September 2025

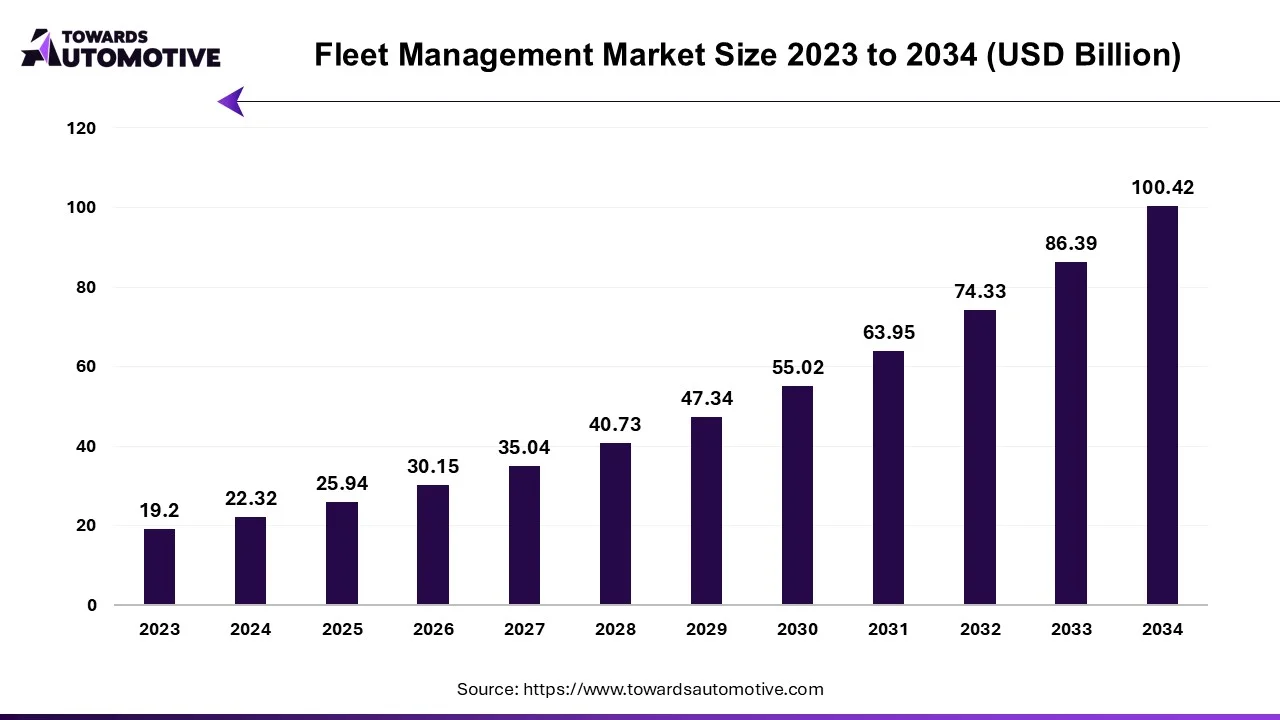

The fleet management market is set to grow from USD 25.94 billion in 2025 to USD 100.42 billion by 2034, with an expected CAGR of 16.23% over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The fleet management market is a prominent sector of the automotive industry. This industry deals in developing and delivering fleet management solutions in different parts of the world. There are several components of this sector consisting of solution and services. These solutions and services are designed for managing fleets of numerous types of vehicles including commercial vehicles and passenger cars. It is installed by different deployment modes comprising of cloud and on-premises. The end-users of this sector consist of various industries such as manufacturing, logistics, transportation, oil & gas, chemical and some others. The rising adoption of wireless fleet management solutions has driven the market growth. This market is expected to rise significantly with the growth of the ride-hailing industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 22.32 Billion |

| Projected Market Size in 2034 | USD 100.42 Billion |

| CAGR (2025 - 2034) | 16.23% |

| Leading Region | North America |

| Market Segmentation | By Component, By Fleet Type, By Deployment, By End User and By Region |

| Top Key Players | IBM Corporation, TomTom N.V. U.S, Fleetmatics Group PLC, General Services Administration, Telogis, AT&T Inc. |

The major trends in this industry consists of AI integrated fleet management solutions, partnerships, mobility-as-a-service.

