October 2025

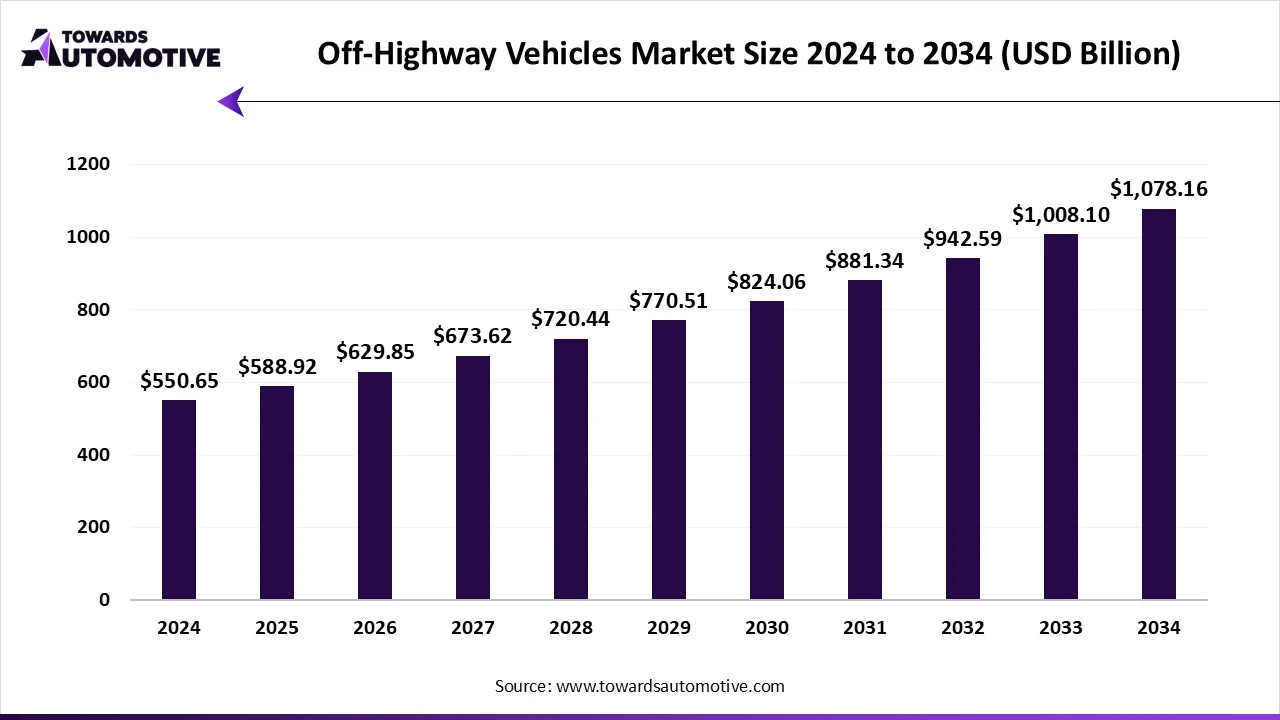

The off-highway vehicles market is forecast to grow from USD 588.92 billion in 2025 to USD 1078.16 billion by 2034, driven by a CAGR of 6.95% from 2025 to 2034. The off-highway vehicle market is rapidly expanding due to increasing construction of roads, bridges, and cities. Moreover, mining continues are engaged in expanding to meet the growing demand for metals and minerals, thereby driving the market growth. The future of electric and hybrid vehicle options continues to provide opportunities in the market.

The global off-highway vehicles (OHV) market includes the manufacturing and sale of vehicles designed primarily for off-roading applications. These vehicles are used in construction, agriculture, mining, forestry, and industrial sectors. OHVs include excavators, loaders, bulldozers, tractors, backhoe loaders, forklifts, and other specialized vehicles. The end-user in the market comprises of construction companies, agricultural enterprises & cooperatives, mining companies, industrial & warehouse operators, and forestry operators. The evolution of smart farming, modern mining and sustainable construction increases the demand for off-highway vehicles.

The trends in the off-highway vehicles market are collaborations and partnerships between prominent companies.

