October 2025

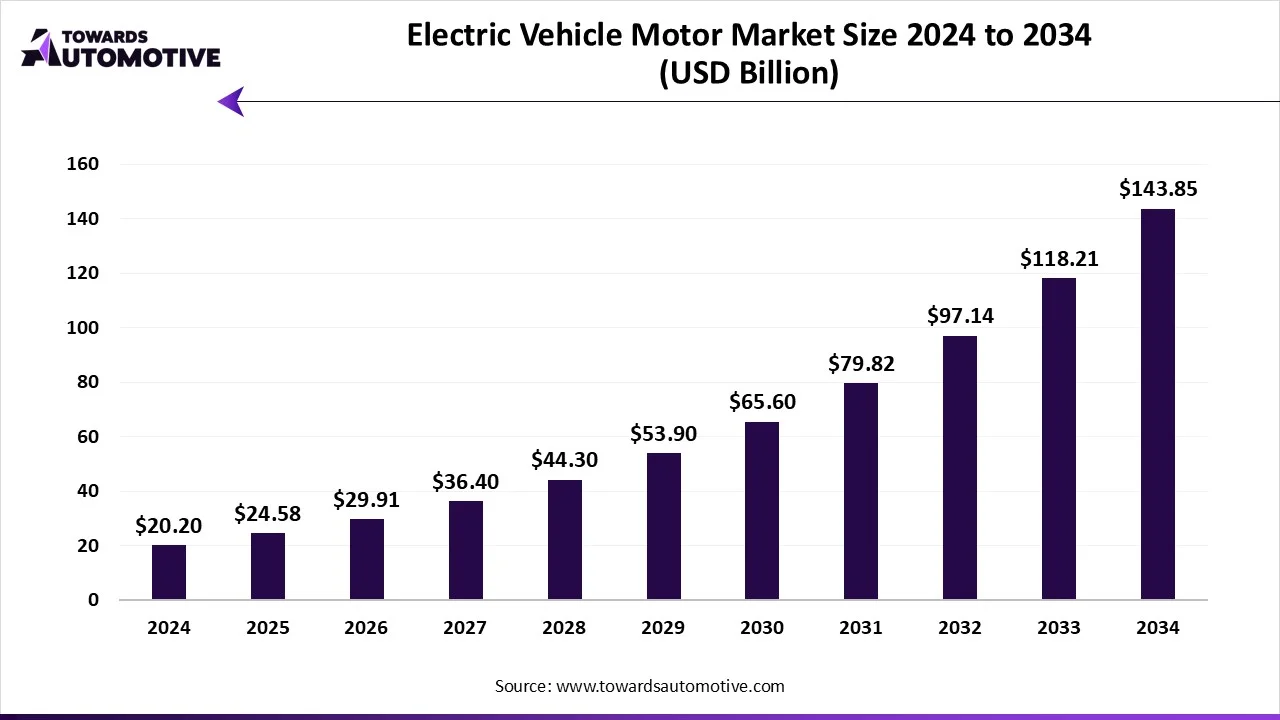

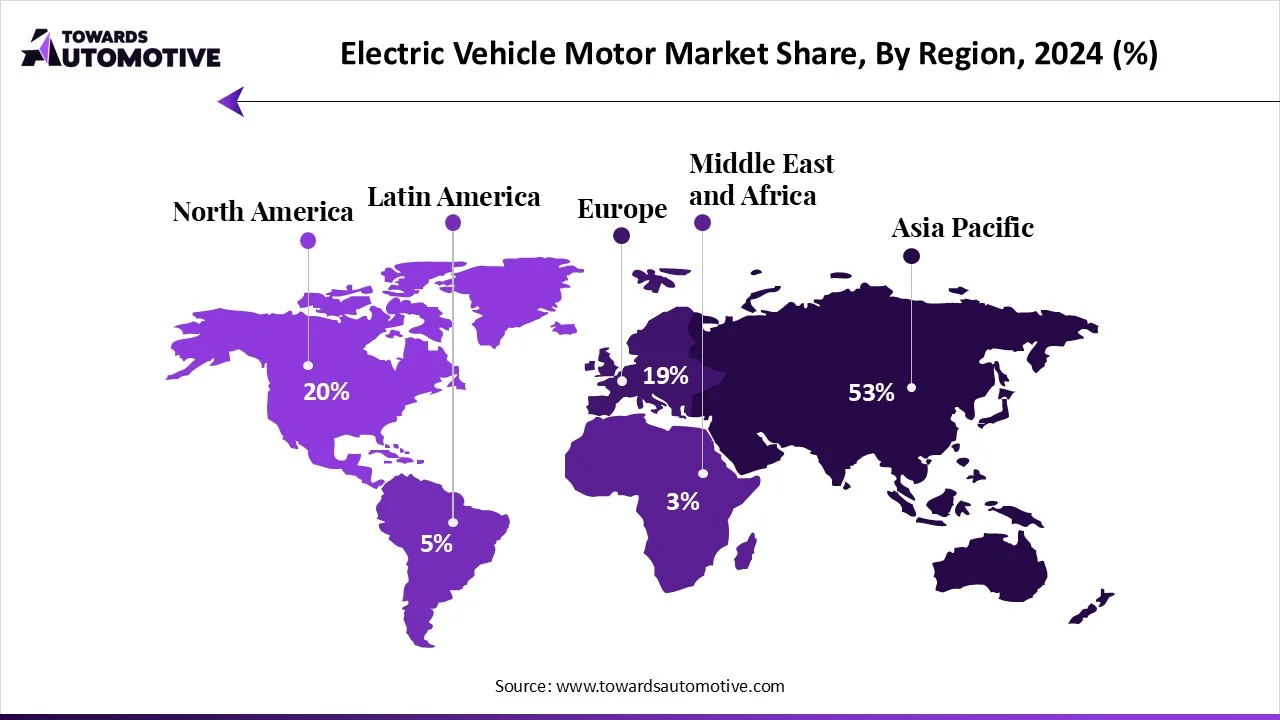

The electric vehicle motor market is set to grow from USD 24.58 billion (2025) to USD 143.85 billion (2034) at a 21.69% CAGR, propelled by EV penetration, policy incentives, and OEM capex. Scope covers vehicle type (two-wheeler, three-wheeler, passenger BEV/Hybrid, commercial BEV/Hybrid), components (stator; rotor/shaft/bearing; permanent magnets; casing; wiring), power ratings (up to 20 kW; 20–100 kW; 100–250 kW lead; >250 kW), and regions (APAC lead; Europe high growth; North America; MEA; LATAM). Includes competitive landscape (Tesla, BYD, Siemens, LG Magna e-Powertrain, Bosch, ABB, AISIN, BorgWarner, Nidec, Mitsubishi Electric, GKN), value chain (magnet & copper supply laminations stator/rotor machining motor + inverter integration OEM), trade flows (notably China→Europe), and technology trends (AI-assisted control, axial-flux, SiC-enabled efficiency, integrated e-axles).

The electric vehicle motor market is experiencing rapid growth due to the rising adoption of electric vehicles globally. As governments implement stringent emission regulations and promote sustainable transportation, the demand for efficient and reliable electric motors for EVs is surging at a rapid pace. The increasing focus on reducing greenhouse gas emissions is driving further innovation in electric motor designs. These innovations include improvements in efficiency, power density, and thermal management.

Additionally, the push for high driving range and faster acceleration has spurred the development of high-performance electric motors, particularly in the luxury and high-performance EV segments. Countries such as China, the U.S., and Germany are adopting electric vehicles, fostering a strong market for EV motors. Furthermore, the integration of cutting-edge technologies such as AI and machine learning in motor control systems is expected to enhance the overall performance and efficiency of electric vehicles.

| Metric | Details |

| Market Size in 2024 | USD 20.20 Billion |

| Projected Market Size in 2034 | USD 143.85 Billion |

| CAGR (2025 - 2034) | 21.69% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle Type, By Component, By Power Rating and By Region |

| Top Key Players | Tesla (U.S.), BYD (China), Siemens AG (Germany), LG Magna e-Powertrain Co., Ltd (South Korea) |

AI plays a crucial role in the electric vehicle motor market by enhancing motor performance, efficiency, and overall vehicle functionality. Advanced algorithms can help in managing torque, speed, and power output of EV motors that in turn ensures smooth and efficient operation across various driving conditions. AI-driven predictive maintenance systems can monitor motor health in real-time and enhances longevity of motors.

