December 2025

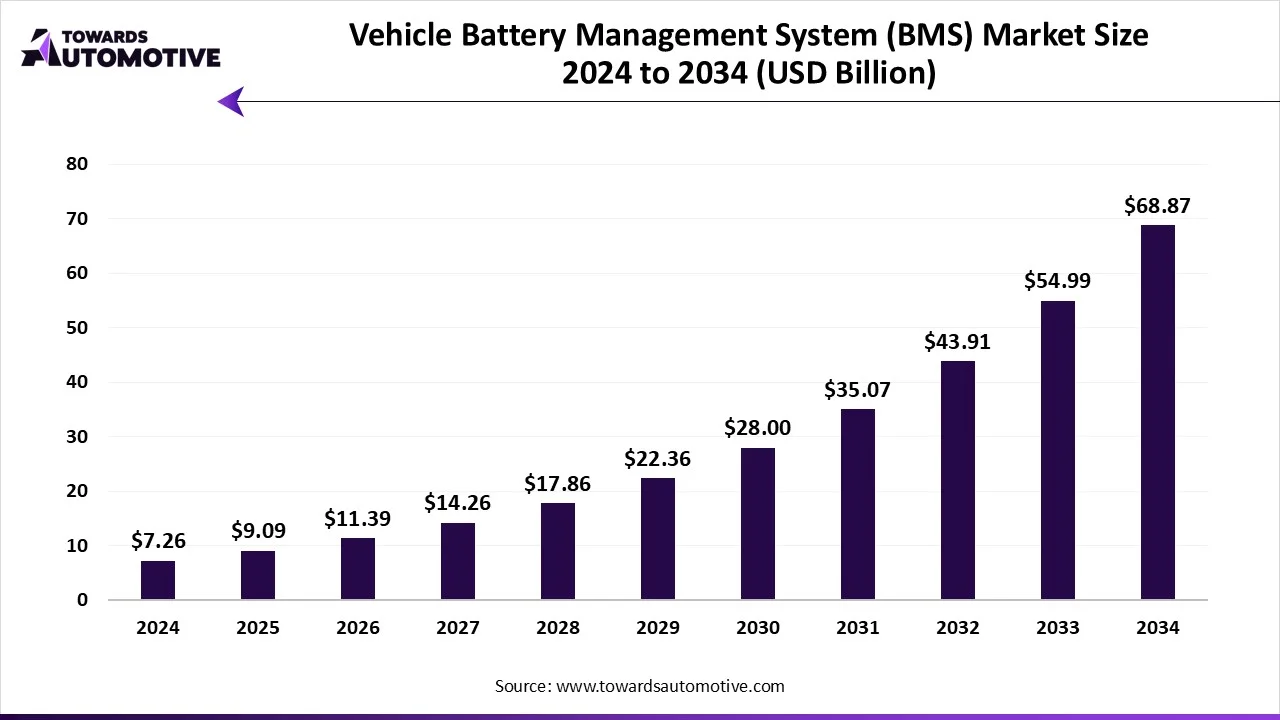

The vehicle battery management system (BMS) market is forecasted to expand from USD 9.09 billion in 2025 to USD 68.87 billion by 2034, growing at a CAGR of 25.23% from 2025 to 2034. The growing emphasis of automotive companies to develop EVs coupled with rapid investment by battery manufacturers to manufacture high-quality automotive batteries has boosted the market expansion.

Additionally, the increasing use of battery management system (BMS) in EVs for maximizing performance and longevity along with numerous government initiatives aimed at enhancing EV adoption is playing a vital role in shaping the industrial landscape. The integration of IoT and cloud in battery management systems is expected to create ample growth opportunities for the market players in the future.

The vehicle battery management system (BMS) market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of automotive battery management solutions in different parts of the world. There are several types of battery management systems developed in this sector comprising of centralized BMS, distributed BMS and modular BMS. These systems are used for monitoring numerous types of batteries including lithium-ion batteries, lead-acid batteries, nickel batteries, flow batteries and some others. It finds application in several types of vehicles consisting of passenger cars and commercial vehicles. This market is expected to rise significantly with the growth of the electric vehicles industry around the globe.