The construction vehicles (excavators & loaders) segment dominated the market due to the rising number of infrastructure projects expanding around the world. Additionally, governments are investing heavily in building roads, bridges, and smart city projects, which is driving demand for construction machines. Moreover, construction companies require excavators and loaders as they are versatile machines for daily earthmoving and lift work.

The electric/hybrid vehicles segment is expected to grow at the fastest rate as a growing number of firms work to lower their carbon emissions and maintenance fuel costs. Improvements in battery capacity and government policies on promoting cleaner energy sources are contributing to this segment. Therefore, many firms are transitioning to hybrid and even fully electric machines in the pursuit of a cleaner, more efficient machine with lower emissions and long-term savings compared to diesel-powered machines.

The diesel segment captured around 70% of the market share. Diesel off-highway vehicles certainly prevail due to more power, better performance, and productivity towards tough applications with difficult terrains. Diesel engines perform well under terrible conditions when a heavy amount of load has to be delivered for long durations. Moreover, diesel vehicles have clear advantages because the diesel supply chain is well established and easy to obtain, while electric vehicles are limited in supply.

The electric/hybrid segment is expected to grow at the fastest rate in the market. The electric/hybrid propulsion segment is rapidly expanding as sustainability and energy efficiency rise. The hybrid vehicles offer reduced fuel consumption, low noise, reduced carbon emissions, and maintenance costs. As clean energy adoption grows and companies commit to net-zero targets, governments and consumers will push for hybrid and fully electric machines, resulting in a transition to this propulsion type.

The construction & infrastructure segment captured 40% of the off-highway vehicles market share. The construction and infrastructure sector needs various off-highway vehicles to complete transportation tasks such as earthmoving tasks, road building tasks, and general ground preparation tasks. Urbanization and government spending on transport, energy, and housing currently drive the demand for off-highway vehicles as an application in construction & infrastructure.

The agriculture & farming segment is expected to be the fastest-growing in the market. The agriculture sector continues to adapt and use advanced off-highway vehicles such as tractors, harvesters, and loaders to become more productive and reduce physical labor. Demand for the global food supply is driving the agricultural sector to implement smart farming and increase its machinery utilization. Precision farming, mechanized irrigation, and government support programs in stimulating the upgrade of old farming equipment are driving the segment.

The construction companies segment captured around 38% of the total market share. Construction companies depend heavily on off-highway vehicles used in construction, infrastructure, and land preparation. These businesses need to purchase, maintain, and sometimes rent many large equipment fleets for their projects, creating consistent demand. A construction company's dependence on and need for equipment like excavators, loaders, and cranes drives a consistent incremental growth in demand for off-highway vehicles.

The mining companies segment is expected to grow at the fastest rate in the off-highway vehicles market. Mining companies are starting to utilize heavier specialized off-highway vehicles such as haul trucks, drills, and loaders, further expanding their interests in mineral extraction. The demand for metals and minerals worldwide is increasing; thus, mining operations will grow alongside it. Additionally, the adoption of automation and the electrification of mining equipment is further creating demand for off-highway vehicles.

