December 2025

The in-car connectivity market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The growing consumer preference to purchase SDVs coupled with numerous government initiatives aimed at enhancing vehicular security has bolstered the market expansion.

Additionally, rapid investment by market players for opening new R&D centers along with developments in 5G infrastructure is playing a prominent role in shaping the industrial landscape. The advancements in C-V2X technology is expected to create ample growth opportunities for the market players in the future.

The in-car connectivity market is driven by the increasing sales of luxury vehicles coupled with numerous government initiatives aimed at developing the 5G infrastructure. In-car connectivity refers to a vehicle’s ability for connecting to the internet and communicate with other cars, infrastructure, and external devices using different technologies. There are several types of connectivity used in enhancing in-car experience such as embedded, tethered. integrated, cellular, Wi-Fi, Bluetooth, dedicated short-range communication (DSRC), satellite and some others. The in-car connectivity is operated using numerous technologies including 3G, 4G, 5G, eSIM, vehicle-to-everything (V2X) and some others. The end-users of in-car connectivity solutions consists of original equipment manufacturer (OEM), aftermarket, fleet operators, telecom providers, insurance companies and some others. This market is expected to rise significantly with the growth of the EV sector in different parts of the world.

| Metric | Details |

| Market Drivers | • Rising sales of luxury and electric vehicles (EVs) • Development of 5G infrastructure and V2X technology • Growing demand for enhanced infotainment and telematics • Government regulations promoting connected and safe mobility |

| Leading Region | North America |

| Market Segmentation | By Connectivity Type, By Technology Type, By Vehicle Type, By Component, By Application, By End-Use and By Region |

| Top Key Players | Continental AG, Robert Bosch GmbH, Harman International, Qualcomm Technologies Inc.,Airbiquity Inc., Elektrobit, Cohda Wireless,Redbend, Commsignia |

The major trends in this market consists of partnerships, business expansions and rapid investment in 5G infrastructure.

The integrated segment dominated the market with a share of around 45%. The growing use of wireless connectivity in software defined vehicles for communicating with other cars has boosted the market expansion. Also, the increasing preference of consumers to use AI-integrated infotainment systems in modern cars to enhance in-cabin experience is further adding to the industrial growth. Moreover, numerous benefits of integrated connectivity such as scalability, superior data quality, improved decision making, advanced data sharing and some others is expected to foster the growth of the in-car connectivity market.

The cellular segment is expected to rise with the fastest CAGR during the forecast period. The growing use of cellular connectivity in electric vehicles for delivering efficient connectivity has boosted the market growth. Additionally, the rising adoption of cellular connectivity solutions by fleet operators for enabling real-time monitoring and remote diagnostics is contributing to the industry in a positive manner. Moreover, numerous advantages of cellular connectivity such as reliability, cost-efficiency, ease of deployment, improved productivity and some others is expected to propel the growth of the in-car connectivity market.

The passenger vehicles segment dominated the market with a share of around 60%. The growing demand for luxury vehicles in numerous countries such as the U.S., Canada, UK, France and some others has boosted the market expansion. Additionally, rapid investment by automotive brands for developing software-defined vehicles coupled with deployment of wireless communication systems in modern cars is contributing to the industry in a positive manner. Moreover, collaborations among automakers and tech providers to integrate advance hardware components in passenger cars to enhance vehicular connectivity is expected to foster the growth of the in-car connectivity market.

The electric vehicles segment is expected to rise with the highest CAGR during the forecast period. The increasing adoption of EVs in various prominent countries such as India, China, Germany, Italy, Canada and some others for reducing vehicular emission has boosted the market growth. Also, the growing emphasis of automakers to integrate WIFI and Bluetooth in EVs coupled with rise in number of EV startups in different parts of the world is playing a vital role in shaping the industrial landscape. Moreover, numerous government initiatives aimed at developing the EV industry along with rising focus of EV companies for integrating high-quality connectivity modules in modern EVs is expected to accelerate the growth of the in-car connectivity market.

The 5G segment led the market with a share of around 35%. The growing emphasis of telecom companies for developing the 5G network in remote areas has boosted the market growth. Additionally, rapid investment by government of several countries such as China, the U.S., Germany and some others for strengthening the 5G infrastructure is playing a crucial role in shaping the industry in a positive manner. Moreover, collaborations among chip manufacturers and automotive companies for developing 5G-enabled processors for modern vehicles is expected to propel the growth of the in-car connectivity market.

