August 2025

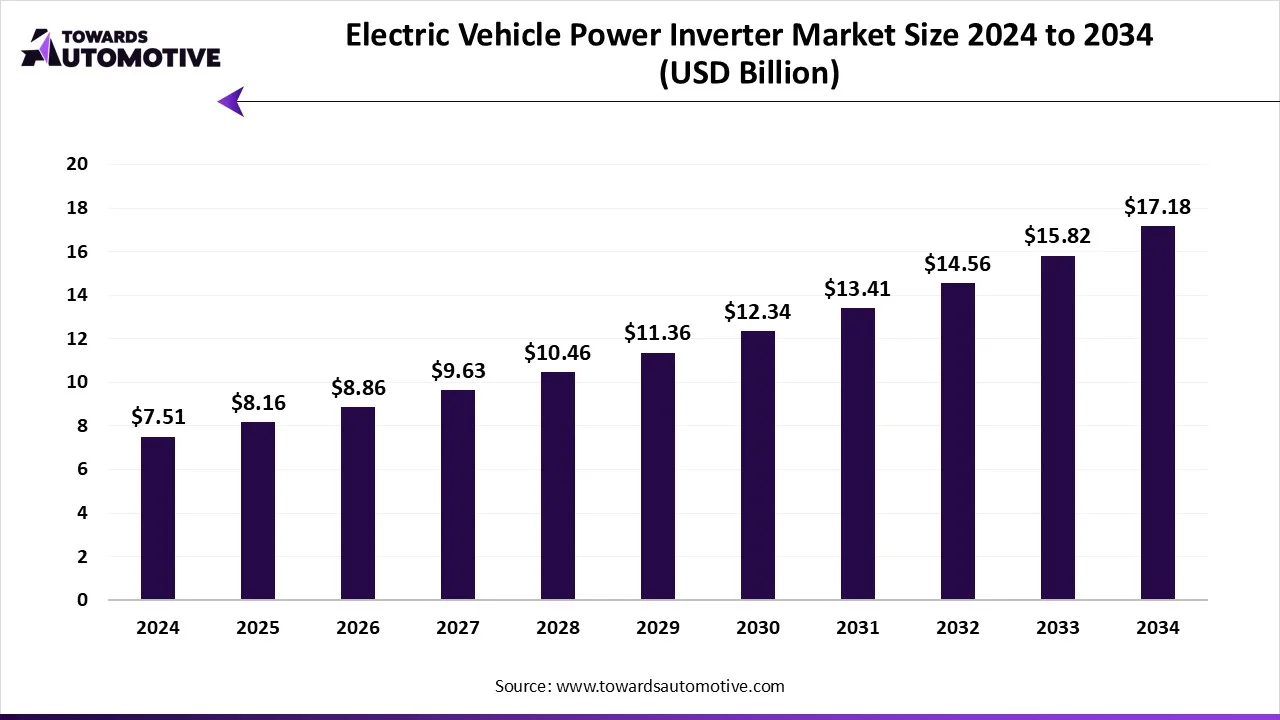

The electric vehicle power inverter market is forecasted to expand from USD 8.16 billion in 2025 to USD 17.18 billion by 2034, growing at a CAGR of 8.63% from 2025 to 2034. The growing demand for eco-friendly vehicles in developed nations coupled with rise in number of EV startups in the APAC region has driven the market expansion.

Additionally, numerous government initiatives aimed at enhancing EV adoption along with increasing sales of LCEVs in the Middle East is playing a vital role in shaping the industrial landscape. The integration of advanced sensors in EV inverters is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The electric vehicle power inverter market is a crucial branch of the automotive industry. This industry deals in manufacturing and distribution of power inverters for EVs. These generators are designed for different types of vehicles comprising of BEVs, PHEVs, HEVs and FCEVs. The EV generators are based on various technology including silicon IGBT, silicon carbide, gallium nitride, hybrid and some others. It is available in a distribution channel consisting of ORMs and aftermarket. This market is expected to rise significantly with the growth of the electric vehicle industry in different parts of the world.

The major trends in this market consists of partnerships, rising sales of EVs and business expansions.

The battery electric vehicles segment dominated the electric vehicle power inverter market with a share of around 59%. The increasing sales of BEVs in numerous countries including China, India, the U.S., Canada and some other has boosted the market expansion. Additionally, rapid investment by EV companies to develop a wide range of BEVs is playing a vital role in shaping the industrial landscape. Moreover, the growing use of voltage source inverters (VSI) in BEVs is expected to propel the growth of the electric vehicle power inverter market.

