December 2025

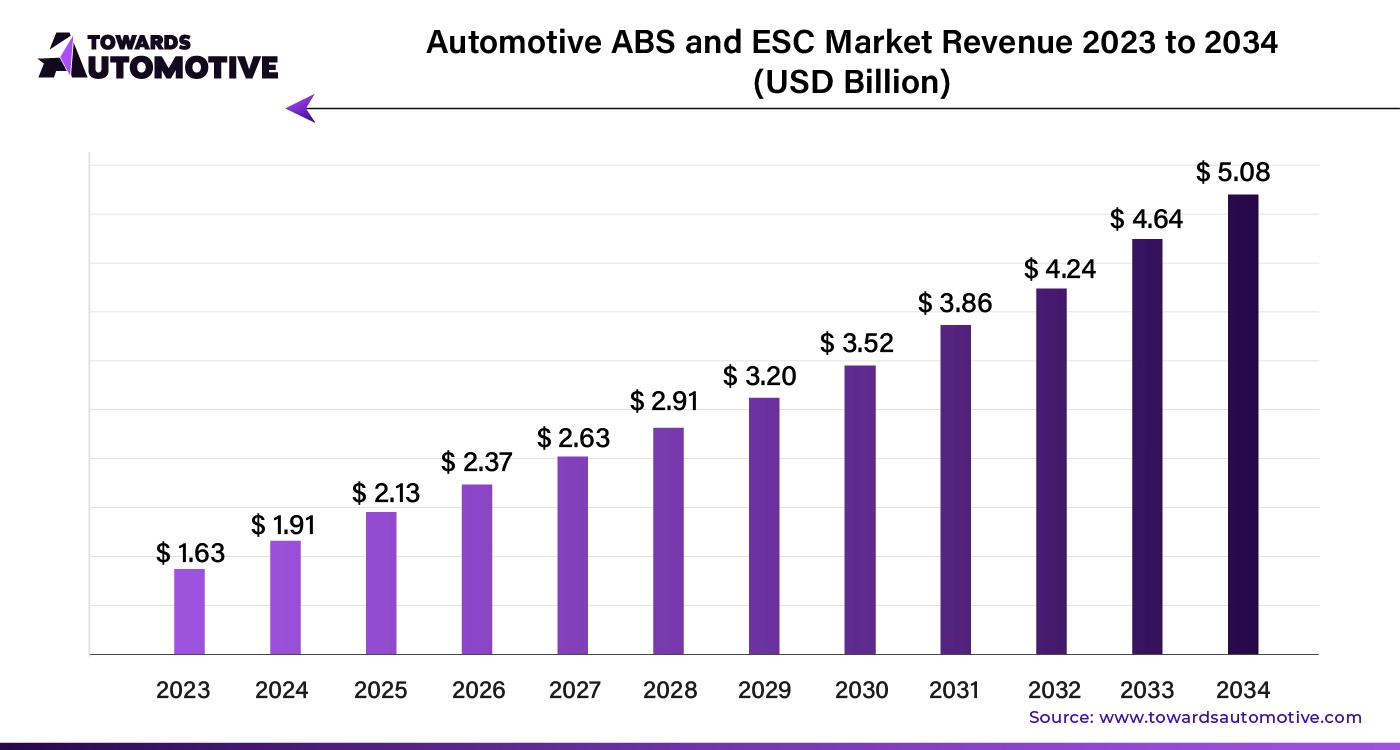

The global automotive ABS and ESC market size is calculated at USD 1.91 billion in 2024 and is expected to be worth USD 5.08 billion by 2034, expanding at a CAGR of 11.54% from 2023 to 2034.

The automotive ABS and ESC market is expanding rapidly, especially in emerging economies, due to increased vehicle production. This growth is driving demand for anti-lock braking systems (ABS) and electronic stability control (ESC), as customers become more aware of their safety benefits.

Strict safety regulations from national governments and automobile safety organizations are boosting the adoption of ABS and ESC systems. As public awareness of road safety rises, so does the demand for these technologies, which help reduce collisions and fatalities.

Modern vehicles with advanced safety features, such as ABS and ESC, attract safety-conscious buyers. Automakers are therefore motivated to incorporate these systems into their vehicles. Additionally, advancements in ABS and ESC technology, including the development of effective and affordable components, are further driving adoption.

