October 2025

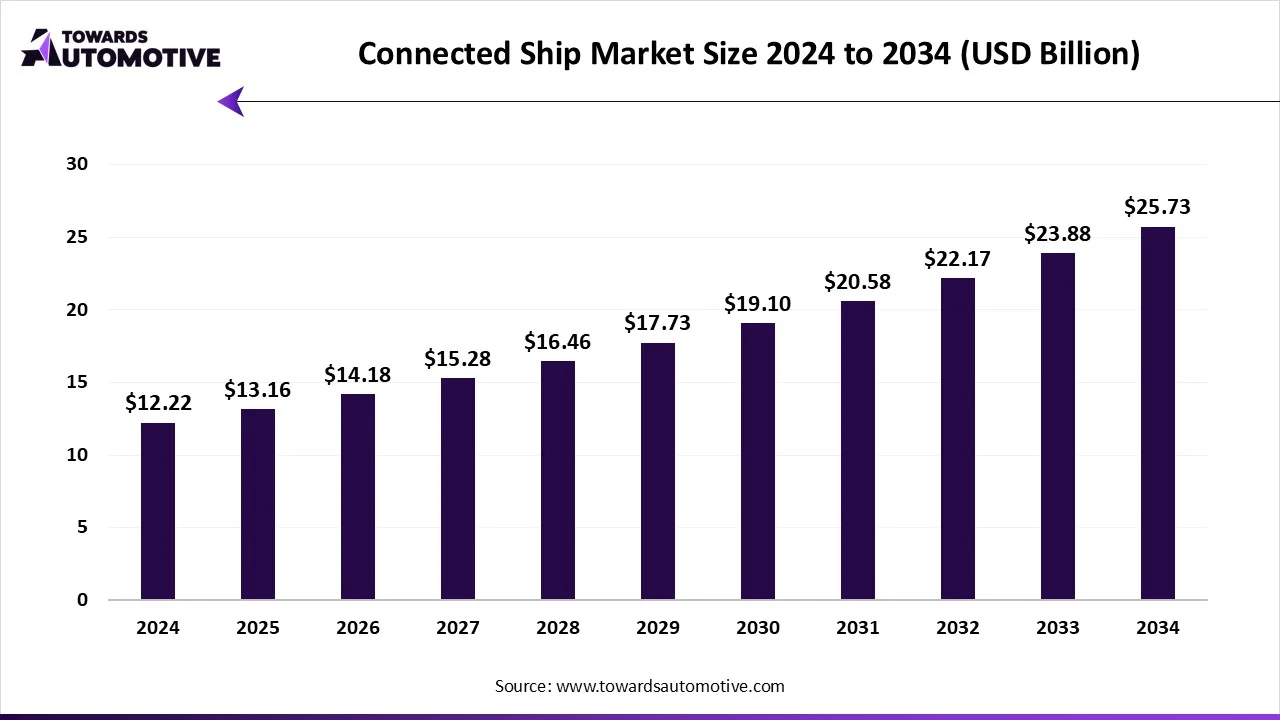

The connected ship market is projected to reach USD 25.73 billion by 2034, expanding from USD 13.16 billion in 2025, at an annual growth rate of 7.73% during the forecast period from 2025 to 2034. The growing demand for advanced communication systems from the marine sector coupled with numerous government initiatives aimed at enhancing maritime safety has boosted the market expansion.

Also, rising focus of market players for developing high-quality navigation systems for ships along with rapid investment in the defense sector is playing a vital role in shaping the industrial landscape. The advancements in 5G technology as well as integration of AI-based navigation systems in modern ships is expected to create ample growth opportunities for the market players in the upcoming days.

