October 2025

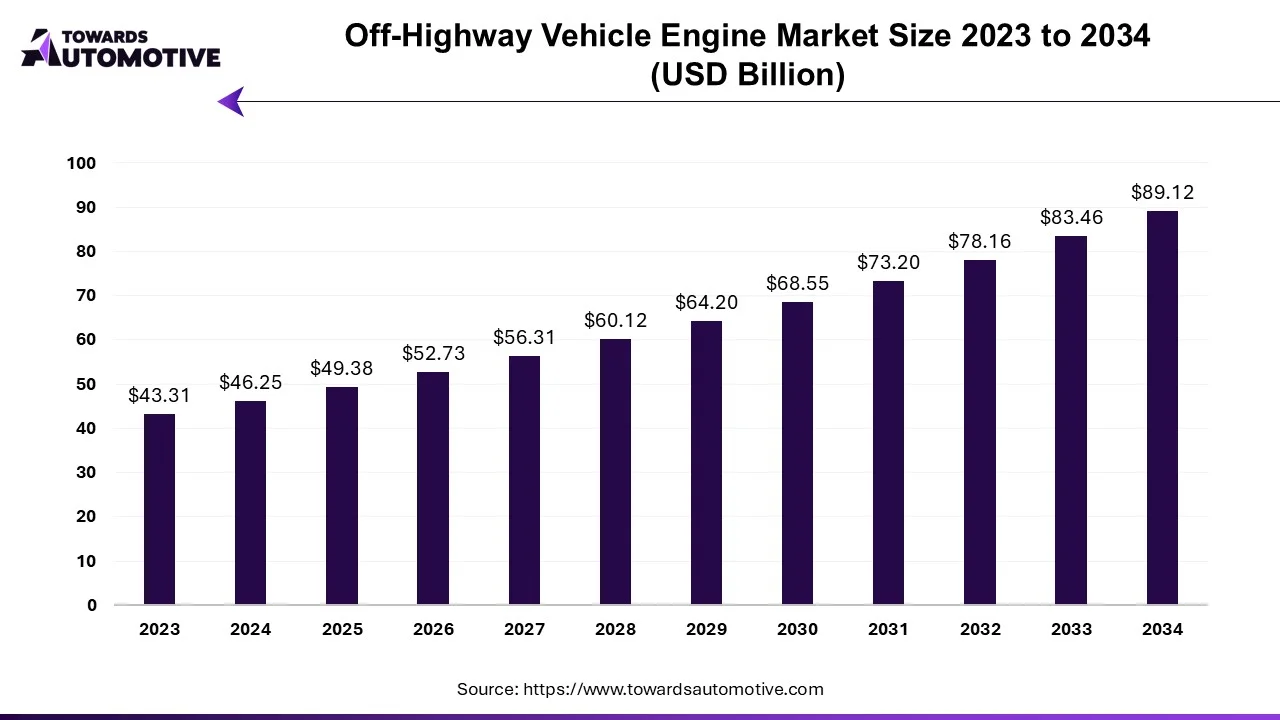

The Off-highway Vehicle Engine market is projected to reach USD 89.12 billion by 2034, expanding from USD 49.38 billion in 2025, at an annual growth rate of 6.78% during the forecast period from 2025 to 2034. The market is primarily driven by the growth of agriculture, construction, mining, and other industries where off-highway vehicles are essential for raw material transportation and other activities.

Off-highway vehicle (OHV) engines are designed for the usage in vehicles operating on challenging terrains such as mud, sand, rocks, and other rough conditions. The evolution of off-road engine technology remains intricately tied to advancements in agriculture and industrial machinery construction. The burgeoning agricultural sector in developing nations, coupled with the expansion of real estate and economic development on a global scale, serves as a catalyst for the continued innovation and economic prosperity of the agricultural machinery segment.

The burgeoning demand for and production of off-road vehicles is poised to propel the electric off-road vehicles market forward during the forecast period. Moreover, heightened activity across diverse sectors such as agriculture, construction, mining, and infrastructure has amplified the utilization of off-road vehicles in these domains.

