December 2025

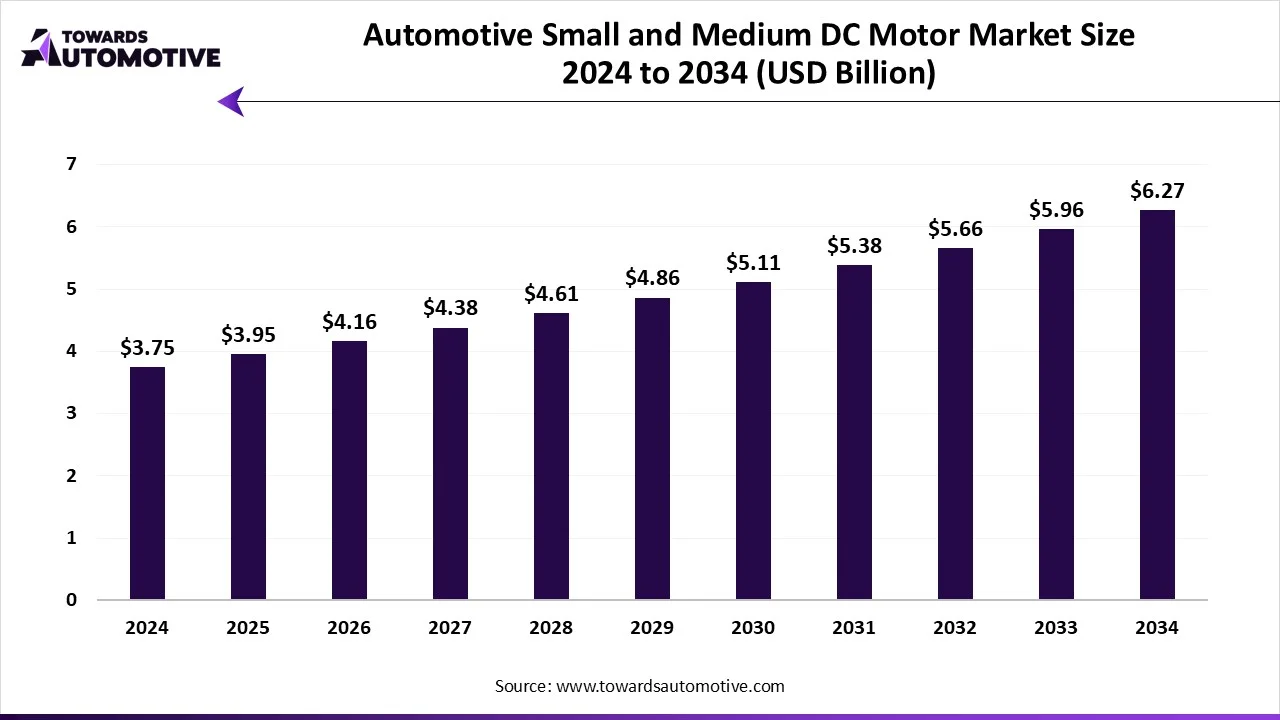

The automotive small and medium DC motor market is projected to reach USD 6.27 billion by 2034, expanding from USD 3.95 billion in 2025, at an annual growth rate of 5.24% during the forecast period from 2025 to 2034. The growing application of small-sized DC motors in luxury cars for performing complex operations coupled with technological advancements in motor industry is contributing to the market growth.

Additionally, the increasing sales of plug-in-hybrid vehicles in developing nations as well as surge in demand for coreless DC motors from the automotive sector has played a prominent role in shaping the industrial landscape. The integration of AI and IoT in DC motors is expected to create numerous growth opportunities for the market players in the future.

The automotive small and medium DC motor market is a prominent branch of the automotive component industry. This industry deals in manufacturing and distribution of medium and small-sized DC motors across the world. There are several types of motors developed in this sector comprising of permanent magnet brushed DC motors, series wound brushed DC motors, inner rotor BLDC motors, outer rotor BLDC motors and some others. These motors comes with different power ratings consisting of below 100W, 100W – 500W, 500W – 1kW, 1kW – 5kW and some others. It finds application in numerous types of vehicles including passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), electric vehicles (EVs) and some others. The growing application of BLDC motors in commercial vehicles has contributed to the overall industrial expansion. This market is expected to rise significantly with the growth of the electric vehicles industry around the globe.

| Metric | Details |

| Market Size in 2025 | USD 3.95 Billion |

| Projected Market Size in 2034 | USD 6.27 Billion |

| CAGR (2025 - 2034) | 5.24% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Motor Type, By Vehicle Type, By Power Rating, By Application, By Distribution Channel and By Region |

| Top Key Players | Denso, Mitsuba, Brose, Mabuchi Motors, Valeo, DY Corporation, LG Innotek, MinebeaMitsumi, ShengHuaBo |

The major trends in this market consists of business expansions, online platforms and EV adoption.

