December 2025

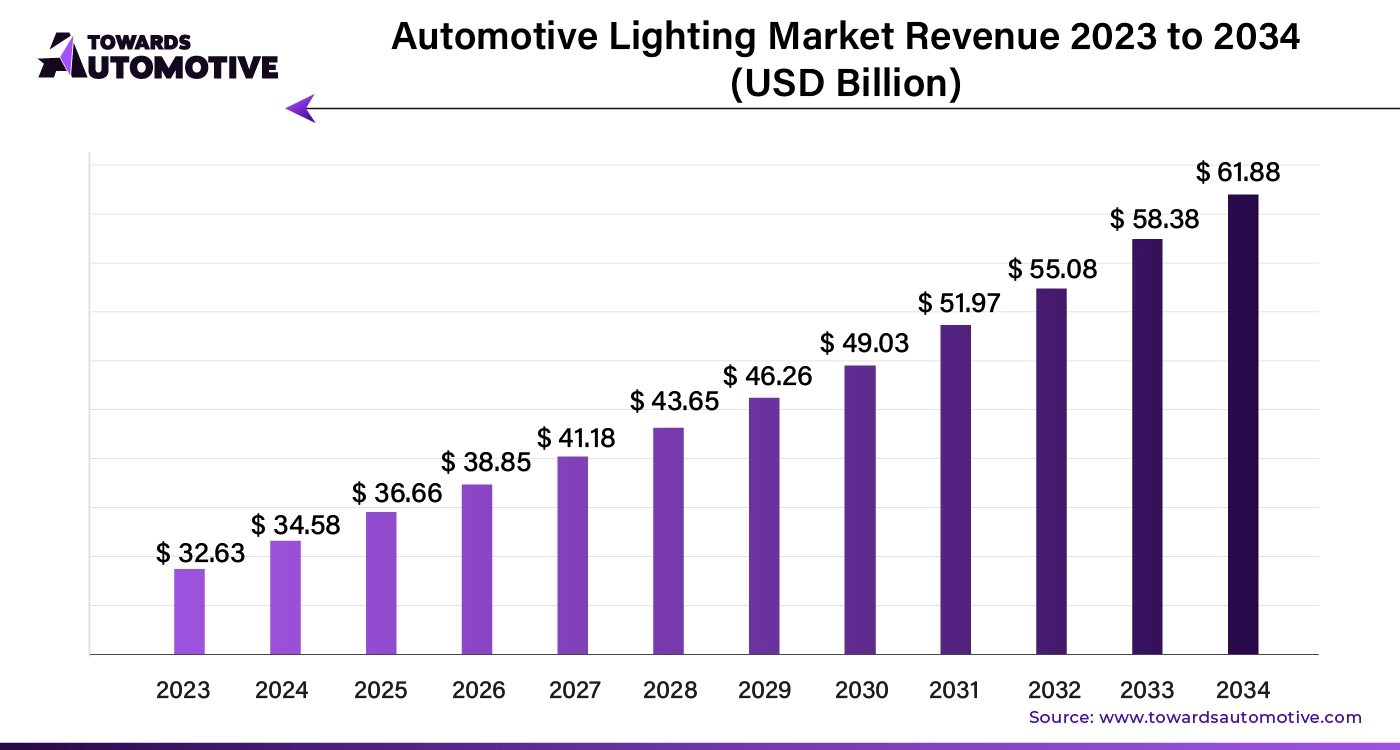

The automotive lighting market is projected to reach USD 61.88 billion by 2034, growing from USD 36.66 billion in 2025, at a CAGR of 5.99% during the forecast period from 2025 to 2034.

The automotive lighting market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of lighting systems for the automotive sector. There are various types of products developed in this sector including LED lights, halogen lights, Xenon lights and some others. These lights find application in front lighting/headlamps, rear lighting, side lighting, interior lighting and some others. It is designed for numerous types of vehicles consisting of passenger vehicles and commercial vehicles. The automotive lighting systems are available in a well-defined sales channel comprising of OEMs and aftermarket. The growing sales of automotives has increased the demand for advanced lighting systems, thereby driving the market expansion. This market is likely to rise significantly with the growth of the automotive components industry across the globe.

