September 2025

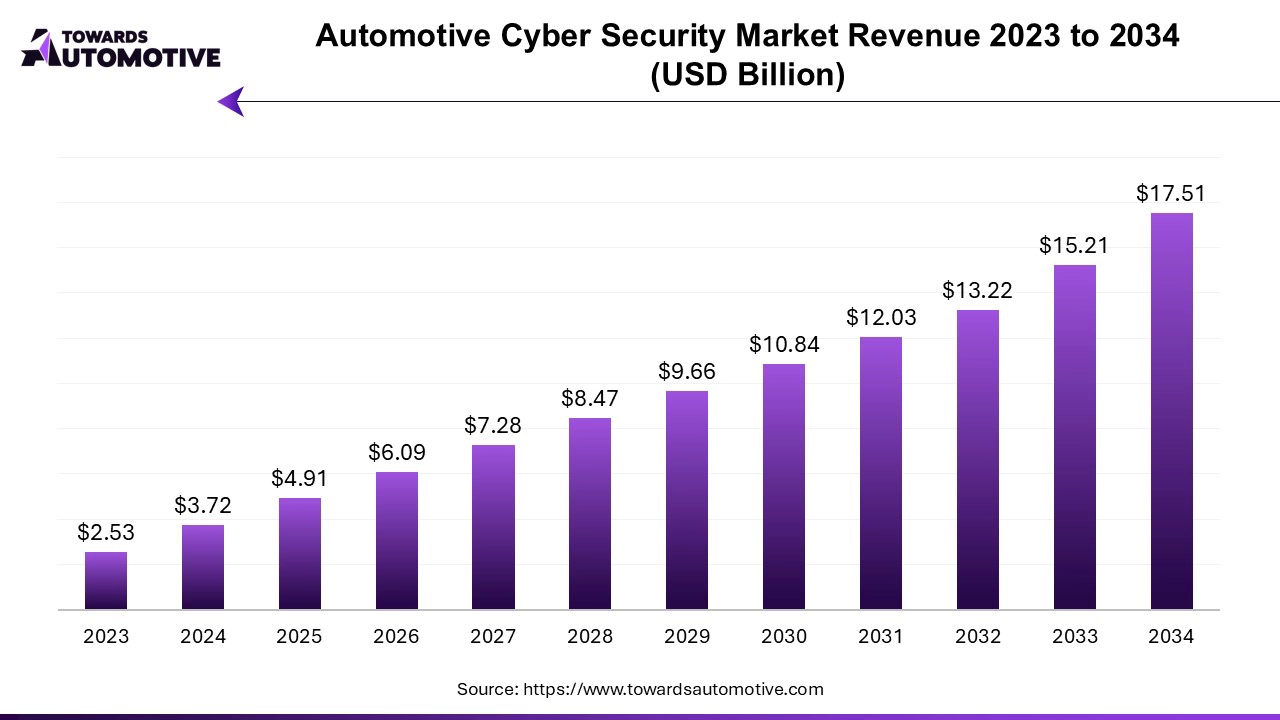

The automotive cyber security market is set to grow from USD 4.91 billion in 2025 to USD 17.51 billion by 2034, with an expected CAGR of 15.14% over the forecast period from 2025 to 2034. The rising cases of phishing attacks in modern cars coupled with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape.

Moreover, the increasing adoption of cloud-based cyber security solutions by automotive companies along with ongoing trend of connected vehicles has contributed to the market expansion. The integration of AI and IoT in cyber security solutions as well as rising complexities in vehicle infrastructure is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive cyber security market is a crucial branch of the automotive industry. This industry deals in developing and distributing cyber security solutions for the automotive sector. There are different types of cybersecurity solutions delivered by this sector comprising of in-vehicle cybersecurity and external cloud security. These solutions are designed for numerous types of vehicles including passenger vehicles and commercial vehicles. It finds application in various automotive systems consisting of ADAS & safety, body control & comfort, infotainment, telematics, powertrain systems, communication systems and some others. The growing number of hackers in western nations has boosted the market expansion. This market is expected to rise significantly with the rise of the software industry in different parts of the world.

The infotainment segment dominated the market. The growing demand for affordable infotainment systems in developing nations has boosted the market growth. Additionally, the integration of AI and blockchain in advanced infotainment systems coupled with rising cases of infotainment-based cyber attacks is playing a crucial role in shaping the industrial landscape. Moreover, the increasing demand for advanced infotainment systems in luxury cars is expected to boost the growth of the automotive cyber security market.