However, persistent challenges related to high upfront costs and ongoing maintenance expenses pose barriers to widespread off-highway vehicle adoption. Economic viability remains a pivotal consideration in the off-road vehicle landscape. Regulatory bodies worldwide have instituted stringent emissions standards aimed at curbing carbon emissions from vehicles. Off-highway engines are thus being adapted to mitigate the environmental impact of off-road vehicles, driving the shift towards cleaner off-road transportation solutions.

The major trends in this industry include adoption of fuel alternatives, increased focus on fuel efficiency and emission reduction, and integration of IoT in OHV.

Consumers are increasingly preferring emission-free vehicles due to environmental concerns. It is fueling the development of off-highway vehicles powered by alternative fuels such as natural gas, electricity, and others.

Engine manufacturers are focusing on designing fuel-efficient and lower emission engines due to stringent environment regulations by governments.

Integrating IoT in off-highway vehicle (OHV) engines involves utilization sensors and data analytics to monitor engine performance, detect faults, and enable predictive maintenance which improve efficiency and reduce downtime.

The construction machinery segment dominated the market. Off-highway vehicle engines are crucial in the construction and mining sectors to power heavy machinery for various tasks such as earthmoving, material handling, and site operations. These engines are important for driving excavators, loaders, dump trucks, and other equipment used in challenging terrains.

The agricultural machinery segment is anticipated to witness the fastest growth rate during the forecast period. The increasing mechanization of agriculture sector has fueled the demand for these engines, particularly in developing countries where agricultural machineries are becoming common. Off-highway diesel engines are a common choice for tractors due to their ability to deliver high torque and power for various agricultural operations such as tilling, planting, and harvesting. These engines power harvesters and other harvesting equipment to provide the required power for cutting and collecting crops.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Construction Machinery | 30.06 | 31.95 | 33.96 | 36.09 | 38.36 | 40.77 | 43.33 | 46.05 | 48.93 | 52 | 55.26 |

| Agricultural Machinery | 16.19 | 17.43 | 18.77 | 20.22 | 21.77 | 23.43 | 25.23 | 27.16 | 29.23 | 31.47 | 33.87 |

The diesel segment dominated the market with the largest market share. Off-highway vehicle engines, particularly those using diesel fuel, are designed for applications in agriculture, construction, and mining. They focus high load-carrying capacity, power output, and durability which make them suitable for heavy-duty tasks on uneven surfaces. Off-highway diesel engines are built for rugged conditions and long-term performance, ensuring consistent operation even under heavy loads. These diesel engines power a wide range of off-highway vehicles such as tractors, excavators, bulldozers, loaders, and more.

The others segment is anticipated to witness the fastest growth in the market. The other segment involved electrified vehicles or natural gas-based vehicles. CNG and LNG off-highway vehicle engines reduce emissions, improve air quality, have quite operation, cost-effective, and safe. CNG/LNG vehicles are suitable for a range of applications, including trucks and smaller off-highway vehicles.

