December 2025

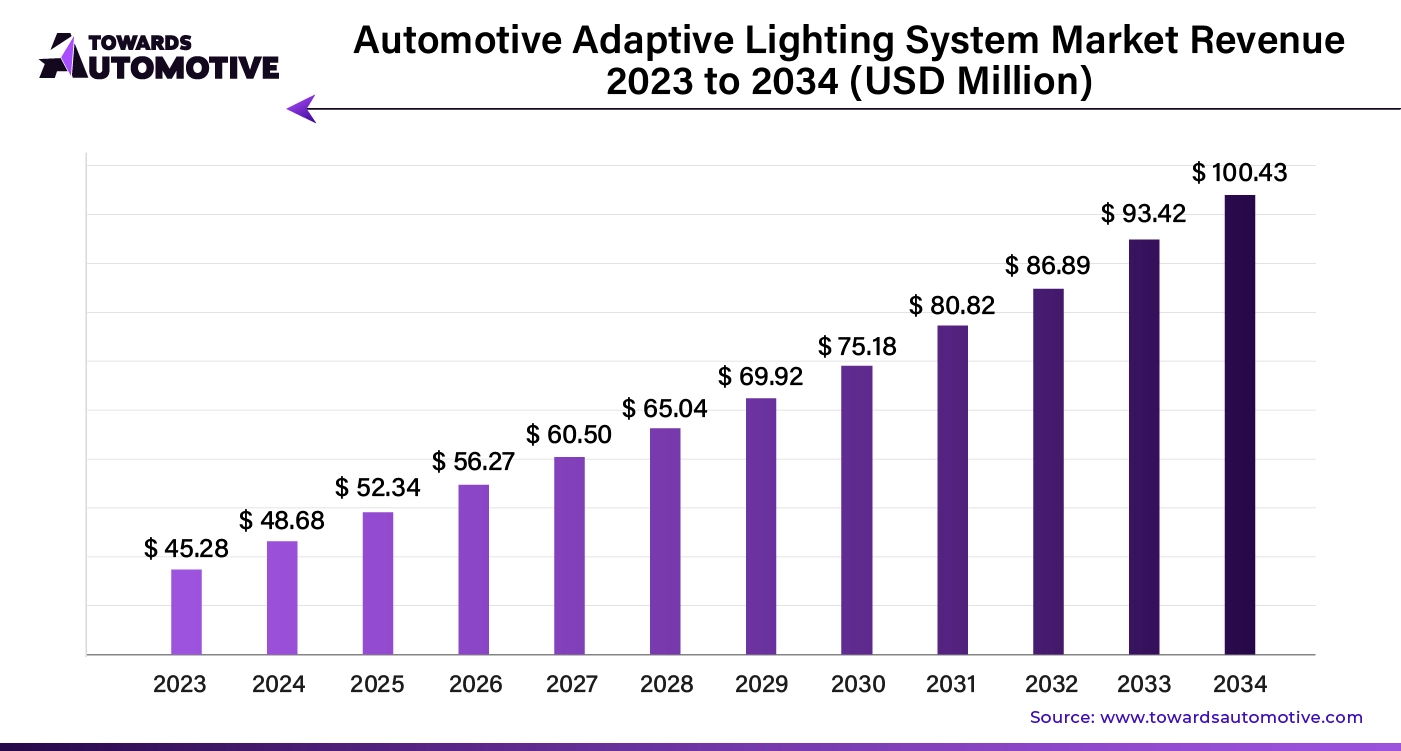

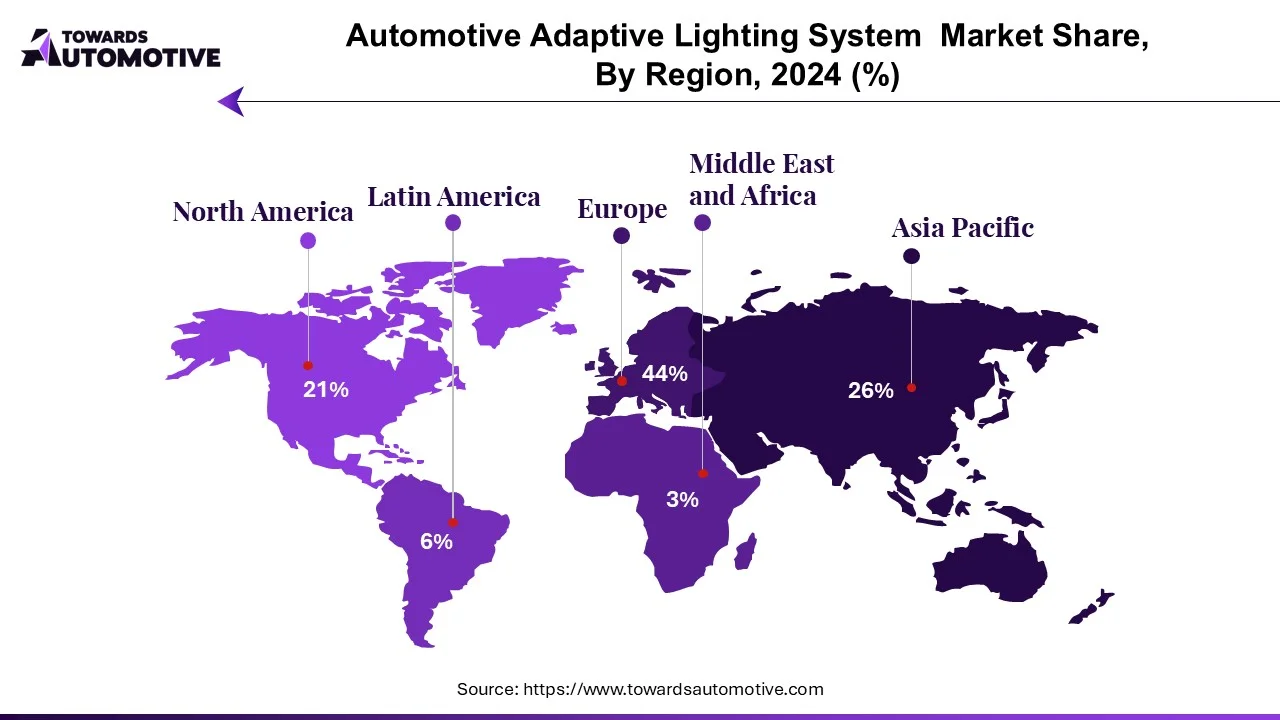

The automotive adaptive lighting system market will grow from USD 52.34 billion in 2025 to USD 100.43 billion in 2034, registering a 7.51 percent CAGR. The report covers Adaptive Front Lighting (Curve Adaptive Lighting, Dynamic Bending Light, Static Bending Light), Adaptive Driving Beam (Matrix LED, Pixel LED), Adaptive Headlight Range Control (Automatic Leveling System, Automatic High Beam Control), Light Source Type (LED, Xenon), Sensor Technology (Camera-Based, Lidar-Based, Radar-Based), and Vehicle Type (Passenger Cars, Commercial Vehicles). Regional data include North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The study also profiles leading companies such as HELLA, Valeo, Koito, ZKW, ams OSRAM, Hyundai Mobis, Magneti Marelli, Stanley Electric, and Texas Instruments, with full competitive, value chain, and trade analysis.

The automotive adaptive lighting system market is witnessing significant growth driven by advancements in vehicle safety and the increasing demand for enhanced driving experiences. Adaptive lighting systems adjust the vehicle's headlights based on various factors, such as speed, steering angle, and road conditions, providing improved visibility and safety for drivers and pedestrians alike. These systems help illuminate curves and intersections more effectively, reducing the risk of accidents during nighttime driving or in adverse weather conditions.

As safety regulations become more stringent and consumers become more aware of the benefits of advanced lighting technologies, automakers are increasingly integrating adaptive lighting systems into their vehicles. Moreover, the growing trend of electric vehicles (EVs) and hybrid vehicles, which often feature advanced technological components, is further propelling the demand for sophisticated lighting solutions.

In addition to safety benefits, adaptive lighting systems enhance the overall aesthetic appeal of vehicles, contributing to brand differentiation in a competitive market. The integration of smart technologies, such as connectivity and automation, is also paving the way for innovative lighting solutions that adapt to real-time driving conditions. As a result, the automotive adaptive lighting system market is poised for continued expansion, driven by the convergence of safety, technology, and consumer demand for smarter, more efficient vehicles.

Artificial intelligence (AI) plays a transformative role in the automotive adaptive lighting system market by enhancing the functionality, efficiency, and user experience of lighting systems in vehicles. AI algorithms enable adaptive lighting systems to analyze real-time data from various sensors, such as cameras, radar, and lidar. By processing this information, the system can automatically adjust the direction, intensity, and range of headlights based on driving conditions, traffic, and environmental factors. This intelligent control improves visibility and safety on the road.

AI enhances the predictive capabilities of adaptive lighting systems by learning from historical driving patterns and conditions. For example, the system can anticipate upcoming curves or changes in traffic flow, allowing for proactive adjustments to lighting, which helps prevent accidents and improves driver comfort.

AI allows for the customization of lighting settings based on driver preferences and behavior. By learning individual driving habits, the system can adapt lighting to suit personal preferences, making nighttime driving more enjoyable and efficient. AI facilitates the integration of adaptive lighting systems with other vehicle systems, such as navigation and driver assistance systems. This interconnectedness enables features like automatic high-beam control, where the system can intelligently switch between high and low beams based on traffic conditions and navigation data.

AI can optimize energy consumption in adaptive lighting systems by adjusting the brightness of lights based on ambient light conditions and the specific needs of the driving situation. This efficiency not only improves safety but also contributes to better overall energy management in electric vehicles.