Several market players are opening up new motor production facilities to cater the needs of the automotive sector. For instance, in May 2025, Yasa inaugurated a new EV motor factory in Yarnton, UK. This new production facility is opened to manufacture advanced motors for the EV sector. (Source: electrive)

The rising consumer preference to purchase automotive components from online platforms is an ongoing trend in the industry. For instance, in May 2025, Uno Minda launched UnoMindaKart platform in India. UnoMindaKart is an online platform that enable Indian people to purchase a wide range of automotive components. (Source: Autocar Professional)

The adoption of EVs has increased rapidly in different parts of the world for reducing vehicular emission. According to the International Agency of Energy, around 6.4 million BEVs were sold in China during 2024. (Source: International Energy Agency)

The passenger cars segment held the highest share of the market with 60%. The growing production of passenger cars in several countries such as China, Japan, Germany, the U.S. and some others has increased the demand for DC motors, thereby driving the market growth. Additionally, the rising application of brushed DC motors in luxury cars to control HVAC systems is expected to drive the growth of the automotive small and medium DC motor market.

The electric vehicles segment is expected to expand with the fastest CAGR during the forecast period. The rising adoption of EVs in several countries such as the U.S., India, China and some others has boosted the market growth. Moreover, the increasing use of brushless DC motors in EVs to deliver high torque output is expected to propel the growth of the automotive small and medium DC motor market.

The brushed DC motors segment dominated the market with a share of 54%. The growing use of brushed DC motors in several automotive applications such as fuel pumps, blowers, wipers and some others has boosted the market expansion. Moreover, numerous advantages of brushed DC motors such as simple design, low cost, ease of control and some others is expected to drive the growth of the automotive small and medium DC motor market.

The brushless DC motors segment is expected to grow with the highest CAGR during the forecast period. The growing application of brushless DC motors in electric vehicles and hybrid vehicles for delivering superior torque and enhanced performance has driven the market expansion. Additionally, numerous benefits of these motors including superior reliability, high efficiency, precise control and some others is expected to boost the growth of the automotive small and medium DC motor market.

The OEMs segment led the market with a share of 81%. The growing demand for genuine automotive products due to their high durability and superior quality has boosted the market expansion. Additionally, numerous offers provided by the automotive OEMs to attract consumers for timely maintenance of their vehicles is accelerating the growth of the automotive small and medium DC motor market.

The aftermarket segment is expected to rise with the fastest CAGR during the forecast period. The rising demand for affordable automotive motors from mid-income countries has boosted the industrial expansion. Moreover, the availability of wide range of DC motors in several online platforms coupled with opening of new automotive aftermarket service centers is expected to boost the growth of the automotive small and medium DC motor market.

The 100-500W segment held the dominant position in the market with a share of 38%. The rising application of 100-500W in automotive sector for operating power steering and windshield wipers has contributed to the market expansion. Additionally, the growing use of these motors in smaller EVs such as electric scooters and e-bikes is expected to drive the growth of the automotive small and medium DC motor market.

The 1kW-5kW segment is expected to rise with the fastest CAGR during the forecast period. The growing application of 1kW-5kW motors in seat adjusters, power windows, and other low-power systems has boosted the market growth. Moreover, the increasing use of these motors in automotive HVAC systems and fuel pumps is expected to foster the growth of the automotive small and medium DC motor market.

The body & comfort systems segment dominated this industry with a share of 34%. The growing demand for sunroofs-based SUVs in India and Japan has boosted the market growth. Additionally, the rising application of brushless DC motors in several automotive applications such as power windows, power seats, mirrors and some others is expected to propel the growth of the automotive small and medium DC motor market.

The electric power steering (EPS) segment is expected to expand with the fastest CAGR during the forecast period. The rising use of electric power steering (EPS) in luxury vehicles has increased the demand for 100-500W DC motors, thereby driving the market expansion. Moreover, partnerships among automotive brands and steering manufacturers to develop high-quality power steering is expected to boost the growth of the automotive small and medium DC motor market.

Asia Pacific held the highest share of the automotive small and medium DC motor market with share of 46%. The growing sales and production of commercial vehicles in several countries such as Japan, China, India, South Korea and some others has boosted the market expansion. Additionally, rise in number of EV startups coupled with rapid investment in the automotive component industry by public-sector entities is contributing to the industrial growth. Moreover, the presence of several market players such as Denso, LG Innotek, ShengHuaBo, Kitashiba Electric, Nidec Corporation and some others is expected to drive the growth of the automotive small and medium DC motor market in this region.

China is the major contributor in this region. In China, the market is generally driven the rapid production of EVs coupled with rise in number of automotive motor companies. Additionally, the availability of raw materials at less prices as well as technological advancements in the automotive sector is contributing to the overall industrial expansion.

