December 2025

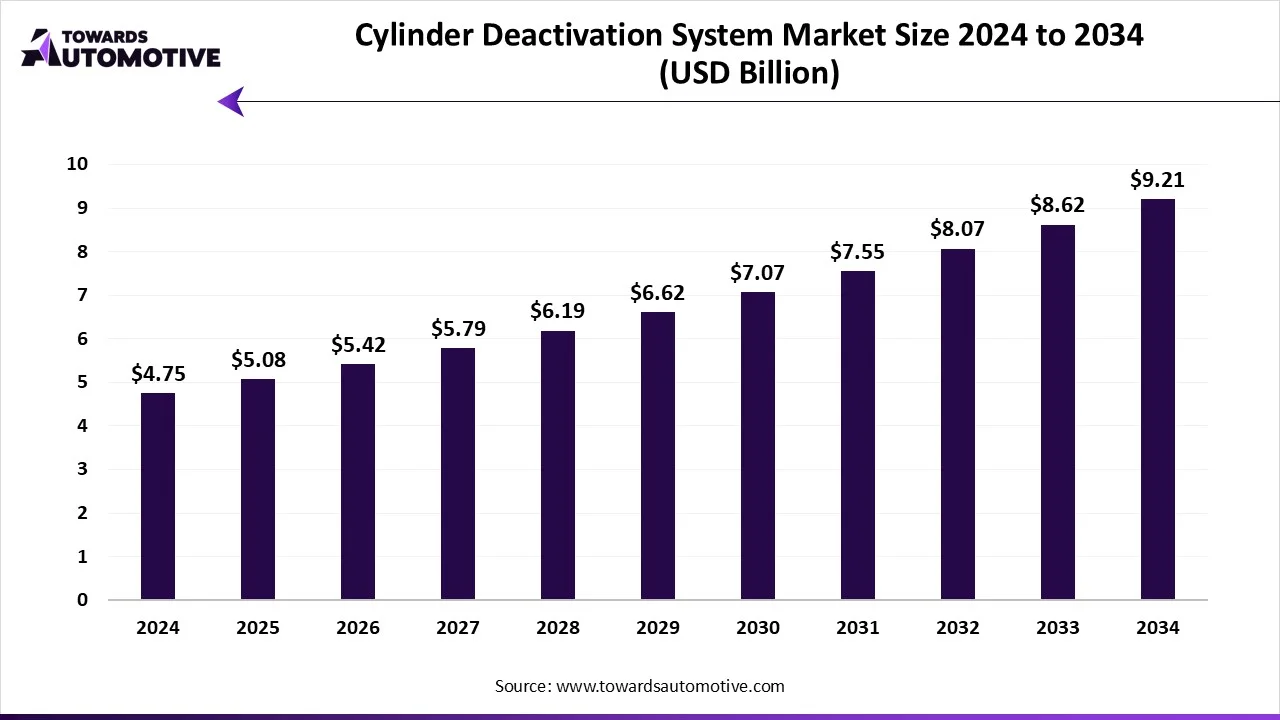

The cylinder deactivation system market is forecast to grow from USD 5.08 billion in 2025 to USD 9.21 billion by 2034, driven by a CAGR of 6.85% from 2025 to 2034. The cylinder deactivation market is growing due to high gas prices, the sale of gas vehicles, stringent emissions laws, and the need for better fuel economy. Automakers are designing and implementing cylinder deactivation systems for passenger cars, SUVs, and light-duty trucks to provide better vehicle performance.

With the emergence of new engine technologies, including advanced programmable ECU control, electromechanical actuators, and alternative fuel use, these systems are becoming more efficient and effective while improving performance expectations. Additionally, the growing presence of hybrid and alternative fuel vehicles creates significant opportunities, as integrating cylinder deactivation systems can reduce fuel costs.

