September 2025

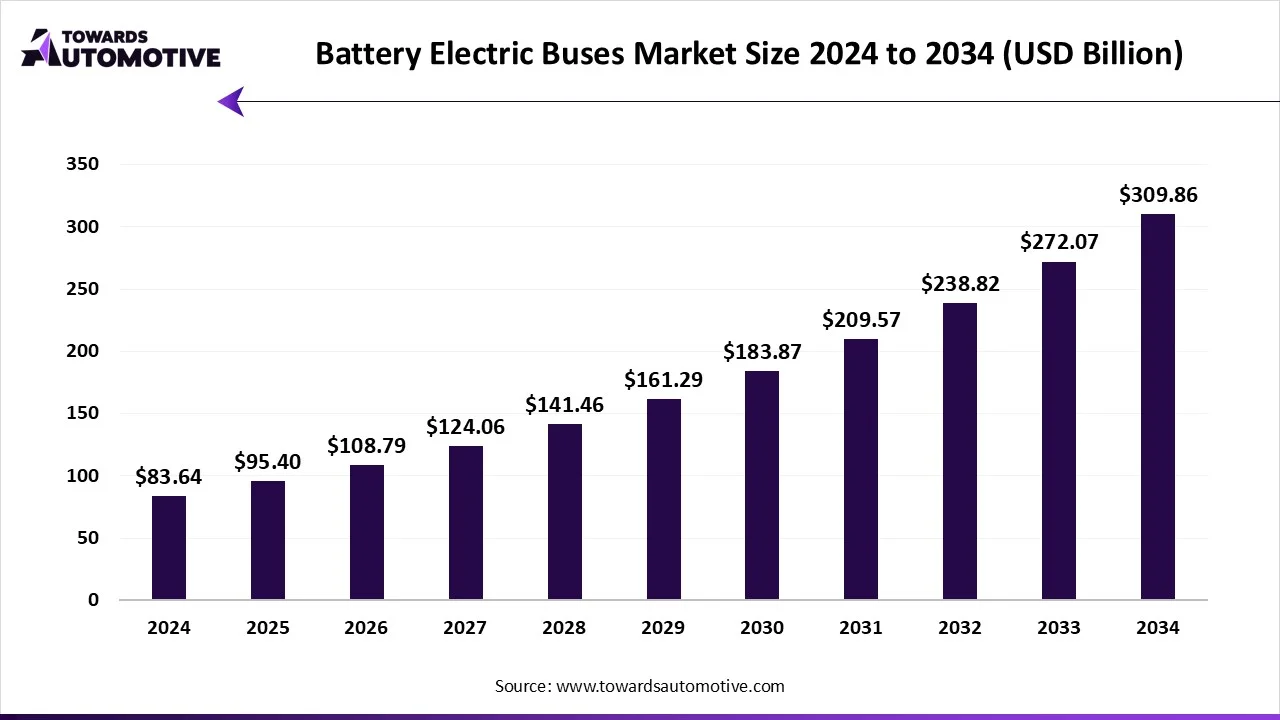

The battery electric buses market is projected to reach USD 309.86 billion by 2034, growing from USD 95.40 billion in 2025, at a CAGR of 14.04% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The battery electric buses market is a prominent segment of the EV industry. This industry deals in manufacturing and distribution of battery electric buses in different parts of the world. There are different buses developed in this sector including standard electric bus, articulated electric bus, shuttle electric bus, midi electric bus, double-decker electric bus and some others. These buses are powered by various types of batteries consisting of nickel-cadmium, Li-ion, lead acid and some others. It finds application in several sectors such as public transit, private fleet and some others. The growing awareness about reducing emission has boosted the market expansion. This market is expected to rise significantly with the growth of the automotive sector in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 83.64 Billion |

| Projected Market Size in 2034 | USD 309.86 Billion |

| CAGR (2025 - 2034) | 14.04% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Bus, By Battery, By Application and By Region |

| Top Key Players | New Flyer Industries Inc., Volvo Buses, Daimler AG, Van Hool NV, Ebusco BV |

The major trends in this market consists of advancement in powertrains, government initiatives and partnerships.

The automotive manufacturers are constantly engaged in research and development of advanced powertrain to enhance the performance of electric buses. For instance, in March 2025, Scania launched e-powertrain for electric buses. This powertrain is integrated with various components including motors, inverters, gearbox and oil system. (Source: Scania)

Government of various countries such as UK, Germany, the U.S., India and some others have started deploying electric buses to reduce emission arising out of public transportation. For instance, in April 2025, the government of UK announced to invest around 38 million euros. This investment is done for deploying 319 electric buses in England by 2027. (Source: Sustainable Bus)

Several EV manufacturers are partnering with bus service providers to deploy electric buses to deliver sustainable transportation in different parts of the world. For instance, in April 2025, Flixbus partnered with Vertelo. This partnership is done for deploying around 500 electric intercity buses across India. (Source: AUTOCAR PROFESSIONAL)

The public transit segment led this industry. The growing adoption of electric buses for public transportation in various developed nations such as Germany, the U.S., Italy and some others has boosted the market growth. Additionally, numerous government initiatives aimed at reducing vehicular emission along with rising awareness of passengers to adopt eco-friendly transportation solutions is further contributing to the industrial expansion. Moreover, partnerships among market players and government for deploying electric buses in public transit systems is expected to propel the growth of the battery electric buses market.