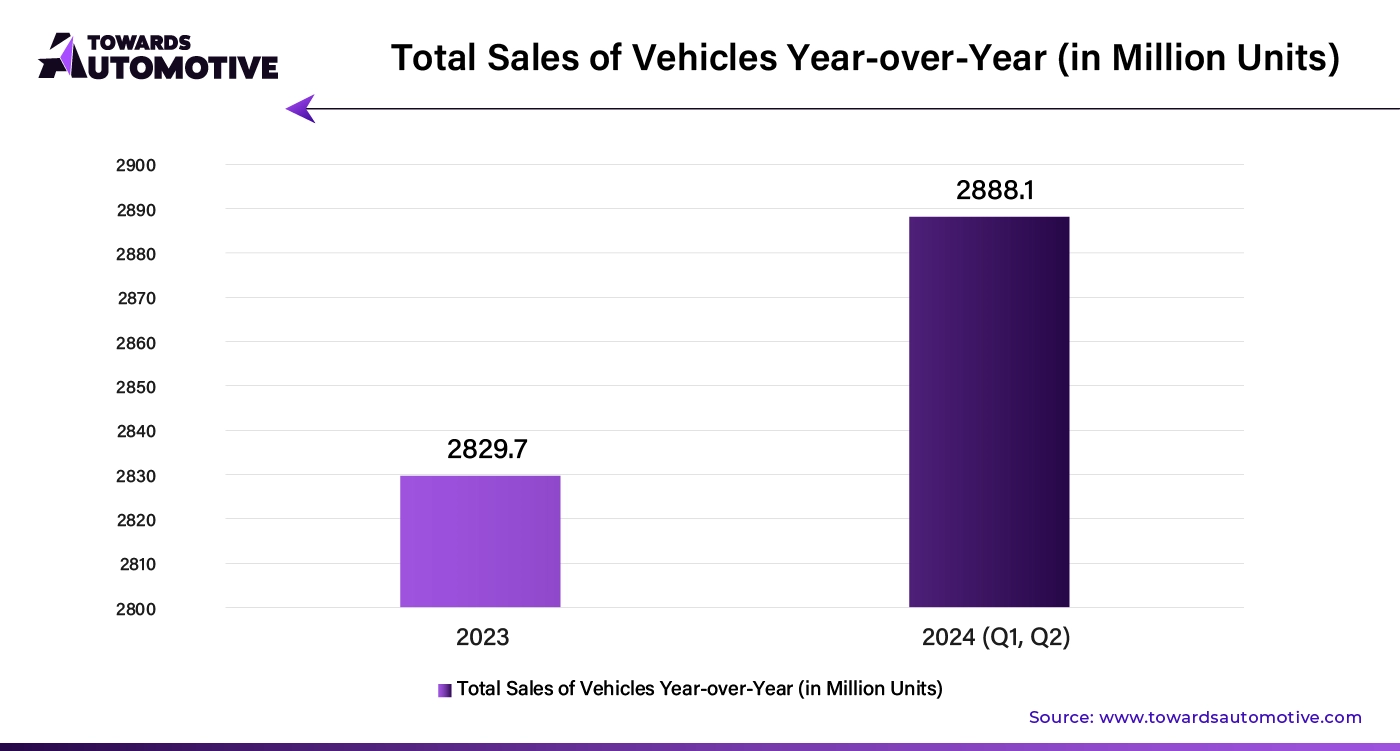

Urbanization and increasing traffic congestion are also contributing to the growing need for reliable safety technologies like ABS and ESC, ensuring continued market growth. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Integrating anti-lock braking systems (ABS) and electronic stability control (ESC) into vehicles can be costly, deterring adoption among budget and entry-level car manufacturers. In developed regions where these systems are already common, market growth may stagnate. Expanding ABS and ESC implementation in developing markets poses an additional challenge. Economic fluctuations also impact the automotive industry, as consumers may opt for cheaper vehicles over those with advanced safety features during downturns.

Automotive ABS and ESC Market Size, By Vehicle Type, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Passenger Vehicles | 42.04 | 46.63 | 51.72 | 57.35 | 63.61 | 70.55 | 78.24 | 86.78 | 96.23 | 106.72 | 118.35 |

| Commercial Vehicles | 11.86 | 13.38 | 15.1 | 17.04 | 19.22 | 21.67 | 24.44 | 27.55 | 31.06 | 35.01 | 39.45 |

In the automotive safety technology sector, the three-channel ABS (Anti-lock Braking System) segment is experiencing the fastest growth. This segment is projected to see significant expansion due to its effective performance in enhancing vehicle stability and safety. The three-channel ABS holds a notable 24.8% of the market share. It provides an affordable solution by distributing braking force evenly among three wheels, improving vehicle control and reducing skidding.

Conversely, the compact vehicle category remains the dominant force in the automotive ABS and electronic stability control (ESC) market. Compact vehicles capture approximately 11.5% of the market share and are expected to continue growing. Their appeal to cost-conscious buyers and the increasing integration of ABS and ESC systems in these vehicles are fueling this trend. Automakers are addressing stricter safety regulations and rising consumer demand by equipping compact cars with advanced safety features, thereby driving sales in this segment.

