September 2025

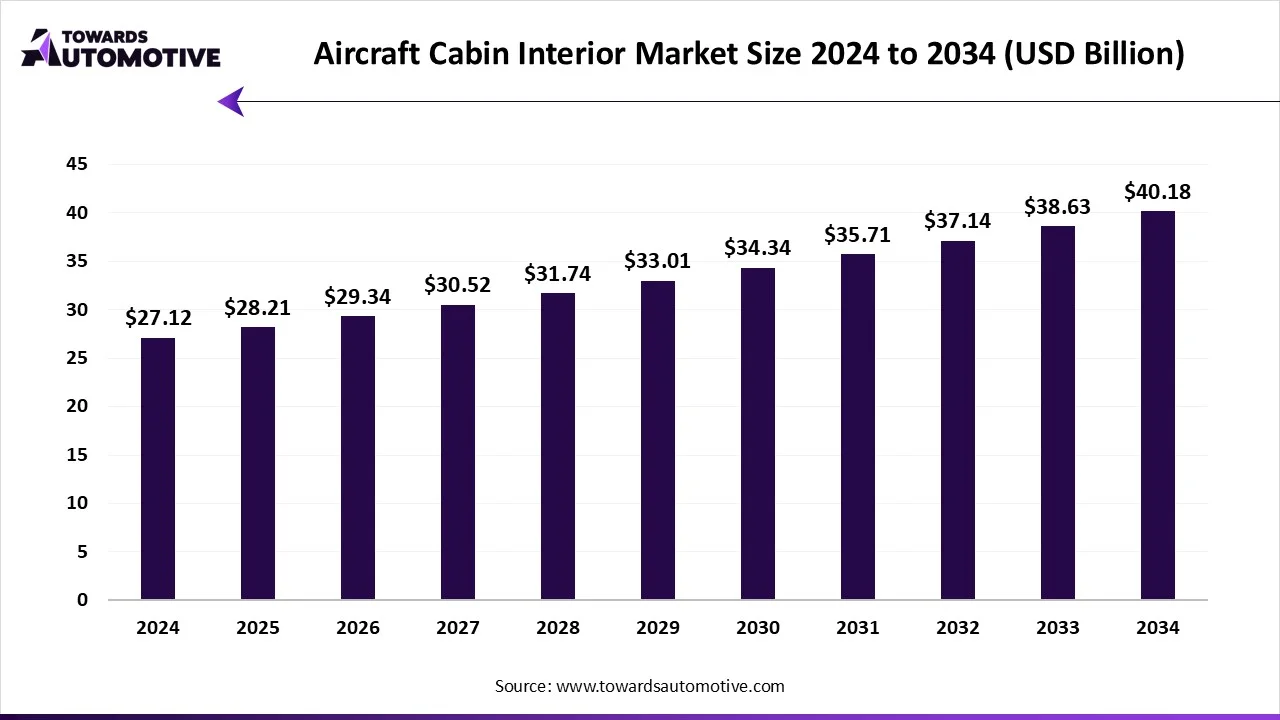

The aircraft cabin interior market is forecast to grow from USD 28.21 billion in 2025 to USD 40.18 billion by 2034, driven by a CAGR of 4.01% from 2025 to 2034. The increasing sales of aircrafts in different parts of the world coupled with rapid deployment of hybrid planes by airline companies has boosted the market expansion. Additionally, technological advancements in the aviation sector along with growing investment by market players for opening new production facilities is playing a vital role in shaping the industrial landscape. The rising use of sustainable materials for manufacturing aircraft interiors is expected to create ample growth opportunities for the market players in the future.

The aircraft cabin interior market is a crucial sector of the aerospace industry. This industry deals in manufacturing and distribution of interior materials for aircrafts around the world. There are several types of products developed in this sector comprising of seating systems, cabin lighting, in-flight entertainment & connectivity (IFEC), galleys & lavatories, cabin panels & partitions, stowage bins & overhead compartments, windows & windshields, flooring & carpets, cabin management systems and some others. These products are manufactured using different types of materials including composites, metals, plastics, textiles, alloys, ceramics and some others. It is designed for numerous types of aircrafts such as narrow-body aircraft, wide-body aircraft, regional jets, business jets, military aircraft and some others. The end-users of this sector comprise of OEMs, aftermarket and MRO. This market is expected to rise significantly with the growth of the aviation sector across the globe.

