December 2025

The battery chemistry for electric vehicles (EVs) market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The growing demand for eco-friendly vehicles in developed nations coupled with technological advancements in the automotive sector has boosted the market expansion. Also, numerous government initiatives aimed at developing the EV battery along with rapid investment by public-sector entities for opening up new battery manufacturing facilities is playing a prominent role in shaping the industrial landscape. The research and development related to solid-state batteries is expected to create ample growth opportunities for the market players in the upcoming years to come.

The demand for EV batteries has increased rapidly in recent times due to rising government policies for EV adoption, increasing battery manufacturing capacity, declining cost per kWh, and growing consumer awareness about EVs. An EV battery is a rechargeable battery pack that serves as the main power source for different types of electric vehicles. There are several types of EV batteries available in the market consisting of lithium nickel manganese cobalt oxide batteries, lithium iron phosphate (LPF) batteries, lithium nickel cobalt aluminum oxide (NCA) batteries, solid-state batteries, lithium-sulfur (Li-S) batteries, and some others. These batteries are designed for numerous types of vehicles including passenger electric vehicles, commercial EVs, two-wheelers & three-wheelers, specialty vehicles and some others. The end-users of these batteries comprise of OEMs, battery manufacturers / module assemblers, aftermarket & retrofit EV conversions and others.

| Metric | Details |

| Key Raw Material Players | Albemarle, Glencore, BHP, Vale. |

| Growth Drivers | EV adoption policies, falling $/kWh cost, OEM–battery partnerships, expansion of giga-factories, recycling & second-life battery initiatives. |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Battery Chemistry, By Vehicle Type / Application, By Component / Cell Type, By End User / Buyer and By Region |

| Top Key Players | CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI, SK On, CALB, Gotion, EVE Energy, Sunwoda, Tesla, Svolt, Farasis, AESC, Ultium Cells |

The major trends in this market consists of business expansions, partnerships, joint ventures, acquisitions and government initiatives.

The lithium nickel manganese cobalt oxide (NMC) segment dominated the market with a share of around 40%. The increasing use of NMC batteries in several vehicles such as BMW i3, Hyundai Kona Electric, Jaguar I-Pace, and Volkswagen ID.3 for delivering superior range has driven the market expansion. Also, rapid investment by battery manufacturers for opening new production facilities to increase the production of NMC batteries is contributing to the industry in a positive manner. Moreover, various advantages of these batteries such as high power output, superior life, fast charging capability, enhanced versatility and some others is expected to propel the growth of the battery chemistry for electric vehicles (EVs) market.

The solid-state segment is expected to grow with a CAGR of more than 25% during the forecast period. The growing use of solid-state batteries in mid-range EVs manufactured by numerous brands such as Nissan, MG, Honda and some others has boosted the market growth. Additionally, the increasing emphasis of battery manufacturers to enhance research and development associated with solid-state batteries is playing a crucial role in shaping the industrial landscape. Moreover, numerous benefits of these batteries including high energy density, enhanced safety, longer lifespan, wider temperature range and some others is expected to boost the growth of the battery chemistry for electric vehicles (EVs) market.

The passenger electric vehicles segment led the market with a share of around 55%. The increasing demand for luxury passenger EVs in various countries such as the U.S., Italy, Germany, China and some others has boosted the market growth. Also, numerous incentives provided by government for adopting EVs coupled with constant research and development activities related to EV battery manufacturing is contributing to the industry in a positive manner. Moreover, partnerships among automotive brands and battery manufacturers for developing high-quality EV batteries is expected to drive the growth of the battery chemistry for electric vehicles (EVs) market.

The two-wheelers & three-wheelers segment is expected to rise with the highest CAGR of around 15% during the forecast period. The growing adoption of electric scooters in several countries such as India, China, Singapore, Italy and some others due to increasing prices of gasoline has driven the market expansion. Additionally, rapid investment by market players for developing high-quality batteries for two-wheelers and three-wheelers is playing a vital role in shaping the industrial landscape. Moreover, rapid deployment of electric bikes by fleet operators to lower vehicular emission and gaining maximum profits is expected to propel the growth of the battery chemistry for electric vehicles (EVs) market.

