August 2025

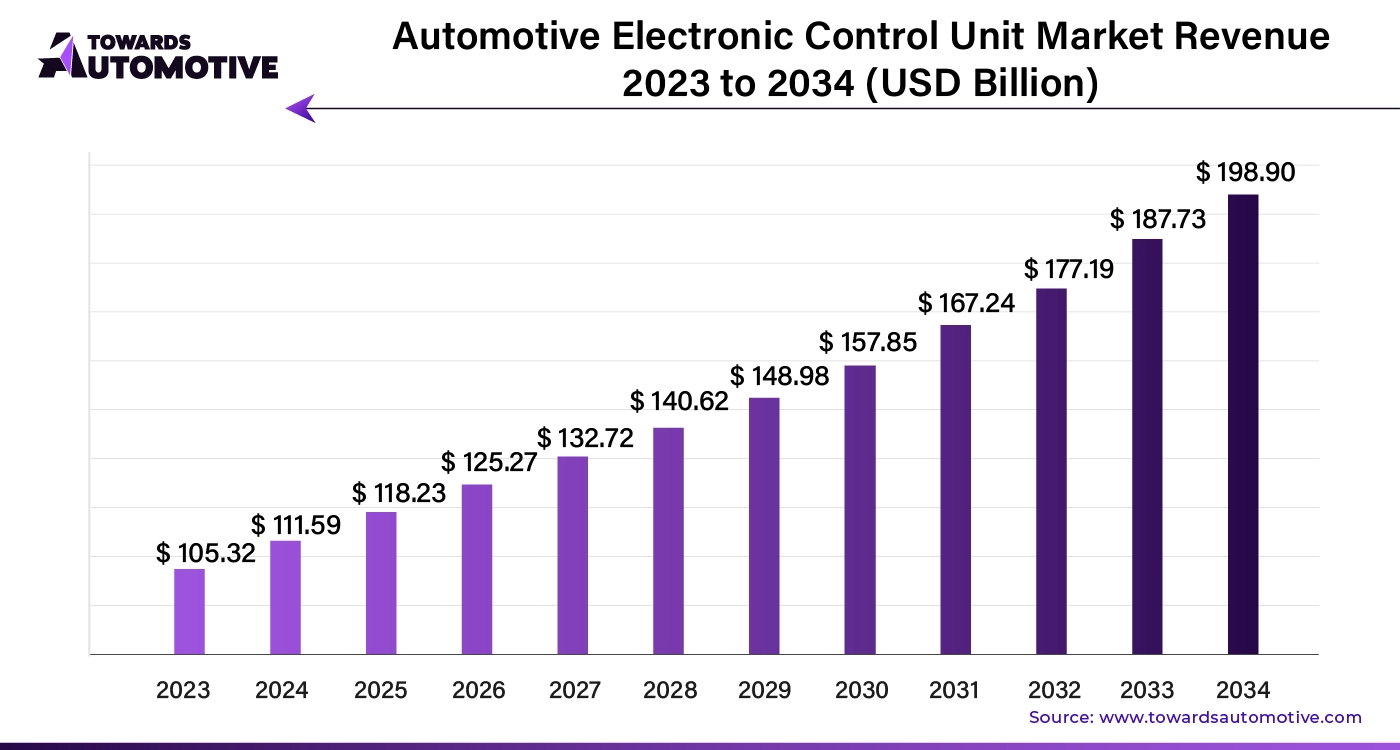

The automotive electronic control unit market is forecasted to expand from USD 118.23 billion in 2025 to USD 198.90 billion by 2034, growing at a CAGR of 5.95% from 2025 to 2034. The increasing use of advanced electronic systems in modern vehicles coupled with integration of ADAS in passenger cars to enhance safety has driven the market expansion.

Additionally, rapid investment by market players for opening new manufacturing plants as well as numerous government initiatives aimed at enhancing EV adoption rate is playing a crucial role in shaping the industrial landscape. The growing emphasis on developing Virtual ECUs (vECUs) for simulation platforms is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive electronic control unit market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of ECUs in different parts of the world. There are various types of ECUs developed in this sector comprising of ABS ECU, airbag controlling ECU, transmission control ECU, battery management ECU and some others. These ECUs are available in different capacities including 16-bit, 32-bit, 64-bit and others. It is designed for numerous types of vehicles consisting of passenger cars and commercial vehicles. The automotive ECUs finds application in controlling several automotive components such as ADAS & safety systems, body electronics, powertrain, infotainment and some others. This market is expected to rise drastically with the growth of the EV industry around the globe.

The major trends in this market consists of partnerships, business expansions and increasing sales of passenger cars.

