December 2025

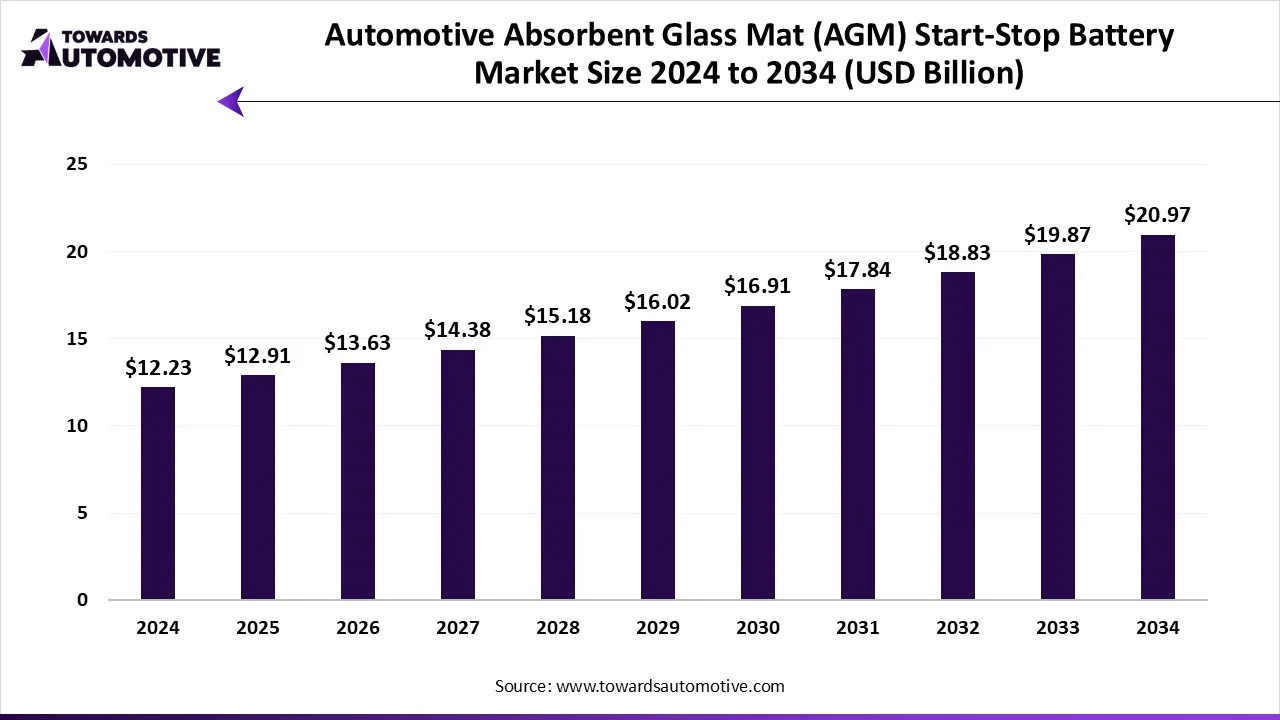

The automotive absorbent glass mat (AGM) start-stop battery market is expected to increase from USD 12.91 billion in 2025 to USD 20.97 billion by 2034, growing at a CAGR of 5.52% throughout the forecast period from 2025 to 2034. The rising use of electronic components in vehicles coupled with rapid investment in battery industry by startup companies drives the market expansion.

Additionally, the growing demand for maintenance-free automotive batteries as well as opening of new battery manufacturing and recycling centers in the APAC region is playing a vital role in shaping the industrial landscape. The growing use of AGM batteries in electric vehicles to enhance performance is expected to create ample growth opportunities for the market players in the upcoming days.

The automotive absorbent glass mat (AGM) start-stop battery market is a crucial branch of the battery manufacturing industry. This industry deals in manufacturing and distribution of AGM batteries for the automotive sector. There are various types of batteries developed in this sector comprising of stationary batteries and motive batteries. These batteries comes with different voltages including 2-4V, 6-8V, 12V and above. It finds applications in numerous vehicles consisting of passenger vehicles, light commercial vehicles, motorcycles, heavy commercial vehicles and some others. The AGM batteries are available in a well-established sales channel comprising of OEMs and aftermarket. The growing sales of commercial vehicles in different parts of the world is a major contributor of this industry. This market is expected to rise significantly with the growth of the automotive sector in different parts of the world.

| Metric | Details |

| Market Size in 2025 | USD 12.91 Billion |

| Projected Market Size in 2034 | USD 20.97 Billion |

| CAGR (2025 - 2034) | 5.52% |

| Leading Region | Europe |

| Market Segmentation | By Vehicle Type, By Start-Stop System, By Distribution Channel, By Battery Capacity, By Application and By Region |

| Top Key Players | Amara Raja Batteries Ltd., GS Yuasa Corporation, VARTA AG (Clarios brand in EU), East Penn Manufacturing, Panasonic Corporation |

The major trends in this market consists of business expansions, rising production of passenger vehicles and partnerships.

