October 2025

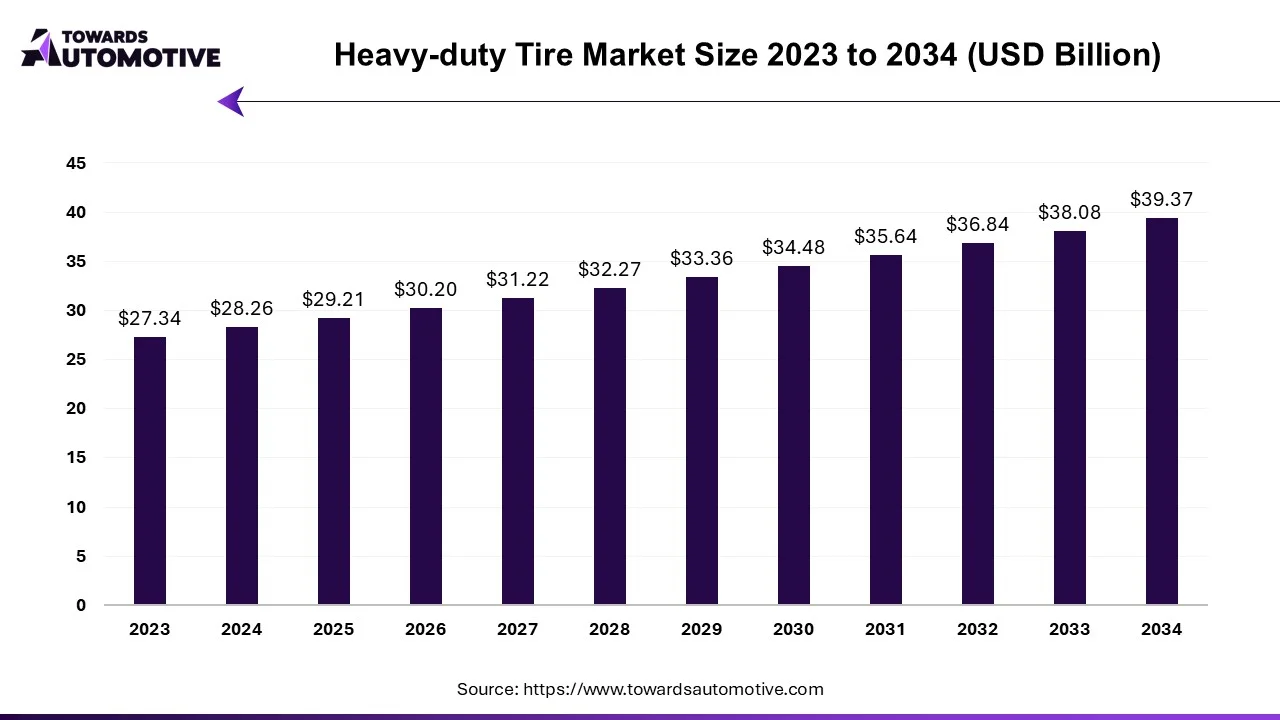

The heavy-duty tires market is expected to increase from USD 29.21 billion in 2025 to USD 39.37 billion by 2034, growing at a CAGR of 3.37% throughout the forecast period from 2025 to 2034.

The heavy-duty tires market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of heavy-duty tires across the world. There are several tires developed in this sector consisting of bias ply tires, radial tires, solid tires, tube tires and some others. These tires are designed for numerous types of vehicles including trucks, construction equipment, agricultural vehicles, mining equipment, industrial vehicles and some others. It finds application in different sectors consisting of on-road applications, off-road applications, heavy construction, agricultural operations, mining operations and some others. The rising development in the mining industry in different parts of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the tire manufacturing industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 28.26 Billion |

| Projected Market Size in 2034 | USD 39.37 Billion |

| CAGR (2025 - 2034) | 3.37% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle Type, By End-User and By Region |

| Top Key Players | Michelin, Titan Tire Corporation, Continental Tires, Balkrishna Industries Limited (BKT), Sumitomo Rubber Industries, Ltd |

