October 2025

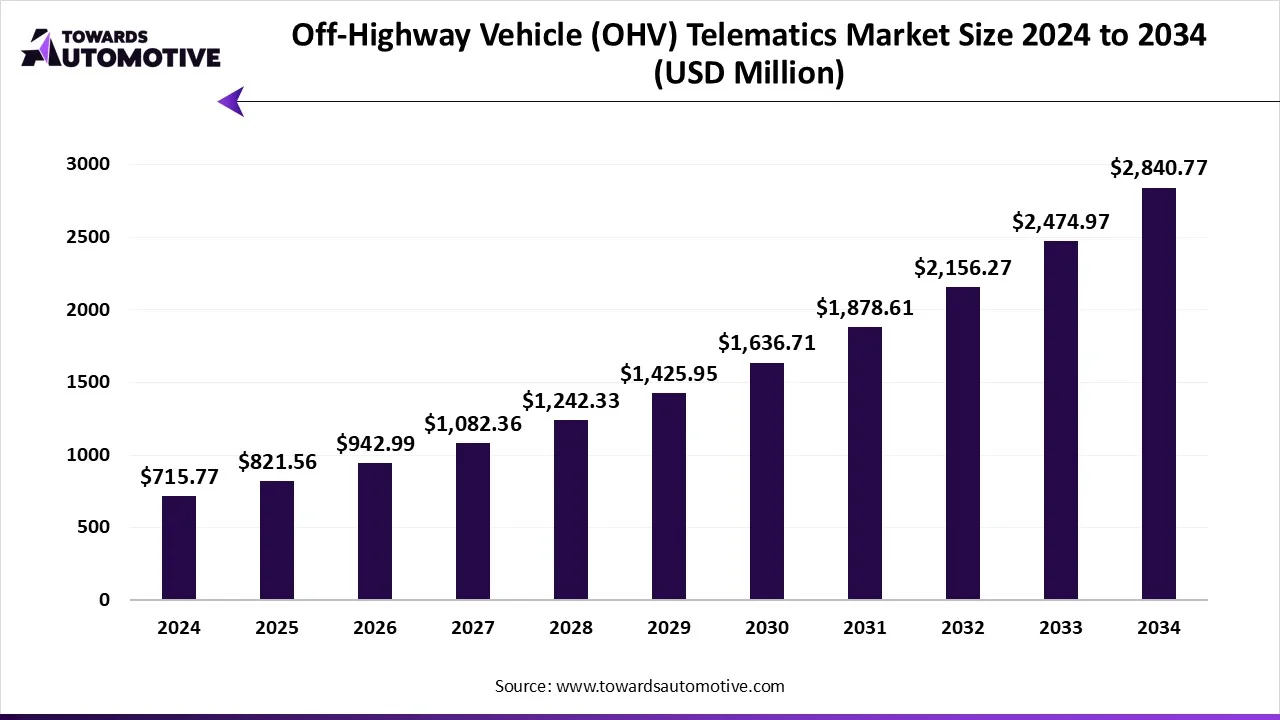

The off-highway vehicle (OHV) telematics market is projected to reach USD 2840.77 million by 2034, expanding from USD 821.56 million in 2025, at an annual growth rate of 14.78% during the forecast period from 2025 to 2034. The increasing demand for advanced equipment from the construction sector along with integration of advanced technologies in telematics solutions has boosted the market expansion.

Additionally, the growing use of haul trucks, drills, dozers and some others in the mining sector coupled with upsurge in demand for autonomous forklifts is playing a vital role in shaping the industrial landscape. The surging adoption of advanced GPS tracking sensors in off-highway vehicles is expected to create ample growth opportunities for the market players in the future.