Several battery manufacturing companies are investing heavily for opening up new AGM battery production facilities to cater the needs of the automotive sector. For instance, in June 2024, Clarios announced to invest around US$ 16 million. This investment is done for opening a new AGM battery manufacturing facility in South Carolina, U.S. (Source: Clarios)

The production of passenger vehicles has increased rapidly in several countries such as Germany, China, the U.S. and some others has increased the application of AGM batteries. According to the OICA, around 4069222 passenger cars were manufactured in Germany during 2024. (Source: OICA)

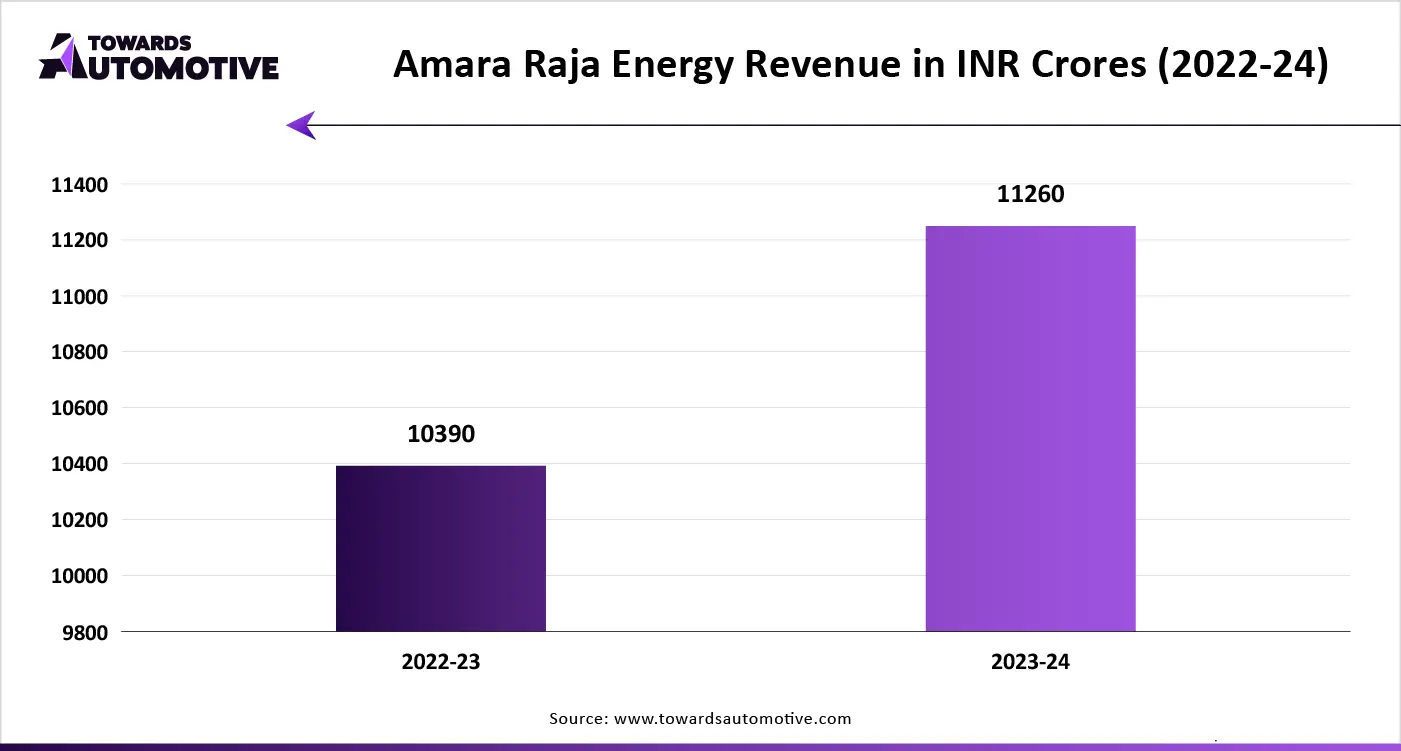

Numerous market players are partnering with automotive brands to integrated advanced AGM batteries in their vehicles. For instance, in December 2024, Hyundai Motors Limited partnered with Amara Raja Energy and Mobility Limited. Through this partnership, Hyundai will use Amara’s AGM batteries in their vehicles. (Source: ETAuto)

