October 2025

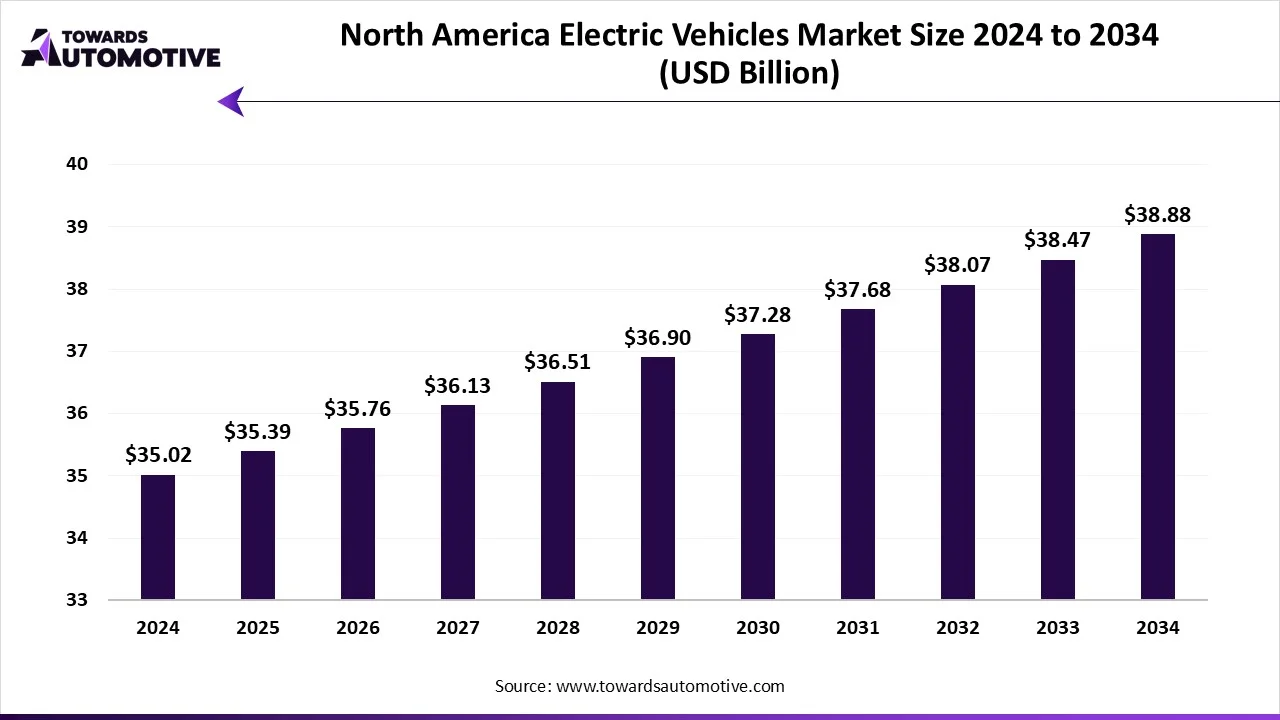

The North America electric vehicles market is set to grow from USD 35.39 billion in 2025 to USD 38.88 billion by 2034, with an expected CAGR of 1.05% over the forecast period from 2025 to 2034.The increasing demand for eco-friendly vehicles along with rise in number of EVs startups has driven the market expansion.

Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rapid investment by market players for opening new EV manufacturing units is playing a crucial role in shaping the industrial landscape. The research and development activities related to sodium-ion batteries as well as technologies advancements in hybrid powertrains is expected to create ample growth opportunities for the market players in the upcoming years.

The North America electric vehicles market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of electric vehicles for the consumers of North America. There are different types of vehicles developed in this sector comprising of passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), buses & coaches and some others. These vehicles are powered by numerous types of batteries including lithium-ion batteries, nickel-metal hydride (NiMH) batteries, solid-state batteries and some others. It delivers various driving range such as up to 150 miles, 151-300 miles and above 300 miles. The end-users of these vehicles comprise of private users and commercial/fleet users. This market is expected to rise significantly with the growth of the battery manufacturing sector around the world.