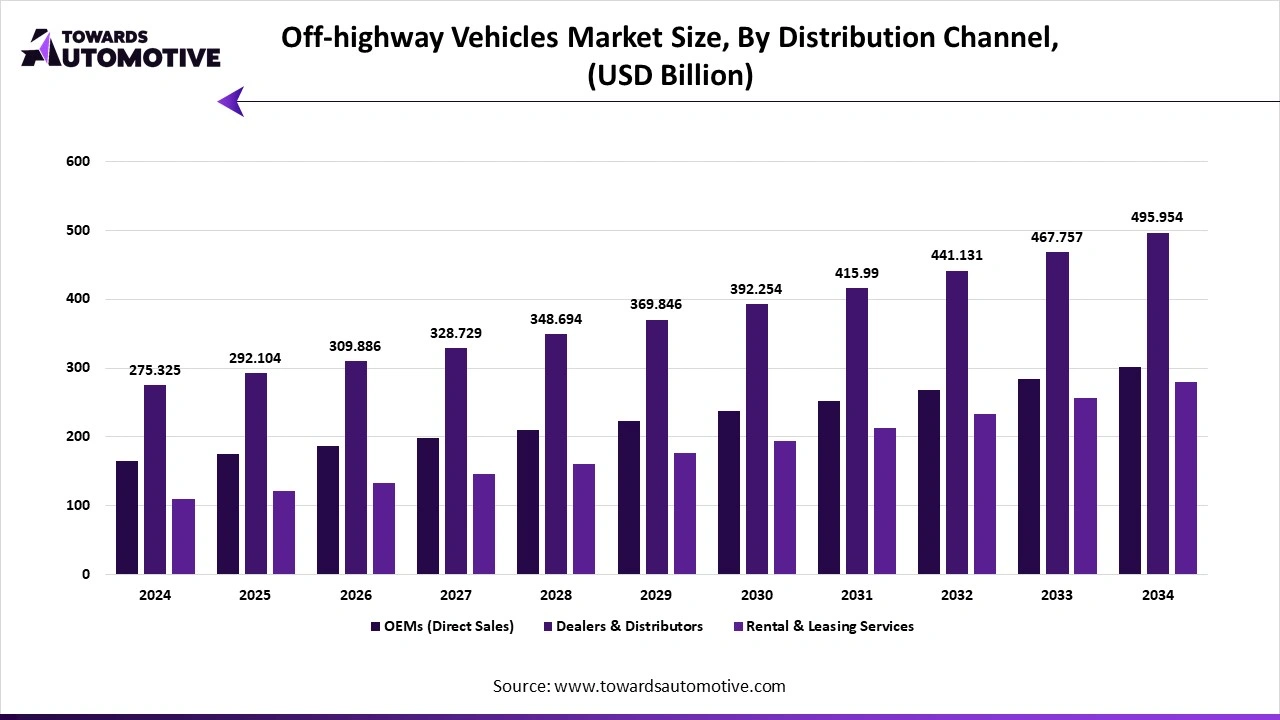

The dealers & distributors segment dominated with almost 50% of the market share. Dealers and distributors are the dominant channel for sales of off-highway vehicles as they offer financing options, after-sales support, and availability of spare parts. Dealers also include many established firms offering preferential treatment to their customers, getting reliable service and access to machinery. Moreover, construction, agriculture, and mining companies prefer developing long-term relationships with suppliers they trust rather than consistently switching suppliers, which contributes to the dominance of the segment.

The rental & leasing services segment is expected to grow at the fastest rate. Rental and leasing businesses are rapidly expanding as businesses look to reduce the initial capital required to purchase costly equipment. Moreover, companies are seeing the benefits of renting equipment, such as flexibility, no maintenance responsibilities, and access to the newest technology. Small contractors and farming operations benefit the most from this distribution model.