| Metric | Details |

| Market Size in 2024 | USD 34.58 Billion |

| Projected Market Size in 2034 | USD 61.88 Billion |

| CAGR (2025 - 2034) | 5.99% |

| Leading Region | North America |

| Market Segmentation | By Vehicle, By Sales Channel, By Application, By Technology and By Region |

| Top Key Players | Sony Corporation, Samsung Electronics, Texas Instruments Incorporated., STMicroelectronics, Omnivision Technologies |

The front lighting/headlamps segment held the largest share of the market. The growing integration of LED-headlamps in luxury vehicles has boosted the market expansion. Also, the rising investment by automotive companies for developing advanced headlamps to enhance safety in automotives is playing a crucial role in shaping the industrial landscape. Moreover, the increasing trend of matrix headlights and laser lighting in western nations such as UK, Germany, U.S. is expected to drive the growth of the automotive lighting market.

The rear lighting segment is anticipated to rise with the highest CAGR during the forecast period. The growing sales of commercial vehicles in different parts of the world has boosted the market growth. Also, the availability of rear lighting systems in various online platforms such as Amazon, Ebay, O'Reilly Auto Parts, AutoZone and some others is likely to shape the industrial landscape. Moreover, numerous partnerships and collaborations among automotive brands and lighting companies is further anticipated to drive the growth of the automotive lighting market.

The original equipment manufacturers (OEMs) segment dominated this industry. The growing demand for genuine automotive products from car owners has boosted the market expansion. Also, the rise in number of OEM service centers coupled with rapid investment by OEMs for manufacturing high-grade automotive components is crucial for the industrial growth. Moreover, the availability of essential lighting systems in OEMs workshops for real-time replacement is further driving the growth of the automotive lighting market.

The aftermarket segment is predicted to rise with a considerable CAGR during the forecast period. The rising demand for modified automotive lights among Generation Z population has driven the market growth. Additionally, the availability of aftermarket lighting systems in third-party platforms and retail outlets is further contributing to the industrial expansion. Moreover, the affordability and uniqueness of aftermarket automotive components as compared to traditional products is accelerating the growth of the automotive lighting market.