The major trends in this market consists of rising sales of EVs, business expansions and government initiatives.

The battery electric vehicles (BEVs) segment led the North America electric vehicles market with a share of around 70%. The increasing sales of BEVs in the U.S and Canada for lowering emission has boosted the market expansion. Additionally, the rising preference of HNIs to purchase luxury BEVs coupled with numerous government initiatives aimed at providing incentives and subsidies for purchasing EVs is playing a vital role in shaping the industrial landscape. Moreover, the growing investment by automotive brands for developing various types of BEVs is expected to boost the growth of the North America electric vehicles market.

The plug-in hybrid electric vehicles (PHEVs) segment is expected to expand with the highest CAGR during the forecast period. The increasing demand for PHEVs in remote areas of Canada and the U.S. due to lack of EV charging network has driven the market growth. Also, rapid investment by automotive brands for developing high-quality hybrid engines to deliver superior fuel efficiency is contributing positively in the industry. Moreover, opening of several PHEV production facilities in the Detroit area is expected to propel the growth of the North America electric vehicles market.

The passenger cars segment dominated the North America electric vehicles market with 75%. The growing demand for passenger EVs in the U.S. and Canada from individuals has driven the market expansion. Also, rapid investment by automotive brands for setting up new manufacturing plants to increase the production of passenger EVs is playing a prominent role in shaping the industrial landscape. Moreover, numerous government initiatives aimed at providing subsidies to purchase passenger EVs is expected to boost the growth of the North America electric vehicles market.

The heavy commercial vehicles (HCVs) & buses segment is expected to rise with the highest CAGR during the forecast period. The growing adoption of electric trucks in several industries such as mining, logistics, construction, e-commerce and some others has boosted the market growth. Additionally, rapid deployment of electric buses by municipalities to lower urban emission is playing a vital role in shaping the industrial landscape. Moreover, the rising investment by battery manufacturers for developing high-quality batteries to cater the needs of heavy commercial vehicles is expected to propel the growth of the North America electric vehicles market.

The lithium-ion batteries segment led the North America electric vehicles market with a share of around 80%. The increasing use of li-ion batteries in mid-ranged EVs for providing high driving range has driven the market growth. Additionally, numerous advantages of these batteries including high energy density, long lifespan, low self-discharge and some others is expected to boost the growth of the North America electric vehicles market.

The solid-state batteries segment is expected to grow with the fastest CAGR during the forecast period. The growing focus of battery manufacturers for developing high-quality solid-state batteries to cater the needs of luxury EVs has boosted the market expansion. Moreover, rapid investment by automobile manufacturers to integrate these batteries in their vehicles to deliver superior driving range is expected to drive the growth of the North America electric vehicles market.

The <100 kW segment led the North America electric vehicles industry with a share of around 55%. The increasing use of <100 kW powertrains in mid-ranged EVs due to their cost-effectiveness and less maintenance has driven the market expansion. Additionally, the growing focus of automotive brands to integrate <100 kW motors in LCEVs is expected to drive the growth of the North America electric vehicles market.

The >250 kW segment is expected to rise with the fastest CAGR during the forecast period. The growing use of >250 kW powertrains in commercial EVs for operating heavy-duty applications has boosted the market growth. Also, the integration of these motors in racing cars to deliver superior power and acceleration is expected to propel the growth of the North America electric vehicles market.

