December 2025

The Europe automotive market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The Europe automotive market is experiencing positive growth due to multiple factors, such as changing trends towards electric and hybrid vehicles, as governments encourage this shift to cleaner transportation with offered tax benefits.

In addition, new technology in the marketplace, including self-driving, connected, and safety-improved vehicles, is also driving demand for new vehicles. Moreover, the growth of charging networks and renewable energy is supporting electric vehicle demand in Europe, coupled with changes in lifestyles, rising incomes, and a renewed interest in smart mobility services.

The Europe automotive market represents one of the largest and most advanced mobility ecosystems globally, encompassing the manufacturing, sales, and servicing of passenger and commercial vehicles across the region. It spans traditional internal combustion engine (ICE) vehicles and the accelerating adoption of electric, hybrid, and hydrogen-powered fleets. The market includes multiple categories such as passenger cars, light and heavy commercial vehicles, buses, and specialty vehicles, supported by advancements in connected technologies, digital platforms, and safety features. Europe remains at the forefront of automotive innovation with global OEMs, strong regulatory frameworks, and a shift toward sustainable mobility solutions. Growing electrification, stringent carbon emission policies, and consumer demand for clean vehicles are reshaping product portfolios and driving structural transformation.

Additionally, the European automotive industry has the necessary infrastructure, skilled labor, and research institutions to promote innovations in mobility. Collaboration by automotive manufacturers, tech companies, and governments will continue to accelerate the development and implementation of the autonomous driving framework, smart-charging solutions, and mobility-as-a-service.

The trends in the Europe automotive market are product launches, collaboration, and business expansions.

One significant factor in growth in the Europe automotive market is the rising trend towards electric vehicles. Building minimum emissions standards imposed by the EU and supporting government subsidies encourage consumers to purchase clean vehicles. In addition, OEMs are committing to EV production, increasing battery facilities in partnership with 3rd parties, installing charging networks, and producing additional models. The transition to EVs supports climate change goals and creates massive consumer demand for green mobility solutions, making electrification one of the key growth factors for the industry.

Another significant growth factor is the advancement in vehicle technology, such as connected car features, smart navigation, safety systems, and semi-autonomous driving. Vehicle OEMs in Europe are working in close partnerships with technology companies to digitize and introduce artificial intelligence (AI) systems and data services in vehicles.

A significant opportunity exists in introducing autonomous driving across Europe. The region is currently testing self-driving cars, trucks, and buses in urban and logistical areas. This will reduce accidents, save costs, and increase efficiencies in public transport and the delivery of goods. As the capabilities of AI and sensors improve, Europe now has an opportunity to lead the market in autonomous mobility.

Another key opportunity in the Europe automotive market is building green infrastructure such as electric charging stations, hydrogen refueling points, and smart grids. The number of consumers who buy electric and hydrogen vehicles will grow, resulting in an increasing demand for electric and hydrogen refueling stations or infrastructure to facilitate the growing need for consumer refueling options. In addition, the expansion of infrastructure is proportional to Europe's climate targets, hence providing the automotive market with long-term opportunities to trend sustainably and meet the demands of future forms of mobility.

The passenger cars segment dominated and captured 35% of the Europe automotive market as they are the most utilized mode of transportation for everyday commuting, family travel, and recreation. The combination of reasonable financing options, choices in body style, and their compact size creates a high level of appeal. In addition, these vehicles are constructed with a focus on fuel economy, safety, and electrification, resulting in ongoing consumer demand. Their appeal as a balance of technology and affordability will allow passenger vehicles to remain the preference of customers, especially in urban/ suburban settings where the desire for individual mobility is high.

The battery electric buses & coaches segment is expected to be the fastest-growing segment in the forecasted period, as European cities require public transport to be 100% emissions-free. The availability and use of government funding by local governments, as well as stringent EU emissions regulations, are helping to drive the transition toward battery electric buses and coaches. Significant advancements in battery technology are also improving range, charging speed, and feasibility. With support from EU initiatives toward sustainable urban mobility plans, battery electric buses and coaches will see rapid growth within Europe.

