December 2025

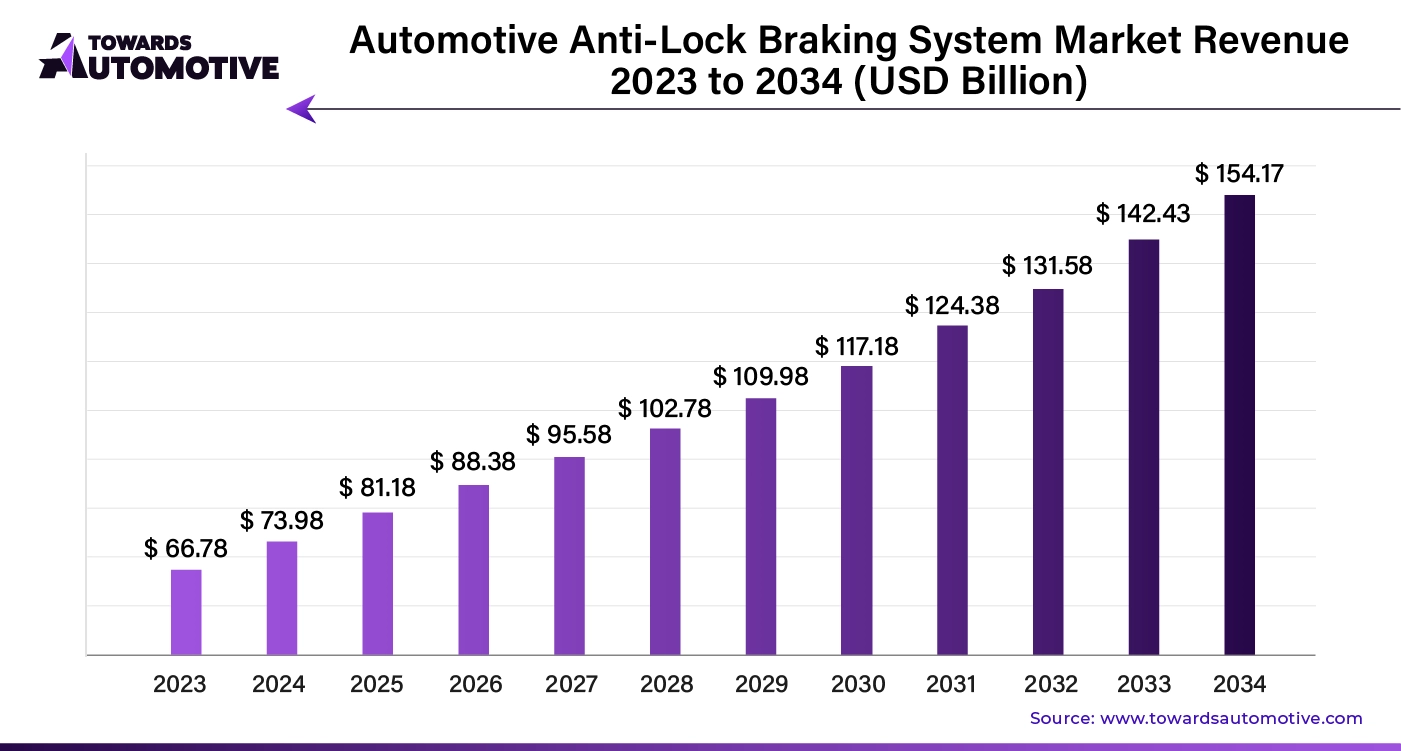

The automotive anti-lock braking system market will expand from USD 81.18 billion in 2025 to USD 154.17 billion by 2034 (CAGR 9.0%). We quantify demand by sub-system type (ECU largest; speed sensors; hydraulic unit; others), vehicle (passenger cars fastest; two-wheelers; commercial; others), and distribution channel (OEM fastest; aftermarket). Regional tables benchmark APAC’s dominance and Europe’s highest CAGR, with full splits for North America, Latin America, and MEA.

Competitive analysis profiles Bosch, Continental, ZF/TRW, Denso, Aisin, ADVICS, Autoliv, Hyundai Mobis, Hitachi, Haldex, Nissin Kogyo, comparing market shares, technology roadmaps (AI/ESC/traction integration), and pricing bands. We map the value chain (semis & sensors ECUs/hydraulic modules OEM assembly aftermarket), include trade flows (HS-coded ABS ECUs, modulators, sensors; ASP trends; key corridors), and provide manufacturer & supplier scorecards (plant footprints, certifications, 2024–2025 EBITDA ranges, localization moves).

