October 2025

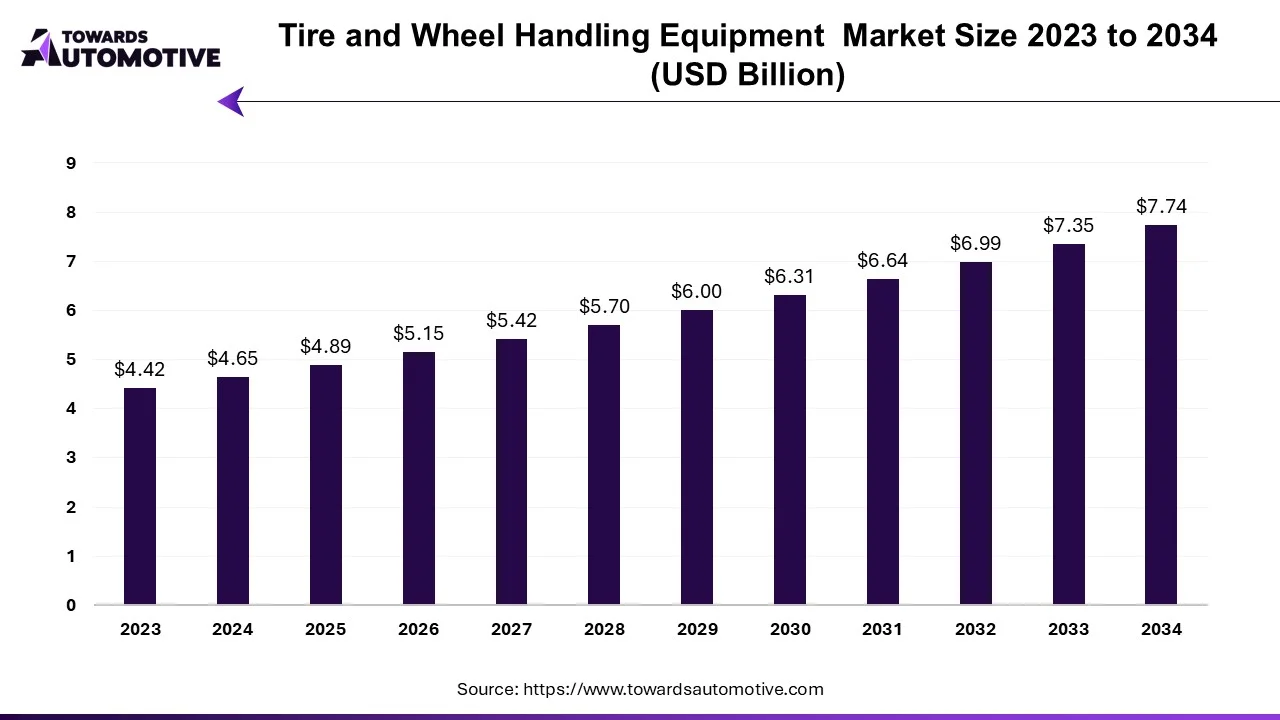

The tire and wheel handling equipment market is forecasted to expand from USD 4.89 billion in 2025 to USD 7.74 billion by 2034, growing at a CAGR of 5.22% from 2025 to 2034.

The automotive industry is witnessing a surge in the production of special vehicles like passenger cars, trucks, buses, electric, and driverless cars to meet growing customer demands. Technological advancements in vehicle design, manufacturing processes, safety features, and the rise of environmentally friendly options such as electric and hybrid vehicles are driving business growth in the automotive sector. These innovations cater to diverse customer preferences, contributing to industry expansion.

Integration of technology, including connected cars and autonomous driving systems, is reshaping the automotive landscape, offering enhanced driving experiences and safety features.

Economic factors such as consumer income levels and overall economic health are significant drivers of automotive industry growth. Strong economic conditions typically lead to increased vehicle purchases, stimulating market demand.

Complex supply chains and a wide array of trucking equipment further fuel industry growth, while government regulations and safety standards incentivize research and development efforts, presenting growth opportunities for companies producing safety-related products.

However, regulatory compliance requirements pose challenges for manufacturers, necessitating investments in technology and processes to ensure adherence. Compliance with emissions regulations, waste management protocols, and energy efficiency standards can increase production costs but also foster innovation and environmental responsibility.

Managing the burden of collecting and reporting environmental compliance data affects productivity, especially for international businesses navigating varied international regulations. Yet, these challenges also present opportunities for innovation and differentiation, allowing companies to emerge as leaders in a sustainable world.

The COVID-19 pandemic significantly impacted the automotive industry, leading to job cuts, production halts, supply chain disruptions, labor shortages, and reduced consumer demand. Auto service centers and tire shops also experienced decreased maintenance and replacement work, further dampening product demand in these sectors.