A cylinder deactivation system refers to a technology used in gasoline engines that can disable multiple cylinders when full power is not required, such as when cruising. This system typically includes advanced valvetrain mechanisms, hydraulic lifters, electronic control units (ECUs), sensors, and actuators to seamlessly switch between full-cylinder and reduced-cylinder operation. The technology is designed to save on fuel while still being able to produce sufficient power. In the automotive industry, cylinder deactivation is a very broadly adopted technology for passenger cars, light trucks, and light-duty vehicles. There are numerous components in the market comprising valve lifters (deactivation & reactivation lifters), engine control unit (ECU) / software, solenoids & actuators, sensors (camshaft, crankshaft, pressure, temperature), and oil control valves & hydraulic systems.

The valvetrain types in the market include overhead camshaft (OHC), overhead valve (OHV), and dual overhead camshaft (DOHC). The engines where the cylinder deactivation systems are fitted run on gasoline engines, diesel engines, or alternative fuel engines (CNG, LPG, etc.). The sales channel in the market comprises OEM installations and aftermarket retrofits. There are numerous opportunities in the market, including the integration of cylinder deactivation systems with hybrid and alternative fuel vehicles to enhance their efficiency and increase demand for aftermarket retrofits.

The major trend in the cylinder deactivation system market is product innovation to build reliable cylinder deactivations technologies.

The valve lifters segment held a dominant presence with a market share of 40% in the market. Valve lifters are the most integral parts of the cylinder deactivation system. These lifters control the opening and closing cycle of the valves, which is needed to cut off fuel into selected cylinders, along with air. Car manufacturers favor advanced valve lifters because they help to improve fuel economy and mitigate CO₂ emissions, with no loss in engine smoothness. As manufacturers are required to comply with stricter regulations over time by government authorities, this critical component has also become a requirement of modern engines with CDA systems.

The engine control unit (ECU) / software segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This is because modern engines require a smarter and faster understanding to switch on the deactivation of the engine without causing shaking of the vehicle or diminishing performance. This is made possible by ECU and software-driven systems that control the requirements of fuel injection, ignition timing, and airflow.

The overhead camshaft segment accounted for a considerable share of 45% in the market. Overhead camshaft design is the most widely adopted design because of its enhancements in the precision, accuracy, and efficiency in controlling valves. Moreover, automakers are using the overhead camshaft engine due to the improved performance, efficiency, and durability.

The dual overhead camshaft segment is projected to experience the highest growth rate in the market between 2025 and 2034. Dual overhead camshafts give a lot of improvements to airflow, timing, and the ability to utilize cylinder deactivation. The adoption of DOHC systems is increasing as consumers demand high-performance fuel-saving designs for combustion engines in vehicles.

The gasoline engine segment registered its dominance with over 55% of the market share because they are still the most prevalent in passenger vehicles globally. Cylinder deactivation is well-suited to gasoline engines as it saves fuel consumption while cruising over long distances. The use of cylinder deactivation systems by OEMS in North America, Europe, and Asia has made its way into mainstream cars. Additionally, the growing interest in powerful vehicles that are also fuel-efficient has led to this segment dominating the market.

The alternative fuel engine (CNG, LPG) segment is set to experience the fastest rate of market growth from 2025 to 2034 because CNG and LPG fuels are cheaper and cleaner than gasoline or diesel. Additionally, CNG and LPG are appealing in areas where pollution is a concern. Cylinder deactivation allows for even greater efficiency for these fuels, making them more economical for consumers. Moreover, governments are encouraging the use of alternative fuels, which adds to the growth of this market.

The passenger cars segment maintained a leading position with a market share of around 60%. Generally, technologies that save fuel are mostly adopted in passenger cars first, as the customer primarily has a goal of finding a reasonable solution for the fuel economy issue without hindering performance. For example, global automakers such as Volkswagen, General Motors, and Honda use cylinder deactivation technologies in popular sedans and SUVs to meet emission regulations. Additionally, passenger cars are being produced and sold more than trucks and buses, which makes them dominant in the market.

