October 2025

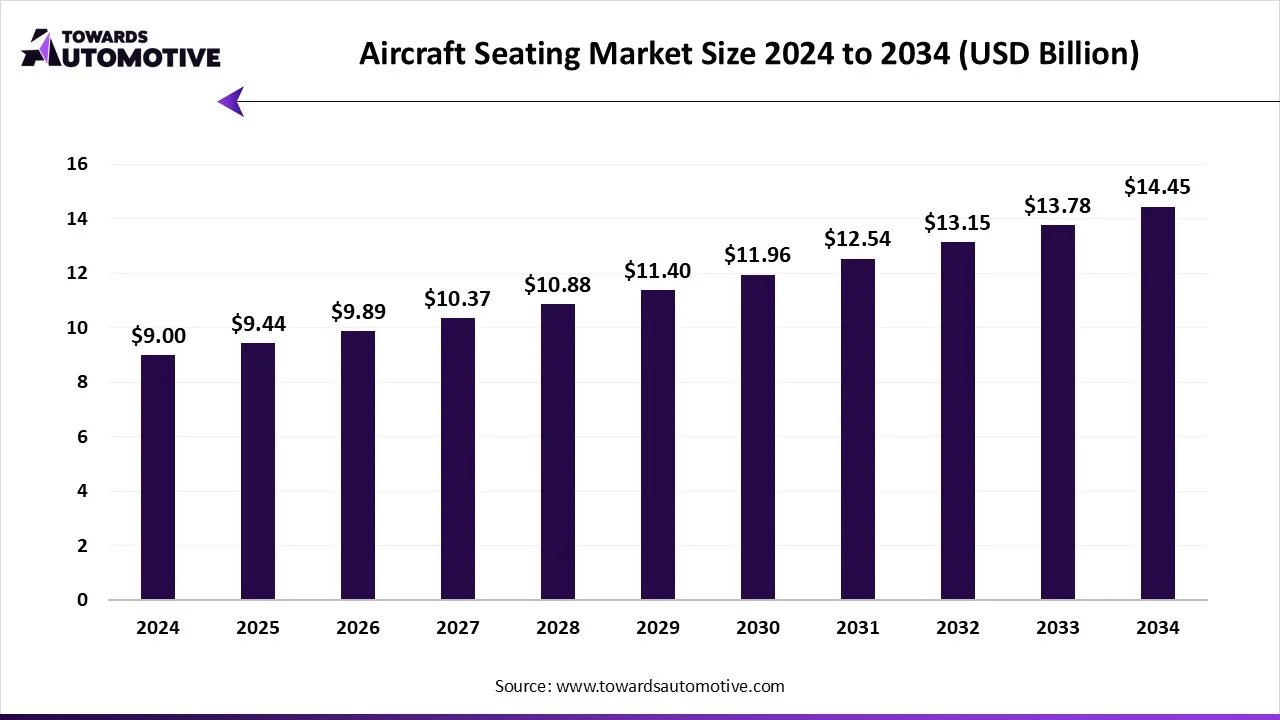

The aircraft seating market is predicted to expand from USD 9.44 billion in 2025 to USD 14.45 billion by 2034, growing at a CAGR of 4.85% during the forecast period from 2025 to 2034. The rising development in the airlines sector coupled with technological advancements in the seating industry is playing a crucial role in shaping the industrial landscape.

Additionally, the growing use of high-quality seats in business jets along with numerous government initiatives aimed at developing the aviation sector has driven the market expansion. The increasing use of carbon fiber composites and sustainable materials for manufacturing aircraft seats is expected to create ample growth opportunities for the market players in the upcoming days.

The aircraft seating market is a crucial sector of the aviation industry. This industry deals in manufacturing and distribution of aircraft seating systems in different parts of the world. There are several types of seats developed in this sector consisting of basic seats, power-enabled seats, Ife-integrated seats, smart / connected seats and some others. These materials are manufactured using various materials including aluminum, carbon-fiber composites, steel, fiberglass and some others. It is designed for different types of aircrafts such as narrow-body aircraft, wide-body aircrafts, regional aircraft, business jets, helicopters / VTOL, military transport aircrafts and some others. The end-users of this sector consists of full-service / network airlines, low-cost carriers (lCCS), regional / commuter operators, business jet operators, military & government operators, helicopter / offshore operators and some others. This market is expected to rise significantly with the growth of the aerospace and defense sector around the globe.

The major trends in this market consists of partnerships, business expansions and government initiatives.