Electric motorcycles are emerging as a significant driver in the electric vehicle motor market, fueled by increasing consumer demand for eco-friendly and cost-efficient transportation alternatives. As urbanization accelerates and traffic congestion worsens, electric motorcycles offer a practical solution for personal mobility, particularly in densely populated cities across Asia Pacific and Europe. These two-wheeled vehicles rely on compact and powerful electric motors that provide quick acceleration, high efficiency, and a quieter, smoother ride as compared to traditional internal combustion engine (ICE) motorcycles.

The increasing popularity of electric motorcycles among urban commuters and environmentally-conscious consumers, is driving demand for efficient and durable electric motors. As electric motorcycles gain traction globally, they are contributing to the overall growth of the EV motor market.

Governments across various regions are also playing a crucial role in promoting electric vehicles by offering subsidies, tax incentives, and implementing stricter emission regulations. The lower operating costs of EVs, further boost their appeal to consumers, particularly those looking for sustainable transportation solutions. Advancements in efficient motors have enabled electric vehicles to offer better range and performance.

In September 2024, the Ministry of Heavy Industry in India, launched PM Electric Drive Scheme, accelerating EV adoption. It aims to provide incentives for EV purchases, charging infrastructure development, and empowerment of the EV manufacturing sector.

Axial flux motors offer significant improvements in power density, efficiency, and size compared to traditional radial flux motors. It has compact and lightweight design that makes them particularly attractive for light-weight electric vehicles. These motors are highly efficient and provides high torque at low speeds. Additionally, axial flux motors can be easily integrated into various EV architectures, including in-wheel and all-wheel-drive systems, offering more flexibility in vehicle design.

The passenger vehicle segment held the largest share of the market. As consumer demand for eco-friendly and cost-efficient transportation rises, the popularity of electric passenger vehicles is increasing rapidly. The shift from internal combustion engine (ICE) vehicles to electric alternatives is driven by factors such as environmental awareness, rising fuel prices, and government incentives aimed at reducing carbon emissions. Passenger EVs, including sedans, hatchbacks, and SUVs, are at the forefront of this transition, requiring efficient and high-performance electric motors to power their operations.

Automakers are focusing heavily on developing advanced EV motors that offer greater power efficiency, improved range, and better driving experiences to meet the growing demand of EV owners. Additionally, the rapid development of charging infrastructure is making electric passenger vehicles more convenient and accessible for everyday use, further boosting adoption. Countries such as China, the U.S., and European nations are witnessing a surge in electric passenger vehicle sales, driving significant growth in the EV motor market.

Two-wheeler segment is witnessing fastest growth segment throughout the forecast period. Urbanization has created a need of handy transportation options to navigate busy areas that results in the increasing production of electric two-wheelers. Bajaj, Ather Energy, Ola Electric, Hero, TVS are the key companies engaged in R&D and vehicle manufacturing. Generally, brushless DC (BLDC) motors are used in two-wheelers due to its efficiency, high torque, and durability.

The permanent magnet segment dominated the electric vehicle motor market. These magnets are used in EV motors due to their ability to create a strong, self-sustaining magnetic field, which enhances motor efficiency, torque density, and overall performance. It also helps to simplify the motor design by eliminating field winding. Permanent magnet motors are known for its high efficiency and high torque density. Multiple automakers such as Tesla, Nissan, BMW, and others make use of permanent magnets in their EV motors.

The rotor, shaft, and bearing segment held a significant share of the market. The rotor is the heart of the motor that helps in converting electrical energy into mechanical energy. The shaft connects the rotor to the vehicle’s drivetrain, ensuring the smooth transfer of power. Bearings play a crucial role in reducing friction between moving parts that helps in enhancing the reliability and durability of the motor.

