October 2025

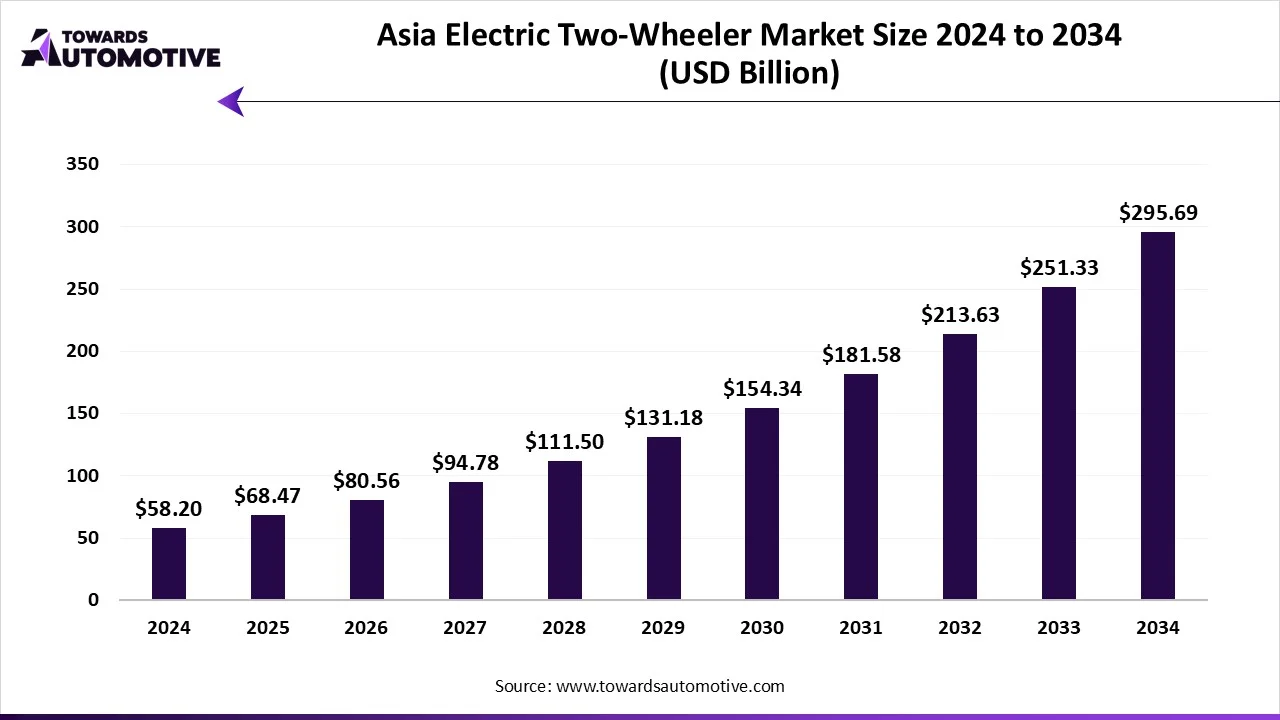

The Asia electric two-wheeler market is forecast to grow from USD 68.47 billion in 2025 to USD 295.69 billion by 2034, driven by a CAGR of 17.65% from 2025 to 2034. The growing emphasis of two-wheeler brands for manufacturing a wide range of electric bikes coupled with technological advancements in the automotive sector has boosted the market expansion.

Also, rapid investment by battery manufacturers for developing a wide-range of li-ion batteries along with numerous government initiatives aimed at developing the EV charging infrastructure is playing a crucial role in shaping the industrial landscape. The research and development activities related to silicon-anode batteries is expected to create ample growth opportunities for the market players in the upcoming years.

| Metric | Details |

| Market Size in 2024 | USD 58.2 Billion |

| Projected Market Size in 2034 | USD 295.69 Billion |

| CAGR (2025 - 2034) | 17.65% |

| Market Segmentation | By Vehicle Type, By Battery Type, By Vehicle Range, By End-User / Buyer Type, By Revenue Model and By Geography |

| Top Key Players | Yadea, Niu Technologies, Ola Electric, TVS Motor Company, Aima Technology Group Co., Ltd., Sunra, TAILG, Luyuan, Vmoto / Vmoto Soco, BYVIN, JinJian, HelloBike, Evoke |

The electric scooters segment dominated the market. The rising investment by electric vehicle companies to develop a wide range of electric scooters has boosted the market growth. Additionally, the growing use of li-ion batteries in electric scooters is expected to accelerate the growth of the Asia electric two-wheeler market.