The 32-bit segment led the automotive electronic control unit market. The rising demand for 32-bit ECUs to enable higher data processing power and speed has driven the market expansion. Additionally, the growing application of these ECUs to handle larger amounts of data from more sensors and perform intricate calculations for advanced automotive functions is playing a vital role in shaping the industrial landscape. Moreover, the integration of these ECUs in ICE vehicles and electric buses is expected to foster the growth of the automotive electronic control unit market.

The 64-bit segment is expected to grow with the highest CAGR during the forecast period. The growing application of 64-bit ECUs in modern vehicles to handle high-performance automotive functions such as autonomous driving, advanced driver-assistance systems (ADAS) and some others has driven the market growth. Also, the increasing use of these ECUs in EVs and self-driving cars to operate complex tasks is contributing to the industry in a positive manner. Moreover, rapid investment by market players for developing 64-bit ECUs to cater the needs of commercial vehicles is expected to propel the growth of the automotive electronic control unit market.

The passenger cars segment held the largest share the automotive electronic control unit market. The increasing sales of passenger vehicles in several nations such as China, the U.S., Germany and some others has boosted the market expansion. Additionally, the growing preference of HNIs to purchase luxury vehicles along with rapid investment by automotive brands to develop a wide range of passenger cars is contributing to the industry in a positive manner. Moreover, partnerships among automotive companies and technology providers to develop advanced ECUs for passenger cars is expected to propel the growth of the automotive electronic control unit market.

The commercial vehicles segment is expected to expand with the highest CAGR during the forecast period. The growing sales and production of commercial vehicles in various nations including Canada, Japan, India, South Korea and some others has driven the market growth. Also, the integration of ADAS-based ECUs in autonomous buses to enhance safety is playing a vital role in shaping the industry in a positive direction. Moreover, rapid investment by automotive companies to manufacture a wide range of commercial vehicles is expected to drive the growth of the automotive electronic control unit market.

The powertrain segment dominated the automotive electronic control unit market. The increasing use of ECU in powertrains to optimize performance, fuel efficiency, emissions and some others has driven the market expansion. Also, the integration of advanced powertrain systems in passenger vehicles to generate power from a fuel source is playing a crucial role in shaping the industrial landscape. Moreover, the growing application of electric powertrain (EV) and hybrid powertrain in electric vehicles is expected to drive the growth of the automotive electronic control unit market.

The ADAS & safety system segment is expected to grow with a considerable CAGR during the forecast period. The growing use of ADAS in luxury vehicles to enhance vehicular safety has driven the market expansion. Also, numerous applications of ADAS CPUs including sensor data processing, sensor fusion, environment interpretation, action coordination and some others is playing a prominent role in shaping the industrial landscape. Moreover, the integration of advanced ADAS components in modern cars is expected to boost the growth of the automotive electronic control unit market.

The internal combustion engine segment led the automotive electronic control unit industry. The integration of advanced ECUs in gasoline-powered vehicles has driven the market expansion. Additionally, the growing application of high-quality electronic components in ICE-based vehicles is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by market players for developing ECUs to cater the needs of internal combustion engine vehicles is expected to drive the growth of the automotive electronic control unit market.

The battery-powered propulsion segment is expected to rise with a notable CAGR during the forecast period. The growing use of advanced electronic components in BEVs to operate several applications has driven the market expansion. Also, numerous government initiatives aimed at developing the EV sector along with rise in number of EV startups is contributing to the industry in a positive manner. Moreover, the increasing focus of automotive brands for manufacturing a wide range of electric vehicles is expected to boost the growth of the automotive electronic control unit market.

Asia Pacific led the automotive electronic control unit market. The growing sales and production of passenger vehicles in various countries including India, China, Japan, South Korea and some others has driven the market expansion. Additionally, rapid investment by government for developing the EV infrastructure coupled with rise in number of automotive component manufacturers is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Denso Corporation, Panasonic Holdings Corporation, Belrise Industries Ltd, Hitachi and some others is expected to boost the growth of the automotive electronic control unit market in this region.

North America is expected to grow with a significant CAGR during the forecast period. The increasing adoption of EVs in the U.S. and Canada for lowering vehicular emission has boosted the market growth. Also, growing investment by automotive brands for opening up new component production facilities coupled with technological advancements in the automotive sector is contributing to the industry in a positive manner. Moreover, the presence of numerous market players such as BorgWarner Inc., Magna International Inc., General Motors, Lear Corporation and some others is expected to foster the growth of the automotive electronic control unit market in this region.

| July 2025 | Announcement |

| Jagan Rajagopalan, the head of Strategy & Portfolio at Elektrobit Automotive GmbH | The Software-Defined Vehicle is a complex ecosystem, and EB tresos AutoCore Light offers a smart, efficient entry point for customers aiming to build scalable, future-ready software. Tailored for resource-constrained peripheral ECUs, it breaks away from traditional monolithic architectures with a lightweight, modular design. By building on proven EB tresos AutoCore components, it empowers customers to accelerate development, reduce integration complexity, and confidently scale their SDV strategies. |