The major trends in this market consists of partnerships, increasing sales of EVs and numerous government initiatives.

The modular BMS segment dominated the vehicle battery management system (BMS) market and is expected to rise with the highest CAGR during the forecast period. The increasing use of modular BMS in the automotive sector for monitoring and controlling large battery packs has boosted the market expansion. Also, numerous advantages of these BMS including improved scalability, superior flexibility, enhanced maintainability and some others is expected to drive the growth of the vehicle battery management system (BMS) market.

The centralized BMS segment is expected to rise with a considerable CAGR during the forecast period. The growing application of centralized BMS in the automotive industry for ensuring safety, optimizing performance, and prolonging battery life has driven the market growth. Additionally, several benefits of these battery management systems such as cost-effectiveness and simplicity, enhanced control and performance, simplified operations, and some others is expected to proliferate the growth of the vehicle battery management system (BMS) market.

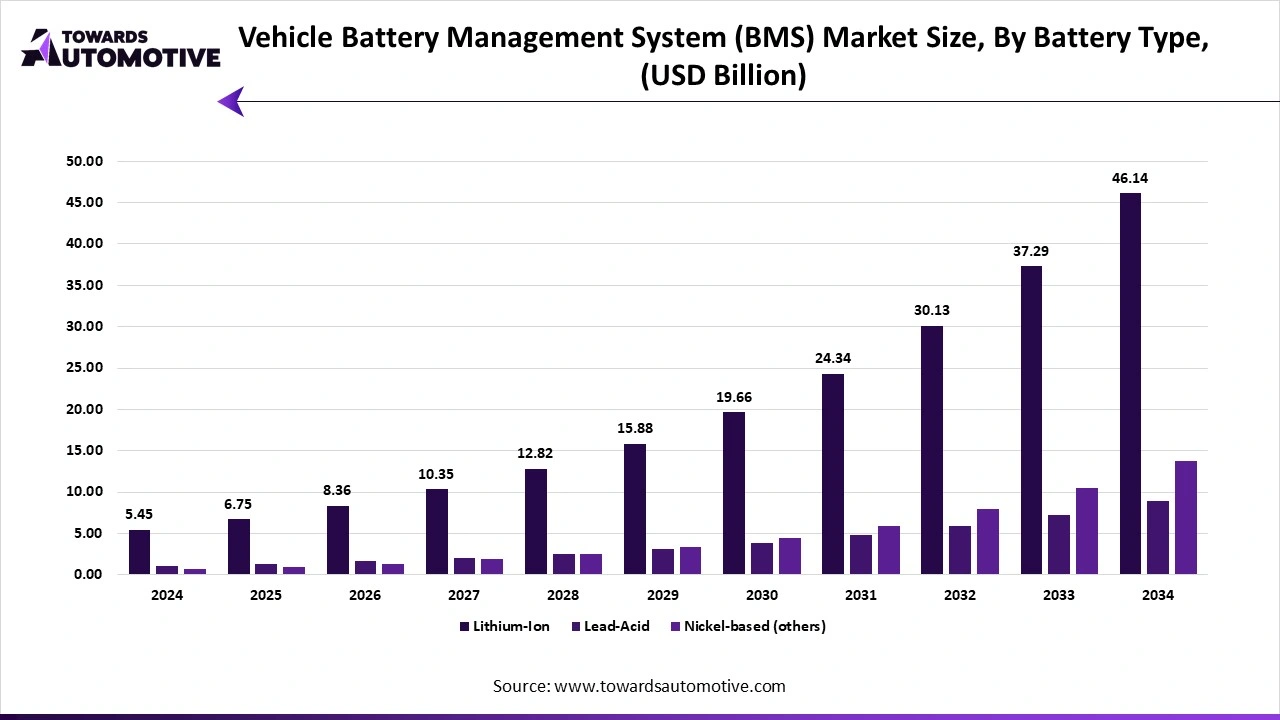

The lithium-ion segment dominated the vehicle battery management system (BMS) market. The increasing use of li-ion batteries in passenger EVs due to several advantages including long lifespan, high energy density, fast charging capabilities, low maintenance and some others has driven the market expansion. Additionally, the integration of BMS in li-ion batteries for monitoring numerous quantities such as voltage, temperature, current and some others is expected to boost the growth of the vehicle battery management system (BMS) market.