The 100 kW to 250 kW segment led the market. The 100 kW to 250 kW power range is a key driver of growth in the electric vehicle motor market, as it meets the performance and efficiency needs of a wide range of electric vehicles. Motors within this power range offer an optimal balance between energy efficiency, acceleration, and driving range, making them ideal for many EV models, including sedans, SUVs, and vans. The increasing demand for vehicles with higher power output to accommodate better performance, quicker acceleration, and smoother driving experiences has fueled the adoption of motors in the 100 kW to 250 kW range.

The 20 kW to 100 kW segment is the fastest-growing segment in the market that are usually used in passenger electric vehicles and LCEVs. Electric motors of this range are highly efficient and causes minimal losses occur while converting electrical energy to mechanical power. AC induction motors and permanent magnet synchronous motors are the basic types of 20 kW to 100 kW range motors.

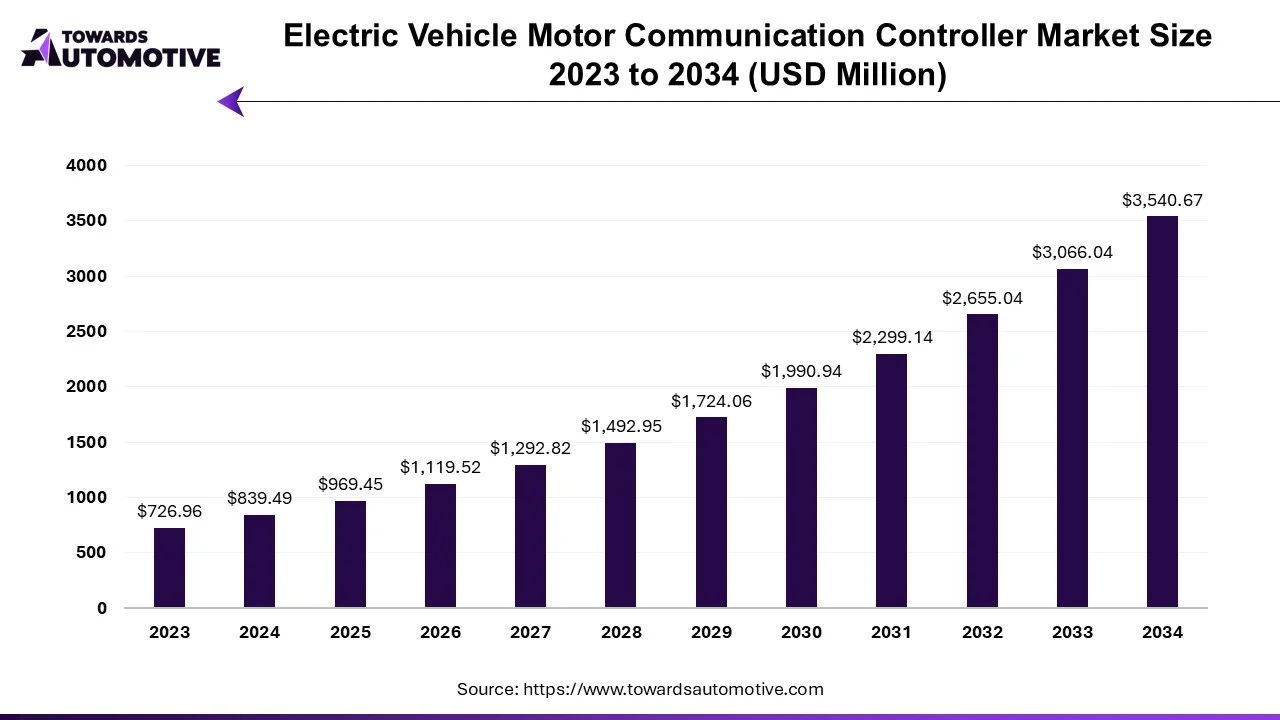

The electric vehicle motor communication controller market is forecasted to expand from USD 969.45 million in 2025 to USD 3,540.67 million by 2034, growing at a CAGR of 15.48% from 2025 to 2034.

The market for electric vehicle charging infrastructure (EVCI) is being propelled by the rising demand for electric charging solutions, driven in part by increased financial incentives provided by governments worldwide. Various governments, such as India's, have initiated programs like the Adoption and Manufacturing of Electric Vehicles in India (FAME India) program to incentivize the purchase of electric vehicles by offering subsidies. This has led to a surge in demand for electric vehicle supply equipment (EVSE), particularly for large-scale charging centers, as businesses in sectors like transportation, logistics, and fast-moving consumer goods (FMCG) invest in electric fleets.