Automation and robotics have become indispensable in the automotive industry, enhancing the efficiency, accuracy, and safety of tire handling and retreading processes. Automated technologies such as automatic transmissions and wheel balancing and assembly machines have significantly reduced the physical labor required for these tasks. Robotic arms and machines adeptly handle heavy tires and wheels with precision, ensuring optimal tire balancing while safeguarding technicians. This automation model boosts service speed and consistency, bridging the skills gap by enabling less experienced professionals to execute complex tasks more efficiently. Additionally, automation and robotics facilitate remote monitoring and control, streamlining maintenance processes and minimizing downtime.

For Instance,

Advancements in the automotive industry, particularly the emergence of electric and automated driving technologies, underscore the importance of wheel assemblies. Performance, safety, and energy efficiency are critical considerations in the development of specialized vehicles, intensifying the demand for advanced racing wheel technology. Safety concerns drive investments in advanced wheel alignment equipment by transportation service providers, ensuring vehicles are maintained in optimal condition to enhance road safety.

Segmentation by end-users includes repair shops, tire service centers, motorcycle repair shops, and OEM suppliers. Automotive OEMs hold a significant market share, accounting for over 31% in 2022. Their close relationships with automakers grant them access to cutting-edge tools and specific instructions, positioning them as industry leaders. Automotive OEMs serve as early adopters of tire equipment, ensuring they provide top-notch service and professional support to customers. Dealerships, functioning as one-stop shops for vehicle sales, service, and maintenance, enjoy a loyal customer base that relies on their equipment and expertise for repair and maintenance needs.

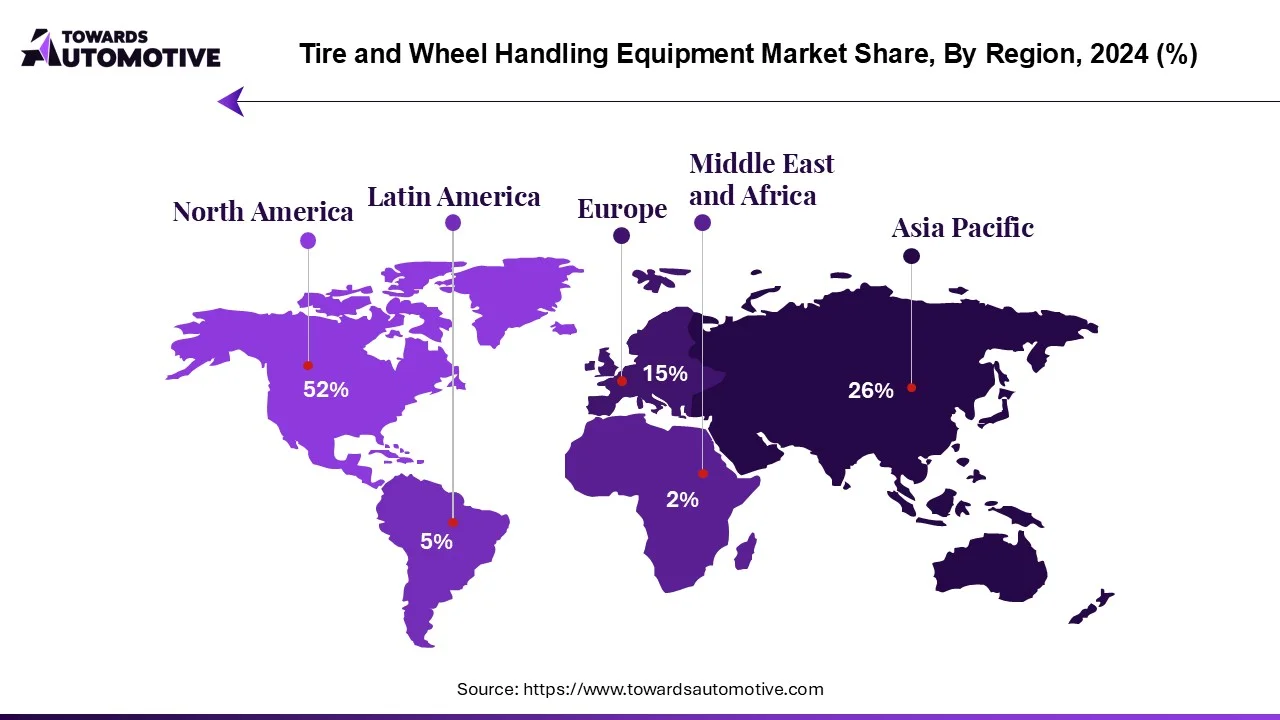

The North American tire and transportation equipment market is experiencing rapid growth and is projected to reach approximately USD 920 million in revenue by 2022. This growth can be attributed to the presence of numerous automakers, auto service centers, and business owners in the region. The high concentration of these entities has led to a significant demand for tire and wheel handling equipment, driven by the need for advanced automotive repair and maintenance services.