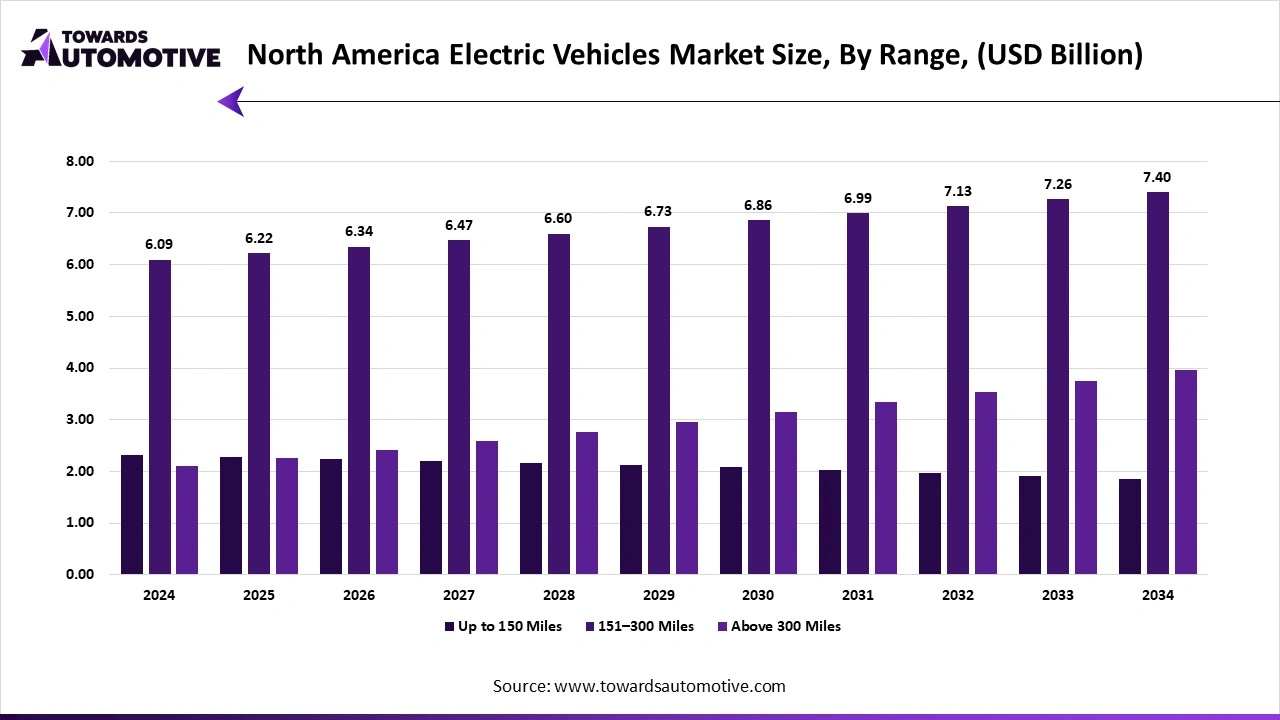

The 151–300 miles segment dominated the North America electric vehicles market with a share of around 50%. The increasing demand for passenger EVs that delivers range of around 151–300 miles from individuals for their personal usage has driven the market expansion. Additionally, the growing emphasis of automotive companies for manufacturing low-range and mid-range EVs to cater the needs of small businesses is expected to foster the growth of the North America electric vehicles market.

The above 300 miles segment is expected to grow with the highest CAGR during the forecast period. The growing adoption of electric buses that delivers range of more than 300 miles by fleet operators to enhance inter-state transportation has boosted the market growth. Also, rapid investment by battery manufacturers for developing solid-state batteries that delivers superior driving range of 500 miles on single charge is expected to drive the growth of the North America electric vehicles market.

The normal charging segment led the North America electric vehicles market with a share of around 60%. The growing use of AC-chargers by EV users in residential settings for charging their EVs at low prices has boosted the market expansion. Additionally, the increasing focus of automotive brands to provide normal charging solutions at free of cost to EV purchasers is expected to accelerate the growth of the North America electric vehicles market.

The fast-charging segment is expected to grow with the highest CAGR during the forecast period. The increasing demand for fast-charging solutions from EV charging stations for charging multiple vehicles at less time has driven the market growth. Also, rapid investment by EV charging providers for deploying fast-chargers in urban areas is expected to propel the growth of the North America electric vehicles market.

