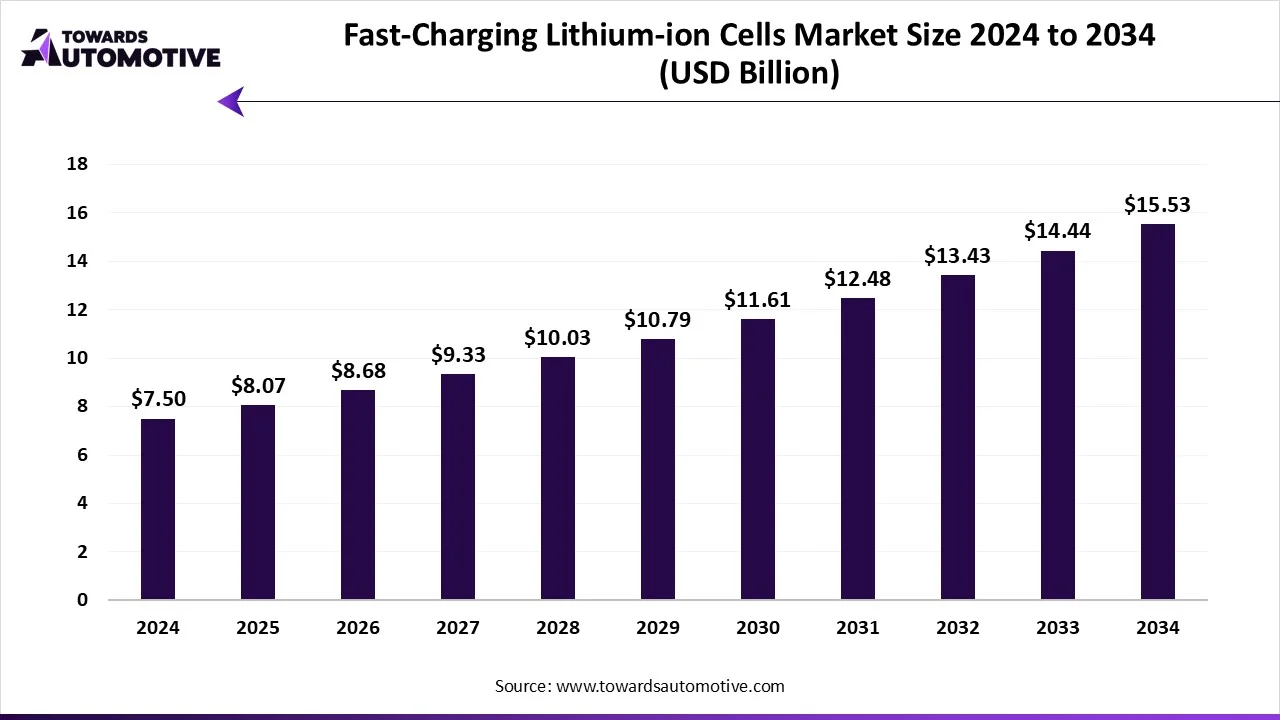

The fast-charging lithium-ion cells market is expected to increase from USD 8.07 billion in 2025 to USD 15.53 billion by 2034, growing at a CAGR of 7.55% throughout the forecast period from 2025 to 2034. The growing demand for fast-charging batteries from the consumer goods industry coupled with technological advancements in battery manufacturing sector has contributed to the market expansion.

Also, rapid investment by market players for opening new production facilities along with increasing sales of BEVs in developed nations for lowering vehicular emission is further adding to the industrial growth. The emergence of solid-state lithium-ion batteries is expected to create ample growth opportunities for the market players in the upcoming days.

