October 2025

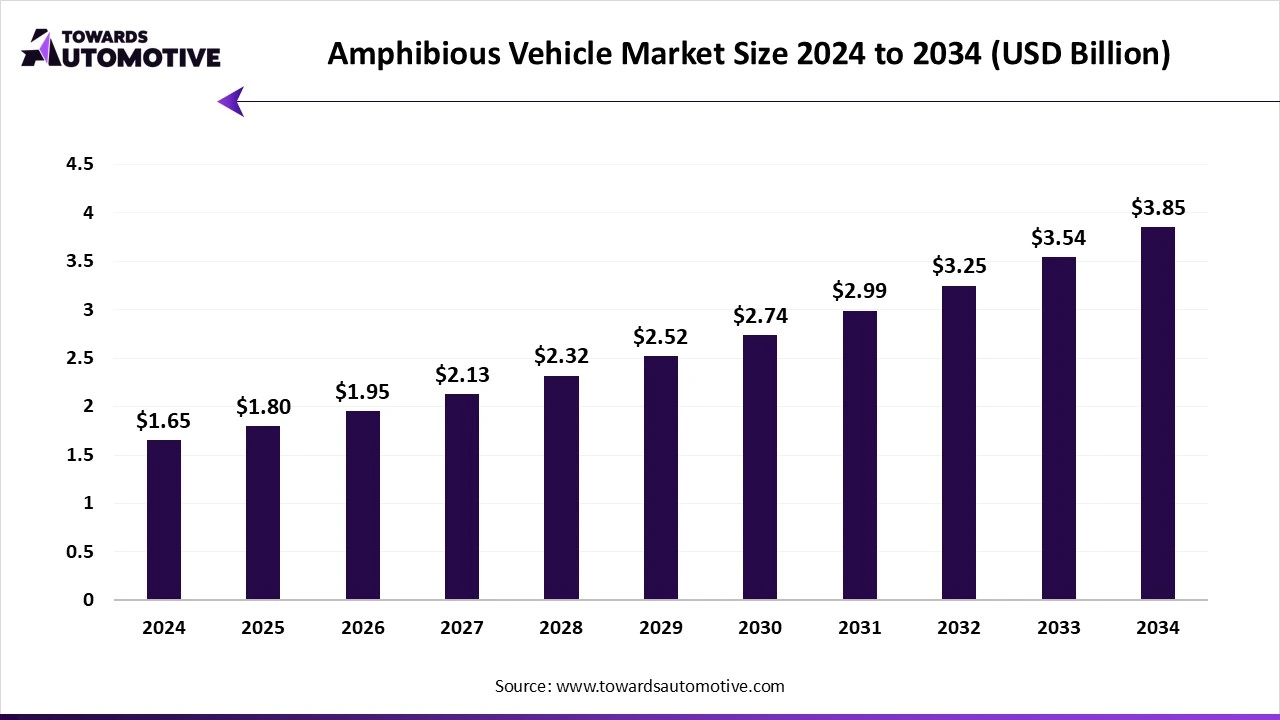

The amphibious vehicle market is anticipated to grow from USD 1.80 billion in 2025 to USD 3.85 billion by 2034, with a compound annual growth rate (CAGR) of 8.85% during the forecast period from 2025 to 2034. The amphibious vehicle market is primarily driven by the increasing defense budgets globally along with growing prevalence of floods, hurricanes, and other disasters.

Additionally, the rise in number of infrastructure projects such as dredging, mining, and land reclamation have increased the demand for amphibious excavators. The integration of AI and sensor fusion technology in military vehicles is expected to create ample growth opportunities for the market players in the future.

An amphibious vehicle can travel on both land and water. In defense sector, an amphibious vehicle is used for troop transport, coastal security, swift response, and other army operations. In the disaster relief operations, these vehicles are used to help with rescuers by supplying essential goods during floods, storms, or other emergencies. In construction, amphibious excavators and dredgers are used for dredging rivers, mining wetland areas, and land reclamation.

The trends in the amphibious vehicle market are collaborations between companies for product development and innovative product launches.

