October 2025

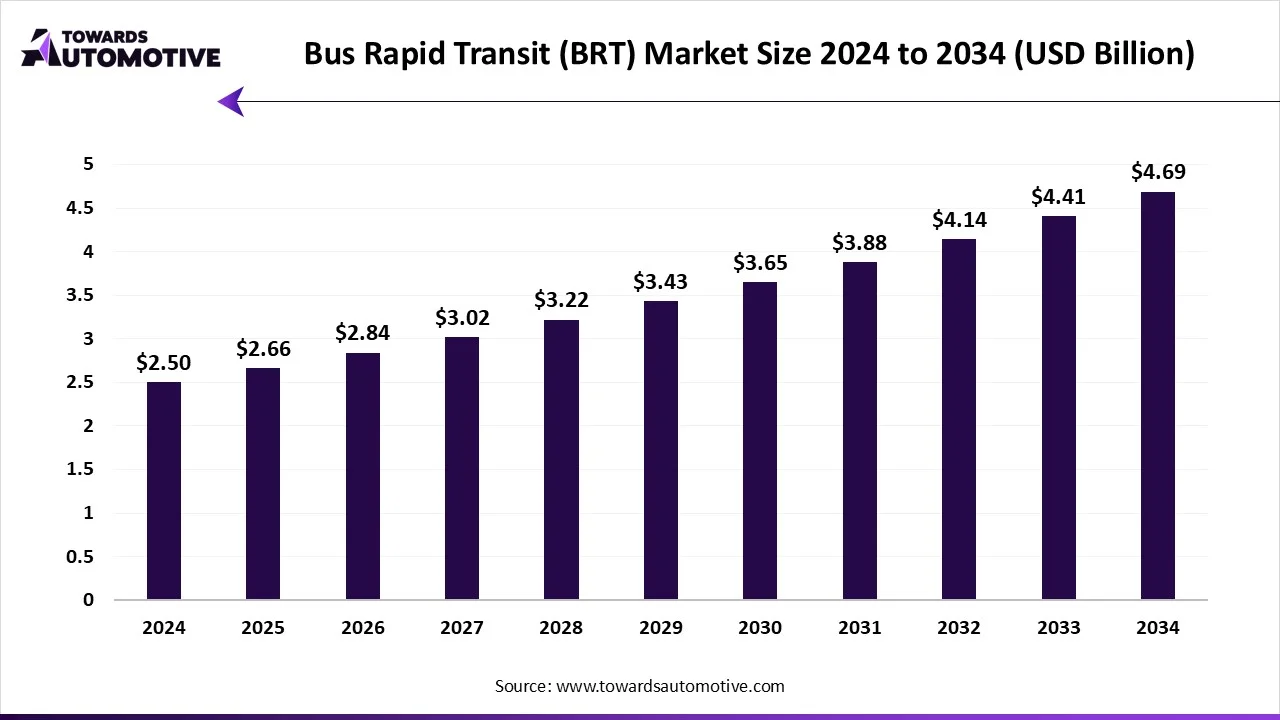

The bus rapid transit (BRT) market is expected to increase from USD 2.66 billion in 2025 to USD 4.69 billion by 2034, growing at a CAGR of 6.50% throughout the forecast period from 2025 to 2034. The market for Bus Rapid Transit (BRT) has been increasing, primarily due to the growing incidence of congestion and pollution in cities worldwide. Governments are investing in enhanced public transport systems in order to reduce personal vehicle use in cities. In terms of costs, BRT is also much more cost-effective and quicker to install than rail-based transport. Thus, BRT systems are an attractive choice for many developing countries.

BRT demand is also being boosted by the rapidly rising urban populations and the significant demand for safer, quicker, and sustainable movement around the city. Further, upgrading technology away from traditional bus systems, which have continued to improve, such as smart ticketing, dispatching software/platforms, and GPS tracking to better coordinate and implement BRT systems, has helped the services be increasingly adopted by cities across the world.

