September 2025

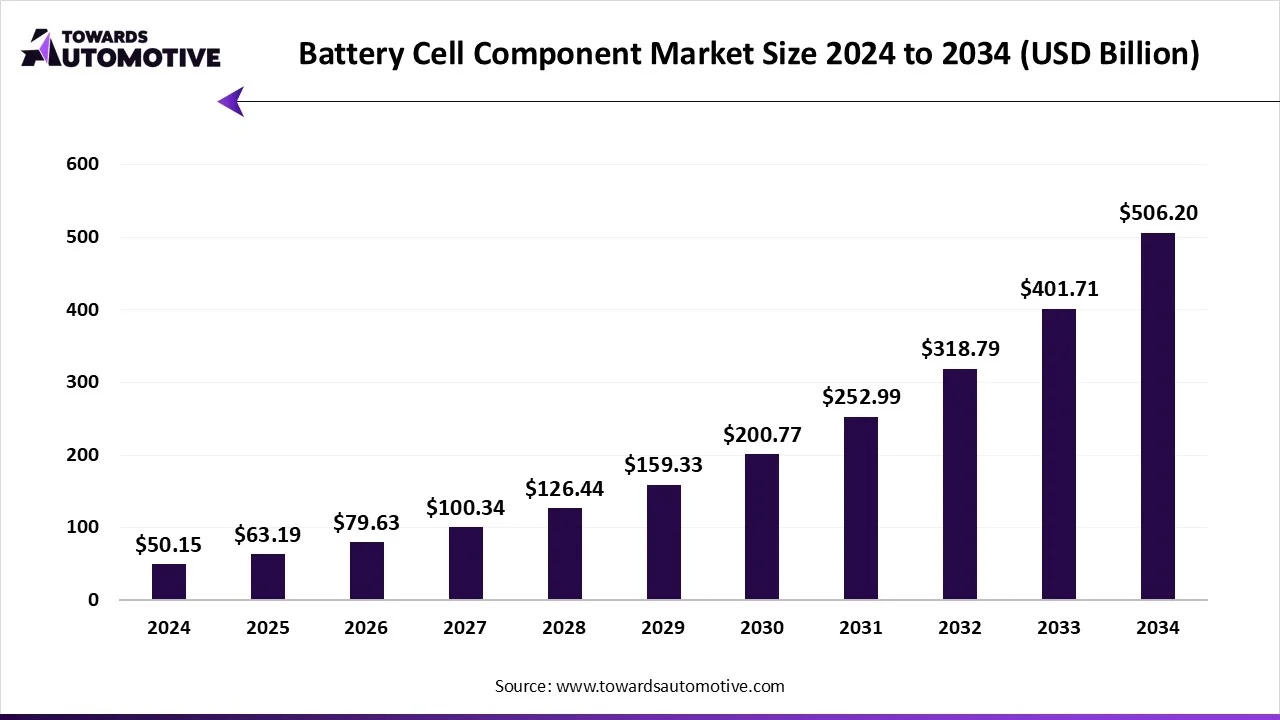

The battery cell component market is set to grow from USD 63.19 billion in 2025 to USD 506.2 billion by 2034, with an expected CAGR of 26.01% over the forecast period from 2025 to 2034. The growing focus of battery companies for manufacturing high-quality EV batteries along with rapid investment by government of several countries for developing the battery industry has driven the market expansion.

Additionally, collaborations among aerospace companies and battery manufacturers for developing aircraft batteries coupled with technological advancements in the battery industry is playing a prominent role in shaping the industrial landscape. The research and development activities related to the development of zinc-air batteries is expected to create ample growth opportunities for the market players in the upcoming years to come.

