October 2025

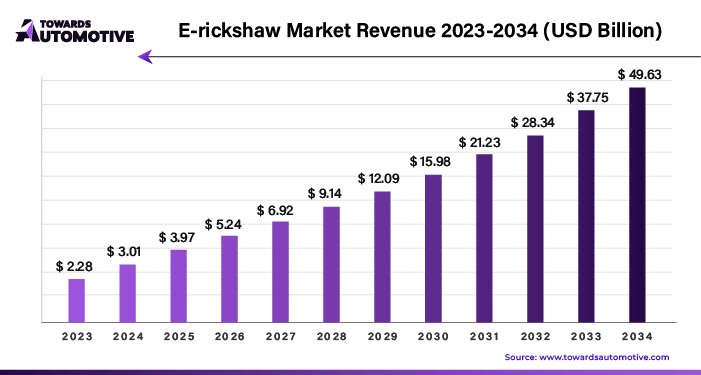

The e-rickshaw market is expected to increase from USD 3.97 billion in 2025 to USD 49.63 billion by 2034, growing at a CAGR of 32.02% throughout the forecast period from 2025 to 2034. The increasing demand for sustainable transportation solutions coupled with technological advancements in the EV sector has boosted the market expansion.

Additionally, numerous government initiatives aimed at developing the EV charging infrastructure along with growing sales of electric three-wheelers in the Asia Pacific region is playing a prominent role in shaping the industrial landscape. The research and development activities related to sodium batteries is expected to create ample growth opportunities for the market players in the future.

The e-rickshaw market is an important sector of the automotive industry. This industry deals in manufacturing and distribution of e-rickshaws in different parts of the world. There are numerous types of e-rickshaws developed in this sector comprising of passenger e-rickshaws and cargo e-rickshaws. These e-rickshaws are powered by different types of batteries including lead-acid battery, lithium-ion battery, nickel-metal hydride battery and some others. It finds application in several sectors including urban commute, last-mile delivery, tourism and pilgrimage, campus and industrial hubs, and some others. This market is expected to rise significantly with the growth of the electric vehicle industry around the globe.

| Metric | Details |

| Market Size in 2025 | USD 3.97 Billion |

| Projected Market Size in 2034 | USD 49.63 Billion |

| CAGR (2025 - 2034) | 32.02% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Battery Type, By Power Rating, By Application, By Battery Capacity and By Region |

| Top Key Players | Apna ERickshaw, Piaggio Vehicles, Geely Automobile Holdings, SUN Mobility, Mahindra Electric, Kinetic Green, TVS Motor Company, Hero Electric, Yadea, BYD Auto. |

The major trends in this market consists of business expansions, partnerships and government initiatives.

The lead-acid batteries segment led the market. The growing use of lead-acid batteries in three-wheelers due to their low cost and high reliability has boosted the market expansion. Additionally, partnerships among battery manufacturers and e-rickshaw companies is playing a crucial role in shaping the industrial landscape. Moreover, numerous advantages of these batteries including superior performance, recyclability, low-self discharge, less cost and some others is expected to drive the growth of the e-rickshaw market.

The nickel-metal hydride batteries segment is expected to expand with a considerable CAGR during the forecast period. The rising adoption of nickel-metal hydride batteries by e-rickshaw companies higher energy density than NiCd batteries has boosted the market growth. Additionally, rapid investment by battery brands for opening up new nickel-metal hydride battery manufacturing plants is expected to drive the growth of the e-rickshaw market.

The urban commute segment held the largest share of the market. The growing use of e-rickshaw for operating urban commute has boosted the market expansion. Additionally, numerous government initiatives aimed at enhancing public transportation infrastructure is expected to drive the growth of the e-rickshaw market.

The last-mile delivery segment is expected to rise with a notable CAGR during the forecast period. The growing popularity of last-mile delivery services in developed nations has boosted the industrial growth. Additionally, the deployment of e-rickshaws for operating last-mile delivery is expected to boost the growth of the e-rickshaw market.