The Bus Rapid Transport (BRT) concept is the high-capacity bus-based public transportation systems that provide metro-like service through dedicated lanes, priority signaling, off-board fare collection, and modern stations. BRT systems are deployed to reduce congestion, improve urban mobility, and provide cost-effective alternatives to metro/rail systems, covering vehicles, infrastructure, operations, and supporting technologies. The BRT transit concept operates or supports several sectors, such as general daily commuting, tourism, airport transfers, and even business travel. The BRT market is growing rapidly, driven by government and private companies investing in sustainable transport solutions such as electric buses. The public is demanding BRT services for transport mobility with the increasing, considerable growth of urbanism, reduced costs of transport compared to traditional metro systems, and increased awareness of green mobility.

| Metric | Details |

| Market Size in 2024 | USD 2.5 Billion |

| Projected Market Size in 2034 | USD 4.69 Billion |

| CAGR (2025 - 2034) | 6.50% |

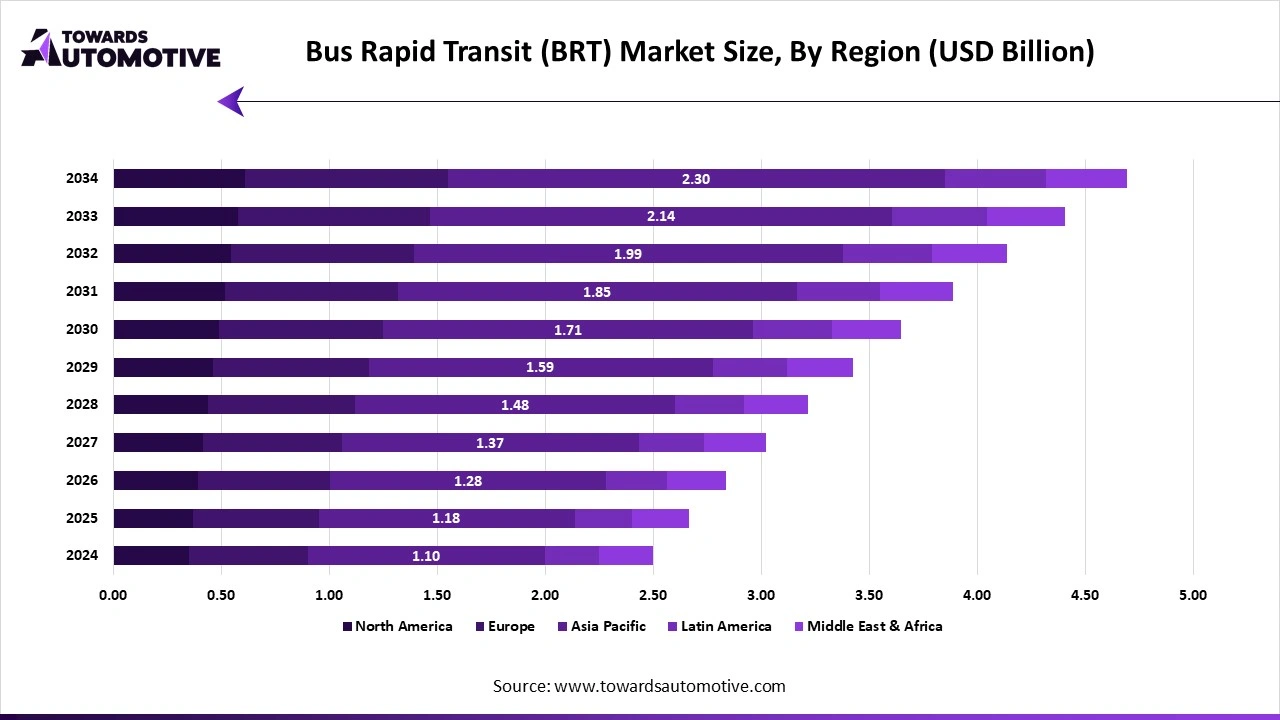

| Leading Region | Latin America |

| Market Segmentation | By System Type, By Bus Type / Vehicle Propulsion, By Infrastructure Component, By Service Type, By Capacity, By Technology Adoption, By Ownership / Operating Model, By End-user / Application and By Region |

| Top Key Players | Volvo Buses, Daimler Buses, Scania AB, MAN Truck & Bus SE, Ashok Leyland Ltd., Wrightbus, Irizar, Van Hool, Voith, ZF Friedrichshafen |

The trends in the bus rapid transit (BRT) market are partnerships and program launches.