The amphibious combat vehicles (ACVs) segment held a dominant presence with over 45% of the market share, largely due to its widespread use in defence operations. ACVs are machines that can operate on both land and water at different speeds, making them essential to any military needing mobility over rivers, coastlines, and wetlands. Increased cross-border tensions and defense modernization programs have led to many governments purchasing more ACVs. The U.S. Marine Corps is one of the countries that invested heavily in ACVs to replace older models, providing more protection to troops and other military personnel.

The amphibious excavators & dredgers segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Amphibious excavators and dredgers are set to grow at the fastest rate in the future due to their involvement in the many growing infrastructure and environmental projects. Amphibious excavators, dredgers, and other machines are used for dredging rivers, flood control, wetland mining, and other coastal land reclamation projects as they relate to climate change. With the growing effects of climate change, such as flooding and rising sea levels, many governments are forced to strengthen their waterways and associated infrastructure.

The water jet propulsion segment captured 40% of the amphibious vehicle market share. Water jets involve mechanical fans and are less sensitive than traditional propeller types. Amphibious vehicles using jet propulsion can operate in shallow-water areas, which can be an advantage when operating in muddy areas typically utilized in military and rescue missions. They are more durable because they are less at risk of being damaged by debris in the water. Jet propulsion differs vastly from the conventional dynamics of propellers, which is why there are fewer limitations, such as operating in shallow water. Many industries incorporate jet propulsion technology from high-speed amphibious craft, such as patrol vessels and ACVs, implemented for military use and offshore operations.

The hybrid propulsion segment is projected to experience the highest growth rate in the market between 2025 and 2034. Hybrid propulsion is expected to grow in demand with increasing demand for energy efficiency and environmentally friendly systems. As a means of providing efficient transportation in a sustainable way, the market is moving towards a sustainable system to reduce fuel costs, reliance on fossil fuels, and ultimately harmful emissions. Hybrid systems provide the basis for a combustion engine with efficient electric motors, combining both power and efficiency. Since hybrid systems can electrify, it also allows the ability to remove combustion engines, reducing noise levels of vehicles such as amphibious vehicles, which can be extremely beneficial in stealth operations in the military or for environmental projects.

The fully amphibious segment dominated the market, capturing almost 65% of the market share, and is anticipated to be the fastest-growing segment in the market. Unlike the partially amphibious type, they can operate on land and water seamlessly without any transition or modification. Fully amphibious vehicles are used in defence, construction, and rescue operations because they carry out missions with speed and mobility. Interest in fully amphibious vehicles from the military and defence has been high, and countries have invested in acquiring multi-purpose platforms.

The defense & military segment registered its dominance by holding over 50% of the market share. This is because amphibious vehicles are used in modern multi-domain combat strategies. Nations with long coastal regions or bordering rivers need amphibious vehicles to transport troops, provide surveillance and reconnaissance, and engage in rapid response missions. This increases mobility and permits militaries to project power across coastal areas. Increased demands were also driven by ongoing territorial disputes in the South China Sea and Eastern Europe. The combination of firepower, transport ability, and versatility explains why the defence & military segments lead the amphibious vehicle market.

The disaster relief & rescue segment is set to experience the fastest rate of market growth from 2025 to 2034. Disaster relief and rescue applications are projected to grow the most due to an increase in natural disasters in the form of floods, hurricanes, and tsunamis. Amphibious vehicles are able to reach areas that would not be possible to reach using regular land or water vehicles, and they are important during an emergency. Governments and various NGOs are well-positioned to utilize these vehicles in order to provide evacuations in a timely manner, as well as deliver supplies to the inhabitants.