The major trends in this market consists of business expansions, partnerships and rising sales of aircraft.

The seating systems segment dominated the aircraft cabin interior market. The growing use of eco-friendly materials for manufacturing aircraft seats has driven the market expansion. Also, the increasing adoption of herringbone seats in business jets coupled with technological advancements in the seat manufacturing sector is playing a vital role in shaping the industry in a positive direction. Moreover, the integration of smart seating solutions in military aircrafts is expected to drive the growth of the aircraft cabin interior market.

The in-flight entertainment & connectivity (IFEC) segment is expected to grow with the highest CAGR during the forecast period. The growing demand for high-speed internet access on flights has boosted the market growth. Additionally, the increasing portable IFE system in modern flights is contributing to the industrial expansion. Moreover, rapid of airline companies to shift towards wireless IFE systems to stream content directly to their devices (BYOD) is expected to boost the growth of the aircraft cabin interior market.

The metals segment held the largest share the aircraft cabin interior market. The growing use of aluminum alloys in aircraft cabin interiors due to its high strength-to-weight ratio and corrosion resistance has driven the market expansion. Also, the increasing application of titanium, steel, and magnesium for developing luxury cabins for aircrafts is playing a vital role in shaping the industrial landscape. Moreover, partnerships among metal companies and aircraft manufacturers to use high-quality metals in modern aircrafts is expected to boost the growth of the aircraft cabin interior market.

The composites segment is expected to rise with the highest CAGR during the forecast period. The increasing use of composites for manufacturing several structural aircraft components including floor panels, ceiling panels, sidewall panels, and overhead bin structures has driven the market expansion. Additionally, the rapid adoption of carbon fiber composites and glass fiber composites by aircraft manufacturers is contributing to the industry in a positive manner. Moreover, numerous advantages of composites including weight reduction, high strength, enhanced safety, flexibility and some others is expected to propel the growth of the aircraft cabin interior market.

The narrow-body aircraft segment led the aircraft cabin interior market. The growing use of sustainable materials in narrow-body aircrafts for lowering emission has boosted the market expansion. Additionally, the deployment of these aircrafts by airline companies to manage their businesses by easily adjusting capacity is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of narrow-body aircrafts including airport flexibility, demand-driven allocation, low operating costs, long-haul capabilities and some others is expected to drive the growth of the aircraft cabin interior market.

The wide-body aircraft segment is expected to grow with the fastest CAGR during the forecast period. The increasing use of carbon fiber composites and glass fiber composites to develop cabin interiors for wide-body aircraft has driven the market growth. Also, the growing adoption of these aircrafts by cargo operators to transport from one nation to another has driven the market growth. Moreover, rapid investment by market players for developing high-quality interior parts for these aircrafts is expected to propel the growth of the aircraft cabin interior market.

The economy class segment held the largest share of the aircraft cabin interior market. The increasing demand for economy flights in various developing nations such as India, Thailand, Indonesia, Vietnam and some others has driven the market expansion. Additionally, the growing use of low-cost composite materials to develop cabins interiors for economy planes is expected to boost the growth of the aircraft cabin interior market.

The business class segment is expected to expand with the highest CAGR during the forecast period. The growing use of high-quality seats in business flights to provide superior flying experience to travelers has boosted the industrial growth. Additionally, the increasing preference of HNIs to opt for business-class planes due to their enhanced comfortability and improved convenience is expected to foster the growth of the aircraft cabin interior market.

