October 2025

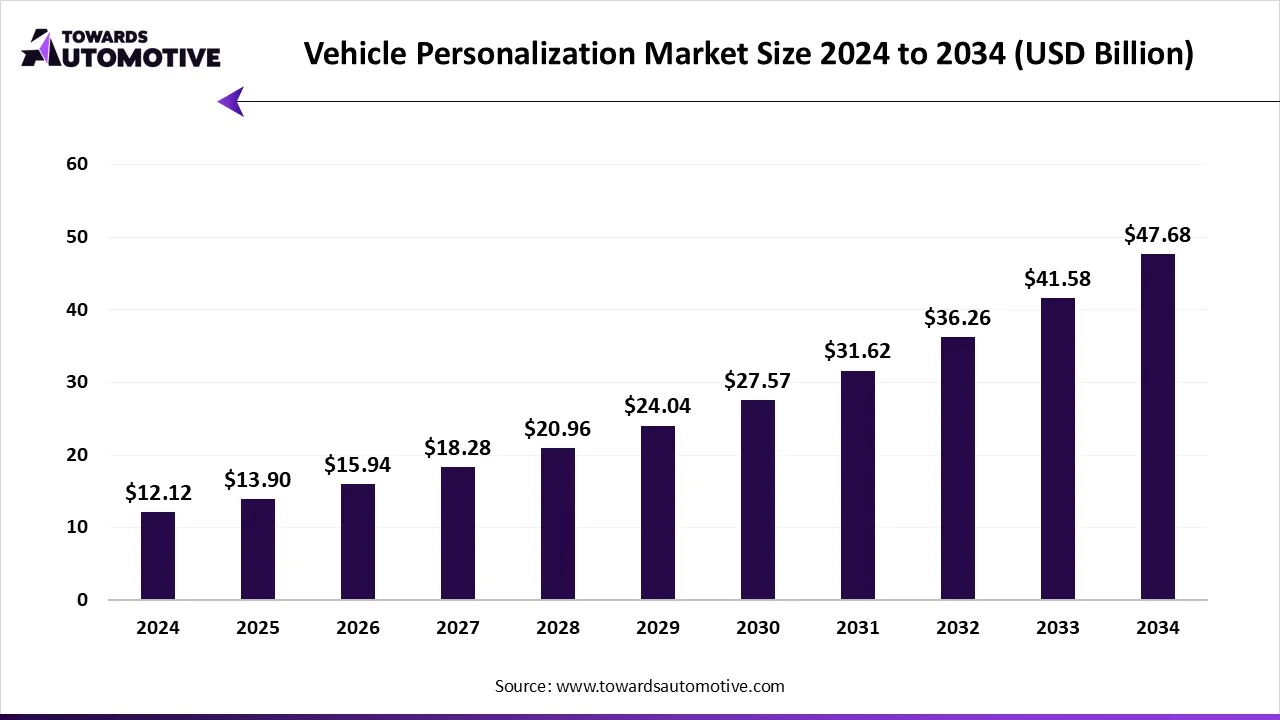

The vehicle personalization market is projected to reach USD 47.68 billion by 2034, growing from USD 13.9 billion in 2025, at a CAGR of 14.68% during the forecast period from 2025 to 2034. The vehicle personalization market is growing rapidly, with many car buyers seeking a vehicle that best suits their lifestyle and style preferences.

The market has been fueled by the emergence of new technology, including artificial-intelligence-based infotainment systems, smarter and adapted interiors of the vehicle, demand for electrified vehicles, and a wider selection of luxury vehicles with advanced personalization options. These options include exterior color, interior color and materials, ambient lighting, performance packages, and more, all being provided by the vehicle manufacturers.

The vehicle personalization market is generally driven by the increasing preference of consumers to adopt advanced seating systems in their vehicles coupled with technological advancements in their manufacturing units. The vehicle personalization covers aftermarket and OEM-based customization of vehicles aimed at enhancing aesthetics, comfort, performance, and technology integration. Personalization encompasses visual, functional, and digital modifications, ranging from exterior wraps, alloy wheels, and lighting kits to infotainment upgrades, ADAS integration, and smart interior systems. Growing consumer preference for unique vehicle identity, comfort enhancements, and digital connectivity has accelerated personalization demand across passenger cars, commercial vehicles, and two-wheelers. The expansion of e-commerce-based accessory retail, connected vehicle technologies, and modular OEM customization programs is further shaping this market’s evolution.

| Metric | Details |

| Market Size in 2024 | USD 12.12 Billion |

| Projected Market Size in 2034 | USD 47.68 Billion |

| CAGR (2025 - 2034) | 14.68% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Vehicle Type, By Product Type, By Technology, By Sales Channel, By End User, By Material Type, By Application Area and By Region |

| Top Key Players | Magna International Inc., Faurecia SE (now part of Forvia Group), Denso Corporation, ZF Friedrichshafen AG, Pioneer Corporation, Alpine Electronics, Inc. (Alps Alpine Co., Ltd.), Borla Performance Industries, MagnaFlow Exhaust Products |

