October 2025

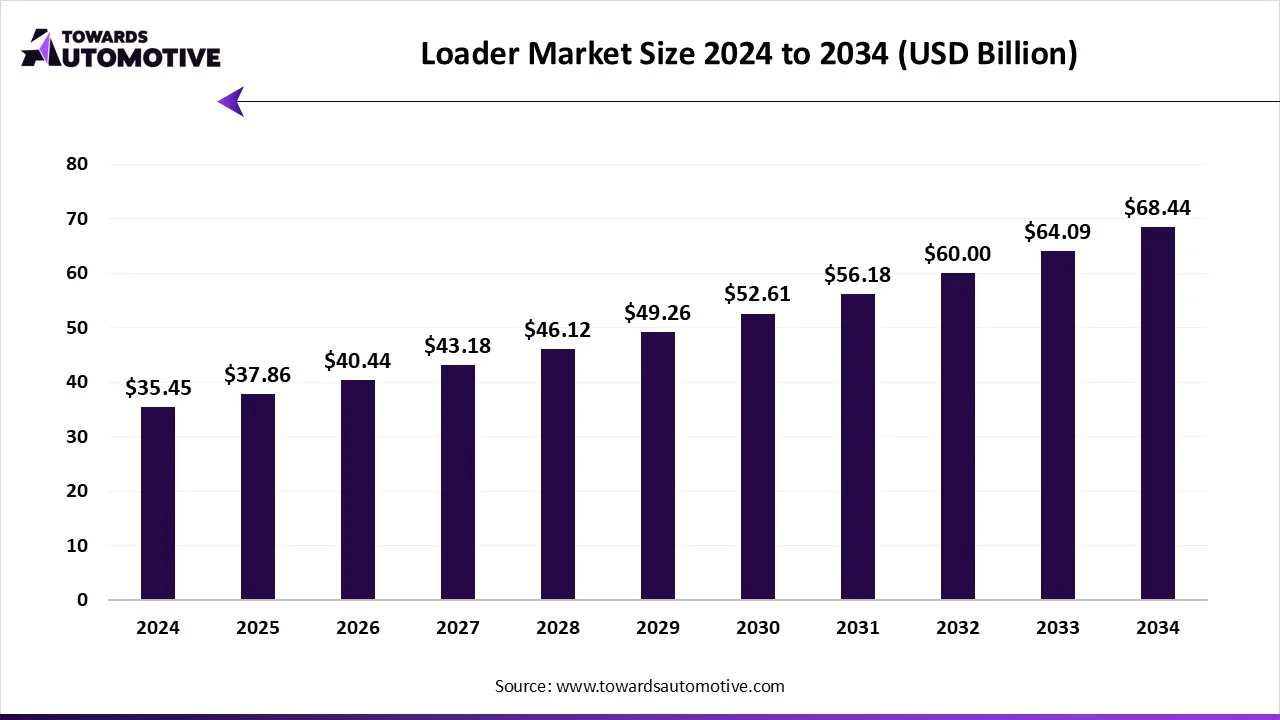

The loader market is forecast to grow at a CAGR of 6.8%, from USD 37.86 billion in 2025 to USD 68.44 billion by 2034, over the forecast period from 2025 to 2034. The rise in number of residential constructions in developed nations coupled with technological advancements in the automotive sector has driven the market expansion.

Additionally, the growing use of loaders in the agriculture sector along with numerous government initiatives aimed at developing the mining industry is playing a vital role in shaping the industrial landscape. The rising adoption of electric compact loaders in the forestry sector is expected to create ample growth opportunities for the market players in the upcoming days.

The loader market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of loaders in different parts of the world. There are several types of loaders developed in this sector including wheel loaders, skid steer loaders, backhoe loaders, track loaders, compact mini loaders and some others. These loaders are equipped with numerous power range consisting of less than 100 HP, 100-300 HP, 300 HP and some others. It finds application in several industries such as construction/infrastructure, mining & quarrying, agriculture & forestry, industrial/ waste management and some others. This market is expected to rise significantly with the growth of the construction sector around the globe.

The major trends in this market consists of business expansions, product launches and rapid growth of the mining sector.

