October 2025

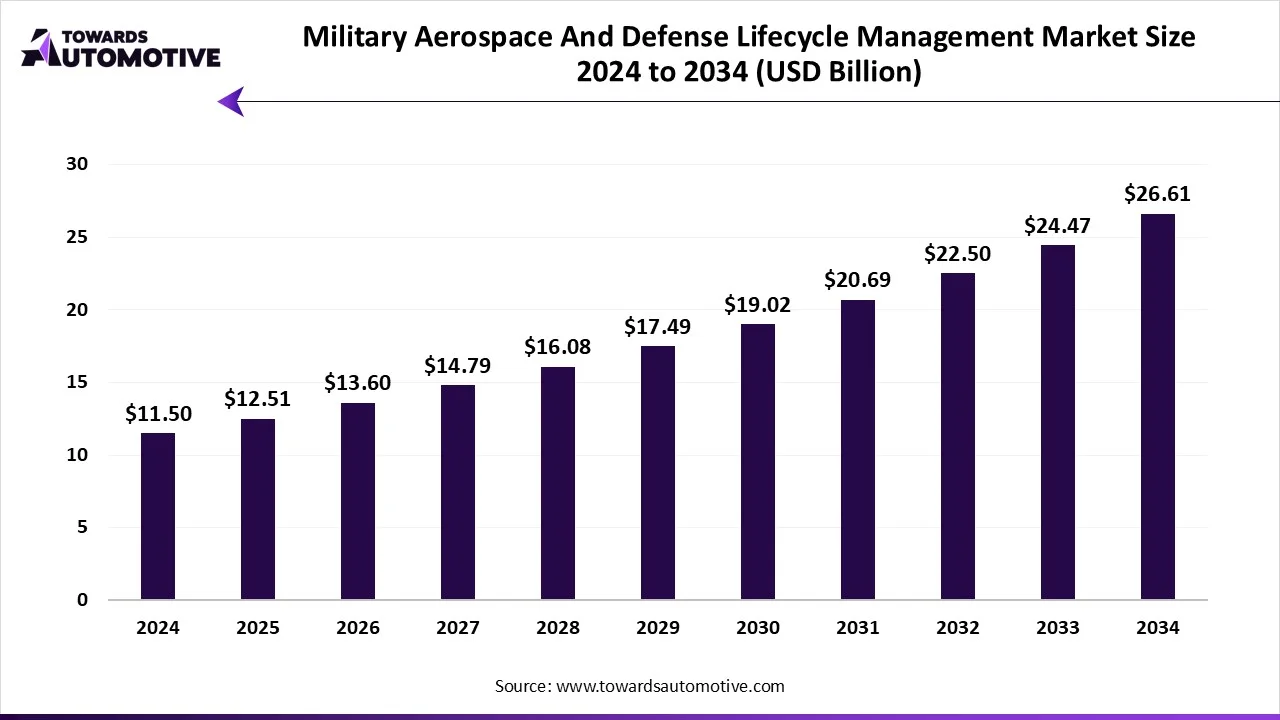

The military aerospace and defense lifecycle management market is forecasted to expand from USD 12.51 billion in 2025 to USD 26.61 billion by 2034, growing at a CAGR of 8.75% from 2025 to 2034. The military aerospace and defense lifecycle management market is on the rise because defense forces around the world are looking for safer, cheaper, and more reliable systems. Increasingly positive defense budgets, the need to modernize aging aircraft and fleets, as well as the continuing focus on predictive maintenance, are major factors for this growth.

Moreover, military hardware is contributing to reduced failures and improved functionality through the use of digital tools such as digital twinning, IoT sensors, and artificial intelligence (AI). Also, cybersecurity has become a major factor for growth as militaries make the transition to digital platforms. Governments are also promoting more efficient, data-driven approaches to support cost-efficiencies and increase the useful life of expensive defense capital assets. Strong opportunities in the market arise with Civil–Military Tech Partnerships, Modernization Programs, sustainment, and adoption of green technology in the military aerospace and defense lifecycle management market.