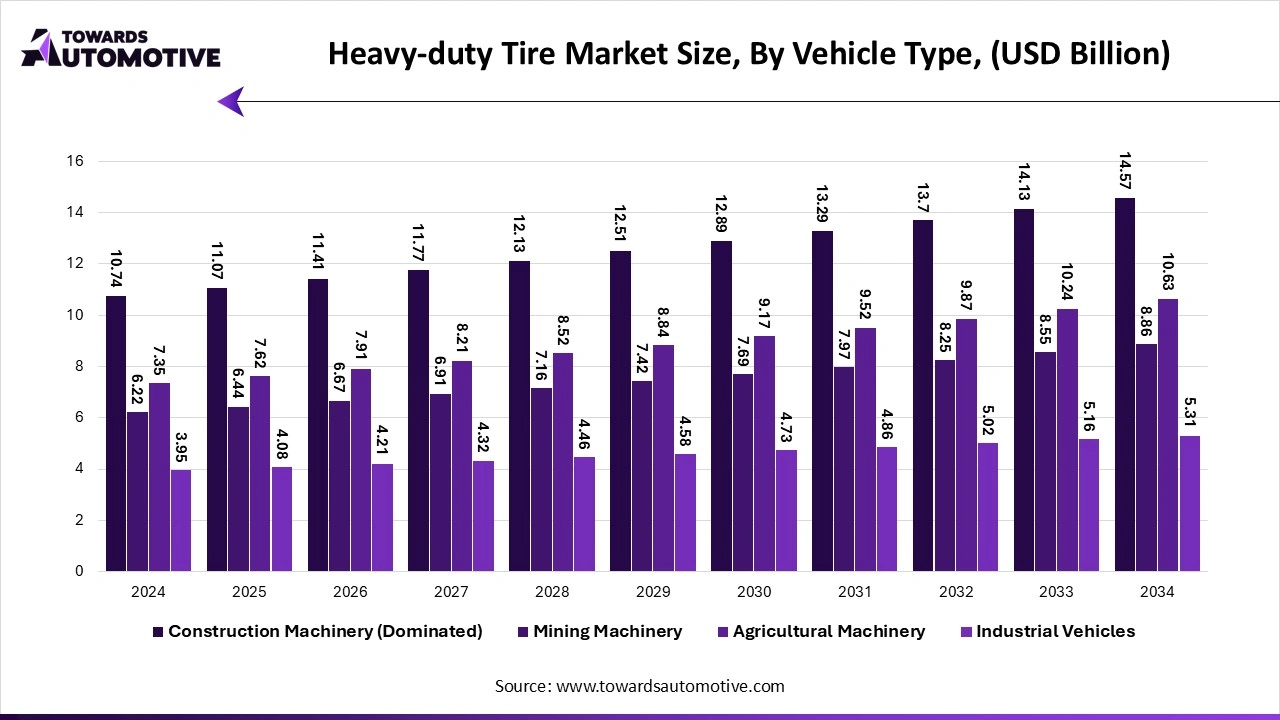

The construction machinery segment held the largest share of the market. The rise in number of residential constructions in developed nations such as U.S., UK, France, Germany, Australia and some others is driving the market expansion. Additionally, the rising investment by government of several countries for developing the road infrastructure coupled with rapid investment by market players to manufacture tires for construction equipment is likely to shape the industrial landscape. Moreover, the growing sales of various construction vehicles such as dump trucks, cranes, bulldozers, excavators, forklifts and some others is expected to drive the growth of the heavy-duty tires market.

The agricultural machinery segment is anticipated to witness the fastest growth during the forecast period. The rising demand for several food crops from several countries such as India, China, Brazil and some others has increased the demand for agricultural equipment, thereby driving the market expansion. Additionally, numerous government initiatives aimed at developing the agricultural sector coupled with increasing sales of tractors and irrigation equipment is playing a positive role in shaping the industrial landscape. Moreover, rapid investment by market players for developing heavy-duty tires to cater the needs of the agricultural equipment is anticipated to boost the growth of the heavy-duty tires market.

The OEM segment dominated this industry. The growing demand for high-quality tires with valid warranty and guarantee among the truck operators has boosted the market growth. Additionally, the rising preference of tractor owners to visit OEM-based service centers is playing a vital role in shaping the industrial expansion. Moreover, numerous collaborations among automotive OEMs and tire manufacturers for manufacturing heavy-duty tires is further adding to the growth of the heavy-duty tires market.

The aftermarket segment is predicted to rise with a notable CAGR during the forecast period. The rising preference of consumers to modify their vehicles has increased the demand for aftermarket products, thereby driving the market growth. Moreover, the growing demand for cost-effective tire maintenance along with rise in number of aftermarket startups is driving the growth of the heavy-duty tires market.