The nickel-based segment is expected to rise with the fastest CAGR during the forecast period. The growing application of nickel-based batteries in hybrid-electric vehicles for offering a balance of good energy and power density has boosted the market growth. Also, the integration of BMS in nickel batteries to ensure safety, optimizing performance, and extending their lifespan is expected to propel the growth of the vehicle battery management system (BMS) market.

The passenger cars segment led the vehicle battery management system (BMS) market with a share of around 70%. The growing sales and production of passenger vehicles in various countries such as India, Germany, U.S., China and some others has boosted the market expansion. Additionally, rapid investment by automotive brands for developing affordable passenger EVs coupled with growing use of li-ion batteries in high-performance EVs is contributing to the industry in a positive manner. Moreover, partnerships among EV manufacturers and battery companies to develop a wide range of EV batteries is expected to boost the growth of the vehicle battery management system (BMS) market.

The commercial vehicles segment is expected to expand with the highest CAGR during the forecast period. The increasing adoption of electric trucks in several industries including e-commerce, logistics, aerospace and some others has driven the market expansion. Additionally, the integration of AI-enabled battery management solutions in LCEVs to monitor battery health is playing a vital role in shaping the industrial landscape. Moreover, the growing focus of automotive brands for using high-quality batteries in commercial vehicles to deliver superior driving range is expected to propel the growth of the vehicle battery management system (BMS) market.