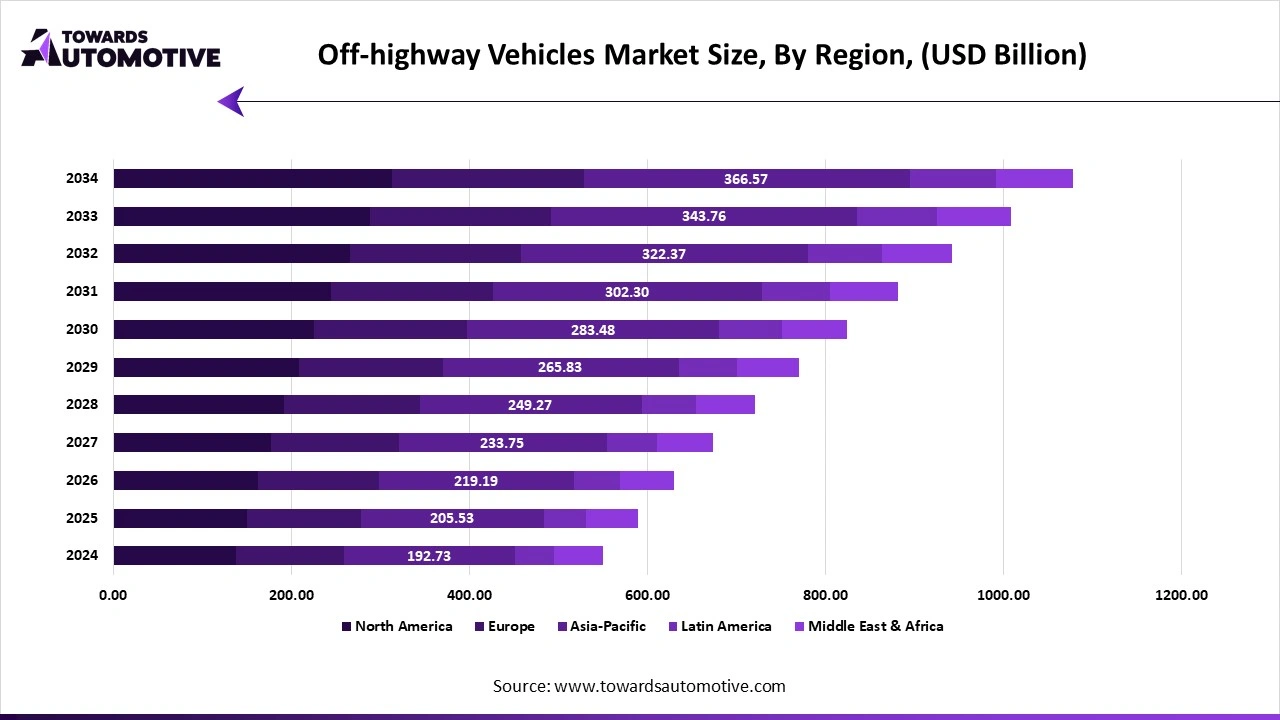

Asia-Pacific is the largest region for off-highway vehicles because of the high volume of infrastructure development, rapid urbanization, and modernizing agriculture. The region is building highways, smart cities, and power generation facilities, which increase the demand for excavators, loaders, and trucks. Agriculture is also transforming with the modernization of machinery to meet the food production demands. Moreover, opportunities in the market include electric off-highway vehicles, automation in agriculture, and smart mining equipment using advanced technology. The governments across the Asia-Pacific region are encouraging sustainable and high-tech development opportunities, resulting in strong long-term prospects for off-highway vehicle manufacturers.

China leads the Asia-Pacific off-highway vehicles market because of the vast amount of construction spending, large-scale mining activities, and wide adoption of modern farming machinery. China is also implementing electric and hybrid vehicles, as the use of fossil fuels creates large amounts of pollution. With its strong manufacturing capabilities and backing from the government for infrastructure creation, China is rapidly expanding in the off-highway vehicles market.

North America is the fastest-growing region in the off-highway vehicles market, aided by strong adoption of new technologies, including automation, telematics, and hybrid systems. With strict emission laws in place for off-highway vehicles, companies are being pushed to invest in electric machines or machines that are more fuel-efficient and powerful while maintaining safety regulations. Demand for these vehicles comes from large construction projects, enhanced farming methods, mining explorations, road building, and other federal clean energy projects. Additionally, opportunities include autonomous vehicles related to mining operations, smart tractors related to precision agriculture, and the electrification of equipment paired with development in charging infrastructure across the United States and Canada.

The United States is the largest market for off-highway vehicles in North America, continuing to grow the off-highway vehicles market through heavy investment into its infrastructure, advanced farming methods, and digital solutions such as telematics. The U.S. has a high degree of adoption of automation and hybrid technologies, making it a very dynamic market. Strong federal funding for clean energy and modern farming solutions ensures the dominance of the region in North America.

