October 2025

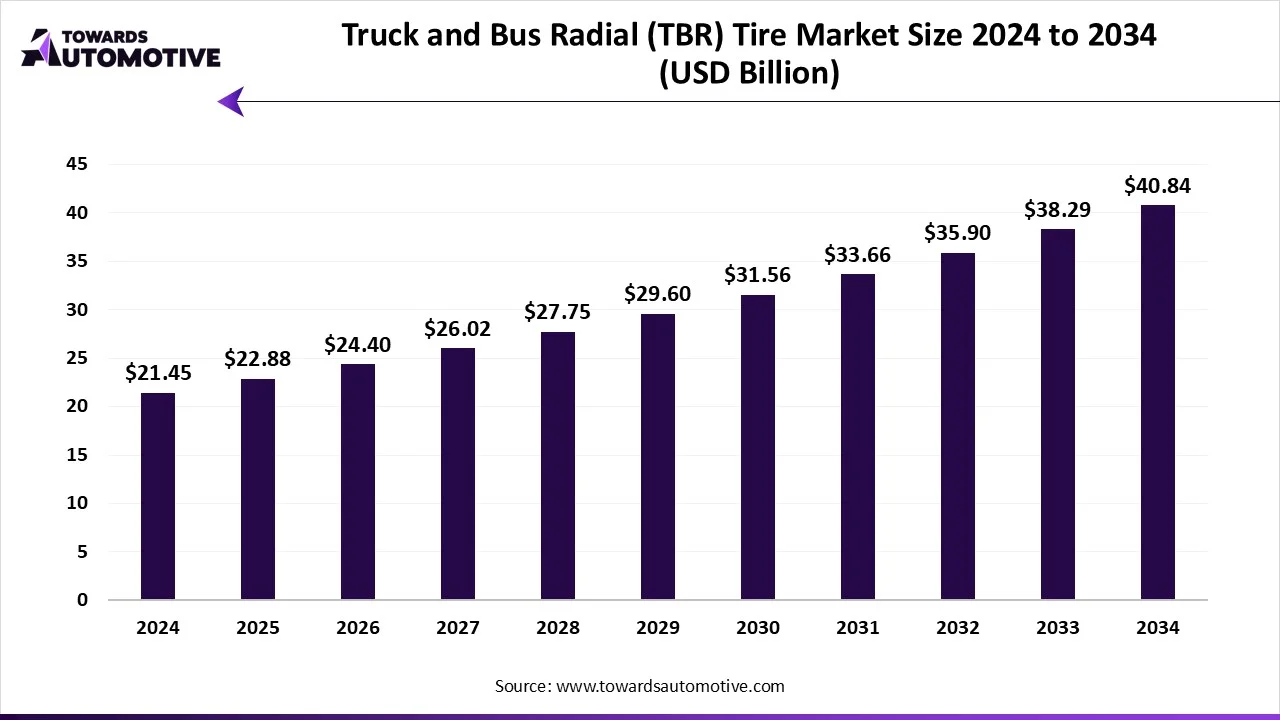

The truck and bus radial tire market is set to grow from USD 22.88 billion in 2025 to USD 40.84 billion by 2034, with an expected CAGR of 6.65% over the forecast period from 2025 to 2034. The truck and bus radial (TBR) tire market is expanding due to the increased demand for freight and passenger transportation around the world. Strong demand for logistics, e-commerce, and international trade further creates greater demand for durable and fuel-efficient tires. Numerous fleets are purchasing radial tires due to their enhanced lifespan, high fuel efficiency, and safety performance. Sustainability initiatives, retread tires, and sustainable manufacturing processes are expected to provide growth opportunities to the market players in the upcoming years.

The global truck & bus radial tire market covers the production, distribution, and use of radial tires designed for commercial trucks, buses, and heavy-duty vehicles. TBR tires are engineered with radial ply construction, offering better durability, fuel efficiency, load-carrying capacity, and safety compared to bias-ply tires. These tires are widely used in long-haul freight, public transport, logistics, construction, and mining sectors. There are several types of tires developed in this sector comprising of long-haul / highway TBR tires, regional/urban TBR tires, on/off-road TBR tires (construction, mining, agriculture), and specialty TBR tires. This market is driven by expanding freight movement, urbanization-led bus transport demand, fleet modernization, stricter emission norms (pushing fuel-efficient tires) and rising adoption of smart tires.

The trends in the truck & bus radial tire market are product launches and business expansions.