The internal combustion engine segment dominated and captured around 60% of the total market share due to its longer history and a more advanced refueling infrastructure established over time across Europe. They are cheap, abundant, and convenient to drive long distances, hence an attractive option for consumers. Even with the tightening of vehicle emission regulations, ICE vehicles are still a preferred vehicle in many countries in Europe.

The battery electric vehicles (BEVs) segment is expected to witness the fastest growth in the market as they are seen as an increasingly viable option due to EU emission targets and consumer demand for cleaner mobility. Subsidies, tax incentives, and an expanding EV charging network are reducing barriers to consumer adoption. Vehicle manufacturers are responding to this demand with investments in EV technology and growing their portfolios of electric vehicle offerings. Moreover, battery prices are falling, making battery electric vehicles more affordable, providing support for rapidly growing BEV sales.

The gasoline segment dominated and captured almost 40% of the Europe automotive market as they are a widely produced, affordable option with an established fueling infrastructure in Europe. Consumers feel comfortable with gasoline vehicles, finding them ergonomically pleasing in passenger cars and traveling within urban environments. Continual work to improve gasoline engines has also led to increased fuel efficiency and lower emissions, helping gasoline vehicles meet the EU’s tightening standards for vehicles.

The electric & hydrogen segment is expected to be the fastest-growing segment in the forecasted period due to the trend toward carbon-neutral transport in Europe. There are consumer incentives from the government, fueling infrastructure and renewable energy legislation, encouraging the transition. Electric vehicles, in particular, are positioning the transition, while hydrogen vehicles are gaining traction as potential vehicles for long-distance transport and heavy transport. In addition, the vehicle OEMs and suppliers continue to invest heavily in clean energy production.

The manual transmission segment dominated and captured 50% of the Europe automotive market because they have traditionally been preferred throughout Europe, where many drivers are trained on manual cars, while also having reduced purchase prices and lower costs of operation, thereby giving them good value for money to the cost-conscious consumer. In addition, while there is a growing demand for automatics, the cultural ties, affordability, and overall comfort of driving manuals continue to keep it as the dominant transmission choice for motor vehicles.

The automatic transmission segment is expected to grow at the fastest rate in the Europe automotive market due to increasing demand for comfort reasons, particularly in congested urban areas. Some technological changes, including CVT and dual-clutch systems, have improved fuel efficiency, making the automatic more affordable. The growing electric vehicle market, which utilizes automatic transmissions, is also consistent with this demand for comfort and efficiency. Moreover, younger drivers also prefer automatic transmission vehicles as a more convenient option.

The OEM / new vehicle sales segment dominated and captured 65% of the Europe automotive market since most consumers prefer warranties, the latest safety standards, and modern technology. Most government initiatives granting subsidies for electric vehicles (EVs) only apply to new car purchases. Automakers are changing models and updating vehicles frequently, which entices both the individual consumer and fleet users. This means that the OEM sales will remain the most important segment, along with Europe's well-established precedent for buying a new car.

The aftermarket/ used vehicle sales segment is expected to grow at the fastest rate in the market, as numerous consumers want an economical choice in a high-cost market. With the advancement of certified pre-owned programs and access through used vehicle websites, the trust factor has increased, as well as ease. There is also an emerging market for second-hand electric vehicles for purchase to satisfy the interest of consumers wanting less expensive vehicles. Moreover, with the skyrocketing expense of living, economic uncertainty, and delivery times, younger age cohorts are purchasing used vehicles over new vehicles.

The personal mobility segment dominated and captured 55% of the Europe automotive market, as people want to own a car for commuting, leisure, or family reasons. Although public transport remains strong in Europe, many people still value the flexibility and comfort of a personal vehicle. Purchase options and the availability of compact cars and less fuel-consuming vehicles make car ownership more convenient. Moreover, vehicle manufacturers continue to offer cars specifically designed for daily use; these include compact cars for city use and SUVs.