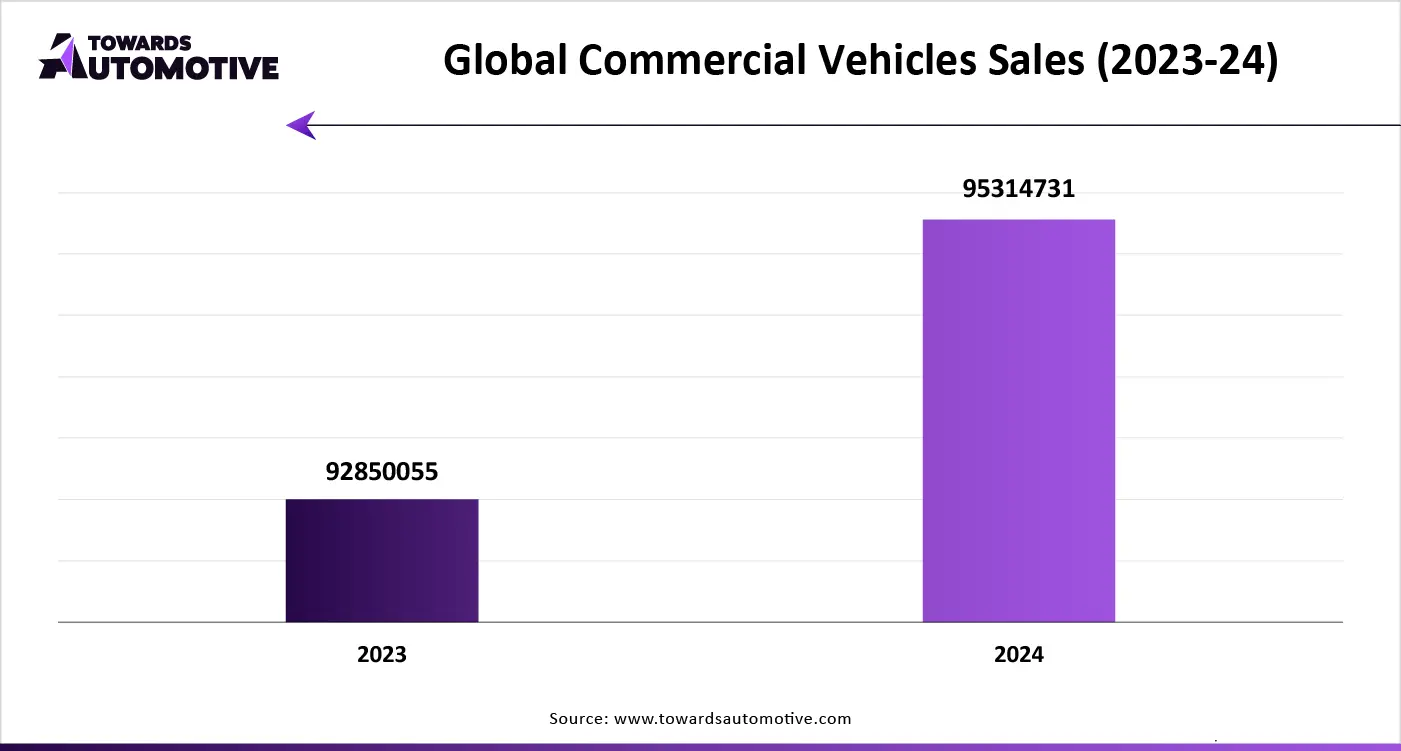

The rising sales of commercial vehicles significantly drive the growth of the automotive adaptive lighting system market due to increasing demand for enhanced safety and efficiency in transportation. Commercial vehicles, such as trucks, vans, and buses, operate in diverse environments, often facing challenging conditions like poor visibility, inclement weather, and varied road types. Adaptive lighting systems play a crucial role in improving visibility, ensuring that these vehicles can navigate safely and effectively under different circumstances.

As the logistics and transportation sectors expand, driven by factors like e-commerce growth and urbanization, there is a heightened emphasis on safety features in commercial vehicles. Fleet operators are increasingly investing in advanced lighting technologies to reduce accident risks and enhance overall operational efficiency. Adaptive lighting systems allow for automatic adjustments to headlight angles and intensity, providing optimal illumination based on speed, steering angle, and environmental conditions, which is particularly beneficial during nighttime and in urban settings.

Moreover, the incorporation of adaptive lighting systems aligns with regulatory trends and safety standards being established for commercial vehicles, further propelling their adoption. As a result, the synergy between rising commercial vehicle sales and the demand for advanced safety features, like adaptive lighting systems, contributes significantly to the overall growth of the automotive adaptive lighting system market.

The automotive adaptivelighting system market faces several restraints, including high costs of development and integration, which make these systems more expensive for consumers, particularly in entry-level vehicles. The complexity of the technology requires sophisticated sensors and software, leading to increased production costs for manufacturers. Additionally, the market is hindered by limited awareness and adoption in emerging economies, where cost-sensitive buyers may prioritize affordability over advanced safety features. Furthermore, regulatory differences across regions and the lack of standardization in adaptive lighting technologies can slow the adoption rate, posing challenges to global market expansion.

Matrix LED technology is creating significant opportunities in the automotive adaptive lighting system market by revolutionizing how headlights operate and enhancing driver safety. Unlike traditional lighting systems, Matrix LED headlights consist of numerous individual LED units that can be controlled independently. This allows the lighting system to adjust the intensity and direction of light in real-time, providing optimal illumination without blinding other road users. For instance, when approaching oncoming traffic, the system can dim specific sections of the headlights, ensuring visibility for the driver while reducing glare for other vehicles.

This advanced technology is gaining traction as it supports the growing demand for intelligent, high-performance lighting solutions in modern vehicles. With the rise of electric and autonomous vehicles, Matrix LEDs offer energy efficiency and precise control, which are essential for optimizing battery usage in electric cars. Moreover, Matrix LED systems can be integrated with sensors, cameras, and AI to enhance their functionality, allowing them to respond dynamically to various road conditions, weather, and driving speeds.

As safety regulations and consumer preferences shift towards advanced driver assistance systems (ADAS), Matrix LEDs provide a competitive edge for automakers. Their ability to improve visibility, reduce accidents, and enhance the overall driving experience creates new growth avenues in the automotive adaptive lighting system market.