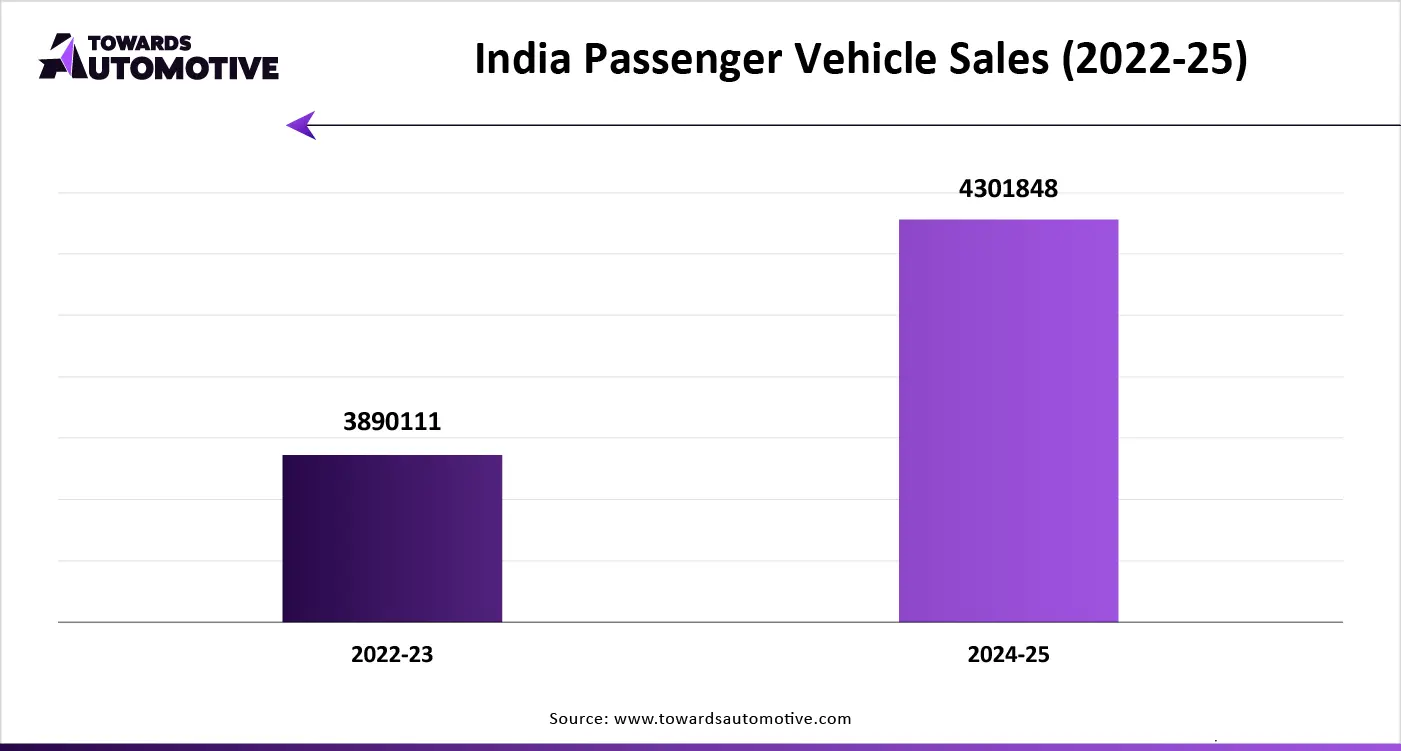

The passenger vehicle segment led the industry. The growing sales of passenger cars in several nations such as India, China, Japan, South Korea and some others is driving the market growth. Additionally, surge in demand for luxury sedans among elite-class consumers coupled with rapid investment by automotive companies for integrating advanced lights in passenger vehicles is adding to the overall industrial expansion. Moreover, the increasing adoption of electric SUVs in developed nations is expected to drive the growth of the automotive lighting market.

The commercial vehicle segment is likely to grow with the fastest rate during the forecast period. The rising production of commercial vehicles in Japan and South Korea has increased the demand for advanced lighting systems, thereby driving the market expansion. Also, the growing adoption of LCEVs by fleet operators along with ongoing trend of autonomous trucks in Europe is further adding to the industrial growth. Moreover, the rapid deployment of electric buses in developed nations such as France, Germany, Italy and some others is accelerating the growth of the automotive lighting market.

North America held the highest share of the automotive lighting market. The growing sales of passenger cars in several countries such as the U.S. and Canada has driven the market expansion. Additionally, surge in demand for eco-friendly transportation coupled with integration of smart lighting systems in automotives is playing a crucial role in shaping the industrial landscape. Moreover, the presence of several automotive brands such as Tesla, Ford, Rivian, Buick, Lucid and some others is further driving the growth of the automotive lighting market in this region.

U.S. dominated the market in this region. In the U.S., the market is generally is driven by the rising adoption of electric vehicles along with technological advancements in automotive sector. Additionally, the presence of various automotive light manufacturers such as Texas Instruments Incorporated, InvenSense, General Electric Company, Omnivision Technologies and some others is driving the market growth.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The rising production of commercial vehicles in various nations such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, the growing use of LED lighting systems in automotives along with rapid developments in the EV manufacturing sector is driving the market in a positive direction. Moreover, the presence of several market players such as Sony Corporation, Samsung Electronics, Panasonic Corporation, Hyundai Mobis Co., Ltd and some others is anticipated to propel the growth of the automotive lighting market in this region.

China is the major contributor in this region. The growing production and sales of EVs along with rise in number of automotive startups has driven the market growth. Also, availability of essential raw materials at less cost coupled with rapid developments in automotive components sector is further adding to the industrial expansion. Moreover, the presence of various automotive lighting companies including Carlightvision Co., Ltd, Valeo, Winson Lighting Technology Ltd., NVC International and some others is driving the market growth.

The conventional automotive lighting market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. This market is growing due to steady demand for cost-effective and reliable lighting solutions in budget and mid-range vehicles, especially in emerging economies.

Conventional automotive lighting refers to traditional lighting technologies used in vehicles, including halogen, xenon (HID), and incandescent systems. These systems serve functional and aesthetic purposes such as visibility, signaling, and vehicle design across various automotive applications. Unlike LED or laser-based systems, conventional lighting is cost-effective, simpler in design, and widely adopted in budget and mid-segment vehicles, particularly in developing regions.