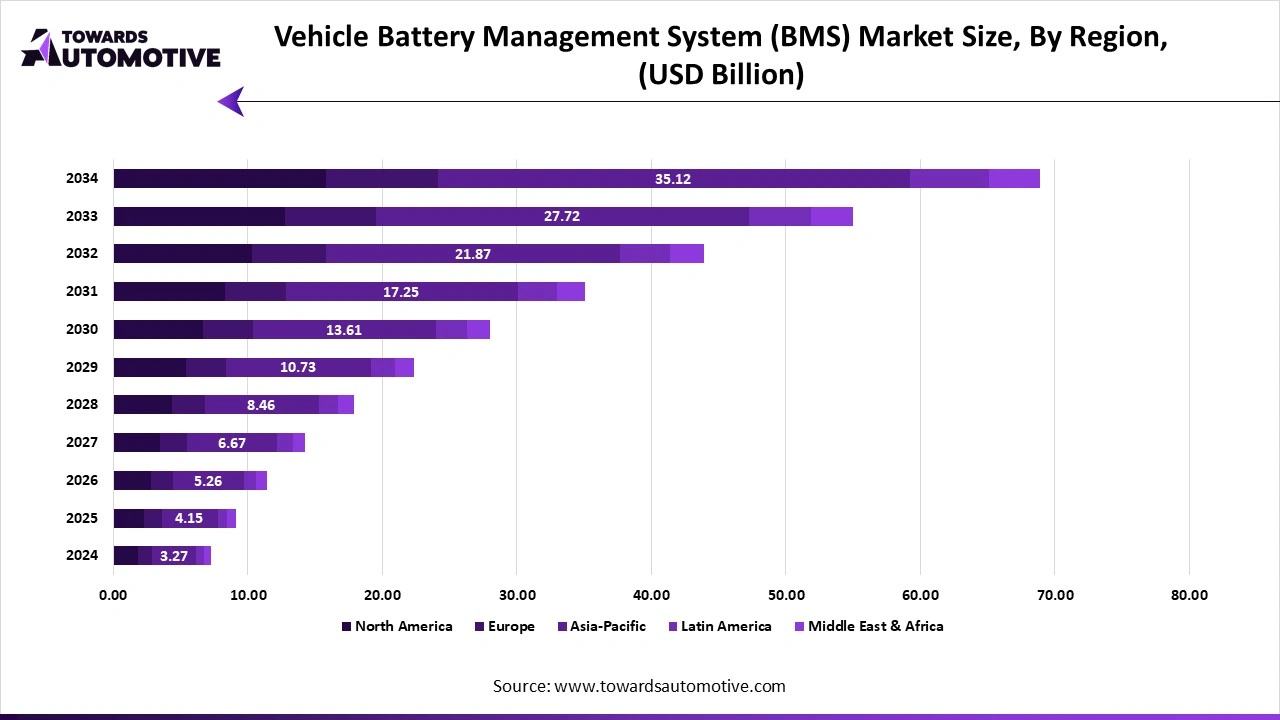

Asia Pacific dominated the vehicle battery management system (BMS) market with a share of around 45% and is expected to grow with the highest CAGR during the forecast period. The increasing adoption of EVs in several countries such as India, China, Japan, South Korea, Australia and some others has driven the market expansion. Additionally, rapid investment by battery companies for opening new production facilities coupled with rising demand for long-range vehicles is contributing to the industry in a positive manner. Moreover, the presence of various market players such as Denso Corporation, Panasonic Corporation, CATL (Contemporary Amperex Technology Co. Ltd.), BYD Company Ltd. and some others is expected to drive the growth of the vehicle battery management system (BMS) market in this region.

China is the major contributor in this region. The growing demand for eco-friendly vehicles as well as technological advancements in the battery manufacturing industry has boosted the market expansion. Also, the availability of raw materials at reasonable prices along with rise in number of EV companies is playing a prominent role in shaping the industry in a positive direction.