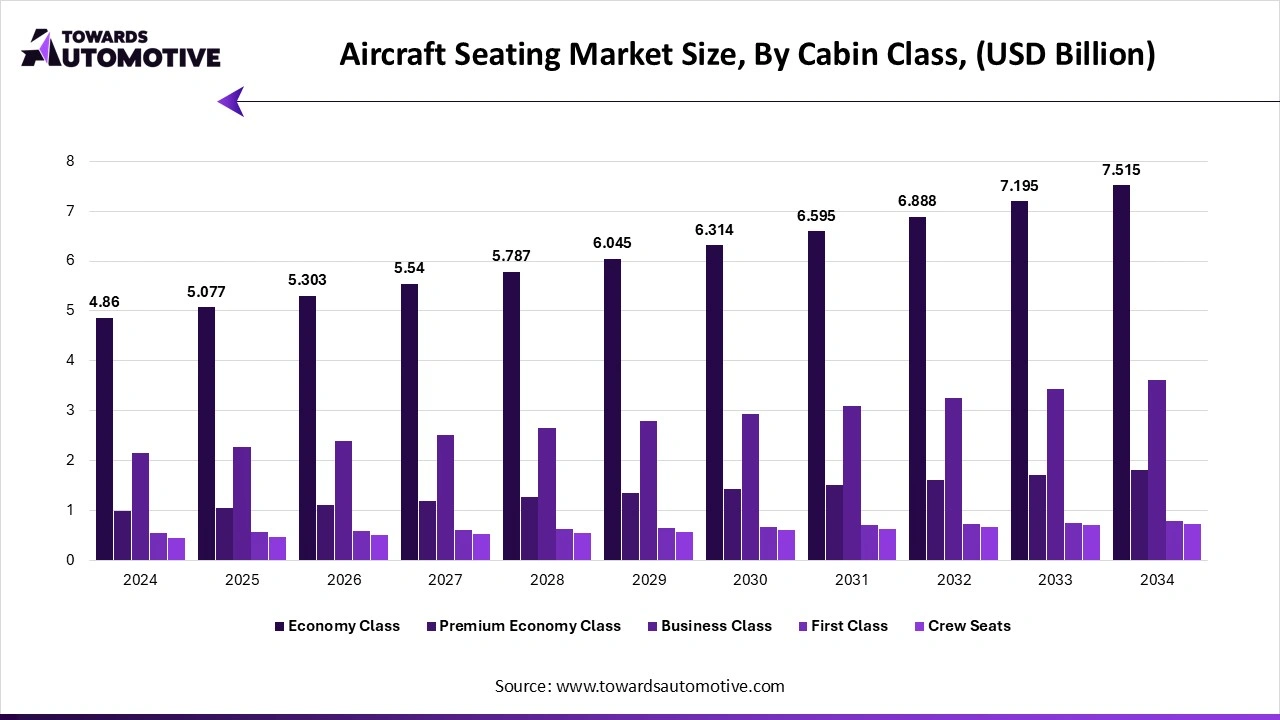

The economy class segment led the aircraft seating market. The growing demand for economy-class aircraft from consumers of several developing nations such as Thailand, Vietnam, India and some others has boosted the market expansion. Additionally, rapid focus of airline companies on deploying cost-effective flights for enhancing inter-state transportation is playing a prominent role in shaping the industry in a positive direction. Moreover, the integration of fixed seats in economy class cabins to lessen maintenance costs is expected to boost the growth of the aircraft seating market.

The premium economy segment is expected to rise with the highest CAGR during the forecast period. The integration of premium economy cabins in international flights to enhance passenger transportation has driven the market growth. Also, the increasing use of reclining seats in premium economy cabins to enable passengers to take rest comfortably is contributing to the industry in a positive manner. Moreover, availability of premium economy seats at lower prices as compared to business class is expected to propel the growth of the aircraft seating market.

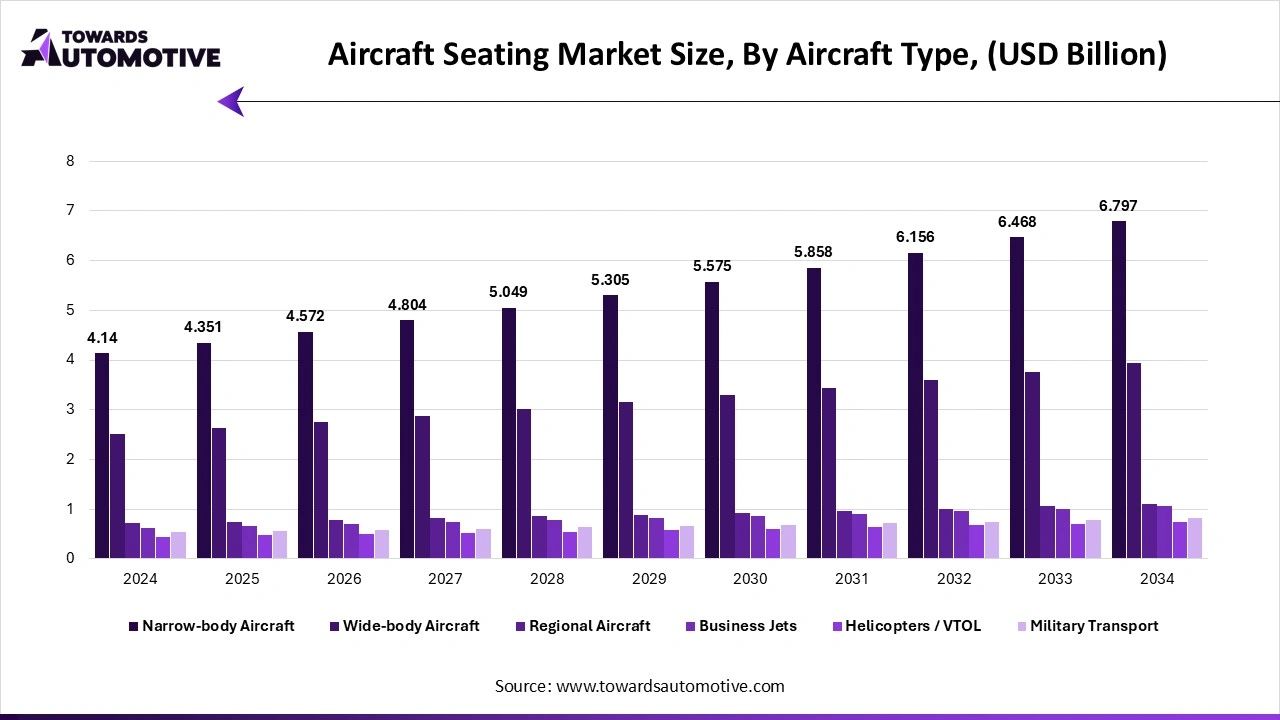

The narrow-body segment held the largest share the aircraft seating market. The growing adoption of narrow-body aircraft by airline companies for operating short-to-medium-haul passenger flights has boosted the market expansion. Also, the integration of high-quality composite-frame seats in narrow-body aircraft to enhance travelling experience of passengers is playing a prominent role in shaping the industrial landscape. Moreover, the deployment of these aircrafts by cargo charter companies and government organizations for transporting key personnels is expected to foster the growth of the aircraft seating market.