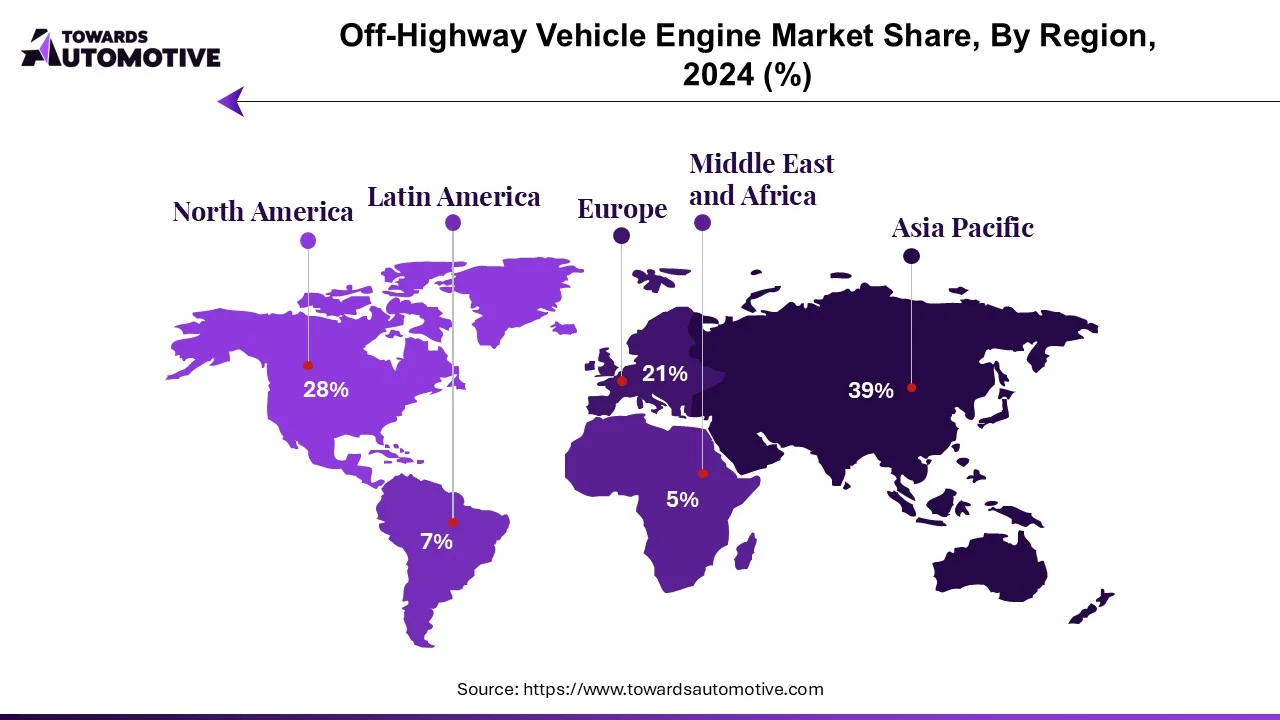

Asia Pacific is dominating the off-highway vehicle engine market due to rapid economic growth, infrastructure, and agricultural developments. Major countries such as China and India are experiencing substantial economic growth and infrastructure development which is causing to surge in demand for construction and mining equipment. Some of the major players in this region are Kubota Corporation (Japan), Deutz AG (Germany), Komatsu Ltd. (Japan), Mahindra & Mahindra Ltd. (India), Weichai Power Co., Ltd. (China), Yanmar Holdings Co., Ltd. (Japan), and Machinery Co. Ltd. (Japan). Asia Pacific is a significant exporter of these engines.

Europe is the fastest-growing in the market due to multiple reasons such as increasing demand for fuel-efficient and low-emission engines, adoption of advanced automotive technologies, and growing construction and agriculture sectors. Stricter EU incentives for electric and hybrid equipment are further accelerating market growth. Hatz, Scania, Mercedes-Benz, Deutz, Liebherr, BMW and Volkswagen are some major off-highway vehicle engines manufacturers in Europe.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 10.18 | 10.77 | 11.39 | 12.05 | 12.75 | 13.48 | 14.26 | 15.08 | 15.95 | 16.86 | 17.83 |

| Europe | 9.71 | 10.3 | 10.92 | 11.57 | 12.27 | 13 | 13.78 | 14.6 | 15.48 | 16.4 | 17.38 |

| Asia-Pacific | 19.89 | 21.33 | 22.89 | 24.55 | 26.34 | 28.25 | 30.3 | 32.5 | 34.86 | 37.39 | 40.11 |

| Latin America | 3.24 | 3.51 | 3.8 | 4.11 | 4.45 | 4.82 | 5.21 | 5.64 | 6.1 | 6.59 | 7.13 |

| Middle East & Africa | 3.24 | 3.48 | 3.74 | 4.03 | 4.33 | 4.65 | 5 | 5.38 | 5.78 | 6.22 | 6.68 |

The off-highway vehicle engine market is a competitive industry with the presence of several dominating players. Some of the prominent companies in this industry are AGCO Corporation, Caterpillar Inc., Cummins Inc., Deere & Company, Deutz AG, Komatsu Ltd, Mahindra & Mahindra Limited (Mahindra Powertrain), Scania AB, Volvo Penta, Yanmar Co. Ltd, Weichai Power Co. Ltd, and Kubota Corporation. These companies adopt numerous strategies such as product launches, partnerships, business expansion, acquisition, and some others to offer best products.

By Power Output

By Fuel Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us