The automotive culture in North America is characterized by a strong reliance on personal automobiles and frequent long-distance journeys. As a result, there is a substantial demand for tire services and accessories to ensure the smooth functioning and safety of vehicles on the roads.

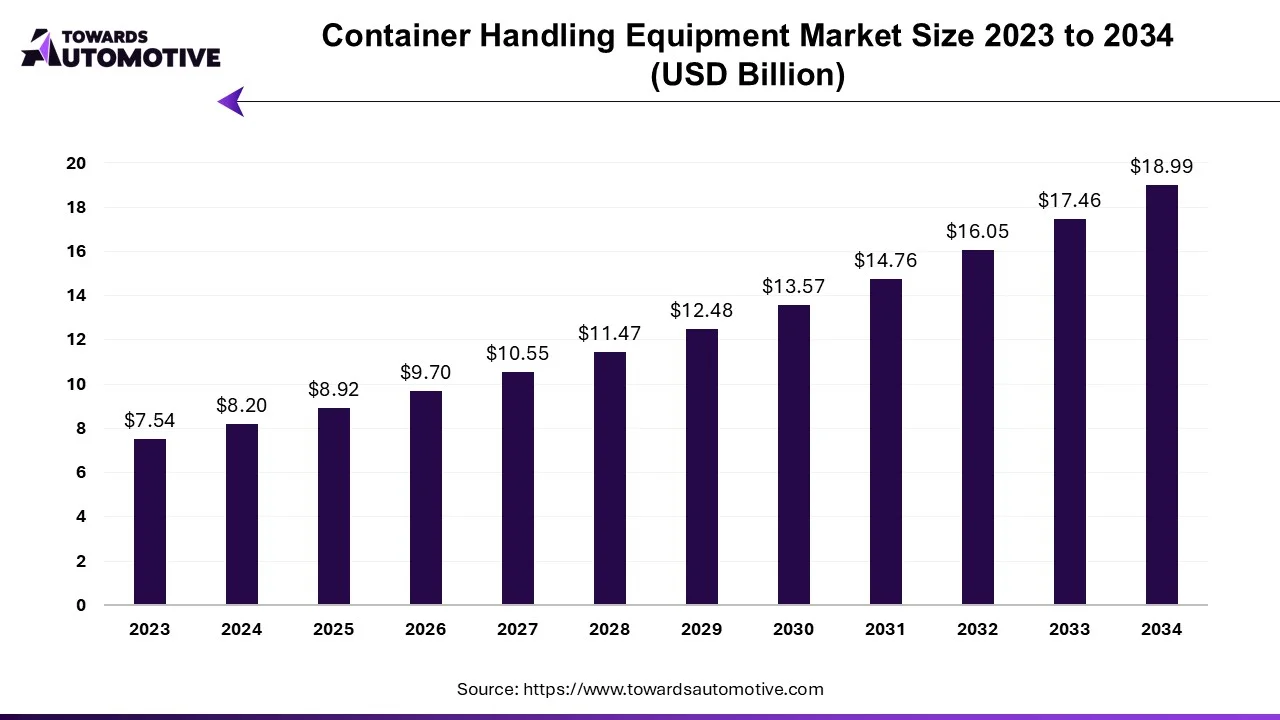

The container handling equipment market is projected to reach USD 18.99 billion by 2034, expanding from USD 8.92 billion in 2025, at an annual growth rate of 8.76% during the forecast period from 2025 to 2034.

The container handling equipment market is a prominent branch of the heavy equipment industry. This industry deals in manufacturing and distribution of container handling equipment in different parts of the world. There are various types of equipment developed in this industry consisting of forklift trucks, stacking cranes, mobile harbor cranes, AGVs, reach stackers and some others. These equipment are powered by different types of propulsion technology including diesel, electric and hybrid. It finds application in numerous sectors such as port terminals, rail yards, warehouses and some others. The end-users of these equipment consist of logistics, manufacturing, construction and some others. The rise in number of loaded containers from different ports has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the maritime sector around the globe.