The commercial & logistics segment is expected to be the fastest growing segment in the Europe automotive market due to the increase in e-commerce and delivery services. Firms are expanding their fleets to address the growing demand for last-mile delivery and goods transport. Policy measures and funding are being proposed by governmental organizations for clean logistics and electric vans and trucks. In addition, several companies have also adopted a sustainable fleet to meet their emissions targets.

The individual consumers segment dominated and captured 55% of the Europe automotive market as private car usage remains an esteemed form of mobility for many people. Consumers place value on the independence and comfort that personal car ownership provides. The cost of initial ownership, the ability to lease, and the models available ensure that cars are accessible for most buyers. Moreover, consumers also continue to seek advanced technological features in their vehicles, such as connectivity, driver safety systems, and environmentally friendly vehicles.

The fleet operators' segment is expected to be the fastest-growing segment in the forecasted period as businesses are increasing their fleets of vehicles for logistics, ride-hailing, and corporate car use. E-commerce is driving growth in delivery vans and public transport, such as electric buses. Government policies and tax benefits are providing benefits to companies with green fleet initiatives as well. Moreover, Mobility-as-a-service options are also emerging and expanding, with companies providing pooled on-demand transport.

Germany is the leading country when it comes to the automotive sector in Europe. Some of the biggest car manufacturers in the world, including Volkswagen, BMW, and Mercedes-Benz, are based in Germany. In addition, Germany has a strong manufacturing base, superior engineering, and skilled laborers, giving it an advantage in the European region. Germany also spends a lot on research and development, especially in electric and autonomous vehicles. Tight emission regulations in Europe compel German manufacturers to innovate even faster. Moreover, German vehicles have a considerable global export network, which contributes to the nation's dominance in the market.

France is one of the fastest-growing countries in Europe automobile market due to its fast embrace of electric mobility. The French government has a number of strong incentives for the purchase of electric vehicles, which provide consumers with affordability. French carmakers such as Renault and Peu dis are at the forefront of electric vehicles in the region and the driving force for growth in France. Moreover, the French government is also investing in charging stations and renewable energy to enable the rise of clean vehicles. With expected demand from shared mobility services and urban transport solutions, the country will expect the most growth opportunities.

The United Kingdom is growing at a considerable rate in the Europe automotive market as it is home to prestigious brands such as Jaguar Land Rover, Aston Martin, and Mini, and is committed to increasing the number of electric and hybrid vehicles, with a date of prohibiting new petrol and diesel car sales by 2035. Since this position, there have been strong opportunities for manufacturers and suppliers of electric vehicles in the UK.

Italy is also a key region in the Europe automotive market thanks to a blend of mass-market and luxury brands. Brands such as Fiat are suitable for customers who are looking for everyday mobility, while Ferrari, Lamborghini, and Maserati enhance the value of the premium and sports car segment. Italy has strong suppliers that provide parts and components across Europe. Moreover, the firms in the country are also increasingly interested in electric and hybrid vehicles to meet EU emissions standards.