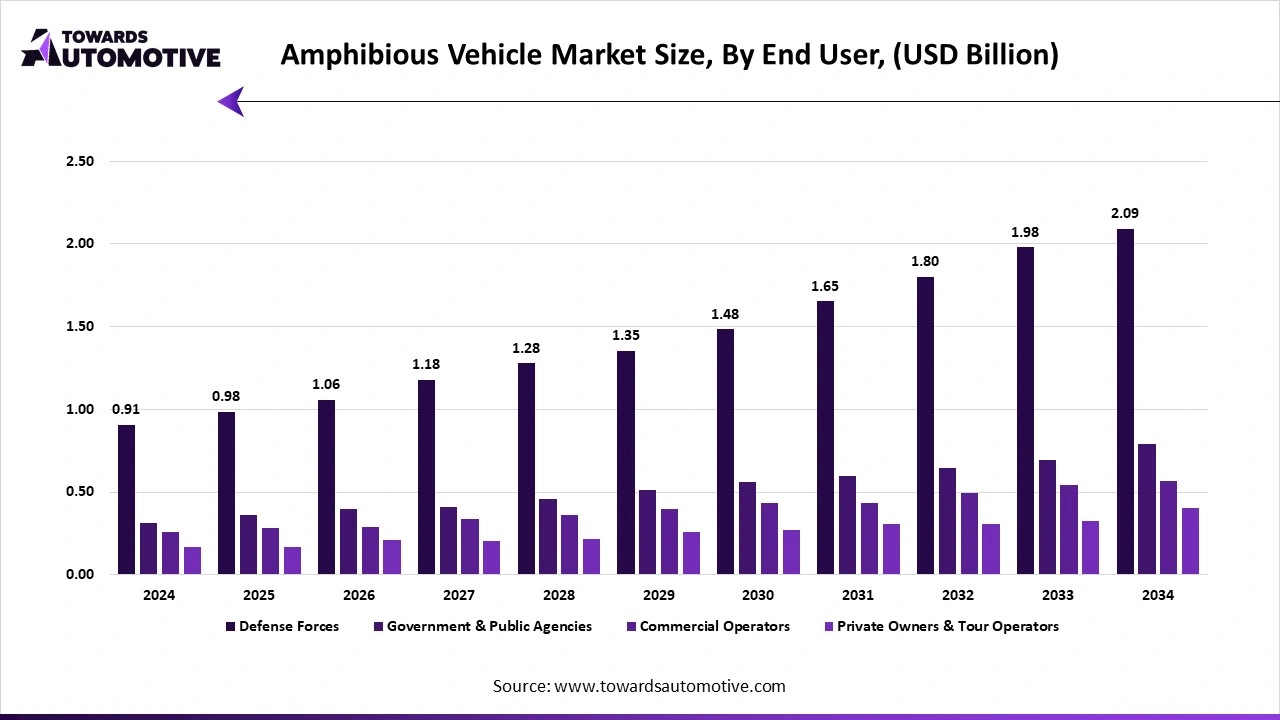

The defense forces segment maintained a leading position with 55% of the total market share. Driven by national security requirements, this consistent procurement for their military fleets, the defense forces trusted amphibious combat vehicles, patrol boats, and transport carriers, employed for coastal defence and border security duties, as well as during amphibious assaults. Countries such as the U.S. and China have presented their interest and priorities in the development of amphibious capabilities in their military modernization programs.

The commercial operators segment is anticipated to grow with the highest CAGR in the market during the years studied. Commercial users are expected to grow the fastest since tourism, dredging, and infrastructure developments have boomed worldwide. Commercial operations such as amphibious tour buses, as well as dredgers and excavators, are now coming into effect. There are already examples of the use of amphibious buses in locations for tourism in nations such as Singapore, Canada, and Australia. Also, similarly, dredging and reclamation projects in the last decade or so have been increasing tremendously within the Asia-Pacific regions due to urbanization and rising sea levels. Commercial users demonstrate the versatility, revenue generation/tactical commercial options, and financial yield for such an amphibious facility, which fuel their market growth.