The off-highway vehicle (OHV) telematics market is a prominent sector of the automotive industry. This industry deals in developing telematics solutions for off-highway vehicles. There are various components developed of these solutions comprising of hardware, software, connectivity solutions and some others. These solutions are designed for numerous types of vehicles consisting of construction equipment, agricultural machinery, mining vehicles, forestry equipment, material handling equipment and some others. It finds application in different sectors including fleet management, asset tracking, remote diagnostics & prognostics, fuel monitoring & optimization, predictive & preventive maintenance, safety & compliance, operator monitoring & behavior analysis, geo-fencing & theft protection and some others. The end-users of these solutions comprise of several types of industries such as construction, agriculture, mining, forestry, logistics & material handling, oil & gas and some others. This market is expected to grow significantly with the rise of the software industry around the globe.

The major trends in this market consists of partnerships, rise in number of residential constructions and rapid investment in the agricultural sector.

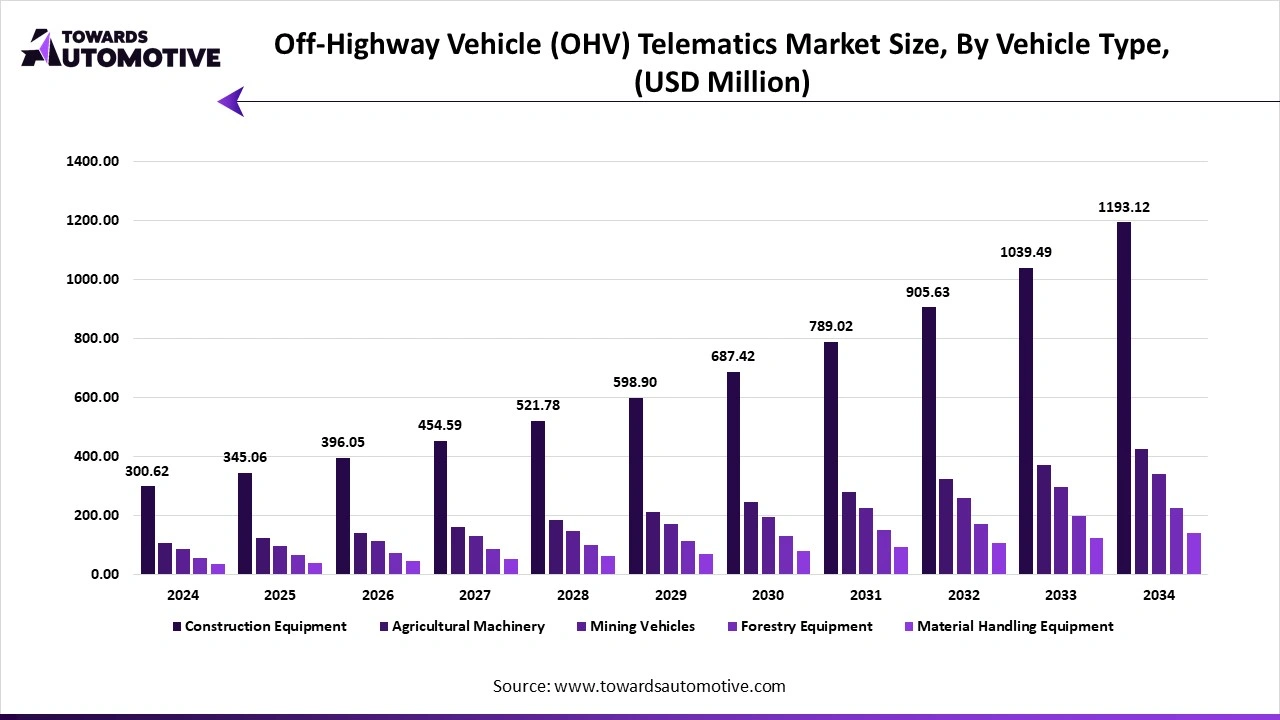

The construction equipment segment dominated the market with a share of 42%. The rising use of advanced telematics solutions in excavators has boosted the market expansion. Additionally, the growing investment by government for developing the road infrastructure coupled with technological advancements in the construction sector is playing a vital role in shaping the industry in a positive direction. Moreover, partnerships among technology providers and equipment manufacturers is expected to boost the growth of the off-highway vehicle (OHV) telematics market.