The connected ship market is a prominent branch of the marine industry. This industry deals in developing advanced connectivity solutions for the shipping sector around the world. There are various types of systems developed in this sector comprising of navigation systems, communication systems, automation & control systems, security & surveillance systems, payload & mission systems and some others. These systems are used in different types of ships including commercial ships, defense ships, autonomous/unmanned surface vessels (USVs) and some others. It finds application in fleet operations & management, predictive maintenance & remote monitoring, safety & security management, environmental compliance & emission monitoring, autonomous & semi-autonomous operations and some others. The end-users of these solutions include commercial shipping operators, defense/ naval forces, offshore oil & gas operators, port authorities & coast guards and some others. This market is expected to rise significantly with the growth of the shipbuilding sector in different parts of the globe.

The major trends in this market consists of partnerships, joint ventures and rising defense expenditure.

The navigation & communication systems segment dominated the connected ship market with a share of around 40%. The rising integration of advanced navigation and communication systems in modern vessels to enhance tracking capabilities has driven the market expansion. Additionally, the growing investment by telecom companies for enhancing marine communication is expected to drive the growth of the connected ship market.

The cybersecurity & surveillance systems segment is expected to rise with the fastest CAGR during the forecast period. The increasing cases of cybercrime issues related to marine transportation has increased the demand for advanced cybersecurity solutions, thereby driving the industrial growth. Also, rapid investment by government for integration high-quality surveillance solutions to enhance maritime safety is expected to proliferate the growth of the connected ship market.

The fleet operations & management segment led the connected ship market with a share of around 35%. The growing adoption of AI-integrated management solutions by fleet operators to track vessel performance and reduce operational cost has boosted the market expansion. Additionally, rise in number of cargo vessel operators in the European region coupled with numerous partnerships among ship operators and technology providers is expected to drive the growth of the connected ship market.

The autonomous & semi-autonomous operations segment is expected to rise with the fastest CAGR during the forecast period. The rising deployment of autonomous vessels by naval forces to strengthen maritime defense has boosted the market growth. Additionally, the integration of advanced sensors in semi-autonomous ships to operate in tough maritime conditions is expected to foster the growth of the connected ship market.

The commercial ships segment led the connected ship market with a share of around 55%. The increasing sales of commercial ships in different parts of the world has increased the demand for advanced fleet management solutions, thereby fostering the market expansion. Also, the integration of IoT-based sensors in modern ships to monitor numerous activities inside the vessel is expected to propel the growth of the connected ship market.

The autonomous/unmanned surface vessels (USVs) segment is expected to expand with the fastest CAGR during the forecast period. The growing application of autonomous ships in defense organizations to invade dangerous areas has boosted the market expansion. Also, the rising use of advanced navigation systems in USVs to track real-time location in oceans and seas is expected to foster the growth of the connected ship market.

The satellite communication (SATCOM) segment led the connected ship market with a share of around 45%. The growing use of orbiting satellites to transmit voice, data, and video signals between ships and shore-based facilities or other vessels has driven the market expansion. Additionally, numerous advantages of SATCOM including global and uninterrupted coverage, enhanced safety and security, operational efficiency and management, high-quality data transmission and some others is expected to foster the growth of the connected ship market.

The cellular/5G maritime networks segment is expected to rise with the fastest CAGR during the forecast period. The rising use of 5G sensors in modern vessels for enhancing communication with fleet operators has driven the industrial growth. Additionally, rapid investment by telecom companies for developing the 5G infrastructure is expected to propel the growth of the connected ship market.

The OEM installation segment led the connected ship market with a share of around 60%. The growing preference of fleet operators to install advanced solutions in modern vessels from OEMs has driven the market expansion. Additionally, rapid investment by OEMs for delivering superior services to ship owners is expected to drive the growth of the connected ship market.

The managed services & cloud-based solutions segment is expected to rise with the fastest CAGR during the forecast period. The rising demand for cost-effective ship management services from vessel owners of developing nations has driven the market growth. Additionally, the growing adoption of cloud-based navigation solutions in modern ships to track real-time location is expected to foster the growth of the connected ship market.