The military aerospace & defense lifecycle management market covers digital solutions, software platforms, and integrated services that manage the entire lifecycle of defense assets from design and development, through production, deployment, maintenance, and eventual disposal or upgrade. ADLM ensures that complex military systems such as aircraft, naval vessels, vehicles, and weapons platforms are designed efficiently, sustain high readiness levels, comply with strict defense regulations, and extend operational lifespan. Adoption is driven by defense digital transformation initiatives, rising complexity of modern weapon systems, the need for predictive maintenance, supply chain resilience, and integration of technologies such as AI, digital twins, IoT, and cloud-based PLM/ERP solutions. They are leveraged in air forces, navies, armies, defense contractors, and others to maintain mission-ready capability for defense assets, which include, but are not limited to, aircraft, ships, and vehicles.

Applications include design & development, manufacturing & production management, fleet & asset management, predictive maintenance & sustainment, training & simulation, and obsolescence & disposal management. Various service models in the market comprise OEM Direct, defense IT/consulting integrators, specialized lifecycle service providers, and academia & defense research partnerships. The growth of this market segment is being driven by cost reduction, safety, and modernization needs of aerospace and defense forces, and the need for more efficient digital platforms. The market currently overlaps multiple sectors across aerospace and defense, but continuing constraints on budgets, shifts towards agility, and the need for modernization will drive the demand for artificial intelligence, cloud, and simulation and modeling tools in the market.

The trends in the military aerospace and defense lifecycle management market are partnerships, product launches, and defense joint ventures.

The PLM & MRO solutions segment dominated the military aerospace & defense lifecycle management market due to the requirements for keeping military aircraft and defense systems in service for longer and safer operations. Defense organizations rely on PLM & MRO systems to track the total lifecycle of equipment from design and manufacturing through in-service to disposal. MRO represents the operations incurred to keep an aircraft or weapon ready for deployment with minimal downtime. Additionally, military budgets are traditionally focused on sustainment and maintenance of equipment over new acquisitions, which makes PLM & MRO solutions an important segment of the market. The increased potential for savings, increased readiness, and improved decision-making of a comprehensive PLM & MRO solution make this segment the most established portion of the market.

The digital twin & simulation platforms segment is expected to grow at the fastest rate in the forecasted period due to the modern defense systems being very complex and costly in the real world. A digital twin makes it possible to create virtual representations of aircraft, ships, or weapons systems. The military can then carry out tests, analyze performance, predict points of failure, and simulate missions in a safe, cost-effective way without real-world risk. In addition, simulation plays an enormous role in the training of pilots, engineers, and others. As new technologies, such as artificial intelligence and advanced data analytics, become mainstream, digital twins are also becoming stronger and more accurate. There is rapid adoption of digital twin & simulation in the military, aerospace, and defense sector as defense agencies and militaries search for ways to more effectively manage, operate, and maintain their assets to be smarter, safer, and more cost-effective.

The on-premises segment dominated with around 55% of the total market share. On-premises deployment leads the military aerospace & defense lifecycle management market due to the need for defense organizations to have full control over their systems and data because of security issues. One of the main limitations to utilizing the cloud for military operations is that defense organizations have access to sensitive details, like the performance of an aircraft, mission, and classified designs, that cannot be put at risk by running on third-party servers. Therefore, on-premises solutions are used as they allow for complete ownership of infrastructure and lessen the likelihood of cyberattacks, data leakage, and other vulnerabilities. Furthermore, defense agencies frequently operate in secure environments with restricted access to the internet, which can make it ineffective to use the cloud. Moreover, most military organizations have long-standing IT infrastructures for on-premises deployment.

The cloud-based/Saas segment is expected to grow at the fastest rate during the forecasted period. Cloud and Software-as-a-Service (SaaS) deployment is accelerating faster than other deployment options as defense actors are slowly starting to understand the flexibility, scalability, and cost benefits attached to it. Cloud offers a unique opportunity for organizations to collaborate in real-time with multiple bases across the globe, contractors, and government agencies during joint operations. SaaS also provides the ability to quickly implement updates and easily apply AI, analytics, and cybersecurity tool integration. Modern defense strategies require faster and adaptable decisions, and cloud-based systems facilitate this need. Governments across the world are also investing in secure defense clouds, which will lessen the security concerns of the SaaS.