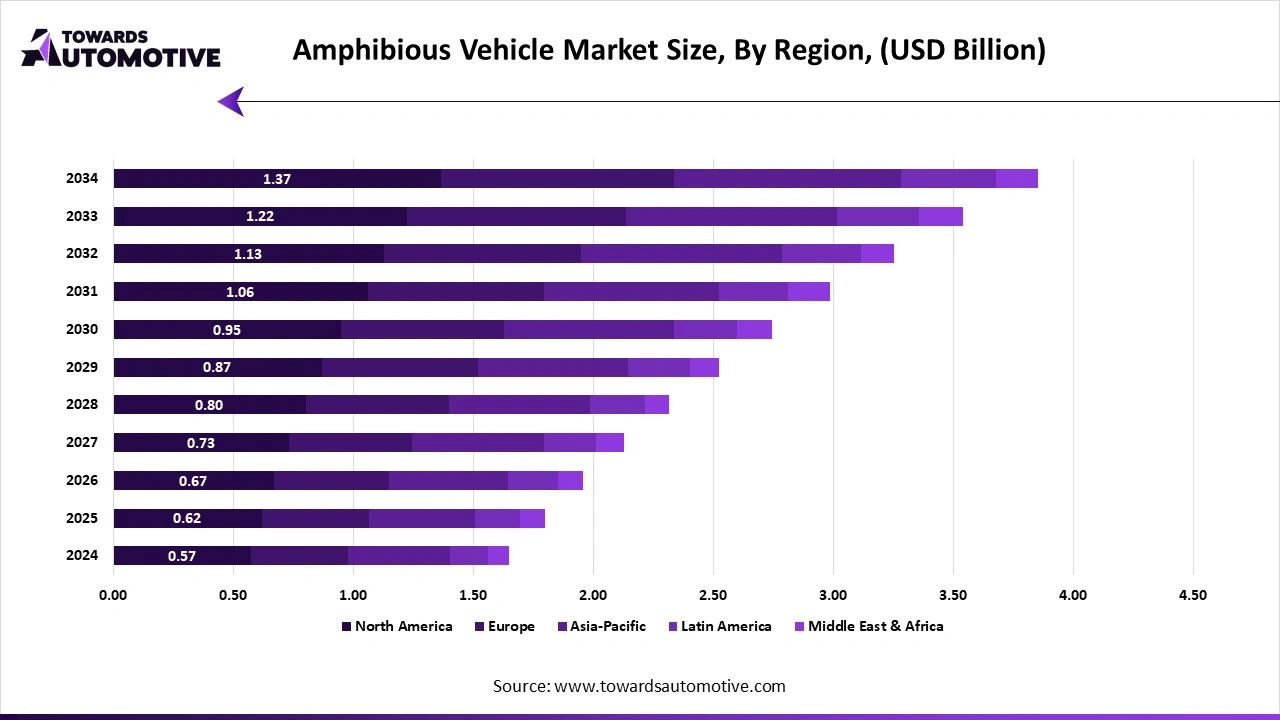

North America held 35% of the total market share in the amphibious vehicles market. North America has the highest usage of amphibious vehicles as it has the largest defense budgets, the most advanced technologies, and constant demand for high-quality defense systems. The U.S. and Canada have made strong investments in amphibious combat vehicles to reinforce coastal defense and the rapid redeployment of troops in flooded areas due to hurricanes. Due to these flood events and hurricanes, amphibious vehicles are necessary for rescue and immediate relief for disaster recovery. Additionally, the presence of large manufacturers that supply systems to clients globally creates opportunities to solidify the market. The region can also broaden the commercial use of amphibious vehicles such as amphibious tour buses, dredging machines, and amphibious vessels, which can make the North American region a center to service defense and non-defense markets.

The U.S. holds a dominant position in North America’s amphibious vehicle market due to its significantly large defense budget and focus on modernization. The U.S. Marine Corps is a core market driver as it regularly and continuously purchases amphibious combat vehicles to replace retiring, aging fleets. Regular hurricanes and floods increase demand for amphibious rescue vehicles. Companies such as General Dynamics and Lockheed Martin design and export advanced amphibious systems around the world. A strong combination of defense requirements, disaster response needs, and industrial capacity means the U.S.A. is the only major country in North America's amphibious vehicle market.

Asia-Pacific is expanding the fastest in the amphibious vehicle market due to the fast pace of infrastructure development, the existence of many disaster-prone geographic regions, and high-level defense spending. Many countries in the region, such as China, India, Japan, South Korea and Indonesia, regularly face floods, tsunamis, and typhoons; thus, the use of amphibious vehicles is very important for disaster response and recovery efforts. Growing tensions in the South China Sea have also resulted in increased/expanded military budgets for amphibious combat vehicles. Additionally, due to the massive population and the impact of climate challenges, the need for amphibious vehicles for both military and civilian roles is the reason why the Asia-Pacific region has rapidly expanded in the amphibious vehicle market.