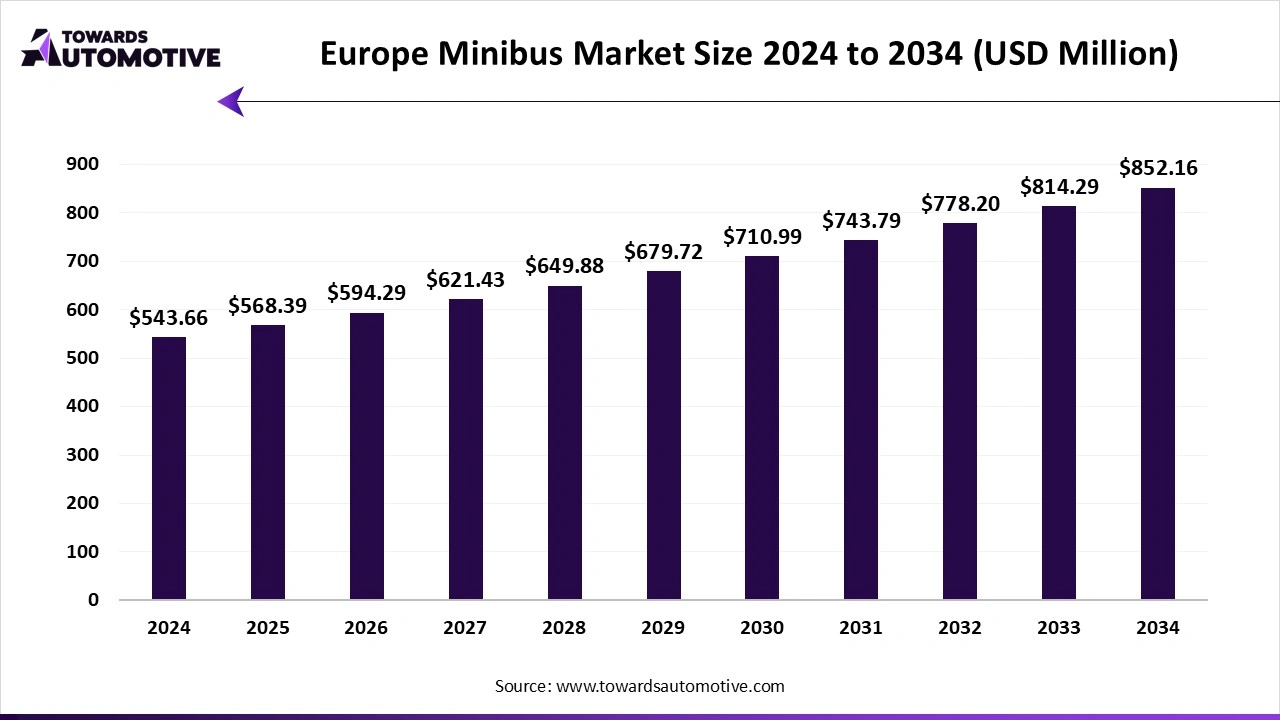

The Europe minibus market is predicted to expand from USD 568.39 million in 2025 to USD 852.16 million by 2034, growing at a CAGR of 4.55% during the forecast period from 2025 to 2034.

The Europe minibus market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of minibuses across Europe. There are several types of buses developed in this sector comprising of M2 buses and M3 buses. These buses are powered using different propulsion technologies consisting of diesel, electric, hybrid, alternative fuel and others.