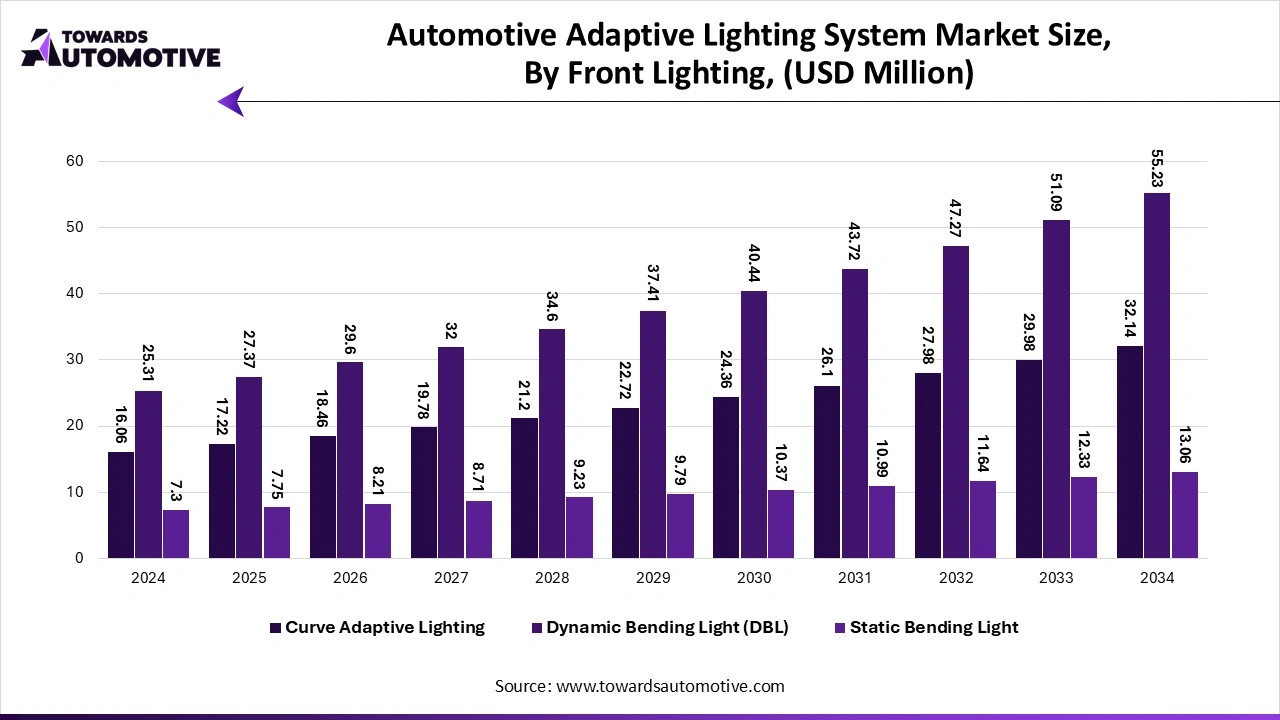

The dynamic bending light segment held the largest share of the market. Dynamic bending light significantly contributes to the growth of the automotive adaptive lighting system market by enhancing visibility and improving driving safety. This innovative lighting technology allows headlights to pivot and adjust their direction based on vehicle speed, steering angle, and road conditions, ensuring that drivers have optimal illumination while navigating curves and corners. By providing improved visibility in challenging driving scenarios, such as winding roads or poorly lit areas, dynamic bending light reduces the risk of accidents and enhances overall driving comfort. As consumer awareness of vehicle safety features increases, the demand for advanced lighting solutions that incorporate dynamic bending capabilities is also on the rise. Automakers are increasingly integrating this technology into new vehicle models to differentiate their offerings and meet consumer expectations for enhanced safety. Additionally, regulatory bodies are emphasizing the importance of advanced lighting systems in improving road safety, further driving manufacturers to adopt dynamic bending light features. Consequently, the proliferation of dynamic bending light technology in modern vehicles not only meets regulatory requirements but also aligns with consumer preferences, positioning it as a crucial driver of growth in the automotive adaptive lighting system market.

The camera-based adaptive lighting segment held a dominant share of the market. Camera-based adaptive lighting is a key driver of growth in the automotive adaptive lighting system market, offering advanced safety and visibility features that enhance the driving experience. This technology utilizes cameras to monitor road conditions, vehicle speed, and surrounding environments, allowing the lighting system to automatically adjust beam patterns in real-time. By detecting oncoming traffic, pedestrians, and obstacles, camera-based adaptive lighting can dim or redirect the headlights to prevent glare for other road users while maintaining optimal visibility for the driver. This real-time adaptability is especially beneficial for night driving and poor weather conditions, significantly reducing the risk of accidents.

As consumer demand for enhanced safety features grows, automakers are increasingly incorporating camera-based adaptive lighting systems into their vehicles to meet market expectations. This technology is particularly appealing in premium and mid-range vehicles, where consumers prioritize cutting-edge safety and comfort features. Furthermore, advancements in camera and sensor technologies are making these systems more accessible, driving wider adoption across various vehicle segments. Regulatory frameworks that emphasize the importance of advanced lighting systems in improving road safety further encourage the integration of camera-based solutions, positioning this technology as a critical growth factor in the automotive adaptive lighting system market.