The private fleet segment is expected to rise with the fastest CAGR during the forecast period. The growing prices of diesel has increased the demand for cost-effective alternatives, thereby driving the market expansion. Also, rapid adoption of electric buses by fleet operators to gain maximum profit and reduce emission is playing a vital role in shaping the industrial landscape. Moreover, collaborations among EV manufacturers and bus operators to deploy electric buses for long-route traveling is expected to drive the growth of the battery electric buses market.

Battery Electric Buses Market Size, By Battery, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Nickel-cadmium | 2.51 | 2.67 | 2.83 | 2.98 | 3.11 | 3.23 | 3.31 | 3.36 | 3.35 | 3.27 | 3.11 |

| Li-ion | 73.6 | 83.36 | 94.41 | 106.93 | 121.09 | 137.12 | 155.27 | 175.81 | 199.06 | 225.37 | 255.15 |

| Lead acid | 5.02 | 5.34 | 5.66 | 5.95 | 6.22 | 6.45 | 6.62 | 6.71 | 6.7 | 6.55 | 6.22 |

| Others | 2.51 | 4.01 | 5.87 | 8.19 | 11.04 | 14.52 | 18.77 | 23.92 | 30.15 | 37.66 | 46.68 |

| Total | 83.64 | 95.38 | 108.77 | 124.05 | 141.46 | 161.32 | 183.97 | 209.8 | 239.26 | 272.85 | 311.16 |

The li-ion segment held the highest share of the market. The growing use of lithium-ion batteries in modern electric buses to deliver superior driving range along with opening of lithium-ion battery recycling facility has boosted the market growth. Additionally, numerous advantages of li-ion batteries including fast charging capabilities, low self-discharge rate, high energy density, long cycle life and some others is adding to the industrial expansion. Moreover, constant research and development by battery manufacturers for developing li-ion batteries to cater the needs of the electric buses is expected to boost the growth of the battery electric buses market.

The lead acid segment is expected to rise with a notable CAGR during the forecast period. The rising application of lead acid batteries in low-range electric buses has boosted the market expansion. Additionally, numerous benefits of lead acid batteries such as low cost, high-power output, reliability and some others is playing a vital role in shaping the industrial landscape. Moreover, several lead-acid battery companies are opening up new manufacturing plants to cater the needs of EV buses, thereby driving the growth of the battery electric buses market.

Battery Electric Buses Market Size, By Region, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 10.04 | 11.64 | 13.49 | 15.63 | 18.11 | 20.97 | 24.28 | 28.11 | 32.54 | 37.65 | 43.56 |

| Europe | 18.4 | 21.08 | 24.15 | 27.66 | 31.69 | 36.3 | 41.58 | 47.62 | 54.55 | 62.48 | 71.57 |

| Asia-Pacific | 48.51 | 54.94 | 62.22 | 70.46 | 79.78 | 90.34 | 102.29 | 115.81 | 131.11 | 148.43 | 168.03 |

| Latin America | 3.35 | 3.91 | 4.57 | 5.33 | 6.22 | 7.26 | 8.46 | 9.86 | 11.48 | 13.37 | 15.56 |

| Middle East & Africa | 3.34 | 3.81 | 4.34 | 4.97 | 5.66 | 6.45 | 7.36 | 8.4 | 9.58 | 10.92 | 12.44 |

| Total | 83.64 | 95.38 | 108.77 | 124.05 | 141.46 | 161.32 | 183.97 | 209.8 | 239.26 | 272.85 | 311.16 |

Asia Pacific dominated the battery electric buses market. The growing demand for eco-friendly public transportation in several countries such as India, Japan, China, South Korea and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at deploying electric buses coupled with rapid investment by private and public entities in EV bus manufacturing sector is positively impacting the industrial growth. Moreover, the presence of several market players such as BYD, Yutong Group, Zhongtong Bus Holding Co., Ltd., CRRC Corporation Limited, Tata Motors and some others is expected to drive the growth of the battery electric buses market in this region.

China is the leading country in this region. In China, the market is generally driven by the rapid adoption of sustainable transportation solutions along with rapid investment in EV industry by automotive brands. Additionally, the presence of well-established battery industry with major players such as CATL, CALB, BYD and some others has further contributed to the market growth.

North America is expected to rise grow with a significant CAGR during the forecast period. The rising adoption of electric buses for intercity transportation in the U.S. and Canada has driven the market growth. Also, the rapid investment by government for developing the EV charging infrastructure coupled with rise in number of EV startups is playing a vital role in shaping the industrial landscape. Moreover, the presence of various EV bus manufacturers such as Proterra Inc, Lion Electric Company, NFI Group Inc. and some others is expected to foster the growth of the battery electric buses market in this region.

U.S. dominated the market in this region. In the U.S, the market is generally driven by the rising consumer awareness to adopt eco-friendly public transportation along with numerous government initiatives to develop the EV manufacturing capabilities. Moreover, the presence of several electric bus manufacturers coupled with rapid advancements in EV powertrain industry has further accelerated the market growth.

The battery electric buses market is a rapidly developing industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of CRRC Corporation Limited, Alexander Dennis Limited, BYD, Yutong Group, Zhongtong Bus Holding Co., Ltd., New Flyer Industries Inc., Volvo Buses, Daimler AG, Van Hool NV, Ebusco BV, Optare PLC, Nova Bus Corporation and some others. These companies are constantly engaged in developing battery electric buses and adopting numerous strategies such as joint ventures, launches, collaborations, acquisitions, partnerships, business expansions and some others to maintain their dominance in this industry.

By Bus

By Battery

By Application

By Region

September 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us