The wide-body segment is expected to expand with the highest CAGR during the forecast period. The rising deployment of wide-body aircrafts by international airline companies to operate in long-haul routes has driven the market growth. Also, the integration of first class suites and business class seats in these aircrafts to cater the needs of elite-class consumers is playing a vital role in shaping the industrial landscape. Moreover, joint ventures among airline operators and aircraft seat manufacturers to design advanced seating systems for wide-body aircrafts is expected to propel the growth of the aircraft seating market.

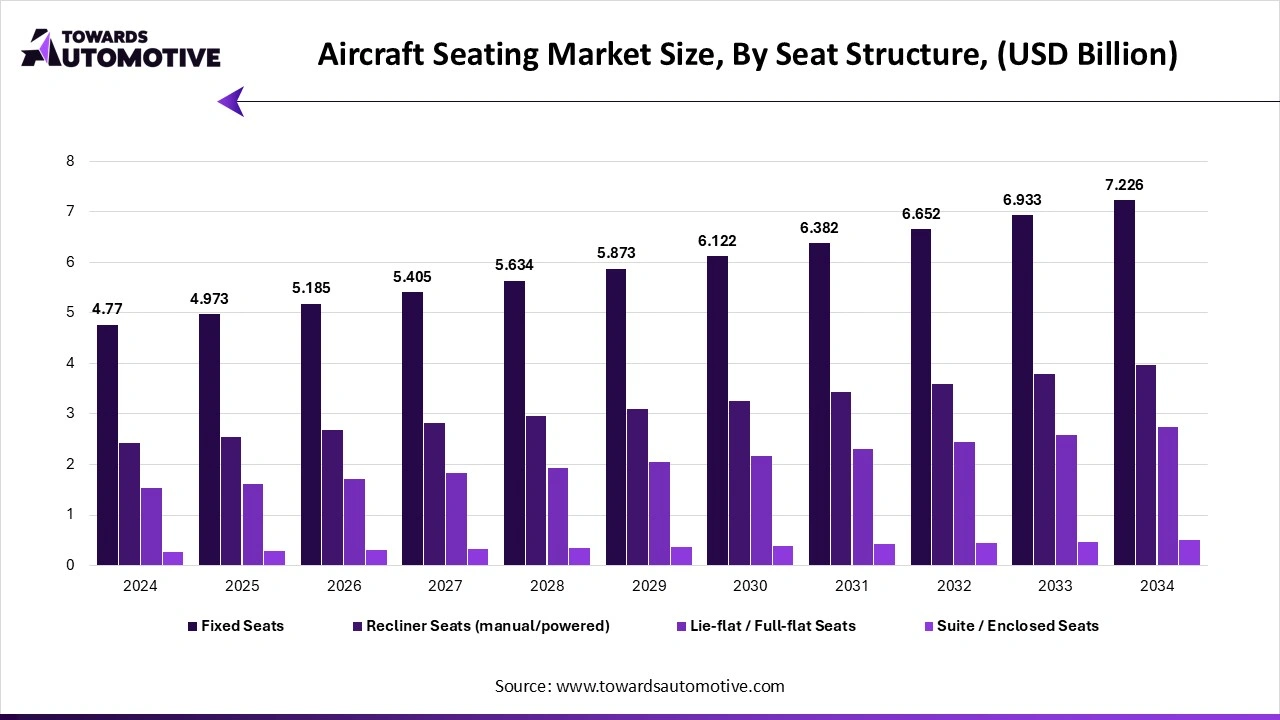

The recliner seats segment dominated the aircraft seating market. The increasing use of recliner seats in short-routes aircrafts for enhancing the seating experience of passengers has driven the market expansion. Additionally, rapid investment by airline companies for integrating high-quality reclining seats in their aircrafts to improve the travelling experience is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of reclining seats including enhanced comfort and relaxation, improved ergonomics, flexibility in cabin design, superior sleeping experience and some others is expected to boost the growth of the aircraft seating market.

The suite / enclosed seats segment is expected to grow with the fastest CAGR during the forecast period. The rising adoption of enclosed seating systems by international airline companies to enhance the travelling experience of passengers has boosted the market growth. Additionally, the rapid focus of business jet operators to integrate suite seating systems in luxury aircrafts for delivering superior comfort to corporate professionals is playing a vital role in shaping the industry in a positive manner. Moreover, several advantages of suite / enclosed seats such as privacy and personal space, superior comfort, premium amenities, reduced fatigue, luxurious experience and some others is expected to drive the growth of the aircraft seating market.