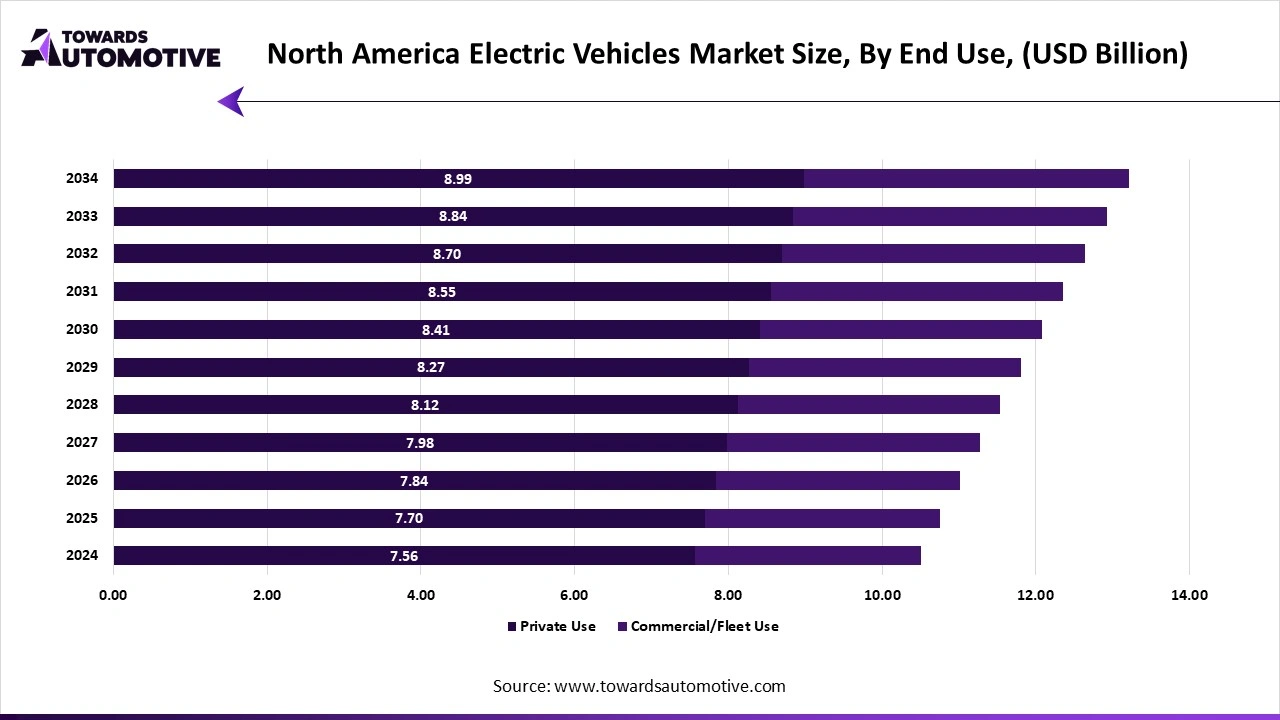

The private use segment dominated the North America electric vehicles market with a share of around 65%. The increasing adoption of EVs by individual consumers of the U.S. with an aim at lowering emission has driven the market expansion. Also, rising emphasis of finance companies for providing long-term EMI facilities to EV purchasers is playing a crucial role in shaping the industrial landscape. Moreover, the growing demand for luxury EVs by HNIs for personal uses is expected to foster the growth of the North America electric vehicles market.

The commercial/fleet use segment is expected to expand with the fastest CAGR during the forecast period. The growing focus of automotive companies for developing a wide range of commercial EVs to cater the needs of the North American region has boosted the market growth. Also, rapid adoption of EVs by fleet operators to minimize fuel costs and lowering emission is contributing to the industry in a positive manner. Moreover, partnerships among EV brands and fleet operators to deploy high-quality EVs for providing sustainable transportation solutions to the consumers of the U.S. and Canada is expected to drive the growth of the North America electric vehicles market.

