October 2025

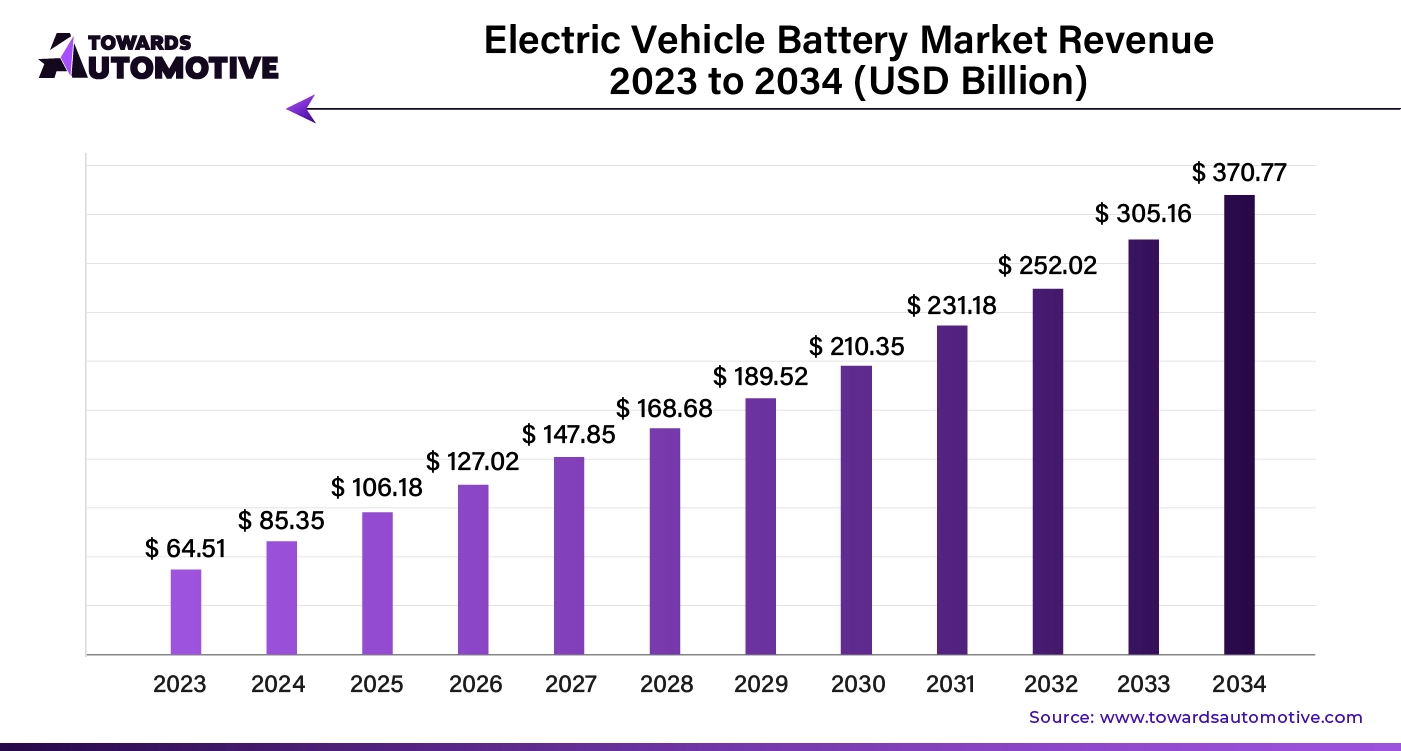

The electric vehicle battery market will grow from USD 106.18 billion in 2025 to USD 370.77 billion by 2034 (CAGR 21.50%). We quantify demand by product (lithium-ion largest; lead-acid; nickel-metal hydride; others) and vehicle type (BEVs dominant; PHEVs; HEVs), with regional splits for Asia Pacific (lead), Europe (significant CAGR), North America, Latin America, and MEA. Competitive analysis benchmarks CATL, LG Energy Solution, Panasonic, BYD, Samsung SDI, Toshiba, Exide, Amara Raja, Okaya, Tata AutoComp GY, Exicom on capacity build-out, chemistries (LFP/NMC), cost curves, and partnerships. We map the value chain (raw materials cells modules/packs BMS/thermal OEMs/aftermarket), include trade flows for cells, packs, and active materials, and provide manufacturer & supplier scorecards (plant footprints, certifications, utilization, and 2024–2025 margin bands).

The electric vehicle battery market is experiencing rapid growth, driven by the increasing global adoption of electric vehicles as part of the transition toward cleaner, more sustainable transportation. EV batteries are a critical component of electric vehicles, powering everything from passenger cars to commercial trucks, and their performance directly impacts vehicle range, efficiency, and cost. As governments worldwide implement stricter emissions regulations and provide incentives for EV adoption, the demand for advanced, high-capacity batteries has surged.