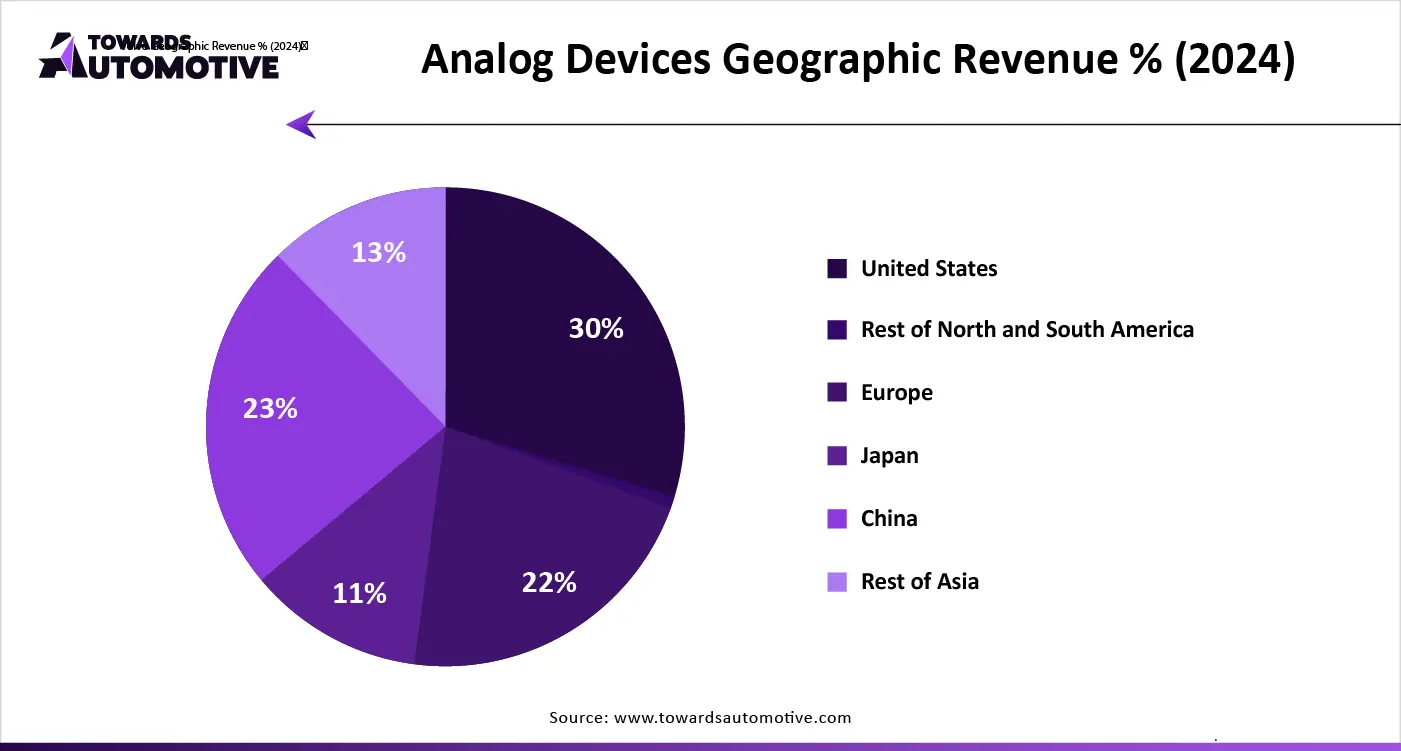

North America held a significant share of the market. The growing demand for luxury EVs from the HNIs residing in the U.S. and Canada has boosted the market growth. Also, the deployment of electric buses by municipal corporations to enhance sustainable transportation coupled with the opening of new automotive research and development centers in Michigan and South Carolina is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Texas Instruments Inc., Sensata Technologies, Analog Devices, Inc. and some others is expected to boost the growth of the vehicle battery management system (BMS) market in this region.

U.S. led the market in this region. The increasing sales of electric trucks along with technological advancements in the automotive sector has driven the market growth. In addition, the presence of various automotive companies such as General Motors, Tesla, Rivian, Ford and some others is contributing to the industry in a positive way.

The manufacturing of BMS depends on several raw materials including silicon, copper, aluminum, and plastics.

BMS component fabrication involves designing a core circuit board, selecting and integrating key integrated circuits (ICs) like the Analog Front-End (AFE) and microcontroller (MCU) for monitoring, and assembling the overall system with necessary sensors, actuators, communication interfaces, and a durable housing.

Automotive OEMs receive Battery Management Systems (BMS) through a supply chain consisting of numerous component suppliers.