The light commercial vehicles (LCVs) segment is projected to expand rapidly in the market in the coming years because they are often run for long distances and fuel consumption is the majority of their cost. By incorporating cylinder deactivation system, many fleet owners and businesses can save fuel costs and meet emissions regulations. Additionally, LCVs such as vans and pickups are currently being used for courier and delivery services in larger numbers, following the boom in e-commerce. Therefore, automakers also integrate CDA systems to their LCV lines of products and services.

The multi-cylinder deactivation segment captured around 65% of the market share because of the ability to reduce fuel usage with more flexibility. Manufacturers can use multi-cylinder deactivation technology in larger vehicles such as SUVs and trucks, and as multiple cylinders can be turned off simultaneously, it results in large reductions in fuel costs.

The single-cylinder deactivation segment is predicted to witness significant growth in the market over the forecast period because it gives manufacturers a cheaper and simpler option in small cars. Single-cylinder deactivation systems provide definite fuel savings in typical in-town driving. Moreover, the single-cylinder systems do not need complicated operating systems. Single-cylinder deactivation systems have the opportunity to be implemented in many low-cost vehicles in Europe and Asia-Pacific, especially as emission standards tighten.

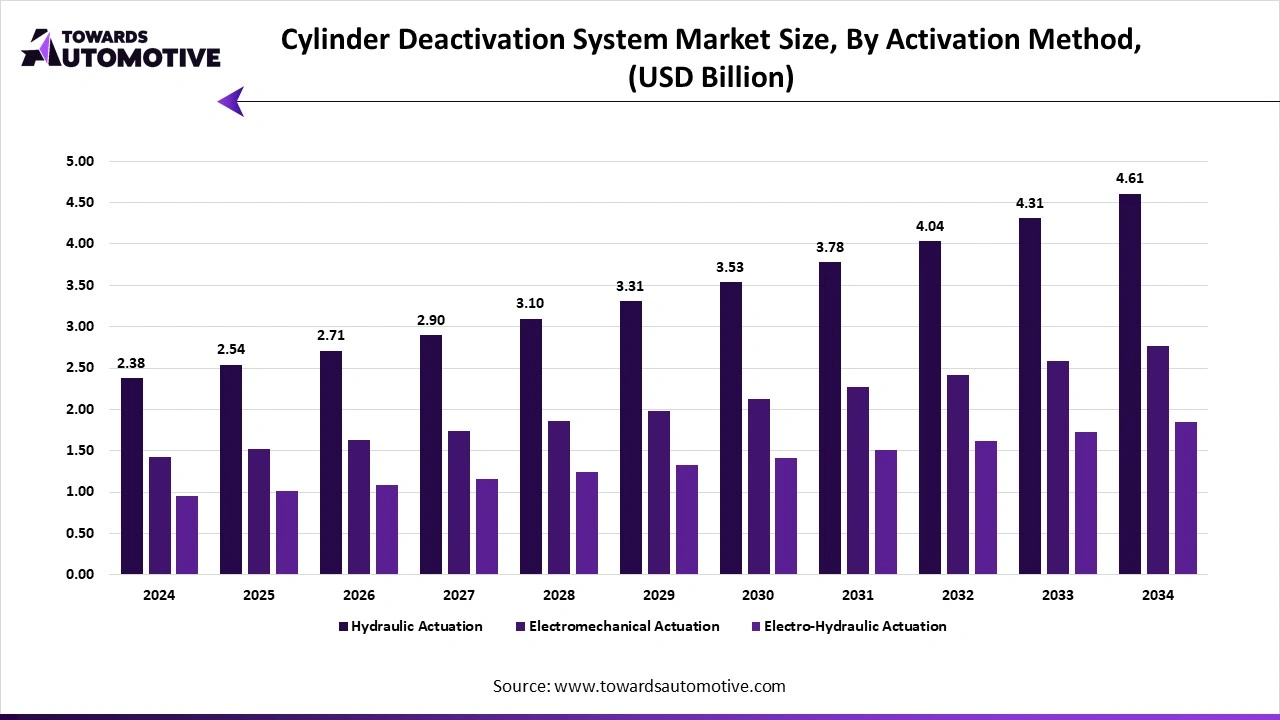

The hydraulic actuation segment enjoyed a prominent position, holding 50% of the market share because it has been in use for several decades and has been proven to be reliable. Hydraulic actuation uses oil pressure to control valve lifters, which is relatively inexpensive and can be easily implemented in the mass market. Hydraulic systems are highly trusted by automakers due to their proven durability, smooth switching, and low maintenance.