The fleet & asset management segment captured almost 35% of the military aerospace & defense lifecycle management market share. Fleet and asset management dominate the market because defence forces own thousands of aircraft, vehicles, and vessels that must be monitored continuously. This fleet & asset management application can help monitor how many hours, days, or nautical miles critical assets are used. Moreover, they are also used to track, as well as schedule maintenance, and maximize the useful service life of critical assets. Military aerospace and defense organizations implement fleet management solutions that reduce costs through less fleet downtime, optimize spare parts and delivery, improve mission capability, and centralized data collection for large fleets simplifies resource management. Since maintaining current assets is more cost-effective than proactively replacing assets, the fleet & asset management segment dominates the market.

The predictive maintenance & sustainment segment is expected to grow at the fastest rate in the market, as it prevents expensive breakdowns and accidents before they happen. A predictive maintenance/sustainment capability uses advanced analytics, sensors, machine learning and artificial intelligence techniques to estimate when a component will likely fail and replace it in time. This system results in significant savings on repair budgets while also increasing safety on important missions. Sustainment also maximizes the lifespan of expensive aircraft and vehicles so that military and defense organizations don't have to replace them sooner than necessary. Moreover, as defense budgets become more constrained, predictive maintenance will provide additional cost efficiencies and, even better, allow for improved operational readiness.