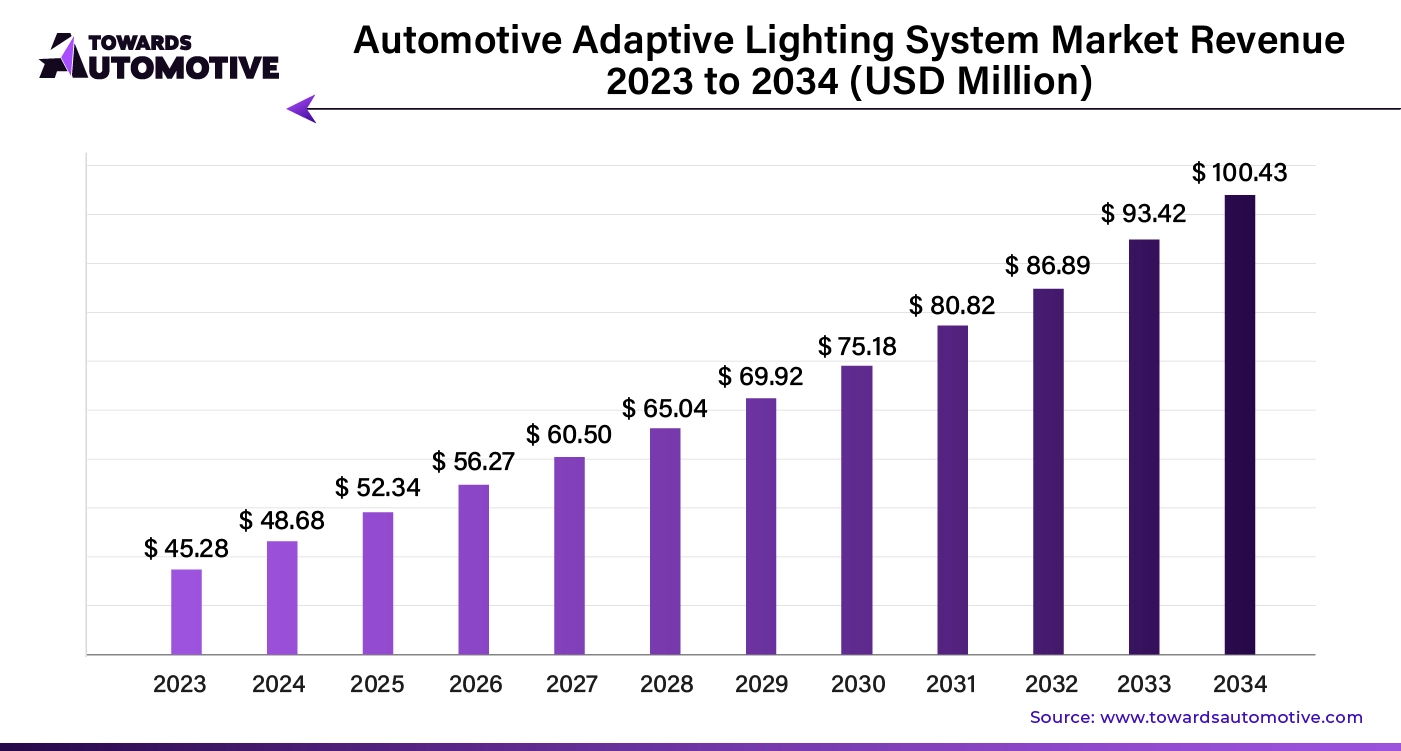

The global automotive adaptive lighting system market size is calculated at USD 52.34 billion in 2025 and is expected to be worth USD 100.43 billion by 2034, expanding at a CAGR of 7.51% from 2024 to 2034.

The automotive adaptive lighting system market is witnessing significant growth driven by advancements in vehicle safety and the increasing demand for enhanced driving experiences. Adaptive lighting systems adjust the vehicle's headlights based on various factors, such as speed, steering angle, and road conditions, providing improved visibility and safety for drivers and pedestrians alike. These systems help illuminate curves and intersections more effectively, reducing the risk of accidents during nighttime driving or in adverse weather conditions.