The closed BRT system segment dominated the BRT market, as they are more reliable and efficient than an open BRT system. Dedicated corridors eliminate interactions with other vehicular traffic, which also reduces delays and congestion. Closed BRT system types support a smoother ride and quicker travel time, while enhancing passenger safety. Many governments prefer the appearance of a closed BRT as it resembles that of a metro service, but they are less expensive to construct and operate. It is the combination of higher capacity or volume of passengers they carry, which is why the closed BRT system dominated the BRT market.

The hybrid BRT system segment is expected to witness the fastest growth rate in the forecasted period as hybrids incorporate the best of both open and closed BRT systems. It favors buses operating in exclusive lanes in large cities, within city centers, and suburban areas. Hybrid BRT lowers the probability of needing to transfer passengers and enhances accessibility throughout the urban region. With the expansion of cities and rising suburban populations, the hybrid system is practical as a mode to blend, transition, and connect various areas effectively.

The diesel-powered buses segment dominated the market, as they are the most cost-effective and accessible option. Most cities also have the infrastructure, refueling stations, and maintenance system already in place to operate diesel buses. In addition, diesel buses can accommodate heavy passenger throughput and longer distance travel for a given route without operation-related issues. Diesel buses are especially favored in emerging and developing regions, as they are more affordable and have become the most prevalent bus type within existing BRT networks today.

The battery electric buses segment is expected to experience the fastest growth rate in the BRT market due to the increased global focus on cleaner, eco-friendly transportation options. Government subsidies and funding for the electrification of their bus fleets are increasing to help minimize carbon emissions, improve air quality, and address pollution issues. In addition, technology is advancing in areas such as battery lifespan, performance, and charging infrastructure. Urban cities that are leaning toward electric mobility and climate action plans are quickly deploying electric BRT buses and creating their own opportunities for strong growth in this area.

The dedicated bus lanes & corridors segment led the BRT market as they help keep buses out of traffic, resulting in faster travel times and more reliable schedules. As cities are building corridors first, installing the bus lanes is important as it builds the infrastructure reach for other related infrastructure, such as stations and terminals. If the lanes are removed from BRT, the efficiency of the BRT would be lost. This is the reason why bus lanes are the most important and common type of infrastructure in the market.

The ITS & smart ticketing segment is expected to witness the highest growth rate in the market as cities are looking to digital solutions to enhance passenger experience and increase efficiency. Smart ticketing means passengers wait less and cash is less to handle, while real-time vehicle tracking and signal prioritization increase reliability. Passengers are relying on digital payment systems and using travel apps more. Governments and operators are investing in ITS technology and smart ticketing systems to modernize their BRT systems and increase ridership, while also integrating with the broader transport network, which also causes rapid adoption in implementation.

The standard/trunk service segment dominated the BRT market as it is the main operation of most systems. These are the services that operate on the main dedicated corridors utilized by high-capacity buses with reliable and frequent trips for everyday commuters. Trunk lines represent the backbone upon which other BRT services are built, such as feeders or express types. As most cities establish standard services before additional services, the trunk service segment remains the dominant global BRT market segment.

The express/limited-stop service segment is expected to grow at the fastest rate in the forecasted period as cities are looking for increased travel time-shortening experiences for longer-distance passengers. These services miss smaller stations and only stop at terminals, providing quicker trips. Express is especially useful where long-distance commuting competitors have a heavy flow from the suburbs to the central city. As cities develop into drivable environments, express transit service availability is in demand to provide quicker, more time-saving routes, resulting in much faster growth of express BRT services.