Lithium-ion batteries dominate the market due to their superior energy density, long lifespan, and declining production costs. However, ongoing research and development efforts are focused on enhancing battery technologies, such as solid-state batteries, which promise even greater energy efficiency, faster charging times, and improved safety features.

The growing investment in battery manufacturing facilities, particularly in regions like Asia-Pacific and North America, is further boosting the market. Additionally, the development of battery recycling technologies is gaining momentum as the industry seeks to reduce the environmental impact of battery disposal and improve the sustainability of electric vehicles. Overall, the expansion of EV infrastructure and continuous advancements in battery technology are driving the growth of the electric vehicle battery market.

AI plays a transformative role in the Electric Vehicle (EV) Battery Market by enhancing various aspects of battery development, production, and management. One of the primary applications of AI is in the research and development of battery technologies. Machine learning algorithms can analyze vast datasets from experimental results, enabling researchers to identify patterns and optimize the chemical compositions of batteries for improved performance, energy density, and longevity. This accelerates the discovery of new materials and battery designs, such as solid-state batteries, which promise greater efficiency and safety.

In battery manufacturing, AI is utilized for process optimization and quality control. Predictive analytics can monitor production lines to detect anomalies in real-time, ensuring that batteries meet stringent quality standards. This reduces waste and enhances manufacturing efficiency, ultimately lowering costs.

AI also plays a crucial role in battery management systems (BMS). Advanced algorithms can analyze battery usage patterns and environmental conditions to optimize charging and discharging processes, prolonging battery life and enhancing performance. Additionally, AI can provide insights into predictive maintenance, helping to identify potential issues before they become critical, thereby improving the reliability of EVs.

Furthermore, AI-driven analytics can enhance energy management in electric vehicles by optimizing energy consumption based on driving patterns, road conditions, and traffic data. This contributes to improved range and efficiency, addressing one of the primary concerns of EV users.

The rising sales of electric vehicles (EVs) are a significant driving force behind the growth of the Electric Vehicle Battery Market. As consumers become more environmentally conscious and governments worldwide implement stricter emissions regulations, the demand for electric vehicles has surged. This trend is further fueled by advancements in EV technology, which have enhanced the performance, range, and affordability of electric cars. With an increasing number of consumers seeking sustainable transportation options, automakers are ramping up production to meet this demand, leading to a corresponding rise in the need for high-quality, efficient battery solutions.

Battery technology is crucial to the success of electric vehicles, as it directly impacts their range, charging speed, and overall performance. Consequently, manufacturers are investing heavily in research and development to produce batteries with higher energy densities, faster charging capabilities, and longer lifespans. This focus on innovation not only supports the growth of the electric vehicle market but also stimulates advancements in battery technologies, such as solid-state batteries and lithium-sulfur batteries, which promise improved efficiency and safety.

Additionally, the establishment of a robust charging infrastructure is further propelling EV sales, creating a positive feedback loop that benefits the electric vehicle battery market. As more charging stations become available and range anxiety diminishes, consumers are increasingly willing to make the switch to electric vehicles. This cycle of rising EV sales and expanding battery capabilities underscores the pivotal role that electric vehicle batteries play in the broader transition to sustainable transportation.