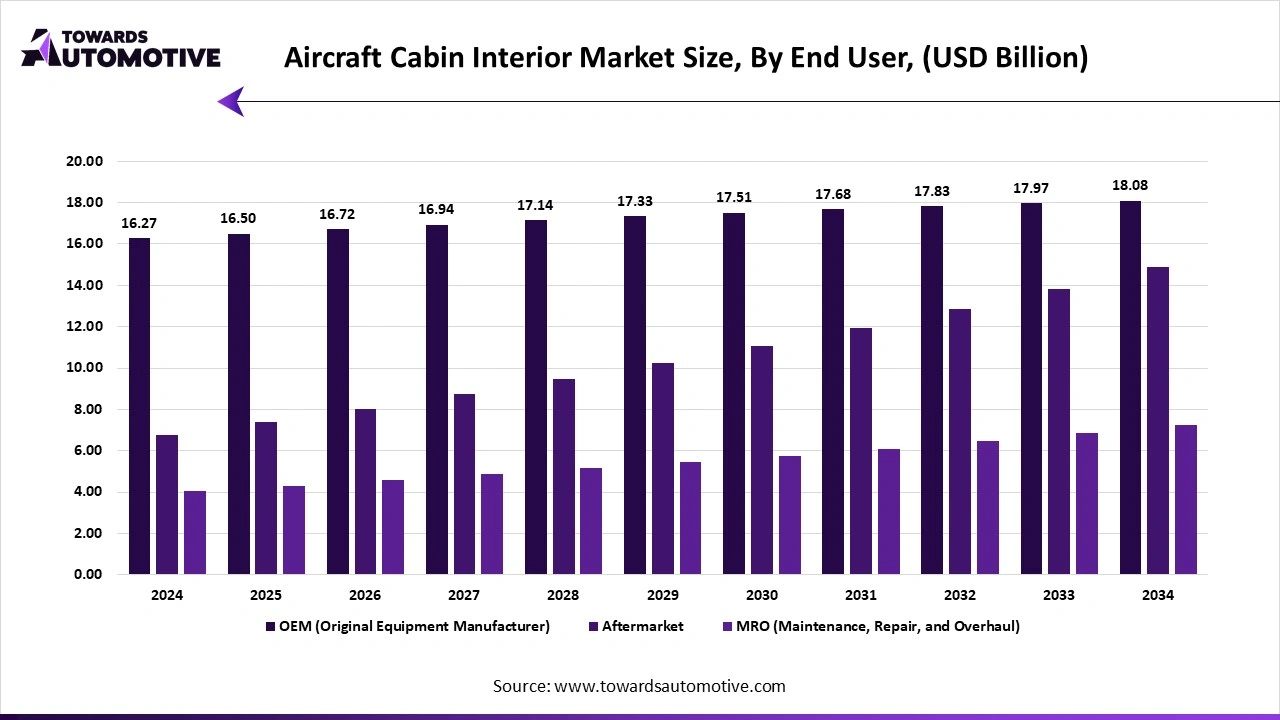

The OEM segment led the aircraft cabin interior industry. The increasing demand for advanced cabin materials from aircrafts OEMs has boosted the market growth. Additionally, rapid investment by OEMs to enhance research and development related to aircraft cabins is expected to propel the growth of the aircraft cabin interior market.

The aftermarket segment is expected to rise with the fastest CAGR during the forecast period. The growing emphasis of aerospace aftermarket companies to use high-quality components for modifying modern aircrafts has driven the market expansion. Additionally, rising focus of aftermarket players to open new outlets to attract large number of customers globally is expected to foster the growth of the aircraft cabin interior market.

The direct sales segment dominated the aircraft cabin interior market. The growing sales of cabin interior components by aircraft manufacturers to OEMs has boosted the market expansion. Additionally, the rising emphasis of airline companies to purchase electronic components from OEMs is expected to foster the growth of the aircraft cabin interior market.

The indirect sales segment is expected to grow with the fastest CAGR during the forecast period. The increasing proliferation of smartphones has enabled consumers to purchase aircraft components from online platforms, thereby driving the market growth. Also, the availability of a wide range of cabin interior materials in e-commerce sites is expected to propel the growth of the aircraft cabin interior market.