Artificial Intelligence (AI) is transforming the automotive ABS and ESC market by driving significant advancements in safety and performance. AI algorithms enhance ABS and ESC systems by analyzing real-time data from vehicle sensors, enabling more precise control of braking and stability functions. This increased accuracy reduces the likelihood of skidding and accidents, boosting driver confidence and safety.

AI-powered predictive maintenance also plays a crucial role. By continuously monitoring system health and predicting potential failures, AI helps prevent breakdowns and ensures that ABS and ESC systems operate at peak efficiency. This proactive approach not only improves vehicle safety but also reduces long-term maintenance costs.

Moreover, AI facilitates the development of advanced driver assistance systems (ADAS) that integrate seamlessly with ABS and ESC technologies. These systems offer enhanced features such as adaptive cruise control and lane-keeping assistance, further contributing to overall road safety.

As automotive manufacturers increasingly adopt AI-driven solutions, the automotive ABS and ESC market is set to experience accelerated growth. The integration of AI not only elevates the performance of safety systems but also aligns with the broader trend of smarter, safer vehicles on the road.

In the automotive ABS and ESC market the supply chain is crucial for maintaining product quality and ensuring timely delivery. The process begins with sourcing raw materials such as sensors, electronic control units, and hydraulic components. Suppliers provide these components to manufacturers who assemble and test them rigorously to meet industry standards.

Manufacturers then distribute these assembled systems to automotive OEMs (Original Equipment Manufacturers) and Tier 1 suppliers. OEMs integrate ABS and ESC systems into vehicles during the production phase. Efficient logistics and inventory management are essential throughout this process to prevent delays and ensure that the systems meet safety regulations and performance standards.

Quality control and continuous monitoring play a significant role in maintaining supply chain integrity. Suppliers and manufacturers work closely to address any issues promptly and adapt to changes in demand. By streamlining sourcing, production, and distribution processes, the automotive ABS and ESC market can deliver reliable and advanced safety systems to consumers effectively and efficiently.

The automotive ABS and ESC market is driven by a few major components and industry leaders. Key components include sensors, control modules, and hydraulic units. Sensors monitor wheel speed, steering angle, and vehicle dynamics, while control modules process this data to adjust braking and stability functions. Hydraulic units modulate brake pressure to prevent skidding.

Leading companies like Bosch, Continental, and Denso play crucial roles in this ecosystem. Bosch is known for its advanced ABS and ESC technologies that enhance vehicle safety and performance. Continental focuses on integrating these systems with other driver assistance technologies, boosting overall vehicle stability. Denso contributes by developing innovative control modules and sensors that improve the accuracy and responsiveness of ABS and ESC systems.

Other notable players include ZF Friedrichshafen, which provides comprehensive ABS and ESC solutions, and Aisin Seiki, known for its high-quality hydraulic components. These companies collectively advance the market by continuously innovating and improving the safety features of modern vehicles, making roads safer for everyone.

Automotive ABS and ESC Market Size, By Regiom, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 11.86 | 13.11 | 14.5 | 16.03 | 17.72 | 19.6 | 21.66 | 23.95 | 26.48 | 29.27 | 32.35 |

| Europe | 12.94 | 14.34 | 15.9 | 17.63 | 19.55 | 21.67 | 24.03 | 26.64 | 29.53 | 32.74 | 36.29 |

| Asia-Pacific | 20.48 | 22.99 | 25.79 | 28.94 | 32.47 | 36.43 | 40.87 | 45.85 | 51.42 | 57.68 | 64.7 |

| Latin America | 4.58 | 5.13 | 5.75 | 6.43 | 7.21 | 8.07 | 9.04 | 10.12 | 11.33 | 12.69 | 14.2 |

| Middle East & Africa | 4.04 | 4.44 | 4.88 | 5.36 | 5.88 | 6.45 | 7.08 | 7.77 | 8.53 | 9.35 | 10.26 |

North America Market Overview

In North America, the automotive ABS (Anti-lock Braking System) and ESC (Electronic Stability Control) markets are experiencing rapid growth. The United States is leading this surge, driven by stringent safety regulations and heightened consumer awareness of vehicle safety. ABS and ESC systems are projected to see steady adoption, with the U.S. market growing at an approximate CAGR of 12.0%. Canada is also witnessing significant growth, with a CAGR of around 9.8%, largely due to similar safety standards and challenging weather conditions that boost the demand for these technologies.

Europe Market Analysis

Europe’s automotive ABS and ESC market are robust, with Germany at the forefront due to its strong automotive sector and stringent safety regulations. German car manufacturers such as Mercedes-Benz, BMW, and Volkswagen are leading in advanced safety features, maintaining a competitive market with a CAGR of about 10.8%. Italy follows with a focus on ESC technology to enhance stability on its winding roads, while Spain and France are also expanding their markets, driven by government regulations and safety priorities. The UK’s market grows at a CAGR of approximately 11.9%, fueled by rigorous safety regulations and advancements in driver assistance systems.