The fast-charging lithium-ion cells market is a crucial segment of the battery industry. This industry deals in manufacturing and distribution of lithium-ion batteries that supports fast-charging. There are various types of cells manufactured in this sector comprising of cylindrical cells, prismatic cells and pouch cells. These cells find application in numerous sectors including electric vehicles (EVs), consumer electronics, power tools, drones & robotics, renewable energy storage, medical devices, telecom backup systems and some others. It is available in a well-established distribution channel consisting of OEMs, aftermarket, online platforms, specialized battery distributors and some others. The rapid investment by public-sector entities in battery manufacturing sector has contributed to the market expansion. This market is expected to rise significantly with the growth of the automotive sector in different parts of the world.

| Metric | Details |

| Market Size in 2025 | USD 8.07 Billion |

| Projected Market Size in 2034 | USD 15.53 Billion |

| CAGR (2025 - 2034) | 7.55% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Cell Format, By Battery Chemistry, By Application, By End-User Industry, By Charging Time Classification, By Distribution Channel and By Region |

| Top Key Players | Contemporary Amperex Technology Co. Limited (CATL), LG Energy Solution, Panasonic Holdings Corporation, BYD Company Ltd., Samsung SDI Co., Ltd., EVE Energy Co., Ltd. |

The major trends in this market consists of business expansions, investments and government initiatives.

The cylindrical cells segment dominated the market. The growing use of cylindrical cells in power banks and laptops due to their compact size has driven the market expansion. Also, numerous advantages of these cells including high production efficiency, cost-effectiveness, good thermal management, widespread availability and some others is driving the growth of the fast-charging lithium-ion cells market.

The pouch cells segment is expected to expand with the highest CAGR during the forecast period. The increasing application of pouch cell li-ion batteries in stationary energy storage systems due to their long cycle life has boosted the market growth. Moreover, the growing use of these cells in drones, electric scooters, military equipment and some others is expected to foster the growth of the fast-charging lithium-ion cells market.

The NMC (Nickel Manganese Cobalt) segment held the highest share of the market. The growing use of nickel manganese cobalt batteries in low-range EVs along with its numerous applications in UAVs and medical devices has driven the market expansion. Additionally, the increasing use of these batteries in smartphones and tablets is further boosting the growth of the fast-charging lithium-ion cells market.

The LFP & LTO segment is expected to rise with the fastest CAGR during the forecast period. The growing application of lithium iron phosphate batteries in home energy storage systems and portable power tools for delivering superior backups has boosted the market growth. Moreover, the rising use of LTO batteries in LCEVs and electric buses due to their fast-charging capabilities is expected to drive the growth of the fast-charging lithium-ion cells market.

The fast charging (15–30 min) segment led the market. The growing demand for fast-charging li-ion batteries from the consumer electronics industry for manufacturing phones, laptops, smart watches and some others has boosted the market growth. Also, the rising use of these batteries in energy storage systems and industrial equipment is further driving the growth of the fast-charging lithium-ion cells market.

The ultra-fast charging (<15 min) segment is expected to rise with the highest CAGR during the forecast period. The rising demand for ultra-fast charging batteries from the EV sector to integrating it in premium passenger vehicles with an aim at reducing range anxiety has driven the market expansion. Moreover, continuous research and development activities related to developing ultra-fast charging batteries for drone industry is accelerating the growth of the fast-charging lithium-ion cells market.

The electric vehicles segment led the industry. The growing adoption of EVs in several countries such as the U.S., Canada, India, China, UK and some others with an aim at reducing vehicular emission has boosted the market growth. Also, numerous government initiatives aimed at providing incentives and subsidies for purchasing EVs coupled with constant research and development associated with fast-charging technologies is shaping the industry in a positive direction. Moreover, rising emphasis of market players for opening new EV battery manufacturing centers in the APAC region is accelerating the growth of the fast-charging lithium-ion cells market.

The drones & industrial power tools segment is expected to grow with the highest CAGR during the forecast period. The rising use of lithium polymer (LiPo) batteries in drones to deliver superior flying range and high stability has boosted the market expansion. Additionally, rapid investment by battery companies for developing high-quality li-ion batteries to cater the needs of the drone manufacturing sector is further adding to the industrial growth. Moreover, the growing application of lithium-ion batteries in several industrial equipment such as brazing equipment, drill presses, lathes, milling machines, nailers & staplers, rotary hammers, drills, grinders and some others is expected to boost the growth of the fast-charging lithium-ion cells market.