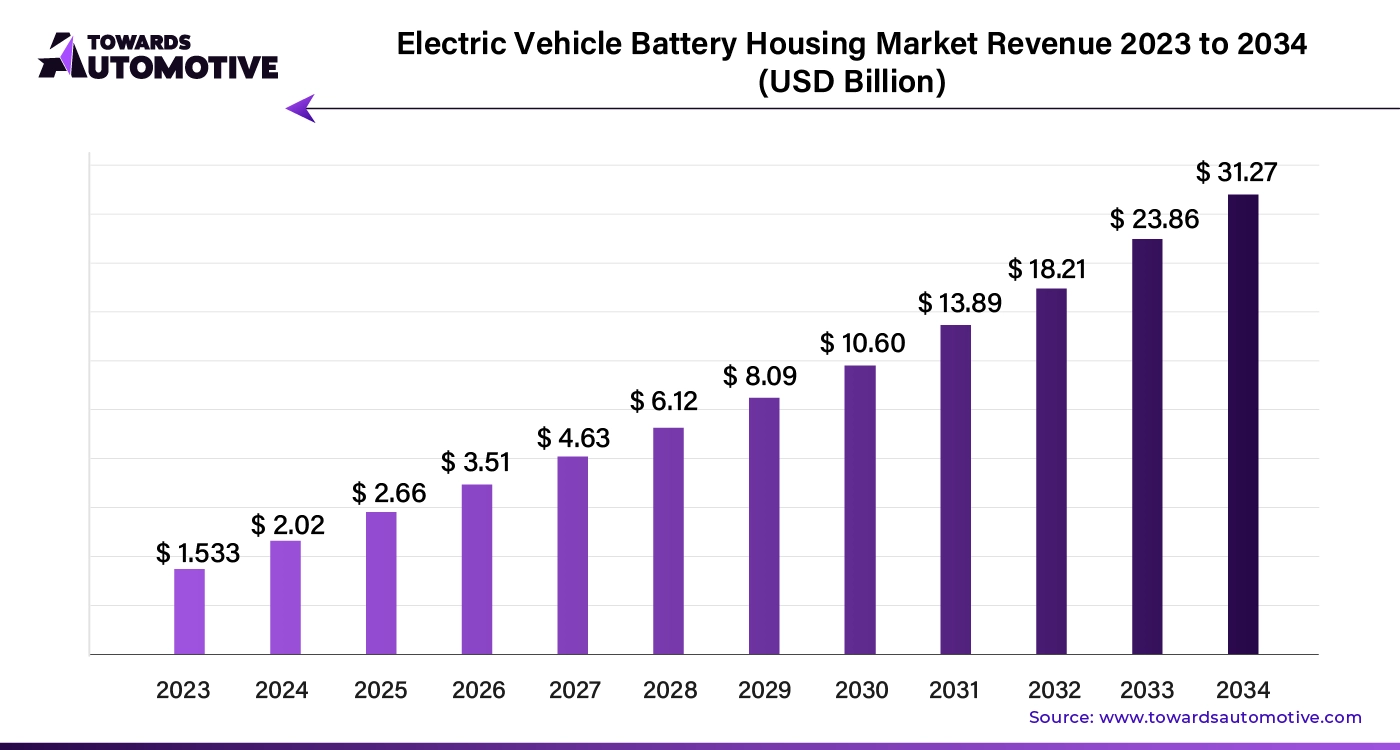

The global electric vehicle battery housing market size is calculated at USD 2.02 billion in 2024 and is expected to reach around USD 31.27 billion by 2034, growing at a CAGR of 31.84% from 2024 to 2034.

The electric vehicle battery housing market is expanding rapidly as the global shift toward sustainable transportation accelerates. Battery housing units play a crucial role in protecting and optimizing the performance of EV batteries, which are essential for powering electric drivetrains. These housings are designed to provide structural support, thermal management, and safety for battery packs, ensuring that they operate efficiently and reliably under various conditions. As electric vehicles gain popularity due to environmental regulations and consumer demand for greener alternatives, the need for advanced battery housing solutions grows.

The Electric Vehicle Battery Market faces several restraints that could hinder its growth. One major challenge is the high cost of battery production, primarily due to the expensive raw materials such as lithium, cobalt, and nickel. These costs can make electric vehicles less affordable for consumers, limiting market penetration. Additionally, issues related to battery recycling and disposal pose environmental concerns, as improper handling can lead to pollution. Moreover, the current charging infrastructure is still developing, contributing to range anxiety among potential EV buyers. These factors collectively impact the overall growth and adoption of electric vehicle batteries in the market.

