October 2025

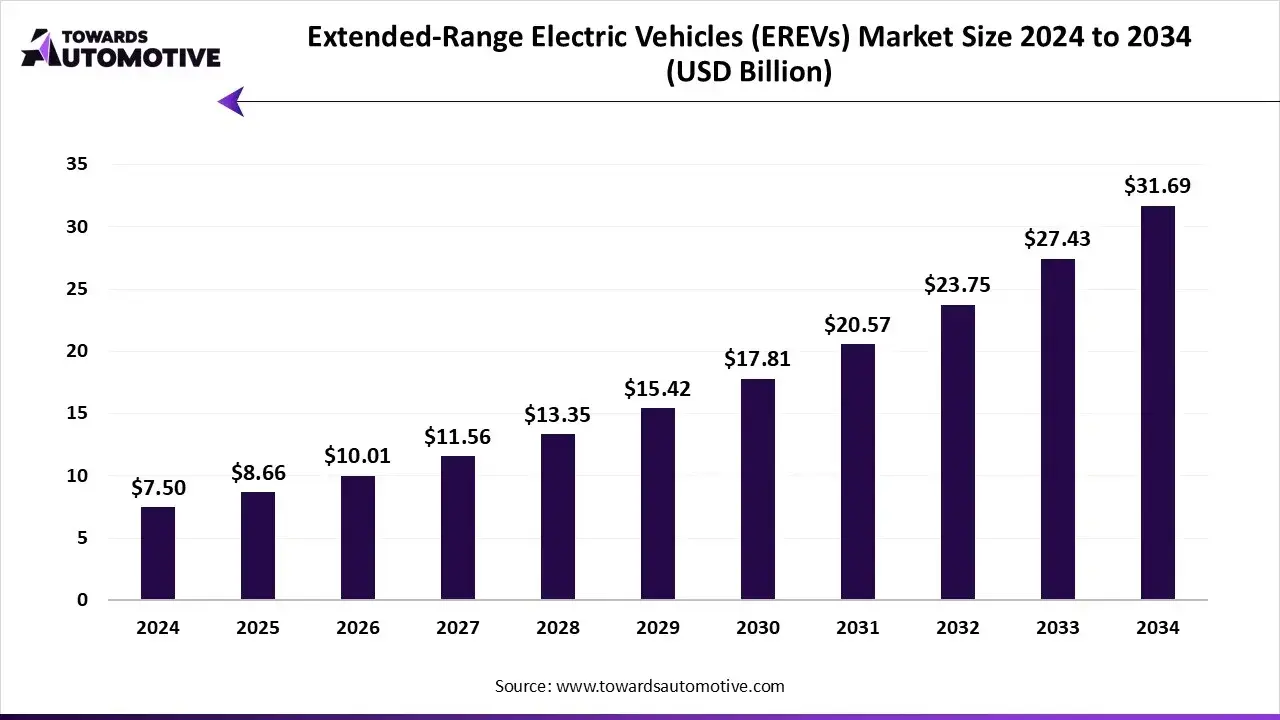

The extended-range electric vehicles (EREVs) market is projected to reach USD 31.69 billion by 2034, growing from USD 8.66 billion in 2025, at a CAGR of 15.5% during the forecast period from 2025 to 2034. The growing emphasis of automotive companies to develop extended-range EVs coupled with technological advancements in the automotive industry has boosted the market expansion.