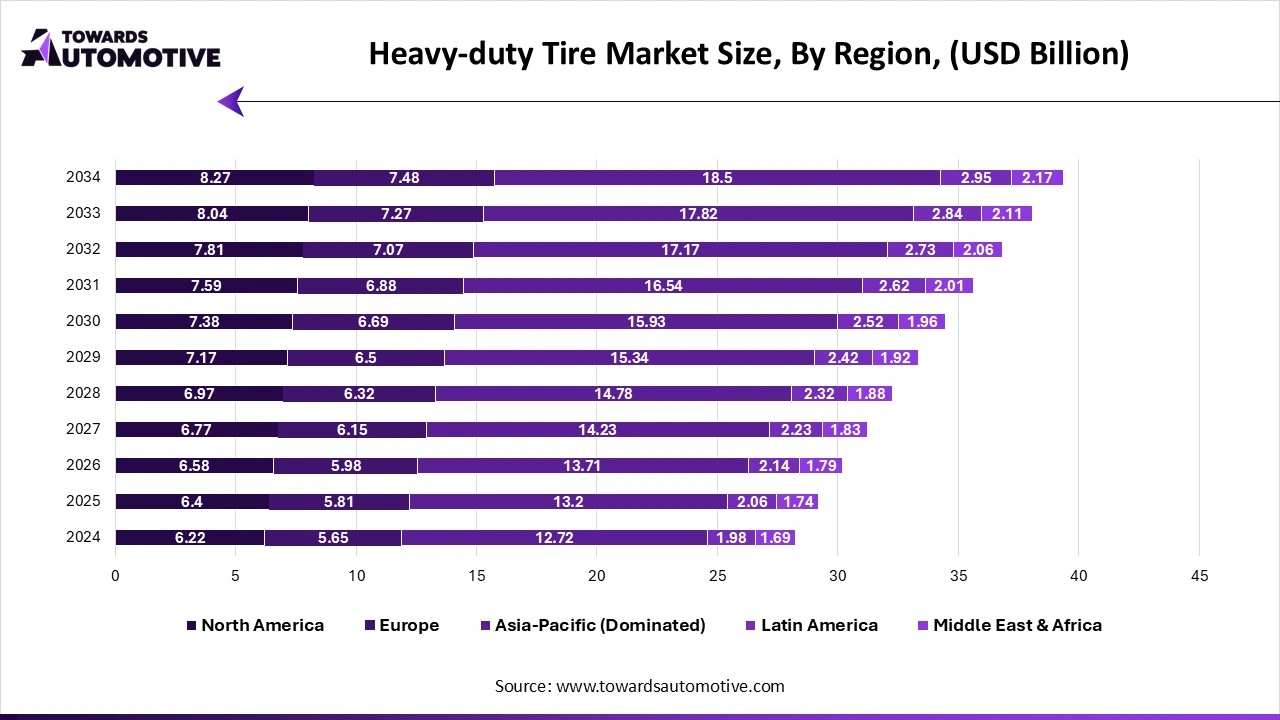

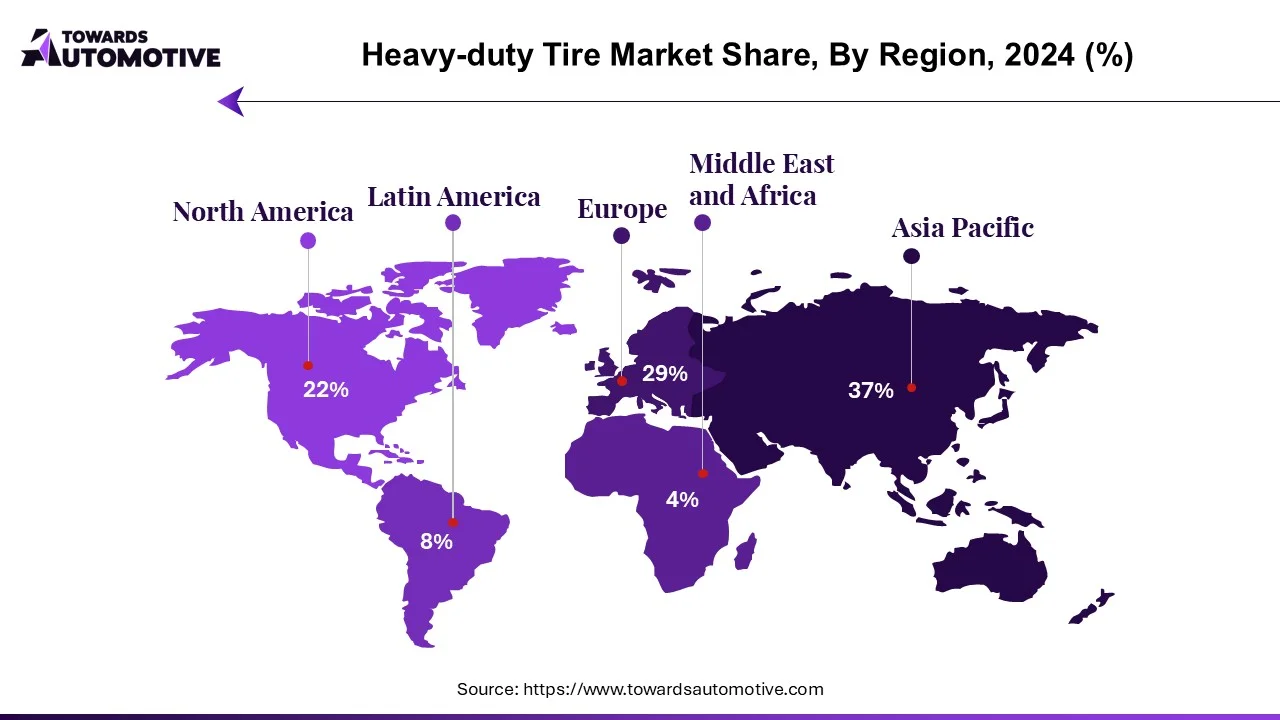

Asia Pacific held the highest share of the heavy-duty tires market. The growing demand for heavy-duty tires from the mining sector across countries such as China, India, South Korea and some others has boosted the market expansion. Additionally, the rising investment by several private entities and public companies for developing the tire manufacturing sector is further contributing to the overall industrial growth. Moreover, the presence of several heavy-duty tire manufacturers such as Balkrishna Industries Limited (BKT), Sumitomo Rubber Industries, Ltd., JK Tyre & Industries and some others has further bolstered the market growth. Furthermore, the growing interest of people towards agriculture along with availability of rubber at a large scale is expected to propel the growth of the heavy-duty tires market in this region.