The eSIM segment is expected to rise with the fastest CAGR during the forecast period. The growing adoption of eSIMs among the people in developing nations has boosted the market growth. Also, rapid investment by telecom operators for rising awareness about eSIMs in different regions is playing a vital role in shaping the industry in a positive direction. Moreover, numerous advantages of eSIMs including convenience & flexibility, device design & durability, security & sustainability, and some others is expected to foster the growth of the in-car connectivity market.

The hardware segment led the market with a share of around 50%. The growing use of high-quality hardware components such as connectivity modules, antennas, and some others in modern cars to enhance connectivity has boosted the market expansion. Also, rapid investment by market players for opening up new production units to increase the manufacturing of hardware components is playing a crucial role in shaping the industry in a positive direction. Moreover, the integration of advanced sensors and low-latency antennas in SDVs is expected to drive the growth of the in-car connectivity market.

The software segment is expected to grow with the highest CAGR during the forecast period. The increasing focus of software companies on developing advanced solutions for enhancing communication between vehicles has boosted the industrial growth. Also, rise in number of software startups in the Asia Pacific region coupled with growing use of cloud-based software in modern cars is contributing to the industry in a positive manner. Moreover, collaborations among software companies and automotive brands for developing advanced software to enhance vehicular communication is expected to accelerate the growth of the in-car connectivity market.

The infotainment segment led the market with a share of around 50%. The growing demand for WIFI-enabled infotainment systems from luxury car owners has driven the market growth. Additionally, rapid investment by automotive companies for integrating advanced infotainment systems in modern cars is contributing to the industry in a positive manner. Moreover, the availability of a wide range of infotainment systems in online platforms such as Amazon, Alibaba, Walmart and some others is expected to foster the growth of the in-car connectivity market.

The telematics segment is expected to rise with the highest CAGR during the forecast period. The increasing use of high-quality telematics solutions in modern vehicles to remotely store, gather, and exchange data from a vehicle to a central server or cloud platform has boosted the market growth. Also, the growing demand for advanced telematics software from fleet operators to track asset movement is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among vehicle manufacturers and software developers to develop AI-integrated telematics solutions for modern cars is expected to proliferate the growth of the in-car connectivity market.

The OEM segment led the market with a share of around 80%. The growing emphasis of automotive OEMs for purchasing high-quality communication systems from third-party companies has boosted the market growth. Additionally, rapid investment by OEMs for opening up new workshops for providing superior service experience to consumers is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among automotive OEMs and software developers for developing advanced communication software for modern vehicles is expected to propel the growth of the in-car connectivity market.

The aftermarket segment is expected to expand with the fastest CAGR during the forecast period. The rise in number of automotive aftermarket companies in different parts of the world has boosted the market growth. Also, rapid investment by aftermarket providers for delivering superior hardware and software components to automotive consumers at less prices is playing a prominent role in shaping the industry in a positive direction. Moreover, the availability of advanced connectivity modules in online platforms such as Amazon, Ebay, Walmart and some others is expected to foster the growth of the in-car connectivity market.

North America led the in-car connectivity market with a share of around 35%. The increasing sales of autonomous vehicles in the U.S. and Canada has boosted the market growth. Also, rapid investment by automotive brands for developing the V2X network coupled with rise in number of technology startups is playing a vital role in shaping the role in shaping the industry in a positive direction. Moreover, the presence of various market players such as Qualcomm Technologies Inc., Visteon Corporation (VC), Magna International Inc. and some others is expected to propel the growth of the in-car connectivity market in this region.

U.S. is the major contributor in this region. The increasing preference of consumers to adopt AI-integrated vehicles for enhancing safety coupled with rapid investment by market players for opening up new production units is playing a vital role in shaping the industrial landscape. Also, the presence of prominent automotive brands such as General Motors, Tesla, Ford and some others has driven the market expansion.