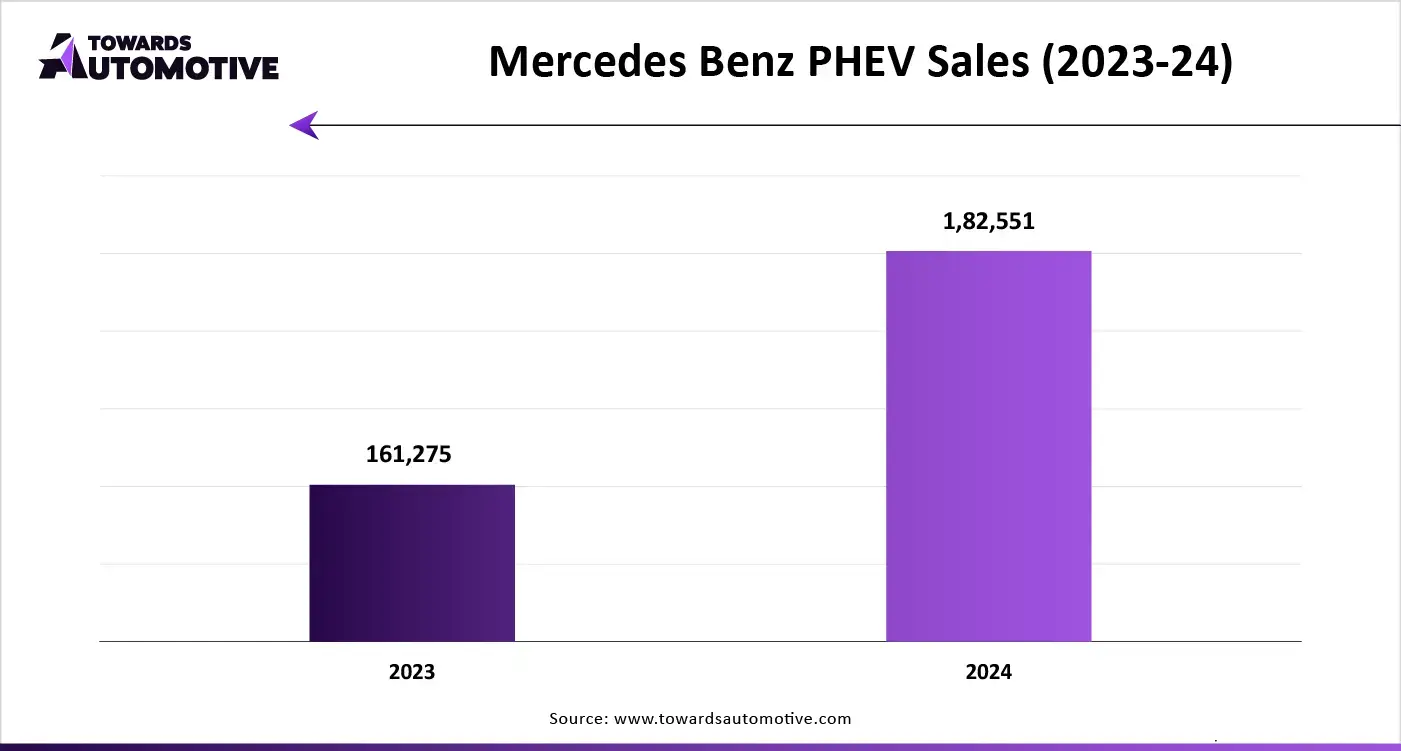

Also, numerous government initiatives aimed at increasing the adoption of EVs along with rising sales of PHEVs in different parts of the world is playing a crucial role in shaping the industry in a positive manner. The research and development activities related to range extenders is expected to create ample growth opportunities for the market players in the upcoming years.

The extended-range electric vehicles (EREVs) market is generally driven by numerous government initiatives, developments in EV industry and rapid investment in battery manufacturing sector. An extended-range electric vehicle is a new type of electric vehicle that uses a small internal combustion engine (ICE) to act as a generator for producing electricity to recharge the battery when it discharges. There are several types of EREVs available in the market comprising of passenger cars, commercial vehicles (light & heavy duty), two-wheelers / three-wheelers (specialty EREVs) and some others. These vehicles are equipped with different types of batteries including lithium-ion batteries, solid-state batteries, nickel-metal hydride batteries and some others. The end-users of these vehicles comprises of individual consumers, fleet operators, corporate & institutional buyers and some others. The EREV market is expected to rise significantly with the growth of the automotive sector in different parts of the world.

| Metric | Details |

| Market Size in 2025 | USD 8.66 Billion |

| Projected Market Size in 2034 | USD 31.69 Billion |

| CAGR (2025 - 2034) | 15.5% |

| Leading Region | North America |

| Market Segmentation | By Vehicle Type, By Propulsion / Powertrain, By Battery Type, By Vehicle Range,By End-User / Buyer Type, By Revenue Model and By Region |

| Top Key Players | Highly competitive, dominated by GM, Toyota, BMW, Mercedes-Benz, Ford, Hyundai, BYD, Nissan, Kia, Stellantis |

The major trends in this market consists of partnerships, business expansions and government initiatives.