The agricultural machinery segment is expected to expand with the highest CAGR during the forecast period. The growing adoption of advanced machineries such as tractors in the agricultural sector has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the agricultural sector coupled with deployment of advanced equipment in the farming industry is contributing to the industry in a positive manner. Moreover, collaborations equipment manufacturers and telematics providers is expected to propel the growth of the off-highway vehicle (OHV) telematics market.

The software & platform segment led the market with a share of around 49%. The rising use of advanced software in construction equipment has boosted the market expansion. Additionally, the growing development in the software industry coupled with integration of AI in telematics solutions is playing a vital role in shaping the industrial landscape. Moreover, partnerships among technology providers and OHV companies is expected to drive the growth of the off-highway vehicle (OHV) telematics market.

The connectivity segment is expected to rise with the highest CAGR during the forecast period. The growing use of cloud-based telematics solutions in the OHVs has boosted the market expansion. Additionally, rapid investment by telecom companies for strengthening the 5G infrastructure coupled with integration of Bluetooth in telematics solutions is contributing to the industry in a positive manner. Moreover, the increasing emphasis of technology providers on developing satellite-based frameworks to enhance vehicle connectivity is expected to foster the growth of the off-highway vehicle (OHV) telematics market.

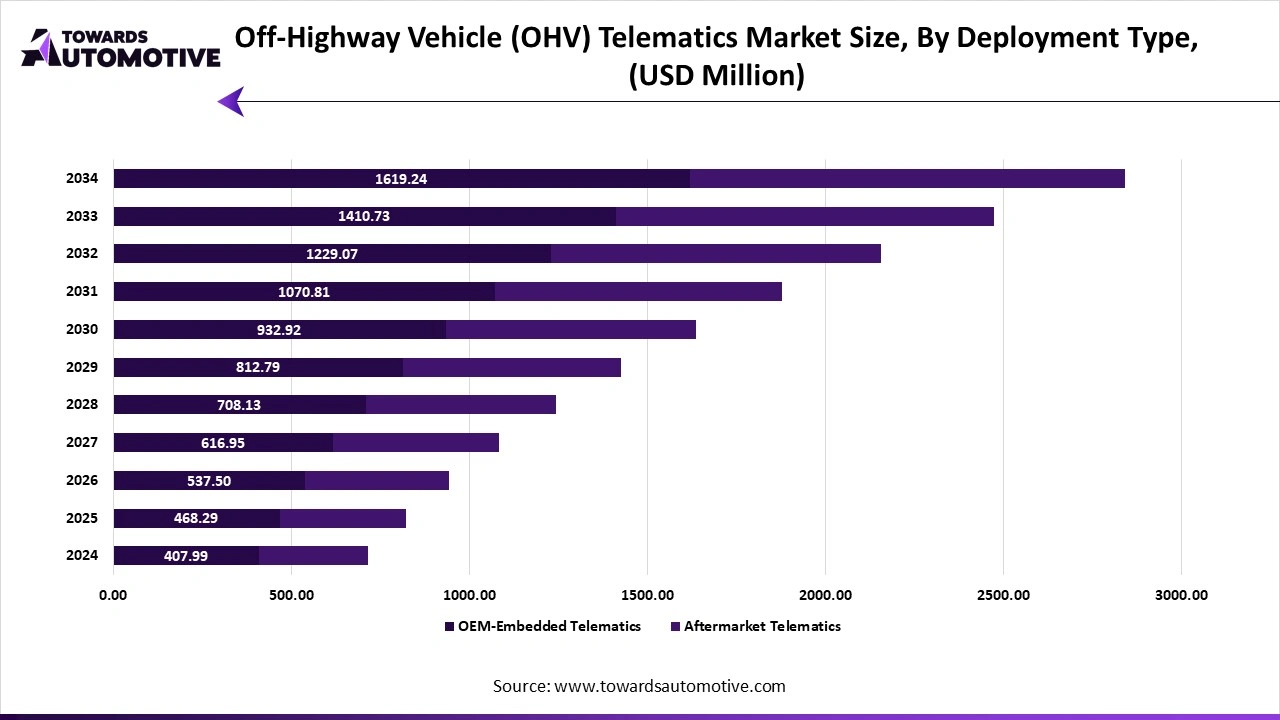

The OEM-embedded telematics segment dominated the industry with a share of 57%. The growing demand for high-quality telematics solutions from fleet operators to optimize OHV operations has boosted the market expansion. Also, the trust and assurance provided by OEMs coupled with numerous benefits of OEM-based telematics solution is expected to foster the growth of the off-highway vehicle (OHV) telematics market.