The electromechanical actuation segment will gain a significant share of the market over the studied period of 2025 to 2034. Electromechanical actuation is increasing rapidly as it provides greater speed, accuracy, and energy efficiency in cylinder deactivation technologies. The electromechanical actuation system is not dependent on oil pressure such as hydraulic systems. As vehicles become more digitalized and software-driven, electromechanical systems can be integrated better with ECUs. Moreover, as cylinder deactivation technology improves, manufacturers will shift towards electromechanical actuation because it complies with stricter emission regulations and greatly reduces engine weight.

The OEM installations segment dominated the cylinder deactivation system market, holding 85% of the total market share. OEM installations are dominant because most of the cylinder deactivation systems are installed on newly manufactured vehicles at the OEM level. Automakers add the system during manufacturing to enable it to work seamlessly with engine design and other software.

The aftermarket retrofits segment is set to experience the fastest rate of market growth from 2025 to 2034. Aftermarket retrofits have also become popular with car owners searching for more value-driven ways to upgrade their older vehicles. As fuel prices is increasing, customers are interested in adding cylinder deactivation technology to their old vehicles to create competitive fuel efficiencies, instead of purchasing a new car. Retrofits are becoming more comprehensive and can be installed on a wider range of engine configurations, generating interest and demand for consumers.