China is the dominant player in this region. In China, the market is generally driven by the rising sales of agricultural equipment and increasing demand for construction machineries. Additionally, the availability of raw materials such as rubber, carbon black, steel and some others that are essential in tire manufacturing sector coupled with rapid integration of advanced technologies such as AI and IoT in automotive industry has further boosted the market expansion. Moreover, the presence of tire companies such as Zhongce Rubber Group, Giti Tire, Sailun Jinyu Group and some others is adding to the overall market growth in this nation.

India and Japan further contributes significantly to the market. In India, the market is generally driven by the rapid developments in the agricultural sector coupled with numerous government initiatives aimed at strengthening the mining industry. In Japan, the technological advancements in tire manufacturing industry along with presence of several tire brands such as Sumitomo Rubber Industries, Bridgestone, Yokohama Rubber Company and some others is driving the market in a positive direction.

North America is expected to grow with a significant CAGR during the forecast period. The rising development in the mining sector along with increased consumer interest towards organic farming has driven the market expansion. Additionally, the growing adoption of electric tractors in U.S. and Canada for operating heavy-duty tasks coupled with integration of AI in tire industry has further contributed positively to the overall industrial growth. Moreover, the presence of several heavy-tire manufacturing companies including Goodyear Tires, Uniroyal, Cooper Tire & Rubber Company and some others is driving the growth of the heavy-duty tires market in this region.

U.S. is the major contributor in this region. The growing adoption of excavators and electric dump trucks in mining sector has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the agricultural sectors coupled with increasing emphasis on using sustainable materials for manufacturing heavy-duty tires is playing a vital role in shaping the industrial landscape. Moreover, the presence of several industrial equipment manufacturers such as Lawson Products, Caterpillar Inc., Terex Corporation and some others is crucial for the industrial expansion.

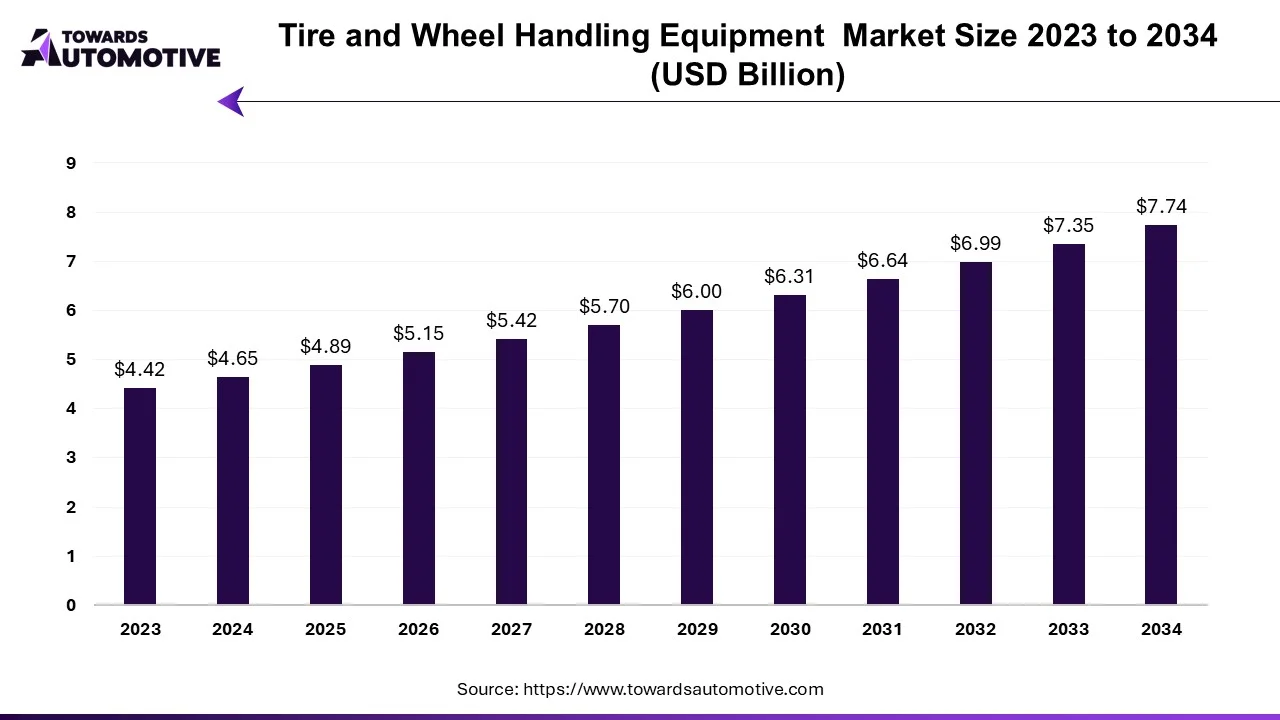

The tire and wheel handling equipment market is forecasted to expand from USD 4.89 billion in 2025 to USD 7.74 billion by 2034, growing at a CAGR of 5.22% from 2025 to 2034.