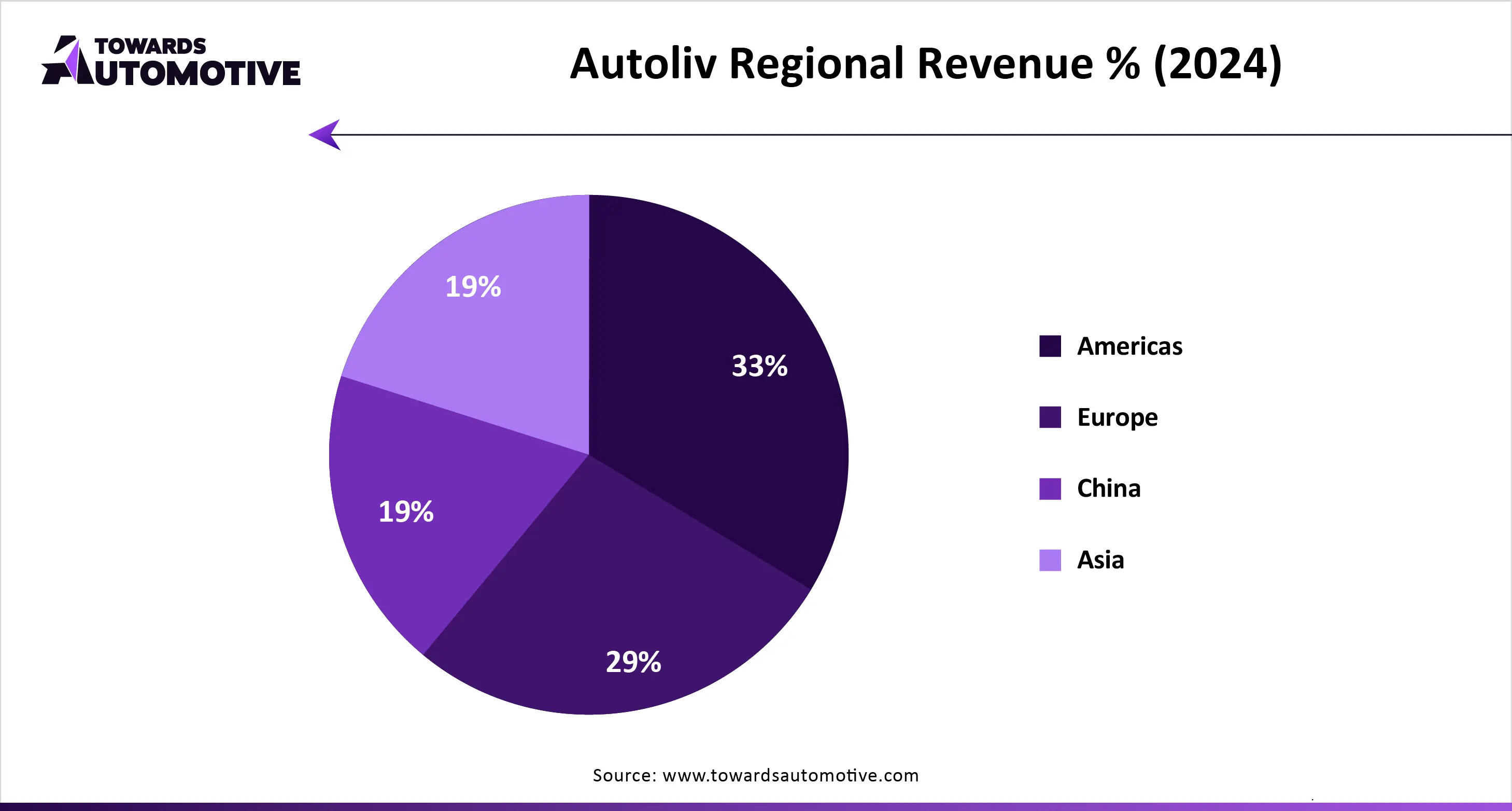

The automotive electronic control unit market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Autoliv Inc.; BorgWarner Inc.; Continental AG; Denso Corporation; Hella KGaA Hueck & Co. (Hella); Hitachi Astemo Americas, Inc.; Panasonic Holdings Corporation; Robert Bosch GmbH; Valeo S.A.; ZF Friedrichshafen AG and some others. These companies are constantly engaged in developing ECUs for the automotive sector and adopting numerous strategies such as acquisitions, partnerships, business expansions, collaborations, launches, joint ventures and some others to maintain their dominance in this industry.

By Capacity Type

By Vehicle Type

By Application

By Propulsion Type

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us