world. There are different types of vehicles manufactured in this sector consisting of dry van, flatbed, refrigerated van, dump truck, box truck and some others. These vehicles are powered using numerous propulsion technologies including diesel, gasoline and electric. It finds application in several sectors comprising of general delivery, construction, hazardous material transportation, refrigerated transportation and some others. This market is expected to rise significantly with the growth of the commercial vehicles industry around the globe.

The major trends in this market consists of business expansion, AI-based fleet management platforms and booming e-commerce industry.

The conventional segment held the largest share of the market. The growing demand for diesel-powered class 4 trucks to operate heavy-duty applications for long time period has boosted the market expansion. Additionally, lack of EV charging infrastructure in developing nations coupled with increasing use of advanced turbochargers in diesel trucks to enhance vehicular performance is further contributing to the industrial growth. Moreover, the rising application of conventional class 4 trucks in the mining sector is expected to foster the growth of the class 4 truck market.

The hybrid segment is expected to grow with a significant CAGR during the forecast period. The rising adoption of hybrid class 4 trucks in the logistics sector has driven the market growth. Also, rapid investment by engine manufacturers for developing superior-grade hybrid engines to cater the needs of the class 4 trucks is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of hybrid trucks including higher fuel efficiency, smooth driving, reduced emission and some others is expected to accelerate the growth of the class 4 truck market.

The general delivery segment dominated the market. The growing adoption of electrically-powered class 4 trucks in the logistics sector to reduce vehicular emission has driven the market expansion. Additionally, deployment of class 4 trucks in the e-commerce industry to transport goods from warehouses to public is further adding to the industrial growth. Moreover, partnerships among automotive brands and fleet operators to develop fuel-efficient class 4 trucks for operating general delivery services is expected to drive the growth of the class 4 truck market.

The construction segment is expected to grow with the highest CAGR during the forecast period. The rise in number of residential constructions in several countries such as the U.S., India, China, Canada and some others has increased the demand for class 4 trucks, thereby accelerating the industrial expansion. Also, numerous government initiatives aimed at renovating the monuments and roads is further adding to the market growth. Moreover, rapid investment by EV market players to develop advanced class 4 trucks to cater the needs of the construction sector is expected to propel the growth of the class 4 truck market.

The dry vans segment led the industry. The rising application of dry vans for transporting clothes and electronics from one place to another has boosted the market expansion. Additionally, the increasing adoption of dry vans in the e-commerce sector along with rapid use of enclosed shipping container in the chemicals industry for transporting hazardous substances is contributing to the industrial growth. Moreover, rising investment by truck manufacturers for opening dry van manufacturing facilities in several countries is expected to propel the growth of the class 4 truck market.

The dump truck segment is expected to rise with a considerable CAGR during the forecast period. The growing adoption of electric dump trucks in the mining sector to reduce emission has boosted the market growth. Also, the increasing application of articulated dump trucks in the construction sector for transporting several materials including gravel, sand, cement and some others is further adding to the industrial expansion. Moreover, the rapid deployment of heavy-duty dumping trucks by municipalities for waste management applications is expected to propel the growth of the class 4 truck market.

North America led the class 4 truck market. The growing demand for class 4 trucks from several industries including construction, mining, logistics and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at increasing awareness related to adoption of EVs coupled with constant research and development activities by engine manufacturers to develop powerful truck engines is playing a positive role in shaping the industry. Moreover, the presence of several market players such as Ford, General Motors, International Trucks and some others is expected to propel the growth of the class 4 truck market in this region.

U.S. dominated the market in this region. The rising adoption of electric and hybrid trucks in the e-commerce sector to reduce vehicular emission coupled with technological advancements in the automotive industry is contributing to the industrial growth. Additionally, the presence of numerous truck manufacturers has further driven the market expansion.

Asia Pacific is expected to rise with a significant CAGR during the forecast period. The rise in number of truck fleet operators in several countries such as India, China, Japan, South Korea and some others has boosted the market growth. Additionally, the growing demand for refrigerated vans from the dairy industry coupled with technological advancements in the battery industry is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Dongfeng, Mitsubishi Fuso, Hino Motors, Changan Automobile Group and some others is expected to boost the growth of the class 4 truck market in this region.