The OEMs segment dominated the industry. The availability of high-quality li-ion batteries in battery OEMs to cater the needs of the EV sector and UAV industry has played a crucial role in shaping the industrial landscape. Moreover, rapid investment by OEMs to open new battery shops to attract maximum consumers along with high-quality assistance and guarantee provided by OEMs is proliferating the growth of the fast-charging lithium-ion cells market.

The online platforms segment is expected to expand with the highest CAGR during the forecast period. The growing proliferation of smartphones has enabled people to purchase and sell goods in online platforms, thereby driving the market growth. Additionally, availability of wide range of batteries in e-commerce platforms coupled with instant discount and EMI offers provided by online stores is expected to boost the growth of the fast-charging lithium-ion cells market.

The automotive & transportation segment dominated the industry. The growing sales of BEVs in different parts of the world has increased the demand for li-ion batteries, thereby driving the market growth. Also, rapid adoption of electric trucks in the logistics and e-commerce sector coupled with numerous government initiatives aimed at developing the EV battery manufacturing sector is playing a crucial role in shaping the industrial landscape. Moreover, rapid investment by battery companies to develop high-quality batteries for the automotive & transportation sector is expected to drive the growth of the fast-charging lithium-ion cells market.

The energy & utilities segment is expected to expand with the highest CAGR during the forecast period. The growing demand for high-quality li-ion batteries from the energy and utility sector to enhance flexible power supply has boosted the market growth. Also, numerous government initiatives aimed at rising awareness for adopting renewable energy sources during emergency situations is contributing to the industry in a positive manner. Moreover, the rising demand for rechargeable energy storage devices from power grid companies is expected to propel the growth of the fast-charging lithium-ion cells market.

Asia Pacific led the fast-charging lithium-ion cells market with a share of 63%. The growing demand for fast-charging batteries from drone manufacturers and smartphone companies has boosted the market expansion. Additionally, the availability of essential raw materials coupled with rapid investment by battery companies for developing advanced lithium-ion batteries is further adding to the industrial growth. Moreover, the presence of numerous market players such as CALB, Toshiba Corporation, BYD Company Ltd. and some others is expected to foster the growth of the fast-charging lithium-ion cells market in this region.

China dominated the market in this region. The growing development in the battery manufacturing sector coupled with technological advancements in the automotive industry has boosted the market expansion. Additionally, rise in number of battery startups along with presence of several consumer electronics brands such as Xiaomi, Samsung, LG and some others is contributing to the industrial growth.

North America is expected to rise with the highest CAGR during the forecast period. The growing sales of electric vehicles in the U.S. and Canada has increased the demand for li-ion batteries, thereby driving the market expansion. Also, rapid investment by government for strengthening the battery manufacturing sector coupled with increasing demand for aviation batteries is contributing to the industry in a positive direction. Moreover, the presence of several battery manufacturers such as Tesla, GE Vernova, Dantona Industries, Inc. and some others is expected to boost the growth of the fast-charging lithium-ion cells market in this region.

U.S. led the industry in this region. The rising adoption of BEVs in several cities such as New York, Los Angeles, Houston and some others has boosted the market expansion. Moreover, numerous government initiatives aimed at developing the battery industry coupled with rapid development in the drone manufacturing sector is playing a vital role in shaping the industry in a positive direction.