New Customization Service

Collaboration

The vehicle personalization market is rapidly evolving as consumer technologies emerge. Cars are now being personalized with digital tools like artificial intelligence, 3D printing, and AR/VR design systems. Connected car functionality gives drivers the ability to customize their vehicles via mobile applications or voice control. Diverse smart interiors, cutting-edge infotainment, and data-driven solutions are emerging in interior customization. Moreover, the electric vehicle and autonomous vehicle markets are prompting companies to develop more technology-based customization that enhances comfort, safety, and overall driving experience.

The passenger cars segment dominated and captured almost 60% of the market share as these vehicles are the most prevalent vehicle type in the world. Consumers will always be interested in enhancing their vehicle comfort, styling, and technology, which increases the demand for personalization that also serves as a function. Increasing disposable incomes, urbanization, and the trend toward luxury vehicles or vehicles that include smart technology are leading to the personalization of interiors, infotainment systems, and exterior styling in passenger vehicles.

The electric passenger cars segment is expected to grow at the fastest rate in the forecasted period due to the increasing trend towards sustainable mobility and environmentally-friendly transportation on a global scale. Most EV buyers are more tech-savvy and are interested in personalized digital experiences in their vehicle, such as AI-based dashboards, connected infotainment technology, and ambient lighting technology. Automakers are more willing to provide extensive personalization opportunities to consumers based on profits associated with EV differential personalization among younger generations.

The interior personalization segment dominated and captured almost 40% of the vehicle personalization market share since the consumer spends the majority of their time inside the vehicle, thus they prefer personalized comfort and design. Products such as custom seats, ambient lighting installations, sophisticated infotainment systems, and high-end materials like leather and wood all have a rapid demand amongst consumers. Auto makers and aftermarket brands are heavily focused on the interior to enhance user experience and to differentiate models from competitors. Additionally, the growing demand for ergonomic-friendly designs and connected features positively contributes to the dominance of the interior personalization segment.

The performance personalization segment is expected to grow at the fastest rate in the forecasted period as vehicle owners are looking to improve speed, handling, and fuel economy. Performance modifications, including engine tuning, suspension upgrades, and enhanced exhaust systems, are becoming easily accessible through advanced technology. This is also aided by the growing culture of motorsports and interest in a sportier driving experience. New personalization trends are emerging around performance as electric and hybrid vehicles become more prevalent, with upgrades related to battery optimization or power delivery customization.

The conventional personalization segment dominated and captured around 65% of the vehicle personalization market share, as it encompasses things like paint jobs, seat covers, and the addition of alloy wheels, which, while providing an upgrade, continues to be inexpensive and easy to obtain. These types of modifications have been around as long as automotive culture itself and can appeal to the largest consumer audience. Therefore, consumers prefer physical and/or visual changes to their vehicles, rather than high-tech options/upgrades, due to the increased cost of technology or the required implementation of modifications and/or installation services.

The connected/digital personalization segment is expected to be the fastest-growing segment in the forecasted period, as the automobile becomes increasingly digitally engaged and software-driven. Connected features such as AI-based infotainment, voice commands, personalized drive modes, and enhanced driver-assistance technology are gaining traction. Consumer demand for an integrated digital experience is steadily being transferred from the smartphone experience to the automobile experience. Expansion of cloud-based and data-driven automobile systems that cultivate consumer habits to improve/evolve functionality, convenience, and safety is integrated into modern vehicles.

The aftermarket segment dominated and captured almost 50% of the vehicle personalization market share, as it has the largest selection of affordably priced and cosmetic products and services that are not typically offered by manufacturers. The aftermarket category can cover all aspects of personalization as these products are often the preferred option for consumers because they offer flexibility, lower cost, and, in many cases, faster installation of accessories such as seat covers, lighting kits, infotainment upgrades, and many more. There are also independent garages and specialized shops that provide customized modifications, which are often featured for the consumer’s specific vehicle type. The number of online marketplaces strengthens the aftermarket category as well by making aftermarket personalization products even easier to access.

The online/e-commerce segment is expected to grow at the fastest rate in the forecasted period. The online or e-commerce segment is the fastest-growing segment, as consumers are gravitating toward digital platforms for ease of use and selection. Online or e-commerce platforms offer an enormous catalog of products, published user experiences, a competitive pricing environment, and the ability for the consumer to compare and purchase personalized parts and accessories specific to their particular vehicle type. Since the growth of online car accessory brands and the use of virtual customization tools in the automotive industry, the e-commerce segment has significantly increased its digital selling power and segment sales.