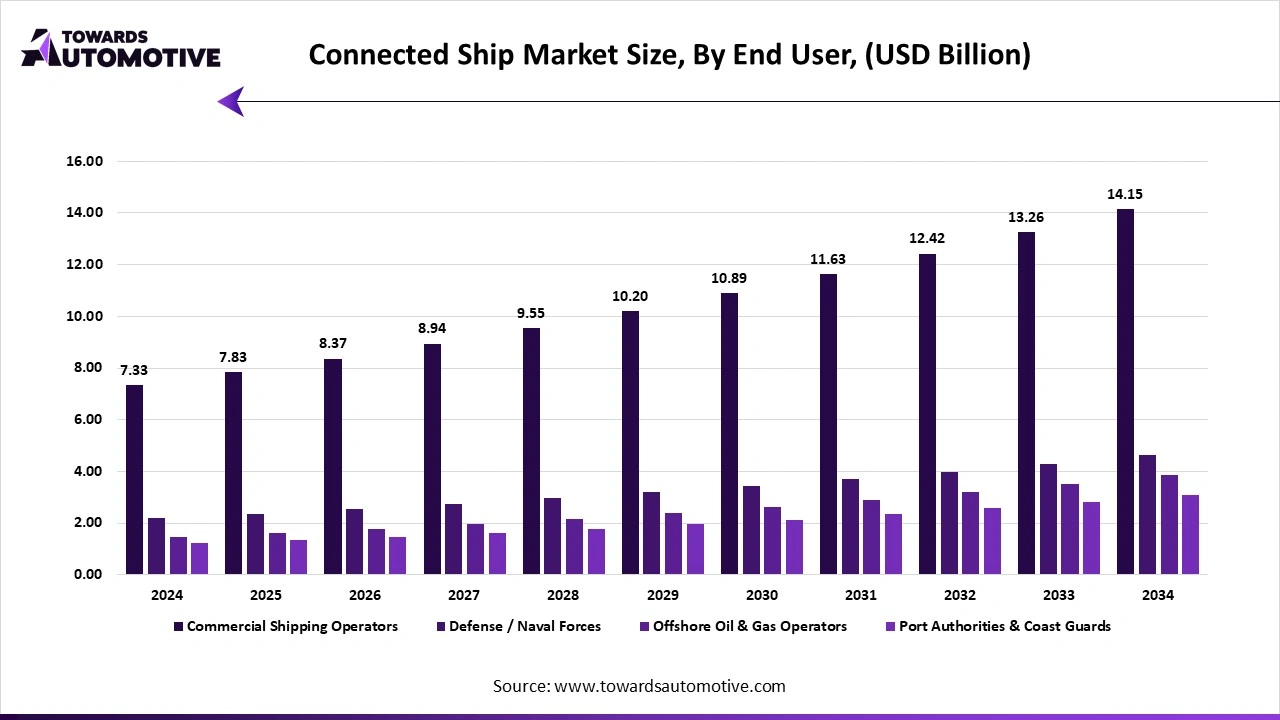

The commercial shipping operators segment dominated the connected ship market with a share of around 50%. The growing use of advanced fleet management solutions by shipping operators to enhance real-time monitoring of modern vessels has driven the market expansion. Also, rapid investment by shipping companies to integrate advanced sensors in commercial ships is expected to drive the growth of the connected ship market.

The defense/naval forces segment is expected to expand with the highest CAGR during the forecast period. The increasing use of autonomous ships by defense organizations to enhance maritime safety has boosted the market growth. Additionally, rising investment by government of several countries for strengthening the defense sector is expected to propel the growth of the connected ship market.