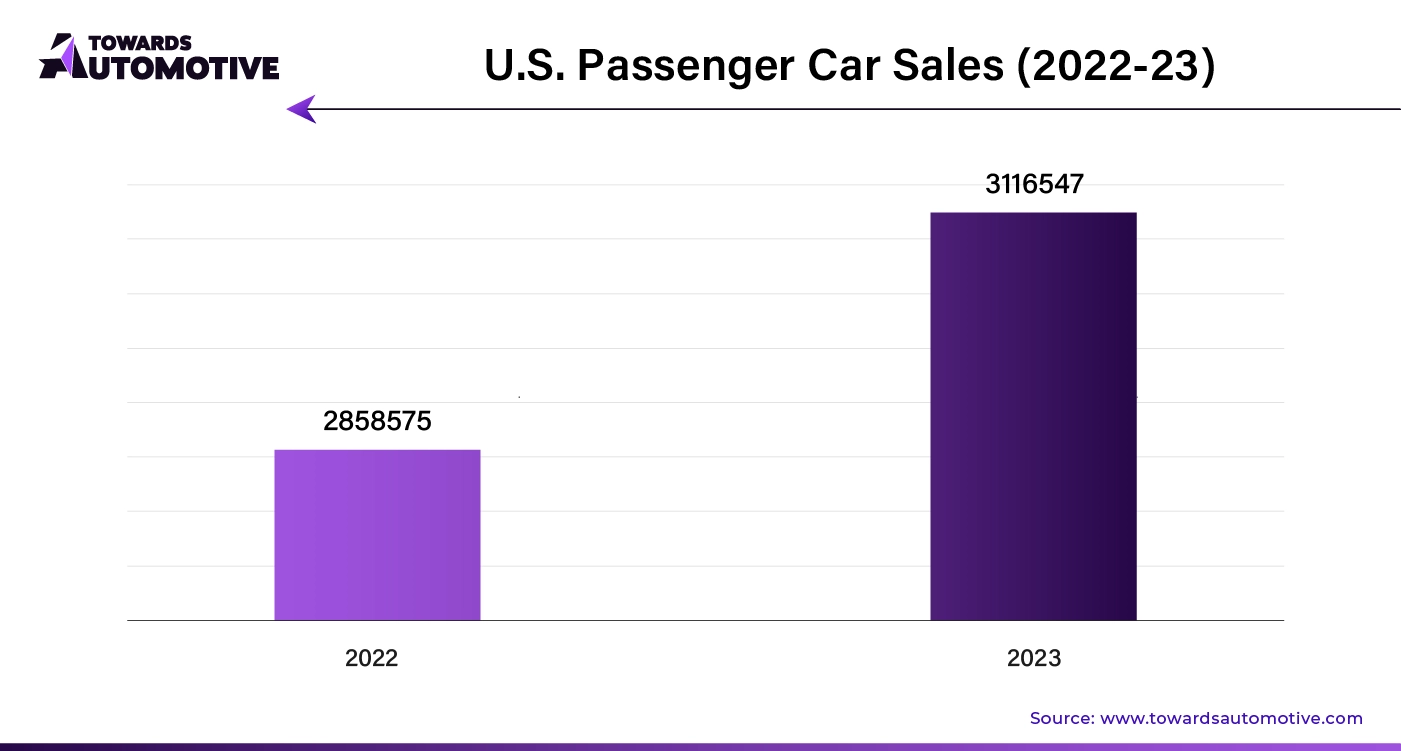

The passenger vehicle segment is likely to grow with the fastest CAGR during the forecast period. The growing demand for passenger vehicles is a major factor driving the expansion of the automotive adaptive lighting system market. As consumer preferences shift toward vehicles equipped with advanced safety and comfort features, adaptive lighting systems have become increasingly sought-after in passenger cars. These systems enhance visibility by adjusting the intensity and direction of the headlights based on real-time driving conditions, improving safety during night driving or adverse weather conditions. This feature is particularly appealing to safety-conscious buyers, who prioritize advanced driver assistance systems (ADAS) when choosing a vehicle.

Passenger vehicles, especially in premium and mid-range segments, are increasingly equipped with adaptive lighting systems as standard or optional features. This trend is driven by the rise of urbanization, increased road traffic, and longer driving hours, which create the need for advanced lighting solutions that offer better visibility and reduce driver fatigue. Additionally, as regulatory bodies worldwide enforce stricter safety standards, manufacturers are incorporating adaptive lighting systems to meet these requirements in their passenger vehicle models.

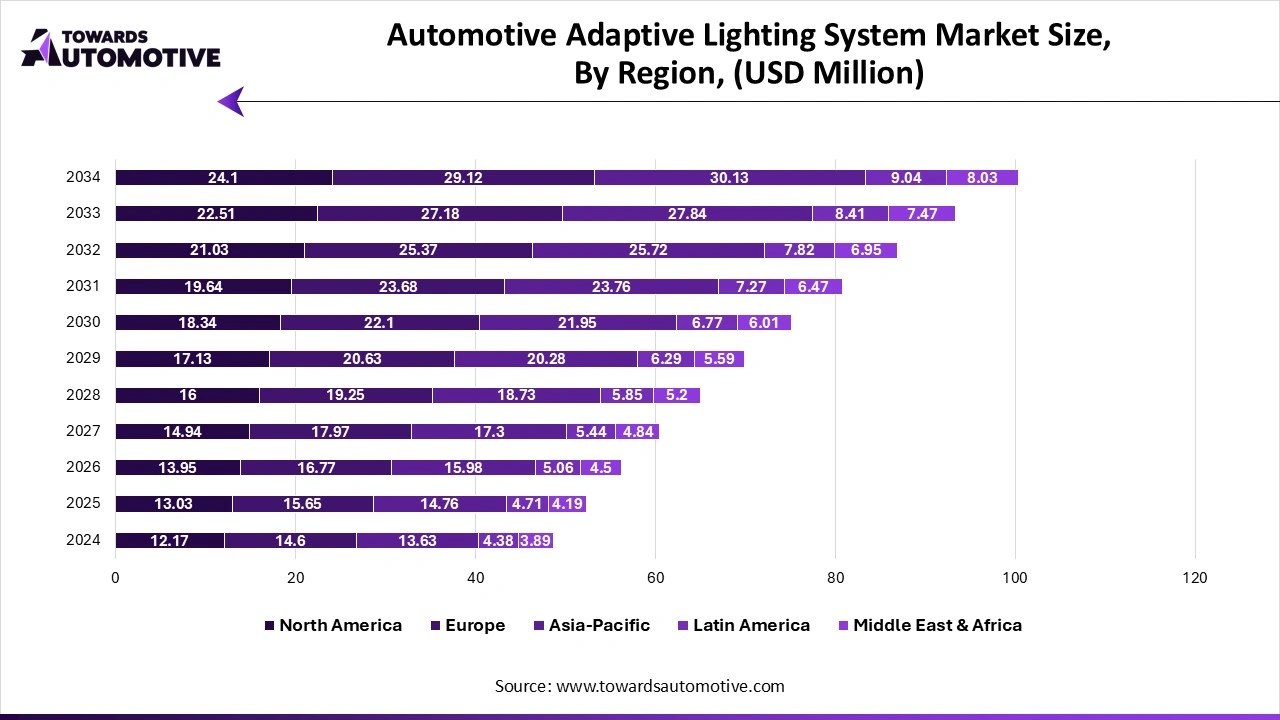

North America dominated the automotive adaptive lighting system market. The growth of the automotive adaptive lighting system market in North America is significantly driven by the increasing demand for safety features among consumers, heightened driving activities, and the growing popularity of passenger cars. As safety becomes a paramount concern for drivers, the demand for advanced driver assistance systems (ADAS) has surged, prompting manufacturers to integrate adaptive lighting solutions into their vehicles. These systems enhance nighttime visibility and improve overall driving safety, making them a key selling point for new models. Furthermore, increased driving activities, particularly during evening and night hours, highlight the need for reliable lighting systems that can adapt to varying road conditions and ensure safe navigation. With urbanization leading to more congested roadways, drivers are more frequently exposed to challenging visibility scenarios, which adaptive lighting systems can effectively address. Additionally, the