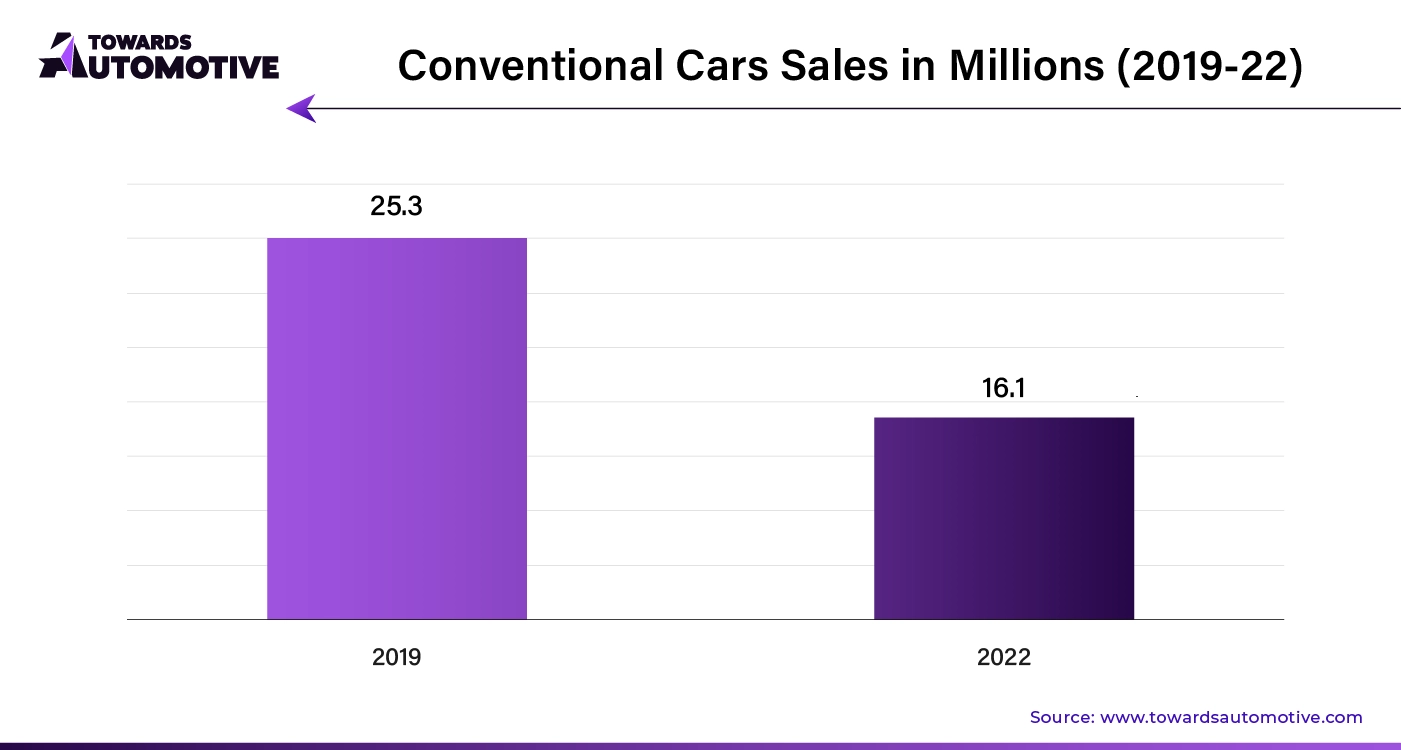

The Automotive Anti-Lock Braking System (ABS) Market is witnessing significant growth, driven by rising safety concerns and increasing regulatory mandates aimed at improving vehicle safety. ABS technology prevents wheel lock-up during sudden braking, allowing drivers to maintain steering control and reducing the risk of skidding or accidents. This safety feature is becoming standard in a wide range of vehicles, from passenger cars to commercial vehicles as automotive manufacturers aim to enhance road safety and meet evolving safety standards.

The market’s expansion is further supported by the growing demand for electric and autonomous vehicles, where advanced safety systems, including ABS, are essential for ensuring vehicle stability and control. Additionally, consumer preferences for vehicles with enhanced safety features, especially in emerging markets, are fueling the demand for ABS-equipped vehicles.

Technological advancements, such as the integration of ABS with electronic stability control (ESC) and traction control systems, are also driving market growth by providing superior braking performance. As governments worldwide implement stringent regulations requiring ABS in vehicles, the market is poised for continued growth, underscoring the importance of safety technology in the automotive industry.

Artificial Intelligence (AI) is playing an increasingly important role in the Automotive Anti-Lock Braking System (ABS) Market by enhancing the efficiency, precision, and safety of braking systems. AI-powered ABS systems can process vast amounts of data from various sensors in real-time, allowing for more accurate adjustments in braking pressure and ensuring that vehicles stop effectively without wheel lock-up, even in complex driving conditions.

AI improves the decision-making capabilities of ABS by analyzing factors such as vehicle speed, road conditions, and driver behavior to optimize braking responses. This leads to faster reaction times and more precise control over braking, especially in situations involving sudden stops or difficult terrains. AI can also integrate ABS with other vehicle systems, such as traction control and electronic stability control (ESC), to enhance overall safety and performance.

In addition, AI algorithms can predict potential failures or inefficiencies in the braking system by analyzing historical data, improving system reliability and enabling proactive maintenance. This predictive maintenance reduces downtime and ensures that the ABS functions optimally over time.

As vehicles become more connected and autonomous, AI's role in enhancing ABS performance will continue to grow, contributing to safer and smarter braking systems.