The wheel loaders segment led the loader market with a share of around 45%. The increasing demand for wheel loaders from the mining sector and construction sector has driven the market expansion. Additionally, rapid investment by market players for opening new production unit to manufacture electric wheel loaders is playing a crucial role in shaping the industrial landscape. Moreover, the growing use of these equipment for scooping, lifting, and transporting large volumes of materials such as sand, gravel, dirt, debris and some others is expected to drive the growth of the loader market.

The compact/mini loaders segment is expected to expand with the fastest CAGR during the forecast period. The growing use of compact loaders in several sectors including landscaping, agriculture, municipal services and some others has boosted the market growth. Also, the increasing application of these equipment for operating numerous tasks such as site preparation, material handling, digging, snow removal and some others is contributing to the industry in a positive direction. Moreover, rapid adoption of electric compact loaders in the agricultural sector is expected to propel the growth of the loader market.

The 3–5 m³ segment dominated the loader market with a share of around 40%. The growing use of medium-capacity loaders in the mining sector has boosted the market expansion. Additionally, the increasing adoption of these loaders from the industrial sector for easing numerous complex operations is expected to foster the growth of the loader market.

The above 5 m³ segment is expected to grow with the fastest CAGR during the forecast period. The increasing use of high-capacity loaders in the construction sector for carrying bulk capacity of raw materials has driven the market growth. Additionally, the growing emphasis of market players for developing loaders with bucket capacity of around 5 m³ is expected to proliferate the growth of the loader market.

The 100-300 HP segment led the loader market with a share of around 50%. The increasing demand for mid-powered loaders from the agricultural sector to simplify numerous applications has driven the market growth. Also, the growing adoption of loaders that delivers power in range of 100-300 HP in the industrial sector is crucial for the shaping the industry in a positive direction. Moreover, rapid investment by market players for manufacturing loaders with 100-300 HP range is expected to foster the growth of the loader market.

The >300 HP segment is expected to rise with the highest CAGR during the forecast period. The increasing use of heavy-duty loaders in the construction sector for carrying heavy loads has driven the market expansion. Also, rapid investment by engine manufacturers for developing more than 300 HP engines to power loaders is playing a prominent role in shaping the industrial landscape. Moreover, the growing preference of mining companies to deploy loaders with more than 300 HP is expected to propel the growth of the loader market.

The diesel engine loaders segment led the loader industry with a share of around 85%. The growing adoption of heavy-duty loaders in the agricultural sector has driven the market expansion. Additionally, rapid investment by engine manufacturers to manufacture high-quality diesel engines for loaders is contributing to the industry in a positive manner. Moreover, numerous advantages of diesel loaders including high power, extended durability, superior fuel efficiency, quick refueling and some others is expected to drive the growth of the loader market.

The hybrid/electric loaders segment is expected to grow with the fastest CAGR during the forecast period. The increasing adoption of eco-friendly equipment in the construction sector for lowering emission has driven the market expansion. Also, the growing focus of automotive brands to develop advanced powertrains for electric and hybrid loaders is playing a prominent role in shaping the industrial landscape. Moreover, rapid investment by battery manufacturers for developing high-quality batteries to cater the needs of loaders is expected to foster the growth of the loader market.