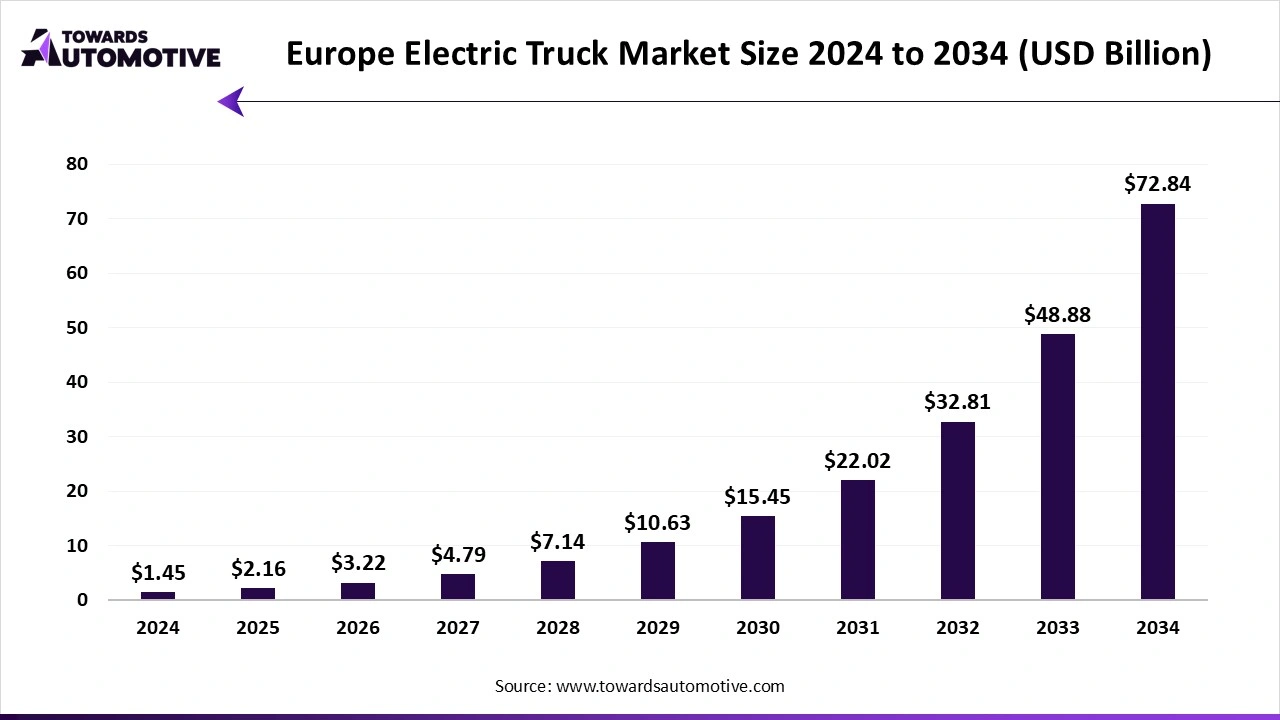

The Europe electric truck market is expected to increase from USD 2.16 billion in 2025 to USD 72.84 billion by 2034, growing at a CAGR of 49% throughout the forecast period from 2025 to 2034.

The Europe electric truck market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of electric trucks in the European region.