The rising demand for motorcycles and two-wheelers is significantly driving the growth of the Automotive Anti-Lock Braking System (ABS) Market. As more consumers opt for bikes as a convenient, cost-effective mode of transportation, the need for enhanced safety features, including ABS, is becoming paramount. ABS technology helps prevent wheel lock-up during sudden braking, offering riders greater control and stability, which is especially crucial for motorcycles due to their higher vulnerability to skidding and accidents.

Governments worldwide are also playing a key role in this market growth by implementing stringent safety regulations that mandate ABS installation in motorcycles. For instance, several regions have introduced laws requiring ABS for bikes over a certain engine capacity, further boosting demand for this safety feature.

The increasing popularity of high-performance and premium motorcycles, which often come equipped with advanced ABS systems, is another contributing factor. As urbanization rises and more people turn to two-wheelers for daily commuting, the demand for motorcycles with ABS is expected to increase, propelling the overall growth of the automotive ABS market. The integration of ABS in bikes enhances rider confidence and safety, making it a critical component in modern motorcyclesTop of Form.Bottom of Form

The Automotive Anti-Lock Braking System (ABS) Market faces several restraints that could hinder its growth. High production and installation costs of ABS technology, particularly in budget and economy vehicles, can be a significant barrier for manufacturers and consumers alike. Additionally, the complexity of ABS integration into older vehicle models or smaller motorcycles presents challenges. In certain developing regions, a lack of awareness about ABS benefits and insufficient regulatory enforcement may also slow adoption rates. These factors collectively restrain the widespread growth of the ABS market.

Integrated sensor technology is creating significant opportunities in the Automotive Anti-Lock Braking System (ABS) Market by enhancing the precision, efficiency, and responsiveness of ABS systems. These advanced sensors play a critical role in monitoring various vehicle parameters, such as wheel speed, traction, and road conditions, providing real-time data that enables the ABS to make split-second adjustments to braking pressure. This level of accuracy improves vehicle stability and control, especially during sudden braking or on slippery surfaces.

The integration of sophisticated sensors allows ABS systems to work seamlessly with other safety technologies like traction control and electronic stability control (ESC). This interoperability enhances overall vehicle safety and performance, particularly in challenging driving environments. As the automotive industry continues to adopt more advanced driver-assistance systems (ADAS) and move towards autonomous driving, integrated sensors will play an even more crucial role in ensuring that ABS systems can operate effectively in tandem with these technologies.

Additionally, the growing demand for electric and autonomous vehicles is further driving the need for advanced sensor-based ABS systems, as these vehicles require highly efficient braking systems to manage unique dynamics. This technological evolution opens new opportunities for innovation and growth in the ABS market.

The electronic control units (ECUs) segment is a key driver of growth in the Automotive Anti-Lock Braking System (ABS) Market, playing a crucial role in enhancing the performance and reliability of ABS systems. ECUs serve as the brain of ABS, processing real-time data from sensors that monitor wheel speed, road conditions, and vehicle dynamics. By analyzing this information, ECUs regulate the braking pressure to prevent wheel lock-up, ensuring optimal control and stability during braking.

The rising demand for advanced safety features in modern vehicles is propelling the integration of sophisticated ECUs within ABS systems. These ECUs offer improved response times and precise braking adjustments, significantly enhancing vehicle safety. Additionally, the growing trend toward autonomous and electric vehicles further amplifies the importance of ECUs, as these vehicles rely on advanced electronic systems to manage complex driving functions, including braking.

As vehicle electronics continue to evolve, ECUs are becoming more powerful, enabling ABS systems to work seamlessly with other safety technologies like electronic stability control (ESC) and traction control. This increasing complexity and functionality of ECUs is driving the adoption of ABS across a broader range of vehicles, from passenger cars to commercial fleets, contributing to the overall growth of the market.