The electric motorcycles segment is expected to rise with the highest CAGR during the forecast period. The incresing emphasis of EV makers to design and develop high-quality electric motorcycles to cater the needs of the APAC consumers has boosted the market expansion. Also, collaborations among battery manufacturers and two-wheelers companies is expected to drive the growth of the Asia electric two-wheeler market.

The lithium-ion batteries segment led the market. The growing use of advanced li-ion batteries in electric scooters for providing superior driving range has boosted the market growth. Additionally, rapid investment by battery manufacturers for opening up new li-ion battery centers is expected to propel the growth of the Asia electric two-wheeler market.

The advanced solid-state batteries segment is expected to rise with the highest CAGR during the forecast period. The research and development activities performed by battery manufacturers to develop solid-state batteries has boosted the market expansion. Also, the growing use of advanced solid-state batteries in electric superbikes is expected to foster the growth of the Asia electric two-wheeler market.

The medium range (50–100 km) segment led the market. The growing adoption of medium range electric bikes by fleet owners for urban commutation has boosted the market growth. Also, rapid investment by battery companies for developing advanced batteries for electric two-wheelers to deliver 50–100 kms range is expected to boost the growth of the Asia electric two-wheeler market.

The long range (>100 km) segment is expected to rise with the fastest CAGR during the forecast period. The rising use of advanced batteries in superbikes for delivering range of more than 100kms has boosted the market expansion. Additionally, technological advancements in solid-state batteries coupled with rapid investment in EV sector is expected to drive the growth of the Asia electric two-wheeler market.

The direct vehicle sales segment dominated the market. The growing sales of electric two-wheelers in various countries such as China, India, Japan, Taiwan, and some others has boosted the market growth. Additionally, rapid investment by market players for opening new outlets to increase the sales of electric scooters is expected to foster the growth of the Asia electric two-wheeler market.

The leasing / rental model segment is expected to rise with the fastest CAGR during the forecast period. The growing emphasis of EV brands to provide electric bikes on rental basis has boosted the market growth. Also, numerous advantages of rental and leasing models is expected to boost the growth of the Asia electric two-wheeler market.

The individual consumers segment dominated the market. The growing focus of individuals to adopt electric two-wheelers in the APAC region has boosted the market growth. Also, rising disposable income of the people along with numerous incentives provided by government for purchasing EVs is expected to drive the growth of the Asia electric two-wheeler market.

The fleet operators segment is expected to grow with the highest CAGR during the forecast period. The growing adoption of electric two-wheelers by fleet operators for lowering vehicular emission has boosted the market expansion. Additionally, partnerships among fleet owners and electric bike manufacturers is expected to propel the growth of the Asia electric two-wheeler market.