The aftermarket telematics segment is expected to expand with the highest CAGR during the forecast period. The availability of advanced telematics solution in several aftermarket platforms has boosted the market growth. Also, the increasing popularity of online shopping platforms such as Amazon, Walmart, Ebay and some others is expected to foster the growth of the off-highway vehicle (OHV) telematics market.

The fleet management segment led the market. The increasing demand for advanced software from fleet managers to enhance vehicular performance has boosted the market expansion. Additionally, the integration of AI and IoT in fleet management platforms is playing a vital role in shaping the industrial landscape. Moreover, partnerships among software developers and fleet operators is expected to foster the growth of the off-highway vehicle (OHV) telematics market.

The preventive & predictive maintenance segment is expected to grow with the highest CAGR during the forecast period. The growing use of telematics solutions in OHVs for predicting future outcomes has boosted the market expansion. Also, the rising popularity of preventive maintenance among fleet operators to maintain industrial equipment is expected to proliferate the growth of the off-highway vehicle (OHV) telematics market.

The construction segment dominated the industry with a share of 44%. The growing use of advanced equipment in the construction sector to enhance the capabilities of workers has boosted the market expansion. Additionally, increase in number of residential constructions in developing nations coupled with rapid adoption of electric excavators in construction sites to lower vehicular emission is playing a vital role in shaping the industrial landscape. Moreover, the rising investment by government of several countries for constructing government offices is expected to boost the growth of the off-highway vehicle (OHV) telematics market.

The agriculture segment is expected to rise with the fastest CAGR during the forecast period. The rising demand for food crops such as rice, wheat, maize and some others from populated countries has boosted the market expansion. Additionally, rapid investment by government of several nations such as India, China, the U.S. and some others for deploying advanced technologies in the agricultural sector is contributing to the industry in a positive manner. Moreover, the increasing use of tractors, harvesters, sprayers and some others in the farming sector is expected to drive the growth of the off-highway vehicle (OHV) telematics market.

-telematics-market-share-by-region.webp)