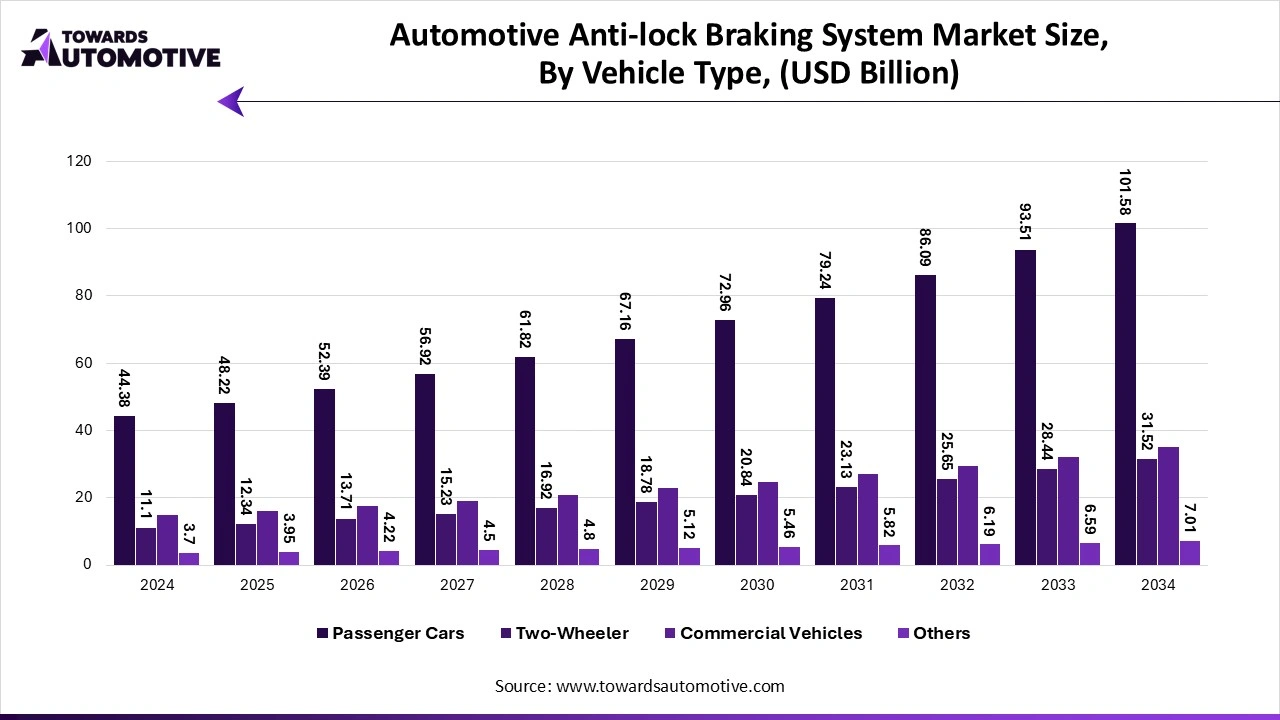

The passenger car segment is expected to grow with the highest CAGR during the forecast period. The passenger car segment is a significant driver of growth in the Automotive Anti-Lock Braking System (ABS) Market, as the demand for enhanced safety features in everyday vehicles continues to rise. ABS technology, which prevents wheel lock-up during sudden braking and improves vehicle control, is becoming a standard feature in passenger cars globally. The growing emphasis on safety, fueled by stringent government regulations and consumer awareness, has led to increased adoption of ABS in this segment.

As the global automotive industry shifts towards more safety-conscious designs, manufacturers are integrating ABS into a wide range of passenger cars, from economy models to luxury vehicles. The increasing production of passenger cars, particularly in emerging markets, is further boosting the demand for ABS systems. In regions like Asia-Pacific and Europe, where passenger car ownership is rapidly rising, ABS is viewed as a critical feature to improve road safety and reduce accidents.

Moreover, technological advancements in ABS systems, such as integration with electronic stability control (ESC) and traction control, enhance the overall driving experience for passenger cars. This makes ABS an essential safety component, driving growth in the market as consumers prioritize vehicle safety and performance.

The OEM segment is anticipated to grow with fastest growth rate during the forecast period. The OEM (Original Equipment Manufacturer) segment is a pivotal driver of growth in the Automotive Anti-Lock Braking System (ABS) Market, significantly influencing the widespread adoption of advanced braking technologies. OEMs are crucial in integrating ABS into new vehicles, aligning with rigorous safety regulations and meeting the increasing consumer demand for enhanced safety features. As regulatory standards for vehicle safety become more stringent globally, OEMs are instrumental in ensuring that ABS technology is incorporated as a standard feature across various vehicle categories, including passenger cars, trucks, and luxury vehicles.

OEMs invest heavily in research and development to advance ABS technology, aiming to improve its integration with other advanced driver assistance systems (ADAS) and enhance overall vehicle performance. This continuous innovation not only meets evolving safety standards but also addresses consumer expectations for reliable and effective braking systems. Strategic collaborations between OEMs and ABS technology providers further accelerate advancements, ensuring that the latest braking solutions are integrated into new vehicle models.

By driving the implementation of cutting-edge ABS technologies and adhering to safety regulations, the OEM segment plays a central role in the expansion of the ABS market, shaping the future of automotive safety and performance.