growing demand for passenger cars, driven by a rising middle class and higher disposable incomes, further propels the market. Consumers are increasingly seeking vehicles equipped with modern safety technologies, including adaptive lighting, to enhance their driving experience. As manufacturers respond to this consumer demand by developing and offering vehicles with advanced lighting systems, the automotive adaptive lighting system market in North America continues to expand, reflecting the industry's commitment to innovation and safety in an evolving automotive landscape. This confluence of factors ensures that adaptive lighting systems remain a vital component of modern vehicles, ultimately driving significant growth in the market.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. Strategic partnerships and collaborations among automotive manufacturers, technology firms, and lighting solution providers significantly drive the growth of the automotive adaptive lighting system market in the Asia Pacific (APAC) region. By pooling resources and expertise, these alliances enable the development of innovative lighting technologies that integrate seamlessly into electric and autonomous vehicles, which are gaining traction in the market. The focus on electric vehicles (EVs) is particularly crucial, as consumers increasingly seek sustainable mobility options equipped with advanced safety features. Adaptive lighting systems enhance visibility and safety, addressing the specific needs of EV users, thereby boosting adoption rates. Moreover, the rise of autonomous vehicles further necessitates sophisticated lighting solutions that facilitate communication between vehicles and their surroundings, ensuring safer navigation in complex urban environments. Rapid urbanization in APAC countries contributes to a surge in vehicle ownership, leading to greater demand for advanced lighting systems that improve nighttime visibility and driving safety. As urban populations grow and traffic congestion increases, adaptive lighting solutions become essential for addressing visibility challenges in densely populated areas. Consequently, the interplay of strategic collaborations, the emphasis on electric and autonomous vehicle technologies, and the dynamics of urbanization creates a robust environment for the automotive adaptive lighting system market to thrive in the APAC region, making it an attractive sector for investment and innovation.