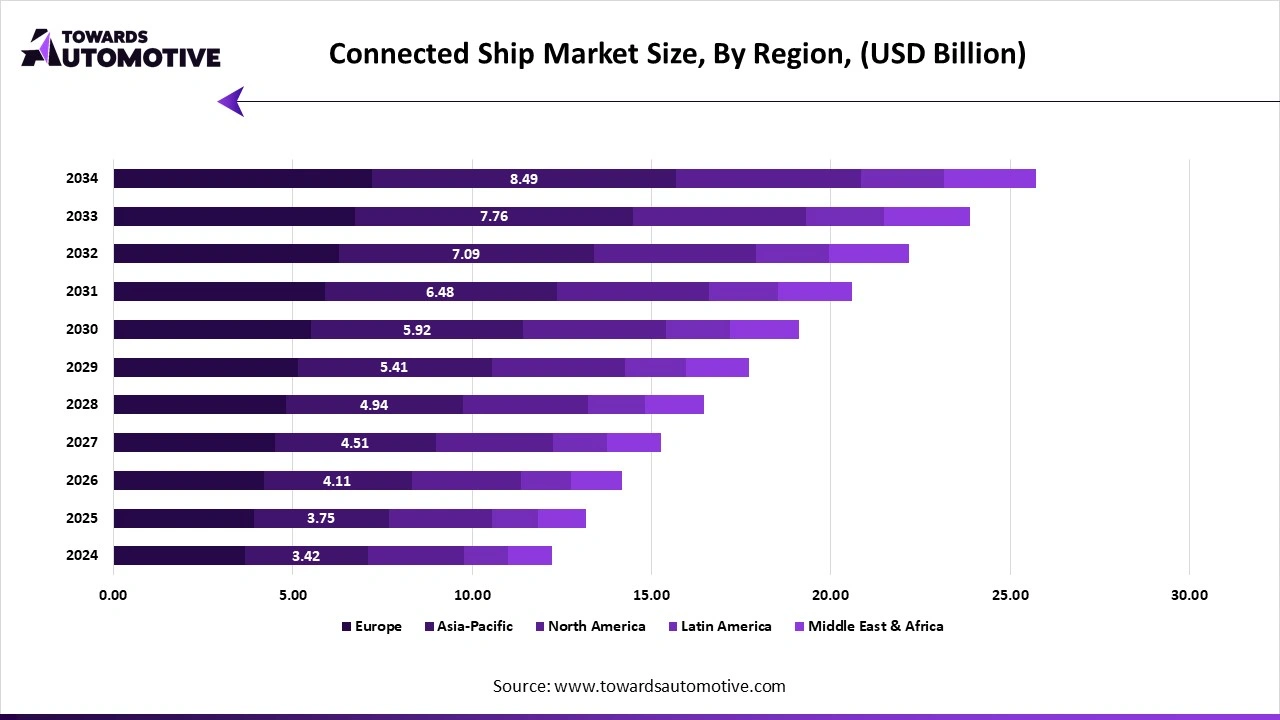

Europe dominated the connected ship market with a share of around 35%. The increasing sales of cargo ships in several countries such as Germany, France, Netherlands, Italy, Luxembourg, UK and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the maritime sector coupled with rapid investment by public sector entities to strengthen the shipbuilding industry is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Sperry Marine B.V., Wärtsilä, Kongsberg Maritime and some others is expected to propel the growth of the connected ship market in this region.

Germany and France are the major contributors in this region. In Germany, the market is generally driven by the rapid adoption of autonomous ships in the defense sector coupled with technological advancements in the shipbuilding sector. In France, the increasing sales of commercial ships along with rise in number of fleet operators has boosted the market growth.

Asia Pacific is expected to expand with the highest CAGR during the forecast period. The growing adoption of autonomous ships by the defense sector in numerous countries including China, India, Japan, South Korea and some others has boosted the market growth. Also, rapid investment by government for strengthening the maritime safety coupled with technological advancements in the telecom sector is contributing to the industry in a positive manner. Moreover, the presence of numerous market players such as Hyundai Heavy Industries Co., Ltd., Ascenz Marorka, Seven Seas Marine Navcom and some others is expected to drive the growth of the connected ship market in this region.