The battery cell component is an integral part of the energy and power industry. The battery cell component industry deals in the manufacturing and distribution of batteries in different parts of the world. There are several types of batteries developed in this sector consisting of li-ion batteries, solid-state batteries, lead-acid batteries, nickel-metal hydride batteries, zinc-based batteries, sodium-ion batteries and some others. These batteries are developed using numerous types of components such as cathode, anode, electrolyte, separator, current collector, binder & additives and some others. It is manufactured by using several types of materials including lithium compounds, graphite & silicon-based materials, electrolyte solutions, polymers & ceramics, copper, aluminum and some others. The end-users of these batteries consist of various industries comprising of automotive, consumer electronics, energy storage systems, industrial applications, defense, aerospace and some others. This market is expected to rise significantly with the growth of the EV sector around the globe.

| Metric | Details |

| Market Size in 2025 | USD 63.19 Billion |

| Projected Market Size in 2034 | USD 506.2 Billion |

| CAGR (2025 - 2034) | 26.01% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Component, By Material, By Battery Type, By End-Use Industry and By Region |

| Top Key Players | ATL (Contemporary Amperex Technology Co. Limited), LG Energy Solution Ltd., Samsung SDI Co., Ltd., Panasonic Corporation, SK On Co., Ltd., BYD Company Ltd., Umicore, BASF SE, Albemarle Corporation, Ganfeng Lithium, Tianqi Lithium, POSCO Chemical (POSCO) |

The major trends in this market consists of partnerships, business expansions, rising sales of EVs, joint ventures and government initiatives.

The cathode segment led the battery cell component market. The growing use of cathode materials for performing electrochemical reactions to manufacturing batteries has boosted the market expansion. Also, the rising application of cathode for developing sodium-ion batteries coupled with rapid adoption of cathode in research centers is playing a crucial role in shaping the industry in a positive direction. Moreover, the increasing use of cathode for storing and releasing lithium ion during charging and discharging is expected to foster the growth of the battery cell component market.

The electrolyte segment is expected to rise with the fastest CAGR during the forecast period. The rising application of electrolyte to serve as an ionic conductor that allows ions to move between the anode and the cathode for facilitating charging and discharging reactions has driven the market expansion. Additionally, various advantages of electrolytes including high ionic conductivity, chemical and thermal stability, improved energy density, and some others is contributing to the industry in a positive manner. Moreover, the growing emphasis of battery manufacturers for advancing research and development related to electrolytes is expected to propel the growth of the battery cell component market.

The lithium compounds segment dominated the battery cell component market. The growing use of li-ion batteries in several industries such as automotive, electronics, industrial and some others has driven the market expansion. Also, rapid investment by government for developing the lithium mining sector along with the rising application of lithium iron phosphate batteries in smartphones and drones is playing a vital role in shaping the role in shaping the industrial landscape. Moreover, constant research activities performed by scientists for developing long-lasting lithium-ion batteries is expected to drive the growth of the battery cell component market.

The graphite & silicon-based materials segment is expected to rise with the fastest CAGR during the forecast period. The rising use of graphite for manufacturing alkali metal batteries and dual-ion batteries has boosted the market growth. Additionally, the growing application of silicon for producing silicon anode lithium-ion batteries is playing a crucial role in shaping the industry in a positive manner. Moreover, rapid investment by government of several countries such as Canada, the U.S., India, Germany and some others for developing the graphite mining sector is expected to propel the growth of the the battery cell component market.

The lithium-ion batteries segment dominated the battery cell component market. The increasing use of li-ion batteries in smartphones and electric equipment has driven the market expansion. Additionally, the growing investment by battery manufacturers for opening li-ion battery production centers along with rapid adoption of these batteries in the aerospace and marine sector is contributing to the industry in a positive manner. Moreover, numerous advantages of li-ion batteries including high-energy density, long lifespan, low self-discharge, fast-charging, low-maintenance, constant power and some others is expected to boost the growth of the battery cell component market.

The solid-state batteries segment is expected to grow with the fastest CAGR during the forecast period. The growing investment by battery companies for opening new production units to manufacture high-quality solid-state batteries has boosted the market expansion. Also, the rising application of these batteries in EVs and consumer electronics due to high reliability and superior performance is playing a prominent role in shaping the industrial landscape. Moreover, several advantages of solid-state batteries such as enhanced safety, high energy density, fast charging ability, low carbon footprint and some others is expected to propel the growth of the battery cell component market.