The intermediate BRT segment led the BRT market, as most urban cities are in the passenger demand range for intermediate BRT to dominate. It combines affordability and capacity, making it practical for corridors that are busy enough to warrant the investment. Many developing cities are joining hands with companies to eliminate high expenditures related to full BRT because intermediate BRT solutions address the growing demands of transport without the investment needed to implement full BRT. These characteristics of intermediate BRT that ensure the system handles moderate volumes efficiently are why intermediate BRT is still very much the most dominant system in the global BRT market.

The full BRT segment is expected to grow at the fastest rate in the forecasted period as megacities increasingly deal with high-density and high-capacity solutions. Full BRT systems will move large flows of passenger demand similar to many full metro systems at much less cost. Cities like Bogotá and Guangzhou have already highlighted how full BRT systems have changed urban mobility. As demand increases rapidly based on urbanization in cities, full BRT solutions will develop and spread more rapidly in the urban environment and globally as the preferred system.

The semi-automated segment is expected to be the fastest growing segment in the market. The semi-automated Bus Rapid Transit (BRT) systems are rapidly evolving as they provide meaningful advancements in transport without the need for a fully smart infrastructure. This could be features such as smart ticketing, or traffic signal prioritization, or just basic integration into Intelligent Transport Systems (ITS), enhancing the speed, efficiency, and user-friendliness of buses. A number of cities are already viewing this as an opportunity to upgrade at a cost-effective path, while also modernizing operations, without having to invest in a brand new service level. Semi-automation is now being adopted suddenly and at a rapid pace as governments attempt to digitize transport, moving towards a fully smart BRT network in the future.

The fully smart BRT segment is expected to grow at the fastest growth rate in the forecasted period. Fully smart BRT systems are also evolving faster than BRT systems more widely because cities are embracing advanced technology to accomplish seamleass and sustainable transport systems. Fully smart BRT systems utilize a combination of ITS, real-time passenger information, automated ticketing systems, and environmentally sustainable buses. They are marketed to governments with a focus on smart city public transport goals and climate change commitments. With increasing interest in the demand for data-driven, efficient, and sustainable mobility options, fully smart BRT systems are no longer just an idea, but rather systems being adopted back into the big cities in developed areas as well as global cities where digital infrastructure is much more mature.

The publicly operated segment dominated the BRT market. Publicly operated bus rapid transit (BRT) systems are the most widespread, as most governments finance and manage large-scale transport initiatives. Publicly owned services guarantee low prices for users, and allow cities to retain complete control over routes, fares, and infrastructure. Many BRT service providers are viewed as public services underpinning jobs, economic development, and traffic reduction, which leads to government-led development of BRT systems (and/or services) for the public good. This narrative is consistent amongst publicly owned BRT systems in both developing and developed countries.

The PPP-operated BRT segment is expected to witness the fastest growth rate in the forecasted period. Public-private partnership (PPP) BRT systems are the fastest growing system due to support from government or public entities and operation by private companies. Government/public entities finance the infrastructure, while private entities operate the services and maintain vehicles and technology. This does not place as much financial burden on public agencies to finance operations, while also providing flexibility for innovation from the private sector. PPPs are successful because they engage global investors who seek long-term returns for sustainable mode of transportation. As global cities look for options to efficiently broaden or expand their BRT networks seeking financial partners, PPP operated systems have been made quickly across substantial geographic areas.