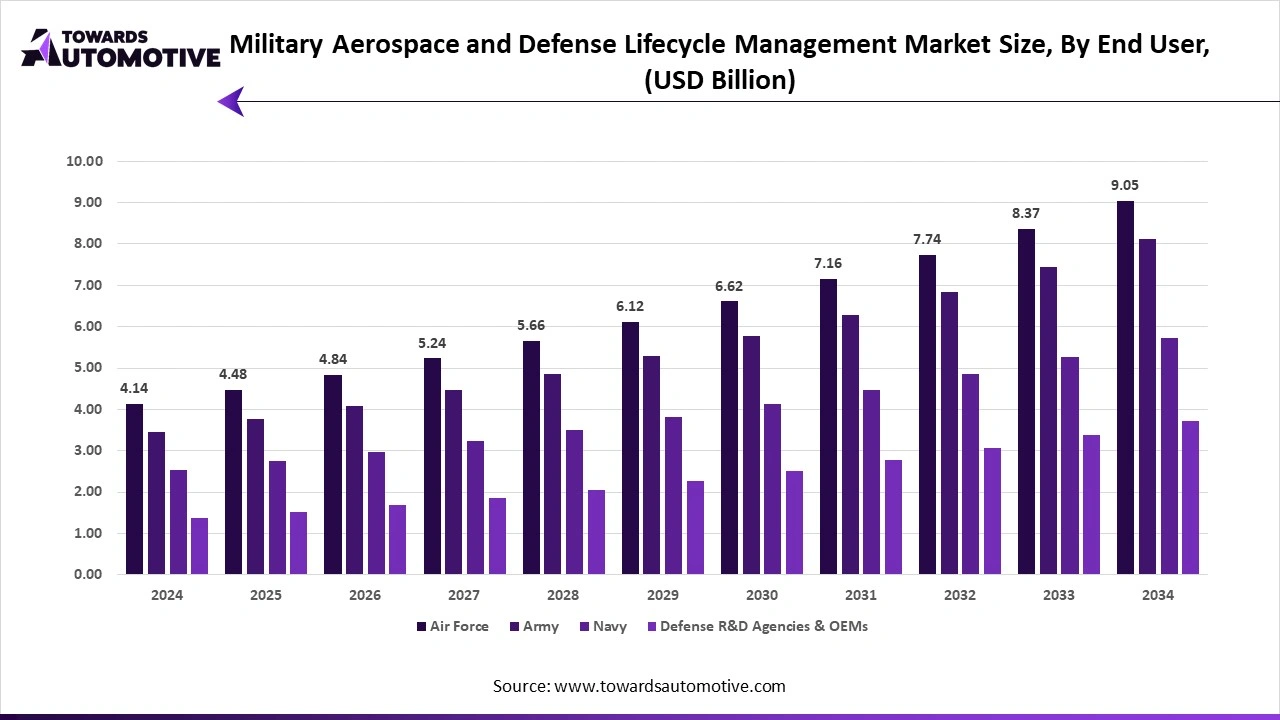

The Air Force dominated the military aerospace & defense lifecycle management market by capturing over 45% of the total market share. The Air Force is, by far, the predominant user of lifecycle management systems for military purposes, as military aviation is commonly used as a modern defense strategy to protect the security of nations around the world. Fighter jets, bombers, and transport aircraft are generally the most technically advanced and expensive categories in defense organizations. In addition, managing aviation resources across the lifecycle requires complex and innovative solutions that help ensure safety, readiness, and mission success. The Air Force maintains the largest percentage of the defence organization's advanced equipment that must be maintained, updated, and sometimes refurbished or recycled. Thus, the complexity of aviation requires the need to leverage lifecycle management solutions to operate efficiently. In summary, military aerospace lifecycle management solutions are highly utilized in aerospace operations as the Air Force demands high availability, strict safety standards, and continuous modernization.

The Navy is expected to be the fastest-growing segment in the forecasted period. The Navy is expanding primarily due to increased commitments to naval modernization and the increasing importance of global maritime security. Naval forces are acquiring advanced submarines, aircraft carriers, and warships, which require an extensive lifecycle management system to work smoothly. The technological complexity involved in naval systems provides an opportunity that requires digital solutions to support predictive maintenance, digital twins, and fleet management. In addition, heightened global tensions in maritime environments are prompting countries to put their emphasis back on naval power, and this supports the demand for lifecycle management technologies. Moreover, the maritime forces that are using unmanned systems and advanced sensors to collect and trade data and information in naval operations will require digital lifecycle solutions. Thus, the Navy is expected to grow at a rapid pace in the military aerospace & defense lifecycle management market.

The OEM direct segment captured almost 50% of the military aerospace & defense lifecycle management market share, as defense organizations prefer to work directly with the company that designed and built their aircraft, ships, or weapons. Original Equipment Manufacturer (OEM) direct services are the overwhelmingly preferred service model as they have the best technical expertise, guarantee original parts, and provide certified upgrades. The direct relationship with the OEM ensures the original manufacturer has the highest available trust, quality, and adherence to defense standards. In addition, the OEM includes long-term maintenance and support contracts, which allow both defense organizations and manufacturers to plan for the future. The military cannot afford to risk equipment failures or provide a prospect to obtain replacement; thus, they prefer OEM direct services, which makes it the preferred service model in the market.

The defense IT/consulting integrators segment is expected to grow at the fastest rate in the military aerospace & defense lifecycle management market, as militaries are investing more in technology while recognizing that OEMs will never be completely capable of a fully integrated IT solution. Defense IT and consulting integrators employ a highly flexible model with deep specialization in a variety of areas, including developing, combining, and integrating a variety of technologies to build a customized lifecycle management platform. They also ensure cybersecurity compliance and enable various defense organizations to adopt technologies such as artificial intelligence (AI), digital twins, and cloud services. In the present world, defense organizations are highly collaborative and require multiple partners and contractors to be fully engaged; thus, integrators play a key role in ensuring streamlined communication and data sharing.