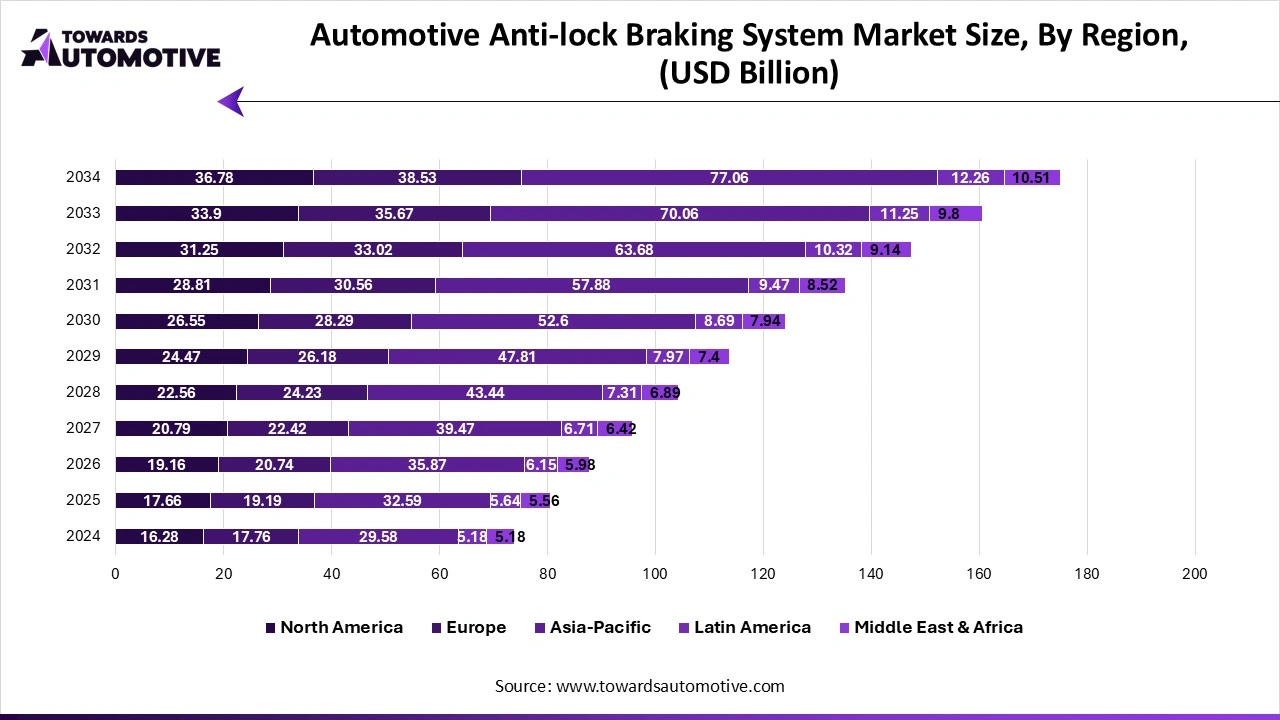

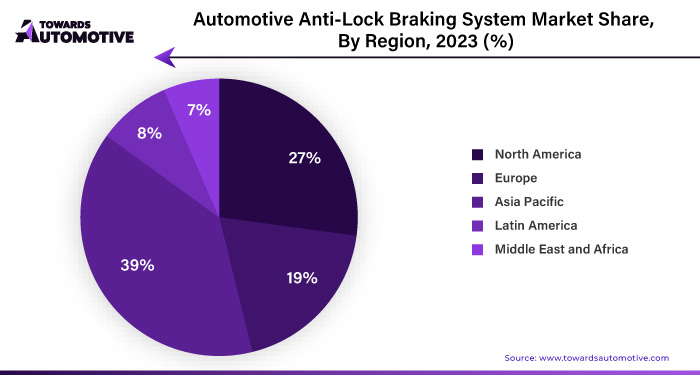

Asia Pacific dominated the automotive anti-lock braking system market. The Automotive Anti-Lock Braking System (ABS) Market in Asia Pacific is witnessing substantial growth, driven by rising vehicle production, the expansion of electric vehicles (EVs), and stringent government regulations. As one of the world’s largest automotive manufacturing hubs, the region, led by countries like China, India, and Japan, is seeing a significant surge in vehicle production. This increase in vehicle output, combined with a growing focus on safety, is propelling the demand for ABS in both passenger cars and commercial vehicles.

The expansion of electric vehicles is also fueling market growth. With EV adoption on the rise, manufacturers are prioritizing the integration of ABS to enhance safety and improve braking performance in these vehicles, which have unique handling characteristics compared to traditional internal combustion engine vehicles.

Moreover, governments across Asia Pacific are implementing stringent safety regulations, mandating the inclusion of ABS in new vehicles, including motorcycles and entry-level cars. Countries such as India and China have introduced laws requiring ABS in vehicles, contributing to its widespread adoption. These factors collectively drive the robust growth of the Automotive ABS Market in the Asia Pacific region, making it a key player in the global market.

Europe is expected to expected grow with the highest CAGR during the forecast period. The Automotive Anti-Lock Braking System (ABS) Market in Europe is experiencing robust growth, driven by technological advancements, an increase in luxury and high-performance vehicles, and a heightened focus on road safety. Europe’s automotive sector is renowned for its innovation, with continuous advancements in ABS technology improving its integration with other safety systems, such as electronic stability control (ESC) and traction control. These innovations enhance vehicle stability and braking performance, meeting the rising expectations of both consumers and regulators.

The growing demand for luxury and high-performance vehicles in Europe also plays a significant role in expanding the ABS market. These vehicles often come equipped with advanced safety features, including state-of-the-art ABS systems, to provide superior driving dynamics and safety. As the market for premium and performance-oriented cars grows, so does the adoption of advanced ABS technology.

Additionally, Europe’s strong emphasis on road safety is driving the widespread implementation of ABS. Stringent safety regulations and increased public awareness of the importance of advanced braking systems contribute to the market’s growth. Collectively, these factors underscore the pivotal role of ABS technology in Europe’s automotive industry, ensuring enhanced vehicle safety and performance.