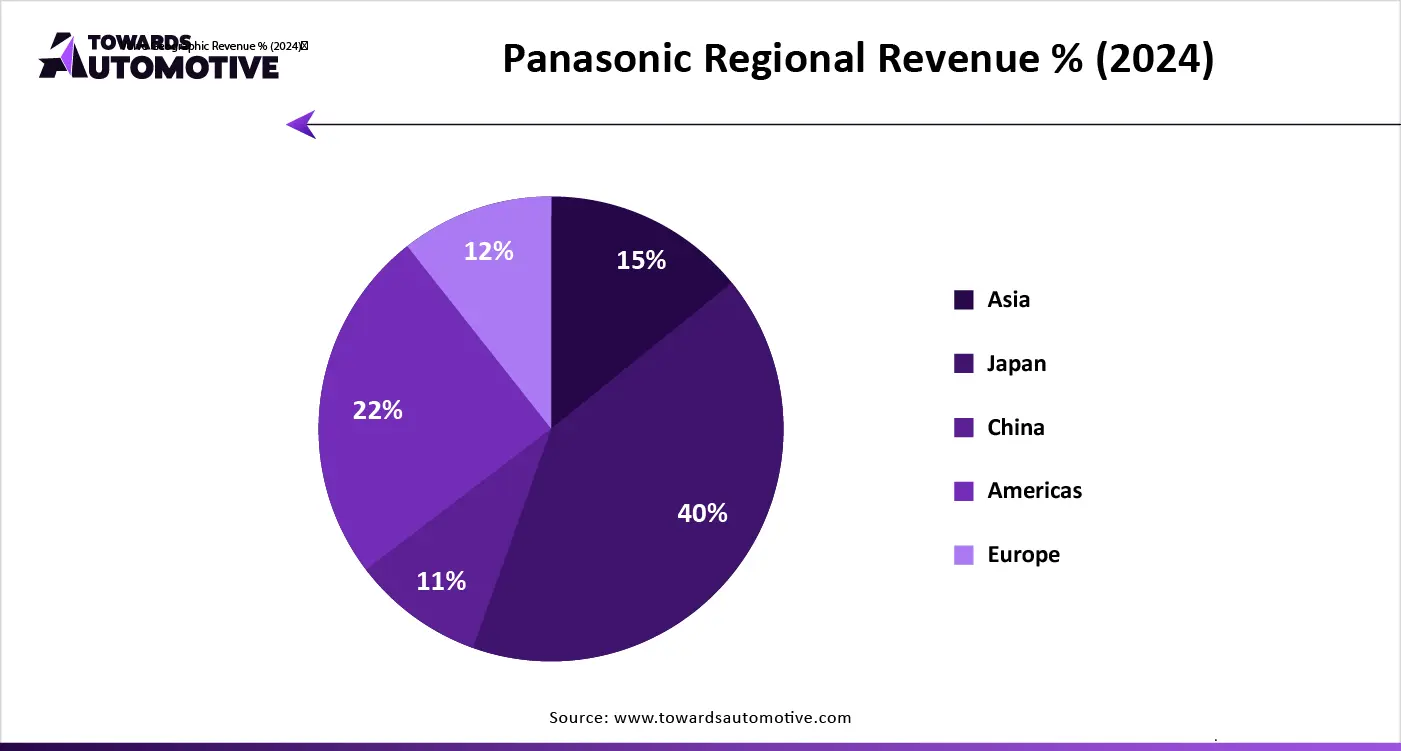

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The growing adoption of electric vehicles in numerous countries such as India, China, South Korea, Japan and some others for lowering vehicular emission has driven the industrial growth. Additionally, the rising investment by government for developing the 5G infrastructure coupled with technological advancements in the automotive sector is contributing to the industry in a positive manner. Moreover, the presence of numerous market players such as Denso Corporation, Panasonic Corporation, Tata Elxsi Limited and some others is expected to foster the growth of the in-car connectivity market in this region.

China and Japan are the prominent contributors in this region. In China, the market is generally driven by the availability of raw materials at reasonable prices coupled with technological advancements in the telecom sector. In Japan, the increasing adoption of self-driving cars by fleet operators along with rapid investment by automotive companies for integrating advanced connectivity in modern cars has contributed to the industry in a positive manner.