China led the market in this region. The growing emphasis of government for deploying advanced vessels in the defense sector coupled with availability of raw materials at reasonable prices has boosted the industrial growth. Additionally, rapid investment by telecom companies for developing the 5G infrastructure is contributing to the industry in a positive manner.

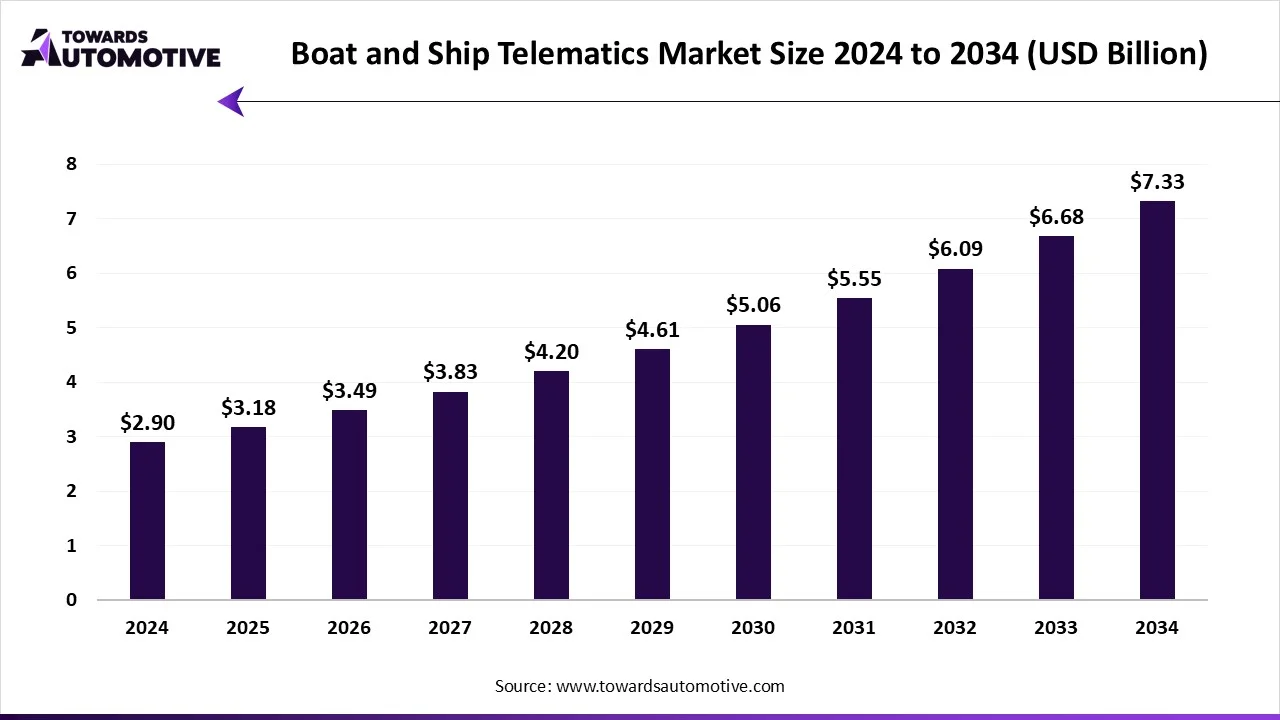

The boat and ship telematics market is projected to reach USD 7.33 billion by 2034, expanding from USD 3.18 billion in 2025, at an annual growth rate of 9.72% during the forecast period from 2025 to 2034.

The boat and ship telematics market is a prominent branch of the marine industry. This industry deals in developing solutions for tracking boats and ships across the world. There are various components of these solutions including hardware, software and services. These solutions use different types of technologies such as GPS tracking, satellite communication, IoT enabled devices, telematics software and some others.

