September 2025

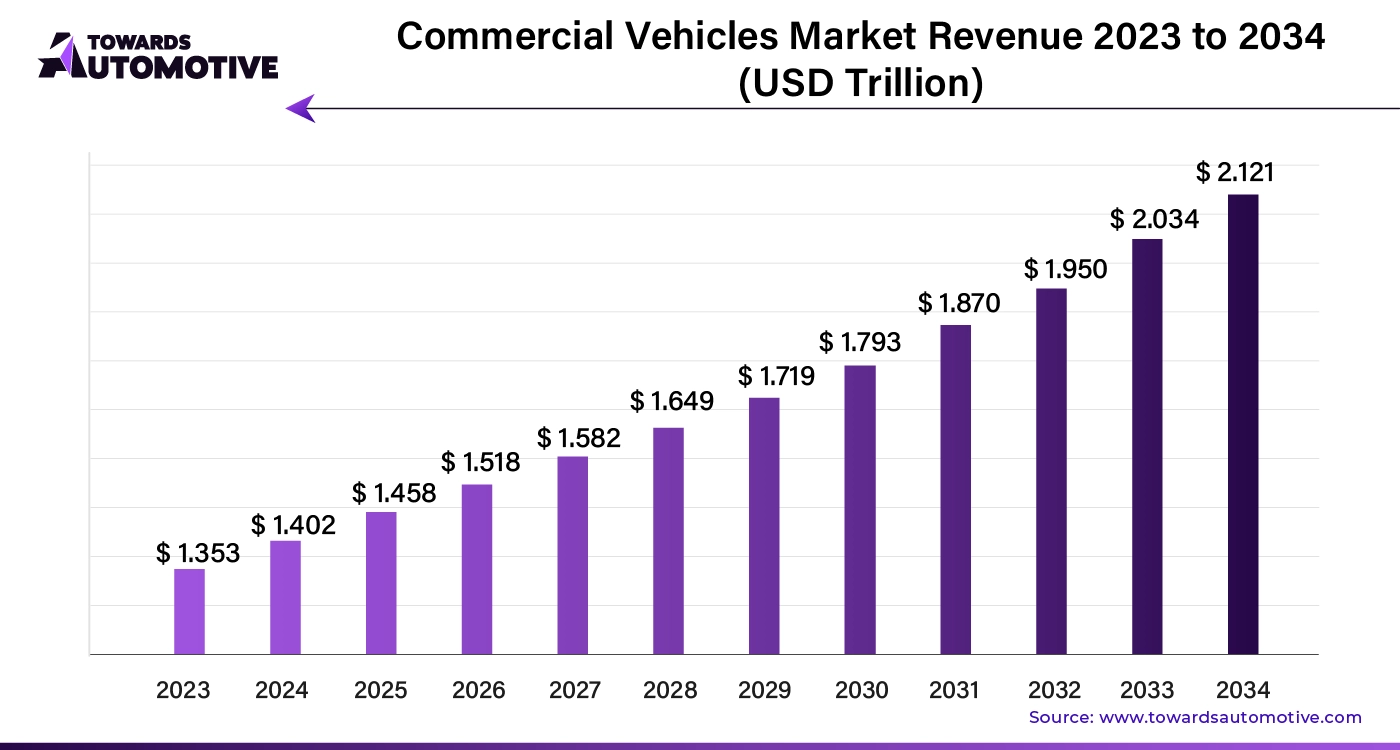

The commercial vehicles market is expected to increase from USD 1.458 trillion in 2025 to USD 2.121 trillion by 2034, growing at a CAGR of 3.75% throughout the forecast period from 2025 to 2034. The growing focus of automotive companies on developing a wide range of commercial vehicles along with rapid adoption of electric trucks by e-commerce brands for operating their daily activities has driven the market expansion.