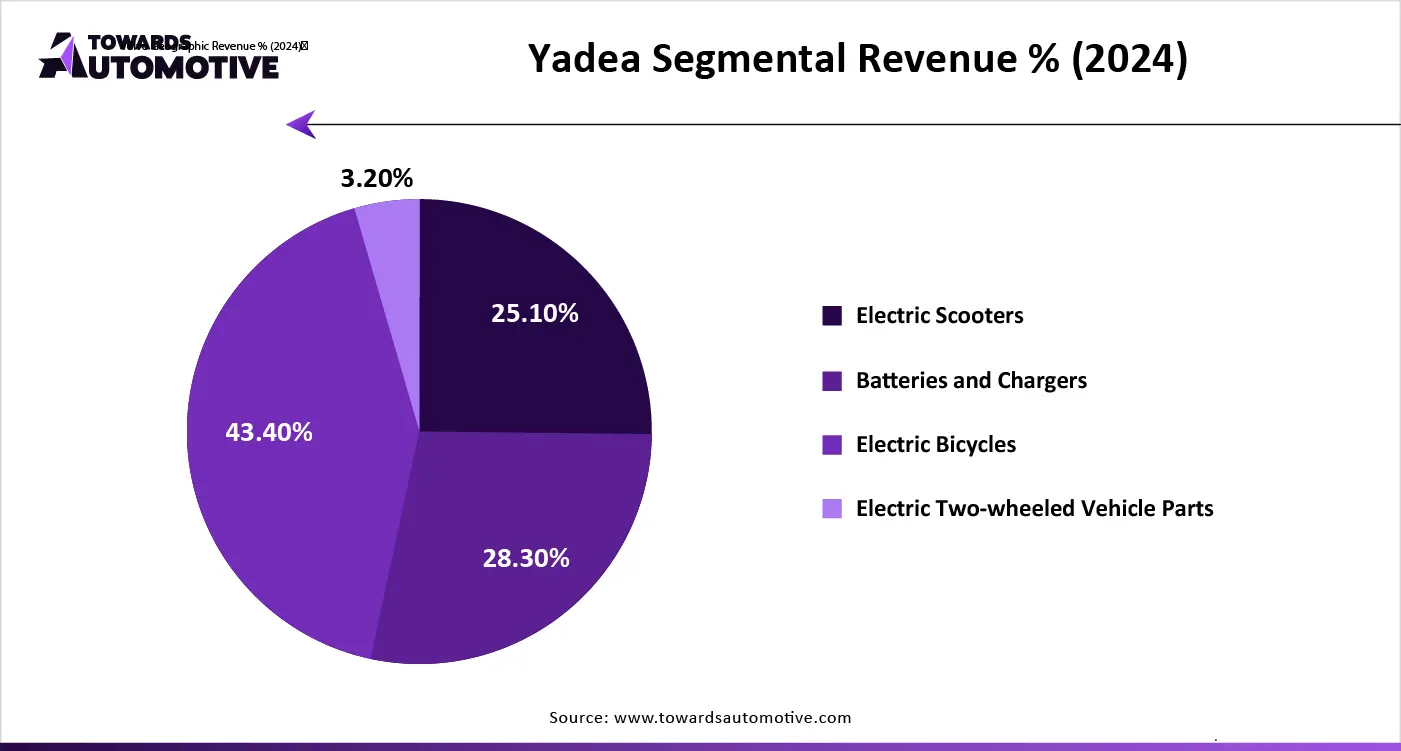

China dominated the Asia electric two-wheeler market. The growing emphasis of automotive brands to develop a wide range of electric two-wheelers has boosted the market growth. Additionally, rapid investment by government for strenghthening the EV charging infrastructure coupled with technological advancements in the EV sector is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Yadea Group Holdings Ltd., Aima Technology Group Co., Ltd. , Niu Technologies and some others is expected to boost the growth of the Asia electric two-wheeler market in this region.

India & Southeast Asia is expected to grow with the highest CAGR during the forecast period. The growing emphasis of EV companies to launch numerous types of electric two-wheelers in Southeast Asia has boosted the market growth. Additionally, rising development in the battery manufacturing sector coupled with opening of new production centers is contributing to the industry in a positive manner. Moreover, the presence of numerous market players such as TVS Motor Company (India), Bajaj Auto Ltd. (India), Gogoro Inc and some others is expected to propel the growth of the Asia electric two-wheeler market in this region.

The raw materials used in manufacturing electric two-wheelers consists of lithium, nickel, cobalt, graphite, and rare earth elements.

Component fabrication for electric two-wheelers involves the manufacturing of individual parts such as motors, batteries, controllers, and chassis components that are integrated into the vehicle's assembly line to create the final product.

The completed electric two-wheelers are delivered to the end-users through a well-established distribution channel comprising of online platforms and retail outlets.

| September 2025 | Announcement |

| Kausalya Nandakumar, Chief Business Officer, Emerging Mobility Business Unit | At VIDA, our mission is to democratize electric mobility, by making it truly accessible and affordable for every customer. With our value-added services such as extended battery warranty, assured buyback, and comprehensive roadside assistance, we are removing barriers and simplifying the transition to sustainable mobility. This festive season, we reaffirm our commitment to empowering customers with solutions that make EV ownership effortless and dependable |

| September 2025 | Announcement |

| Ajinkya Firodia, the Vice Chairman of Kinetic India | These first batteries rolling off our production line represent more than just a milestone for Range-X. They are the backbone of the Kinetic DX EV and the next wave of clean mobility in India. With AIS 156 certification, Range-X delivers durability, safety, and sustainability in every battery. |

| June 2025 | Announcement |

| Niraj Rajmohan sai, CTO and Co-founder at Ultraviolette | For India, this milestone represents not just our ability to participate in the global EV transition, but to lead it with technology that competes at the highest level. |

The Asia electric two-wheeler market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Yadea Group Holdings Ltd. (China), Aima Technology Group Co., Ltd. (China), Niu Technologies (China), Hero Electric (India), Okinawa Autotech Pvt. Ltd. (India), Ampere Vehicles Pvt. Ltd. (India), Super Soco (China), Yamaha Motor Co., Ltd. (Japan), TVS Motor Company (India), Bajaj Auto Ltd. (India), Gogoro Inc. (Taiwan), Honda Motor Co., Ltd. (Japan), Suzuki Motor Corporation (Japan) and some others. These companies are constantly engaged in manufacturing electric two-wheelers for the consumers of Asia and adopting numerous strategies such as business expansions, partnerships, collaborations, launches, acquisitions, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Vehicle Type

By Battery Type

By Vehicle Range

By End-User / Buyer Type

By Revenue Model

By Geography

October 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us