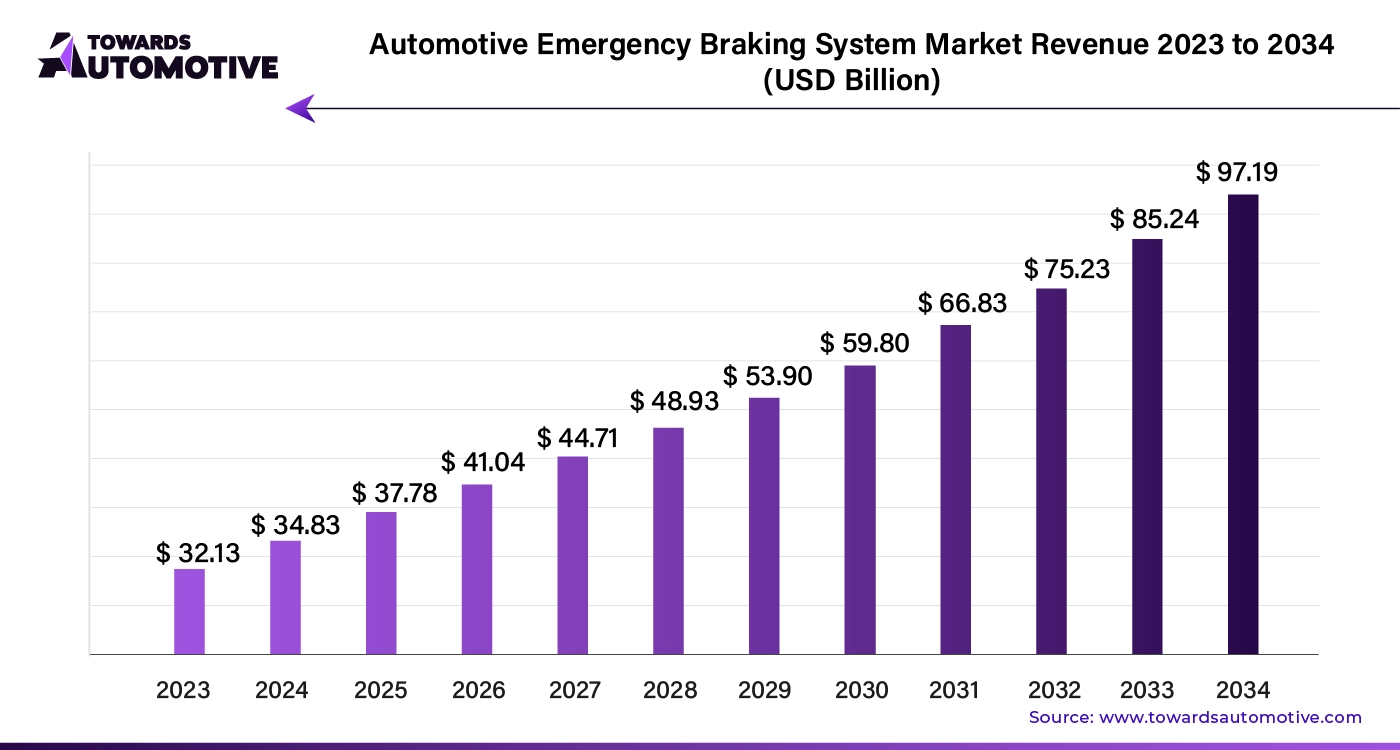

The global automotive emergency braking system market size is calculated at USD 34.83 billion in 2024 and is expected to be worth USD 97.19 billion by 2034, expanding at a CAGR of 8.5% from 2024 to 2034.

Rapid Advances in Braking Features: Modern braking systems are integrating AI with lidar, radar, and camera-based sensors to enhance object recognition and reaction times. This advancement boosts market potential and improves safety. Government Regulations: Governments worldwide are increasingly requiring advanced safety features, such as emergency braking systems, in new vehicles. Strict safety regulations in the U.S., China, and Europe are driving the adoption of these technologies as standard equipment.