Companies like FedEx have made significant investments in EVSE equipment for their transportation fleets, and industry players such as Siemens, Efacec, and ABB Ltd. are actively involved in developing advanced solutions like pantograph chargers to meet the growing demand. Furthermore, government initiatives to establish national electric vehicle charging networks, as seen in the partnership between ABB Ltd. and Mitsubishi Electric in Estonia, are driving the demand for electric vehicle charging infrastructure (EVCI) globally.

Despite challenges posed by the COVID-19 pandemic, the demand for electric vehicles has remained resilient, particularly in regions like Asia-Pacific and Europe, creating a positive outlook for the EVCI market. As economies continue to grow, governments are increasingly investing in electric vehicle projects, incentivizing both automakers and consumers to embrace electric mobility. This growth in electric vehicle adoption is expected to drive sales of electronic products like physical communication controllers, presenting opportunities for companies operating in the EV motor control sector.

In response to these trends, manufacturers are ramping up research and development efforts to innovate and introduce new products tailored to meet the evolving needs of the electric vehicle market. This strategic focus on product development and innovation reflects a commitment to capitalizing on the opportunities presented by the burgeoning electric vehicle industry, both now and in the future.

Asia Pacific dominated the electric vehicle motor market. Rapid urbanization, population growth, and government initiatives are key drivers of the electric vehicle motor market in the Asia Pacific region. As cities expand and populations increase, the demand for efficient, eco-friendly transportation solutions has intensified. Urban areas face rising concerns over air pollution and traffic congestion, making electric vehicles a crucial alternative to conventional internal combustion engine (ICE) vehicles. Governments of several countries such as China, Japan, and India, are implementing policies and regulations to encourage EV adoption. These include subsidies, tax incentives, and stringent emission norms aimed at reducing carbon footprints and combating air pollution.

Europe is expected to grow with a significant CAGR during the forecast period. Stringent emission regulations, increasing EV adoption, and the development of charging infrastructure are key drivers of the electric vehicle motor market in Europe. The European Union's strict carbon emission standards, aimed at reducing greenhouse gases, have pushed automakers to manufacture electric vehicles at a large scale. Regulations such as the EU's goal of reducing emissions by 55% by 2030 have accelerated the shift, encouraging manufacturers to invest in advanced EV motor technologies to meet these requirements.

European consumers are increasingly adopting electric vehicles due to rising environmental awareness and government incentives. Countries such as Norway, Germany, and the Netherlands offer substantial subsidies, tax breaks, and rebates for EV purchases, which are boosting demand for EV motors. Furthermore, the expansion of a comprehensive charging infrastructure across Europe is making electric vehicles more practical for everyday use, encouraging greater adoption. Public and private investments in fast-charging networks are addressing range anxiety, and helps in facilitating the widespread adoption of electric mobility. Volkswagen, BMW, Mercedes-Benz, Sono Motors, GO Mobile, Audi, Skoda, Seat, Volvo, Renault, and Fiat are some of the major EV players in the Europe.

The global electric vehicle motor market is aggressively competitive, with both established automotive giants and new entrants. Some of the key companies are Tesla (U.S.), BYD (China), Siemens AG (Germany), LG Magna e-Powertrain Co., Ltd (South Korea), Robert Bosch GmbH (Germany), Allied Motion, Inc. (U.S.), TECO Corporation (Taiwan), Toshiba International Corporation (Japan), Siemens AG (Germany), ABB (Switzerland), AISIN CORPORATION (Japan), Johnson Electric Holdings Limited (Hong Kong), BorgWarner Inc. (U.S.), Nidec Industrial Solutions (Japan), Mitsubishi Electric Corporation (Japan), Tata, GKN Automotive (U.K.), and some others. Collaborations and partnerships are becoming increasingly common to build an EV friendly infrastructure.

By Vehicle Type

By Component

By Power Rating

By Region

Market insights predict the global electric lift truck industry will increase from USD 49.87 billion in 2024 to USD 190.63 billion by 2034, achieving ...

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us