September 2025

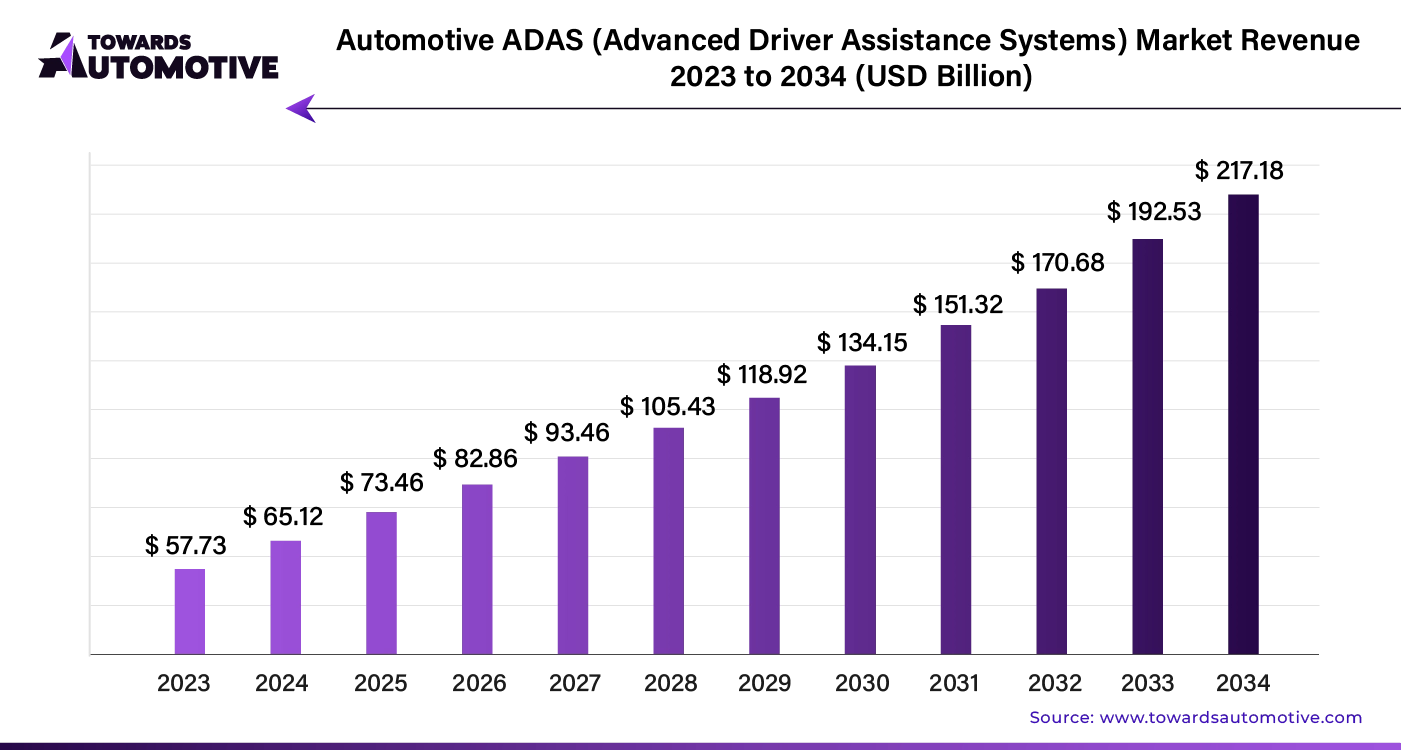

The automotive ADAS (Advanced Driver Assistance Systems) market is forecast to grow from USD 73.46 billion in 2025 to USD 217.18 billion by 2034, driven by a CAGR of 12.8% from 2025 to 2034. The growing emphasis of government on enhancing road safety coupled with technological advancements in the ADAS sector has driven the market expansion.

Additionally, rising investment by automotive companies for integrating advanced sensors in modern cars along with rising deployment of robotaxis by fleet operators is playing a crucial role in shaping the industrial landscape. The integration of AI and machine learning in ADAS system is expected to create ample growth opportunities for the market players in the upcoming years.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive ADAS (Advanced Driver Assistance Systems) market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of ADAS solutions in different parts of the world. There are several solutions developed in this sector comprising of adaptive cruise control (ACC), blind spot detection system (BSD), park assistance, lane departure warning system (LDWS), tire pressure monitoring system (TPMS), autonomous emergency braking (AEB), adaptive front lights (AFL) and some others. These solutions are operated using numerous components including processors, sensors, software and some others. It is designed for various types of vehicles consisting of passenger cars and commercial vehicles. This market is expected to rise significantly with the growth of the EV sector around the globe.

The major trends in this market consists of partnerships, business expansions and government initiatives.