The long-haul/highway TBR tires segment captured almost 40% of the market share. This is because trucks and buses operating in long-haul routes need a durable, fuel-efficient tire designed for high mileage. Thus, long-haul TBR tires are designed to minimize rolling resistance, improving fuel economy, and extend tire wear life, so they are favored by fleet operators that are focused on cost control and predictability.

The on/off-road TBR tires segment is expected to grow at the fastest rate during the forecast period. The demand for these types of tires are growing rapidly due to increasing investments in construction, mining, and infrastructure. These industries require advanced tires capable of being used both off and on-highway as they have the best traction and durability, thereby driving the market growth.

The heavy trucks segment captured around 45% of the total market share. Heavy trucks are the largest consumers of radial tires due to its benefits in freight transport, logistics, and long-distance travel. Heavy trucks are capable of carrying very heavy loads, which require durable and reliable tires, thereby driving the market expansion. Moreover, the rapid expansion of the e-commerce sector has increased the demand for heavy trucks, thus driving demand for truck and bus radial tires.

The bus & coaches' segment is expected to witness the fastest growth in the forecasted period. The increasing use of radial tire is modern buses to deliver superior mileage and enhanced safety has driven the market expansion. Moreover, government funding for electric and cleaner buses increases the demand for radial tires.

The freight & logistics segment captured almost 55% of the TRB tire market share. The increasing use of heavy-duty trucks for operating logistics operations has driven the market growth. Additionally, rapid investment by market players for developing high-quality radial tires to cater the needs of freight trucks is accelerating the industry in a positive direction.

The passenger transport segment is expected to grow at the fastest rate during the forecast period. Passenger transport is the fastest growing vehicle radial tire application segment, as more cities are increasing their focus on providing superior bus services for travelling long-distances. The market growth is also attributed by the rapid urbanization, increased populations, and government efforts to expand sustainable public transport solutions.

The aftermarket/replacement segment captured around 70% of the total market share. The aftermarket is the largest market segment since truck and bus tires tend to wear out relatively quickly because of the constant stress of heavy loads and long distances on the road. Fleet operators tend to regularly replace tires since they want to operate as safely and efficiently as possible.

The OEM segment is expected to be the fastest-growing in the market. The OEM segment is growing rapidly as companies increase the number of new trucks and buses they purchase, given the continued growth of logistics needs and public transport expansion. As vehicle manufacturers emphasize fuel efficiency and performance, there appears to be increased demand for advanced radial tires from OEMs for their vehicles, leading to potential increased vehicle use by the operators and therefore more replacement tire demand in the future. The increasing electrification of all commercial vehicles is prompting OEMs of these vehicles to fit high-quality, durable tires to their vehicles to provide greater efficiency and life cycle expectations for their customers.

-tire-market-size-by-distribution-channel.webp)

The tire dealers & retailers segment captured around 50% of the market share. Tire dealers and retailers dominate the market because most fleet operators and individual buyers feel confident and comfortable purchasing tires through a distributor or industry tire dealer, and customers can check the product prior to making the purchase. In addition, tire dealers and retailers are present in urban and rural communities, allowing for consistent tire sales and therefore the preferred route for purchasing tires.

The online tire platforms segment is expected to grow at the fastest rate in the truck & bus radial tire market. This is because of the increased digital accessibility, online platforms are quickly capturing market share from traditional tread pile dealers and tire retailers, as they offer price comparison options, and home delivery.

The standard radial tires segment captured around 60% of the total market share. Standard radial tires are cheap, easily accessible, and offers superior performance in commercial applications. These tires provides superior fuel efficiency, enhanced durability, and improved ride quality over advanced bias tires, thereby driving the market expansion.

The smart/connected radial tires & retreadables segment is expected to grow at the fastest rate in the truck & bus radial tire market. Smart/connected radial tires are growing at a faster pace as more fleets begin to utilize digital solutions for monitoring performance to reduce downtime and costs. Technologies that facilitate real-time pressure and temperature monitoring provide safety benefits and operational efficiencies.

-tire-market-size-by-region.webp)

The Asia Pacific region has the leading share of the truck and bus radial tire market due to a strong road transport industry and a consistent demand from both freight transport and passenger transport. The economy of countries such as China, India, and Japan continues to grow, resulting in an increasing number of fleets that require durable tires for logistics and passenger transport. Additionally, growth drivers for the market also include growth in e-commerce delivery and growth in infrastructure projects. However, along with these growth factors, additional opportunities are present in smart tire technology, sustainable tire production, and online sales.

China remains the dominant country in the Asia Pacific truck & bus radial tire market due to having both a major logistics and a growing manufacturing market. The nation also has one of the largest commercial vehicle fleets in the world, which creates increasing demand for tires. Rapid growth from e-commerce and long-distance transport in the region will continue to support the truck and bus radial tire market growth in Asia Pacific. Furthermore, China is a major player in the tire manufacturing business, with both domestic and foreign tire manufacturers heavily investing to meet the growing demand for tires in China.