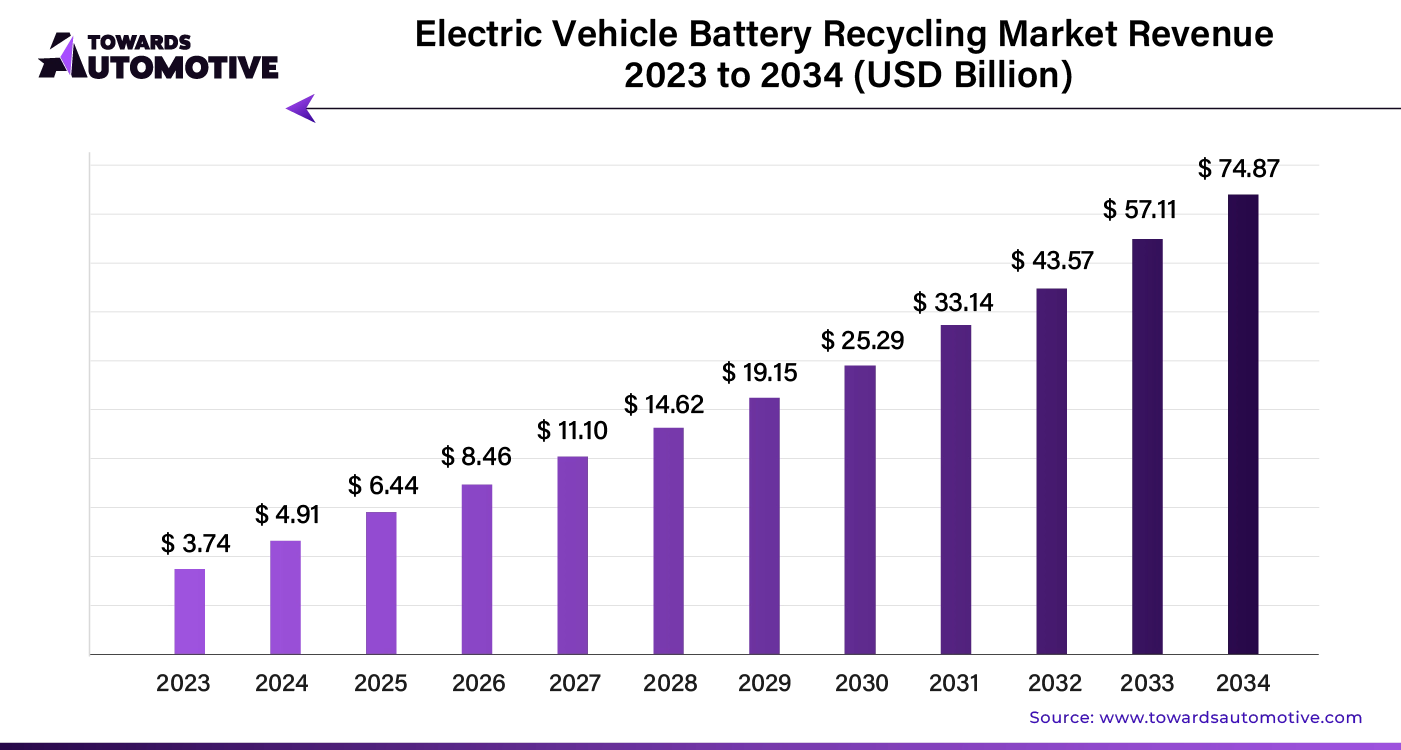

The global electric vehicle battery recycling market size is calculated at USD4.91 billion in 2024 and is expected to be worth USD 74.87 billion by 2034, expanding at a CAGR of 31.34% from 2024 to 2034.

The electric vehicle battery recycling market is rapidly gaining momentum as the adoption of EVs continues to rise globally. With the increasing use of lithium-ion batteries in electric vehicles, there is a growing need for sustainable solutions to manage battery disposal and recycling. Recycling EV batteries not only addresses environmental concerns related to hazardous waste but also helps recover valuable materials such as lithium, cobalt, and nickel, which can be reused in manufacturing new batteries. This reduces the dependency on mining for raw materials and supports a circular economy.

Solid-state batteries present a significant opportunity in the Electric Vehicle (EV) battery market, primarily due to their potential for higher energy density, improved safety, and longer lifespan compared to traditional lithium-ion batteries. Unlike conventional batteries that use liquid electrolytes, solid-state batteries utilize solid electrolytes, which reduce the risk of leakage and flammability, addressing one of the key safety concerns associated with lithium-ion technology. This enhanced safety profile not only boosts consumer confidence but also opens avenues for automakers to design more compact and lightweight vehicles, thereby improving overall efficiency.

Moreover, solid-state batteries can deliver higher energy capacity, enabling electric vehicles to achieve longer ranges on a single charge. This capability is crucial in alleviating range anxiety among consumers, a common barrier to EV adoption. As manufacturers invest in the development and scaling of solid-state technology, we can expect advancements that will lower production costs and enhance performance, making electric vehicles more competitive with traditional combustion engine vehicles.

The ongoing research and collaboration between battery manufacturers and automotive companies signal a growing trend toward solid-state battery integration in future EV models, positioning this technology as a cornerstone for the next generation of electric vehicles and significantly driving growth in the electric vehicle battery market.

The lithium-ion segment held the largest share of the market. The lithium-ion segment is a major driving force behind the growth of the Electric Vehicle (EV) battery market, primarily due to its superior energy density, efficiency, and declining costs. Lithium-ion batteries offer a significant advantage in terms of energy storage, enabling electric vehicles to achieve longer ranges compared to other battery technologies.

Moreover, advancements in lithium-ion battery technology, such as improvements in anode and cathode materials, have led to enhanced performance, faster charging times, and increased lifespan. These innovations contribute to the overall appeal of electric vehicles, driving higher adoption rates among consumers.

The scaling up of lithium-ion battery production has also led to economies of scale, further reducing costs and making electric vehicles more affordable. Governments and manufacturers are increasingly investing in lithium-ion battery production facilities to meet the growing demand, which in turn supports the establishment of a robust supply chain for raw materials.

Additionally, as more automakers transition to electric fleets, the demand for lithium-ion batteries will continue to rise, solidifying their pivotal role in shaping the future of the electric vehicle battery market and accelerating the shift towards sustainable transportation.