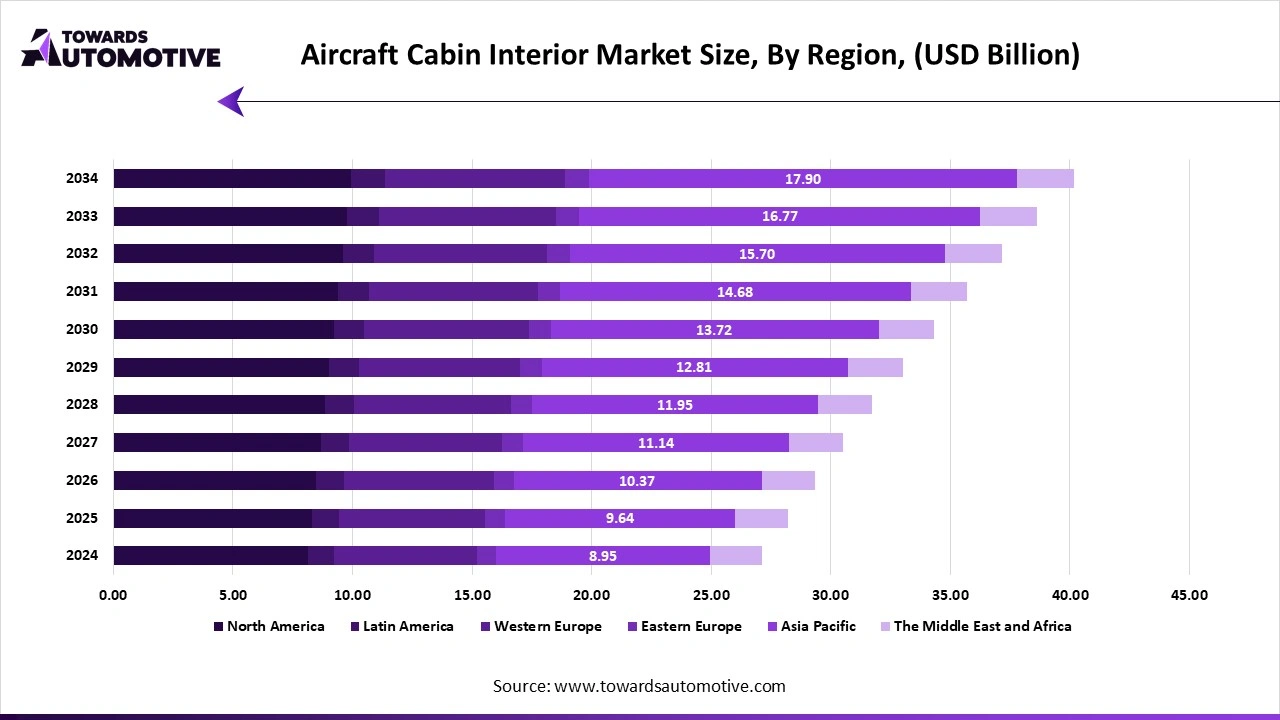

North America led the aircraft cabin interior market. The increasing adoption of hybrid aircrafts in the U.S. and Canada for lowering atmospheric emission has driven the market expansion. Additionally, numerous government initiatives for developing the aviation sector coupled with rapid investment by aerospace brands for opening up new production facilities is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Collins Aerospace, Elevate Aircraft Seating, Astronics Corporation and some others is expected to drive the growth of the aircraft cabin interior market in this region.

U.S. is the major contributor in this region. The growing development in the aerospace industry coupled with rapid investment by government for strengthening the defense sector has contributed to the market expansion. Additionally, the increasing adoption of business aircrafts by corporate companies is playing a vital role in shaping the industrial landscape.

Asia Pacific is expected to expand with the highest CAGR during the forecast period. The growing demand for passenger aircrafts in several countries such as India, China, Japan, Australia, Singapore and some others has boosted the market growth. Also, rapid deployment of cargo planes by logistics operators coupled with technological advancements in the aircraft manufacturing sector is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Panasonic Avionics Corporation, Hong Kong Aircraft Engineering Company Limited, Jamco Corporation and some others is expected to boost the growth of the aircraft cabin interior market in this region.

China and Japan contribute significantly in this region. In China, the market is generally driven by the availability of essential raw materials at low prices coupled with technological advancements in the aviation sector. In Japan, the increasing sales of private jets along with rapid investment by market players for opening new production plants is driving the industry in a positive direction.

There are several types of raw materials used in the production of aircraft cabin interior such as carbon fiber composites, aluminum alloys, and advanced polymers.

Component fabrication in aircraft cabin interiors involves manufacturing diverse components from seats and panels to overhead bins and galleys.