AI Integrated Fleet Management Solutions

AI-based fleet management solutions has gained traction in recent times due to its numerous benefits such as reduced costs, enhanced efficiency, and improved safety. For instance, in April 2025, Azuga launched SafetyCam Plus and SafetyCam Pro. These cameras are integrated with AI to enhance fleet management operations. (Source: Businesswire)

Partnerships

Several market players are partnering with each other to develop advanced fleet management solutions. For instance, in May 2025, Samsara Inc. announced partnership with Samsara. This partnership is done for streamlining fleet management of electric vehicles. (Source: Businesswire)

Mobility-as-a-service

The rising awareness related to mobility-as-a-service has increased the demand for advanced fleet management tools to enhance urban mobility. For instance, in May 2024, HCLTech collaborated with Cisco. This partnership is done for launching wireless mobility as-a-service to enhance fleet operations.

(Source: https://www.hcltech.com/press-releases/hcltech-and-cisco-launch-pervasive-wireless-mobility-service)

The solution segment dominated this industry. The growing demand for advanced fleet management solutions from several end-users such as construction, transportation, government, logistics, retail and some others has boosted the market expansion. Additionally, the increasing adoption of vehicle maintenance and diagnostic solutions by EV fleet owners has further contributed to the industrial growth. Moreover, the rapid deployment of cloud-based solutions in aircrafts is expected to propel the growth of the fleet management market.

The services segment is predicted to rise with the fastest CAGR during the forecast period. The growing demand for several professional fleet management services from automotive sector has boosted the market growth. Additionally, surge in demand for consulting and advisory services for managing fleet operations is further adding to the industrial expansion. Moreover, the rising demand for advanced fleet management services coupled with increasing adoption of these services from government sector is expected to foster the growth of the fleet management market.

The commercial fleet segment held the largest share of the industry. The growing demand for advanced fleet management solutions from commercial vehicle owners has boosted the market growth. Also, the rapid adoption of advanced tracking tools for monitoring autonomous trucks and driverless buses is playing a vital role in shaping the industrial landscape. Moreover, the rise in number ride-hailing startups in developed nations such as China, Thailand, Germany, India and some others is expected to propel the growth of the fleet management market.

The passenger cars segment is likely to grow with a considerable CAGR during the forecast period. The growing use of vehicle monitoring systems to enhance privacy in passenger cars has boosted the market growth. Additionally, the rising demand for luxury vehicles along with increased application of car tracking solution to enhance vehicular safety and increase fuel consumption is anticipated to foster the growth of the fleet management market.

The cloud segment led the industry. The growing adoption of cloud-based fleet management solutions in several industries such as car rental, logistics, transportation and some others has boosted the market growth. Additionally, rapid investment by market players for developing advanced cloud-based fleet management platforms is further adding to the industrial expansion. Moreover, numerous advantages of cloud fleet management solutions including enhanced scalability, reduced costs, improved data security, real-time data access and some others is likely to propel the growth of the fleet management market.

North America held the highest share of the fleet management market. The growing adoption of advanced fleet management solutions in the transportation sector has driven the market growth. Additionally, the rise in number of truck operators along with the increasing demand for vehicle tracking system from ride-hailing companies is playing a positive role in shaping the industrial landscape. Moreover, the presence of several market players such as IBM Corporation, American Traffic Solutions (Verra Mobility), Uber Technologies, AT&T, Fleetio and some others is likely to foster the growth of the fleet market in this region.

U.S. dominated the market in this region. In the U.S., the market is generally driven by the rapid adoption of autonomous vehicles along with deployment of cloud-based fleet management solutions in aircrafts. Moreover, technological advancements in automotive sector coupled with numerous government initiatives related to enhance vehicular safety has bolstered the market expansion.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The growing adoption of ride-hailing services in several countries including China, Singapore, India, Japan and some others has driven the industrial expansion. Also, the rising demand for advanced telematics solutions from numerous industries such as construction, healthcare, oil & gas, chemical and some others is playing a vital role in shaping the industry. Moreover, the presence of numerous fleet management companies such as DiDi Chuxing, MiTAC Holdings Corporation, Ola Cabs, Hitachi and some others is expected to boost the growth of the fleet market in this region.