The ADAS & safety system segment is expected to grow with a notable CAGR during the forecast period. The rising cases of cyber attacks related to ADAS systems coupled with rapid adoption of autonomous vehicles in the U.S. and China has boosted the market expansion. Also, numerous government initiatives for mandating ADAS in vehicles along with integration of advanced cybersecurity solutions in ADAS systems is playing a vital role in shaping the industry. Moreover, the integration of AI-based cybersecurity solutions in ADAS-enabled cars is expected to propel the growth of the automotive cyber security market.

The electric vehicle segment held the highest share of the market. The growing demand for eco-friendly vehicles in the European region to curb emission has boosted the market expansion. Additionally, the rising adoption of EVs in China, India, the U.S. and some others along with technological advancements in the EV sector is playing a vital role in shaping the industrial landscape. Moreover, partnerships among EV brands and cybersecurity providers to develop advanced solutions for the automotive sector is expected to propel the growth of the automotive cyber security market.

The passenger car segment is expected to grow with a considerable CAGR during the forecast period. The growing use of advanced security systems in passenger vehicles to provide additional protection against cyber attacks has boosted the market growth. Also, the increasing sales of luxury vehicles in the developed nations coupled with integration of cybersecurity solutions in modern vehicles is positively contributing to the industry. Moreover, collaboration among market players and automotive companies to design new cybersecurity solutions is expected to boost the growth of the automotive cyber security market.

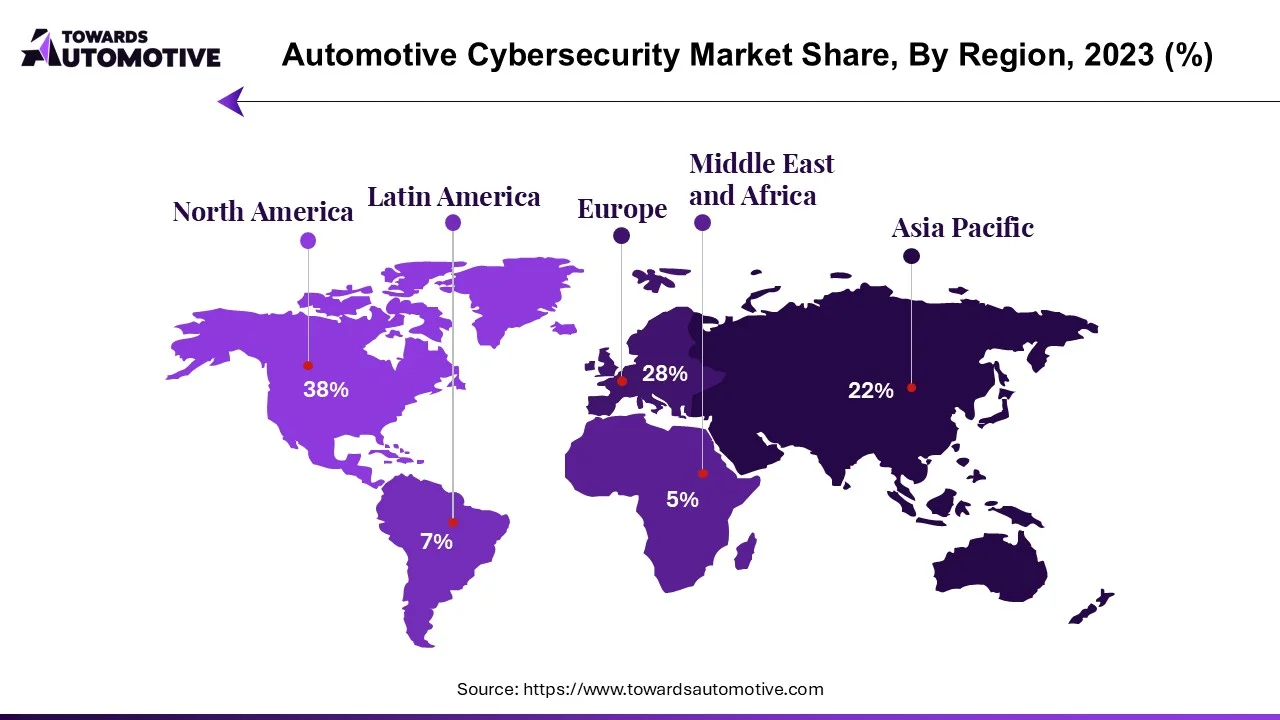

Asia Pacific led the automotive cyber security market. The growing sales of low-range hatchbacks in several countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, the increasing consumer preference to purchase affordable infotainment systems coupled with rising cases of cybercrime issues is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of numerous market players such as Denso, SecureKloud Technologies, Beijing Jingwei HiRain Technologies and some others is expected to drive the growth of the automotive cyber security market in this region.