The passenger cars segment held the highest share of the market with 65%. The growing production of passenger cars in several countries such as India, China, the U.S., Germany and some others has driven the market growth. Additionally, the rising adoption of AGM batteries by passenger car manufacturers to deliver superior performance and high durability is expected to drive the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The heavy commercial vehicles (HCVs) segment is expected to expand with the highest CAGR of around 8% during the forecast period. The rising use of advanced absorbent glass batteries in trucks for handling high electrical loads as well as providing additional resistance to vibration and shock is contributing to the market expansion. Moreover, rapid investment by battery companies for developing AGM batteries to cater the needs of the heavy commercial vehicles is expected to propel the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The enhanced start-stop systems segment held the highest share of the market with 48%. The growing use of advanced AGM batteries to optimize enhanced start-stop systems in heavy vehicles is playing a vital role in shaping the industrial landscape. Moreover, the rising application of advanced start-stop system in modern cars to enhance the driving experience is expected to boost the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The regenerative braking-based systems segment is expected to rise with the fastest CAGR of 9% during the forecast period. The growing application of AGM batteries in hybrid vehicles to enhance driving range has boosted the market expansion. Additionally, numerous advantages of regenerative braking systems including reduced braking damage and less environmental impact is expected to foster the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The OEM (Original Equipment Manufacturer) segment led the market with 55% share. The availability of AGM batteries in automotive OEMs to cater the needs of vehicle owners has driven the market expansion. Additionally, the growing demand for genuine batteries from automotive users coupled with rise in number of OEM dealerships in developed nations such as the U.S., Germany, China and some others is expected to boost the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The aftermarket segment is expected to grow with the highest CAGR of around 10% during the forecast period. The rising consumer interest for purchasing automotive components from online platforms such as Ebay, Amazon, Flipkart and some others has driven the market growth. Also, the increasing demand for low-range batteries to cater the needs of the old vehicles is expected to propel the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The 60-90 AH segment held the highest share of the market with 50%. The growing use of 60 AH battery to cater the needs of passenger vehicles has boosted the market expansion. Also, the increasing demand for 80-85 AH AGM batteries from caravan manufacturers to deliver superior-performance and high durability is expected to drive the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The >90 AH segment is expected to grow with the fastest CAGR during the forecast period. The growing use of 90 AH batteries to handle electronics components in heavy-duty trucks has driven the market growth. Moreover, the increasing application of these batteries to cater high-energy demands of the electric vehicles is accelerating the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The private use vehicles segment led this industry with a market share of 68%. The growing sales of luxury vehicles in numerous developed nations such as the U.S., Germany, UK, Japan and some others has boosted the market growth. Additionally, rapid investment by battery companies for developing advanced AGM batteries to cater the needs of the private vehicles is expected to drive the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

The fleet & commercial vehicles segment is expected to rise with the fastest CAGR of 9.5% during the forecast period. The rise in number of EV fleet operators in numerous countries such as Germany, the U.S., China and some others has driven the market expansion. Moreover, the growing sales of electric trucks and electric buses along with constant research and development activities related to production of AGM batteries to cater the needs of commercial vehicles is expected to foster the growth of the automotive absorbent glass mat (AGM) start-stop battery market.

Europe dominated the automotive absorbent glass mat (AGM) start-stop battery market with a market share of 48%. The growing sales and production of passenger vehicles in several countries such as Germany, France, Italy, UK and some others has contributed to the industrial expansion. Additionally, the rising adoption of EVs in EU region to reduce vehicular emission coupled with rapid investment by market players for opening up new battery manufacturing plant is playing a crucial role in shaping the market. Moreover, the presence of several AGM battery companies such as HOPPECKE Batterien, FIAMM Energy Technology, Bosch (Robert Bosch GmbH) and some others is expected to drive the growth of the automotive absorbent glass mat (AGM) start-stop battery market in this region.

Germany led the market in this region. In Germany, the market is generally driven by the presence of well-established automotive industry with various companies such as AUDI, BMW, Mercedes and some others. Additionally, rapid investment by battery companies for constructing new automotive battery production centers in Stuttgart, Wolfsburg and some others is further adding to the industrial expansion.

Asia Pacific is expected to expand with the highest CAGR of around 15% during the forecast period. The growing demand for commercial vehicles in various nations such as India, China, Japan, South Korea, Indonesia and some others has boosted the market expansion. Additionally, rapid investment by public-sector entities for developing the battery industry coupled with availability of essential raw materials is contributing to the industrial growth. Moreover, the presence of various market players such as CSB Energy Technology, Tata Green Batteries, Camel Group Co., Ltd, Panasonic Energy and some others is expected to propel the growth of the automotive absorbent glass mat (AGM) start-stop battery market in this region.

China is the major contributor in this region. The growing demand for advanced batteries from the EV industry coupled with presence of skilled workforce at cheap prices is contributing to the market expansion. Additionally, the abundance of essential raw materials such as lead plates, sulfuric acid electrolyte and some others is playing a vital role in shaping the industrial landscape.

The automotive absorbent glass mat (AGM) start-stop battery market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Clarios (Johnson Controls), Amara Raja Batteries Ltd., GS Yuasa Corporation, VARTA AG (Clarios brand in EU), East Penn Manufacturing, Panasonic Corporation, EnerSys, FIAMM Energy Technology, C&D Technologies, HOPPECKE Batterien, Luminous Power Technologies, Hitachi Chemical Co., Exide Technologies, Leoch International, Banner Batteries, Bosch (Robert Bosch GmbH), Tata Green Batteries, CSB Energy Technology, Camel Group Co., Ltd., Sebang Global Battery Co., Ltd. and some others. These companies are constantly engaged in developing advanced AGM batteries and adopting numerous strategies such as launches, partnerships, business expansions, acquisitions, joint ventures, collaborations and some others to maintain their dominance in this industry.

By Vehicle Type

By Start-Stop System

By Distribution Channel

By Battery Capacity

By Application

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us