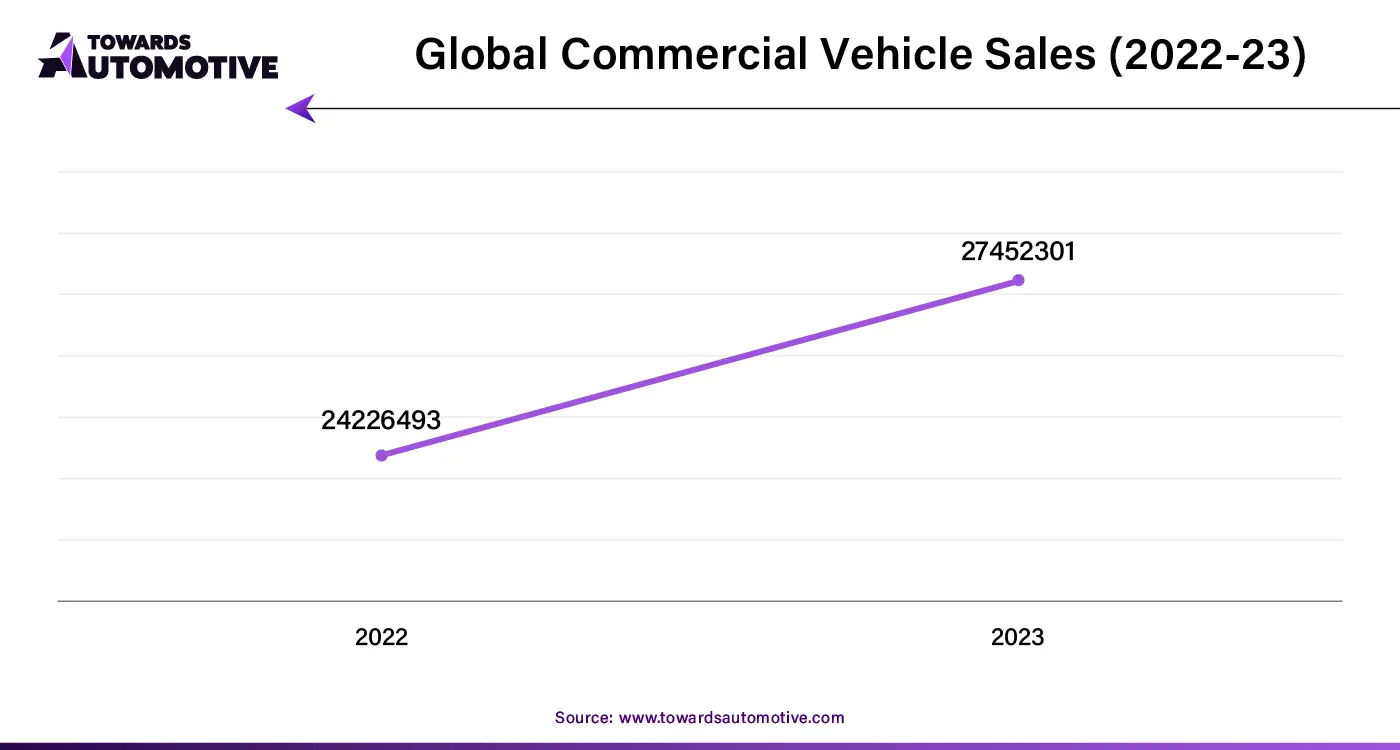

The automotive industry is witnessing a surge in the production of special vehicles like passenger cars, trucks, buses, electric, and driverless cars to meet growing customer demands. Technological advancements in vehicle design, manufacturing processes, safety features, and the rise of environmentally friendly options such as electric and hybrid vehicles are driving business growth in the automotive sector. These innovations cater to diverse customer preferences, contributing to industry expansion.