Additionally, the rising investment by automotive brands for opening new production facilities coupled with numerous government initiatives aimed at developing the public transportation infrastructure is playing a vital role in shaping the industrial landscape. The integration of ADAS and telematics solutions in commercial vehicles is expected to create various growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The commercial vehicles market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of commercial vehicles in different parts of the world. There are several types of vehicles developed in this sector comprising of light commercial vehicles (LCVs), heavy trucks, buses & coaches and some others. It finds application in numerous end-use sectors consisting of industrial, mining and construction, logistics, passenger transportation, and some others. This market is expected to rise significantly with the growth of the EV industry around the globe.

The major trends in this market consists of partnerships, popularity of LCEVs and business expansions.

The light commercial vehicles (LCVs) segment dominated the commercial vehicles market. The increasing adoption of LCVs in several industries such as construction, healthcare, retail and some others has driven the market growth. Additionally, rapid investment by automotive brands for opening new LCV manufacturing plants coupled with growing emphasis of EV startups on developing LCEVs is contributing to the industry in a positive manner. Moreover, partnerships among LCV companies and technology providers to integrate advanced technologies in LCVs is expected to foster the growth of the commercial vehicles market.

The buses & coaches segment is expected to expand with a robust CAGR during the forecast period. The increasing adoption of electric buses by government of several countries for providing sustainable transportation solution to urban commuters has boosted the market expansion. Also, rapid investment by automotive brands for advancing research and development related to bus manufacturing is playing a vital role in shaping the industrial landscape. Moreover, collaborations and partnerships among fleet operators and bus manufacturers to deploy electric luxury buses to enhance long-route travelling experience is expected to drive the growth of the commercial vehicles market.

The logistics segment led the commercial vehicles market. The growing adoption of LCEVs in from the logistics providers to reduce vehicular emission has driven the market expansion. Additionally, rapid investment by automotive brands for developing a wide range of commercial vehicles to cater the needs of the logistics sector is playing a vital role in shaping the industrial landscape. Moreover, partnerships among automotive brands and logistics companies to deploy powerful trucks for transporting goods in different places is expected to boost the growth of the commercial vehicles market.

The passenger transportation segment is expected to grow with a notable CAGR during the forecast period. The increasing emphasis of automotive companies on developing high-quality vans to enhance passenger transportation has driven the market growth. Also, the growing investment by bus companies for manufacturing luxury buses to cater the needs of travelers is contributing to the industry in a positive manner. Moreover, rapid adoption of autonomous vehicles by fleet operators to operate ride-hailing services is expected to drive the growth of the commercial vehicles market.

North America led the commercial vehicles market. The growing demand for electric trucks in the U.S. and Canada for reducing vehicular emission has driven the market expansion. Additionally, the rising emphasis of government for strengthening the public transportation infrastructure coupled with rapid investment by automotive companies for opening new commercial vehicle production facilities is contributing to the industry in a positive manner. Moreover, the presence of various market players such as General Motors, Paccar, Navistar, Peterbilt and some others is expected to boost the growth of the commercial vehicles market in this region.

U.S. dominated the market in this region. The rapid expansion of the e-commerce sector coupled with technological advancements in the automotive industry has driven the market expansion. Additionally, the presence of various local commercial vehicle manufacturers along with increasing sales of electric buses is contributing to the industry in a positive manner.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The increasing sales of luxury buses in several countries including India, China, South Korea, Japan and some others has boosted the market growth. Also, the rise in number of EV startups along with numerous government initiatives aimed at deploying electric trucks for infrastructure activities is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Toyota Motor Corporation, Mahindra and Mahindra, TATA Motors and some others is expected to drive the growth of the commercial vehicles market in this region.

China is the major contributor in this region. In China, the market is generally driven by the ongoing development in the automotive industry coupled with rapid expansion of the logistics sector. Moreover, the increasing emphasis of large automotive giants for opening new manufacturing facilities to produce commercial vehicles is further adding to the industrial expansion.