North America is expected to rise with a significant CAGR during the forecast period. The rising adoption of electric vehicles in the U.S. and Canada has driven the market growth. Also, numerous government initiatives aimed at strengthening the automotive cyber security along with growing sales of autonomous vehicles is playing a crucial role in shaping the industrial landscape. Moreover, the presence of several market players such as Harman International, Trillium Secure, Dellfer and some others is expected to boost the growth of the automotive cyber security market in this region.

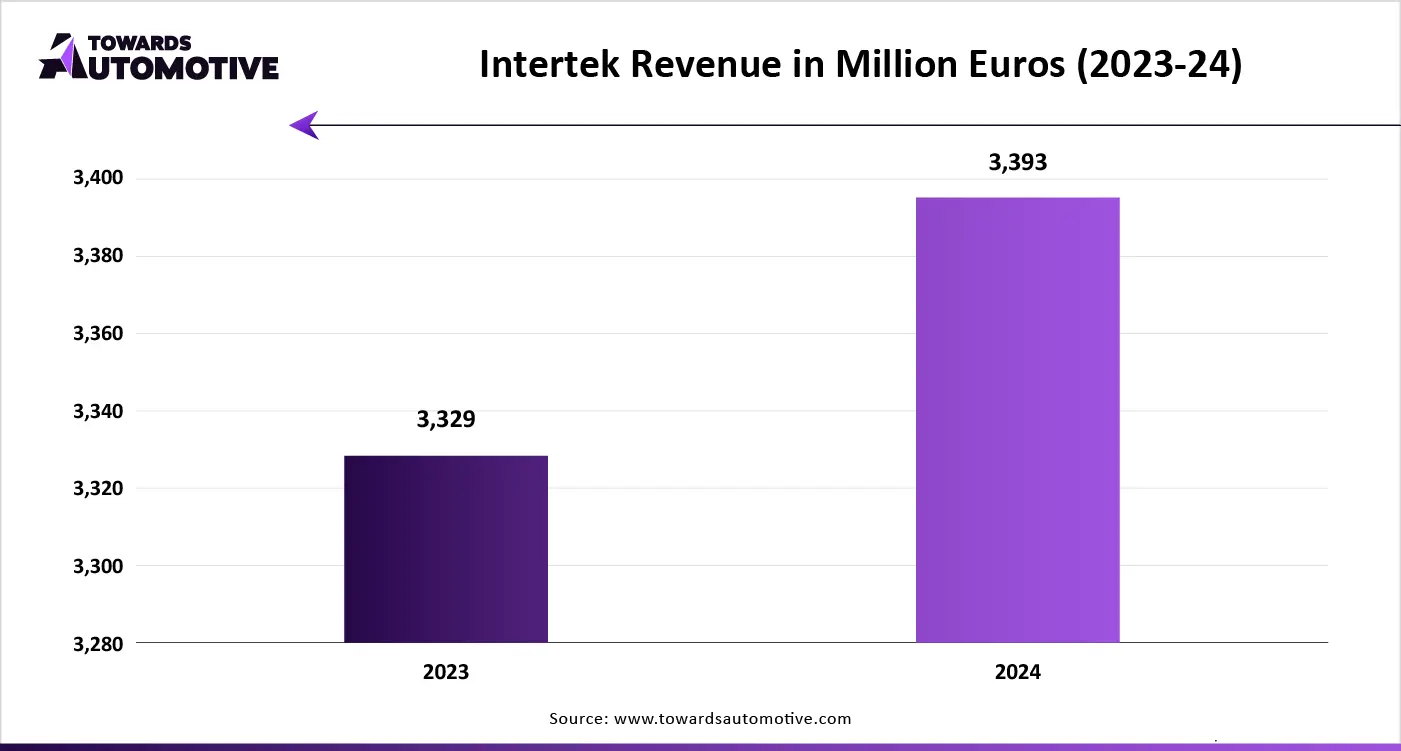

The automotive cyber security market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Harman International (U.S.), Continental AG (Germany), Robert Bosch GmbH (Germany), NXP Semiconductors (Netherlands), Argus Cyber Security (Israel), Karamba Security (Israel), GuardKnox (Israel), Trillium Secure (U.S.), ETAS (Germany), SafeRide Technologies (Israel), Autotalks (Israel), Intertek, Vector Informatik GmbH (Germany), Enigma and some others. These companies are constantly engaged in developing cyber security solutions for the automotive sector and adopting numerous strategies such as product launches, business expansion, acquisition, partnerships, collaborations, joint ventures and some others to maintain their dominant position in this industry.

By Security Type

By Vehicle Type

By Application

By Service

By Region

September 2025

September 2025

September 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us