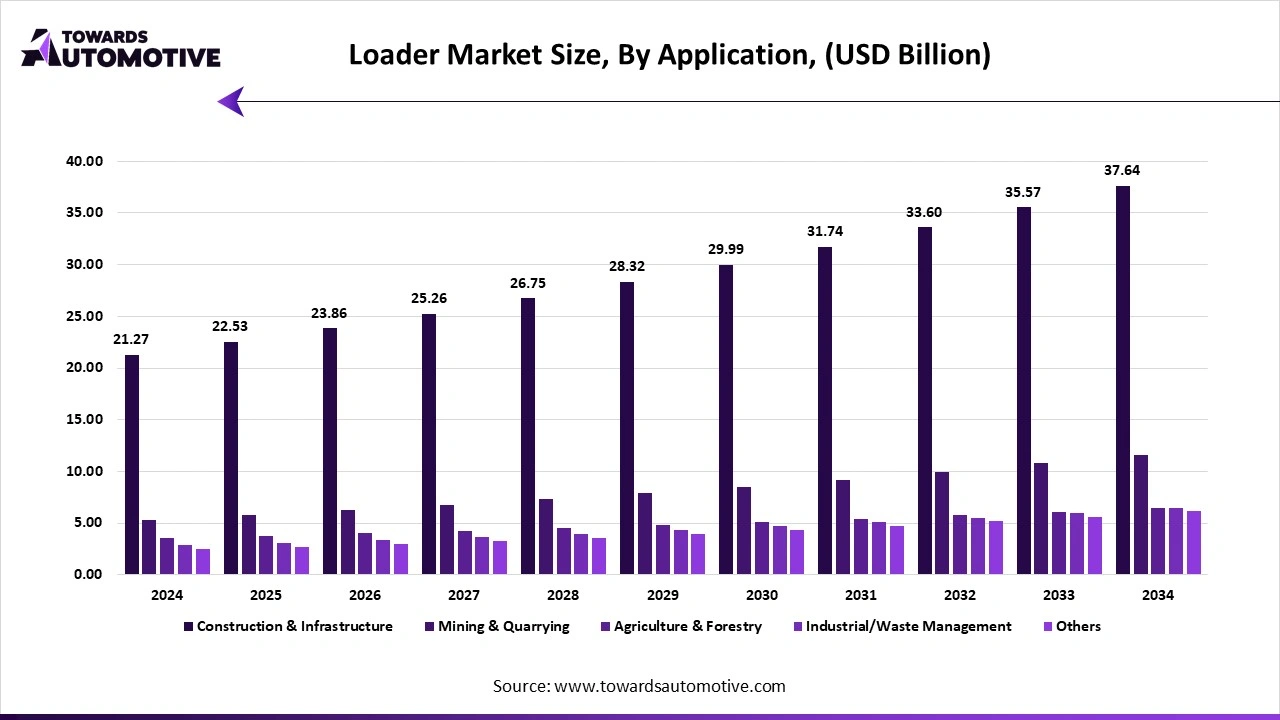

The construction & infrastructure segment held the largest share of the loader market with 55%. The rise in number of residential constructions in several nations such as India, the U.S., Canada, China and some others has driven the market expansion. Also, numerous government initiatives aimed at developing the road infrastructure along with rapid adoption of electric equipment in the construction sector is playing a prominent role in shaping the industrial landscape. Moreover, the rising use of track loaders and backhoe loaders in the construction sites is expected to foster the growth of the loader market.

The agriculture & forestry segment is expected to grow with the highest CAGR during the forecast period. The increasing preference of farmers to deploy advanced loaders in the agricultural sector for operating numerous tasks has boosted the market expansion. Additionally, the growing investment by government of several countries for developing the agricultural sector coupled with rapid adoption of hybrid loaders in the forestry sector is playing a positive role in the industrial development. Moreover, the rising use of tractor loaders and wheel loaders in the farming sector is expected to boost the growth of the loader market.

The OEM sales segment dominated the loader market with a share of around 60%. The rising preference of mining companies to purchase advanced loaders for long-term usage has driven the market expansion. Additionally, rapid investment by OEMs to open outlets for showcasing different types of loaders to attract new consumers is contributing to the industry in a positive manner. Moreover, numerous benefits and offers provided by OEMs to purchase new loaders is expected to drive the growth of the loader market.

The rental services & leasing segment is expected to expand with the fastest CAGR during the forecast period. The increasing emphasis of small-sized businesses to adopt loaders on rental basis for short-term usage has boosted the industrial growth. Also, the growing popularity of subscription-based loader leasing services in various nations such as the U.S., China, Canada and some others is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of rental services including reduced upfront costs, predictable budgeting, low operating costs and some others is expected to propel the growth of the loader market.

