October 2025

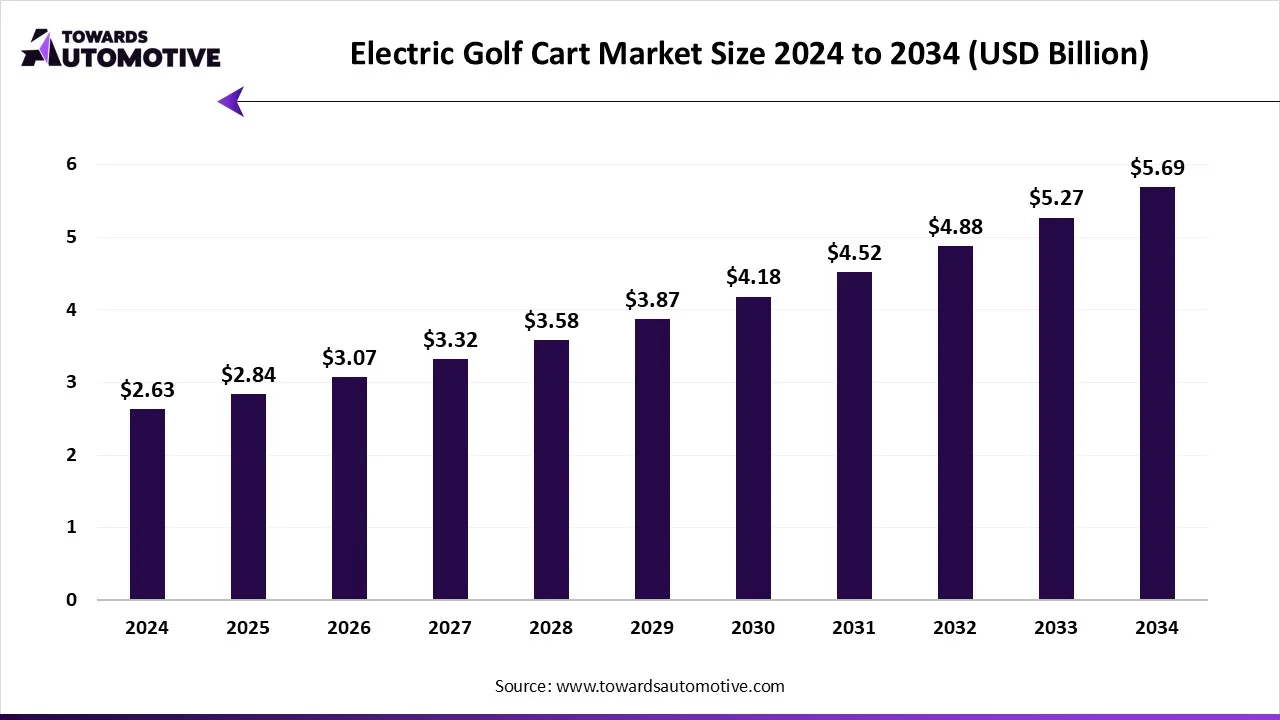

The electric golf cart market is forecast to grow from USD 2.84 billion in 2025 to USD 5.69 billion by 2034, driven by a CAGR of 8.03% from 2025 to 2034. The rising emphasis of market players to enhance product innovation as well as partnerships among golf cart manufacturing companies and composite brands play a vital role in positively shaping the market growth.

Additionally, the rising demand for eco-friendly transportation in several places such as airports, universities, resorts & hotels and some others also boosts the market expansion. Electric golf cart manufacturing companies are constantly evolving and bringing innovation to golf carts in order to attract new consumers, thereby driving the industry in a positive direction. The research and development activities related to solid-state batteries is expected to create ample growth opportunities for the market players in the future.

Electric golf carts are battery-powered vehicles designed primarily to transport golfers and their equipment across golf courses. In the present time, these vehicles are also used in resorts, hotels, universities, gated communities, and industrial premises due to their operational efficiency, compact design, environmental friendliness and low noise levels. The various vehicle types manufactured in this sector includes personal golf carts, fleet golf carts, and utility golf carts. These golf carts are powered by different types of batteries consisting of lead-acid battery, lithium-ion battery, and other battery types (e.g., Gel Cell, AGM). It finds applications in numerous sectors comprising of golf courses, resorts & hotels, airports, industrial use, residential use, and others (e.g., educational institutions, parks). The market is developing positively due to the technological developments in electric vehicles industry in different parts of the world.

The major trends in the electric golf cart market include partnerships, joint ventures, and product launches.

The fleet golf carts segment dominated the market. These vehicles are utilized by golf courses, resorts, gated community associations, and many corporate or university campuses. They make up a huge portion of the market because many operators prefer to have standardized vehicles that are easy to maintain, charge, and replace. Fleet carts are simply a recognizable and consistently standardized option that allows an organization to drive many uses in a managed environment and remains the most popular on the golf cart market.

The utility golf carts segment is expected to rise with the highest CAGR during the forecast period. Utility golf carts are used for carrying goods in several industries such as warehouses, resorts, and municipal facilities because they are small, easy to maneuver, and environmentally friendly. They are useful for some businesses because they can perform a variety of tasks such as maintenance, landscaping, and deliveries within large properties.

The lead-acid battery segment held a considerable share of the market as lead-acid batteries used in the electric golf carts are less expensive to purchase and easy to maintain. Additionally, lead-acid batteries are easily available and generally easy to replace, and their charging systems are supported by most charging operators.