The passenger cars segment led the industry. The growing sales of long-range passenger vehicles in several countries such as India, China, the U.S, Germany, France and some others has boosted the market growth. Additionally, rapid investment by automotive brands for developing high-quality range extender systems for passenger cars along with rising disposable income of the people in developing nations is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among EV makers and battery companies for manufacturing advanced batteries for passenger EVs is expected to propel the growth of the extended-range electric vehicles (EREVs) market.

The commercial vehicles segment held a considerable share of the market. The increasing adoption of EREV trucks in various industries such as mining, logistics, construction, e-commerce and some others with an aim at reducing vehicular emission has driven the market expansion. Also, the growing research and development conducted by truck manufacturers for developing EREV trucks coupled with rapid investment by EV companies for opening up commercial EREV centers is contributing to the industry in a positive manner. Moreover, collaborations among automotive brands and engine manufacturers to develop plug-in-hybrid engines for luxury buses is expected to foster the growth of the extended-range electric vehicles (EREVs) market.

The series hybrid EREVs segment led the market. The growing emphasis of Chinese automotive brands such as Li Auto, Voyah, Changan and some others for manufacturing series hybrid EREVs has boosted the market growth. Also, the increasing use of electric powertrain in series hybrid EREVs to operate at efficient speed and providing superior fuel economy is contributing to the industry in a positive manner. Moreover, numerous advantages of series hybrid powertrains such as flexibility and comfort, reduced emission, optimized engine performance, regenerative energy and some others is expected to drive the growth of the extended-range electric vehicles (EREVs) market.

The parallel hybrid EREVs segment is expected to rise with the fastest CAGR during the forecast period. The growing focus of prominent automotive brands such as Toyota, Hyundai, Jeep, GM and some others to develop EREVs on parallel hybrid platform has driven the market expansion. Also, the increasing investment by powertrains manufacturers such as Denso, Continental, Borgwarner, Schaeffler for developing a wide range of parallel hybrid powertrains is playing a vital role in shaping the industrial landscape. Moreover, numerous benefits of these powertrains including increased fuel efficiency, improved performance from combined power, reduced emissions, and efficient regenerative braking is expected to boost the growth of the extended-range electric vehicles (EREVs) market.

The lithium-ion batteries segment dominated the market. The growing use of li-ion batteries in EREVs for delivering superior performance in tough conditions has boosted the market growth. Also, rapid investment by battery manufacturers for opening new manufacturing plants to increase the production of li-ion batteries coupled with numerous government initiatives aimed at developing the lithium mining sector is playing a vital role in shaping the industry in a positive direction. Moreover, numerous advantages of li-ion batteries such as high energy density, long lifespan, low self-discharge, fast charging & high efficiency and some others is expected to propel the growth of the extended-range electric vehicles (EREVs) market.

The solid-state batteries segment is expected to expand with the fastest CAGR during the forecast period. The rising emphasis of EV companies to integrate solid-state batteries in their vehicles for providing superior driving range on a single charge has boosted the market expansion. Also, rapid investment by battery manufacturers for advancing research activities related to solid-state batteries coupled with surging use of superionic conductors for manufacturing solid-state batteries is contributing to the industry in a positive manner. Moreover, partnerships among automotive companies and battery manufacturers for developing high-quality solid-state batteries is expected to foster the growth of the extended-range electric vehicles (EREVs) market.