The plug-in hybrid electric vehicles segment is expected to grow with the fastest CAGR during the forecast period. The growing demand for PHEVs in developing nations such as India, Indonesia, Thailand and some others has boosted the market growth. Also, the increasing use of traction inverters in PHEVs to convert DC power from the battery into AC power to drive the electric motor is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for manufacturing a wide-range of PHEVs is expected to boost the growth of the electric vehicle power inverter market.

The up to 100 kW segment led the electric vehicle power inverter market with a share of around 48%. The growing use of low-capacity power inverters in affordable EVs has boosted the market expansion. Additionally, rapid investment by market players for manufacturing 100 kW inverters to cater the needs of LCEVs is playing a vital role in shaping the industrial landscape. Moreover, the increasing application of these inverters in electric SUVs is expected to boost the growth of the electric vehicle power inverter market.

The 601 kW & above segment is expected to rise with the fastest CAGR during the forecast period. The rising application of high-capacity power inverters in electric trucks to power electric motors has driven the market growth. Also, the increasing use of 601 kW inverters in luxury and high-performance vehicles to deliver superior power is contributing to the industry in a positive manner. Moreover, rapid investment by market players to develop powerful inverters is expected to drive the growth of the electric vehicle power inverter market.

The silicon IGBT segment dominated the electric vehicle power inverter market with a share of around 65%. The increasing use of silicon IGBT in EV inverters to handle high voltages and currents has boosted the market expansion. Additionally, numerous advantages of silicon IGBT including fast switching speeds, low on-state resistance, cost-effectiveness and some others is expected to drive the growth of the electric vehicle power inverter market.

The silicon carbide (SiC) segment is expected to grow with the fastest CAGR during the forecast period. The growing application of silicon carbide in EV inverters for enhancing performance and efficiency has driven the market growth. Also, various benefits of silicon carbide such as higher efficiency, higher voltage and current capabilities, faster switching speeds, improved thermal management and some others is expected to boost the growth of the electric vehicle power inverter market.

The passenger cars segment led the electric vehicle power inverter market with a share of around 70%. The growing sales of luxury EVs in several countries including the U.S., Canada, France, Italy and some others has boosted the market expansion. Additionally, rapid investment by automotive brands on developing affordable passenger EVs to cater the needs of developing nations is contributing to the industry in a positive manner. Moreover, collaborations among market players and EV brands to develop inverters for passenger EVs is expected to boost the growth of the electric vehicle power inverter market.

The commercial vehicles segment is expected to grow with the fastest CAGR during the forecast period. The growing adoption of electric trucks in several industries such as construction, logistics, e-commerce and some others has driven the market growth. Additionally, rise in number of startup companies dealing in LCEVs along with rapid expansion of the EV sector is playing a vital role in shaping the industrial landscape. Moreover, the increasing emphasis of inverter companies on developing high-quality inverters for electric buses is expected to boost the growth of the electric vehicle power inverter market.

The OEM segment led the electric vehicle power inverter market with a share of around 80%. The growing emphasis of EV consumers to adopt genuine products has boosted the market expansion. Additionally, numerous benefits provided by automotive OEMs to purchase high-quality EV components is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by OEMs to open new EV servicing outlets is expected to drive the growth of the electric vehicle power inverter market.

The aftermarket segment is expected to expand with the fastest CAGR during the forecast period. The growing demand for affordable EV components in developing nations has driven the market expansion. Also, rise in number of automotive aftermarket companies dealing in EV inverters is contributing to the industry in a positive manner. Moreover, the availability of wide variety of inverters in several online platforms such as Ebay, Amazon, Alibaba and some others is expected to boost the growth of the electric vehicle power inverter market.

Asia Pacific dominated the electric vehicle power inverter market with a share of around 44%. The increasing sales of BEVs in several countries such as India, China, Japan, South Korea and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Denso Corporation, Toyota Industries Corporation, Mitsubishi Electric Corporation and some others is expected to boost the growth of the electric vehicle power inverter market in this region.

China led the market in this region. The growing development in the EV industry coupled with availability of essential raw materials at less prices has driven the market expansion. Also, rapid investment by automotive brands for setting up new production facilities along with increasing sales of EVs is playing a vital role in shaping the industrial landscape.