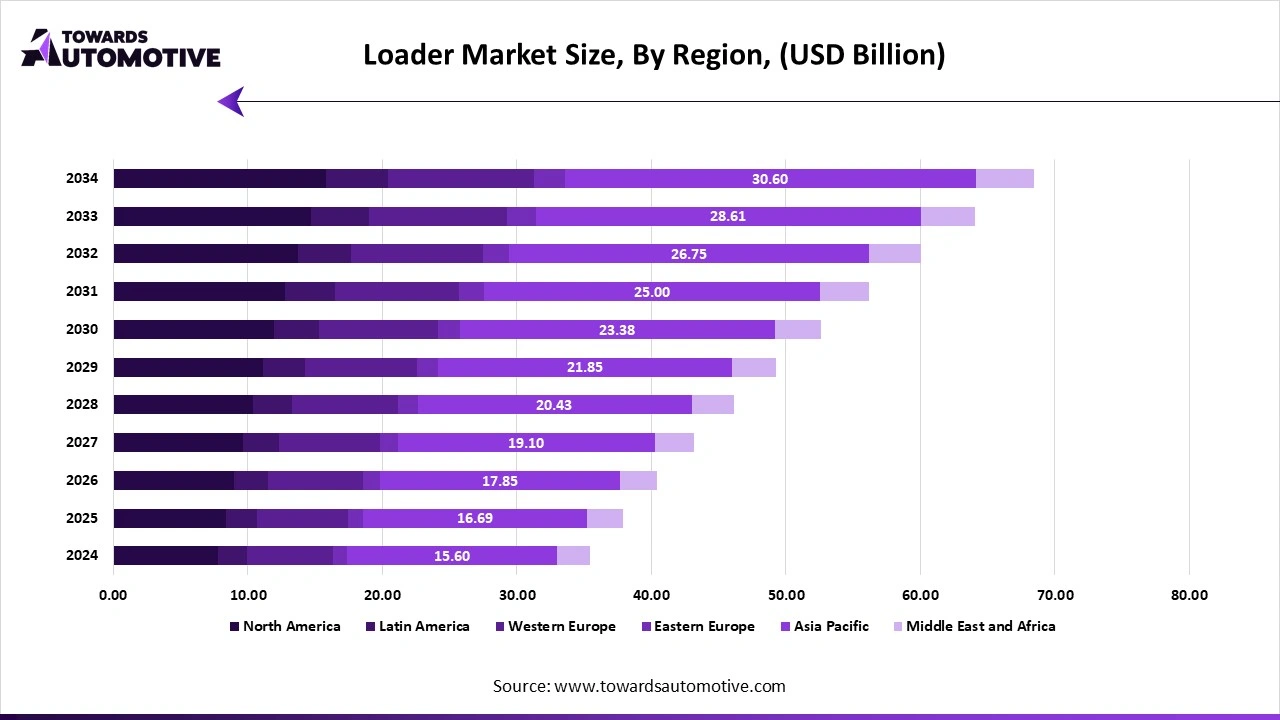

Asia Pacific led the loader market with a share of around 45%. The growing number of residential constructions in numerous countries such as India, China, Japan, South Korea and some others has driven the market growth. Also, numerous government initiatives aimed at developing the agriculture sector along with rapid investment by loader manufacturers for constructing new production units is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Hitachi Construction Machinery Co. Ltd, Hyundai Heavy Industries Co. Ltd, Doosan Infracore Co. Ltd and some others is expected to foster the growth of the loader market in this region.

China is the major contributor in this region. The growing emphasis of government for developing the road infrastructure along with rapid expansion of the mining sector has driven the market expansion. Additionally, the presence of several local loader manufacturers coupled with availability of raw materials at low prices is contributing to the industrial growth.

Middle East & Africa is expected to grow with the highest CAGR during the forecast period. The rise in number of government buildings in various nations such as UAE, Saudi Arabia, Qatar, South Africa and some others has boosted the market expansion. Additionally, the growing investment by government for developing the mining sector along with rapid adoption of eco-friendly equipment in the industrial sector is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Al-Bahar, Al-Futtaim Auto & Machinery Company (FAMCO), Thor Middle East and some others is expected to drive the growth of the loader market in this region.

UAE is the leading country in this region. The increasing adoption of electric loaders and hybrid loaders in the mining sector has propelled the market expansion. Also, rapid investment by government for developing the road infrastructure coupled with ongoing development in the agricultural sector is playing a crucial role in shaping the industry in a positive direction.