The individual vehicle owners segment dominated and captured almost 55% of the market share, as customization is largely dependent on individual preference and lifestyle. Vehicle owners tend to customize their vehicles to express their preferences, enhance comfort, or elevate appearance. Furthermore, the trend toward luxury and mid-tier ranks of cars available with customized features will further fuel this population. Additionally, the younger generation of consumers sees personalized cars as a symbol of status, stimulating perpetual demand for unique features and interior and exterior upgrades.

The fleet operators segment is expected to grow at the fastest rate in the forecasted period, as corporations have identified that personalized vehicles have value in terms of branding and functionality. Companies are applying custom graphics, interior options, and tracking technology to their fleets of company vehicles. Ride-sharing companies and rental companies are even using personalization to improve the end-user experience and separate themselves from competitors. The expansion of commercial electric fleets will represent an additional avenue of growth for customized vehicle features.

The plastics & polymers segment dominated and captured almost 35% of the vehicle personalization market share due to their lightweight, flexible, and cost-friendly characteristics. Interior panels, trims, and dashboards utilize a variety of polymers, enabling customization to textures and colors. Moreover, their durability and recyclability fit well with sustainability targets. As both traditional and electric vehicle manufacturers endeavor to reduce overall vehicle weight for better fuel efficiency and range, the automakers continue to meet customer preferences through the use of plastics and polymers.

The composites & carbon fiber segment is expected to grow at the fastest rate in the forecasted period due to strength, lightweight properties, and premium appearance. Manufacturers of luxury and performance vehicles are employing composites and carbon fiber more and more for performance and aesthetics. Their sustainability outcomes of enhancing vehicle efficiency and reducing emissions increase the use of vehicles in more instances. With manufacturing costs decreasing and opportunities greater, more manufacturers and aftermarket suppliers provide embedded, exterior, and interior carbon fiber personalization options.

The comfort & convenience segment dominated and captured around 30% of the vehicle personalization market share as consumers prefer comfortable features that enhance daily driving. There has been much demand for new technologies such as heated seats, ambient lighting, noise-dampening, and climate control. Sports car manufacturers are investing in ergonomics, and luxury car companies and the accessories market are focused heavily on elegant interior designs. Moreover, with the increasing aspect of long-distance travel and workforce commuting in urban environments, developing features that promote the ability for passengers to relax and usability inside the vehicle is increasingly becoming a major area of vehicle personalization.

The digital/infotainment enhancement segment is expected to be the fastest-growing segment in the forecasted period, as there is increasing demand for in-vehicle connectivity and entertainment. Drivers expect smart systems that utilize smartphone connectivity, along with voice assistance, navigation, or real-time information, and more. In response to this demand, automakers are introducing new digital interfaces through customizable dashboards, AI, or audio systems. In addition, the introduction of electric and autonomous vehicles is pushing for infotainment innovations that enhance owners' personalized digital interaction.

Asia-Pacific dominated and captured around 40% of the total vehicle personalization market share due to the higher number of customers and strong automobile production. The Asia-Pacific vehicle personalization market was led by countries such as China, Japan, and South Korea, where demand for luxury and electric vehicles was on an upward trend. Increased disposable incomes and urbanization encouraged customers to purchase personalized vehicles. Furthermore, the growing aftermarket sector for personalization services was seen as another factor that established Asia-Pacific as the leading region in the vehicle personalization market.

China

China dominated the Asia-Pacific vehicle personalization market due to its vast automobile industry and a technology-savvy consumer base. The growing popularity of electric vehicles and digital car accessories is a driving factor in overall market growth. Many customer-focused local manufacturers provide cost-effective solutions for vehicle personalization, ranging from vehicle interior durability to autonomous smart vehicle features. Moreover, government support for electric vehicles and recent advancements in connected car technology allowed China to establish itself as the global hub for vehicle personalization and vehicle aftermarket solutions.

North America is expected to be the fastest-growing region in the vehicle personalization market as consumers focus on enhancements in performance, luxury, and technology. For instance, the U.S market exhibited strong demand for smart infotainment systems, AI-enabled interiors, and sustainably sourced materials. Increased electric vehicle adoption, coupled with a well-developed aftermarket industry, also increased customization opportunities. Further opportunities arose from connected car technology and the use of subscription-based vehicle models, allowing users to personalize specifications via an app.

United States

The United States emerged as the primary country driving growth in North America's vehicle personalization market due to its advanced automotive sector and higher consumer spending power relative to other countries in the region. The U.S consumer, in particular, has shown a greater preference for smart, performance, and comfort vehicle customization options. Moreover, automakers and aftermarket companies continue to create numerous customization options using AI, 3D printing, and digital interfaces.