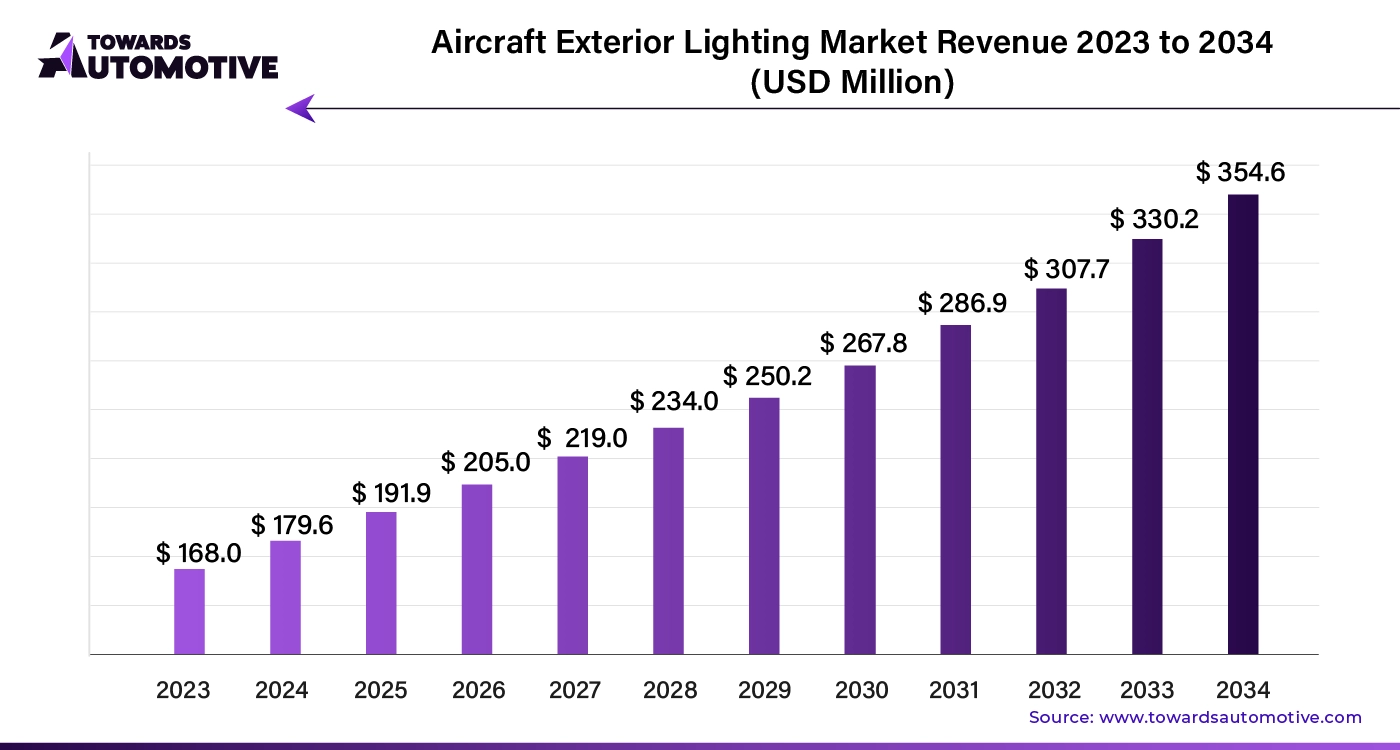

The global aircraft exterior lighting market size is calculated at USD 168 million in 2023 and is expected to be worth USD 354.6 million by 2034, expanding at a CAGR of 6.9% from 2024 to 2034.

AI is revolutionizing the aircraft exterior lighting market by introducing advanced capabilities that enhance safety, efficiency, and operational performance. By leveraging machine learning algorithms and real-time data analysis, AI can optimize the functionality of exterior lighting systems, such as navigation lights, landing lights, and strobe lights. These AI-driven systems dynamically adjust the intensity, pattern, and timing of lights based on various factors like flight conditions, weather, and the aircraft's position, ensuring optimal visibility and minimizing the risk of accidents.