United States led the North America electric vehicles market with a share of around 80%. The increasing sales of hybrid cars in various states including Florida, Massachusetts, South Dakota, Minnesota and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with opening of new R&D centers is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Tesla, Rivian, Ford, General Motors and some others is expected to drive the growth of the North America electric vehicles market.

Canada is expected to grow with the highest CAGR during the forecast period. The growing adoption of electric buses in numerous states such as Alberta, Ontario, Quebec, Manitoba and some others for lowering vehicular emission has driven the market expansion. Additionally, rapid investment by government for developing the EV sector along with increasing focus of battery manufacturers to open up new manufacturing facilities is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Nova Bus, Damon, Lion Electric Company and some others is expected to foster the growth of the North America electric vehicles market.

The electric vehicles market is forecast to grow from USD 2,072.80 billion in 2025 to USD 29,283.45 billion by 2034, driven by a CAGR of 34.21% from 2025 to 2034. The increasing demand for eco-friendly vehicles in developing nations along with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape.

Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rise in number of EV startups in developed regions has driven the market expansion. The research and development activities related to solid-state batteries is expected to create ample growth opportunities for the market players in the future.

The electric vehicles market is a prominent segment of the automotive industry. This industry deals in development and distribution of vehicles that are powered by batteries. There are several types of vehicles developed in this sector comprising of scooters, motorcycles, three-wheelers, passenger cars, buses, trucks, and some others. These vehicles are integrated with numerous components including battery pack & high voltage component, motor, brake, wheel & suspension, body & chassis, low voltage electronic components and some others. The end-users of these vehicles comprise of personal users and commercial users. This market is expected to rise significantly with the growth of the battery manufacturing sector around the globe.