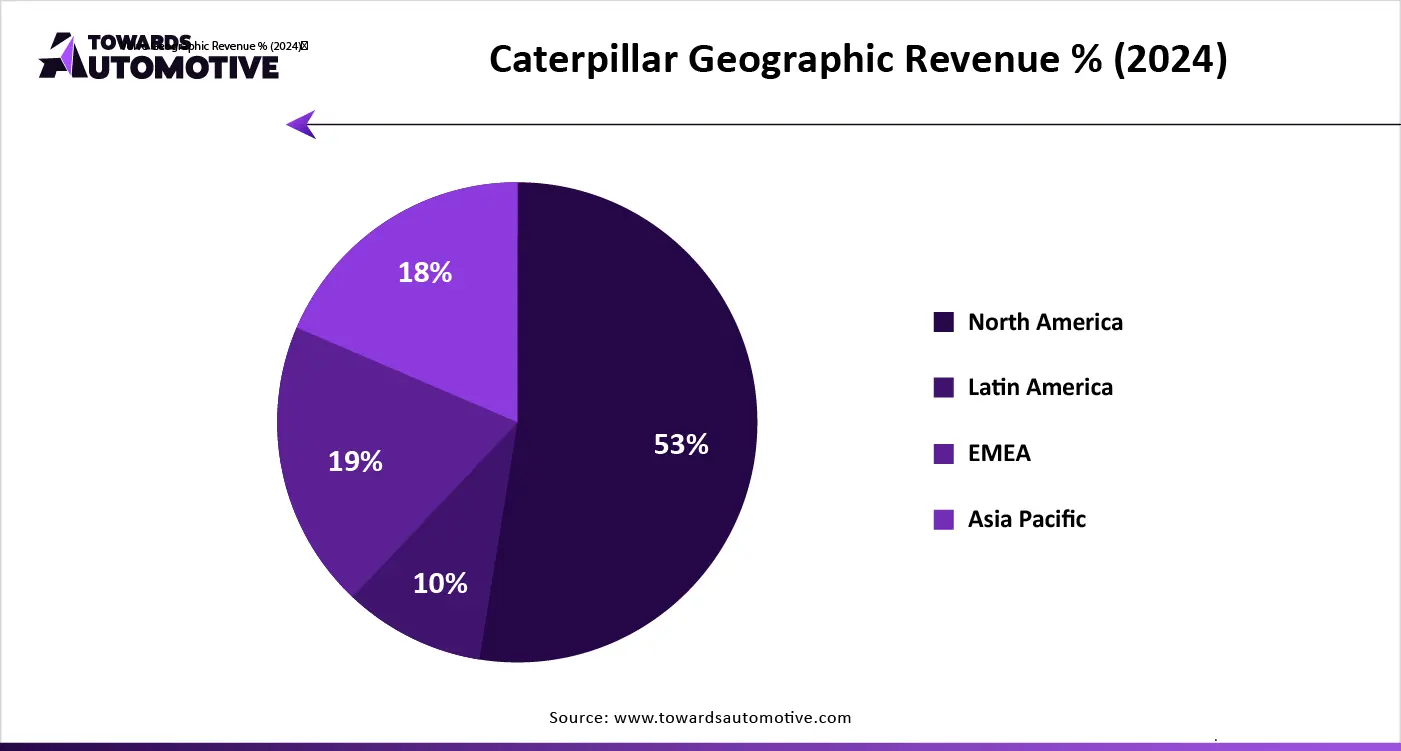

North America led the off-highway vehicle (OHV) telematics market with a share of 34%. The increasing sales of OHVs in the U.S. and Canada has boosted the market expansion. Additionally, the deployment of advanced equipment in the mining sector coupled with rise in number of fleet operators is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Caterpillar, Deere & Company, Geotab Inc and some others is expected to boost the growth of the off-highway vehicle (OHV) telematics market in this region.

The U.S. dominated the market in this region. The growing development in the logistics sector along with numerous government initiatives aimed at enhancing workers safety has driven the market growth. Moreover, the increasing use of advanced telematics solutions in the construction sector is playing a vital role in shaping the industrial landscape.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The growing sales of electric tractors in several countries such as India, China, Japan, South Korea and some others has driven the market growth. Also, numerous government initiatives aimed at developing the agricultural sector coupled with surge in demand for excavators and dozers from the construction sector is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Hitachi Construction Machinery, Komatsu, Skyfy Technology and some others is expected to foster the growth of the off-highway vehicle (OHV) telematics market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the rising development in the mining sector coupled with technological advancements in the automotive sector has boosted the market expansion. In India, the growing development in the agricultural sector along with rapid investment by government for developing smart cities is playing a crucial role in shaping the industrial landscape.