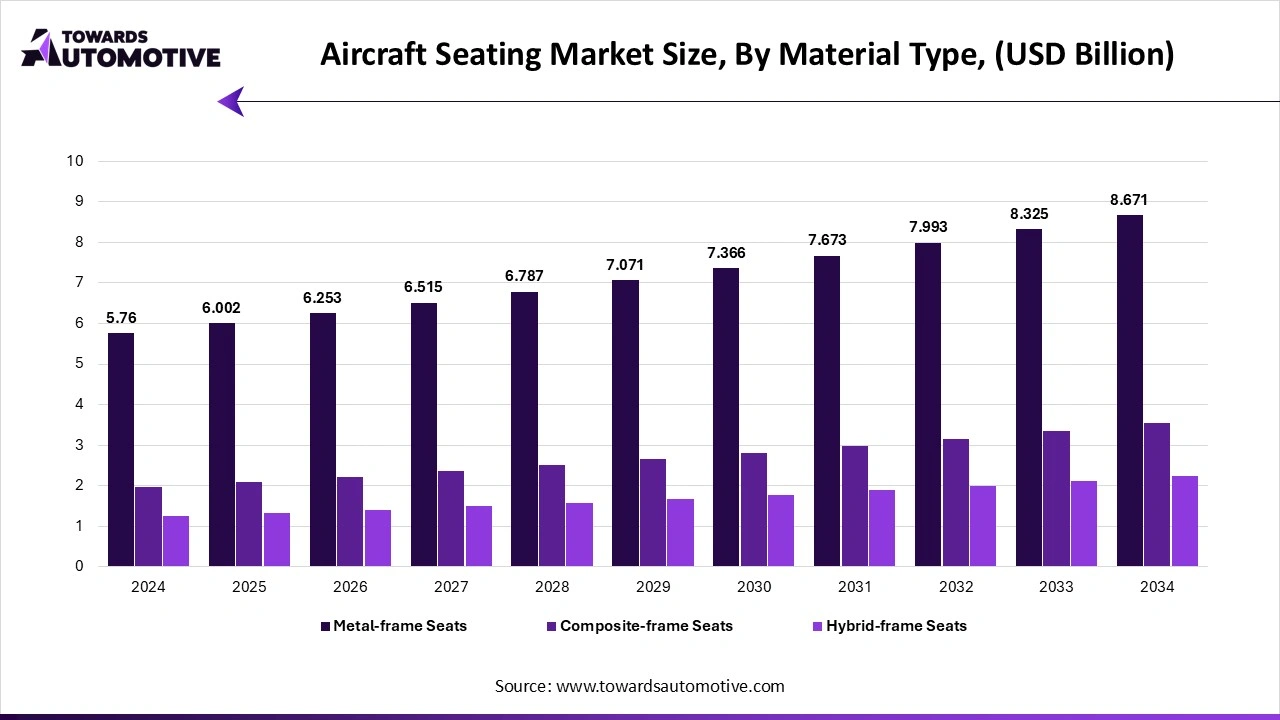

The metal frame segment led the aircraft seating industry. The metal frame in aircraft seats provides enhanced support and stability for ensuring passenger’s safety during turbulence and emergencies, thereby driving the market expansion. Also, the growing use of aluminum alloys to manufacture metal frames for providing enhanced strength to hold aircraft seats is playing a vital role in shaping the industry in a positive manner. Moreover, numerous advantages of metal frames including superior strength, high durability, long-term pest resistance, and some others is expected to foster the growth of the aircraft seating market.

The composite-frame segment is expected to rise with the fastest CAGR during the forecast period. Composite frames offer significant advantages in aircraft seating due to their superior strength-to-weight ratio, that leads to enhancing fuel efficiency, reduced aircraft weight and operational costs, thereby driving the market expansion. Additionally, the growing use of composite frames for integrating high-quality seats in electric aircrafts is playing a prominent role in shaping the industry in a positive direction. Moreover, rapid investment by market players for developing superior-quality composite frames is expected to boost the growth of the aircraft seating market.