Seats and Cabin Interiors Testing encompasses all evaluations carried out on seating systems, cabin components, and interior materials for aircrafts.

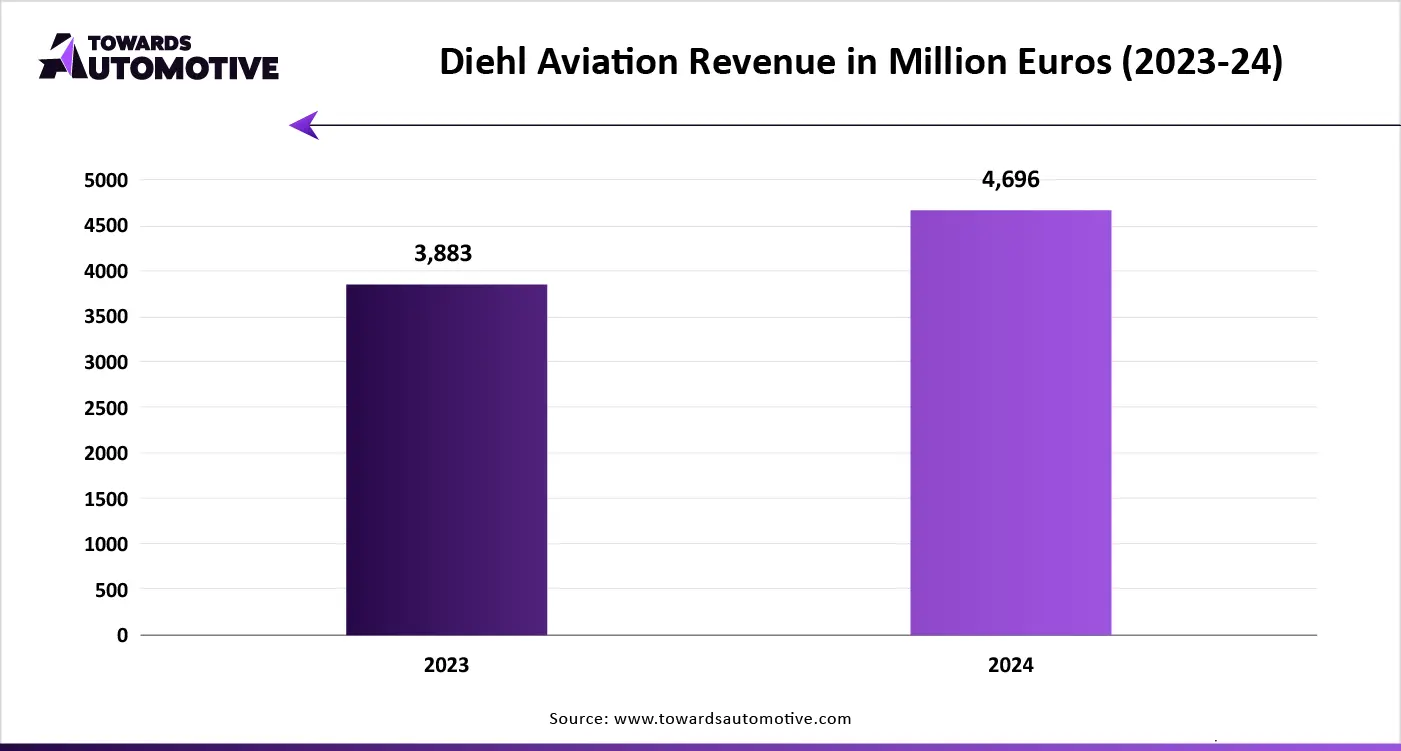

The aircraft cabin interior market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of STELIA Aerospace, Thompson Aero Seating, Safran S.A., Collins Aerospace (Raytheon Technologies), Diehl Aviation, JAMCO Corporation, RECARO Aircraft Seating GmbH, Lufthansa Technik AG, Geven S.p.A, AIM Altitude, FACC AG, ZODIAC Aerospace, Panasonic Avionics Corporation, Thales Group, Hong Kong Aircraft Engineering Company Limited (HAECO) and some others. These companies are constantly engaged in manufacturing cabin interior for the aircraft and adopting numerous strategies such as partnerships, collaborations, launches, expansions, joint ventures, business expansions, acquisitions, and some others to maintain their dominance in this industry.