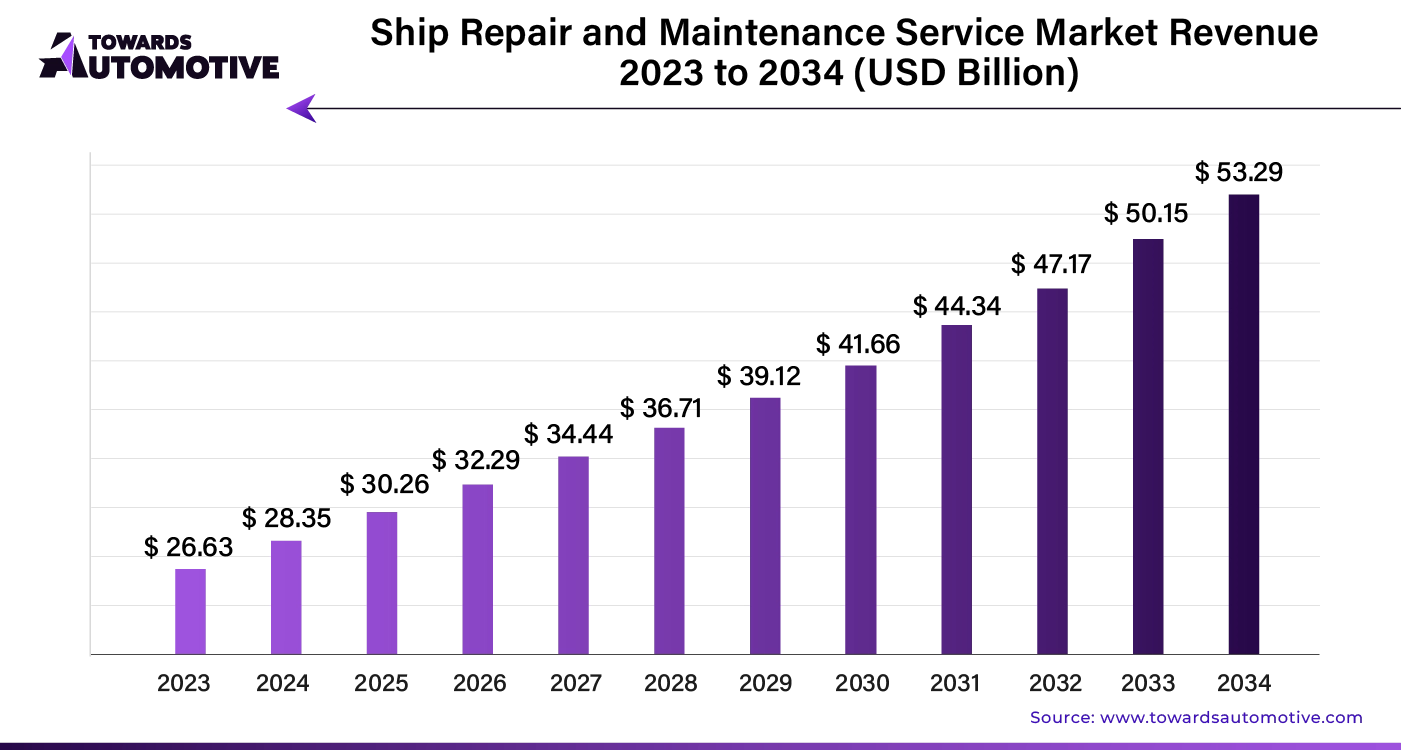

The ship repair and maintenance service market is projected to reach USD 53.29 billion by 2034, expanding from USD 30.26 billion in 2025, at an annual growth rate of 6.63% during the forecast period from 2025 to 2034.