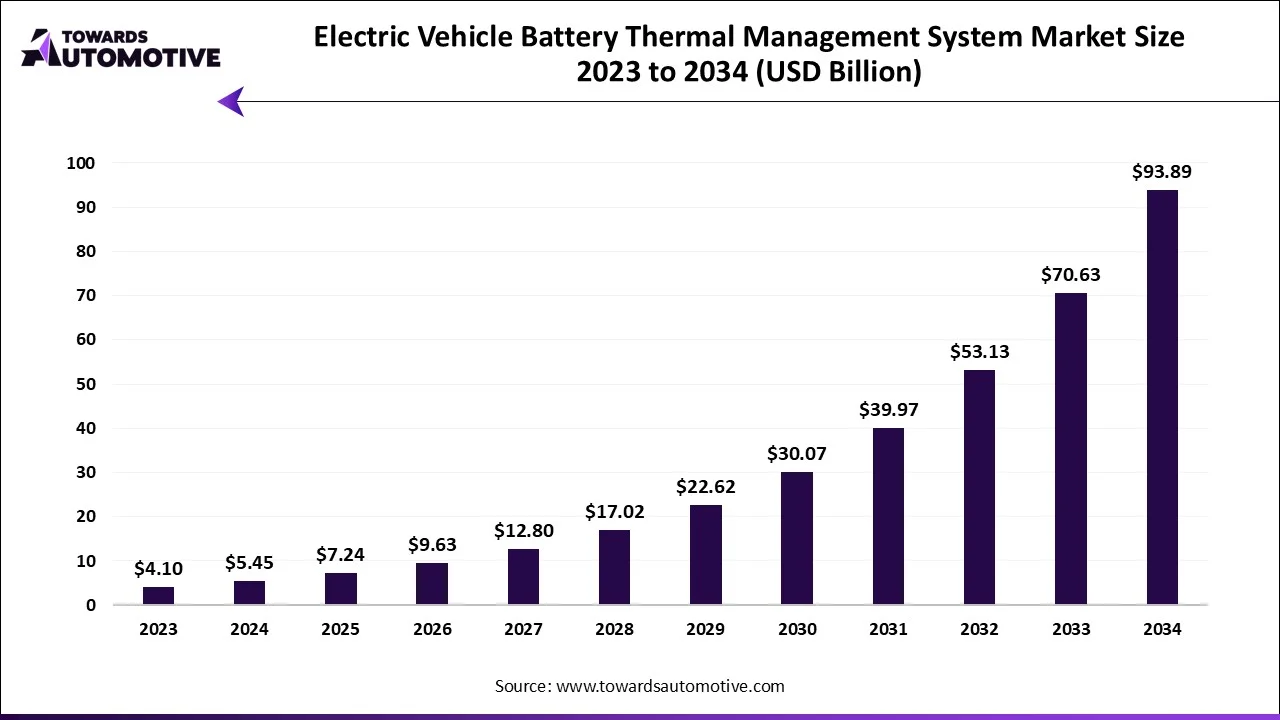

The electric vehicle battery thermal management system market is forecast to grow from USD 7.24 billion in 2025 to USD 93.89 billion by 2034, driven by a CAGR of 32.93% from 2025 to 2034.

The electric vehicle battery thermal management system market is a crucial sector of the electric vehicle industry. This industry deals in manufacturing and distribution of thermal management system for preventing electric vehicle batteries. There are several types of systems available in the market consisting of active system and passive system. It finds application in different types of vehicles comprising of passenger vehicles and commercial vehicles. The rising demand for electric vehicles in different regions of the world has driven the market growth. This market is projected to grow exponentially with the rise of the automotive industry across the globe.

Electric Vehicle Battery Market Size, By Vehicle Type, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Battery Electric Vehicles (BEVs) | 61.45 | 75.70 | 93.24 | 114.81 | 141.36 | 174.01 | 214.17 | 263.55 | 324.26 | 398.91 | 490.66 |