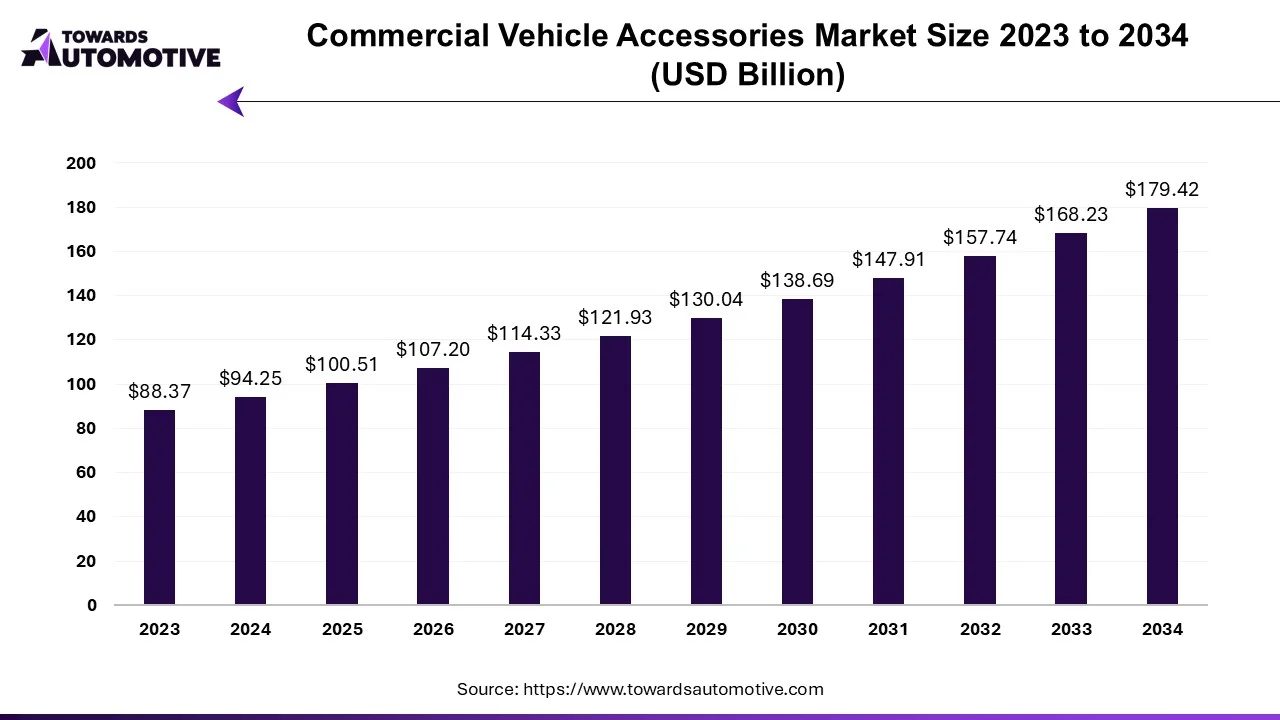

The commercial vehicle accessories market is projected to reach USD 179.42 billion by 2034, growing from USD 100.51 billion in 2025, at a CAGR of 6.65% during the forecast period from 2025 to 2034.

The commercial vehicle accessories market is witnessing robust growth, driven by the increasing demand for efficiency, safety, and customization in commercial fleets. With the rise of e-commerce, last-mile delivery, and logistics services, commercial vehicles play a vital role in supporting economic activities worldwide.

The commercial vehicle accessories market is poised for substantial growth, driven by the increasing demand for efficiency, safety, and customization in commercial fleets. With technological advancements, regulatory mandates, and evolving customer preferences shaping the market landscape, commercial vehicle accessory manufacturers and suppliers need to innovate, collaborate, and adapt to changing market dynamics to capitalize on emerging opportunities and maintain a competitive edge in the global marketplace.

The commercial vehicle accessories market is experiencing a period of transformation, driven by factors such as urbanization, digitalization, and sustainability initiatives. Commercial vehicle accessories encompass a wide range of products and solutions designed to enhance vehicle performance, functionality, and aesthetics. From safety equipment and cargo management systems to telematics solutions and aftermarket upgrades, commercial vehicle accessories cater to diverse needs and requirements across different industries.