China is the largest player in the Asia-Pacific amphibious vehicle market, mainly due to the enormous military modernization program and territorial disputes in the South China Sea. The rapid modernization of the Chinese military involved the purchase of new amphibious combat vehicles, as troops are transported rapidly by land or naval transport. Certain developments, such as dredging and reclamation projects, expand China's seriously limited coastal areas, like the Pearl River Delta in Guangdong province, with large amphibious excavators. With the largest manufacturing capability and significant domestic uptake in respect to defense programs and civil projects, China is leading the growth of the region's amphibious vehicle market.

The foundations of the amphibious market require extraction and supply of raw materials such as steel and aluminum (for frame), rubber (for tires), and plastic.

The raw materials are transformed into engines, transmissions, propulsion systems and armor & safety systems.

These vehicles are assembled with armored frames, engines, and other electrical components integrated with smart features such as GPS, communication tools and defense equipment.

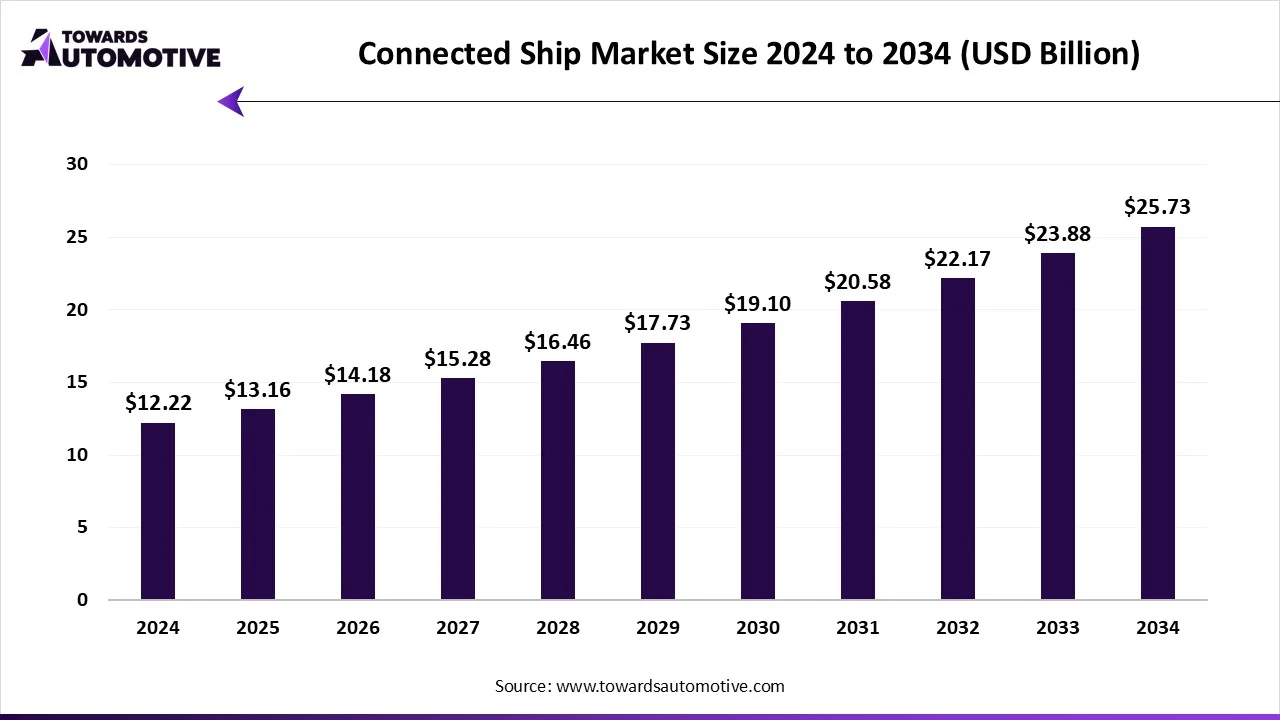

The connected ship market is projected to reach USD 25.73 billion by 2034, expanding from USD 13.16 billion in 2025, at an annual growth rate of 7.73% during the forecast period from 2025 to 2034. The growing demand for advanced communication systems from the marine sector coupled with numerous government initiatives aimed at enhancing maritime safety has boosted the market expansion.