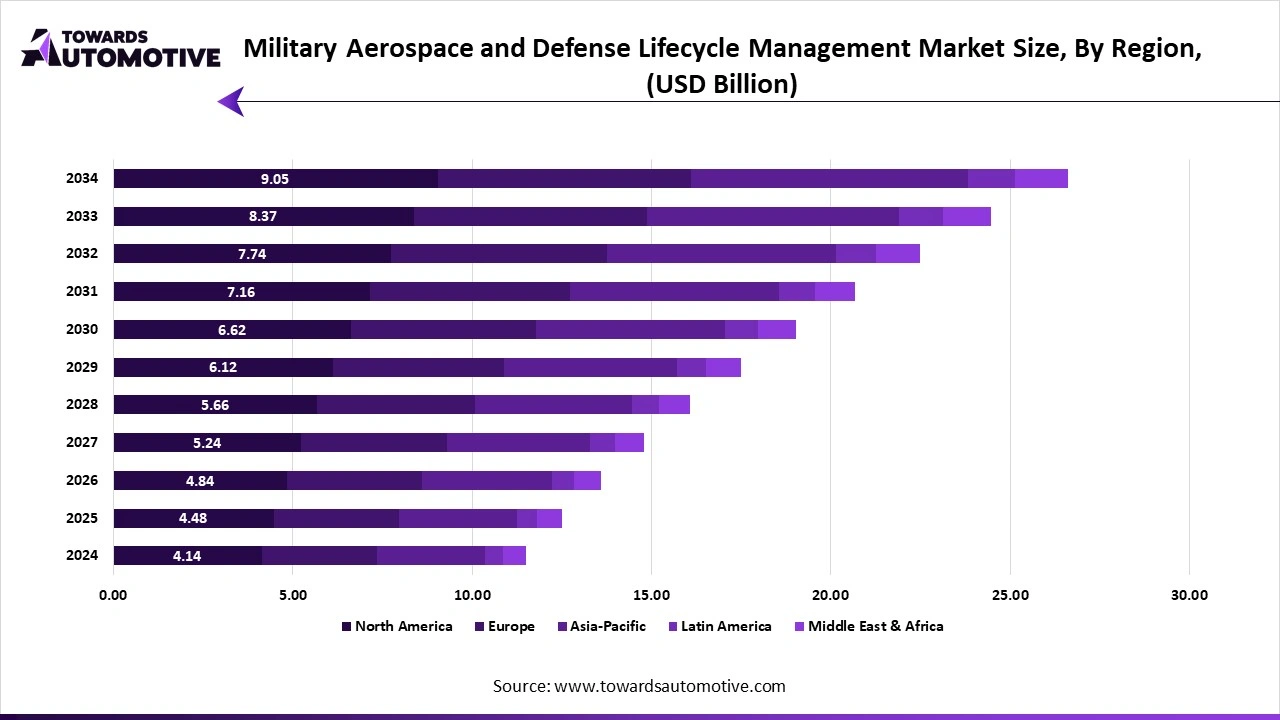

North America is the leading market in the global military aerospace and defense lifecycle management due to its very high defense budgets, highly advanced technologies, leading aerospace manufacturers, advanced research laboratories, and long-term partnerships with government agencies in the defense industry. In present times, military forces in North America lead innovation in digital twin, predictive maintenance, AI-based analytics, and secure defense cloud systems. The region has strong opportunities in fleet upgrades from old platforms to a modern digital solution, including environmental and green technologies. As the region moves toward more advanced infrastructure for authorized users, AI-powered and cybersecurity applied lifecycle tools for the aerospace & defense sector will continue to grow. These advanced adaptations in military development led North America to stand dominant in the global military aerospace and defense lifecycle management market.

The U.S. dominated the military aerospace and defense lifecycle management market in North America. The U.S. is one of the biggest investors in defense across the world, with the largest fleets of aircraft, naval vessels, and advanced weapons at its disposal. U.S. military aerospace and defense agencies are focused on increasing readiness and lowering costs long-term through predictive maintenance, AI, and digital twin platforms. Moreover, the U.S.-based companies are leaders in simulation, training, and secure defense IT systems. The market opportunities for the nation lie in upgrading aging military assets, reinforcing cybersecurity initiatives, and increasing the adoption of sustainability, such as energy-efficient systems, eco-friendly maintenance practices, and green technology. The U.S. government's push for innovation and global defense commitments makes it a dominant and key player in this market.

Asia-Pacific is expected to grow at the fastest rate in the global military aerospace and defense lifecycle management market due to increasing defense budgets, regional conflicts, and significant modernization programs in countries such as China, India, Japan, and South Korea. The governments in these countries are making considerable investments in advanced aircraft, navy vessels, and munitions to ensure strong lifecycle management. The region is adopting digital twins, AI analytics, and simulation platforms more rapidly than any other region. Significant opportunities persist in predictive maintenance, cloud- and subscriber-based solutions, and naval fleet management, primarily due to the increasing importance of maritime security in the South China Sea and illegal activities in the Indian Ocean. In addition, the combination of rapid economic growth and adoption of technology for military aerospace and defense lifecycle management in the Asia-Pacific region presents rapid growth opportunities for future market penetration in the region.