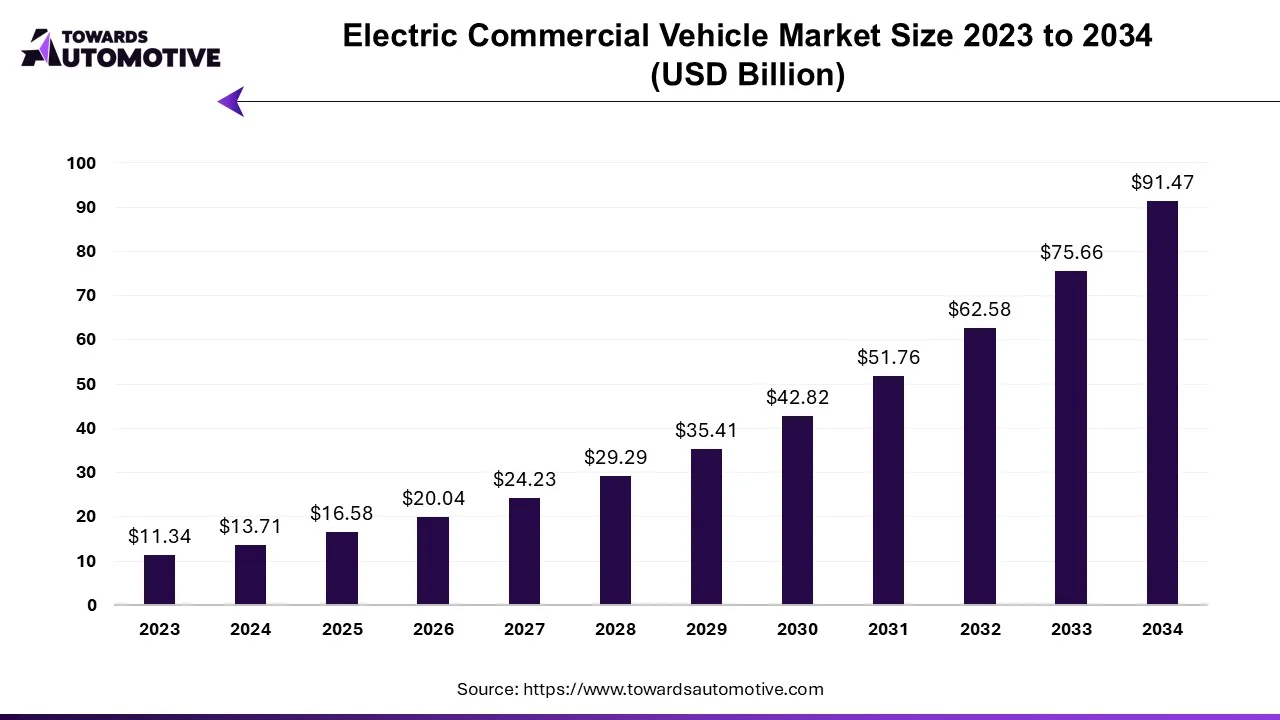

The electric commercial vehicle market is set to grow from USD 16.58 billion in 2025 to USD 91.47 billion by 2034, with an expected CAGR of 20.90% over the forecast period from 2025 to 2034.

The electric commercial vehicle market is a crucial sector of the automotive industry. This market deals in manufacturing and distribution of commercial vehicles that are powered by electricity. This industry manufactures various types of vehicles comprising of bus, trucks and some others. These commercial vehicles are available in different propulsion such as BEV, PHEV, FCEV. There are various components of these vehicles consisting of electric motor, electric vehicle battery, hydrogen fuel cell and some others. The growing demand for electric trucks in different parts of the world has fostered the market growth. This market is predicted to rise significantly with the growth of the EV sector around the world.