Latin America is expected to be the fastest-growing region in the global truck & bus radial tire market. It is the fastest-growing region due to increased trade, infrastructure projects, and growth in road freight activity. As countries in Latin America are enhancing their highways and logistics systems, there is a growing need for reliable tires. The increasing growth of tourism, in addition to public transport, also contributes to growth in the tire segment. The aftermarket sales sector will be an opportunity for market growth in the region. Retreaded tires will also be a strong opportunity, as fleets will look for cost-effective, durable solutions in the future. As fleets become more aware of sustainability and fuel efficiency in the upcoming days, the demand for radial tires in Latin America is expected to rise significantly in the future.

Brazil is leading the Latin American truck & bus radial tire market due to the nation’s large transport sector, with a growing need for logistics. Brazil has a strong road freight system, as nearly all goods are transported by trucks. As the country focuses on improving its infrastructure and growing demand for passenger buses, growth in radial tire sales will be strong. Moreover, Brazil has the strongest aftermarket in Latin America, as fleets will continually replace tires to reduce downtime.

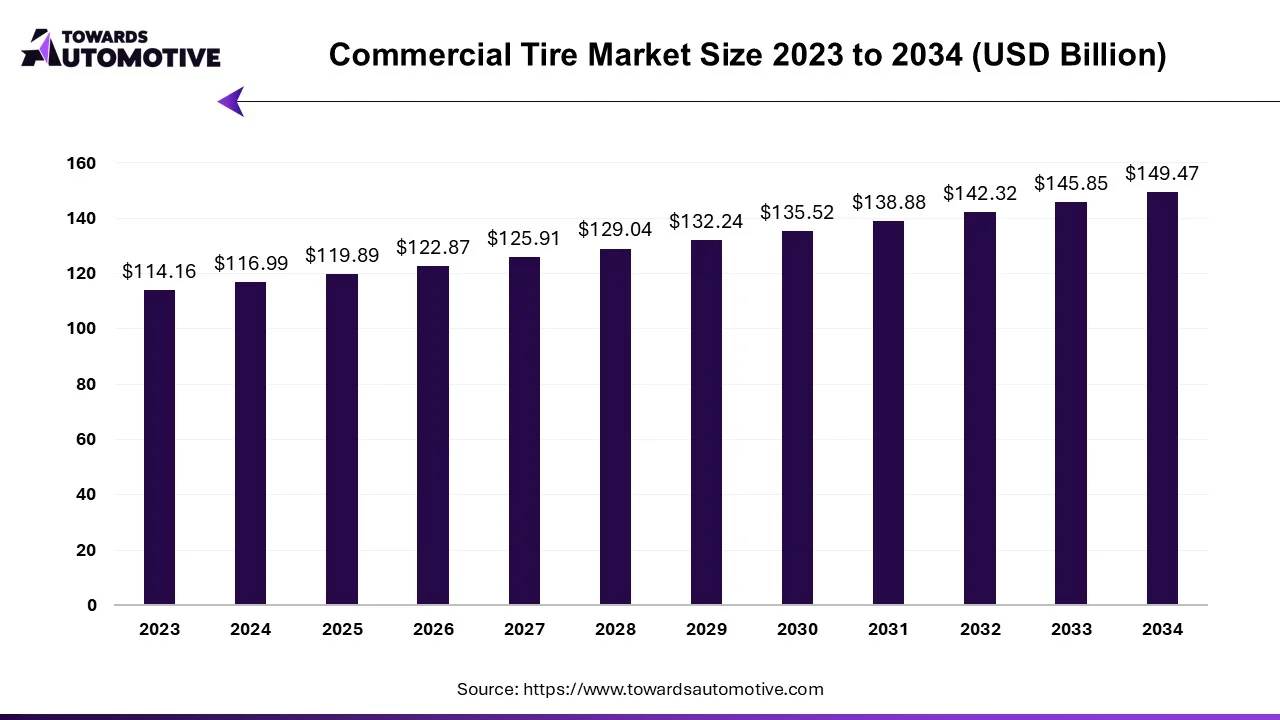

The commercial tire market is expected to increase from USD 119.89 billion in 2025 to USD 149.47 billion by 2034, growing at a CAGR of 2.48% throughout the forecast period from 2025 to 2034.