Also, rising focus of market players for developing high-quality navigation systems for ships along with rapid investment in the defense sector is playing a vital role in shaping the industrial landscape. The advancements in 5G technology as well as integration of AI-based navigation systems in modern ships is expected to create ample growth opportunities for the market players in the upcoming days.

The connected ship market is a prominent branch of the marine industry. This industry deals in developing advanced connectivity solutions for the shipping sector around the world. There are various types of systems developed in this sector comprising of navigation systems, communication systems, automation & control systems, security & surveillance systems, payload & mission systems and some others.

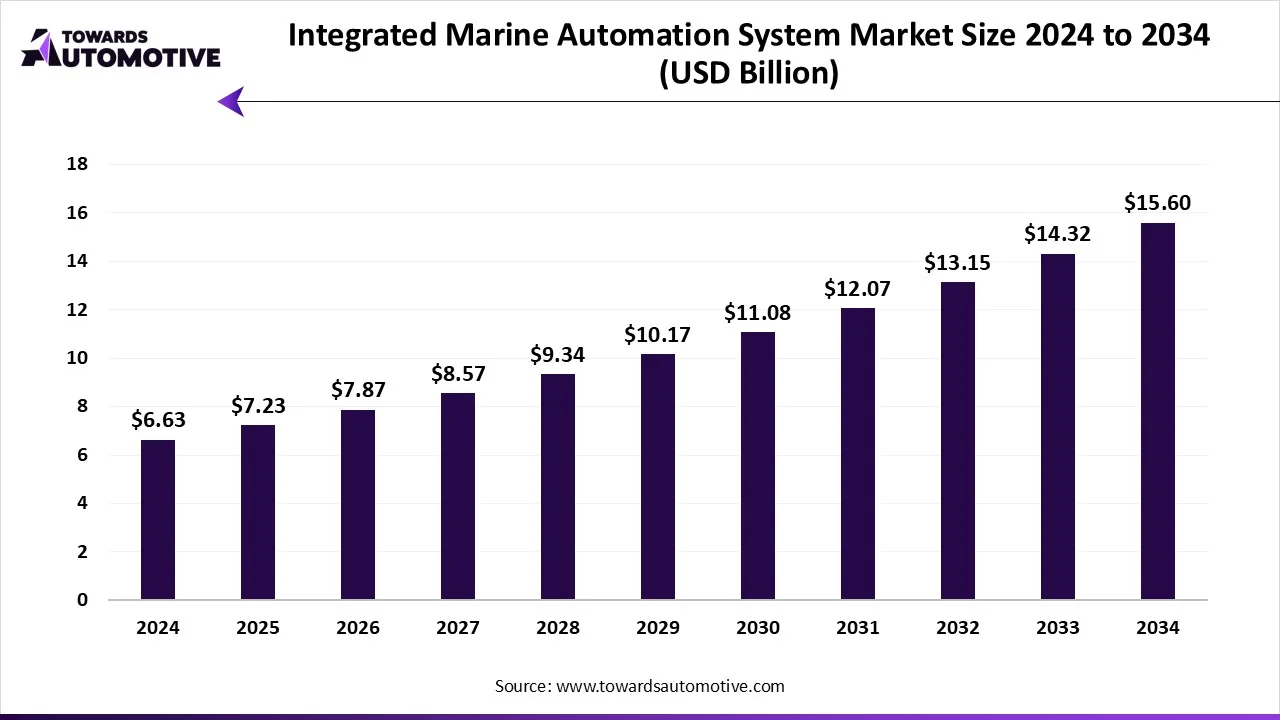

The integrated marine automation system market is predicted to expand from USD 7.23 billion in 2025 to USD 15.60 billion by 2034, growing at a CAGR of 8.93% during the forecast period from 2025 to 2034.