The automotive segment dominated the battery cell component market. The growing sales of EVs in several countries such as India, China, the U.S., Germany, Canada, UK and some others has boosted the market growth. Also, rapid investment by government for developing the automotive sector coupled with increasing focus of battery manufacturing brands for developing li-ion batteries to cater the needs of PHEVs is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among automotive brands and battery companies for manufacturing high-quality automotive batteries is expected to propel the growth of the battery cell component market.

The energy storage systems segment is expected to expand with the highest CAGR during the forecast period. The increasing use of lead-acid batteries and tubular batteries for providing backup power in the residential sector has driven the market expansion. Additionally, the growing demand for heavy-duty batteries from the power stations to balance grid operations is playing a vital role in shaping the industry in a positive manner. Moreover, rapid investment by battery manufacturers for developing high-quality energy storage system is expected to foster the growth of the battery cell component market.

Asia Pacific dominated the battery cell component market. The increasing demand for high-quality batteries from the electronics sector in numerous countries such as India, China, Japan, South Korea, Singapore and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the battery industry coupled with availability of raw materials at reasonable prices is playing a crucial role in shaping the industrial landscape. Moreover, the presence of several market players such as CATL, CALB, Amaron, Luminous and some others is expected to drive the growth of the battery cell component market in this region.

China is the major contributor in this region. The rapid expansion of the automotive industry along with the rising emphasis of government for enhancing the lithium mining sector has bolstered the market growth. Additionally, the growing investment by battery manufacturers for opening up new production facilities is contributing to the industry in a positive manner.

Europe is expected to rise with the fastest CAGR during the forecast period. The growing adoption of electric buses in several countries such as Germany, France, Italy, UK, Norway and some others has driven the market expansion. Also, rapid investment by startup companies for opening battery recycling centers along with rising demand for lithium-ion batteries from the industrial sector has played a prominent role in shaping the industry in a positive direction. Moreover, the presence of various market players such as Saft, BMZ Group, TESVOLT and some others is expected to propel the growth of the battery cell component market in this region.

Germany and UK are the main contributors in this region. In Germany, the market is generally driven by the rapid expansion of the automobile industry along with rising use of advanced batteries in heavy-duty industries. In UK, the increasing sales of PHEVs as well as rapid investment by government for developing the battery manufacturing sector is playing a significant role in shaping the industrial landscape.

North America held a considerable share of the industry. The rising adoption of BEVs in the U.S. and Canada for lowering vehicular emission has driven the market expansion. Additionally, rise in number of battery research centers in several cities such as Boston, Chicago, Denver and some others coupled with increasing sales of electronic items such as smartphones, smart watches, iPods and some others is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Tesla, East Penn Manufacturing Co., EnerSys and some others is expected to foster the growth of the battery cell component market in this region.

U.S. is the significant contributor in this region. The growing sales of EVs coupled with rapid expansion of the aerospace sector has played a vital role in shaping the industrial landscape. Moreover, technological advancements in the battery manufacturing sector as well as opening of new battery production units has driven the market growth.

The foundation of battery production lies in the extraction and supply of essential minerals such as lithium, cobalt, nickel, and graphite.

Raw materials are processed into battery-grade components including electrolytes, cathodes, anodes, and separators.

The battery cells are assembled in pouch, cylindrical, or prismatic form under strict quality and thermal control standards.

Battery cells are configured into modules and packs that are integrated with advanced battery management systems (BMS) for enhancing safety, real-time monitoring, and efficiency.

Completed battery packs are delivered to numerous industries such as automotive, electronics, aerospace, medical and some others.

| July 2025 | Announcement |

| Dr. Raj Talluri, the CEO of Enovix | Enovix invented technology that led the industry in energy density for wearables in 2023 thanks to our unique architecture and the use of 100% silicon-anode technology, however, when I joined as CEO, I recognized that the portion of the wearables market immediately available to us would not be enough to support our full revenue plan, so I decided to take the opportunity to introduce our breakthrough battery to the much bigger smartphone market and the Enovix story to the smartphone accounts that I knew well from running Micron’s $6 billion mobile memory division. With the launch of AI Class technology, we are now sampling production AI-1 batteries to those customers who demand not only industry-leading energy density, but have other stringent requirements for cycle life, fast charging, and safety. Enovix is now positioned to support the next generation of smartphones in a 1.2-billion units market. |

