December 2025

The automotive digital transformation market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The integration of smart manufacturing solutions such as IoT and digital twins in the automotive sector coupled with rapid development in the ADAS industry has played a crucial role in shaping the industrial landscape.

Moreover, the growing investment by automotive brands for deploying advanced technologies in the automobile factories to enhance the production process along with rising adoption of electric vehicles in developed nations has boosted the market expansion. The technological advancements in 5G & edge connectivity is expected to create ample growth opportunities for the market players in the upcoming days.

The automotive digital transformation market is a prominent segment of the automotive industry. This industry deals in developing advanced digital solutions for transforming the automotive sector. There are several types of solutions developed in this sector comprising of connected vehicle platforms, smart manufacturing solutions, digital retailing & aftersales, cybersecurity solutions., data & analytics platforms, cloud & edge computing, autonomous & ADAS enablement tools and some others. These solutions are deployed on several modes including on-premises, cloud-based, hybrid and some others. It finds application in various types of vehicles including passenger cars, light commercial vehicles, heavy commercial vehicles, electric vehicles, autonomous vehicles and some others. The end-user of these tools consists of OEMs, tier 1 & tier 2 suppliers, mobility service providers, dealerships & distributors, fleet operators & leasing companies, technology integrators and startups. This market is expected to rise significantly with the growth of the telecom sector in different parts of the world.

The major trends in this market consists of partnerships, opening of innovation centers and popularity of autonomous trucks.

The connected vehicle platforms segment dominated the market with a share of around 31%. The increasing focus of automotive companies to develop SDVs has boosted the market expansion. Additionally, the advancement in 5G technology coupled with growing emphasis of software developing companies to develop an advanced OS for connected vehicles is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of these platforms including enhanced safety, improved efficiency, superior convenience and some others is expected to drive the growth of the automotive digital transformation market.

The autonomous & ADAS enablement tools segment is expected to grow with the highest CAGR during the forecast period. The increasing demand for autonomous vehicles in developed nations such as the U.S., Denmark, Canada and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at enhancing automotive safety is playing a crucial role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for integrating ADAS-based software and hardware in modern cars is expected to foster the growth of the automotive digital transformation market.

The passenger cars segment held the largest share of the market with a share of around 43%. The rising demand for passenger vehicles in various countries such as India, Japan, Germany and some others has boosted the market expansion. Additionally, the popularity of autonomous cars in developed nations coupled with numerous government initiatives aimed at mandating ADAS in personal vehicles is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for developing technologically advanced passenger cars is expected to boost the growth of the automotive digital transformation market.

The electric vehicles segment is expected to rise with the fastest CAGR during the forecast period. The rising adoption of EVs in several countries such as China, the U.S., India and some others has driven the market expansion. Additionally numerous government initiatives aimed at developing the EV charging infrastructure coupled with rise in number of EV startups is playing a crucial role in shaping the industry in a positive direction. Moreover, the growing emphasis of automotive companies to develop wide range of EVs is expected to propel the growth of the automotive digital transformation market.

The cloud-based segment led the market with a share of around 49%. The growing use of cloud-based solutions in the automotive sector to enhance the manufacturing procedure has boosted the market expansion. Additionally, the increasing focus of software developing companies to develop cloud-based automotive platforms is playing a vital role in shaping the industrial landscape. Moreover, partnerships and joint ventures among automotive brands and software developers is expected to foster the growth of the automotive digital transformation market.

The hybrid segment is expected to grow with the fastest CAGR during the forecast period. The increasing emphasis of automotive brands on deploying hybrid data analytics software has driven the market expansion. Additionally, the growing adoption of on-premises infrastructure and public cloud services in the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of hybrid software including cost-effectiveness, enhanced functionality, scalability, improved user experience and some others is expected to boost the growth of the automotive digital transformation market.

The vehicle operations & lifecycle services segment dominated the industry with a share of around 36%. The integration of advanced software platforms in the automotive manufacturing sector for enhancing vehicle operations and lifecycle services has driven the market expansion. Additionally, the adoption of cloud-based solutions in the EV sector to enhance lifecycle services is playing a prominent role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for deploying cloud-native software to enhance designing and manufacturing of vehicles is expected to drive the growth of the automotive digital transformation market.