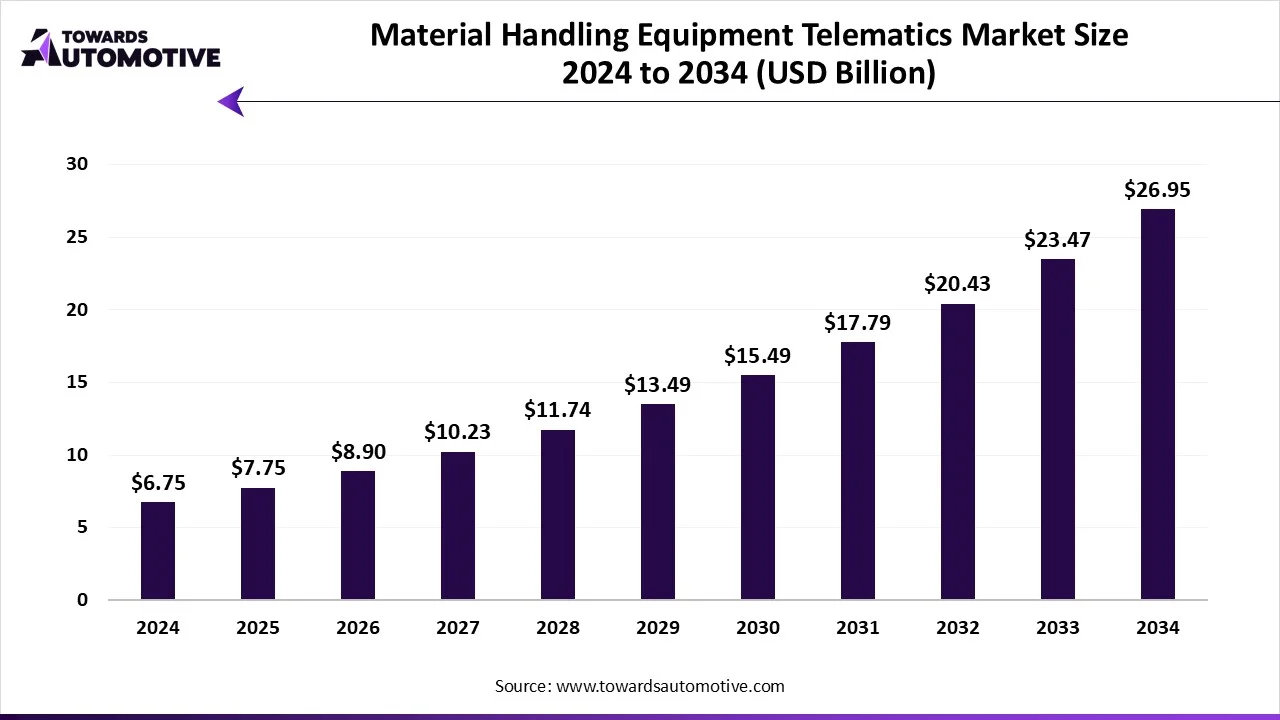

The material handling equipment telematics market is forecast to grow from USD 7.75 billion in 2025 to USD 26.95 billion by 2034, driven by a CAGR of 14.85% from 2025 to 2034. The material handling equipment telematics market continues to grow as industries pursue the benefits of improved efficiency, safety, and cost savings. The growth of e-commerce and logistics has led to increased demand for smarter warehouses, where telematics can help track equipment and manage fleets.

Businesses are increasingly looking at automation and digitalization, which further increases the use of telematics in various industries. Automated guided vehicles also boost the use of telematics. Another key driver that supports telematics growth includes the need for predictive maintenance to reduce downtime. The material handling equipment telematics market is further supported by GPS and IoT technology, along with stricter safety regulations, with financial penalties driving business towards telematics implementation.

The material handling equipment telematics market refers to the integration of telecommunication and informatics technologies into material handling equipment, such as forklifts, cranes, conveyor systems, and automated guided vehicles (AGVs). These solutions enable real-time tracking, monitoring, diagnostics, predictive maintenance, fleet optimization, and safety management. By leveraging technologies like GPS, cellular connectivity, Wi-Fi, and IoT-based analytics, telematics improves operational efficiency, reduces downtime, enhances equipment lifespan, and supports data-driven decision-making in industries such as manufacturing, warehousing, logistics, construction, and automotive. The components in the market comprise hardware, software, and services. Companies provide telematics systems that can help to reduce costs and improve efficiency, reduce damage, or ensure proper use of equipment. Moreover, telematics is increasingly becoming a popular choice as delivery is required faster in e-commerce. There is an increased need for innovation and automation, while telematics will help businesses improve productivity for long-term sustainability.

Bosch Automotive Service Solutions holds the largest market share, primarily attributed to its strong focus on research and development. By prioritizing innovation, Bosch ensures that its equipment remains at the forefront of technological advancements, including automation, digitalization, and environmental solutions. This commitment to innovation gives Bosch a competitive edge, enabling it to offer a comprehensive range of vehicle service solutions to both service centers and original equipment manufacturers (OEMs).

Furthermore, Bosch's extensive global reach and distribution network allow the company to efficiently supply its products to various markets and customers worldwide, further solidifying its position as a leader in the automotive service solutions industry.

By Equipment Type

By Vehicle Type

By End User

By Geography

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us