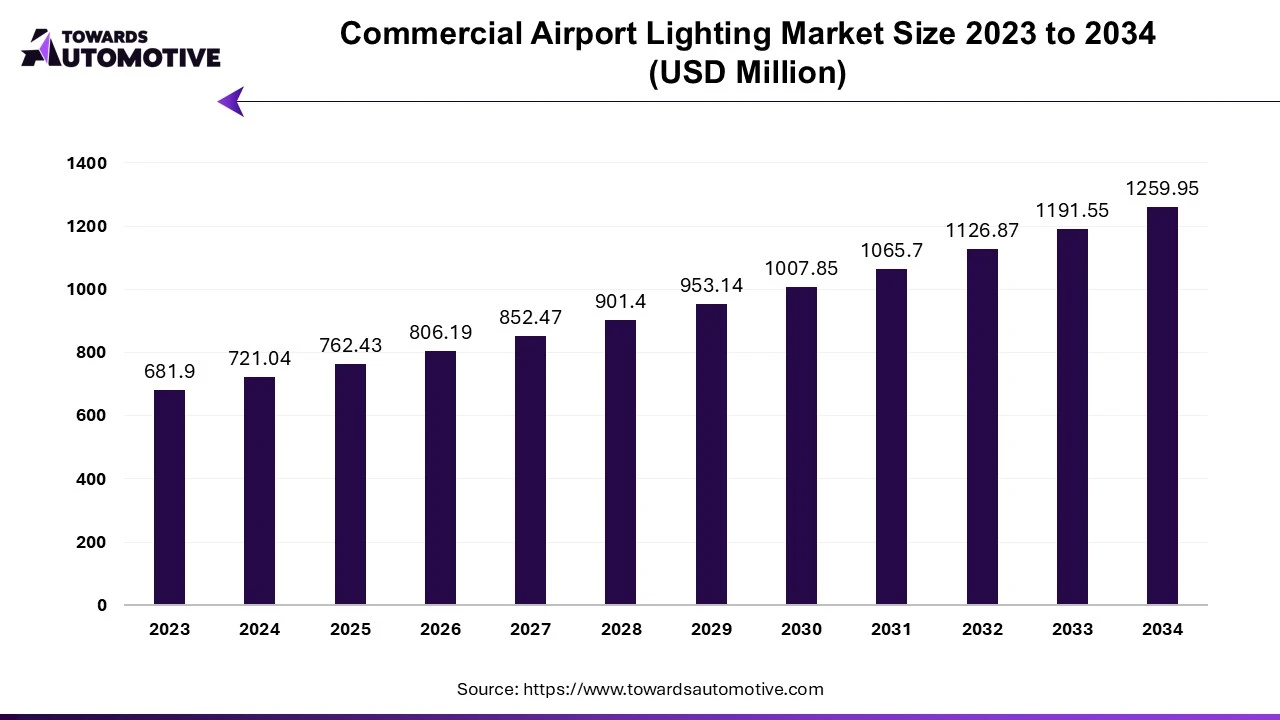

The commercial airport lighting market is projected to reach USD 1259.95 million by 2034, growing from USD 721.04 million in 2024, at a CAGR of 5.74% during the forecast period from 2025 to 2034.

The commercial airport lighting market is a crucial branch of the aerospace and defense sector. This industry deals in manufacturing and distribution of lighting systems for airport. There are several types of lighting systems available in the market consisting of runway lighting system, taxiway lighting system, apron lighting systems and some others. These lights are designed for use in different positions including insert airfield lights, elevated airfield lights and precision approach path indicator (PAPI). This industry uses different types of technology consisting of LED and Non-LED. The growing number of airports in different parts of the world is crucial for the market development. This market is expected to rise significantly with the growth of the aviation industry in different parts of the globe.

The conventional automotive lighting market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. This market is growing due to steady demand for cost-effective and reliable lighting solutions in budget and mid-range vehicles, especially in emerging economies.

Conventional automotive lighting refers to traditional lighting technologies used in vehicles, including halogen, xenon (HID), and incandescent systems. These systems serve functional and aesthetic purposes such as visibility, signaling, and vehicle design across various automotive applications. Unlike LED or laser-based systems, conventional lighting is cost-effective, simpler in design, and widely adopted in budget and mid-segment vehicles, particularly in developing regions.