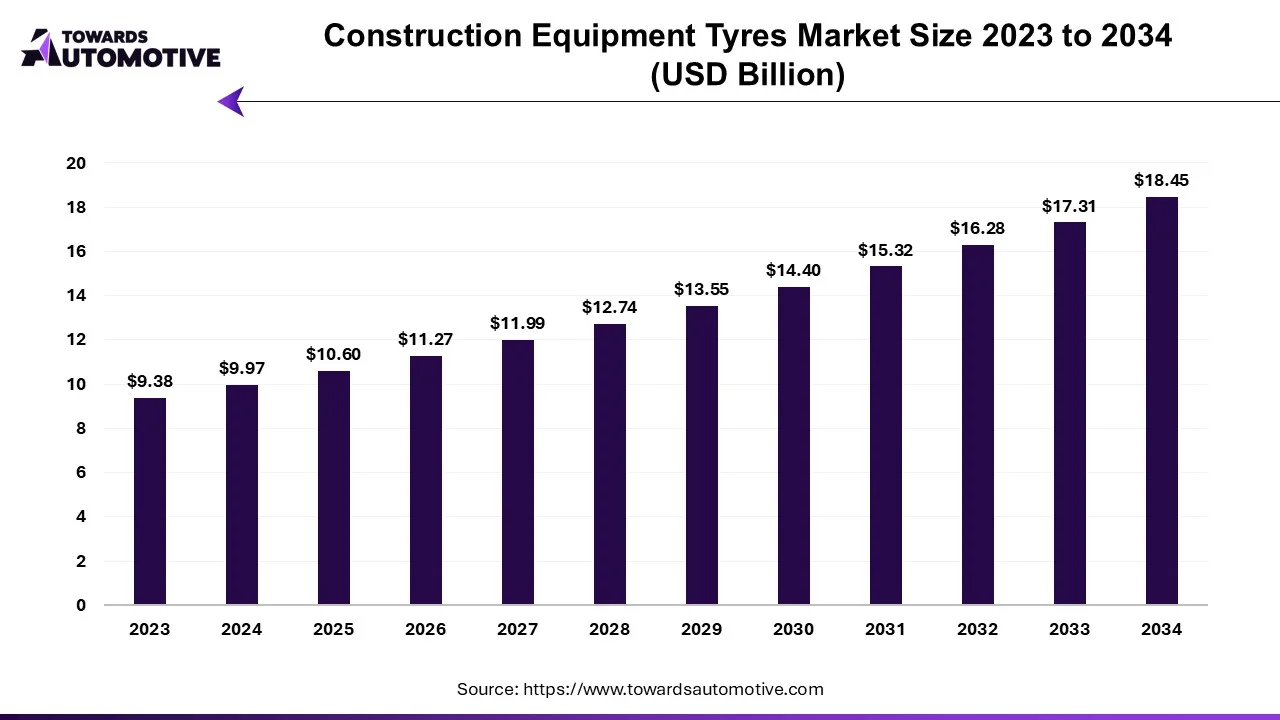

The global construction equipment tyres market is forecasted to expand from USD 10.60 billion in 2025 to USD 18.45 billion by 2034, growing at a CAGR of 6.32% from 2025 to 2034.

The construction equipment tires market is an important segment of the global construction and infrastructure ecosystem, supporting the efficient operation of heavy machinery across diverse industries. These tires are designed to endure extreme conditions, including rugged terrains, heavy loads, and varying weather environments, making them indispensable for construction, mining, and agricultural activities.