The integrated marine automation system market is a crucial segment of the marine industry. This industry deals in the development and distribution of automation solutions for the marine sector. There are various types of solutions developed in this sector comprising of vessel management system, power management system, safety system and some others. These systems consist of several components including hardware, software, services and others.

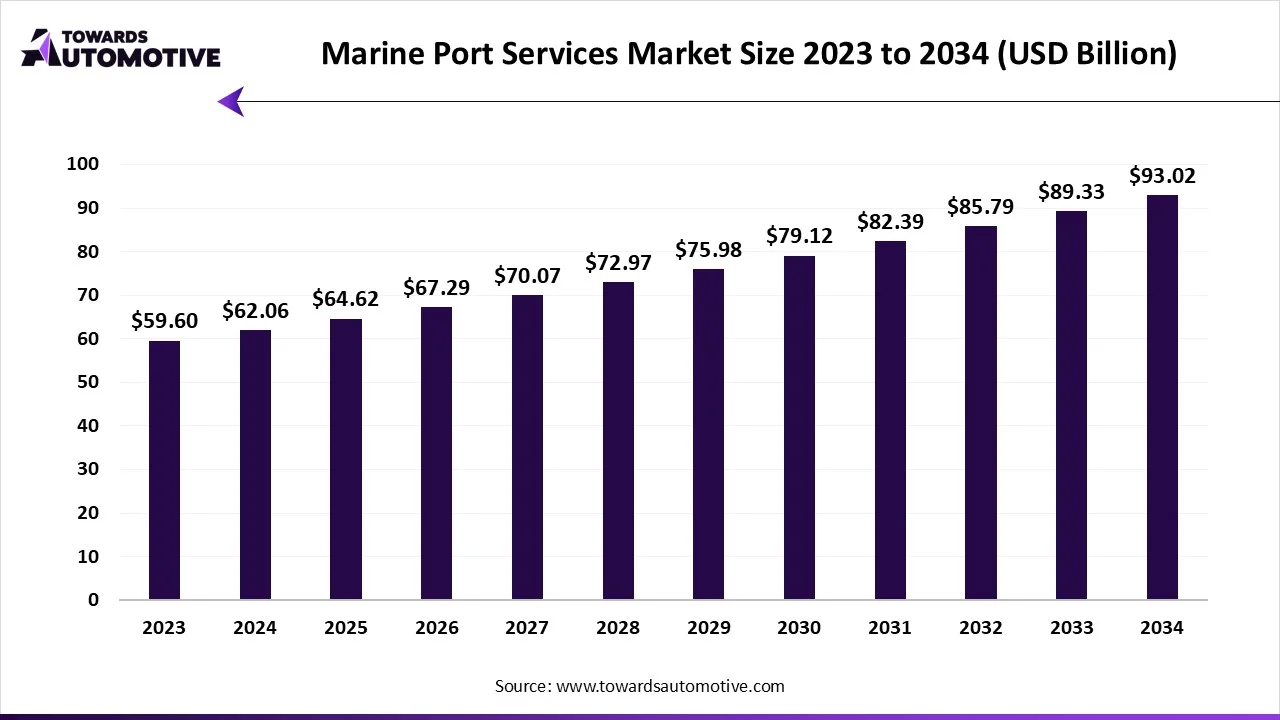

The marine port services market is forecasted to expand from USD 64.62 billion in 2025 to USD 93.02 billion by 2034, growing at a CAGR of 4.13% from 2025 to 2034.

The marine port services market is a prominent branch of the maritime industry. This industry deals in delivering advanced port services for the marine sector. This sector deals in operating different types of ports consisting of container ports, bulk ports, break-bulk ports, ro-ro ports and some others.