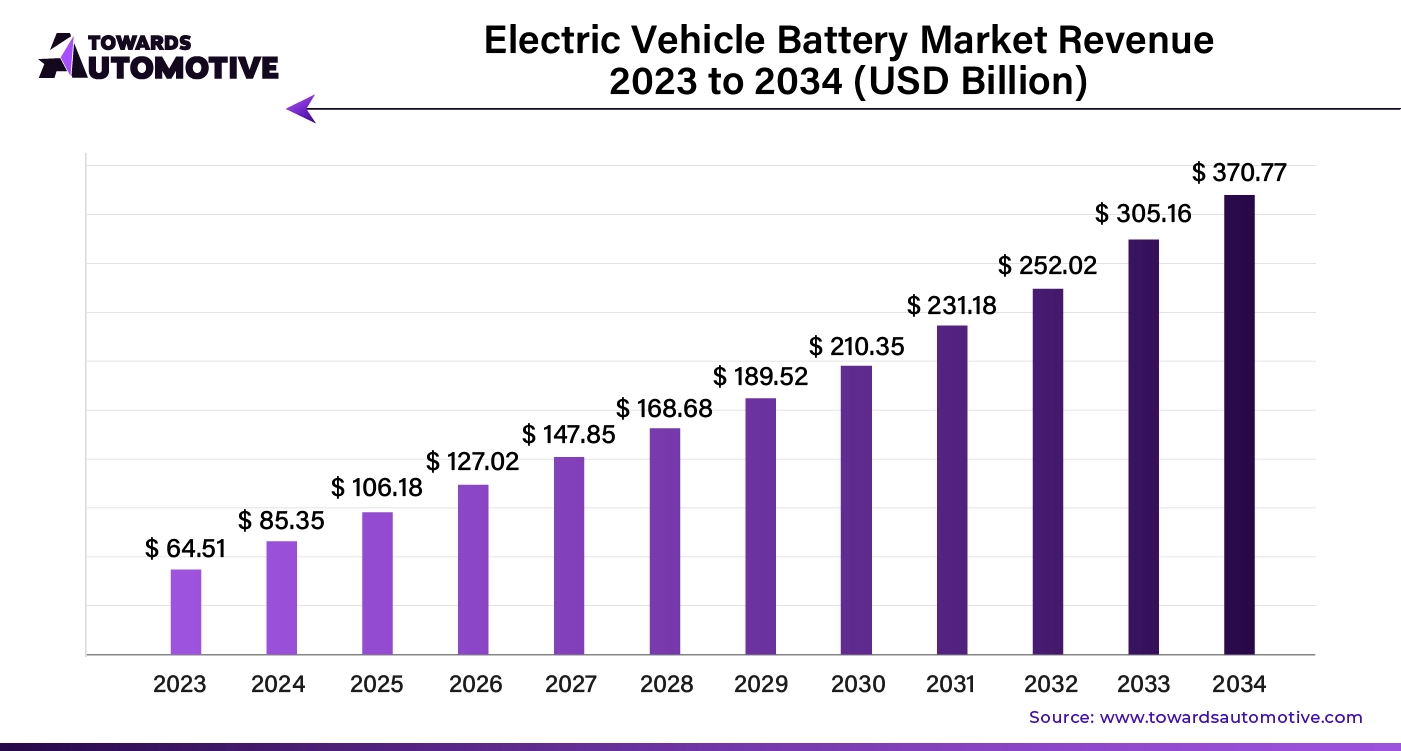

The electric vehicle battery market will grow from USD 106.18 billion in 2025 to USD 370.77 billion by 2034 (CAGR 21.50%). We quantify demand by product (lithium-ion largest; lead-acid; nickel-metal hydride; others) and vehicle type (BEVs dominant; PHEVs; HEVs), with regional splits for Asia Pacific (lead), Europe (significant CAGR), North America, Latin America, and MEA. Competitive analysis benchmarks CATL, LG Energy Solution, Panasonic, BYD, Samsung SDI, Toshiba, Exide, Amara Raja, Okaya, Tata AutoComp GY, Exicom on capacity build-out, chemistries (LFP/NMC), cost curves, and partnerships. We map the value chain (raw materials cells modules/packs BMS/thermal OEMs/aftermarket), include trade flows for cells, packs, and active materials, and provide manufacturer & supplier scorecards (plant footprints, certifications, utilization, and 2024–2025 margin bands).

The electric vehicle battery market is experiencing rapid growth, driven by the increasing global adoption of electric vehicles as part of the transition toward cleaner, more sustainable transportation. EV batteries are a critical component of electric vehicles, powering everything from passenger cars to commercial trucks, and their performance directly impacts vehicle range, efficiency, and cost. As governments worldwide implement stricter emissions regulations and provide incentives for EV adoption, the demand for advanced, high-capacity batteries has surged.