The European vehicle personalization market is growing at a considerable rate, due to an early-stage innovating automotive sector and consumer demand for sustainable and premium features. The European buyer's preference for eco-friendly materials, innovative smart interiors, and advanced infotainment systems supports the growth in the market. This region benefited from stringent emission control regulations, which fuelled the utilization of lightweight and recyclable materials for personalization. The increasing popularity of electric and hybrid cars in Europe created new avenues for vehicle personalization and engagement, especially in luxury and comfort upgrades.

Germany

Germany led the European vehicle personalization markets given its strong automotive heritage combined with a normative global presence in luxury brands. Companies such as BMW, Mercedes-Benz, and Audi, engaged with vehicle personalization, provide a host of sustainable options to maximize performance tuning and utilize a smart interior. The German consumer places a high value on precision engineering, along with the utilization of advanced technology for increased comfort. The emphasis on innovation, electric mobility, and sustainability in Germany has incentivized automotive manufacturers to create personalization features that satisfy the quality of luxury.

| August 2025 | Announcement |

| Hikaru Ikeuchi, President, Lexus India. | We are thrilled to announce the new Smart Ownership Plan under the Lexus Promise, which represents our strong commitment to the Indian market. Guided by the spirit of Omotenashi our unique approach to anticipating and fulfilling our guests’ needs this plan goes beyond delivering luxury, offering true peace of mind and convenience. It reflects the evolving aspirations of our guests, especially those seeking financial flexibility along with premium experiences. This forward-looking initiative is designed to deliver an amazing ownership experience one that is not only desirable, but also smart, accessible, and a true reflection of the Lexus Promise. |

| March 2025 | Announcement |

| Maurizio Martinelli, CEO of Valeo LIGHT Division. | Around the world, OEMs are redefining their use of lighting as their clients ask for more ADAS, differentiation and communication. To meet these new needs, our lighting solutions evolve from lines to surface, with a higher number of LED sources. With Valeo expertise and In-Mold Structural Electronics (IMSE) lighting platforms, we have the tools to transform lighting design to offer new personalisation experience and more safety on the roads. |

| January 2025 | Announcement |

| Gino Ferru, SVP and General Manager EMEA at HERE Technologies. | Our collaboration with Togg showcases the power of AI and high-quality data to transform the driving experience. By integrating HERE’s AI-powered navigation with Intelligent Speed Assistance, we’re equipping Togg drivers with technology that adapts to their needs while promoting safer driving practices. We are excited to support Togg with an end-to-end professional services implementation and deliver a dynamic, user-centric driving experience that evolves seamlessly over time. |

| December 2024 | Announcement |

| Luciano Saracino, head of the Mechanics and Optics Center of Expertise, Marelli Electronic Systems. | We’re committed to empowering our customers through the smooth transition to centralized vehicle architecture. Our tailored solutions are designed to meet the demands of connected cars currently on the road, as well as automated vehicles of the future. Ansys helps us to deliver hardware design and manufacturing, as well as top-tier software development, integration, and validation services that satisfy industry standards for safety and cybersecurity. |

The vehicle personalization market is highly competitive. Some of the prominent players in the market are 3M Company, Robert Bosch GmbH, Continental AG, Valeo SA, Hella GmbH & Co. KGaA, Magna International Inc., Faurecia SE, Denso Corporation, Bridgestone Corporation, ZF Friedrichshafen AG, Adient plc, Lear Corporation, Motherson Group, Pioneer Corporation, Alpine Electronics, Inc., AkzoNobel N.V., BASF SE (Coatings & Finishes Division), Harman International Industries, Garrett Motion Inc., and Recaro Automotive Seating. These companies in the vehicle personalization market are working toward a high level of differentiation and product dominance. They enhance their vehicles by investing in digital configurators, software platforms, and connected vehicle interfaces to allow customers to preview and select various custom options online.

| Company | About |

| 3M Company | 3M Company was established in 1902. It made available innovative materials such as films, adhesives, and wraps used for vehicles, making interior styling and aesthetic enhancements a reality, while providing proven paint protection. |

| Robert Bosch GmbH | Robert Bosch GmbH was founded in 1886. It invented practical and truly smart automotive technologies such as sensors, infotainment systems, and digital displays which helped to create personalized and advanced experiences in driving and vehicle customization. |

| Continental AG | Continental AG was established in 1871. It provided some of the smartest systems for vehicles, including interior or connected solutions that allowed the automakers to provide a more personal level of comfort, safety, and digital experiences to modern car owners. |

| Valeo SA | Valeo SA was established in 1923. It brought cutting-edge technologies and smart interior features, like the ability to personalize vehicles in advanced ways through intelligent design and innovative user experiences. |

Tier 1

Tier 2

Tier 3

Vehicle Personalization Market Segments

By Vehicle Type

By Product Type

By Technology

By Sales Channel

By End User

By Material Type

By Application Area

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us