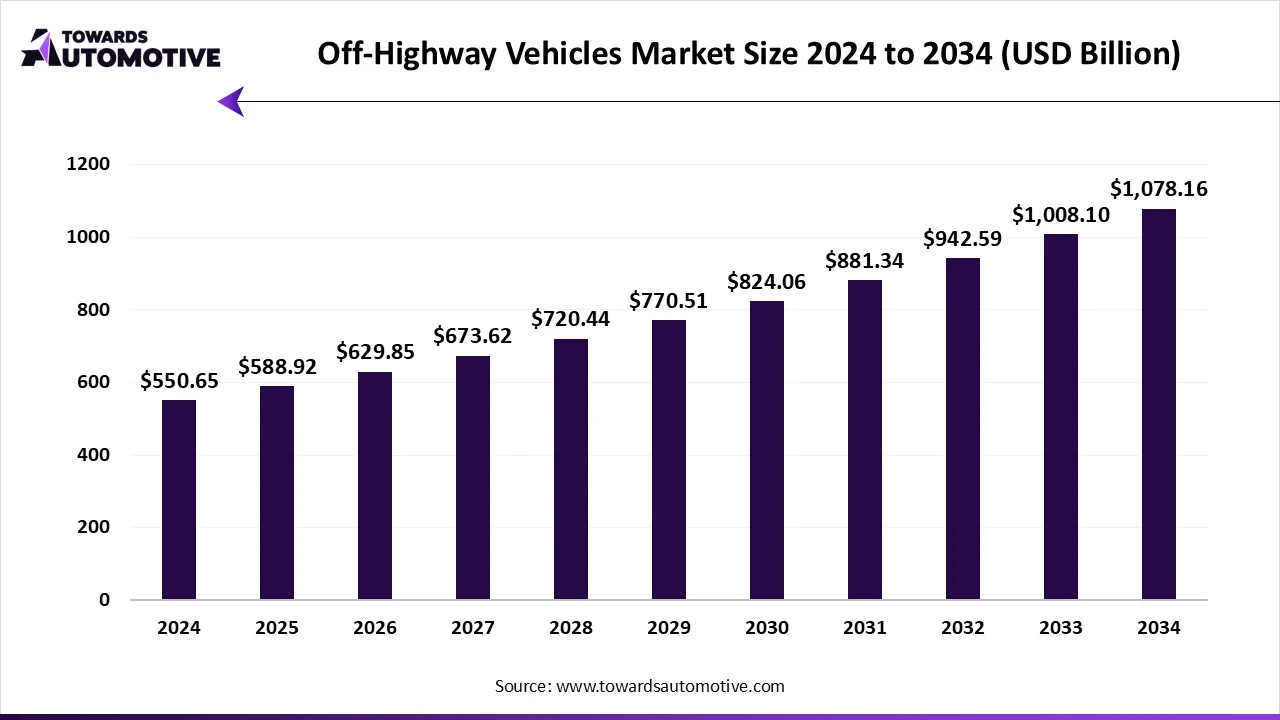

The off-highway vehicles market is forecast to grow from USD 588.92 billion in 2025 to USD 1078.16 billion by 2034, driven by a CAGR of 6.95% from 2025 to 2034. The off-highway vehicle market is rapidly expanding due to increasing construction of roads, bridges, and cities. Moreover, mining continues are engaged in expanding to meet the growing demand for metals and minerals, thereby driving the market growth. The future of electric and hybrid vehicle options continues to provide opportunities in the market.

The global off-highway vehicles (OHV) market includes the manufacturing and sale of vehicles designed primarily for off-roading applications. These vehicles are used in construction, agriculture, mining, forestry, and industrial sectors. OHVs include excavators, loaders, bulldozers, tractors, backhoe loaders, forklifts, and other specialized vehicles. The end-user in the market comprises of construction companies, agricultural enterprises & cooperatives, mining companies, industrial & warehouse operators, and forestry operators. The evolution of smart farming, modern mining and sustainable construction increases the demand for off-highway vehicles.