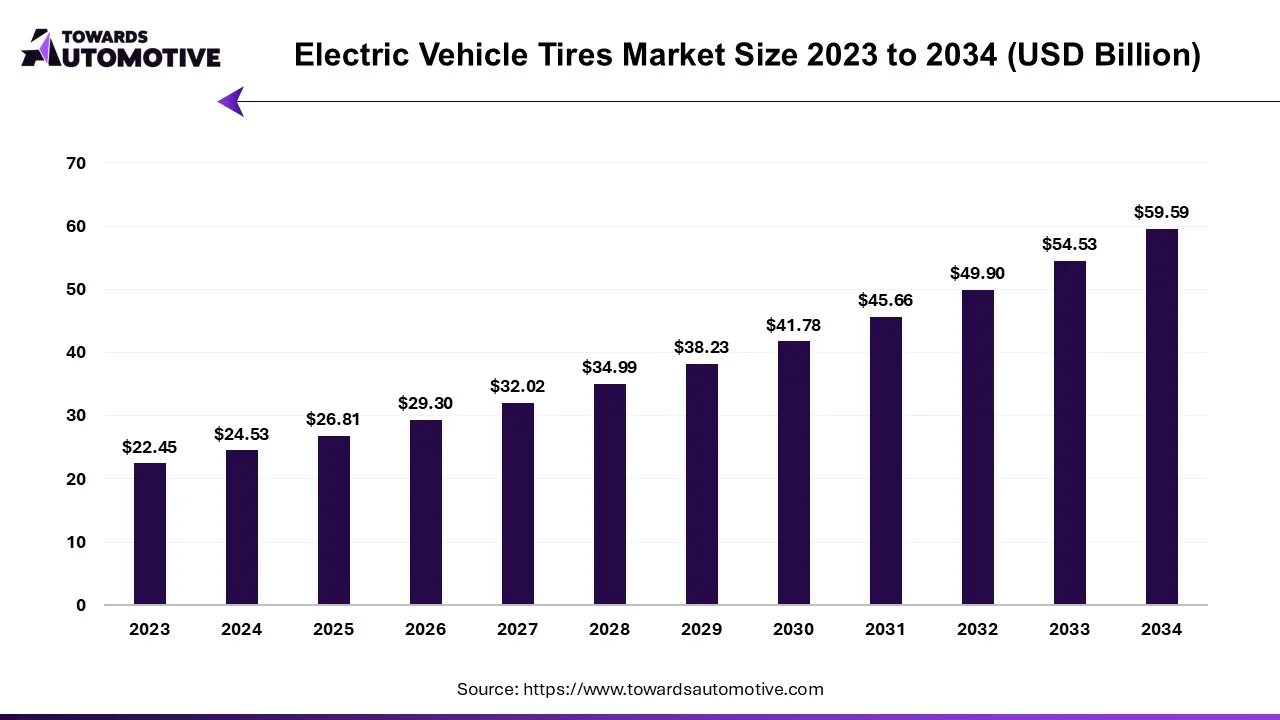

The global electric vehicle tires market is forecasted to expand from USD 26.81 billion in 2025 to USD 59.59 billion by 2034, growing at a CAGR of 9.28% from 2025 to 2034.

The electric vehicle tires market is a rapidly expanding segment within the automotive industry, driven by the growing adoption of electric vehicles worldwide. EV tires are specifically designed to meet the unique demands of electric vehicles, such as higher torque, heavier weight due to battery packs, and the need for improved energy efficiency to maximize range. These specialized tires play a crucial role in enhancing the overall performance, safety, and longevity of electric vehicles, making them an essential component in the EV ecosystem.