The medium range (300–500 km) segment led the market. The growing demand for medium range EREVs from individual consumers of several countries such as India, China, France and some others has boosted the market growth. Additionally, the growing emphasis of automotive brands for using high-quality lithium-ion batteries in EREVs to deliver a driving range in between 300-500 kms is playing a prominent role in shaping the industrial landscape. Moreover, rapid investment by EV makers to develop medium-range EVs is expected to propel the growth of the extended-range electric vehicles (EREVs) market.

The long range (>500 km) segment is expected to grow with the highest CAGR during the forecast period. The rising demand for luxury EVs in several developed nations such as Canada, France, Germany, Italy, UK and some others has driven the market expansion. Also, the growing emphasis of truck manufacturers to integrate advanced range extenders in electric trucks for delivering superior driving range is contributing to the industry in a positive manner. Moreover, partnerships among battery manufacturers and automotive companies for developing long-range commercial vehicles is expected to foster the growth of the extended-range electric vehicles (EREVs) market.

The direct vehicle sales segment led the market. The growing emphasis of middle-class consumers to purchase EREVs for long duration usage has boosted the market growth. Additionally, the increasing focus of automotive brands to integrate high-quality range extenders in luxury cars along with rapid investment by EV makers for opening new retail outlets to cater the needs of maximum end-users is playing a prominent role in shaping the industrial landscape. Moreover, numerous EMI facilities provided by BFSI companies for purchasing EREVs is expected to boost the growth of the extended-range electric vehicles (EREVs) market.

The leasing & subscription models segment is expected to rise with the highest CAGR during the forecast period. The increasing focus of automotive brands to provide EREVs on leasing and subscription basis has boosted the market expansion. Additionally, the growing adoption of EREVs by tourists on rental basis to enjoy short-term travelling coupled with rise in number of insurance companies providing short-term automotive policies is contributing to the industry in a positive manner. Moreover, numerous benefits of subscription models including higher customer lifetime value, valuable customer insights, scalability, flexibility, budget-friendly pricing and some others is expected to propel the growth of the extended-range electric vehicles (EREVs) market.

The individual consumers segment dominated the industry. The increasing adoption of EREVs by individual consumers of several countries such as the U.S., France, Germany, China and some others has boosted the market expansion. Additionally, numerous government incentives aimed at providing subsidies to EV consumers along with surging demand for luxury EREVs from HNIs is playing a prominent role in shaping the industrial landscape. Moreover, the growing consumer awareness about eco-friendly vehicles in developed nations is expected to propel the growth of the extended-range electric vehicles (EREVs) market.

The fleet operators segment is expected to rise with the fastest CAGR during the forecast period. The growing adoption of EREV vans by fleet operators with an aim at lowering vehicular emission has driven the market growth. Additionally, the increasing emphasis of truck operators to deploy EREV trucks in several industries such as mining, construction, logistics and some others coupled with numerous government initiatives aimed at deployment of electric vehicles in public transportation is contributing to the industry in a positive manner. Moreover, collaborations among fleet operators and automotive companies for deploying electric scooters in urban areas is expected to accelerate the growth of the extended-range electric vehicles (EREVs) market.

North America dominated the extended-range electric vehicles (EREVs) market. The growing sales of luxury EVs in the U.S. and Canada has boosted the market growth. Additionally, rapid investment by automotive companies for opening new EV production centers along with numerous government initiatives aimed at developing the EV industry is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Fisker Inc., Ford Motor Company, General Motors and some others is expected to boost the growth of the extended-range electric vehicles (EREVs) market in this region.

U.S. led the market in this region. The growing emphasis of consumers to adopt eco-friendly vehicles as well as technological advancements in the automotive industry has boosted the market growth. Additionally, the rising adoption of plug-in-hybrid vehicles by fleet operators is playing a prominent role in shaping the industry in a positive direction.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The rising demand for long-range EVs in several countries including China, India, South Korea, Japan and some others has driven the market expansion. Also, the rise in number of startup companies deaing in EVs along with rapid investment by government for developing the EV charging infrastructure is contributing to the industry in a positive direction. Moreover, the presence of various market players such as Geely Automobile Holdings Limited, BYD, Hyundai, Xpeng and some others is expected to propel the growth of the extended-range electric vehicles (EREVs) market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the rapid expansion of the automotive industry coupled with technological advancements in the battery manufacturing sector. In India, the growing adoption of long-range two-wheelers by individual owners along with numerous subisidies provided by government for adopting EVs has boosted the industrial expansion.