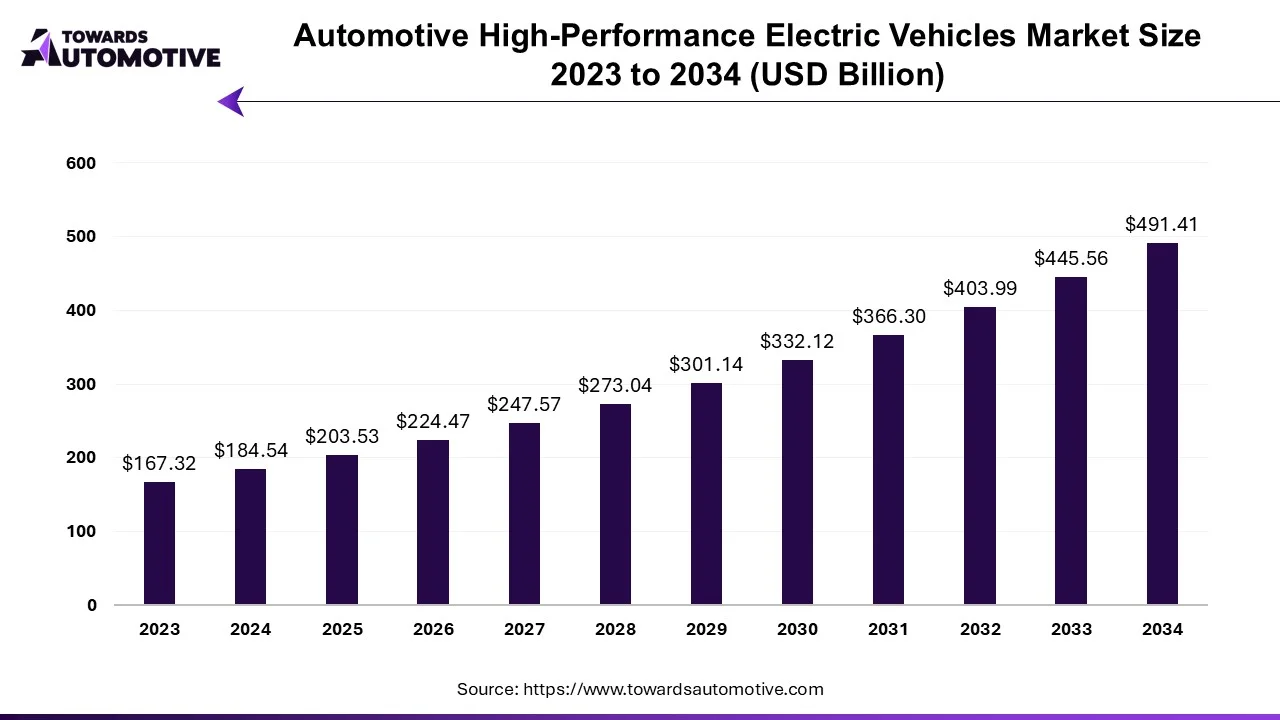

The automotive high-performance electric vehicles market is projected to grow from USD 203.53 billion in 2025 to USD 491.41 billion by 2034, expanding at a CAGR of 10.29%. The report offers a detailed segmentation by drive type (plug-in hybrid, pure electric) and vehicle type (passenger cars, commercial vehicles). Regional insights cover North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific leading due to strong EV adoption in China and Japan. The study further outlines the value chain structure, trade flows, and supplier relationships, supported by import–export data and performance metrics of OEMs like Tesla, BMW, Volkswagen, and General Motors.

The battery chemistry for electric vehicles (EVs) market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The growing demand for eco-friendly vehicles in developed nations coupled with technological advancements in the automotive sector has boosted the market expansion. Also, numerous government initiatives aimed at developing the EV battery along with rapid investment by public-sector entities for opening up new battery manufacturing facilities is playing a prominent role in shaping the industrial landscape. The research and development related to solid-state batteries is expected to create ample growth opportunities for the market players in the upcoming years to come.

The demand for EV batteries has increased rapidly in recent times due to rising government policies for EV adoption, increasing battery manufacturing capacity, declining cost per kWh, and growing consumer awareness about EVs. An EV battery is a rechargeable battery pack that serves as the main power source for different types of electric vehicles. There are several types of EV batteries available in the market consisting of lithium nickel manganese cobalt oxide batteries, lithium iron phosphate (LPF) batteries, lithium nickel cobalt aluminum oxide (NCA) batteries, solid-state batteries, lithium-sulfur (Li-S) batteries, and some others. These batteries are designed for numerous types of vehicles including passenger electric vehicles, commercial EVs, two-wheelers & three-wheelers, specialty vehicles and some others. The end-users of these batteries comprise of OEMs, battery manufacturers / module assemblers, aftermarket & retrofit EV conversions and others.

The foundation of EV production lies in the extraction and supply of essential materials such as lithium, nickel, cobalt, and graphite.

Cells are assembled in cylindrical, pouch, or prismatic form under strict quality and thermal control standards.

Testing and quality control (QC) of Electric Vehicles (EVs) is a comprehensive process that verifies the safety, performance, and efficiency of EV components and systems, including batteries, charging interfaces, software, and structural integrity, to meet stringent regulatory standards and customer expectations

| March 2024 | Announcement |

| RJ Scaringe, the Founder and CEO of Rivian | I have never been more excited to launch new products – R2 and R3 are distinctly Rivian in terms of performance, capability, and usability, yet with pricing that makes them accessible to a lot of people, our design and engineering teams are extremely focused on driving innovation into not only the product features but also our approach to manufacturing to achieve dramatically lower costs. R2 provides buyers starting in the $45,000 price range with a much-needed choice with a thoroughly developed technology platform that is bursting with personality. I can’t wait to get these to customers. |