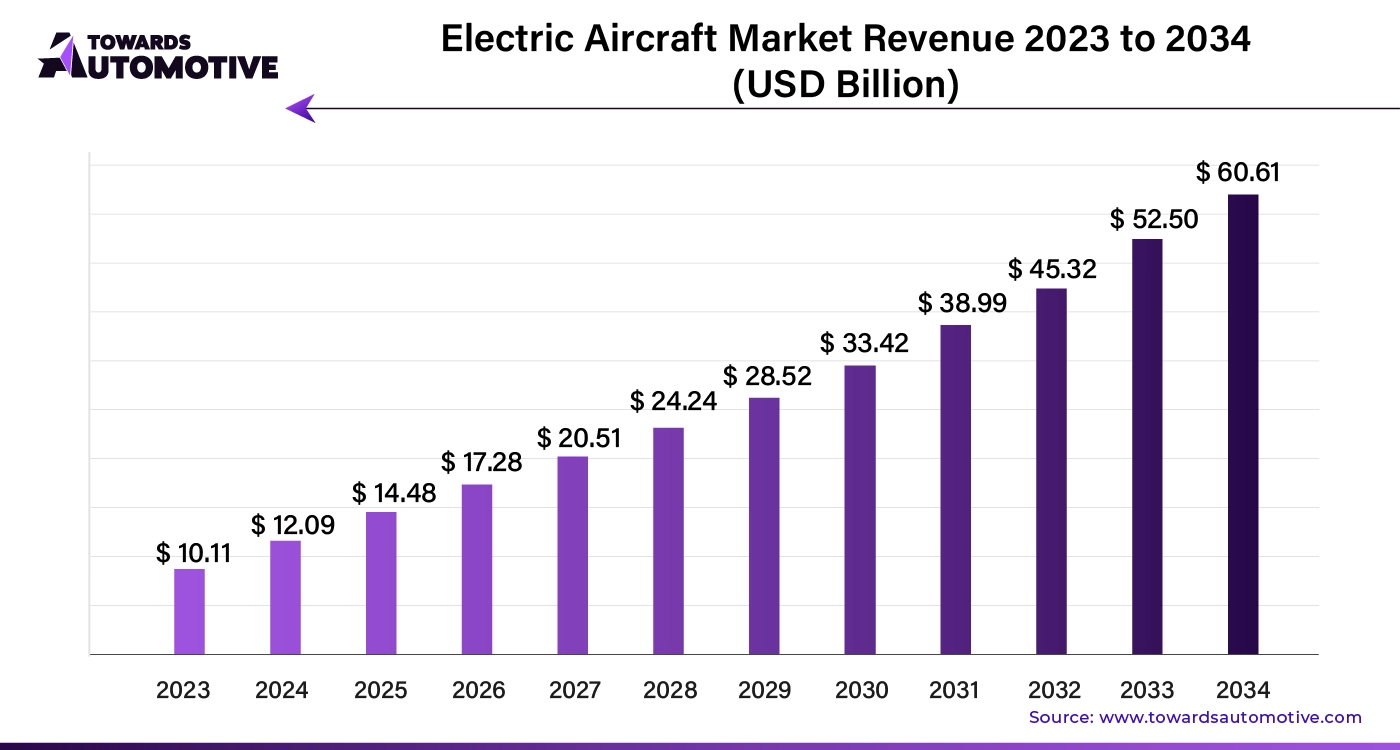

The electric aircraft market is expected to increase from USD 14.48 billion in 2025 to USD 60.61 billion by 2034, growing at a CAGR of 19.83% throughout the forecast period from 2025 to 2034. The growing adoption of eco-friendly aircrafts in developed nations coupled with numerous government initiatives aimed at lowering CO2 emission has driven the market expansion.

The electric aircraft market is a crucial branch of the aviation industry. This industry deals in manufacturing and distribution of electric aircraft in different parts of the world. There are several types of aircrafts developed in this sector comprising of fixed-wing airplanes, eVTOLs (electric vertical takeoff and landing), eSTOLs (electric short takeoff and landing), unmanned aerial vehicles (UAVs) and some others.