The commercial tire market is a crucial branch of the automotive materials industry. This industry deals in manufacturing and distribution of tires for commercial vehicles. There are different types of tires developed in this sector consisting of radial tires, bias tires and solid tires. These tires are designed for numerous vehicles such as light commercial vehicles, medium commercial vehicles and heavy commercial vehicles. It finds various application in several sectors including transportation, construction, agriculture, mining and some others. The growing demand for commercial vehicles in different parts of the world has contributed to the market expansion. This market is expected to grow drastically with the growth of the tire industry across the globe.

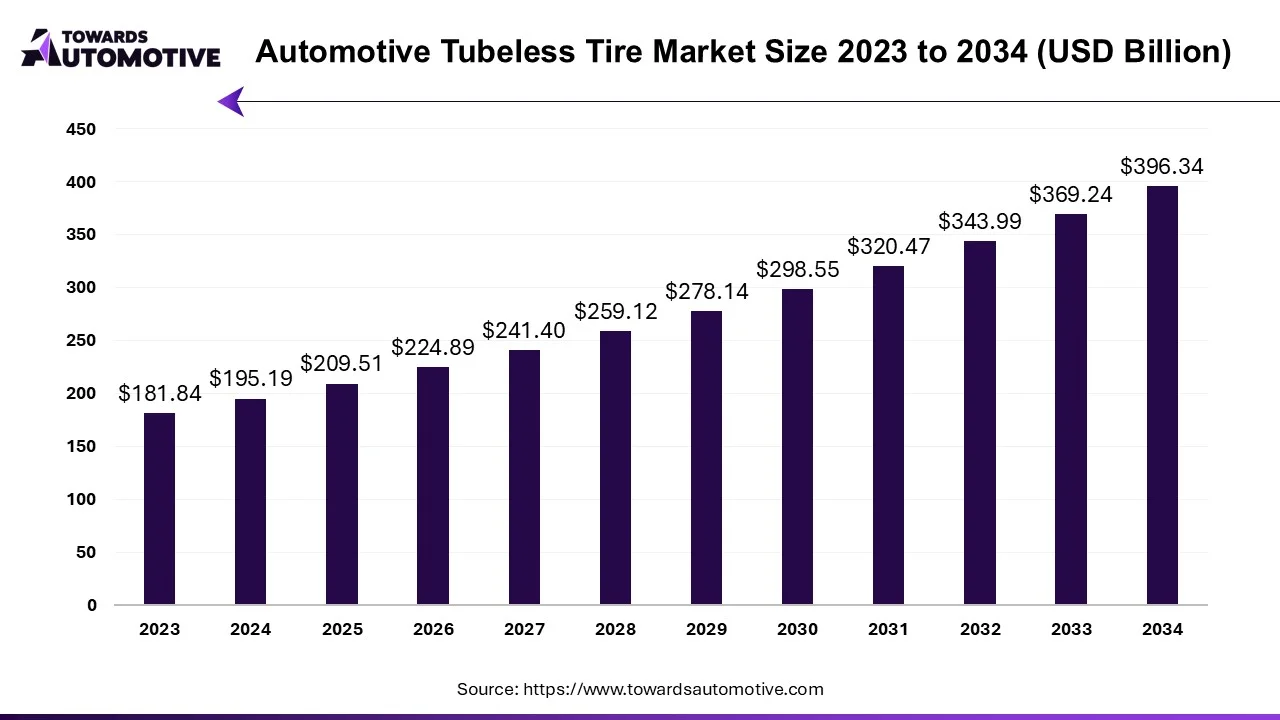

The automotive tubeless tire market is forecasted to expand from USD 209.51 billion in 2025 to USD 396.34 billion by 2034, growing at a CAGR of 7.34% from 2025 to 2034.

The automotive tubeless tire market is an integral branch of the tire industry. This industry deals in manufacturing and distribution of tubeless tires for automotive sector. There are several products manufactured in this industry consisting of radial tires and bias tires. These tires are designed for different vehicles such as two-wheeler, passenger cars, commercial vehicles and some others. It is available in a well-organized sales channel comprising of OEM and aftermarket. The growing demand for SUVs in different parts of the world has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the automotive materials industry around the globe.