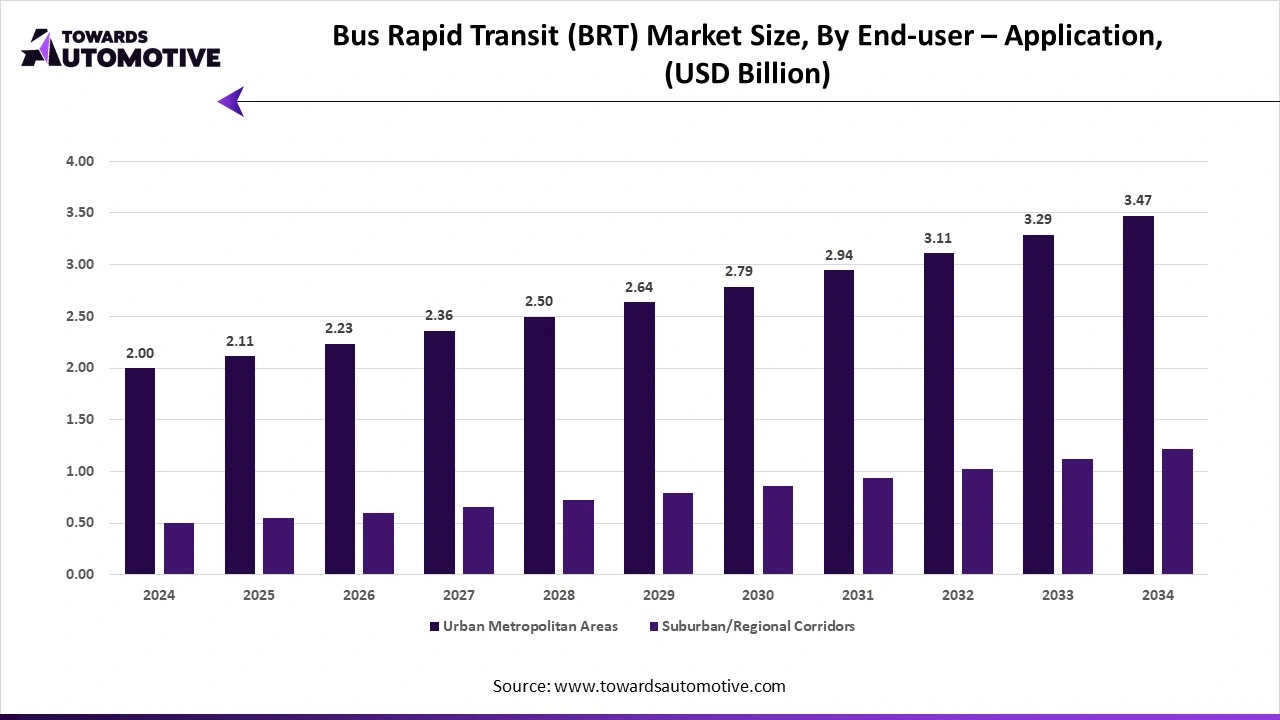

The urban metropolitan areas segment dominated the BRT market. Urban metropolitan regions represent the majority of the BRT market as they deal with the most traffic congestion and greatest passenger demand. For cities with millions of residents, the entire metropolitan environment relies on mass transport solutions like BRT to relieve road congestion while delivering affordable mobility. BRT corridors especially facilitate high levels of transit demand in areas of dense urban development and population - locations that replace or enhance metro or rail systems. Furthermore, the commuter/staff flows created in metropolitan regions make this customer market the largest and most consistent end-user of BRT systems in the world.

The suburban/regional corridors segment is expected to experience the fastest growth rate in the BRT market. Suburban and regional corridors are the fastest growing segments because more and more people are living outside cities as housing prices rise, and urban sprawl occurs. What is required to the expanding suburban environment is long-distance, reliable public transport to connect new residents to jobs and services in the city. BRT systems, often in conjunction with metro or rail, provide an effective and economically viable solution to serve these suburban regions. With the increasing population in suburban environments, the demand for BRT in regional corridors is likely to grow the fastest.

Latin America dominated the BRT market due to the traffic and pollution challenges many cities in the region faced. Therefore, governments decided to invest in affordable high-capacity public transportation systems. The system of BRT is relatively cheap compared to metros and significantly faster, thus it was an excellent alternative in cities where metro systems were not established. Additionally, Latin American countries developed robust networks that included segregated corridors to enhance traffic flows as well as large-capacity buses. On the other hand, considering Latin America, revitalizing existing BRT systems with new technology and using electric buses is a salient opportunity to meet the needs of growing ridership as services are extended further into suburban neighborhoods.