The foundation of EREVs lies in the extraction and supply of essential minerals such as lithium, nickel, cobalt, and graphite.

The raw materials are processed into several components including battery pack, electric motor, power electronics, and lightweight chassis.

The completed EREVs are delivered to the consumers through a suitable supply-chain consisting of retail outlets and online platforms.

| September 2025 | Announcement |

| José Munoz, the President and CEO of Hyundai Motor Company | In an industry facing unprecedented transformation, Hyundai is uniquely positioned to win through our unmatched combination of compelling products, manufacturing flexibility, technology leadership, outstanding dealer partners and global scale. We are delivering comprehensive electrified portfolios across all segments, localizing production in key markets, and leveraging breakthrough technologies from Software-Defined Vehicles to next-generation batteries. Our ability to adapt quickly, combined with the power of Hyundai Motor Group's 50+ affiliates and our unwavering commitment to customers, will enable us to continue unlocking tremendous value for our stakeholders. It's a great time to be with Hyundai. |

| August 2025 | Announcement |

| Kurt Kelty, VP, battery, propulsion and sustainability at General Motors | Getting this kind of range on a full charge doesn’t happen by accident. It takes deep integration across battery chemistry, drive unit efficiency, software and vehicle engineering and that’s exactly what the team delivered. This achievement is a great example of how far our EV technology has come, and the kind of innovation we’re building on every day at GM. |

| August 2025 | Announcement |

| Jim Farley, the president and CEO at Ford | We took a radical approach to a very hard challenge: Create affordable vehicles that delight customers in every way that matters – design, innovation, flexibility, space, driving pleasure, and cost of ownership – and do it with American workers, We have all lived through far too many ‘good college tries’ by Detroit automakers to make affordable vehicles that ends up with idled plants, layoffs and uncertainty. So, this had to be a strong, sustainable and profitable business. |

| September 2025 | Announcement |

| Anna Westerberg, President of Volvo Buses | Our new BZR Electric chassis not only delivers record range but also provides operators with versatility to run longer routes efficiently. This is a major milestone for sustainable intercity travel |

| June 2025 | Announcement |

| Eiichi Akashi, the Chief Technology Officer and executive officer, Nissan Motor Corporation | This new, third generation e-POWER system redefines Nissan’s hybrid technology providing smooth and responsive driving in all conditions. We’ve embedded close to a decade of learnings to ensure the system is more efficient, more refined and more competitive. The launch with Qashqai is just the beginning, we look forward to delivering this advanced powertrain to customers in North America and Japan in FY26, with other markets to follow. |

| March 2025 | Announcement |

| Marques McCammon, the President of Karma Automotive | Karma Automotive remains at the forefront of EREV powertrains, and believes now more than ever that the freedom of refueling either with gasoline or electricity is ideally suited to the marketplace. "With our gorgeous Amaris 2-door coupe and soon-to-be-revealed Gyesera 4-door, we're building a range of vehicles that will deliver exceptional EV torque and performance paired with worry-free cruising range, a combination that only EREV can deliver. |

The extended-range electric vehicles (EREVs) market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Nissan Motor Corporation, BMW AG, General Motors, BYD Auto Co., Ltd., , Geely Automobile Holdings Ltd, Toyota Motor Corporation, Mercedes-Benz, Ford Motor Company, Volvo Car Corporation, Fisker Inc., Kia Motors, Hyundai Motor Company, Porsche AG, Chery Automobile Co., Ltd., Mitsubishi Motors Corporation and some others. These companies are constantly engaged in developing long-range EVs and adopting numerous strategies such as partnerships, collaborations, business expansions, launches, acquisitions, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Vehicle Type

By Propulsion / Powertrain

By Battery Type

By Vehicle Range

By End-User / Buyer Type

By Revenue Model

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us