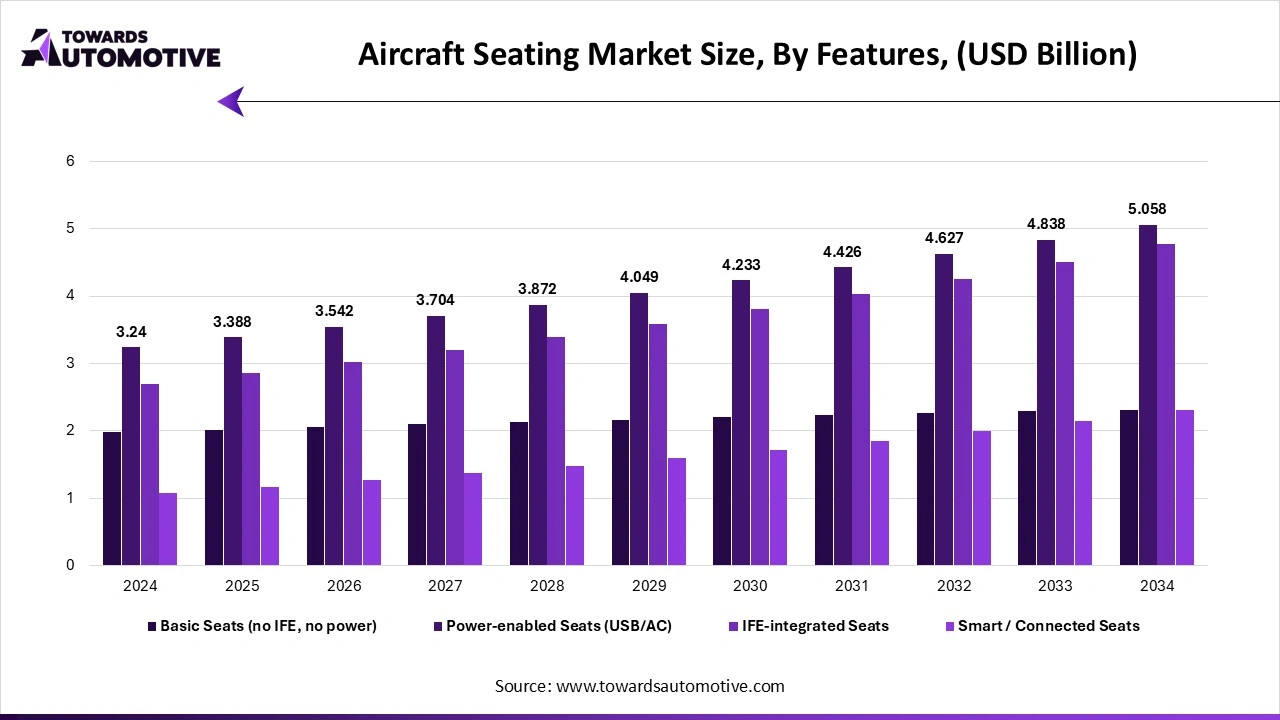

The power-enabled segment held the largest share of the aircraft seating market. The integration of USB charging ports in aircraft seats to enable passengers for charging their devices during travelling has boosted the market expansion. Additionally, the growing focus of airline companies to deploy air-conditioned seats in long-haul aircrafts for providing enhanced comfort to passengers is playing a vital role in shaping the industry in a positive direction. Moreover, partnerships among aircraft developers and seat manufacturers to develop power-enabled seating system for business jets is expected to propel the growth of the aircraft seating market.

The smart / connected seats segment is expected to grow with the highest CAGR during the forecast period. The growing adoption of smart seating systems in private planes to enhance the entertainment and luxury experience has driven the market expansion. Additionally, connected seats in an aircraft are used to integrate electronic components such as power outlets, in-flight entertainment products, seat adjustment mechanisms and some others is playing a crucial role in shaping the industrial landscape. Moreover, the integration of AI and IoT in aircraft seating systems to improve the in-cabin experience of passenger aircrafts is expected to foster the growth of the aircraft seating market.

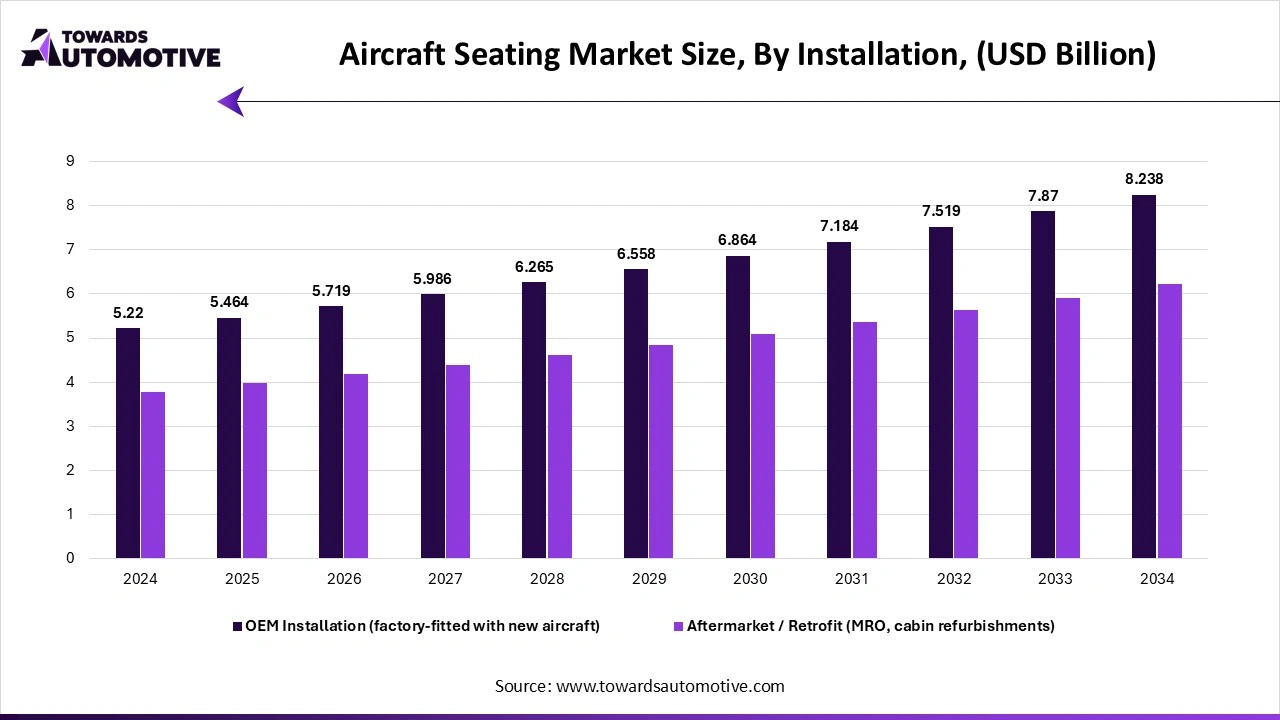

The OEM segment led the aircraft seating market. The growing preference of airline operators to use OEM components in their aircrafts due to guaranteed quality and ensured reliability has boosted the market expansion. Additionally, numerous subscription plans provided by aerospace OEMs to airline companies for regular servicing of aircrafts coupled with availability of wide range of seating systems in OEM platforms is contributing to the industry in a positive manner. Moreover, rapid investment by aircraft OEMs to open new outlets in urban areas to gain maximum consumer attention is expected to propel the growth of the aircraft seating market.