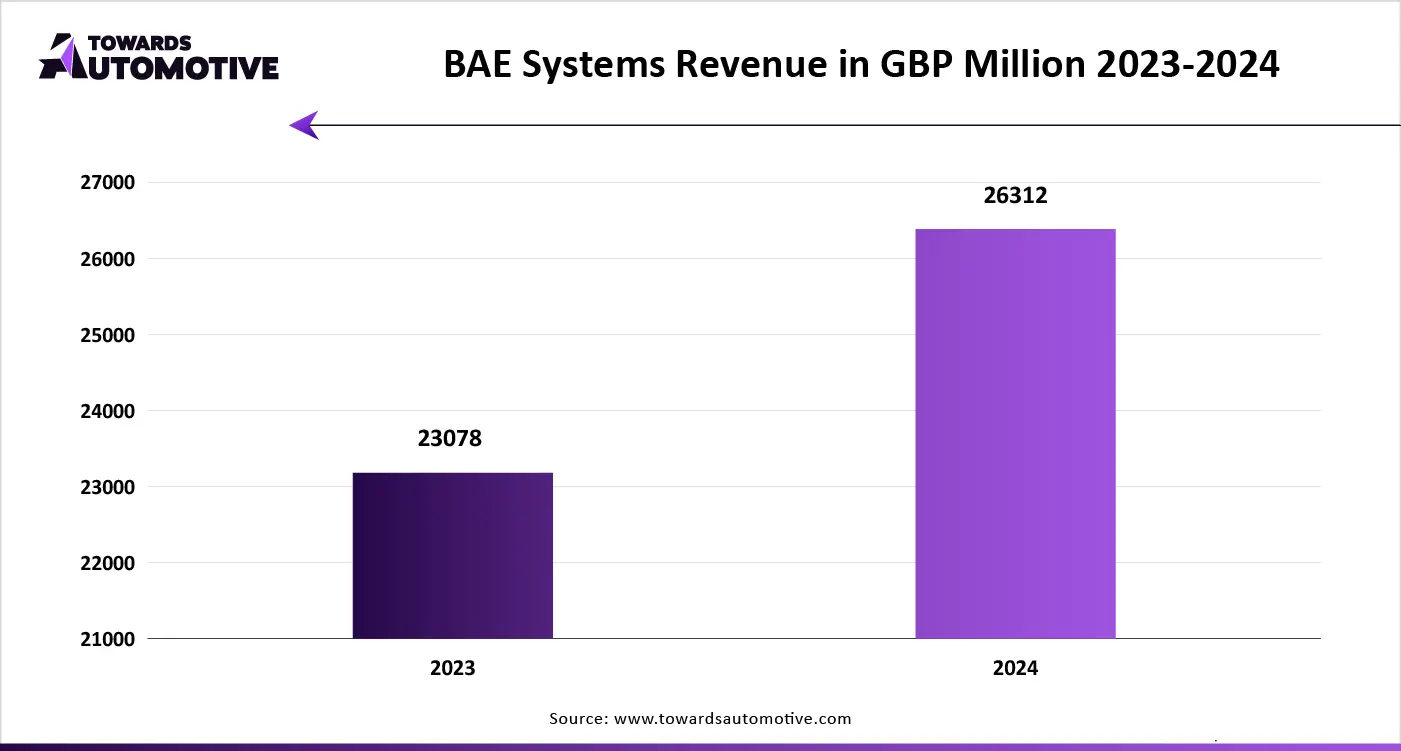

The amphibious vehicle market is highly competitive. The market is comprised of several international and domestic players committed to researching and developing innovative products in the market. A few key players in the market include BAE Systems plc, EIK Engineering Sdn. Bhd., General Dynamics Corporation, Griffon Hoverwork Ltd. (GHL), Iveco Defense Vehicles, Science Applications International Corporation (SAIC), Wetland Equipment Company Inc., Hitachi Construction Machinery Co. Ltd, Lockheed Martin Corporation, and Wilco Manufacturing, L.L.C. Companies in the amphibious vehicle market are focusing on research and development to build advanced vehicles that are faster, safer, and more fuel-efficient. Many companies are working on hybrid and electric propulsion systems to meet global emission standards. Companies are also improving designs for better mobility in shallow waters and rough terrains. Partnerships with defense forces and governments are helping them secure long-term contracts.

By Vehicle Type

By Propulsion Type

By Mode of Operation

By Application

By End-User

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us