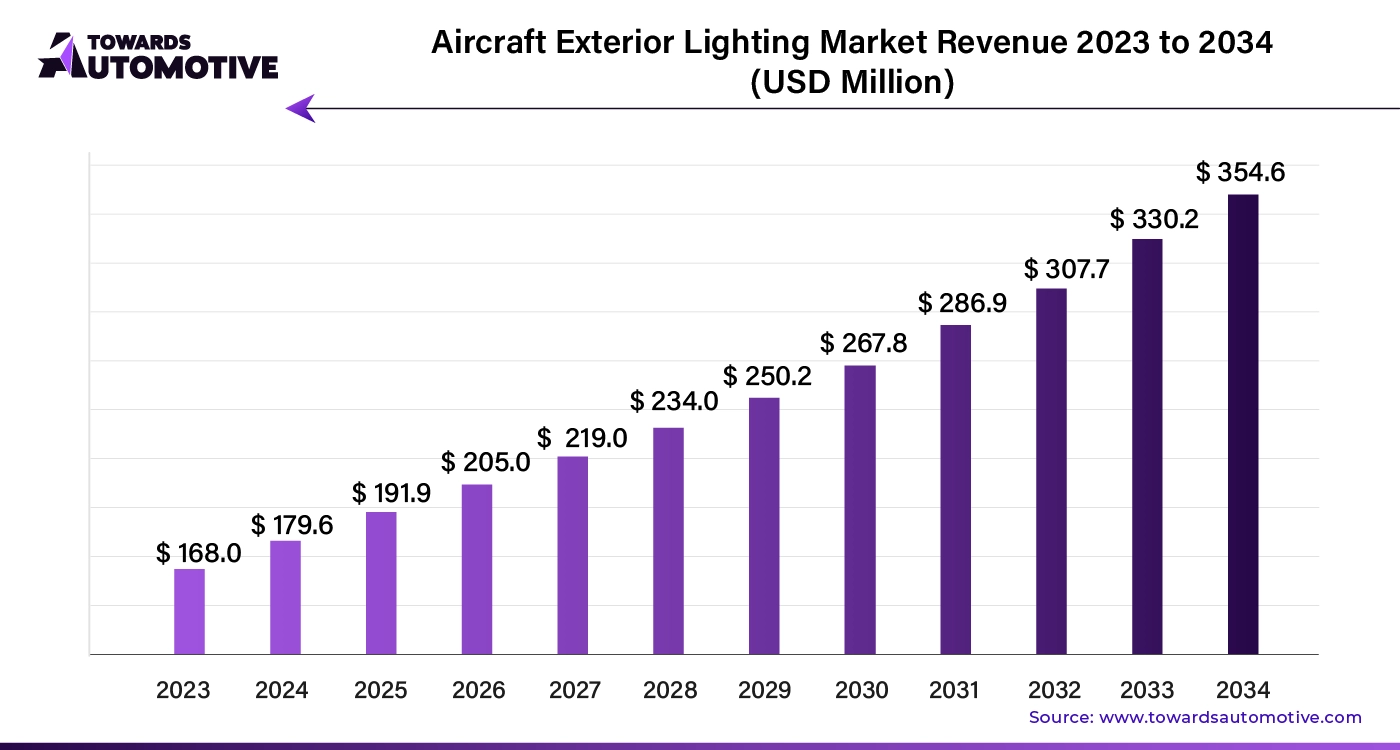

The global aircraft exterior lighting market size is calculated at USD 168 million in 2023 and is expected to be worth USD 354.6 million by 2034, expanding at a CAGR of 6.9% from 2024 to 2034.

AI is revolutionizing the aircraft exterior lighting market by introducing advanced capabilities that enhance safety, efficiency, and operational performance. By leveraging machine learning algorithms and real-time data analysis, AI can optimize the functionality of exterior lighting systems, such as navigation lights, landing lights, and strobe lights. These AI-driven systems dynamically adjust the intensity, pattern, and timing of lights based on various factors like flight conditions, weather, and the aircraft's position, ensuring optimal visibility and minimizing the risk of accidents.