The aftermarket / retrofit segment is expected to grow with the highest CAGR during the forecast period. The increasing focus of private jet owners to integrate smart seating systems in their aircrafts for enhancing their travelling experience has driven the market expansion. Also, rapid investment by business jet operators to use AI-enabled seating systems in business jets is playing a prominent role in shaping the industry in a positive manner. Moreover, the availability of high-quality seating systems in aftermarket platforms is expected to boost the growth of the aircraft seating market.

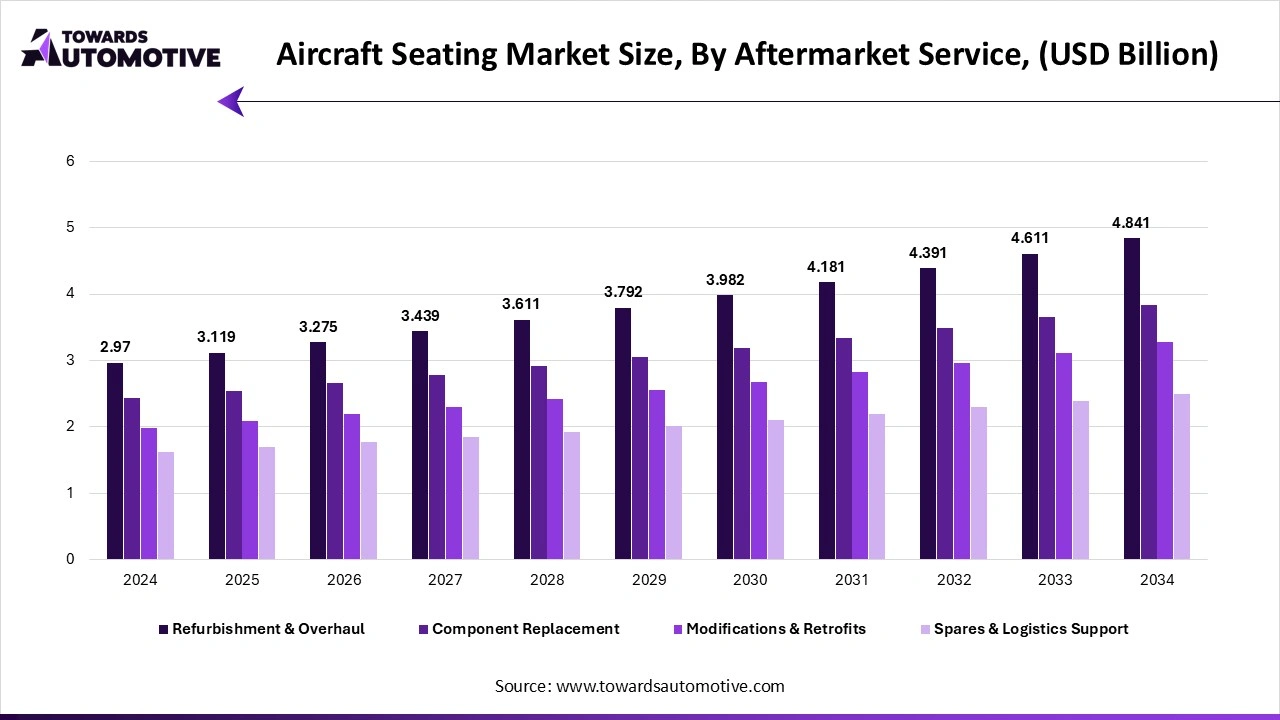

The spares & logistics support segment held the highest share of the aircraft seating market. The rising focus of logistics companies for launching new services to transport aircraft components in different parts of the world has boosted the market expansion. Also, partnerships among aftermarket dealerships and logistics providers to deliver aircraft products in remote areas is playing a vital role in shaping the industrial landscape. Moreover, the availability of a wide range of aircraft parts in several aftermarket platforms is expected to drive the growth of the aircraft seating market.

The modifications & retrofits segment is expected to expand with the highest CAGR during the forecast period. The increasing emphasis of private jet owners to modify their aircrafts to enhance their travelling experience has driven the industrial expansion. Also, rise in number of aircraft modification centers in several nations such as the U.S., France, Israel, China and some others is accelerating the market in a positive direction. Moreover, the growing focus of business jet operators to integrate advanced seating systems in modern aircrafts is expected to propel the growth of the aircraft seating market.