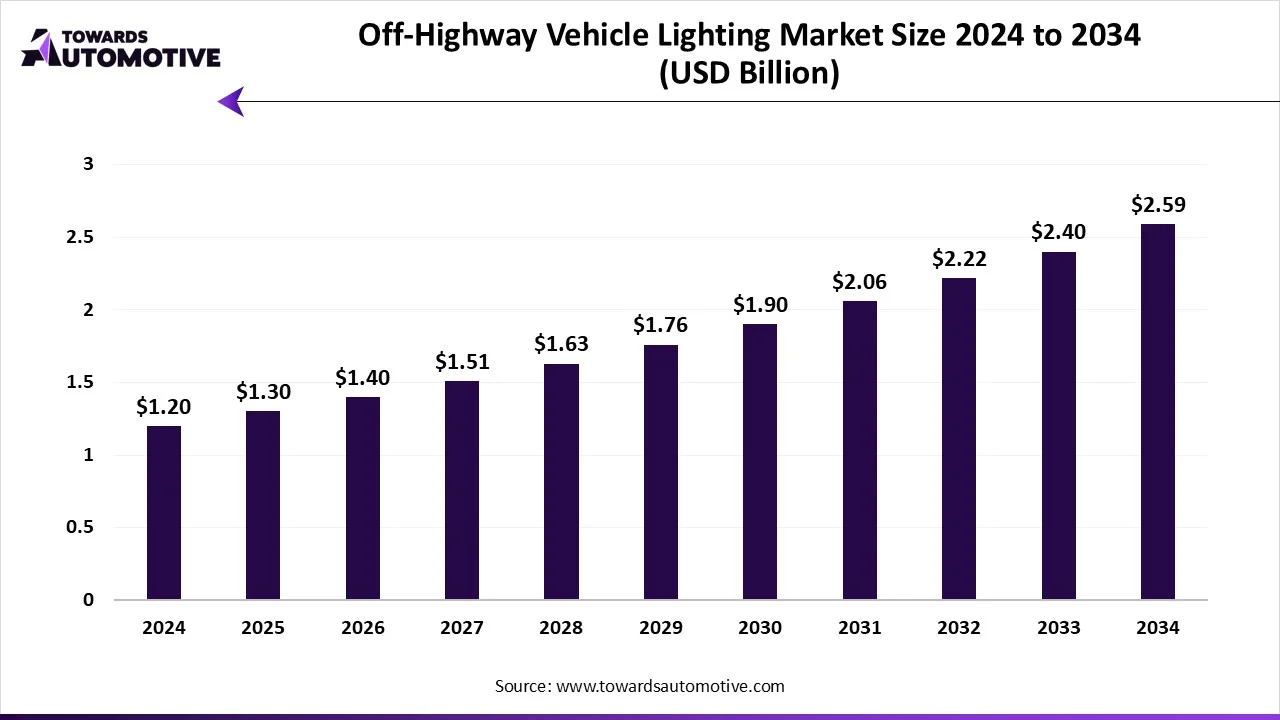

The off-highway vehicle lighting market is expected to increase from USD 1.30 billion in 2025 to USD 2.59 billion by 2034, growing at a CAGR of 8% throughout the forecast period from 2025 to 2034. The growing sales of off-highway vehicles in developed nations coupled with rise in number of residential constructions in different parts of the world has boosted the market expansion.

Additionally, growing emphasis of automotive brands for using high-quality lights in off-highway vehicles along with rapid investment by market players for opening new production facilities is playing a crucial role in shaping the industrial landscape. The increasing popularity of laser lighting as well as research and development related to matrix headlights is expected to create ample growth opportunities for the market players in the upcoming days.

The off-highway vehicle lighting market is a prominent branch of the automotive industry. This industry deals in the development and distribution of lighting systems for the off-highway vehicles. There are several types of products developed in this sector comprising of LED lighting, halogen lighting, HID lighting, incandescent lighting and some others.

These lights are designed for numerous types of vehicles consisting of excavators, loaders, dump trucks, cranes, tractors and some others. The end-users of these lighting systems comprise of numerous industries such as construction, agriculture, mining, recreational vehicles, marine, military and defense, industrial equipment and some others. This market is expected to rise significantly with the growth of the electronics industry in different parts of the world.

The automotive lighting market is a rapidly growing industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of Sony Corporation, Samsung Electronics, Texas Instruments Incorporated., STMicroelectronics, Omnivision Technologies, Bosch Sensortec, Analog Devices, Panasonic Corporation, Hella, Knowles Electronics and InvenSense and some others. These companies are constantly engaged in developing lighting systems for the automotive sector and adopting numerous strategies such as business expansions, collaborations, acquisitions, joint ventures, launches, partnerships, and some others to maintain their dominant position in this industry. For instance, in April 2025, NOVOSENSE Microelectronics launched NSUC1500-Q1. NSUC1500-Q1 is a System-on-Chip (SoC) designed to fulfill the needs of modern automotive ambient lighting systems. Also, in October 2024, Neolite ZKW announced to open a new manufacturing plant in Pune, India. This new production facility is inaugurated to enhance the manufacturing of automotive lights in India.

By Vehicle

By Sales Channel

By Application

By Technology

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us