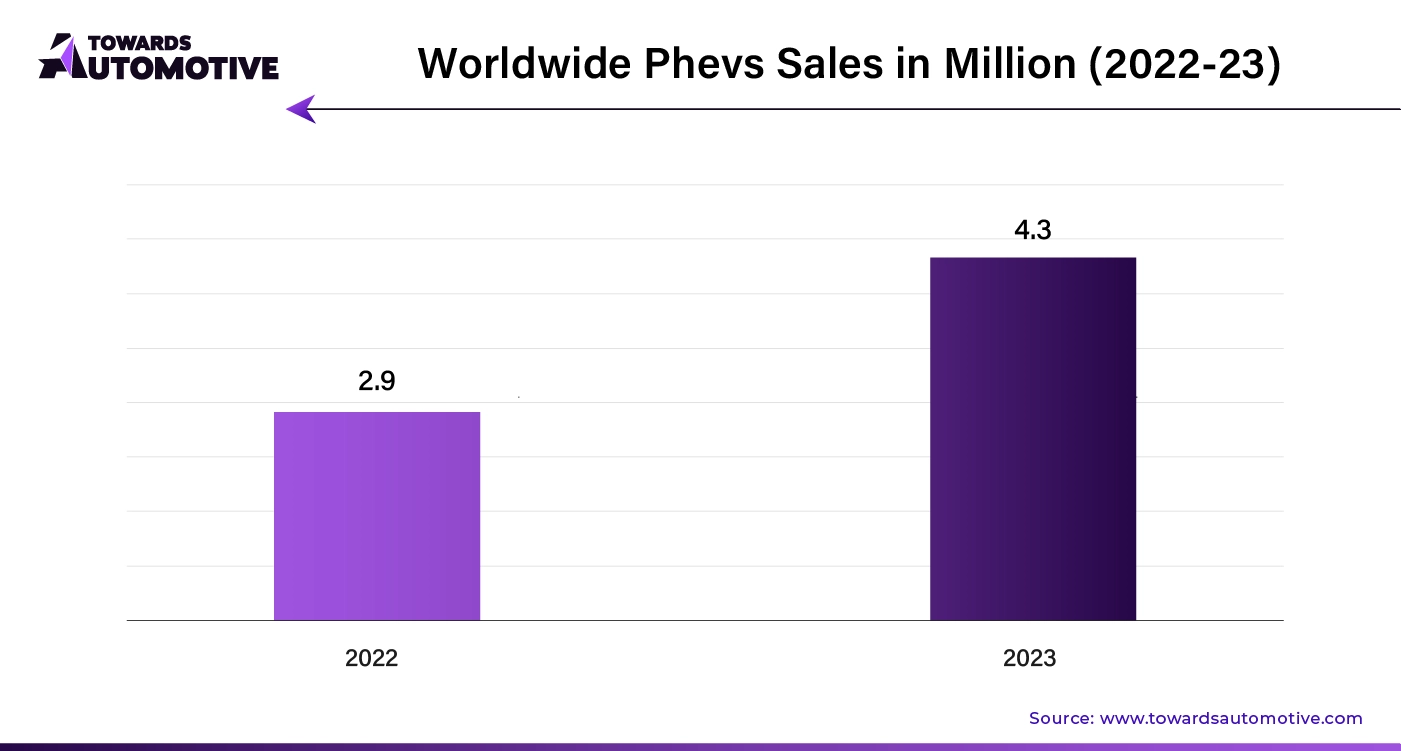

| Plug-in Hybrid Electric Vehicles (PHEVs) | 15.36 | 18.04 | 21.17 | 24.80 | 29.02 | 33.90 | 39.54 | 46.04 | 53.50 | 62.05 | 71.80 |

| Hybrid Electric Vehicles (HEVs) | 8.54 | 9.96 | 11.59 | 13.47 | 15.62 | 18.08 | 20.87 | 24.02 | 27.57 | 31.52 | 35.91 |

The BEVs segment dominated the electric vehicle battery market. The Battery Electric Vehicle (BEV) segment significantly drives the growth of the Electric Vehicle (EV) battery market, primarily due to the increasing consumer preference for fully electric vehicles over hybrid or internal combustion engine options. As governments worldwide implement stricter emissions regulations and incentivize the adoption of zero-emission vehicles, BEVs have emerged as the frontrunners in the shift towards sustainable transportation. The growing availability of diverse BEV models, ranging from compact cars to larger SUVs, caters to a broader consumer base, further fueling demand.

The substantial energy requirements of BEVs necessitate high-capacity batteries, leading to increased investments in battery technology and production capacity. Manufacturers are focusing on enhancing battery performance, including improvements in energy density, charging speeds, and overall lifespan, which directly impacts the appeal of BEVs. Additionally, advancements in battery technologies, such as solid-state and next-generation lithium-ion batteries, promise to address range anxiety, a critical barrier to consumer adoption.

Moreover, as charging infrastructure continues to expand, facilitating convenient and fast charging options, the attractiveness of BEVs increases. The convergence of these factors not only propels the growth of the BEV segment but also stimulates the entire electric vehicle battery market, positioning BEVs as a central component of the transition to sustainable mobility.

Electric Vehicle Battery Market Size, By Region, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Asia-Pacific | 46.94 | 57.35 | 70.06 | 85.57 | 104.53 | 127.68 | 155.96 | 190.49 | 232.66 | 284.16 | 347.05 |

| North America | 17.92 | 21.67 | 26.21 | 31.69 | 38.32 | 46.33 | 56.01 | 67.72 | 81.88 | 98.99 | 119.67 |

| Europe | 17.07 | 20.53 | 24.70 | 29.70 | 35.71 | 42.94 | 51.62 | 62.05 | 74.58 | 89.63 | 107.71 |

| Latin America | 2.13 | 2.54 | 3.02 | 3.60 | 4.28 | 5.08 | 6.04 | 7.17 | 8.51 | 10.10 | 11.97 |

| Middle East & Africa | 1.29 | 1.61 | 2.01 | 2.52 | 3.16 | 3.96 | 4.95 | 6.18 | 7.70 | 9.60 | 11.97 |