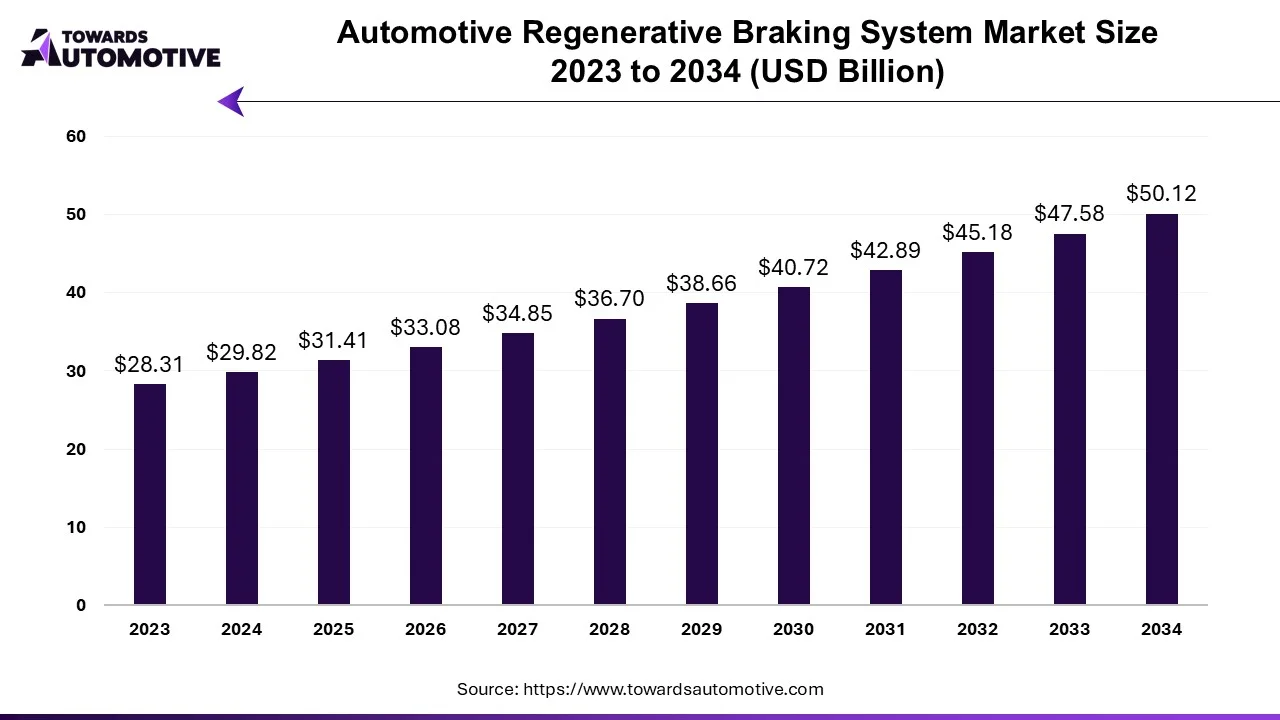

The automotive regenerative braking system market is set to grow from USD 31.41 billion in 2025 to USD 50.12 billion by 2034, with an expected CAGR of 5.33% over the forecast period from 2025 to 2034.

The automotive regenerative braking system market is a prominent segment of the automotive components industry. This industry deals in development and distribution of regenerative braking system for automotives. There are various types of components of these braking systems comprising of brake pads, brake calipers, electronic control units, battery packs and others. These braking systems use different technologies including electromechanical braking, hydraulic braking and pneumatic braking. It finds application in numerous vehicles such as passenger vehicles, commercial vehicles, two wheelers and heavy vehicles. The growing sales of commercial vehicles in different parts of the globe has driven the market growth. This market is projected to grow drastically with the rise in the automotive sector around the globe.

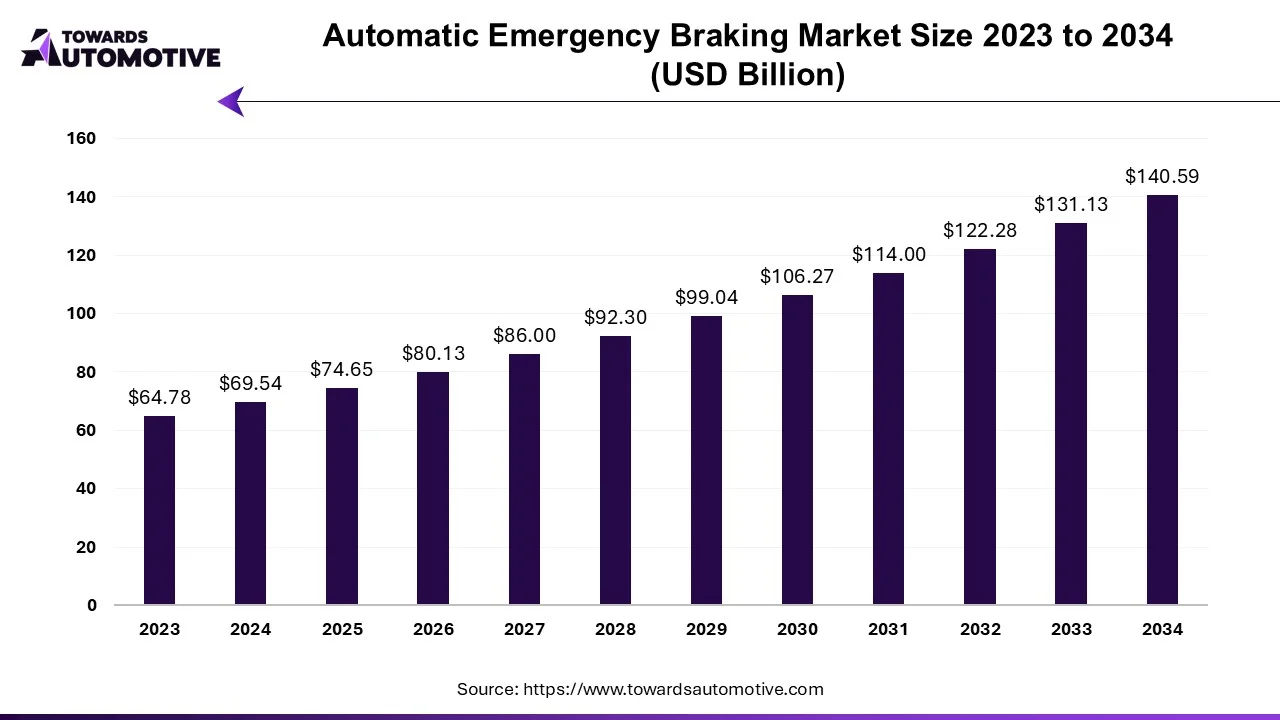

The automatic emergency braking market is expected to increase from USD 74.65 billion in 2025 to USD 140.59 billion by 2034, growing at a CAGR of 7.34% throughout the forecast period from 2025 to 2034.