China is the dominant country in the military aerospace and defense lifecycle management market in Asia-Pacific, due to its state government spending extensively to develop new advanced aircraft, warships, and weapons systems to grow its global superpower status. The Chinese defense industry is quickly modernizing its approach to lifecycle management, investing heavily in AI, digital twins, and simulation tools across its entire defense portfolio to reduce cost and improve operational efficiencies. Additionally, the country is investing in products and services related to predictive maintenance and sustainability to support the lifespan of its growing fleet across various defense sectors. Strong opportunities in China’s military aerospace and defense lifecycle management market arise with developments in naval asset management and complete digital defense solutions packages to solidify management, accountability, and visibility of its maritime interests. Moreover, the country’s rapid industrial success and development agendas, fueled by state support, place it as the regional leader in the military aerospace and defense lifecycle management market.

| June 2025 | Announcement |

| Karen Schultheis, the agency’s Information Technology executive director, chief information officer and Organizational Infrastructure Board manager. | Onboarding is a new employee's first impression of the agency, and we want to make it great for everyone. Think back to when you onboarded to DCMA. Was it smooth? Was it fast? Did you get everything you needed when you needed it? I'm sure some of you are saying ‘yes, it was great,’ while others are rolling your eyes and thinking, ‘no, that was not my experience. |

| June 2025 | Announcement |

| Nadir Izrael, CTO and Co-Founder at Armis. | As threat actors continue to amplify the scale and sophistication of cyberattacks, a proactive approach to reducing risk is essential, the Armis Vulnerability Intelligence Database is a critical, accessible resource built by the security community, for the security community. It translates vulnerability data into real-world impact so that businesses can adapt quickly and make more informed decisions to manage cyber threats. |

| April 2025 | Announcement |

| Guillaume Faury, CEO, Airbus | Digitalization is a key enabler that we are leveraging to support our core priorities, whether it is ramping up the production of our commercial aircraft, preparing the next generation of platforms that will further contribute to the decarbonization of our sector, or pioneering the defense and security solutions of tomorrow, This renewed partnership with Dassault Systèmes will play an important role in accelerating our progress towards these goals, while ensuring the highest levels of quality, safety and security throughout the lifecycle of our products and solutions, from design to in-service operations. |

| April 2025 | Announcement |

| Edward Mehr, CEO and Co-Founder of Machina Labs. | When an aircraft is grounded waiting for a replacement part, it’s not just a logistics issue – it’s a readiness issue, At Machina Labs, we’re enabling the U.S. military to manufacture mission-critical parts on demand, as close to the point of need as possible. This contract demonstrates the DoD’s confidence in our technology and its commitment to advancing agile, AI-driven manufacturing across sustainment operations. |

| February 2025 | Announcement |

| Danny de Vreeze, Vice President, Identity & Access Management at Thales | Authentication is at the heart of securing identities and we are committed to supporting organizations securely transition to passwordless authentication. This solution eliminates the barriers to smooth adoption and enables IT teams to easily manage FIDO security keys beyond just the enrollment. The OneWelcome FIDO Key Lifecycle Management solution is a crucial part of our Passwordless 360° approach that encourages organizations to deploy passwordless at scale and reap its strategic benefits. |

The military aerospace and defense lifecycle management market is highly competitive. Some of the prominent players in the market are Aras Corporation, ATS Global B.V., Dassault Systèmes SE, Honeywell International Inc., Infor, PROLIM, PTC Inc., Cyient Limited, Siemens AG, and Nikon SLM Solutions AG. Firms in the military aerospace and defense lifecycle management market are either partnering or collaborating to strengthen their technology and boost innovation in key areas, such as predictive maintenance, electromagnetic systems, and overall lifecycle offerings. Contracts with military OEMs are being secured for long-term commitments to develop a supply chain, as well as heavy investments in research and development. Moreover, the contracts also help in acquiring specialist firms to fill expertise gaps.

Additionally, some start-ups are also demonstrating autonomous drones, launching hybrid-electric engine programs, or building sovereign defense clouds to build national security trust. Opportunities for companies in the military aerospace and defense lifecycle management market include advancements in cybersecurity, AI & machine learning, digitization & automation, and sustainability through green technology.

By Solution / Component

By Deployment Mode

By Application

By End-User / Military Branch

By Service Model

By Region / Country

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us