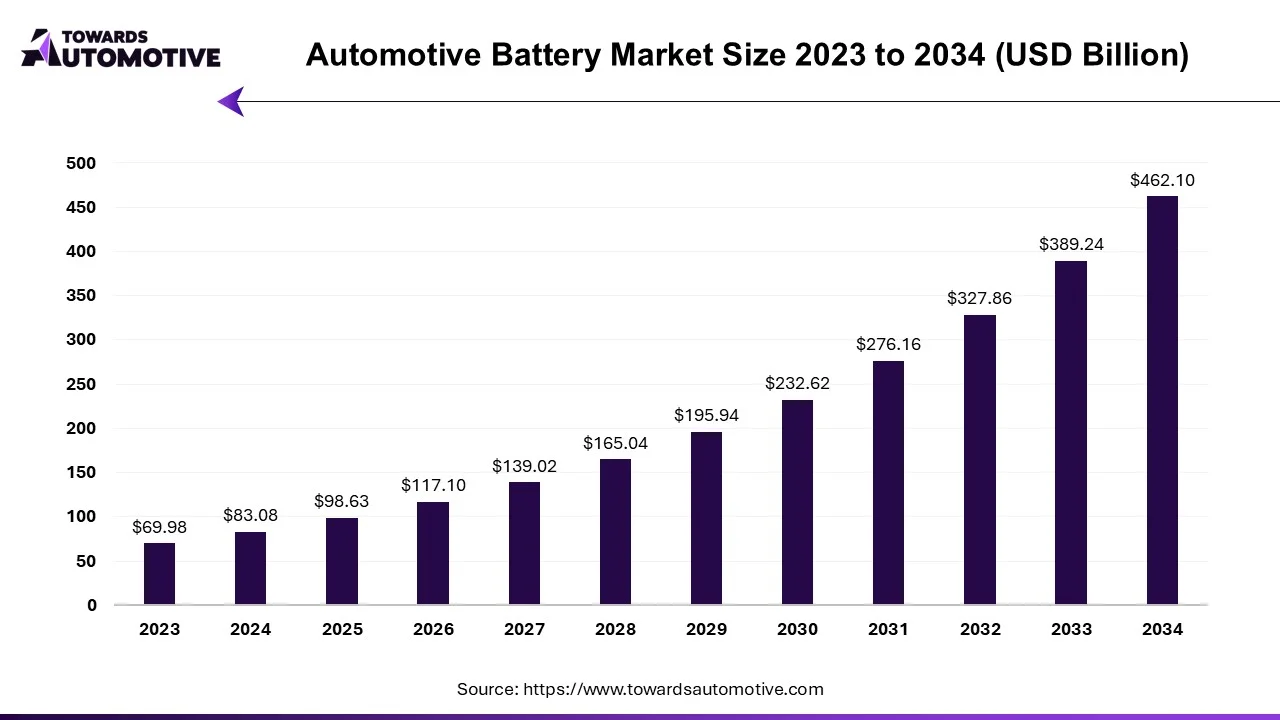

The automotive battery market is set to grow from USD 98.63 billion in 2025 to USD 462.10 billion by 2034, with an expected CAGR of 18.72% over the forecast period from 2025 to 2034.

The automotive battery market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of batteries for the automotive sector. There are several types of batteries developed in this sector comprising of lithium-ion based, lead-acid based, nickel based, sodium-ion and some others. These batteries are designed for different types of vehicles consisting of passenger cars, commercial vehicles, and some others. The growing sales of BEVs in different parts of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the electric vehicle industry around the world.