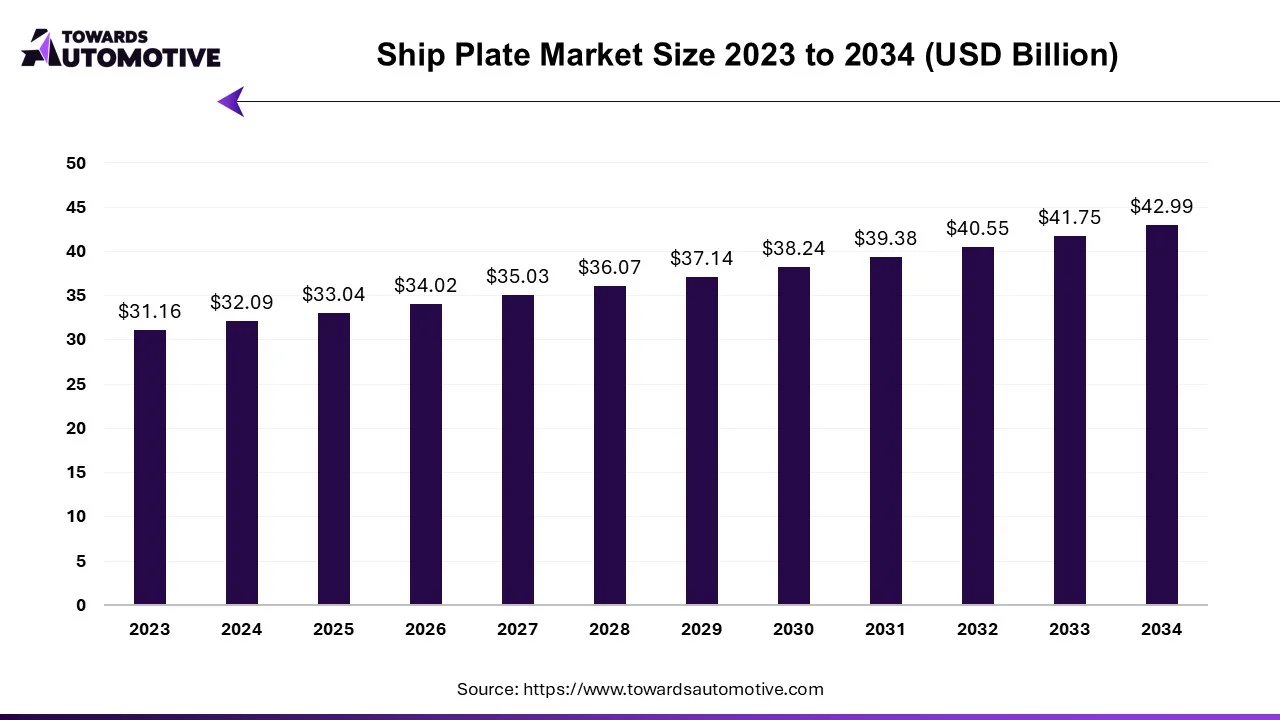

The ship plate market is set to grow from USD 33.04 billion in 2025 to USD 42.99 billion by 2034, with an expected CAGR of 2.97% over the forecast period from 2025 to 2034.

The rapid expansion of international trade and commerce has led to a growing need for new and efficient ships to transport cargo across the world's oceans. Ship plating, a critical component of the shipbuilding industry, plays a vital role in ensuring the strength, durability, and reliability of vessels. As global trade volumes continue to rise, there is increasing pressure on shipbuilders to construct vessels that can withstand the rigors of maritime transportation while maximizing efficiency and safety.