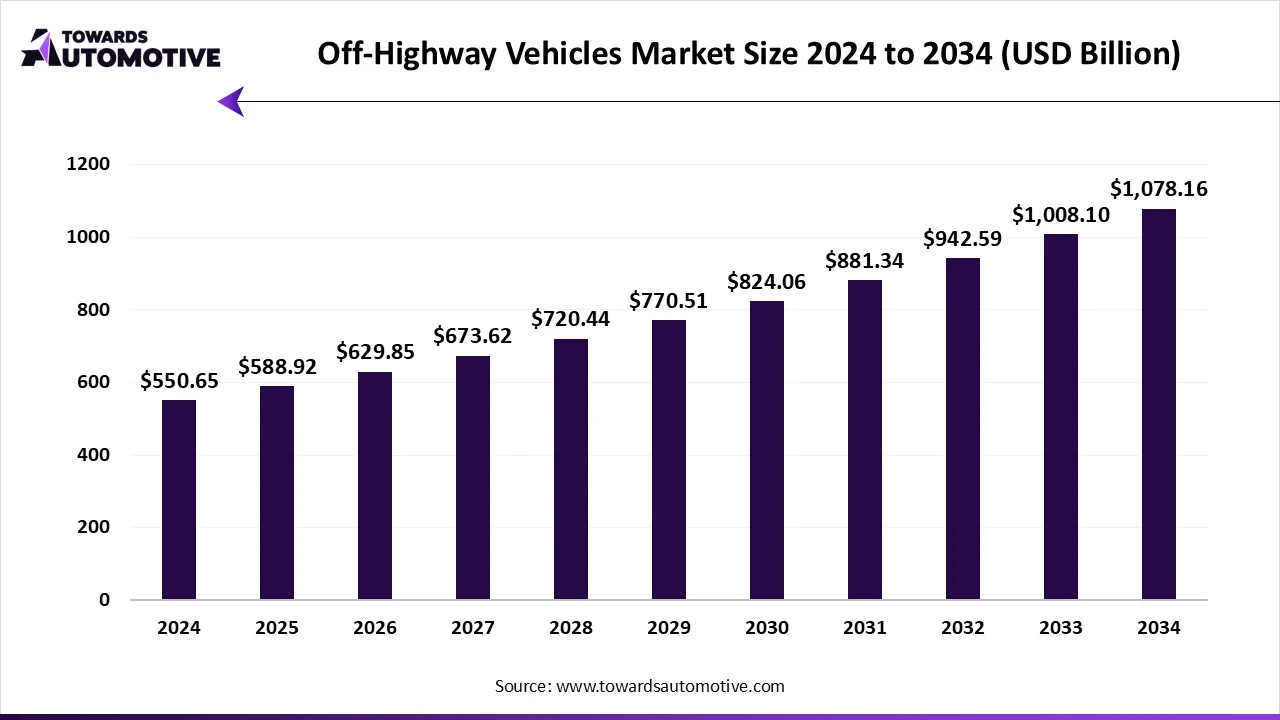

The off-highway vehicles market is forecast to grow from USD 588.92 billion in 2025 to USD 1078.16 billion by 2034, driven by a CAGR of 6.95% from 2025 to 2034. The off-highway vehicle market is rapidly expanding due to increasing construction of roads, bridges, and cities. Moreover, mining continues are engaged in expanding to meet the growing demand for metals and minerals, thereby driving the market growth. The future of electric and hybrid vehicle options continues to provide opportunities in the market.

The global off-highway vehicles (OHV) market includes the manufacturing and sale of vehicles designed primarily for off-roading applications. These vehicles are used in construction, agriculture, mining, forestry, and industrial sectors. OHVs include excavators, loaders, bulldozers, tractors, backhoe loaders, forklifts, and other specialized vehicles. The end-user in the market comprises of construction companies, agricultural enterprises & cooperatives, mining companies, industrial & warehouse operators, and forestry operators. The evolution of smart farming, modern mining and sustainable construction increases the demand for off-highway vehicles.