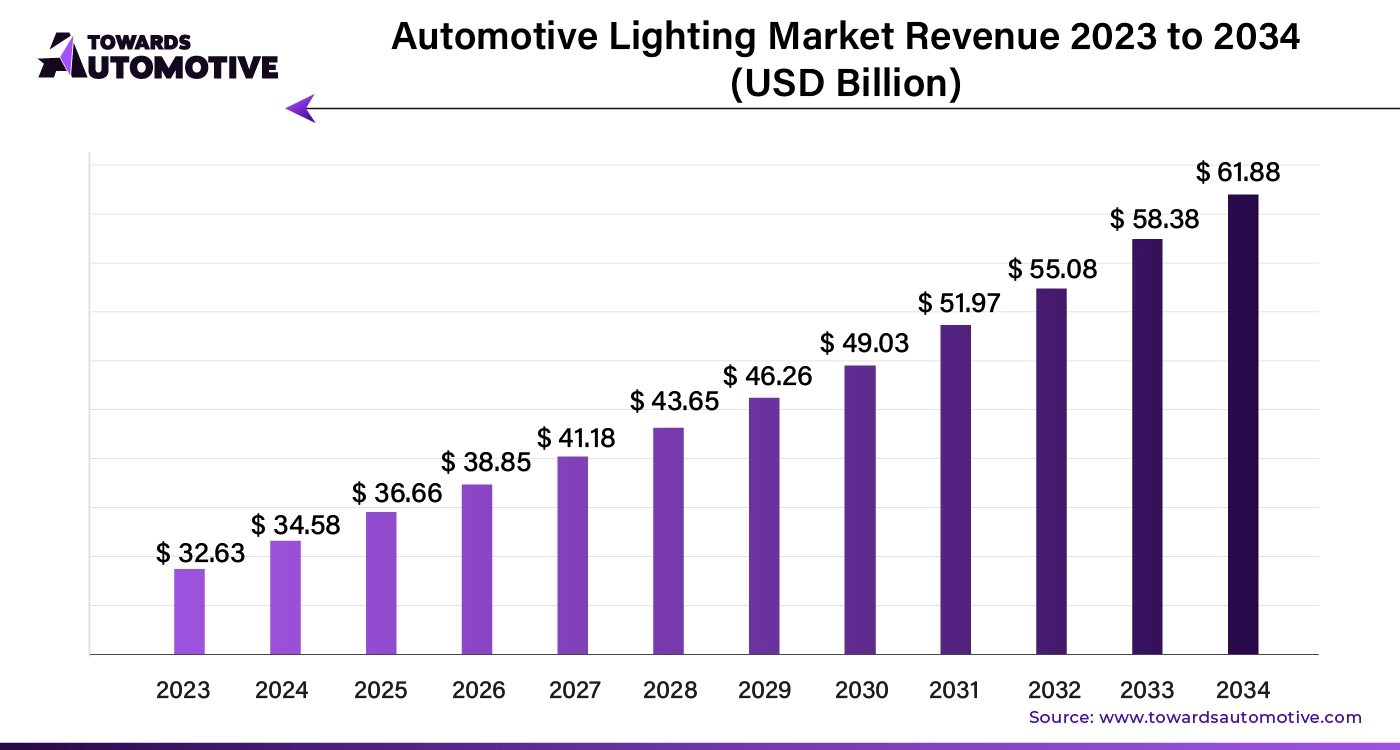

The automotive lighting market is projected to reach USD 61.88 billion by 2034, growing from USD 36.66 billion in 2025, at a CAGR of 5.99% during the forecast period from 2025 to 2034.

The automotive lighting market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of lighting systems for the automotive sector. There are various types of products developed in this sector including LED lights, halogen lights, Xenon lights and some others. These lights find application in front lighting/headlamps, rear lighting, side lighting, interior lighting and some others. It is designed for numerous types of vehicles consisting of passenger vehicles and commercial vehicles. The automotive lighting systems are available in a well-defined sales channel comprising of OEMs and aftermarket. The growing sales of automotives has increased the demand for advanced lighting systems, thereby driving the market expansion. This market is likely to rise significantly with the growth of the automotive components industry across the globe.

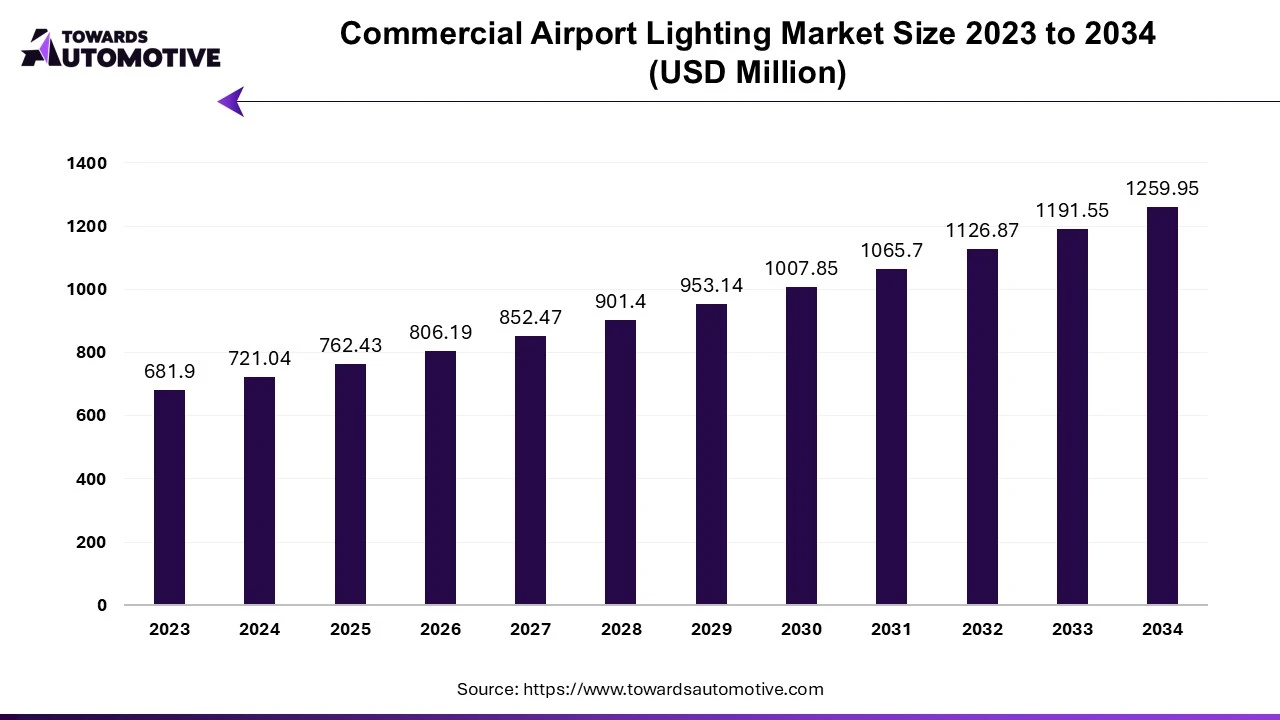

The commercial airport lighting market is projected to reach USD 1259.95 million by 2034, growing from USD 721.04 million in 2024, at a CAGR of 5.74% during the forecast period from 2025 to 2034.