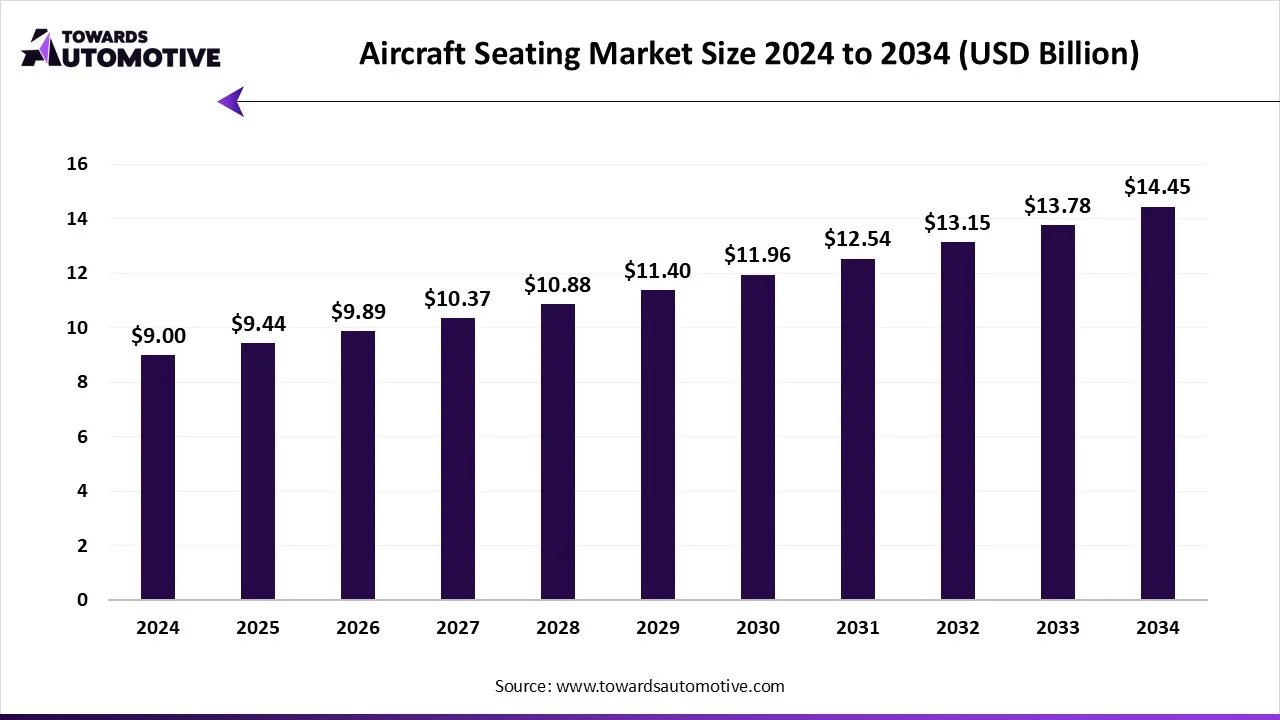

The aircraft seating market is predicted to expand from USD 9.44 billion in 2025 to USD 14.45 billion by 2034, growing at a CAGR of 4.85% during the forecast period from 2025 to 2034. The rising development in the airlines sector coupled with technological advancements in the seating industry is playing a crucial role in shaping the industrial landscape.

Additionally, the growing use of high-quality seats in business jets along with numerous government initiatives aimed at developing the aviation sector has driven the market expansion. The increasing use of carbon fiber composites and sustainable materials for manufacturing aircraft seats is expected to create ample growth opportunities for the market players in the upcoming days.

The aircraft seating market is a crucial sector of the aviation industry. This industry deals in manufacturing and distribution of aircraft seating systems in different parts of the world. There are several types of seats developed in this sector consisting of basic seats, power-enabled seats, Ife-integrated seats, smart / connected seats and some others. These materials are manufactured using various materials including aluminum, carbon-fiber composites, steel, fiberglass and some others.