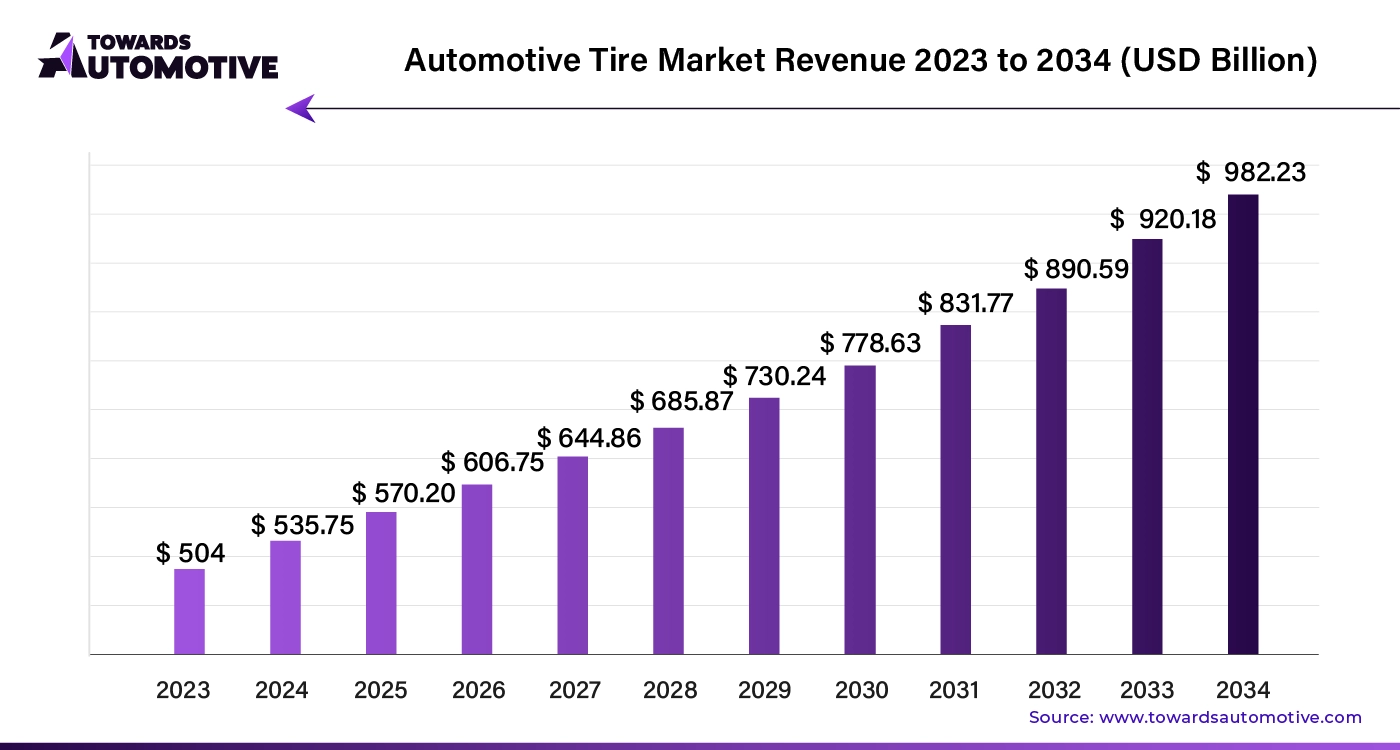

The automotive tire market is projected to reach USD 982.23 billion by 2034, expanding from USD 570.20 billion in 2025, at an annual growth rate of 6.36% during the forecast period from 2025 to 2034. The increasing focus of autonomous vehicle brands to use radial tires in their cars along with technological developments in the tire industry is playing a prominent role in shaping the industrial landscape.

Additionally, rapid investment by government for developing the tire manufacturing sector as well as integration of advanced sensors in tires to monitor pressure and temperature has driven the market expansion. The growing emphasis of tire manufacturers on developing eco-friendly automotive tires is expected to create ample growth opportunities for the market players in the upcoming days.

The automotive tire market is a crucial segment of the rubber industry. This industry deals in manufacturing and distribution of automotive tires in different parts of the world. There are several types of tires manufactured in this sector consisting of summer tires, winter tires, off-roading tires, all-season tires and some others. These tires are designed for various types of vehicles including passenger cars, LCV, HCV, two-wheelers and some others. It is available in different sizes comprising of less than 15 inches, 15-20 inches, more than 20 inches and some others. The automotive tires are distributed by a well-established distribution channel such as OEMs and aftermarket. This market is expected to grow drastically with the rise of the automotive sector around the globe.

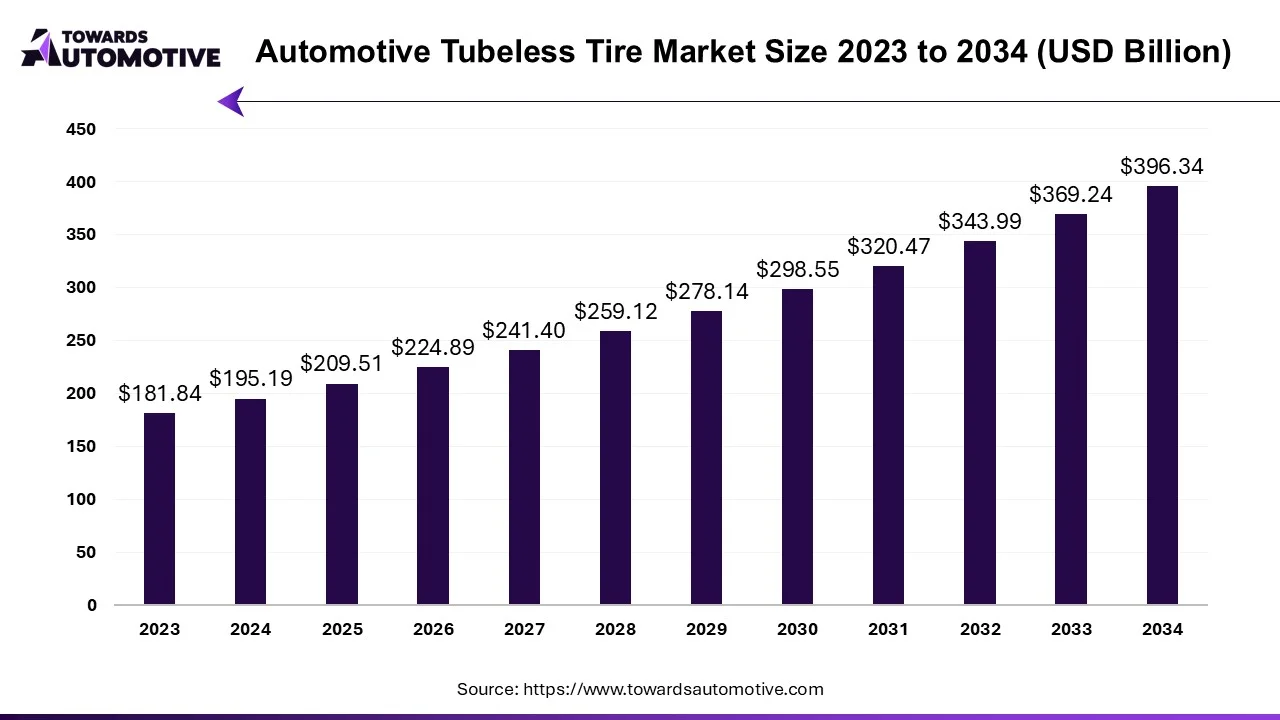

The automotive tubeless tire market is forecasted to expand from USD 209.51 billion in 2025 to USD 396.34 billion by 2034, growing at a CAGR of 7.34% from 2025 to 2034.