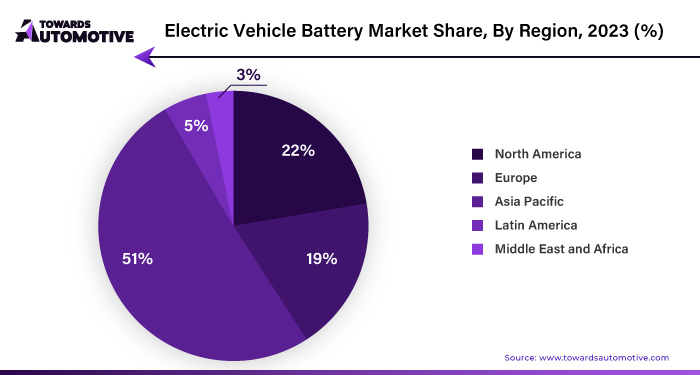

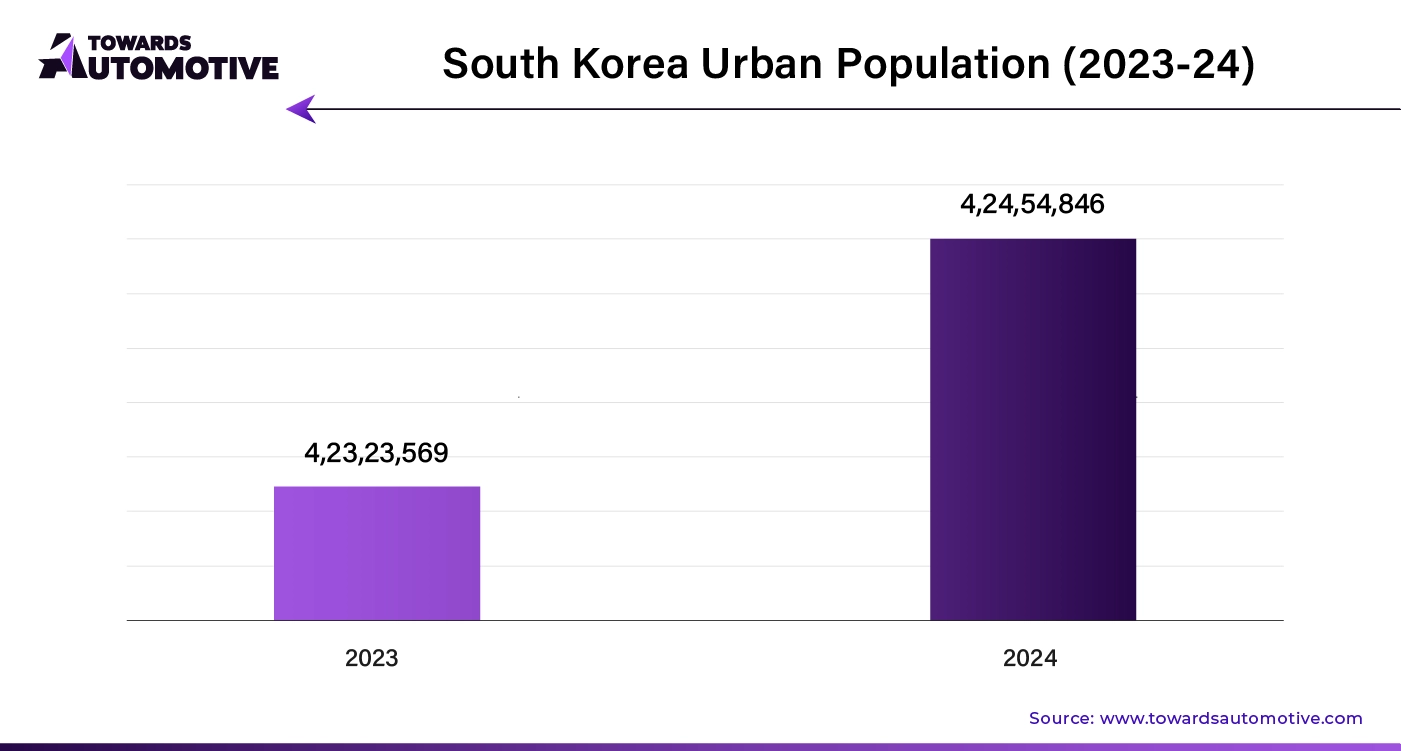

Asia Pacific dominated the electric vehicle battery market. Rapid urbanization in the Asia-Pacific (APAC) region is a significant driver of growth for the Electric Vehicle (EV) battery market, as increasing population density in urban areas leads to heightened demand for sustainable transportation solutions. With more vehicles on the road, cities face challenges such as traffic congestion and air pollution, prompting a shift towards electric vehicles as cleaner alternatives. This urban trend creates a favorable environment for the adoption of EVs and, consequently, the batteries that power them.

Additionally, the expanding manufacturing capabilities in APAC, particularly in countries such as China, Japan, and South Korea, are vital for supporting the rising demand for EV batteries. Local production not only reduces costs through economies of scale but also ensures a more resilient supply chain, further enhancing the region’s competitiveness in the global market.

Moreover, growing investments in charging infrastructure are addressing consumer concerns about range anxiety, making electric vehicles more convenient to use. Governments and private entities are increasingly funding the installation of charging stations, which promotes EV adoption and drives demand for batteries.