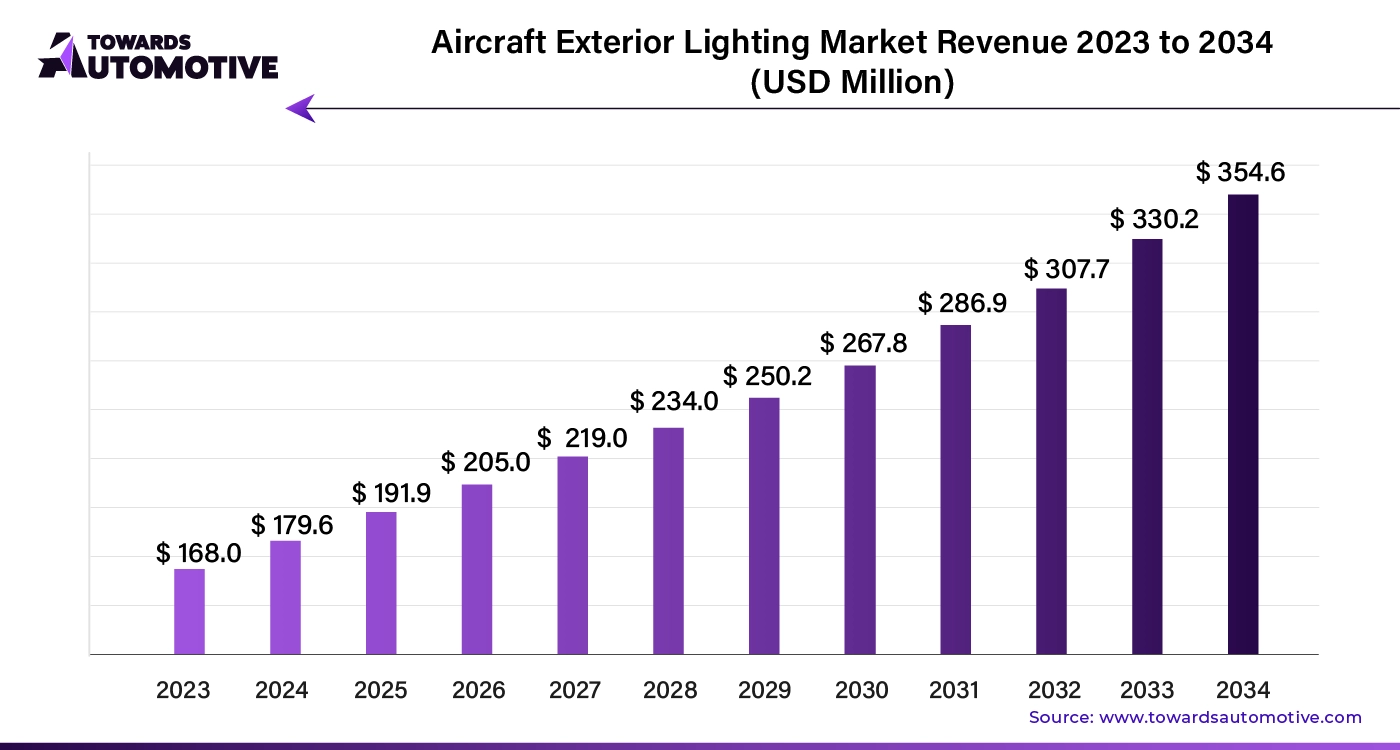

The global aircraft exterior lighting market size is calculated at USD 168 million in 2023 and is expected to be worth USD 354.6 million by 2034, expanding at a CAGR of 6.9% from 2024 to 2034.

AI is revolutionizing the aircraft exterior lighting market by introducing advanced capabilities that enhance safety, efficiency, and operational performance. By leveraging machine learning algorithms and real-time data analysis, AI can optimize the functionality of exterior lighting systems, such as navigation lights, landing lights, and strobe lights. These AI-driven systems dynamically adjust the intensity, pattern, and timing of lights based on various factors like flight conditions, weather, and the aircraft's position, ensuring optimal visibility and minimizing the risk of accidents.

By Product Type

By Material

By Aircraft Type

By End User

By Class

By Sales Channel

By Region

September 2025

January 2025

August 2025

September 2024

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us