The digital retailing & mobility-as-a-service segment is expected to rise with the highest CAGR during the forecast period. The increasing use of online tools and platforms to enhance the car purchasing process has boosted the market expansion. Also, the rising popularity of MaaS platforms in the developed nations coupled with rapid investment by software developers to developed advanced retailing platforms is playing a vital role in shaping the industry in a positive direction. Moreover, partnerships among automotive brands and technology providers is expected to boost the growth of the automotive digital transformation market.

The IoT & connectivity segment dominated the industry with a share of around 34%. The integration of IoT solutions in modern cars to enhance connectivity has driven the market expansion. Additionally, the growing use of advanced IoT in semi-autonomous vehicles to improve safety is playing a prominent role in shaping the industrial landscape. Moreover, the increasing application of advanced IoT sensors to enhance vehicular safety, functionality, performance and some others is expected to propel the growth of the automotive digital transformation market.

The digital twin & simulation segment is expected to rise with the highest CAGR during the forecast period. The increasing use of digital twin solutions in the automotive sector for optimizing vehicle design, maintenance, manufacturing and some others has driven the market expansion. Also, numerous applications of digital twins in the automotive industry to enhance product testing and employee training is playing a vital role in shaping the industry in a positive direction. Moreover, partnerships among automotive brands and technology providers to integrate advanced digital twin solutions in the automotive industry is expected to boost the growth of the automotive digital transformation market.

The OEMs segment dominated the industry with a share of around 44%. The increasing adoption of cloud-based software by the automotive OEMs for streamlining numerous applications has boosted the market expansion. Additionally, the growing integration of IoT-enabled platforms in the OEMs to enhance operational efficiency is playing a vital role in shaping the industrial landscape. Moreover, partnerships among automotive companies and software developers to deploy advanced software in the OEM sector is expected to propel the growth of the automotive digital transformation market.

The mobility service providers segment is expected to expand with the highest CAGR during the forecast period. The increasing adoption of AI-based software by MaaS platforms to enhance the booking experience has boosted the market expansion. Additionally, the growing application of IoT-enabled solutions by MaaS providers to improve fleet management operations is contributing to the industry in a positive manner. Moreover, rapid investment by mobility service providers to deploy advanced technologies in their vehicles to enhance autonomous driving is expected to foster the growth of the automotive digital transformation market.

Europe led the automotive digital transformation market with a share of around 32%. The increasing demand for luxury vehicles in several countries such as Germany, Italy, France, UK and some others has boosted the market expansion. Additionally, rapid investment by government for strengthening the V2X connectivity network coupled with rise in number of fleet operators & leasing companies is positively contributing to the industry. Moreover, the presence of numerous market players such as Bosch GmbH, Siemens AG, Aptiv PLC, Valeo and some others is expected to boost the growth of the automotive digital transformation market in this region.

Germany is the major contributor in this region. The integration of advanced technologies such as big data & advanced analytics and augmented reality (AR) / virtual reality (VR) in the automotive sector has driven the market expansion. Also, rise in number of ride-sharing companies along with growing production and sales of passenger cars is playing a vital role in shaping the industry in a positive direction.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The growing sales of electric vehicles in various nations such as India, China, Japan, South Korea, Australia and some others has boosted the market growth. Also, rising emphasis of technology integrators & startups for developing advanced AI-based solution for the automotive sector coupled with technological advancements in 5G network is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Denso Corporation, Tata Consultancy Services (TCS), LG Innotek, Hesai Technology and some others is expected to propel the growth of the automotive digital transformation market in this region.

China dominated the market in this region. The integration of advanced technologies such as AI and IoT in the automotive sector coupled with rapid investment by software companies to develop advanced automotive platforms has driven the market expansion. Additionally, the presence of numerous automotive companies such as XPENG, BYD, SAIC Motors and some others is playing a vital role in shaping the industrial landscape.