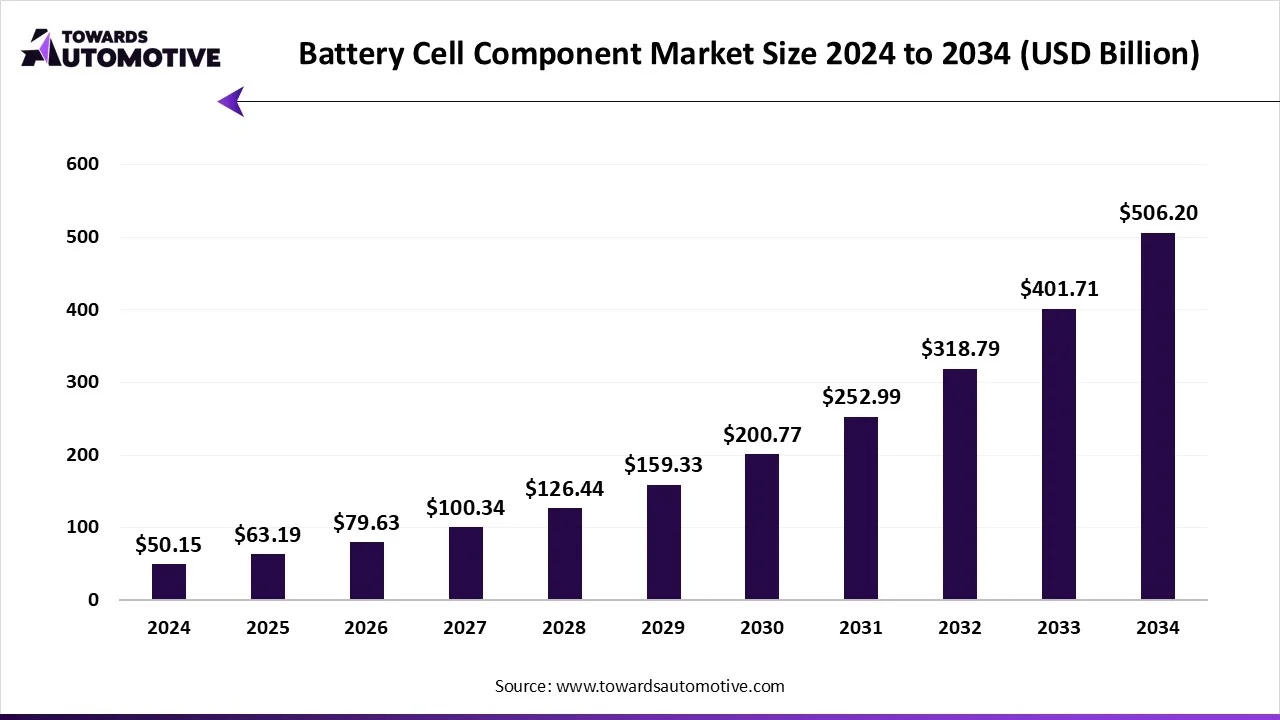

The battery cell component market is set to grow from USD 63.19 billion in 2025 to USD 506.2 billion by 2034, with an expected CAGR of 26.01% over the forecast period from 2025 to 2034. The growing focus of battery companies for manufacturing high-quality EV batteries along with rapid investment by government of several countries for developing the battery industry has driven the market expansion.

Additionally, collaborations among aerospace companies and battery manufacturers for developing aircraft batteries coupled with technological advancements in the battery industry is playing a prominent role in shaping the industrial landscape. The research and development activities related to the development of zinc-air batteries is expected to create ample growth opportunities for the market players in the upcoming years to come.

The battery cell component is an integral part of the energy and power industry. The battery cell component industry deals in the manufacturing and distribution of batteries in different parts of the world. There are several types of batteries developed in this sector consisting of li-ion batteries, solid-state batteries, lead-acid batteries, nickel-metal hydride batteries, zinc-based batteries, sodium-ion batteries and some others.

The vehicle battery management system (BMS) market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Robert Bosch GmbH, Continental AG, Toshiba Corporation, Intel Corporation, NXP Semiconductors NV, BYD Company Ltd., Sensata Technologies, Analog Devices, Inc., Renesas Electronics Corporation, Johnson Matthey (Battery Systems), LG Energy Solution / LG Chem, Infineon Technologies AG, Texas Instruments Inc., Denso Corporation, Panasonic Corporation, CATL (Contemporary Amperex Technology Co. Ltd.), Inc., STMicroelectronics, AVL, Ficosa Internacional SA, Texas Instruments and some others. These companies are constantly engaged in developing BMS for the automotive industry and adopting numerous strategies such as joint ventures, partnerships, acquisitions, collaborations, launches, business expansions and some others to maintain their dominance in this industry.

By Topology

By Battery Type

By Vehicle Type

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us