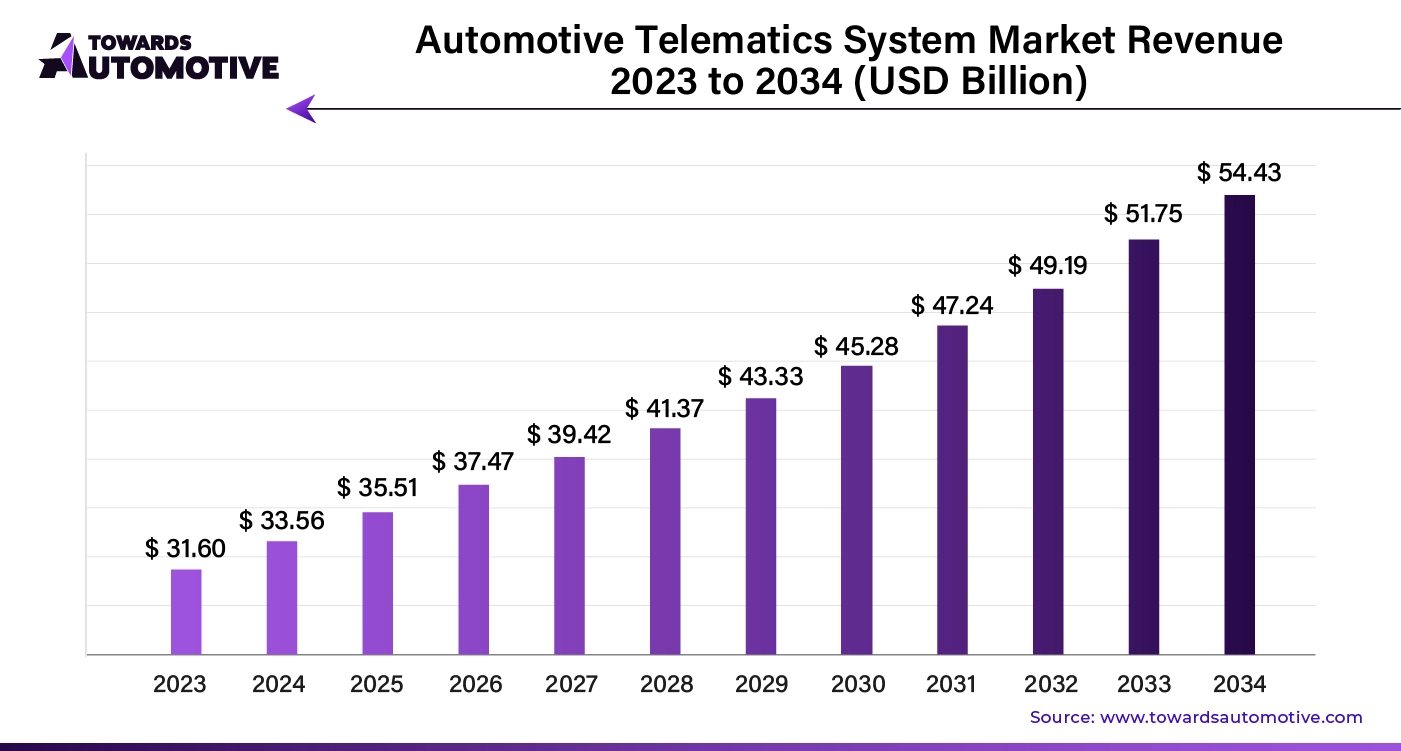

The automotive telematics system market is projected to grow from USD 35.51 billion in 2025 to USD 54.43 billion by 2034 at a CAGR of 5.04 percent. The report provides full segment data by technology type with embedded leading, tethered and integrated as additional categories, by sales channel with OEM leading and aftermarket as the secondary channel, by vehicle type with passenger vehicles holding the largest share and commercial vehicles expanding, and by application including information and navigation, safety and security, fleet management, insurance telematics, and others.

The automotive telematics system market is experiencing rapid growth driven by advancements in connected vehicle technology and increasing demand for enhanced vehicle safety, navigation, and communication systems. Telematics systems combine telecommunications and informatics to provide real-time data, enabling features such as vehicle tracking, remote diagnostics, and emergency assistance.