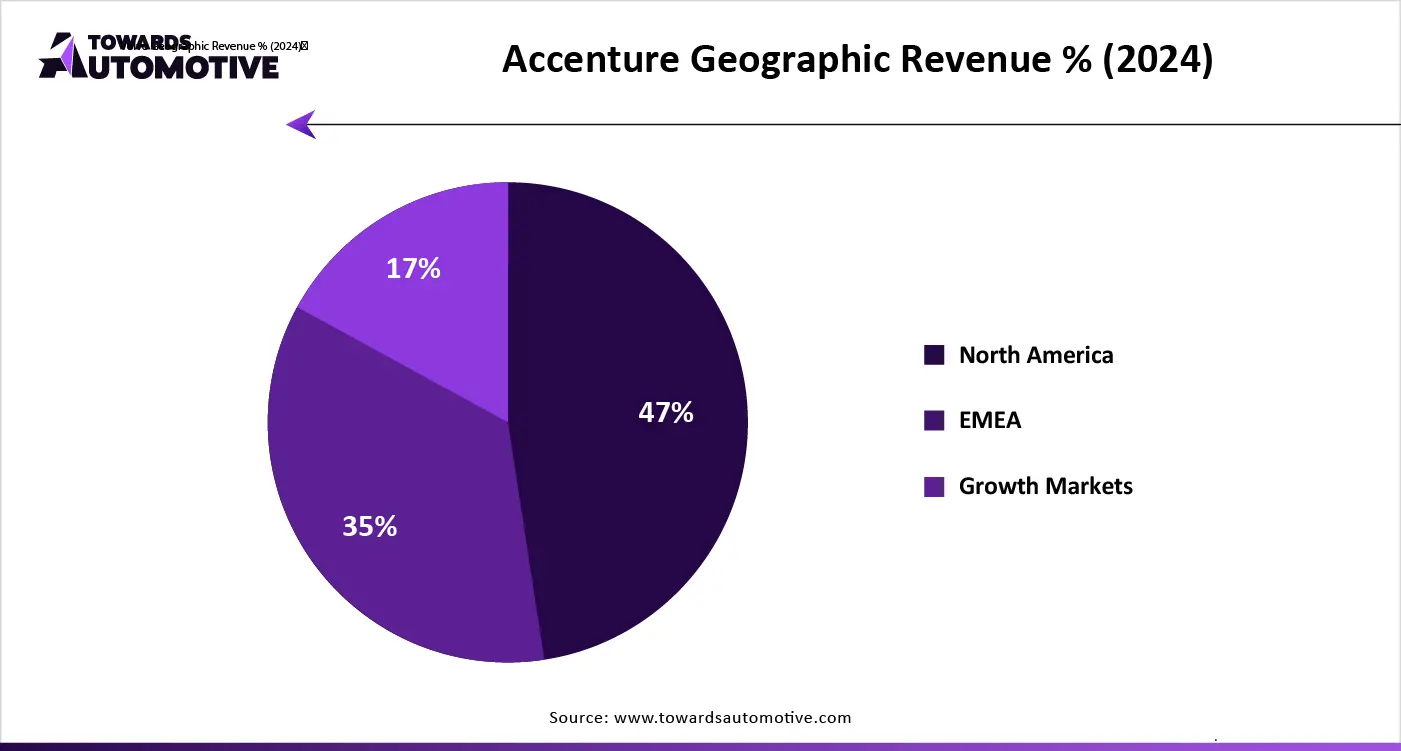

The automotive digital transformation market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Bosch GmbH, Siemens AG, Microsoft Corporation, IBM Corporation, Accenture Plc, Infosys Ltd., Cognizant, DXC Technology, Amazon Web Services (AWS), Google (Alphabet Inc.), Intel Corporation, NVIDIA Corporation, SAP SE, PTC Inc., Harman International (Samsung), Continental AG, Capgemini SE, ZF Friedrichshafen AG, Qualcomm Technologies, Inc., Tata Consultancy Services (TCS) and some others. These companies are constantly engaged in developing digital solutions for the automotive industry and adopting numerous strategies such as acquisitions, collaborations, launches, partnerships, business expansions, joint ventures and some others to maintain their dominance in this industry.

By Solution Type

By Vehicle Type

By Deployment Model

By Application Area

By Technology

By End User

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us