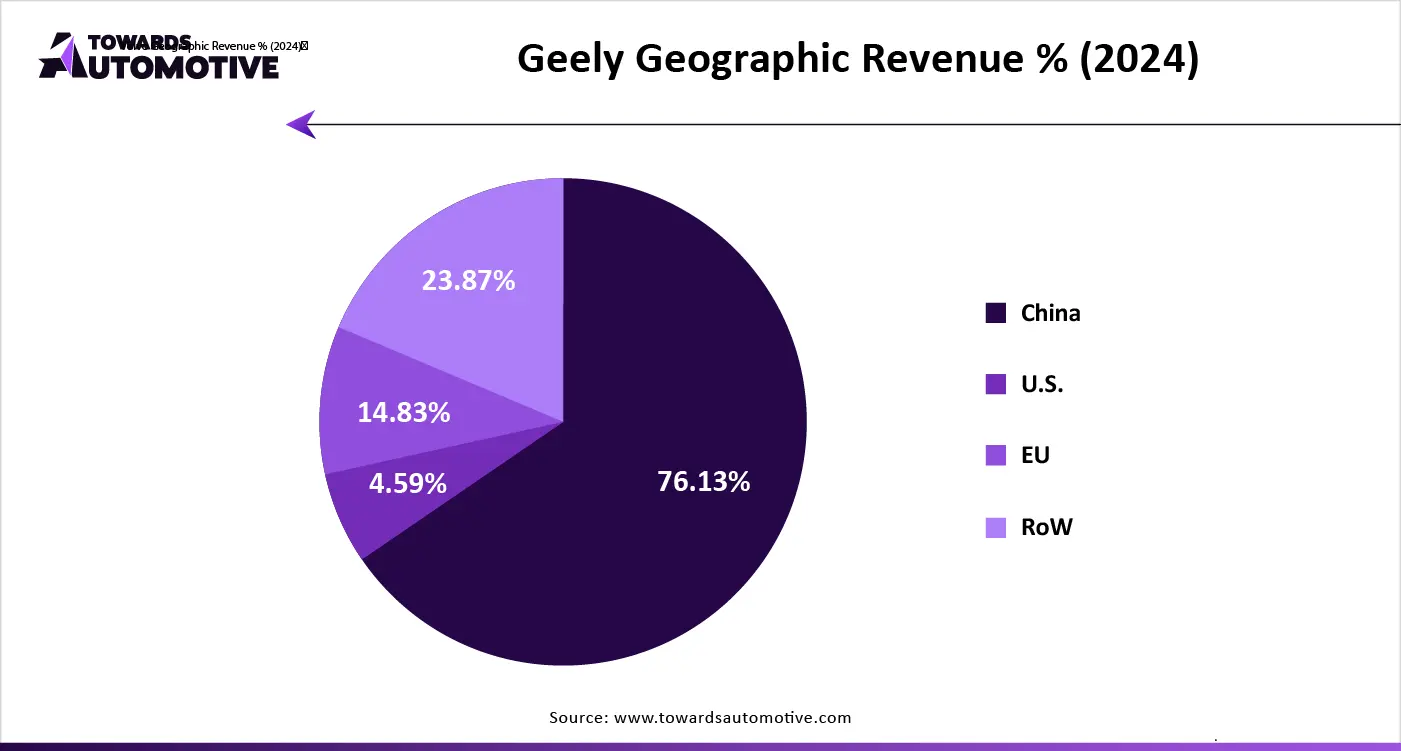

Asia Pacific dominated the e-rickshaw market. The growing demand for e-rickshaws in several countries such as India, China, Singapore, Thailand and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the EV sector coupled with opening of new EV manufacturing plants is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as BYD Auto, Geely Automobile Holdings, Hero Electric, Bajaj Auto and some others is expected to boost the growth of the e-rickshaw market in this region.

North America is expected to rise with a significant CAGR during the forecast period. The rising adoption of sustainable transportation solutions in the U.S. and Canada has driven the market growth. Additionally, rapid investment by government for developing the EV charging infrastructure coupled with technological advancements in the EV sector is contributing to the industry in a positive direction. Moreover, the presence of numerous market players such as GreenPower Motor Company, Star EV, Ride Green and some others is expected to propel the growth of the e-rickshaw market in this region.

The e-rickshaw market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Apna ERickshaw, Great Wall Motor, Eicher Motors, Piaggio Vehicles, Geely Automobile Holdings, SUN Mobility, Mahindra Electric, Kinetic Green, TVS Motor Company, Hero Electric, Yadea, BYD Auto, Omega Seiki Mobility, Gemopai, Bajaj Auto and some others. These companies are constantly engaged in manufacturing e-rickshaws and adopting numerous strategies such as business expansions, joint ventures, launches, partnerships, acquisitions, collaborations, and some others to maintain their dominance in this industry.

By Type

By Battery Type

By Power Rating

By Application

By Battery Capacity

By Region

October 2025

September 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us