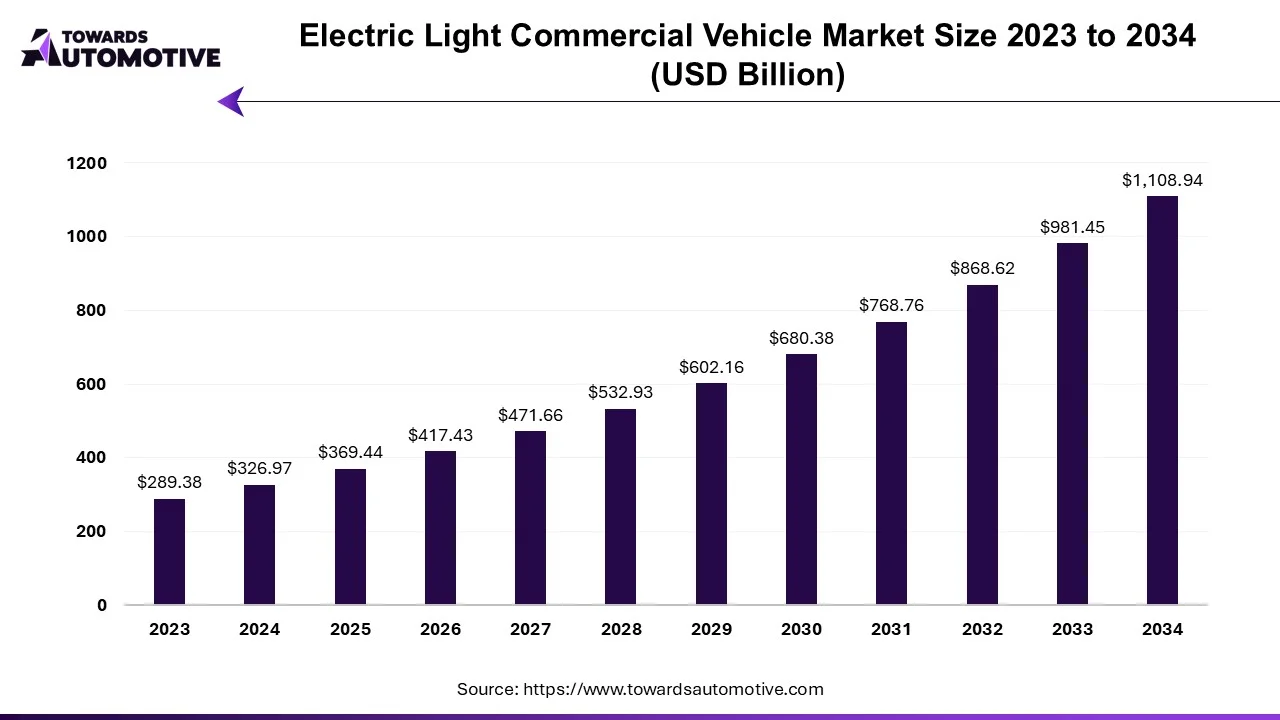

The electric light commercial vehicle market is forecasted to expand from USD 369.44 billion in 2025 to USD 1,108.94 billion by 2034, growing at a CAGR of 12.99% from 2025 to 2034.

The significant growth observed in the electric light commercial vehicle (eLCV) market can be largely attributed to the increasingly stringent environmental regulations and sustainable development measures being implemented across various industries worldwide. Governments are enacting strict standards and regulations aimed at combating air pollution and reducing greenhouse gas emissions, prompting businesses and fleet operators to seek cleaner and more sustainable transportation solutions. eLCVs offer a compelling alternative as they produce zero tailpipe emissions, contributing to cleaner and safer urban environments.

Moreover, the adoption of eLCVs aligns with businesses' goals to comply with regulatory mandates and demonstrate their commitment to environmental sustainability. By transitioning their fleets to electric vehicles, companies can not only meet regulatory requirements but also enhance their corporate social responsibility initiatives and improve their public image.