China is the leading country in this region. The growing demand for e-mobility services along with rapid deployment of vehicle tracking systems in commercial vehicles has boosted the market growth. Additionally, constant research and development activities for developing advanced fleet management solutions for monitoring ships is further contributing to the industrial expansion.

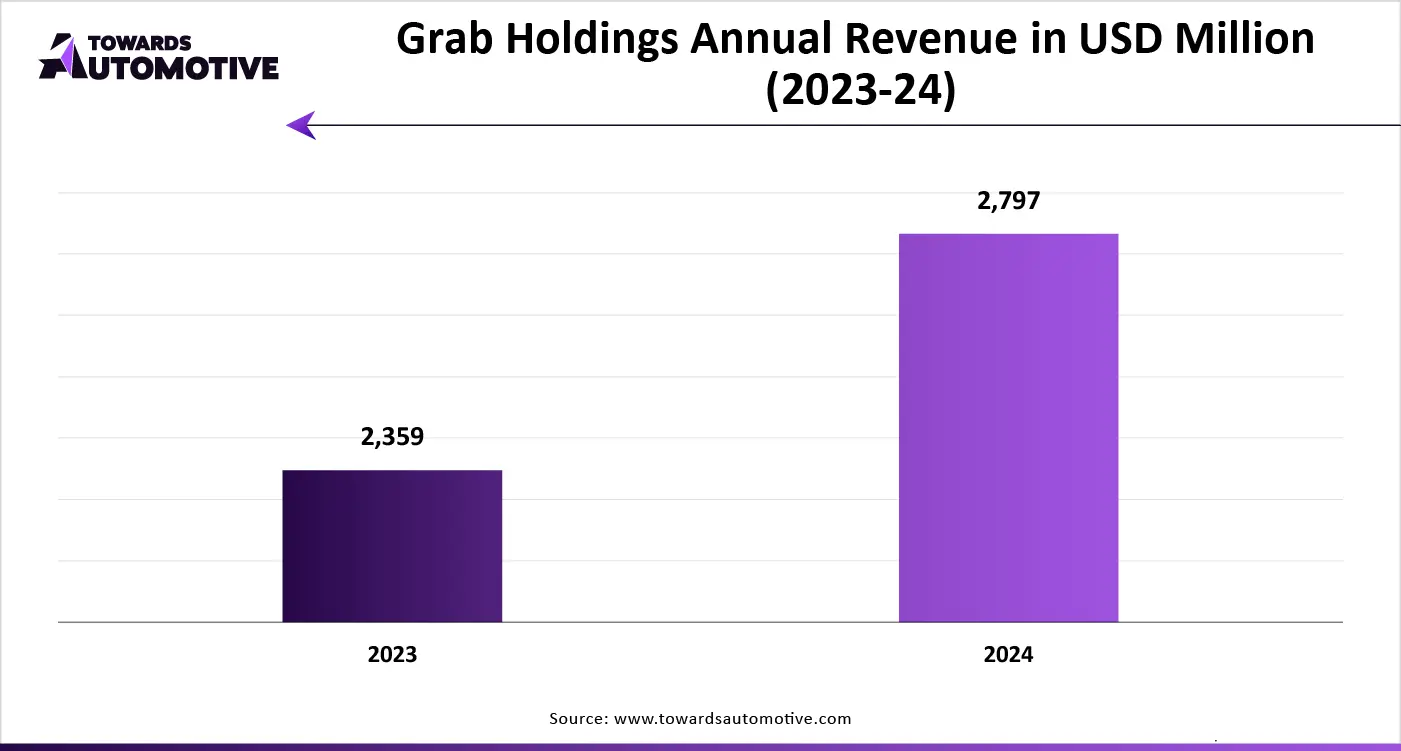

The fleet management market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Freeway Fleet Systems, IBM Corporation, TomTom N.V. U.S, Fleetmatics Group PLC, General Services Administration, Telogis, AT&T Inc., Grupo Autofin de Monterrey, Navico I.D. System, MiTAC International Corporation, Trimble Transportation & Logistics, Didi Chuxing, Grab, Cisco Systems, Uber Technologies, Scope Technologies and some others. These companies are constantly engaged in developing fleet management solutions and adopting numerous strategies such as partnerships, joint ventures, collaborations, launches, business expansions, acquisitions, and some others to maintain their dominance in this industry.

By Component

By Fleet Type

By Deployment

By End User

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us