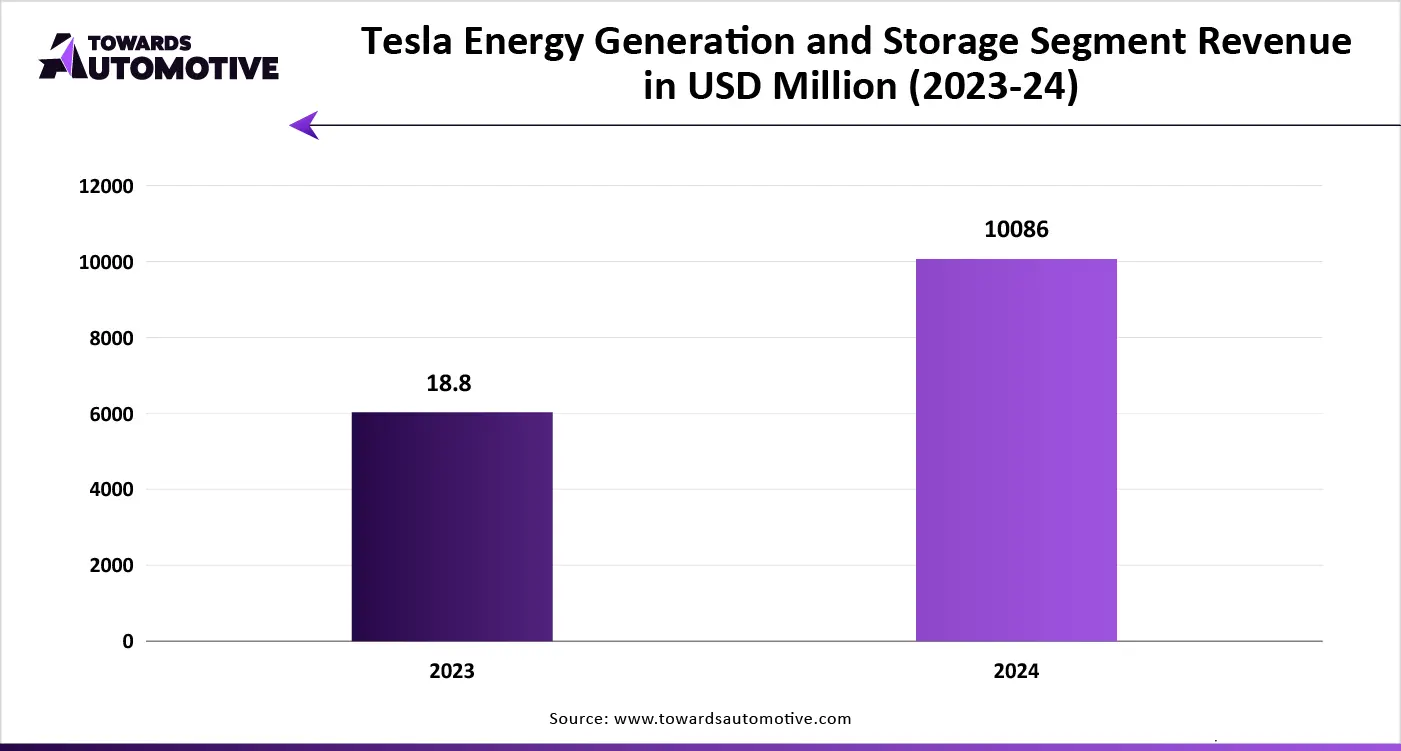

The cylindrical cells segment led the market with a share of around 40%. The growing adoption of cylindrical cell batteries in premium EVs manufactured by various companies such as Tesla, Rivian, BMW, Lucid and some others has driven the market expansion. Also, rapid investment by market players for developing a wide range of cylindrical cells is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of these batteries such as cost-effectiveness, reliability & consistency, stable performance, good heat dissipation and some others is expected to propel the growth of the battery chemistry for electric vehicles (EVs) market.