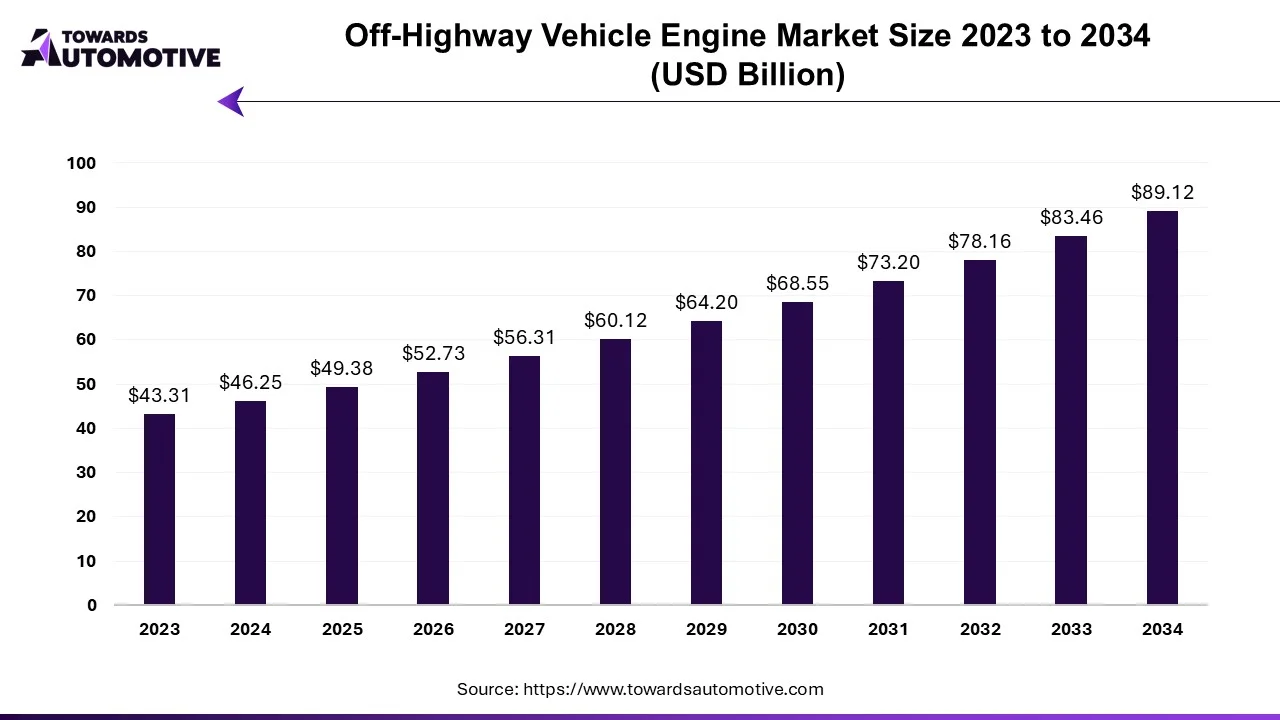

The Off-highway vehicle engine market is projected to reach USD 89.12 billion by 2034, expanding from USD 49.38 billion in 2025, at an annual growth rate of 6.78% during the forecast period from 2025 to 2034. The market is primarily driven by the growth of agriculture, construction, mining, and other industries where off-highway vehicles are essential for raw material transportation and other activities.

Off-highway vehicle (OHV) engines are designed for the usage in vehicles operating on challenging terrains such as mud, sand, rocks, and other rough conditions. The evolution of off-road engine technology remains intricately tied to advancements in agriculture and industrial machinery construction. The burgeoning agricultural sector in developing nations, coupled with the expansion of real estate and economic development on a global scale, serves as a catalyst for the continued innovation and economic prosperity of the agricultural machinery segment.

The foundation of loaders lies in the extraction and supply of essential raw materials such as Iron, Steel, Aluminum and Plastics.

Loader component fabrication involves forming (e.g., forging, bending, cutting) and joining (e.g., welding, bolting) metal parts like frames, arms, and buckets, followed by finishing processes such as cleaning, electrocoating, and painting for durability and corrosion resistance.

Retail trailer sales involvea buyer selecting a trailer and securing financing, typically through a loan from a bank, credit union, or finance company.

| September 2025 | Announcement |

| Nathan Ryan, the global product manager of skid steers and CTLs, Manitou | The demand for larger skids steers and CTLs continues to grow and it's preferred to add that power and capacity in the footprint of a compact machine that's still easy to transport and is familiar to operators versus adding a larger piece of construction equipment in many applications, at Manitou, we approached this as an opportunity to completely redesign the larger end of our product line to go toe-to-toe with other large-frame machines in the industry while maintaining our focus on lower total cost of ownership, versatility through attachment capabilities and connected technologies that improve fleet management. |