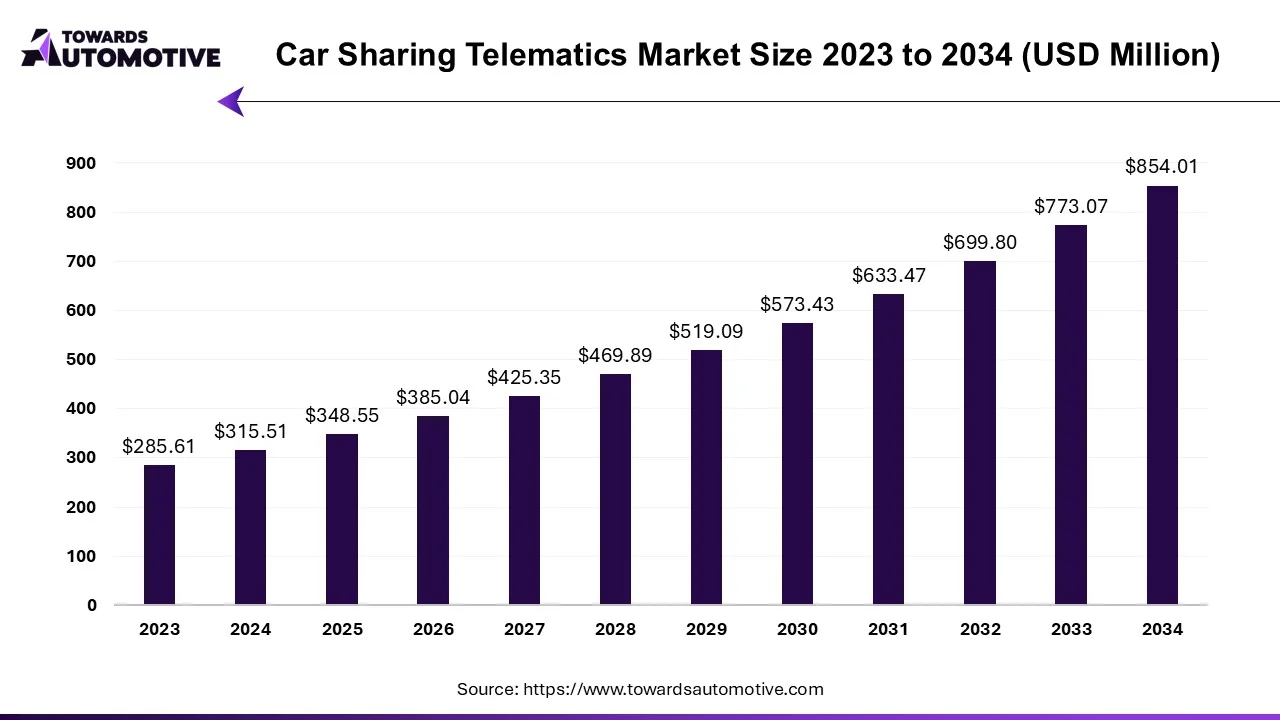

The global car sharing telematics market is projected to reach USD 854.01 million by 2034, growing from USD 348.55 million in 2025, at a CAGR of 10.47% during the forecast period from 2025 to 2034.

The car sharing telematics sector denotes the application of telematics technology in car sharing services. Car sharing offers the opportunity to minimize fleet expenses, promote the adoption of electric vehicles, enhance environmental conservation by decreasing CO2 emissions, and expand car accessibility to additional urban regions. Moreover, it delivers favorable organizational outcomes by facilitating asset sharing among employees. Telematics integrates telecommunications and information processing, facilitating data transmission across vast distances. The car sharing, telematics technology further facilitates several functions including vehicle tracking, remote diagnostics, fleet management, and user authentication.

The off-highway vehicle (OHV) telematics market is a rapidly industry with the presence of several dominating players. Some of the prominent companies in this industry consists of ORBCOMM Inc., Trackunit, MiX Telematics, Trimble Inc., Topcon Corporation, Teletrac Navman, ZF WABCO, Volvo CE (CareTrack), Caterpillar (VisionLink), John Deere (JDLink), Komatsu (Komtrax), CNH Industrial (AFS Connect, PLM Intelligence), Hitachi Construction Machinery (ConSite), JLG (ClearSky Smart Fleet), Doosan Infracore (DoosanCONNECT), Geotab, CalAmp Corp., Bosch Rexroth, Danfoss Power Solutions (PLUS+1 Connect) and some others. These companies are constantly engaged in developing telematics solutions for off-highway vehicles and adopting numerous strategies such as collaborations, launches, acquisitions, partnerships, business expansions, joint ventures and some others to maintain their dominance in this industry.

By Vehicle Type

By Telematics Component

By Application

By End-Use Industry

By Deployment Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us