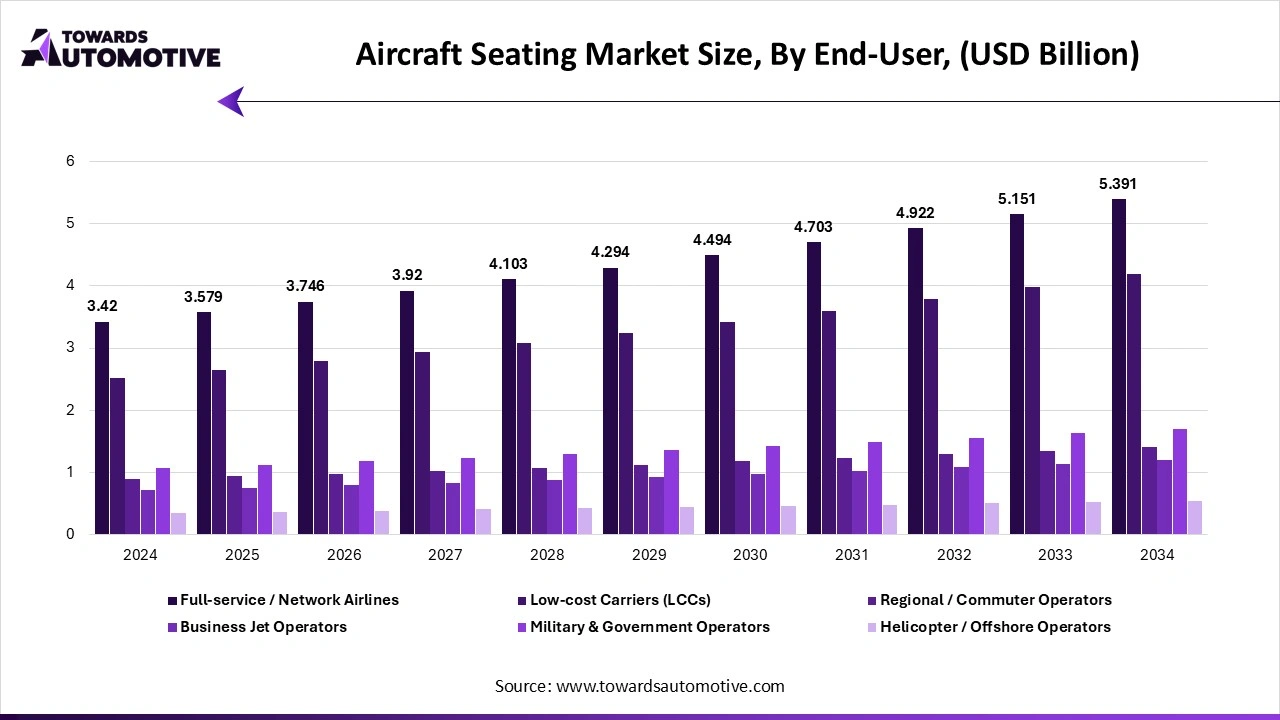

The full-service / network airlines segment held the largest share of the aircraft seating market. The growing focus of airline operators to integrate high-quality seating systems in passenger aircrafts to improve the experience of long-route journeys has boosted the market growth. Also, the integration of power-enabled seats (USB/AC) in premium economy cabins along with rapid investment by airline companies to enhance the travelling experience of passengers is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among airline operators and seat manufacturers to integrate high-quality seating systems in modern flights is expected to proliferate the growth of the aircraft seating market.

The business jet operators segment is expected to expand with the highest CAGR during the forecast period. The increasing demand for luxury planes from the corporate sector to arrange business meetings has driven the market expansion. Additionally, the growing focus of business jet operators to integrate recycling seats in their aircrafts to enhance the travelling experience of corporate leaders is playing a significant role in shaping the industry in a positive direction. Moreover, collaborations among aircraft seat manufacturing companies and business jet operators for developing advanced seating systems for business aircrafts is expected to boost the growth of the aircraft seating market.