Europe is expected to grow with a significant CAGR during the forecast period. Local production and supply chain development are pivotal in driving the growth of the Electric Vehicle (EV) battery market in Europe. By establishing battery manufacturing facilities within the region, European countries are reducing reliance on imports, enhancing supply chain resilience, and fostering innovation in battery technologies. This localized production not only lowers costs but also shortens lead times, enabling automakers to meet the rising demand for electric vehicles more efficiently.

Moreover, the automotive industry is undergoing a significant transition towards electrification, with major manufacturers committing to electrifying their fleets. This shift is accompanied by substantial investments in research and development, ensuring the production of high-quality, high-capacity batteries that meet evolving consumer expectations. As traditional automakers pivot to electric mobility, they are also collaborating with battery manufacturers, leading to advancements in technology and efficiency.

Furthermore, the growing focus on renewable energy enhances the sustainability of electric vehicles. By integrating renewable energy sources into the charging infrastructure, European countries promote the use of clean energy for EV charging, aligning with consumer preferences for environmentally friendly options.

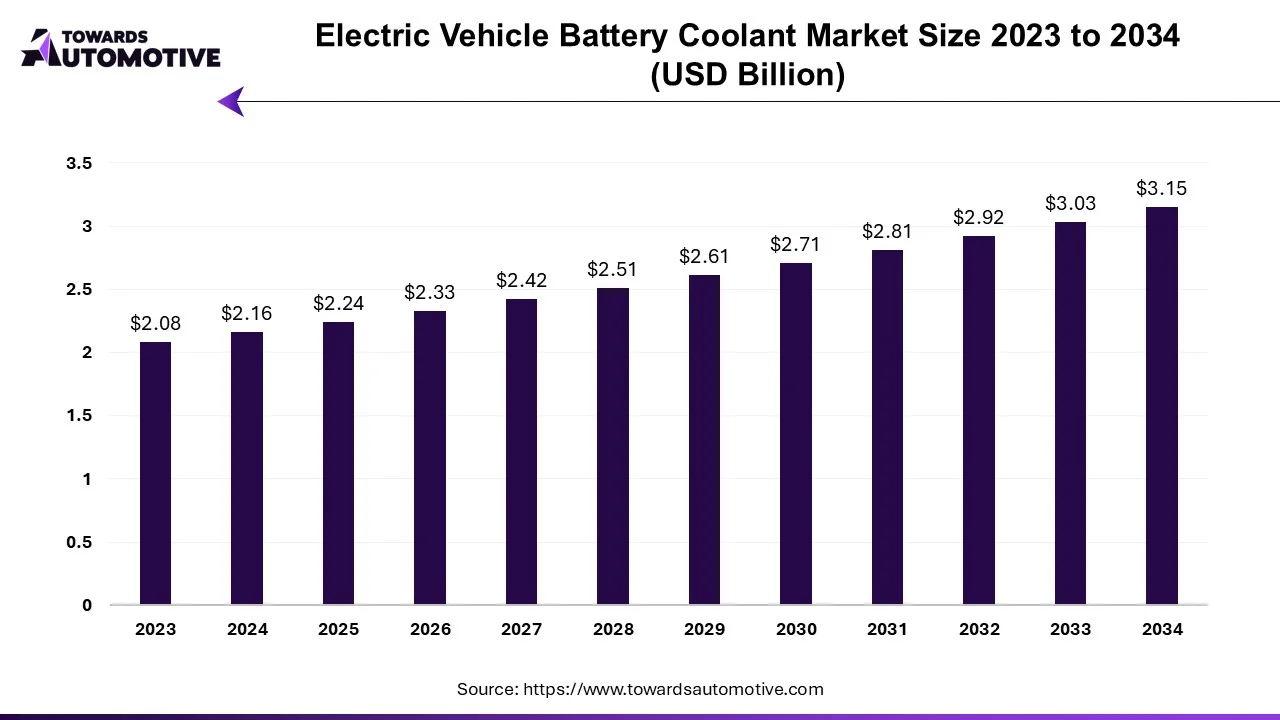

The electric vehicle battery coolant market is projected to reach USD 3.15 billion by 2034, expanding from USD 2.24 billion in 2025, at an annual growth rate of 3.85% during the forecast period from 2025 to 2034.

The electric vehicle battery coolant market is a prominent branch of the automotive materials industry. This industry deals in manufacturing and distribution of coolant for electric vehicles across the globe. The coolants are used for maintaining stable temperature and ensures optimal performance in EVs. It is designed for different types of vehicles containing battery electric vehicles and hybrid electric vehicles. These coolants finds application in various types of batteries comprising of lead acid battery and lithium ion battery. The growing demand for hybrid vehicles in different parts of the world has boosted the market growth. This market is expected is grow drastically with the rise of the electric vehicles industry around the world.

By Product

By Vehicle Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us