The prismatic cells segment held around 30% share of the industry. The rising use of prismatic cell batteries in electric vehicles (EVs) and hybrid vehicles (HEVs) due to their high energy storage capacity has driven the market expansion. Additionally, rapid focus of battery manufacturers for developing advanced prismatic cell batteries for trucks is contributing to the industry in a positive manner. Moreover, various benefits of these batteries including high energy density, space efficiency, high thermal management, customizable designing and some others is expected to foster the growth of the battery chemistry for electric vehicles (EVs) market.

The OEMs segment dominated the industry with a share of around 60%. The growing demand for high-end li-ion batteries from automotive OEMs such as Tata Motors, BYD, Tesla, GM and some others has boosted the market growth. Additionally, rapid investment by automotive brands for opening new service centers dealing in electric vehicles is playing a crucial role in shaping the industrial landscape. Moreover, collaborations among EV brands and battery manufacturing companies for high-quality EV batteries is expected to propel the growth of the battery chemistry for electric vehicles (EVs) market.

The aftermarket & retrofit EV conversions segment is expected to grow with the highest CAGR of 10% during the forecast period. The rising emphasis of middle-class people to purchase low-cost EV batteries for temporary usage has driven the market growth. Additionally, increase in number of aftermarket workshops in developing nations coupled with popularity of EV modification among HNIs is playing a prominent role in shaping the industry in a positive direction. Moreover, the availability of wide range of batteries in online platforms such as Amazon, Flipkart, Ebay, Alibaba and some others is expected to accelerate the growth of the battery chemistry for electric vehicles (EVs) market.

Asia-Pacific dominated the battery chemistry for electric vehicles (EVs) market with a share of around 45%. The increasing sales of battery electric vehicles (BEVs) in several countries such as India, China, Japan, South Korea, Australia and some others has driven the market growth. Additionally, numerous government initiatives aimed at developing the EV industry coupled with availability of essential raw materials is playing a prominent role in shaping the industrial landscape. Moreover, the presence of various market players such as CATL, CALB, BYD, LG Energy Solution and some others is expected to boost the growth of the battery chemistry for electric vehicles (EVs) market in this region.

China is the major contributor in this region. The growing sales and production of electric vehicles along with technological advancements in the battery manufacturing sector has boosted the industrial expansion. Also, the abundance of skilled workforce as well as rapid investment by government for developing the automotive industry is playing a crucial role in shaping the industry in a positive direction.

Europe is expected to grow with the highest CAGR during the forecast period. The increasing sales of luxury EVs in various nations such as Germany, Italy, UK, France, Netherlands and some others has boosted the market expansion. Also, rapid investment by government for expanding the EV charging network coupled with rising trend of battery swapping is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Northvolt, VARTA, Automotive Cells Company (ACC) and some others is expected to drive the growth of the battery chemistry for electric vehicles (EVs) market in this region.

Germany led the market in this region. The growing production of passenger cars coupled with rapid adoption of electric trucks in the e-commerce sector has played a prominent role in shaping the industry in a positive manner. Additionally, the presence of a well-established automotive industry with several prominent EV companies such as BMW, Audi, Volkswagen and some others has driven the market expansion.

North America is growing at rapid pace by holding around 30% share of the industry. The increasing sales of electric buses in the U.S. and Canada for lowering vehicular emission has boosted the market growth. Also, several government initiatives aimed at enhancing EV adoption coupled with rise in number of startups dealing in EVs is playing a crucial role in shaping the industry in a positive direction. Moreover, the presence of numerous market players such as Sila Nanotechnologies, QuantumScape, Factorial Energy, Romeo Power and some others is expected to proliferate the growth of the battery chemistry for electric vehicles (EVs) market in this region.

U.S. and Canada are the prominent contributors in this region. In the U.S., the market is generally driven by the increasing sales of electric buses coupled with rapid investment by market players for opening new manufacturing plants. In Canada, the growing adoption of electric buses by fleet operators along with numerous government initiatives aimed at strengthening the EV sector is playing a vital role in shaping the industry in a positive manner.