The automatic emergency braking market is an integral sector of the automotive industry. This industry deals in manufacturing and distribution of automatic emergency braking systems for automotives. There are several types of products manufactured in this industry consisting of low-speed AEBS and high-speed AEBS. These braking solutions are integrated with advanced technologies such as crash imminent braking, dynamic brake support, forward collision warning and some others. It is designed for various vehicles comprising of passenger cars and commercial vehicles. The growing sales of electric vehicles in different parts of the world has driven the market growth. This market is projected to rise significantly with the growth of the automotive components industry across the globe.

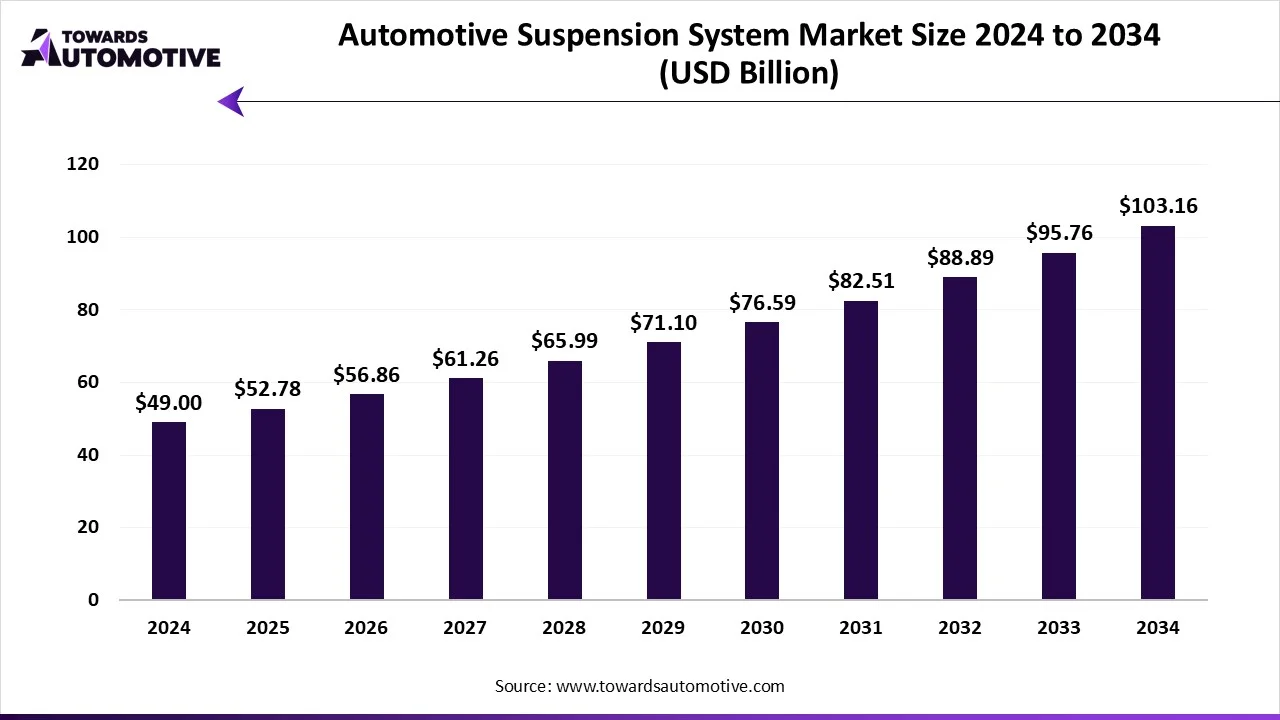

The automotive suspension system market is forecast to grow from USD 52.78 billion in 2025 to USD 103.16 billion by 2034, driven by a CAGR of 7.73% from 2025 to 2034.

The automotive suspension system market is a crucial sector of the automotive components industry. This industry deals in the manufacturing and distribution of automotive suspension system around the world. There are various types of suspension systems developed in this sector consisting of passive system, active system and semi-active systems. These systems consist of numerous components including shock dampener, struts, control arm, ball joint, air compressors and some others. It is designed for different types of vehicles such as two-wheelers, passenger cars, commercial vehicles and some others. The rising sales of electric vehicles across the world has increased the demand for advanced suspension systems, thereby boosting the market expansion. This market is growing drastically with the rise in the automotive industry around the world.

By Sub-System Type

By Vehicle Type

By Distribution Channel

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us