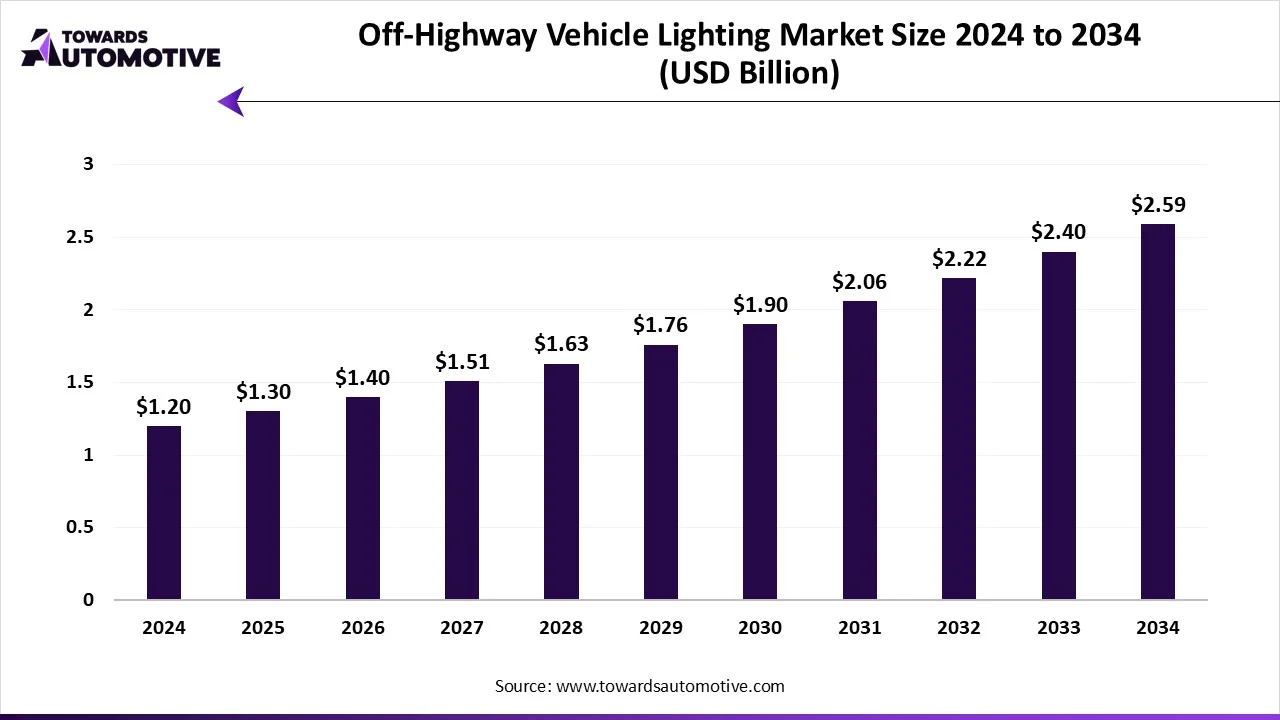

The off-highway vehicle lighting market is expected to increase from USD 1.30 billion in 2025 to USD 2.59 billion by 2034, growing at a CAGR of 8% throughout the forecast period from 2025 to 2034. The growing sales of off-highway vehicles in developed nations coupled with rise in number of residential constructions in different parts of the world has boosted the market expansion.

Additionally, growing emphasis of automotive brands for using high-quality lights in off-highway vehicles along with rapid investment by market players for opening new production facilities is playing a crucial role in shaping the industrial landscape. The increasing popularity of laser lighting as well as research and development related to matrix headlights is expected to create ample growth opportunities for the market players in the upcoming days.

The off-highway vehicle lighting market is a prominent branch of the automotive industry. This industry deals in the development and distribution of lighting systems for the off-highway vehicles. There are several types of products developed in this sector comprising of LED lighting, halogen lighting, HID lighting, incandescent lighting and some others.