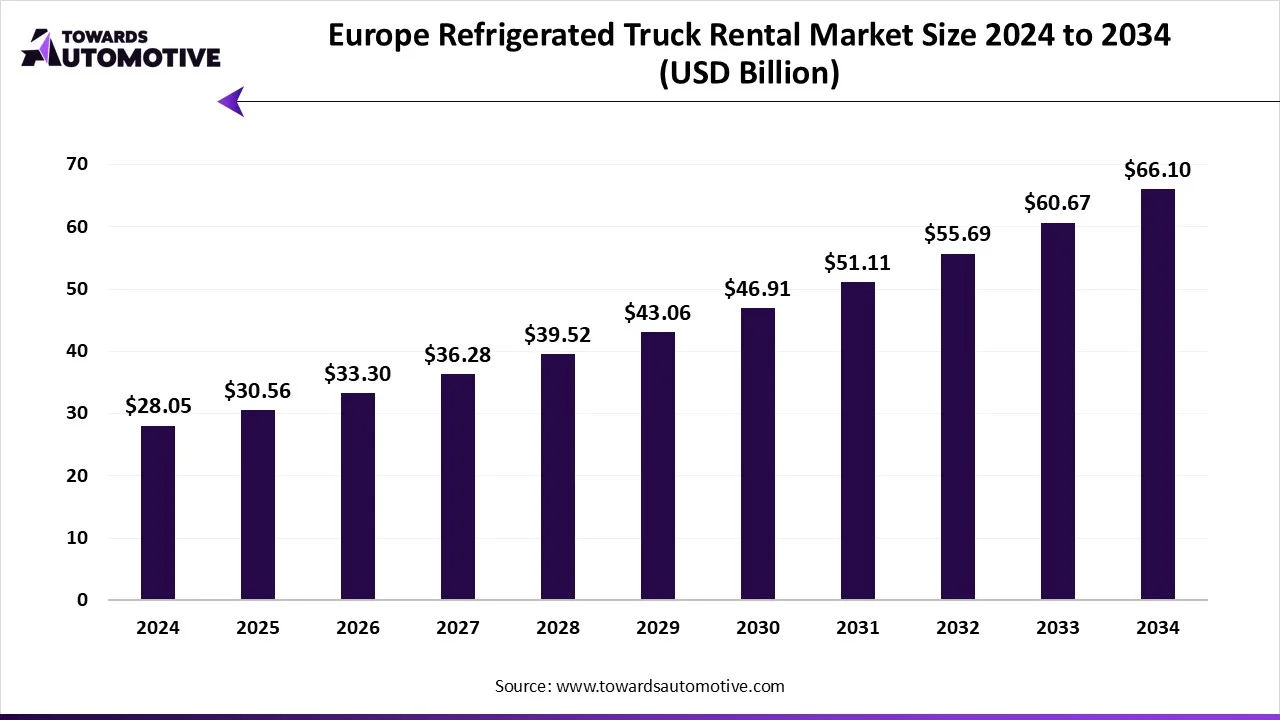

The Europe refrigerated truck rental market is expected to increase from USD 30.56 billion in 2025 to USD 66.10 billion by 2034, growing at a CAGR of 8.95% throughout the forecast period from 2025 to 2034. The growing focus of pharmaceuticals companies on deploying refrigerated trucks for transporting medicinal items along with technological advancements in refrigeration systems is playing a crucial role in shaping the industrial landscape.

The Europe refrigerated truck rental market is a crucial branch of the logistics industry. This industry deals in providing refrigerated truck rental services across the European territory. There are several types of rental services delivered by this sector consisting of short-term rental, long-rental, full-service lease and some others.

The raw material sourced to produce automobiles are steel, aluminum, plastics, rubber, glass, and rare earth minerals for batteries.

Components to be manufactured to produce vehicles include engines, transmissions, tires, electronics, braking systems, and batteries.

The raw material and components are then combined to produce a vehicle and is tested for safety before entering for sale in the market.

| September 2025 | Announcement |

| Takao Kato, president and chief executive officer of Mitsubishi Motors. | Following the launch of the Outlander plug-in hybrid EV (PHEV) and the Grandis hybrid EV (HEV), rolling out the all-new Eclipse Cross marks a crucial step in our electrification strategy in Europe. Having developed the world’s first mass-produced BEV, Mitsubishi Motors has made it a mission to provide environmentally friendly vehicles and has been working toward achieving carbon neutrality. We will continue contributing to the realization of a decarbonized society by expanding our lineup of electrified vehicles, as well as addressing the diverse needs of our European customers. |

| September 2025 | Announcement |

| Roland Prettner, President Magna Complete Vehicles. | We are thrilled to collaborate with XPENG, marking a significant milestone as our first Chinese OEM here in Europe. This partnership underscores our commitment to innovation and flexibility in meeti partner ng the evolving needs of the automotive industry. By leveraging our extensive experience and state-of-the-art facilities, we are well-positioned to support XPENG’s ambitious goals for the European market. |

| June 2025 | Announcement |

| Anupam Singhal, President and Business Group Head, Manufacturing, TCS. | The shift to software-defined vehicles marks a defining moment for the automotive industry. With the launch of these new centers, we are deepening our commitment to support OEMs in building the next generation of intelligent, connected, and sustainable vehicles. This expansion is a key milestone in our journey toward Future-Ready Mobility where software, engineering, and design, backed by AI, converge to deliver safer, more personalized, and continuously enriching experiences for drivers and passengers. |

| October 2024 | Announcement |

| Toshihiro Suzuki, President of Suzuki Motor Corporation. | Suzuki will supply our first BEV to Toyota globally. I am grateful that the collaboration between the two companies has further deepened in this way. While continuing to be competitors, we will deepen our collaborations toward solving social issues, including the realization of a carbon-neutral society through a multi-pathway approach. |