| September 2025 | Announcement |

| Mats Lundquist, CEO of Telenor Connexion and Head of Telenor IoT | Together with leading automotive brands we were pioneers within IoT, and we understand the unique challenges they face. The creation of our dedicated automotive unit and now the launch of IoT Drive reflects our deep commitment to supporting both our existing customers and the future of mobility. Our success is tied to our customers’ success, which is why delivering reliable, expert-driven solutions is at the heart of everything we do. |

| June 2025 | Announcement |

| Yasmine King, Corporate VP and Head of the Automotive Business Unit at ADI | We’re proud of our GMSL technology and eager to collaborate with fellow association members on a standard that will strengthen the entire automotive ecosystem. |

| June 2025 | Announcement |

| Shamik Basu, the vice president, Verizon Business | Cars are evolving from mechanical vehicles to software-defined mobile devices with the ability to leverage incredible connected technology. Edge Transportation Exchange leverages that technology to give automakers, governments, and tech developers a robust platform for building out the cellular-connected future of transportation – with visibility and reliability for all road users top of mind. |

| May 2025 | Announcement |

| Chris Jang, Managing Director, Equinix Korea | The future of the automotive industry lies in connected cars. Through a hybrid multicloud infrastructure, auto manufacturers can take advantage of cloud services while maintaining the flexibility to choose between secure, dedicated colocation infrastructure and highly scalable cloud services for each workload they support. Equinix, with its global footprint, offers not only the necessary infrastructure but also an interconnected digital ecosystem and network-dense infrastructure. This can enable Korean companies, including Hyundai Motor, to accelerate their digital transformation and optimize the customer experience. |

| January 2025 | Announcement |

| Masahiro Aono, the CEO of ACCESS Europe | We are thrilled to partner with smart to bring the ACCESS NetFront Browser to its vehicles. Smart is redefining urban mobility, and this collaboration allows us to integrate our in-car browsing technology expertise with smart’s pioneering vision for mobility experiences. Together, we are delivering an outstanding internet experience that meets the needs of modern Chinese drivers. |

| February 2024 | Announcement |

| Luis De La Cruz, Managing Director for OnStar at General Motors Africa and Middle East | Introducing OnStar to the Kingdom of Bahrain is the next step in our efforts to elevate connectivity, safety and an elevated driving experiences in the region. Following the recent launch in the Kingdom of Saudi Arabia alongside Kuwait and the UAE, we are continuing to expand the Middle East’s access to connected mobility, in line with our vision for a world of Zero Crashes, Zero Emissions and Zero Congestion. Through this launch, we are keen to play a role in achieving the nation’s Vision 2030, alongside our journey towards bringing everybody into the next generation of mobility. |

| August 2025 | Announcement |

| Jacques Bonifay, the CEO of Transatel | We are very proud to see MINI joining our prestigious client portfolio. Transatel’s global partnership with BMW Group is growing and so is our footprint in the connected car industry. With Ubigi we offer a unique value proposition to OEMs and their customers for seamless connectivity management. |

| November 2024 | Announcement |

| Eun Seok-hyun, president of LG Vehicle Component Solutions | Digital Cockpit gamma demonstrates LG’s leadership in cutting-edge in-vehicle innovations and our dedication to creating working concepts of transformative technologies for future commercialization in the automotive industry. We will continue to provide customizable vehicle solutions that enhance the in-car experience, ensuring seamless connectivity and a smarter, safer on-road environment. |

| September 2025 | Announcement |

| Pascal Pekcan, the CEO of Technaxx | We are proud to present two smart additions to our automotive product line at IFA 2025. Both the TX-361 and the FMT1800 are designed to enhance in-car comfort and connectivity, reflecting our ongoing mission to deliver technology that improves daily life. |

| June 2025 | Announcement |

| Alex Rawitz, Co-Founder of DIMO | We hear from automakers about the demand for their data, we hear from users about their desire for new connected products and services, and we hear from enterprises about their interest in building new experiences like smart city projects, AI agents, and gamification. DIMO Japan will provide the infrastructure necessary to make these experiences possible. |

The in-car connectivity market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Continental AG, Robert Bosch GmbH, Harman International, Airbiquity Inc., Visteon Corporation, Samsung Electronics Co., Ltd., Siemens AG, Qualcomm Technologies Inc., Denso Corporation, NXP Semiconductors, Aptiv PL, Magna International Inc., Valeo SA, Panasonic Corporation, LG Electronics Inc., ZF Friedrichshafen AG, Tata Elxsi Limited, NVIDIA Corporation, Infineon Technologies AG, TomTom International BV and some others. These companies are constantly engaged in developing advanced connectivity solutions for modern vehicles and adopting numerous strategies such as launches, collaborations, business expansions, partnerships, acquisitions, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Connectivity Type

By Technology Type

By Vehicle Type

By Component

By Application

By End-Use

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us