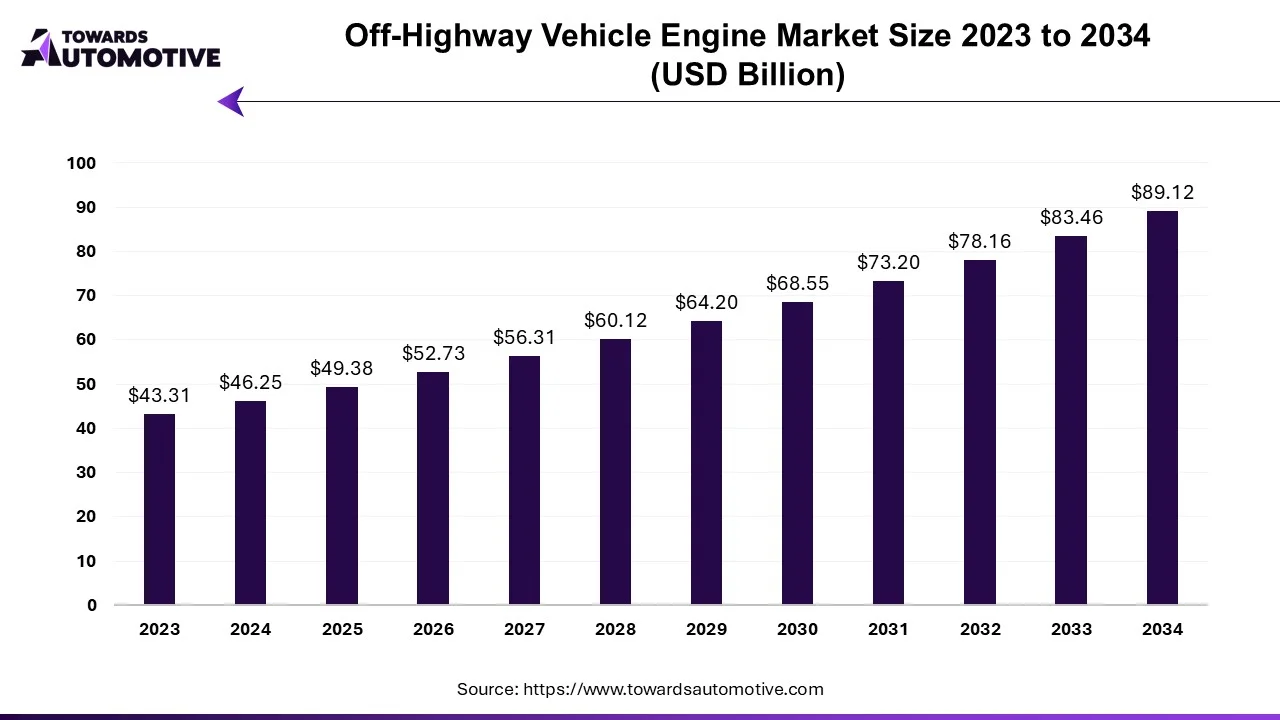

The Off-highway vehicle engine market is projected to reach USD 89.12 billion by 2034, expanding from USD 49.38 billion in 2025, at an annual growth rate of 6.78% during the forecast period from 2025 to 2034. The market is primarily driven by the growth of agriculture, construction, mining, and other industries where off-highway vehicles are essential for raw material transportation and other activities.

Off-highway vehicle (OHV) engines are designed for the usage in vehicles operating on challenging terrains such as mud, sand, rocks, and other rough conditions. The evolution of off-road engine technology remains intricately tied to advancements in agriculture and industrial machinery construction. The burgeoning agricultural sector in developing nations, coupled with the expansion of real estate and economic development on a global scale, serves as a catalyst for the continued innovation and economic prosperity of the agricultural machinery segment.