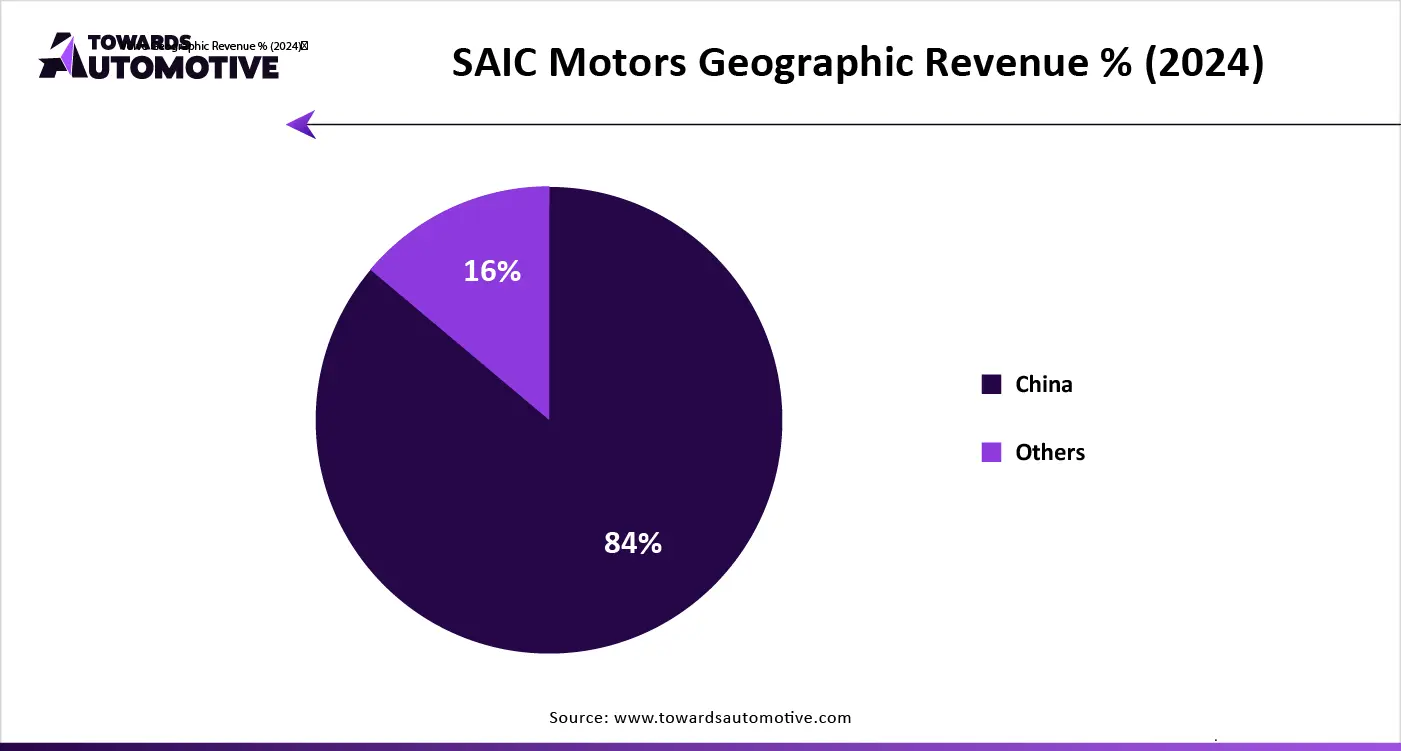

China led the market in this region. The growing development in the mining sector coupled with numerous government initiatives aimed at developing the automotive sector has contributed to the industrial expansion. Moreover, the presence of numerous truck manufacturing brands along with availability of essential raw materials is further adding to the market growth.

The class 4 truck market is a highly fragmented industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of JAC Motors, Nissan, Mitsubishi Fuso, Isuzu, Dongfeng, Hino Motors, UD Trucks, Foton, International Trucks, Changan Automobile Group, Ford, Great Wall Motors, Foton Motor, SAIC Motor, Beiqi Foton Motor, Chevrolet, GMC and some others. These companies are constantly engaged in developing class 4 trucks and adopting numerous strategies such as joint ventures, launches, business expansions, acquisitions, partnerships, collaborations and some others to maintain their dominance in this industry.

By Type

By Application

By Payload Capacity

By Body Type

By Powertrain

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us