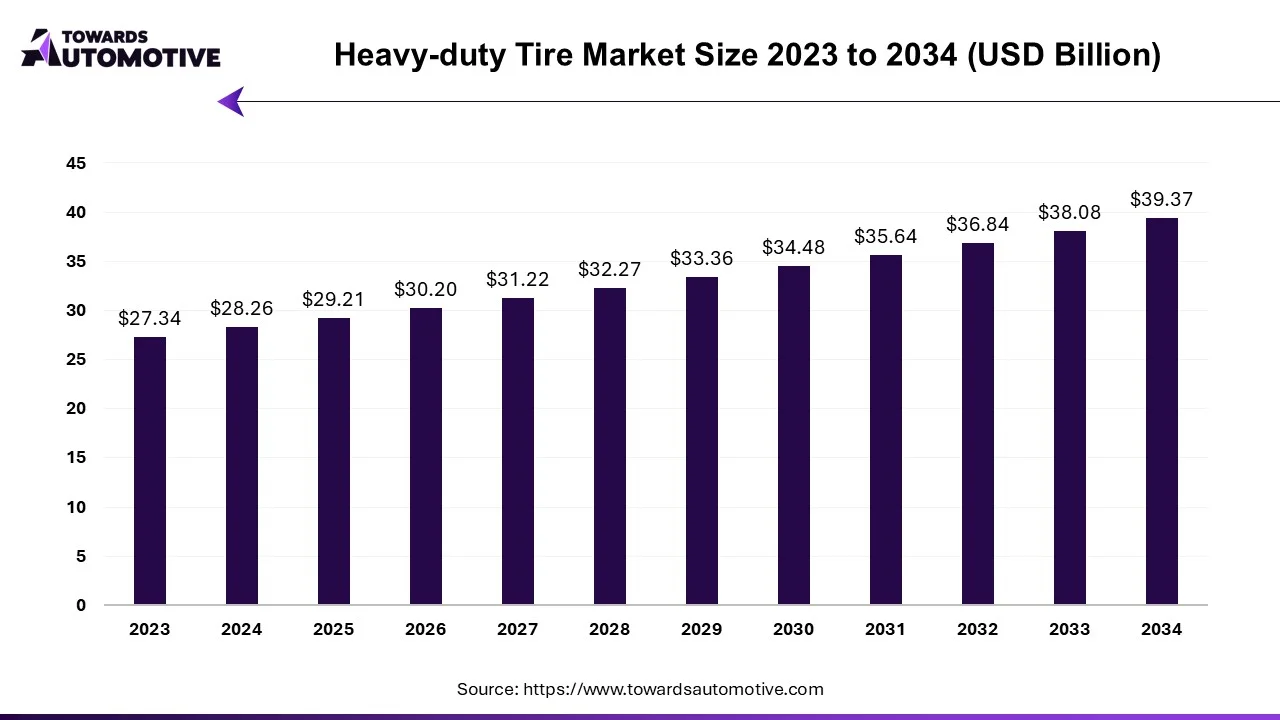

The heavy-duty tires market is expected to increase from USD 29.21 billion in 2025 to USD 39.37 billion by 2034, growing at a CAGR of 3.37% throughout the forecast period from 2025 to 2034.

The heavy-duty tires market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of heavy-duty tires across the world. There are several tires developed in this sector consisting of bias ply tires, radial tires, solid tires, tube tires and some others. These tires are designed for numerous types of vehicles including trucks, construction equipment, agricultural vehicles, mining equipment, industrial vehicles and some others. It finds application in different sectors consisting of on-road applications, off-road applications, heavy construction, agricultural operations, mining operations and some others. The rising development in the mining industry in different parts of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the tire manufacturing industry around the globe.

The raw material sourced for manufacturing truck & bus radial tires are mainly natural rubber, synthetic rubber, and steel.

The components manufactured for the radial tire are tread, sidewall, beads, carcass, and steel belts which are combined to produce tires.

After the production of tires, they are fitted during vehicle assembly or sold as replacements by automobile manufacturers.

| September 2024 | Announcement |

| Arnab Banerjee, the Managing Director and CEO of CEAT | Inauguration of the truck bus radial line at our export centric Chennai plant is a key step in CEAT’s global expansion strategy of offering a complete range of tyresacross markets including Europe and the US. By integrating smart technologies and connected systems, we are creating a safer, more efficient, and sustainable workplace |

The truck & bus radial tire market is highly competitive. Some of the prominent players in the market are MICHELIN, Apollo Tires, Yokohama Rubber Corporation, Bridgestone Corporation, Sumitomo Rubber Industries, Ltd., Continental AG, Balkrishna Industries Limited (BKT), Giti Tire, The Goodyear Tire & Rubber Company, Kumho Tire, Hankook Tire, ZC Rubber, and MRF. These companies are focusing on innovation, sustainability, and digital platforms to strengthen their dominance in the trucks & buses radial tire market. Additionally, companies are investing in advanced materials for manufacturing reliable and fuel-efficient tires.

By Tire Type

By Vehicle Type

By Application

By End-User

By Distribution Channel

By Technology

By Region / Country

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us