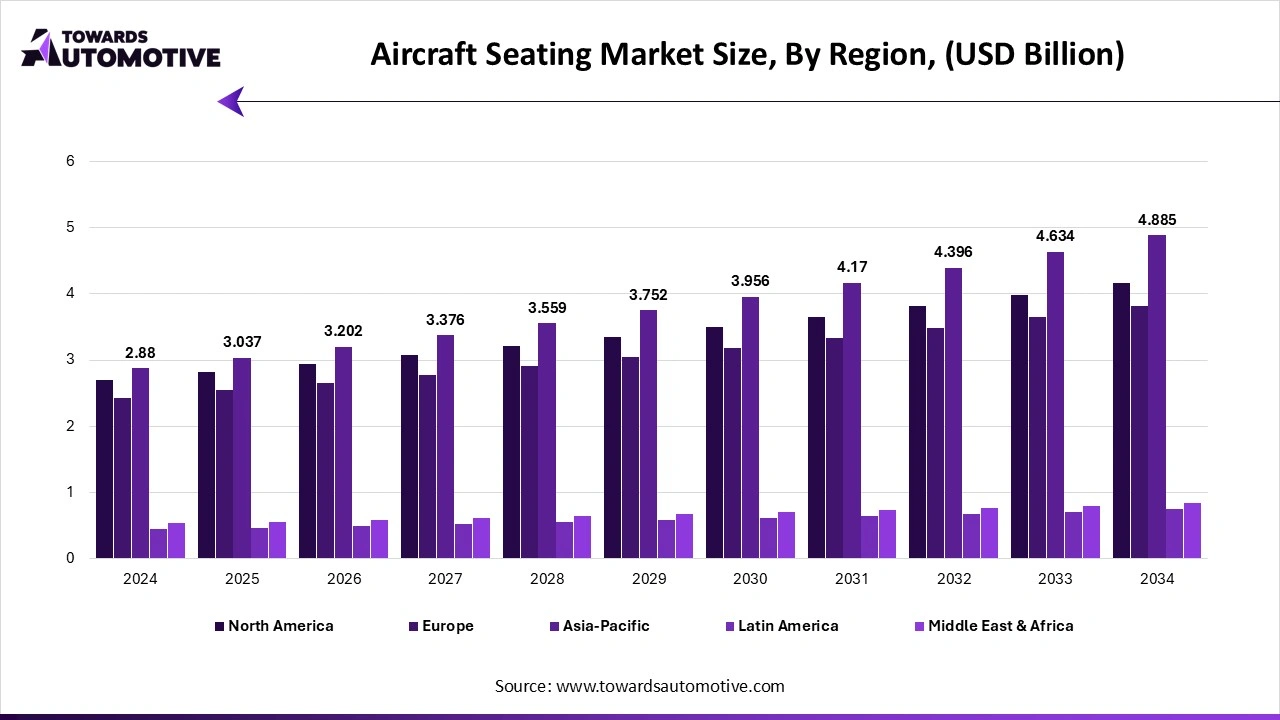

Asia Pacific dominated the aircraft seating market. The growing sales of passenger aircrafts in several countries such as India, China, Japan, South Korea, Singapore and some others has boosted the market expansion. Additionally, the rising focus of government for developing the aviation sector coupled with rapid investment by market players for opening new production facilities is contributing to the industry in a positive direction. Moreover, the presence of various market players such as Jamco Corporation, Mitsubishi Aircraft Corporation, ST Engineering and some others is expected to boost the growth of the aircraft seating market in this market.

China led the market in this region. In China, the market is generally driven by the rapid focus of aircraft companies for developing eco-friendly aircraft seats coupled with technological advancements in the aerospace sector. Additionally, the availability of essential raw materials at low prices along with rise in number of aircraft startups is playing a prominent role in shaping the industrial landscape.

Middle East and Africa is expected to rise with the highest CAGR during the forecast period. The growing demand for utility planes in the African region for remote operations along with rapid adoption of military aircrafts such as Airbus C295 for enhancing the defense sector has driven the market expansion. Additionally, the increasing deployment of electric aircrafts by airline companies of the Middle East region is playing a prominent role in shaping the industrial landscape. Moreover, the presence of several market players such as Sling Aircraft, STRATA Manufacturing PJSC, Joramco and some others is expected to drive the growth of the aircraft seating market in this market.

UAE and South Africa are the prominent contributors in this region. In UAE, the market is driven by the increasing demand for luxury seats from airline companies along with opening of new aircraft MRO centers. In South Africa, the growing sales of passenger aircrafts for operating passenger transportation coupled with rise in number of aerospace startups has played a prominent role in shaping the industrial landscape.

The foundation of aircraft seat production lies in the extraction and supply of essential minerals such as aluminum, carbon-fiber composites and polyurethane foam.

Aircraft seat manufacturing involves assembling various components derived from numerous materials such as aluminum, polyurethane foam, composites (including carbon fiber-reinforced polymers), and fire-resistant fabrics, using processes such as compression molding, wet compression molding (WCM), and Sheet Moulding Compound (SMC) techniques to develop lightweight and strong structures.

Completed seating systems are delivered to aircraft manufacturers for integration into aeroplanes.

| April 2025 | Announcement |

| Marcus Williams, the Sales & Marketing Director at Mirus | We’re now confident we’re launching the best seat in its class, and based on early feedback of the final design, expect it to really challenge the more established seats that are available now. With airlines across the board telling us that they desperately want new seat options to consider in this segment, we’re excited to see how it can disrupt the marketplace and drive Mirus’ growth further. |

| March 2025 | Announcement |

| Andy Morris, Chief Commercial Officer at Thompson Aero Seating | We are incredibly proud of the market’s response to our VantageNOVA platform. The launch of VantageNOVA First offers airlines even greater opportunity to provide truly unique experiences for their passengers. |

| April 2025 | Announcement |

| Tomoji Ishii, the Executive Vice President, Customer Experience Management and Planning of ANA | ANA is committed to continually elevating the passenger experience and the new seats represent our ongoing investment in providing customers with greater comfort and convenience on our international flights, we will continue to seek out and implement innovative solutions to enhance every aspect of the passenger journey with ANA. |

| March 2025 | Announcement |

| Dr Warren Bowden, Head of Innovation & Sustainability at Muirhead and Scottish Leather Group | By incorporating our own bio-protein into the foam’s chemistry, we’ve eliminated the need for harmful additives while improving durability. This sets a new benchmark for next-generation seat foam technology and reflects our commitment to vertically integrated, circular manufacturing. |

| July 2025 | Announcement |

| Michał Fijoł, the CEO of LOT Polish Airlines | LOT’s decision to equip its new aircraft with RECARO seats was driven by a commitment to passenger comfort, durability, and quality. An added benefit is the fact that the seats are produced in Poland. Manufacturing in Świebodzin directly supports local jobs and serves as a strong example of international collaboration with local impact. |

The aircraft seating market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Collins Aerospace, Safran Seats, Recaro Aircraft Seating, Jamco Corporation, Adient Aerospace, Aernnova Aerospace, Acro Aircraft Seating, STELIA Aerospace, Avio Interiors, Expliseat, Thompson Aero Seating, HAECO Cabin Solutions, Mitsubishi Aircraft Interiors (MHI), Poltrona Frau (Interiors), FACC Seating Solutions, Skyline Aircraft Seating, LIFT by EnCore, ZIM Aircraft Seating and some others. These companies are constantly engaged in developing seats for aircrafts and adopting numerous strategies such as partnerships, collaborations, business expansions, acquisitions, launches, joint ventures and some others to maintain their dominance in this industry.

By Cabin Class

By Aircraft Type

By Seat Structure / Design

By Material Type

By Feature / Technology Integration

By Installation Channel

By Aftermarket Service

By End-User

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us