The lithium-ion battery segment is expected to grow with the highest CAGR during the forecast period. The application of lithium-ion batteries in modern golf carts has increased rapidly as these batteries are lighter, charge faster and last longer than lead-acid batteries. They also perform better in every aspect such as charging, maintenance, and performance.

The golf courses segment registered its dominance over the electric golf cart market, as they were designed specifically for golf courses. The electric golf cart allows players to move comfortably to the next hole carrying equipment. Golf courses appreciate the lower operating costs and ease of maintenance offered by electric models, especially as environmental regulations get stricter in certain countries. Cart fleets continue to accelerate and improve services along with providing better experience for guests in the process.

The resort & hotels segment is expected to grow with the highest CAGR during the forecast period. Resorts and hotel properties are using electric golf carts to move guests, luggage and supplies across large areas. Electric golf carts provide a smooth, quiet mode of transport that maximizes guest comfort along with helping businesses to meet their sustainability goals. Electric carts are ideal for beach-front resorts, mountain retreats, and amusement parks where there are many short-haul, or "first mile" transport needs.

The 2-seater segment maintained a leading position in the market. Most golf courses and small personal or commercial users select two-seater golf carts as the preferred option for transport. Golf carts in general are compact, have a small turn radius for turning around tighter spaces and paths, and they are cheaper to purchase and operate compared to larger vehicles.

The 6-seater and above segment is expected to expand rapidly in the market during the forecast period. These golf carts are used more frequently large areas such as a resort, airport, university campus, or large residential community to transport people. In addition, these electric golf carts are preferred by operators as it takes less time for transporting passengers across golf courses. Many 6-seater golf carts are equipped with advanced features such as extra-long roofs (for sun and rain protection), cushioned seat and support arms, as well USB ports and last-mile gear to enhance consumer experience.

The 5–10 kW segment captured a significant portion of the market as it represents a perfect blend between performance and efficiency. The 5-10 kW output is highly powerful to handle hilly terrain, carry light cargo, and provide regular passenger loads. Golf carts in this range are popular in residential community where sufficient range is essential for everyday activity.

The above 10 kW segment is predicted to witness significant growth in the market over the forecast period. Carts with a power output of 10 kW and higher are usually purchased for heavier-duty applications where more torque, speed, and load capacity are required. High power models are used in large resorts, industrial applications and some others. The advancement in technology for motors and battery capacity has made higher power output models of golf cart more practical and reliable.

The commercial segment dominated the market. Commercial users such as golf course owners, operators, hotels, airports, factories, and universities are the largest consumers of electric golf carts. These vehicles are highly preferred in commercial sector due to their enhanced reliability and low cost of ownership.

The personal segment is expected to grow with the highest CAGR during the forecast period. These vehicles are typically used by individual owners for recreation, running errands, or other short-distance travel around their neighborhood. The personal golf carts industry is likely to experience immense growth in the future as people find them convenient for saving time.

North America dominated the electric golf cart market in 2024 due to the rapid expansion of golf culture throughout the U.S. and Canada. Within this market, gated communities, retirement villages, and resorts use electric carts daily for easy and quiet movement of individuals. Airports, universities, and large corporate campuses use electric golf carts for efficient movement of people and products. North America has a good local manufacturing capacity, extensive dealership networks, and good servicing facilities to make ownership and upkeep easier, thereby driving the growth of the electric golf car market.

U.S led the electric golf cart market in this region because it has a vast golf industry and there's strong demand for personal and commercial segment. Golf courses, golf resorts, retirement communities and private residential communities all use electric carts for practicality and sustainability.

The Asia-Pacific region is growing with the highest CAGR during the forecast period. The growth is largely driven by the increased popularity of golf sports, urban development, and infrastructure projects in this region. Also, rapid expansion of the tourism sector in numerous countries such as China, India, Thailand, and Indonesia has increased the demand for electric golf carts. Governments in these countries are incentivizing electric vehicle adoption, including electric golf carts, and they are continuing to develop eco-friendly mobility type solutions.

China dominated the Asia-Pacific region in the electric golf cart market with its strong manufacturing base and fast adoption of electric mobility solutions. The Chinese government’s push for lowered emissions and a larger uptake of electric transport, has created demand for various EV platforms.

The electric golf cart market is considerably competitive with several companies. Some of the prominent companies in the market are Club Car, Yamaha Golf-Car Company, E-Z-GO (Textron Inc.), Polaris Industries Inc., Garia Inc., Columbia Vehicle Group Inc., STAR EV (JH Global Services, Inc.), Bintelli Electric Vehicles, HDK Electric Vehicles, Tomberlin (a Polaris brand), Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd., Marshell Electric Vehicle, Dongguan Excar Electric Vehicle, Melex, CitEcar Electric Vehicles, Cruise Car, Inc., ICON Electric Vehicles, LVTONG, Caddyshack Golf Cars, and PowerDrive Golf Cars. These companies are consistently engaged in production of electric golf carts and stay competent in the market through product innovations, joint ventures, collaborations, partnerships and adopting numerous strategies.

By Vehicle Type

By Battery Type

By Application

By Drive Type

By Power Output

By End-User

By Region

The Truck-as-a-Service (TaaS) market is estimated at $24.41 billion in 2024 and anticipated to reach $161.76 billion by 2034. ...

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us