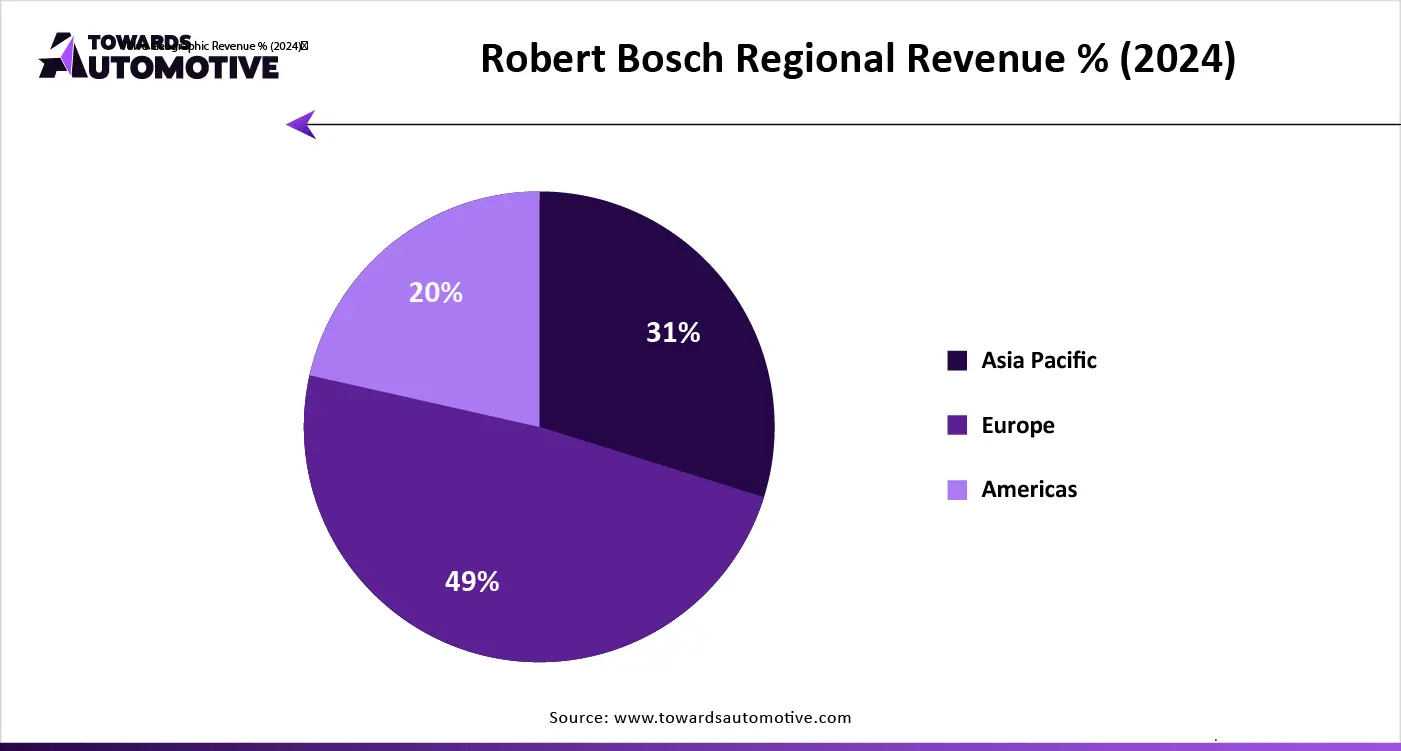

Europe is expected to grow with the highest CAGR during the forecast period. The growing demand for luxury EVs in various nations including France, UK, Italy, Germany and some others has boosted the market growth. Additionally, rapid investment by government for enhancing the EV adoption coupled with technological advancements in the automotive sector is playing a crucial role in shaping the industry in a positive manner. Moreover, the presence of various market players such as Valeo SA, ABB LTD, Continental AG, Bosch Mobility Solutions and some others is expected to propel the growth of the electric vehicle power inverter market in this region.

Germany is the major contributor in this region. The technological advancements in the automotive sector coupled with presence of numerous automotive manufacturers has boosted the market expansion. Also, the increasing sales of luxury EVs along with numerous government initiatives aimed at rising awareness about EVs is contributing to the industry in a positive manner.

The production of inverters mainly depends on several raw materials including high-purity manganese and synthetic graphite.

Various performance parameters of the inverter are measured, such as its efficiency, voltage regulation, current regulation, waveform quality, and maximum power output.

These inverters are primarily distributed through authorized dealerships and online platforms.

The electric vehicle power inverter market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Nissan Motor Co., Ltd., BYD Auto Co., Ltd., General Motors Company, Denso Corporation, Toyota Industries Corporation, Mitsubishi Electric Corporation, Valeo SA, Continental AG, Bosch Mobility Solutions, Hitachi Astemo, Tesla, Inc., Stellantis N.V., Ford Motor Company, BMW AG, Hyundai Motor Company, Kia Corporation, Zhejiang Geely Holding Group, NIO Inc., Rivian Automotive, Inc., Lucid Group, Inc. and some others. These companies are constantly engaged in manufacturing power inverters for EVs and adopting numerous strategies such as joint ventures, partnerships, acquisitions, collaborations, launches, business expansions and some others to maintain their dominance in this industry.

By Vehicle Propulsion Type

By Power Output

By Inverter Technology

By Vehicle Category

By Distribution Channel

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us