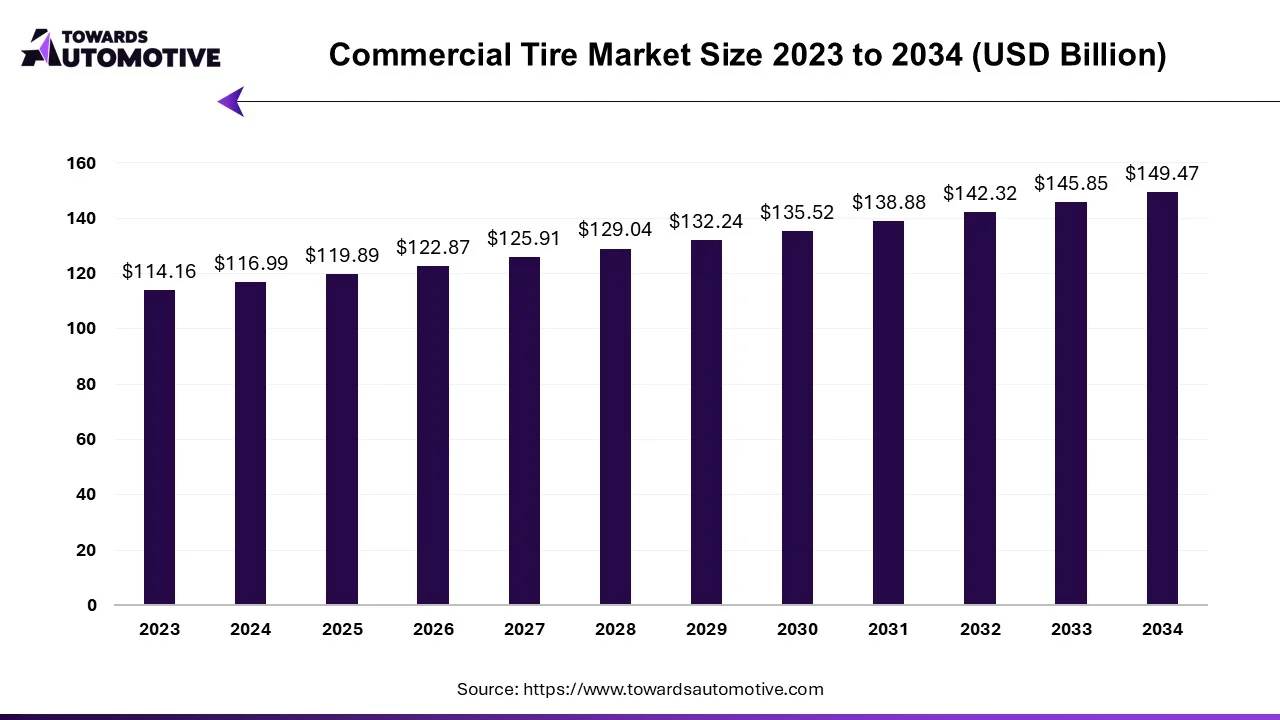

The commercial tire market is expected to increase from USD 119.89 billion in 2025 to USD 149.47 billion by 2034, growing at a CAGR of 2.48% throughout the forecast period from 2025 to 2034.

The commercial tire market is a crucial branch of the automotive materials industry. This industry deals in manufacturing and distribution of tires for commercial vehicles. There are different types of tires developed in this sector consisting of radial tires, bias tires and solid tires. These tires are designed for numerous vehicles such as light commercial vehicles, medium commercial vehicles and heavy commercial vehicles. It finds various application in several sectors including transportation, construction, agriculture, mining and some others. The growing demand for commercial vehicles in different parts of the world has contributed to the market expansion. This market is expected to grow drastically with the growth of the tire industry across the globe.

Commercial vehicles rely on a wide range of raw materials consisting mainly of steel, aluminum, and rubber.

Testing and certification of commercial vehicles ensures they meet safety and environmental standards for roadworthiness.

The commercial vehicles are generally distributed through authorized dealerships and e-commerce platforms.