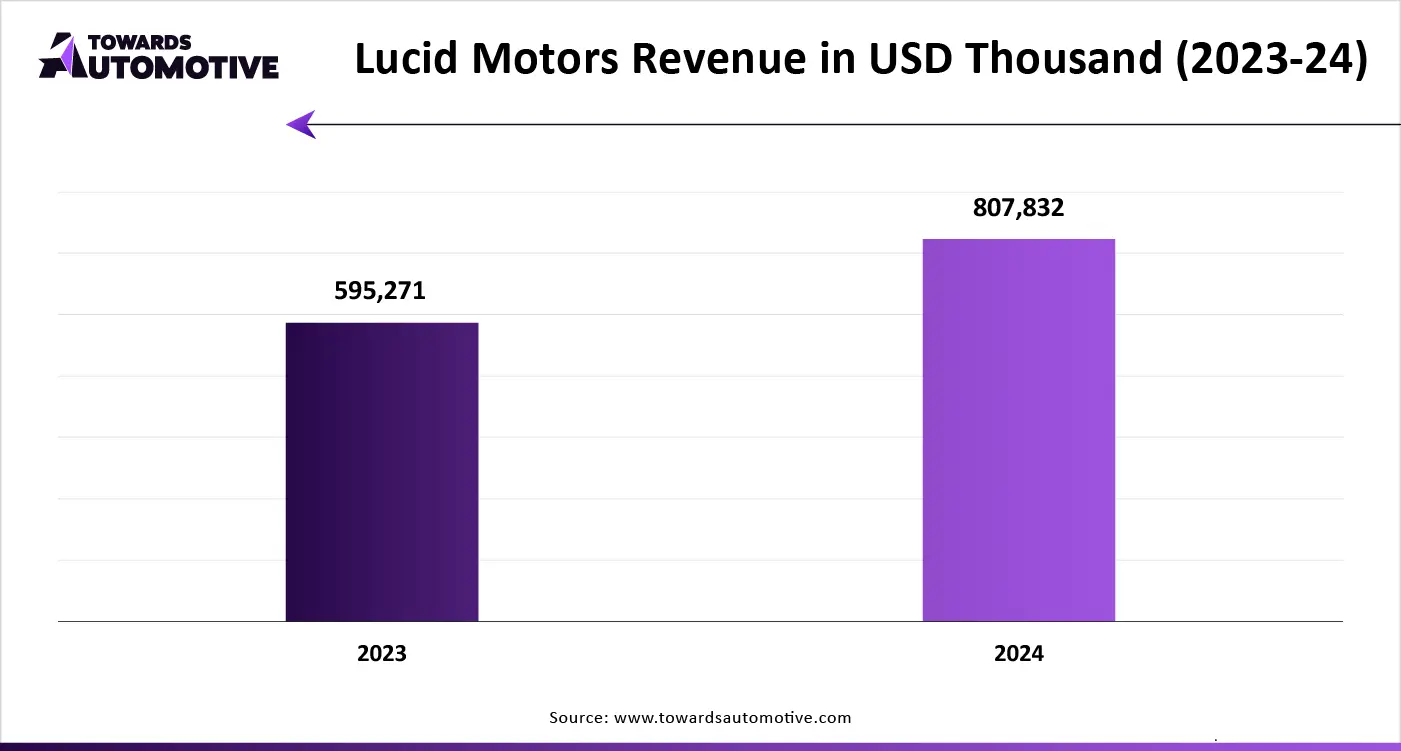

The North America electric vehicles market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Ford Motor Company; General Motors; Rivian, Fisker, Nikola Corporation, Lucid, Tesla, Canoo Inc., Proterra, Faraday Future and some others. These companies are constantly engaged in manufacturing EVs in North America and adopting numerous strategies such as partnerships, collaborations, launches, business expansions, acquisitions, joint ventures and some others to maintain their dominance in this industry.

By Propulsion Type

By Vehicle Type

By Battery Type

By Power Output

By Range

By End Use

By Charging Infrastructure

By Country

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us