Latin America & MEA held around with 5% share of the battery chemistry for electric vehicles (EVs) market. The growing demand for light-duty electric trucks in several nations such as Brazil, Argentina, UAE, Saudi Arabia and some others to cater the needs of manufacturing sector has bolstered the market growth. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure along with rapid investment by battery companies for opening new research centers is contributing to the industry in a positive manner. Moreover, the presence of several local EV battery manufacturers such as Baterias Moura, Unionbat S.A., Zoxcell Supercapacitors and some others is expected to foster the growth of the battery chemistry for electric vehicles (EVs) market in this region.

UAE is the major contributor in this region. The growing demand for electric sportscar along with rapid expansion of the EV charging infrastructure is playing a prominent role in shaping the industrial landscape. Moreover, numerous government initiatives for developing the EV sector coupled with presence of various automotive brands has boosted the market expansion.

The foundation of EV battery production lies in the extraction and supply of essential minerals such as lithium, cobalt, nickel, and graphite.

Raw materials are processed into battery-grade components including cathodes, anodes, electrolytes, and separators.

Cells are assembled in cylindrical, pouch, or prismatic form under strict quality and thermal control standards.

Battery cells are configured into modules and packs, integrated with advanced Battery Management Systems (BMS) for real-time monitoring, safety, and efficiency.

Completed battery packs are delivered to Electric Vehicle manufacturers for integration into EV platforms.

| June 2025 | Announcement |

| Pratik Kamdar, Co-founder & CEO at Neuron | The Gen 2 battery launch is a pivotal step in our journey to build more reliable and intelligent power solutions, provide greater cost efficiency and enhanced performance for India’s growing EV ecosystem. These battery packs represent not just technological progress, but a deeper commitment to safety, sustainability, and performance for EV users across the spectrum. |

| June 2025 | Announcement |

| Bob Lee, the corporate executive vice president and president of North America LGES | The new facility as representing the company's resilience in the face of the slower-than-forecasted growth of battery-electric vehicles. That slowdown prompted the company to pivot to applying its technical and manufacturing expertise to develop and produce LFP batteries for energy storage systems applications. Lee discussed how, despite current tariff and tax-credit challenges, the company remains committed to investing in North American battery production. |

| September 2025 | Announcement |

| Dr. Zhu Lingbo, the CTO of CATL's International Business Unit | Shenxing Pro seamlessly fuses world-class safety standards with mobility needs, delivering a safer, more efficient, and carefree experience for every journey, with uncompromised range, charging, and durability, Shenxing Pro is the ultimate solution for electric mobility in Europe |

| August 2025 | Announcement |

| Tom Slabe, President and CEO of Ecobat | Upon completion, this transaction – along with the previously announced divestitures of France, Italy, and Battery Distribution – will enable Ecobat to concentrate its efforts on core recycling operations, as well as our global lithium-ion battery business. |

| February 2025 | Announcement |

| Sang Fengjie, Executive Vice President and Head of Procurement at Volkswagen Group (China) | The partnership will not only improve battery performance and affordability but also strengthen supply chain transparency and resilience. The collaboration will extend beyond power batteries to include battery recycling, battery swapping, Vehicle-to-Grid (V2G) technology, carbon reduction initiatives, and raw material supply chain transparency. |

The battery chemistry for electric vehicles market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Romeo Power, Envision AESC, CATL, LG Energy Solution, Tesla, Northvolt, EVE Energy, AESC, Farasis Energy, Svolt Energy, Contemporary Amperex Technology (CATL) JV / Subsidiaries, Amperex Technology / Microvast, Solid Energy Systems, Quantum Scape, Factorial Energy, Ionic Materials, Panasonic, BYD, Samsung SDI SK On and some others. These companies are constantly engaged in developing advanced batteries for electric vehicles and adopting numerous strategies such as launches, acquisitions, collaborations, partnerships, business expansions, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Battery Chemistry

By Vehicle Type / Application

By Component / Cell Type

By End User / Buyer

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us