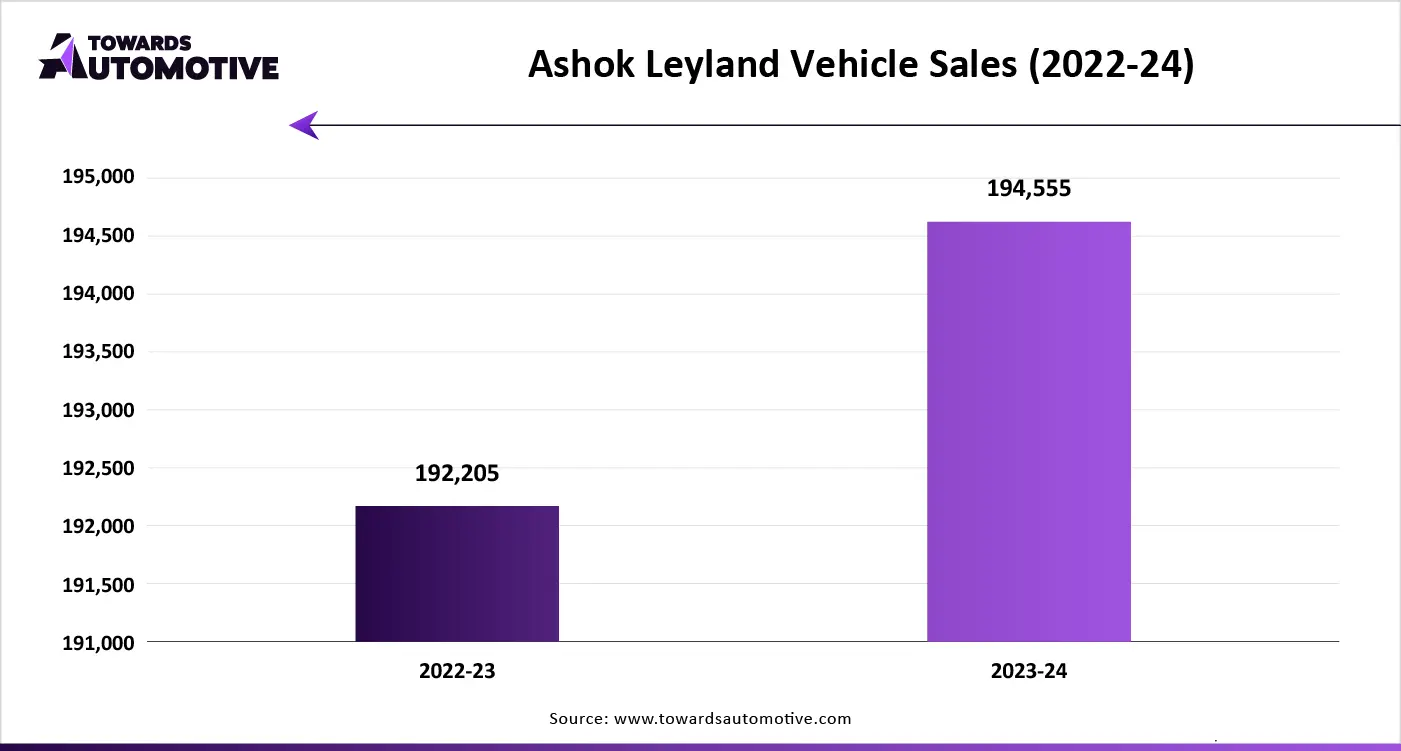

The commercial vehicles market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Toyota Motor Corporation; Mahindra and Mahindra; Ashok Leyland; Bosch Rexroth AG; Daimler; Volkswagen AG; TATA Motors; AB Volvo; Golden Dragon; General Motors and some others. These companies are constantly engaged in manufacturing commercial vehicles and adopting numerous strategies such as launches, business expansions, joint ventures, partnerships, acquisitions, collaborations, and some others to maintain their dominance in this industry.

By Product

By End-Use

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us