| March 2025 | Announcement |

| Chris Allexandre, the Senior Vice President and General Manager of Power at Renesas | One of the biggest bottlenecks for designing advanced power management solutions is the complex task of firmware development and validation, not everyone has the expertise or in-house resources to write their own algorithms. Our all-in-one R-BMS F battery management system eliminates this process and provides market-ready power solutions that work without requiring specialized technical knowledge of MCU programming or advanced battery management design. |

| May 2025 | Announcement |

| Jennifer Scanlon, the president and CEO of UL Solutions | Our new location in Germany provides us with access to the region’s deep engineering talent and places us close to many of our key European customers, we are meeting our customers where they are, helping the automotive and power sectors safely innovate in a world increasingly reliant on battery storage |

| June 2025 | Announcement |

| Pratik Kamdar, the Co-founder & CEO at Neuron Energy | The Gen 2 battery launch is a pivotal step in our journey to build more reliable and intelligent power solutions, provide greater cost efficiency and enhanced performance for India’s growing EV ecosystem. These battery packs represent not just technological progress, but a deeper commitment to safety, sustainability, and performance for EV users across the spectrum. |

| August 2025 | Announcement |

| Michael Mo, the CEO of KULR Technology Group | Our new K1A product line represents a pivotal step forward in bringing space-proven technologies to the UAS market, we’ve built our legacy on delivering energy and thermal solutions for applications where failure is not an option. With K1A, we’re applying that same level of performance and reliability to advanced unmanned aircraft systems, which are slated to become more common in our everyday lives |

| January 2025 | Announcement |

| Yang Wu, the CEO of Microvast | Our solid-state battery innovation represents a significant leap forward in addressing real-world safety and efficiency challenges, by developing a technology that eliminates liquid electrolytes and prioritizes scalability, we are well-positioned to meet the evolving needs of industries requiring reliable and safe energy storage solutions. |

| April 2025 | Announcement |

| Siyu Huang, the CEO of Factorial Energy | Battery development is about compromise. While optimizing one feature is simple, balancing high energy density, cycle life, fast charging, and safety in an automotive-sized battery with OEM validation is a breakthrough, this achievement with Stellantis is bringing next-generation battery technology from research to reality |

| April 2025 | Announcement |

| Michael Hierholzer, the Director of Strategy, Business Development and Product Management | With this market launch, we are reaffirming our strategic goal of systematically expanding our battery portfolio and positioning Rolls-Royce as a provider of integrated, safe and powerful energy storage solutions – a key component for reliability and sustainability in a rapidly evolving energy system. |

| April 2025 | Announcement |

| Nurdin Pitarević, the COO at Rimac Technology | What we're showcasing at IAA represents the convergence of breakthrough innovation and production readiness. These aren't simply concept technologies; they’ve been developed to be production-ready solutions that will power hundreds of thousands of vehicles in the coming years. |

| June 2025 | Announcement |

| Pankaj Kapoor, the Vice President, Distribution Business, Cummins India Limited | As the demand for reliable power continues to grow across industries, customers are increasingly seeking smarter ways to manage energy costs and improve power quality. Backed by our global expertise, Cummins’ BESS solutions are built to address these evolving needs while supporting our customer’s sustainability goals. With the added assurance of our world-class service and support network, we remain committed to delivering dependable energy solutions that empower long-term success |

The battery cell component market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Hitachi Chemical Co., Ltd., Umicore, CATL (Contemporary Amperex Technology Co. Limited), LG Energy Solution Ltd., Samsung SDI Co., Ltd., Panasonic Corporation, SK On Co., Ltd., BYD Company Ltd., BASF SE, Asahi Kasei Corporation, Toray Industries, Inc., Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Group, Johnson Matthey Plc, W-SCOPE Corporation and some others. These companies are constantly engaged in developing different types of batteries and adopting numerous strategies such as acquisitions, partnerships, collaborations, launches, business expansions, joint ventures, and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Component

By Material

By Battery Type

By End-Use Industry

By Region

September 2025

October 2025

July 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us