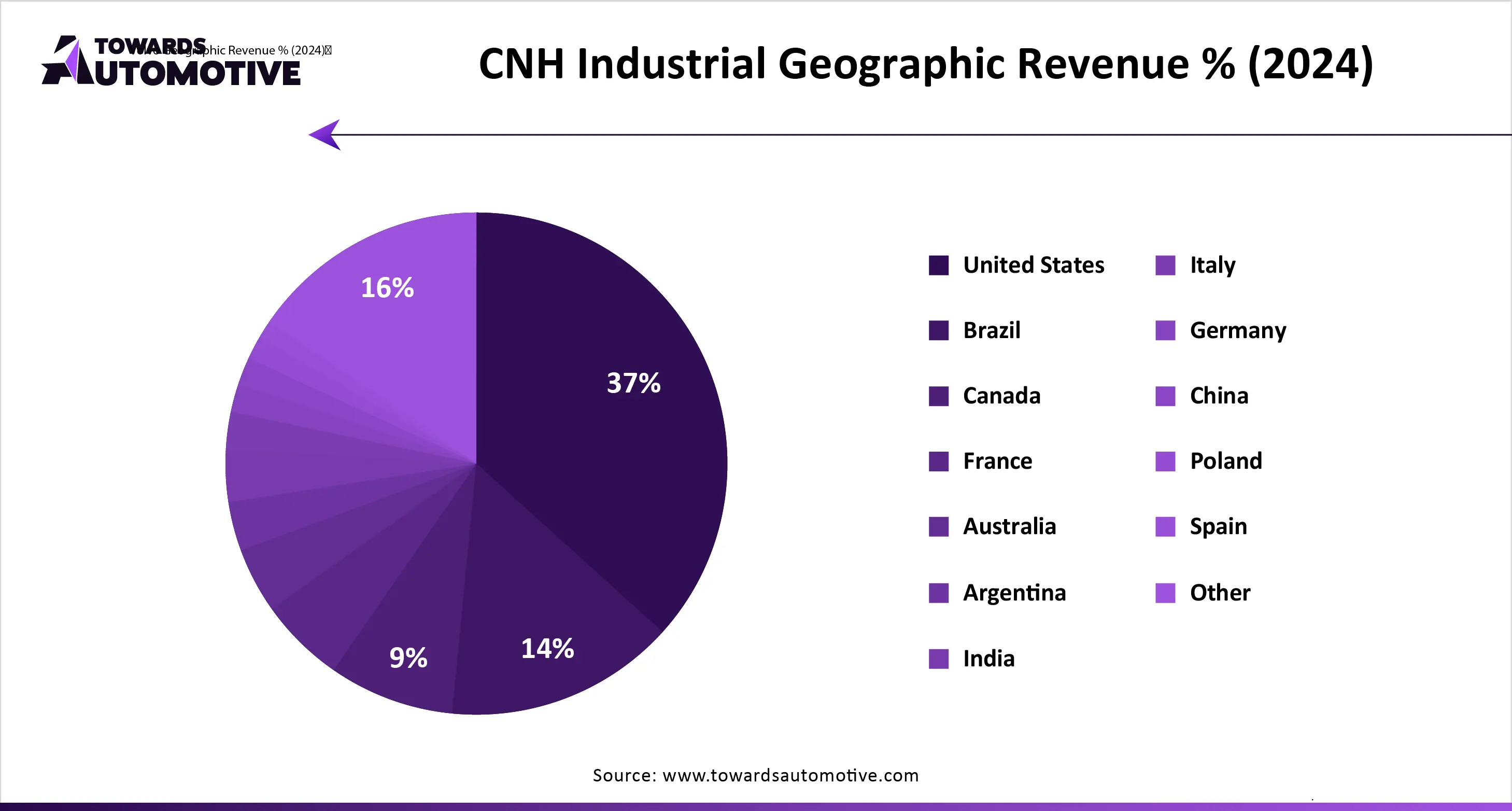

The loader market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Doosan Bobcat; Hitachi Construction Machinery Co., Ltd.; Kobelco Construction Machinery Co., Ltd.; Komatsu; Caterpillar; CNH Industrial N.V.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; AB Volvo; Liebherr and some others. These companies are constantly engaged in developing loaders and adopting numerous strategies such as partnerships, collaborations, launches, expansions, business expansions, acquisitions, joint ventures and some others to maintain their dominance in this industry.

By Type

By Power Range

By Drive Type

By Application / End-Use Industry

By Distribution / Business Model

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us