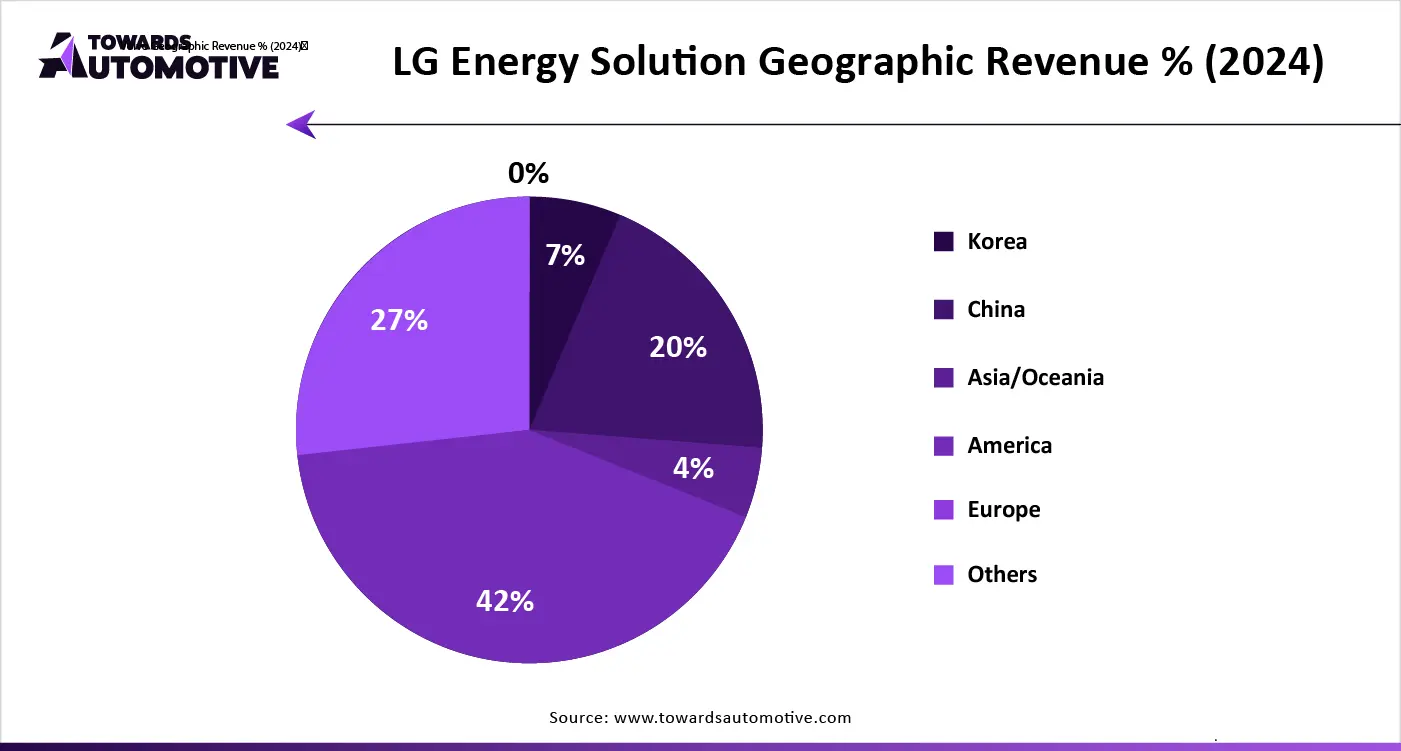

The fast-charging lithium-ion cells market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of EVE Energy Co., Ltd., Amperex Technology Limited (ATL), A123 Systems LLC, Toshiba Corporation, Contemporary Amperex Technology Co. Limited (CATL), LG Energy Solution, Panasonic Holdings Corporation, BYD Company Ltd., Samsung SDI Co., Ltd., SK On (SK Innovation), Tesla, Inc. (Cell R&D and production), Envision AESC Group, CALB (China Aviation Lithium Battery), Hitachi Energy Ltd., StoreDot Ltd., QuantumScape Corporation, Sila Nanotechnologies Inc., ProLogium Technology and some others. These companies are constantly engaged in developing fast-charging Li-ion batteries and adopting numerous strategies such as business expansions, acquisitions, partnerships, joint ventures, launches, collaborations and some others to maintain their dominance in this industry.

By Cell Format

By Battery Chemistry

By Application

By End-User Industry

By Charging Time Classification

By Distribution Channel

By Region

According to market projections, the automotive torque converter sector is expected to grow from USD 3.93 billion in 2024 to USD 6.75 billion by 2034,...

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us