Brazil has been the leading country in the BRT market across Latin America because Brazil has cities like Curitiba and Rio de Janeiro that have developed good practical BRT systems. Brazil set the precedent as a model for other countries on how affordable BRT could be, while at the same time running an efficient system. Brazil's leadership position in the BRT market stems from a focus on minimizing traffic congestion issues while being consistent with viable public transportation. Opportunities for growth in this country lie within the implementation of smart ticketing and expanded routes to compete with growing urban and suburban ridership.

Asia-Pacific is expected to witness the fastest growth in the BRT market due to excessive urbanization, population growth, and increasing traffic congestion. Governments in the region put a high emphasis on designing low-cost transit systems that can carry large volumes of passengers every day. There have been recent funding and investment opportunities in electric bus systems, smart technologies, and growing government policies to encourage green mobility. There are opportunities for expansion of transit networks in megacities, creation of hybrid transport systems to connect suburban communities, and construction of more reliable and eco-friendly networks with the use of smart ITS solutions in the BRT market.

China has led the BRT market in the Asia-Pacific region due to the ongoing investment it has made over the years into large urban transport systems. Cities in China, such as Guangzhou, developed one of the largest BRT networks in the world. China is using BRT to reduce congestion, lower emissions, and provide affordable transport to millions of commuters. In comparison with most countries in the region, China's market leadership is linked to government support, infrastructure spending, and the introduction of smart technologies, including electric bus systems, which has created a clear market leadership.

| September 2025 | Announcement |

| Jennifer Li, CFO and Head of International of WeRide. | We are deploying our GXRs for the first time in Singapore and Southeast Asia, marking a regional milestone in urban transportation. This paves the way for WeRide to extend GXR passenger services to more communities. By integrating our AVs with the public transport network, WeRide aims to provide Singapore residents with a smarter, more seamless travel experience. |

| August 2025 | Announcement |

| André Marques, President at Volvo Buses Latin America. | It is with great satisfaction that we announce this important sale for one of the main BRT-systems in Brazil. The city of Goiânia takes a major step toward decarbonizing public transport by adopting high-tech electric buses with exceptional safety features. |

| August 2025 | Announcement |

| Audrey DeBarros, Executive Director of Commuting Solutions. | Our goal with the new branding and wayfinding system is to create a cohesive and user-friendly experience for all travelers along CO 119. This branding will not only establish a recognizable identity but will also foster ease of use and enhance safety as travelers explore moving between modes of transportation. |

| March 2025 | Announcement |

| Ly Sary, Deputy Governor of Siem Reap Province during his opening remarks. | We have finished the study on the electric bus project, which we hope will reduce gasoline use and traffic congestion for the benefit of residents and tourists. We hope this can be implemented smoothly, in harmony with other initiatives, and will not harm the livelihood of people working in the transport sector. |

The bus rapid transit (BRT) market is highly competitive. Some of the prominent players in the market are Volvo Buses, Daimler Buses, Scania AB, MAN Truck & Bus SE, Tata Motors Limited, Ashok Leyland Ltd., Yutong Bus Co., Ltd., BYD Company Ltd., Zhengzhou King Long Bus Co., Marcopolo S.A., Wrightbus, Solaris Bus & Coach, NFI Group, CAF Group, and Cubic Transportation Systems. Businesses in the BRT market are intensely focused on the research and development of electric and hybrid buses, which helps reduce emissions while minimizing operating costs. They are also investing in intelligent infrastructure to create more reliable and convenient services. This could include real-time tracking for buses, priority of signals and signage, or contactless payments and tickets. In addition, there are various initiatives to establish public-private partnerships so that risk and funding can be shared amongst the businesses competing for market share.

Tier 1

Tier 2

Tier 3

By System Type

By Bus Type / Vehicle Propulsion

By Infrastructure Component

By Service Type

By Capacity

By Technology Adoption

By Ownership / Operating Model

By End-user / Application

By Region

October 2025

July 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us