Asia Pacific Market Dynamics

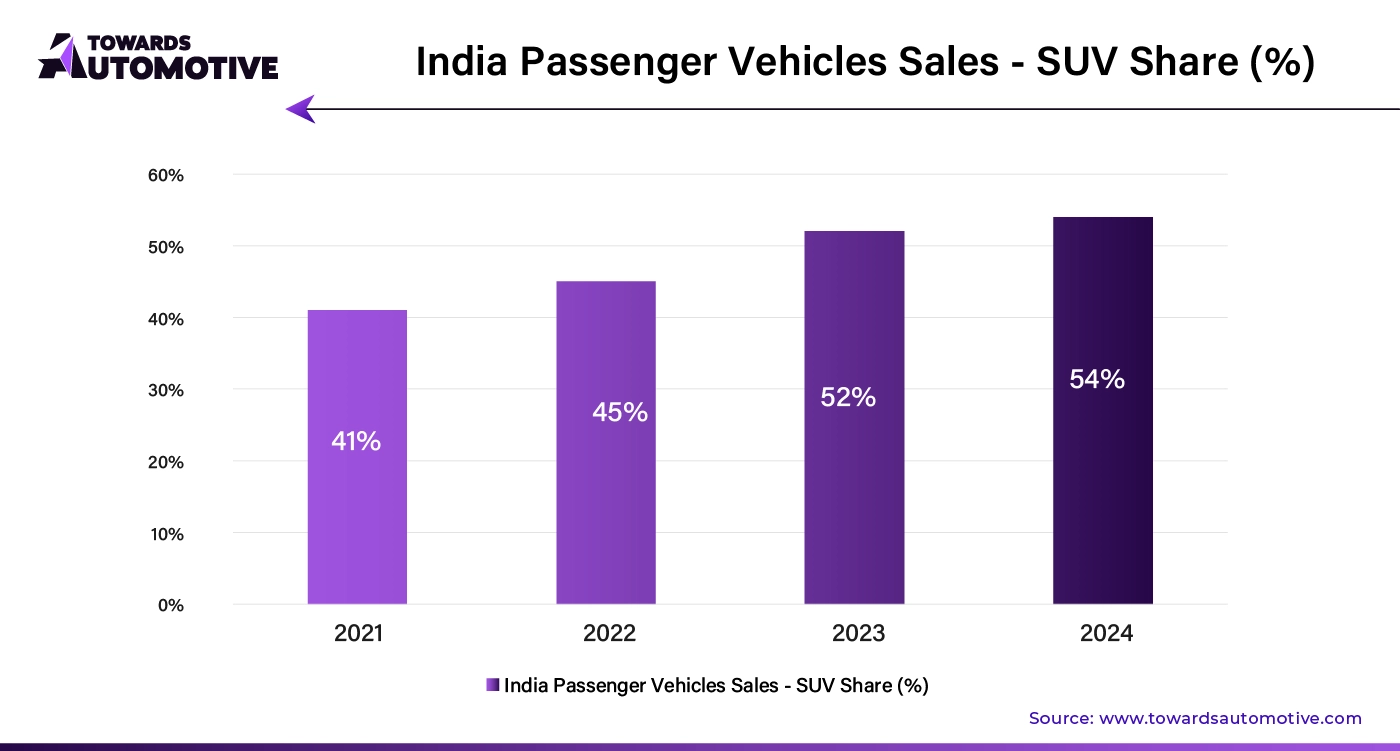

In the Asia Pacific region, China stands out as a dominant player, with its market expanding rapidly at a CAGR of around 11.4%. This growth is propelled by increasing car production and regulatory requirements for safety features. India is also a significant contributor to market growth, with a CAGR of approximately 11.7%, driven by rising car ownership and safety awareness. Japan’s market, growing at a CAGR of about 10.3%, benefits from high vehicle adoption and continuous innovation in safety technology. The ASEAN region, with a CAGR of around 9.7%, is seeing steady growth, influenced by stricter safety regulations and the popularity of affordable cars with safety features.

Key Takeaways

Fastest Growing Market: India, with a CAGR of approximately 11.7%, is the fastest-growing automotive ABS and ESC market, driven by increasing safety consciousness and regulatory mandates.

Market Leader: China leads the global market with its rapid expansion and strong demand for automotive safety features, reflecting its position as the largest and most dynamic market in the Asia Pacific region.

These milestones highlight the industry's focus on enhancing safety features and expanding production capabilities in response to growing safety regulations and consumer demand.

By Technology Type

By Vehicle Type

By Sales Channel

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us