The commercial airport lighting market is a crucial branch of the aerospace and defense sector. This industry deals in manufacturing and distribution of lighting systems for airport. There are several types of lighting systems available in the market consisting of runway lighting system, taxiway lighting system, apron lighting systems and some others. These lights are designed for use in different positions including insert airfield lights, elevated airfield lights and precision approach path indicator (PAPI). This industry uses different types of technology consisting of LED and Non-LED. The growing number of airports in different parts of the world is crucial for the market development. This market is expected to rise significantly with the growth of the aviation industry in different parts of the globe.

The conventional automotive lighting market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. This market is growing due to steady demand for cost-effective and reliable lighting solutions in budget and mid-range vehicles, especially in emerging economies.

AI can optimize the manufacturing process of conventional automotive lighting components by improving production efficiency, reducing defects, and minimizing downtime. AI can predict the need for equipment maintenance before failures happen through predictive analytics, guaranteeing seamless operations. AI-powered machine vision systems can identify minute flaws in housing units or lightbulbs, enhancing quality control. AI-driven automation can also simplify processes like inventory management, assembly, and packaging, which lowers labor costs and improves output consistency. This aids producers in remaining competitive even in a market where consumers are price-sensitive, such as traditional lighting.

Conventional automotive lighting refers to traditional lighting technologies used in vehicles, including halogen, xenon (HID), and incandescent systems. These systems serve functional and aesthetic purposes such as visibility, signaling, and vehicle design across various automotive applications. Unlike LED or laser-based systems, conventional lighting is cost-effective, simpler in design, and widely adopted in budget and mid-segment vehicles, particularly in developing regions.

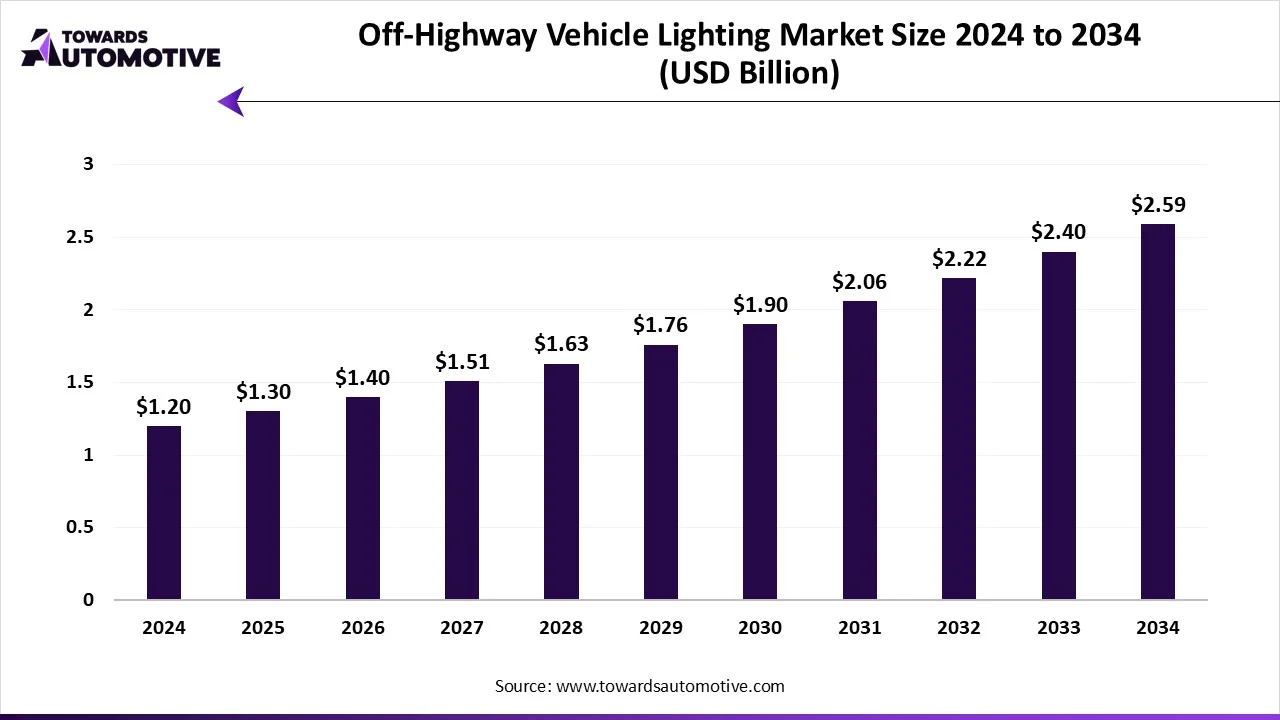

The off-highway vehicle lighting market is expected to increase from USD 1.30 billion in 2025 to USD 2.59 billion by 2034, growing at a CAGR of 8% throughout the forecast period from 2025 to 2034. The growing sales of off-highway vehicles in developed nations coupled with rise in number of residential constructions in different parts of the world has boosted the market expansion.

Additionally, growing emphasis of automotive brands for using high-quality lights in off-highway vehicles along with rapid investment by market players for opening new production facilities is playing a crucial role in shaping the industrial landscape. The increasing popularity of laser lighting as well as research and development related to matrix headlights is expected to create ample growth opportunities for the market players in the upcoming days.

The off-highway vehicle lighting market is a prominent branch of the automotive industry. This industry deals in the development and distribution of lighting systems for the off-highway vehicles. There are several types of products developed in this sector comprising of LED lighting, halogen lighting, HID lighting, incandescent lighting and some others. These lights are designed for numerous types of vehicles consisting of excavators, loaders, dump trucks, cranes, tractors and some others. The end-users of these lighting systems comprise of numerous industries such as construction, agriculture, mining, recreational vehicles, marine, military and defense, industrial equipment and some others. This market is expected to rise significantly with the growth of the electronics industry in different parts of the world.

By Adaptive Front Lighting System

By Adaptive Driving Beam

By Adaptive Headlight Range Control

By Light Source Type

By Sensor Technology

By Vehicle Type

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us