North America is expected to rise with a significant CAGR during the forecast period. The growing adoption of electric vehicles in the U.S. and Canada to reduce vehicular emission has increased the demand for DC motors, thereby driving the market growth. Additionally, the rising sales of luxury vehicles coupled with technological advancements in the motor manufacturing sector is further adding to the industrial expansion. Moreover, the presence of numerous local market players such as Allied Motion Technologies Inc, ElectroCraft Inc, AMETEK, Inc, Regal Rexnord Corporation and some others is expected to propel the growth of the automotive small and medium DC motor market in this region.

(Source: https://www.electrocraft.com/news/read/major-facility-expansion-to-strengthen-us-manufaturing-and-reduce-lead-times/)

U.S. led the market in this region. The growing sales of luxury SUVs coupled with rapid investment in automotive component industry by private players has contributed to the market growth. Additionally, the presence of several automotive companies such as Tesla, Ford, General Motors and some others is driving the industry in a positive direction.

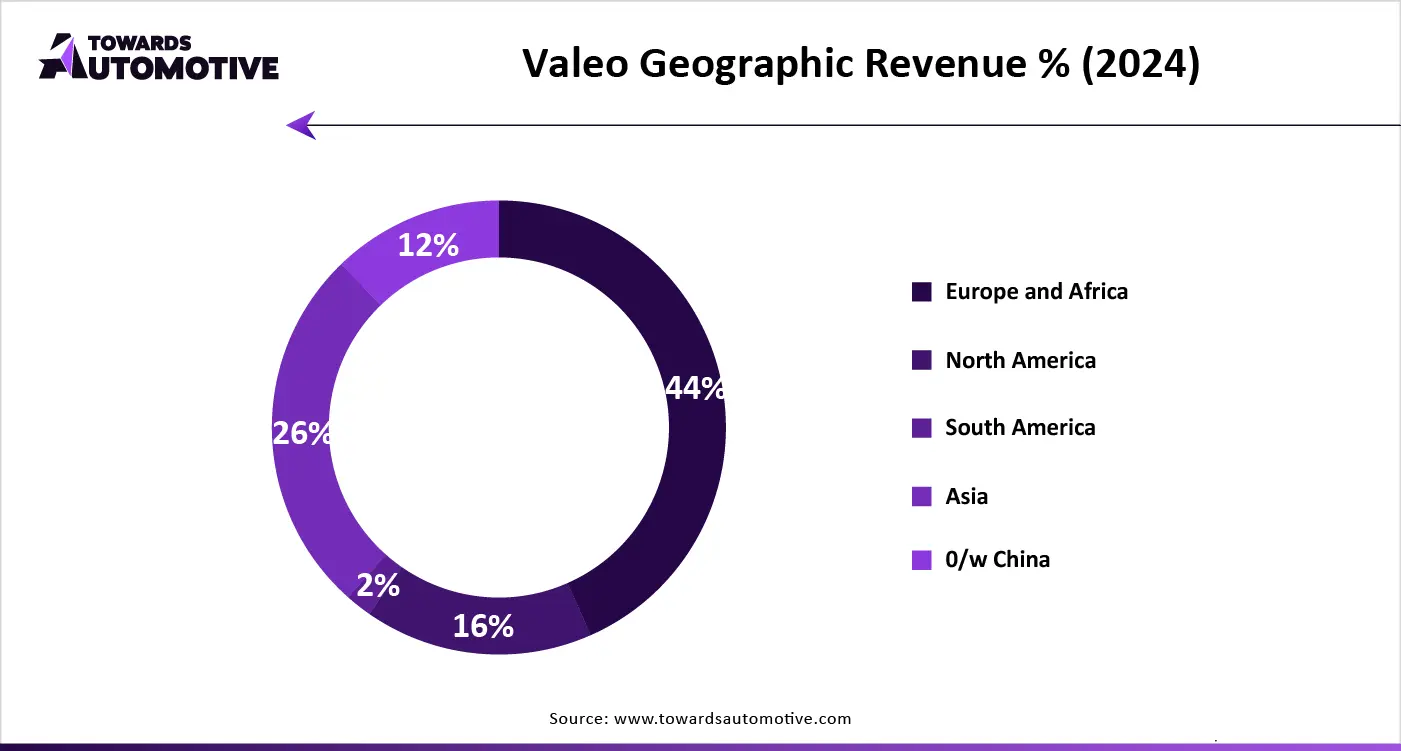

The automotive small and medium DC motor market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Johnson Electric, NIDEC, Bosch, Buhler Motor, Shanghai SIIC Transportation, Denso, Mitsuba, Brose, Mabuchi Motors, Valeo, DY Corporation, LG Innotek, MinebeaMitsumi, ShengHuaBo, Keyang Electric Machinery, Igarashi Motors India, Kitashiba Electric, Ningbo Hengshuai and some others. These companies are constantly engaged in developing small and medium-sized DC motors for the automotive sector and adopting numerous strategies such as business expansions, acquisitions, launches, partnerships, joint ventures, collaborations and some others to maintain their dominance in this industry.

By Motor Type

By Vehicle Type

By Power Rating

By Application

By Distribution Channel

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us