The adaptive cruise control (ACC) segment dominated the ADAS (Advanced Driver Assistance Systems) market. The growing use of adaptive cruise control in passenger vehicles to maintain constant speed has boosted the market expansion. Additionally, the increasing application of radar-based ACC systems and camera-based ACC systems in autonomous trucks is playing a vital role in shaping the industrial landscape. Moreover, numerous benefits of ACC including increased comfort, enhanced safety, smooth driving and some others is expected to boost the growth of the automotive ADAS (Advanced Driver Assistance Systems) market.

The blind spot detection system (BSD) segment is expected to rise with a significant CAGR during the forecast period. The integration of blind spot detection system (BSD) in self-driving vehicles for enhancing autonomous driving in vacant roads has boosted the industrial growth. Also, numerous advantages of BSD systems such as enhanced safety, improved driver awareness, high confidence, reduced driver fatigue and some others is expected to drive the growth of the automotive ADAS (Advanced Driver Assistance Systems) market.

The sensors segment led the automotive ADAS (Advanced Driver Assistance Systems) market. The integration of ultrasonic sensors in luxury vehicles to measure distances, detect objects, sense levels and some others has driven the market expansion. Also, the growing use of radar sensors in autonomous cars to enhance object detection and tracking is playing a crucial role in shaping the industrial landscape. Moreover, the increasing demand for LiDAR sensors from the automotive sector is expected to drive the growth of the automotive ADAS (Advanced Driver Assistance Systems) market.

The processor segment is expected to expand with a robust CAGR during the forecast period. The growing use of system-on-chips (SoCs), application processors, deep learning processing units (DPUs), and graphics processing units (GPUs) and some others in autonomous vehicles has driven the market growth. Also, the increasing application of advanced processors in driverless trucks to enhance safety is contributing to the industry in a positive manner. Moreover, rapid investment by component manufacturers to develop automotive processors is expected to proliferate the growth of the automotive ADAS (Advanced Driver Assistance Systems) market.

The passenger cars segment held the highest share of the ADAS (Advanced Driver Assistance Systems) market. The growing sales and production of passenger vehicles in several countries including China, India, the U.S., Canada and some others has boosted the market expansion. Additionally, the integration of ADAS in luxury vehicles for enhancing safety is playing a vital role in shaping the industrial landscape. Moreover, partnerships among automotive component manufacturers and car brands for developing high-quality ADAS solutions to cater the needs of passenger vehicles is expected to foster the growth of the automotive ADAS (Advanced Driver Assistance Systems) market.

The commercial vehicle segment is expected to grow with a substantial CAGR during the forecast period. The increasing adoption of autonomous trucks in various industries such as mining, construction, logistics and some others has driven the market growth. Also, numerous government initiatives aimed at mandating ADAS in commercial vehicles is contributing to the industry in a positive manner. Moreover, collaborations bus manufacturers and ADAS solution providers to develop high-grade ADAS for commercial vehicles is expected to propel the growth of the automotive ADAS (Advanced Driver Assistance Systems) market.

North America led the automotive ADAS (Advanced Driver Assistance Systems) market. The growing sales of autonomous vehicles in the U.S. and Canada has boosted the market growth. Also, numerous government initiatives aimed at enhancing road safety coupled with rapid investment by market players for opening up new automotive component manufacturing plants is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Altera Corporation, Magna International Inc., Garmin Ltd and some others is expected to drive the growth of the automotive ADAS (Advanced Driver Assistance Systems) market in this region.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The increasing adoption of luxury EVs in various countries such as India, China, Japan, South Korea and some others has driven the market expansion. Additionally, the growing emphasis of government for mandating ADAS in vehicles along with technological advancements in the automotive sector is contributing to the industry in a positive manner. Moreover, the presence of various market players such as Denso Corporation, Hyundai Mobis, Aisin Seiki and some others is expected to boost the growth of the automotive ADAS (Advanced Driver Assistance Systems) market in this region.

Automotive ADAS component are manufactured using different types of raw materials including aluminum, copper, PBT, ceramic and some others.

Testing ADAS solutions involves exposing a vehicle to numerous situations that trigger the system to intervene, then measuring the outcome for assessing car’s performance. The testing is monitored, and variables are controlled for ensuring consistent repeatable application of every test method.

The primary distribution channel for automotive ADAS (Advanced Driver Assistance Systems) is through direct integration by original equipment manufacturers (OEMs).

The automotive ADAS (Advanced Driver Assistance Systems) market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Denso Corporation; Continental AG; Altera Corporation; Autoliv; Garmin Ltd.; Infineon Technologies AG; Magna International Inc.; Mobileye; Robert Bosch GmbH; Valeo SA; Wabco Holdings Inc and some others. These companies are constantly engaged in developing ADAS solutions and adopting numerous strategies such as joint ventures, collaborations, partnerships, acquisitions, launches, business expansions and some others to maintain their dominance in this industry.

By Solution

By Component

By Vehicle

By Region

September 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us