The automotive tubeless tire market is an integral branch of the tire industry. This industry deals in manufacturing and distribution of tubeless tires for automotive sector. There are several products manufactured in this industry consisting of radial tires and bias tires. These tires are designed for different vehicles such as two-wheeler, passenger cars, commercial vehicles and some others. It is available in a well-organized sales channel comprising of OEM and aftermarket. The growing demand for SUVs in different parts of the world has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the automotive materials industry around the globe.

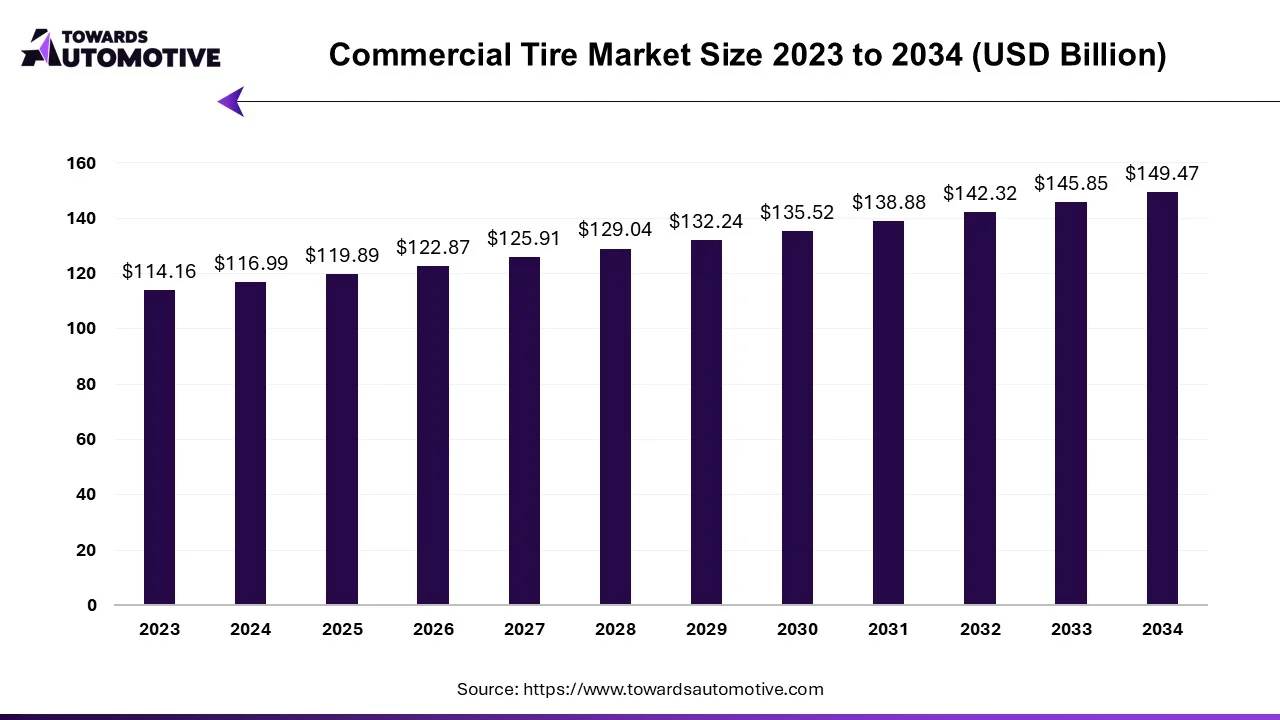

The commercial tire market is expected to increase from USD 119.89 billion in 2025 to USD 149.47 billion by 2034, growing at a CAGR of 2.48% throughout the forecast period from 2025 to 2034.

The commercial tire market is a crucial branch of the automotive materials industry. This industry deals in manufacturing and distribution of tires for commercial vehicles. There are different types of tires developed in this sector consisting of radial tires, bias tires and solid tires. These tires are designed for numerous vehicles such as light commercial vehicles, medium commercial vehicles and heavy commercial vehicles. It finds various application in several sectors including transportation, construction, agriculture, mining and some others. The growing demand for commercial vehicles in different parts of the world has contributed to the market expansion. This market is expected to grow drastically with the growth of the tire industry across the globe.

The heavy-duty tires market is a highly fragmented industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of Michelin, Titan Tire Corporation, Continental Tires, Balkrishna Industries Limited (BKT), Sumitomo Rubber Industries, Ltd. and some others. These companies are constantly engaged in manufacturing heavy-duty tires and adopting numerous strategies such as business expansions, collaborations, launches, partnerships, acquisitions, joint ventures, and some others to maintain their dominant position in this industry. For instance, in March 2025, Michelin launched Agilis HD. Agilis HD is a heavy-duty tire designed for trucks to deliver world-class durability and enhanced traction. Also, in November 2024, Titan launched AgraVANTAGE. AgraVANTAGE is a new range of Bias R-1 tires designed for tractors.

By Vehicle Type

By End-User

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us