The European automotive market is highly competitive. Some of the prominent players in the market are Opel Automobile GmbH, Renault, Volkswagen Group, Alfa Romeo, BMW, Citroën, Audi, Mercedes-Benz Group, Hyundai Motor Group, Jaguar Land Rover Automotive PL, Robert Bosch GmbH, Continental AG, Ferrari, Porsche, Ford, Skoda, and many more. European automobile manufacturers are concentrating on innovation and sustainability as a means of gaining market leadership. They are actively investing in fully electric, hybrid, and hydrogen-powered vehicles and infrastructure in response to stringent regulations to cut vehicle emissions. Many established automakers are entering into partnerships with battery manufacturers and technology companies with a specific focus on improving range, charging speed, and vehicle-to-vehicle connectivity.

| Company | About |

| Opel Automobile GmbH | The company was established in 1862 in Germany. Opel is a European automaker that produces passenger and light vehicles that are affordable, fuel efficient, and modern. The company performs strongly in family and urban mobility. |

| Renault | The company was established in 1898 in France. Renault is a European automaker that provides cars and electric vehicles, meaning they offer clean and affordable options. The company is known for its models that are compact and suitable for city lifestyles, to assist with the revolution in transportation. |

| Volkswagen Group | The company was established in 1937 in Germany. Volkswagen is one of the largest automotive manufacturers in Europe, with a notable line of passenger and luxury vehicle options. Volkswagen is a leader in electric mobility and exports vehicles, and they are heavily shaping the present and future of the automotive industry in Europe. |

| Alfa Romeo | The company was established in 1910 in Italy. Alfa Romeo is an automaker that produces remarkably stylish performance vehicles, boasting high-performance option-oriented vehicles. In Europe, it markets to a premium client base that can afford electrics, presenting the excitement of driving. |

| BMW | The company began in 1916 in Germany. BMW produces luxury cars, electric vehicles, and motorcycles. It is popularly known in the European market for its high-quality engineering, safety features and luxury driving experience. The company is making investments in electric mobility. |

| Citroën | The business was established in 1919 in France. Citroën is known in Europe for providing families and daily commuter passengers with affordable and comfortable cars. The business is also easily developing electric and hybrid models to support the growing demand for green transport in Europe. |

| Audi | The company began in 1909 in Germany. Audi manufactures luxury and premium vehicles, prioritizing design, advanced technology, and electrification. In Europe, Audi is a leading manufacturer of connected cars, electric vehicles, and high-performance vehicles. |

| Mercedes-Benz Group | The company was established in Germany in 1926. It is one of the leading luxury automotive companies in Europe, building passenger cars, trucks, and vans. Mercedes-Benz is advancing in electric vehicle development, as well as autonomous driving, in the premium segment. |

| Hyundai Motor Group | The business was established in 1967 in South Korea. Hyundai offers passenger cars, SUVs, and electric vehicles in Europe. The brand has grown rapidly due to its affordable pricing, fuel efficiency, and investment in electric and hydrogen modes of transport. |

| Jaguar Land Rover Automotive PLC | The company was founded in 2008 in the United Kingdom. It builds premium vehicles and SUVs under the Jaguar and Land Rover brands. In Europe, it focuses on luxury design, electric innovation, and strong performance in the premium vehicle markets. |

| Robert Bosch GmbH | The business was established in 1886 in Germany. In Europe’s automotive market, Bosch is a major supplier of auto parts to the world, electronic, and mobility solutions. It works on concepts in developing advanced vehicle safety systems, electric drive technology, and, although not currently in development, connected vehicle software is an important meeting point for nearly all automobile manufacturers. |

| Continental AG | Founded in 1871 and headquartered in Germany, Continental provides tires, automotive parts, and mobility technologies, with significant involvement in connected vehicles, battery and electrical systems, and tire technology. In Europe, Continental is a key player in advancing safety and sustainability. |

Tier 1

Tier 2

Tier 3

By Vehicle Type

By Propulsion Type

By Fuel Type

By Transmission Type

By Sales Channel

By Application

By End User

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us