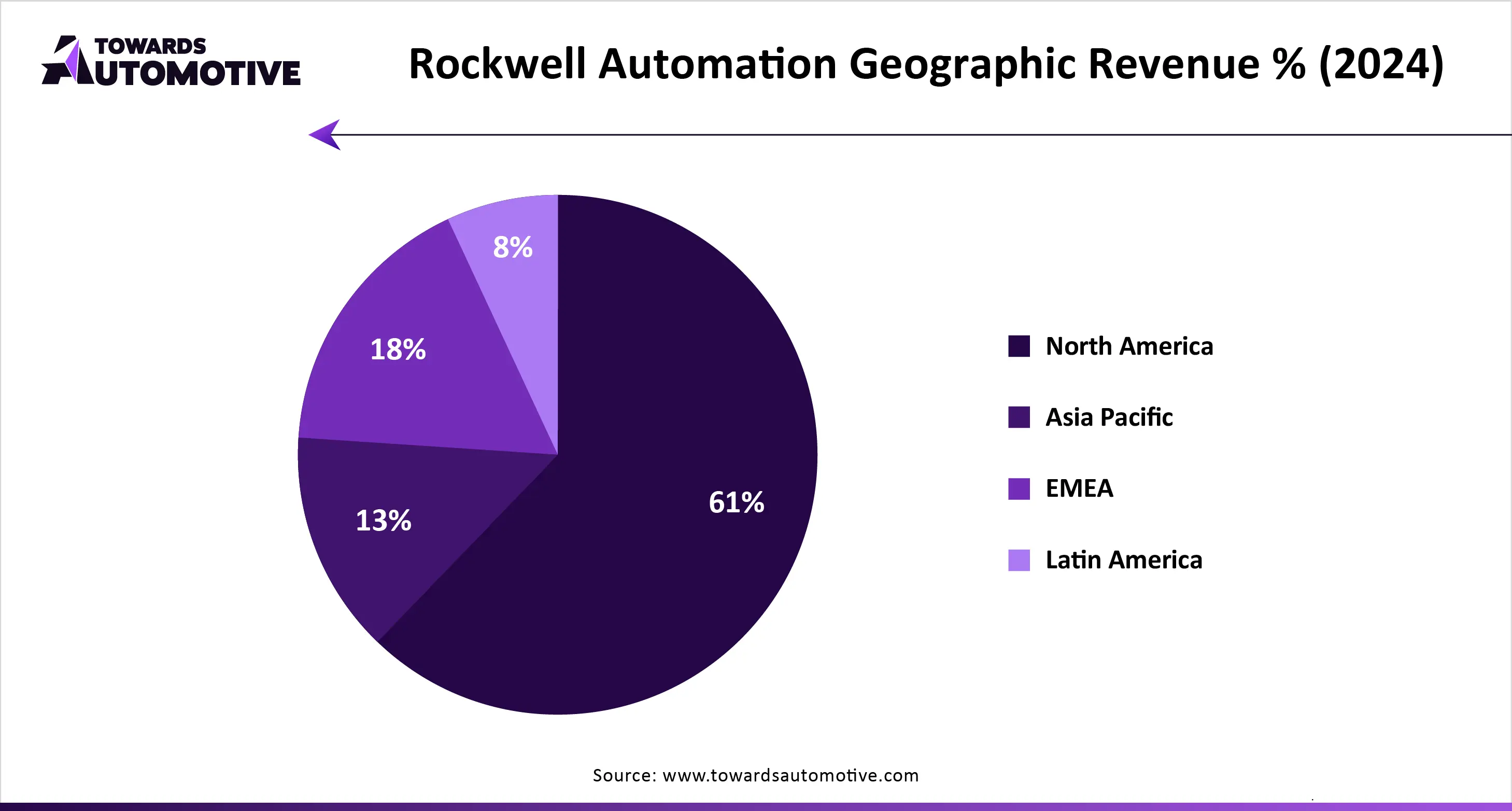

The connected ship market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Schneider Electric; Sperry Marine B.V.; YALTES Electronic and Information Systems Production and Trade Inc.; Wärtsilä; Kongsberg Maritime; Danelec Marine A/S; Anglo-Eastern; Rockwell Automation; Marlink B.V.; HD Hyundai Heavy Industries Co., Ltd. and some others. These companies are constantly engaged in developing connectivity solutions for the shipping sector and adopting numerous strategies such as acquisitions, partnerships, launches, business expansions, collaborations, joint ventures and some others to maintain their dominance in this industry.

By System

By Application

By Ship Type

By End-User

By Connectivity / Communication Mode

By Distribution / Business Model

By Region

October 2025

August 2025

August 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us