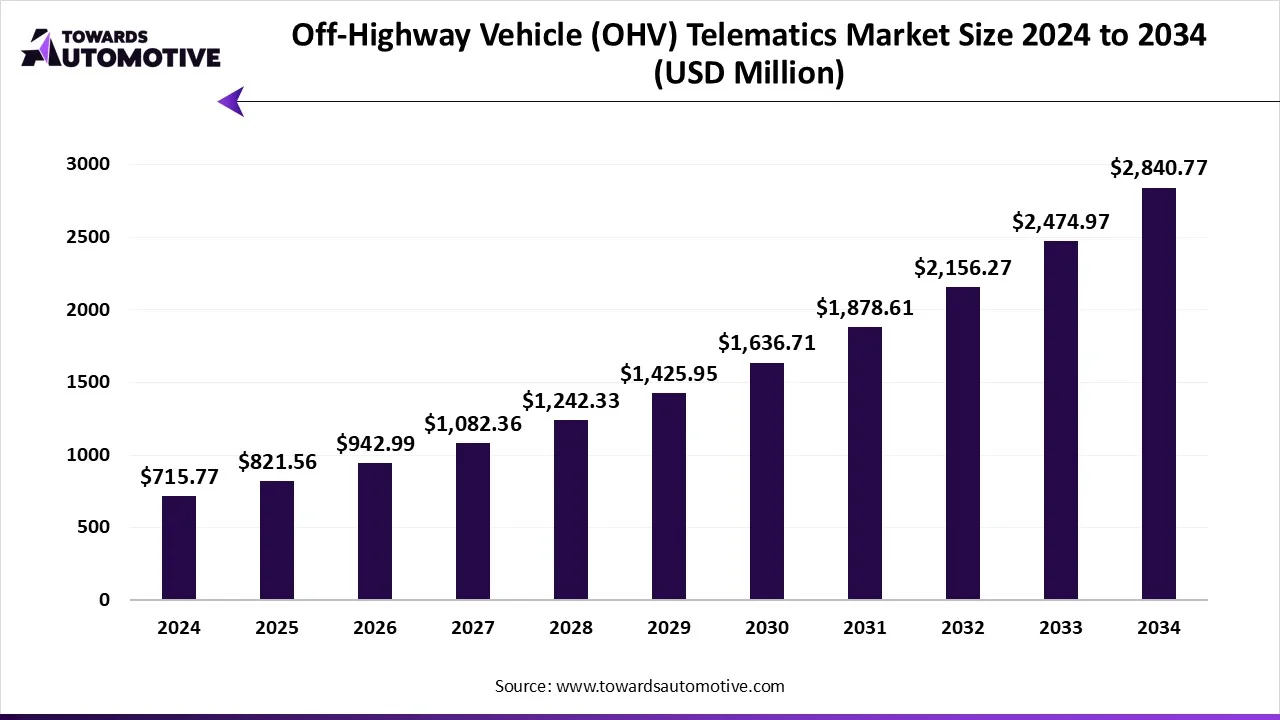

The off-highway vehicle (OHV) telematics market is projected to reach USD 2840.77 million by 2034, expanding from USD 821.56 million in 2025, at an annual growth rate of 14.78% during the forecast period from 2025 to 2034. The increasing demand for advanced equipment from the construction sector along with integration of advanced technologies in telematics solutions has boosted the market expansion.

Additionally, the growing use of haul trucks, drills, dozers and some others in the mining sector coupled with upsurge in demand for autonomous forklifts is playing a vital role in shaping the industrial landscape. The surging adoption of advanced GPS tracking sensors in off-highway vehicles is expected to create ample growth opportunities for the market players in the future.

The off-highway vehicle (OHV) telematics market is a prominent sector of the automotive industry. This industry deals in developing telematics solutions for off-highway vehicles. There are various components developed of these solutions comprising of hardware, software, connectivity solutions and some others. These solutions are designed for numerous types of vehicles consisting of construction equipment, agricultural machinery, mining vehicles, forestry equipment, material handling equipment and some others.

The raw materials required for building strong off-highway vehicles are steel, aluminum, rubber, and plastics.

The components required in off-highway vehicles include engines, transmissions, hydraulics, braking systems, axles, and electronic parts.

The components are combined with the frame to build the off-highway vehicles. These vehicles are properly tested as per the safety regulations before entering the market for sales.

The off-highway vehicles market is highly competitive. Some of the prominent players in the market are Caterpillar Inc., Komatsu Ltd., Deere & Company, CNH Industrial N.V., Hitachi Construction Machinery Co., Ltd., Liebherr Group, Volvo Group (AB Volvo), ABB, XCMG Group, Kubota Corporation, and SANY Group. These firms are constantly engaged in developing off-highway vehicles, entering into partnerships, and accelerating research and development in the products, as they work to replace diesel engines with cleaner alternatives on excavators, loaders, and haul trucks.

By Vehicle Type

By Propulsion Type

By Application

By End-User Industry

By Distribution Channel

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us