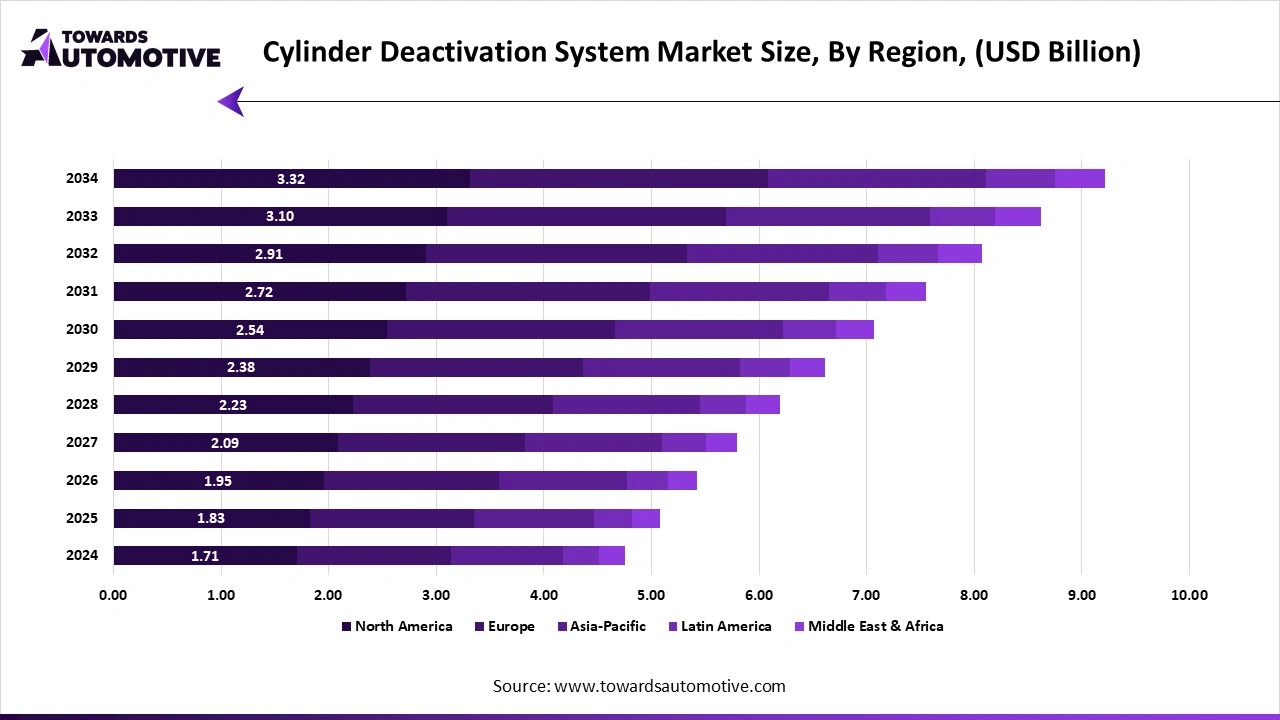

North America registered its dominance with 40% market share in the cylinder deactivation system market due to the rapid development of the automotive industry. Government regulations concerning fuel economy and emissions, such as Corporate Average Fuel Economy (CAFE) standards urges automotive manufacturers to widely increase the use of the CDA system. Strong opportunities in North America comprise the use of advanced ECUs in the CDA systems, rising demand for LCVs, and aftermarket retrofits.

The United States dominates the North American cylinder deactivation market due to the presence of a large automotive industry featuring brands such as General Motors, Ford, and Chrysler. The U.S. government imposed strict emissions and fuel economy standards on automobile manufacturers, which boosts the adoption of cylinder deactivation technology. Moreover, strong opportunities for cylinder deactivation will arise with the increasing demand for larger vehicles, which consume more fuel than other vehicles.

Asia-Pacific is expected to show the fastest growth rate in the market in the coming years. This is because of the size of the population, the increase in ownership of vehicles, and stringent emission regulations. Manufacturers are reacting to the demands of governments in China, India, Japan, and South Korea to reduce emissions and increase fuel economy. They are now investing in advanced engines equipped with CDA systems with intelligent software and ECUs. A few opportunities in the region include the huge base of passenger automobiles, demand for low-cost alternatives to fuel-saving technologies, government regulations for cleaner engines, and adoption of alternative fuel types such as CNG and LPG to greatly increase fuel efficiency.

China is the leading country in the Asia-Pacific cylinder deactivation system market due to technological developments in the automotive sector. The government and regulators have established specific emission regulations and promote the use of CDA systems. Manufacturers in the region like BYD, Changan, Geely & many global automakers & OEMs all use cylinder deactivation in their high-volume engines. Moreover, the type of fuel used in China is also evolving, as consumers show interest in clean fuels, such as CNG and LPG.

Numerous types of raw material are sourced for the production of cylinder deactivations systems such as high-strength steel, aluminum, alloys, electronic chips, sensors and a few other.

The raw materials are used to manufacture several components including valvelifters, actuators, ECUs, software controls, rocker arms and some others.

After all components are prepared, automakers integrate the components into the cylinder deactivation system which is installed in the engine.

The cylinder deactivation system market is highly competitive, with the presence of several international and domestic players. Some of the most prominent companies in the market are Eaton Corporation, Tula Technology, Schaeffler AG, Continental AG, Robert Bosch GmbH, BorgWarner, Denso Corporation, Delphi Technologies, Hitachi Automotive Systems, Mahle GmbH, Rheinmetall Automotive, and Tenneco Inc. Numerous companies in the cylinder deactivation market are investing in research and development to make the CDA system smoother, more reliable, and less expensive to install. Moreover, these companies are adopting numerous strategies to maintain their dominance in this industry.

By Component

By Valvetrain Type

By Fuel Type

By Vehicle Type

By Technology Type

By Activation Method

By Sales Channel

By Region

The in-vehicle apps industry is expected to grow from USD 72.09 billion in 2024 to USD 190.41 billion by 2034, driven by a CAGR of 10.12%. The in-vehi...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us