October 2025

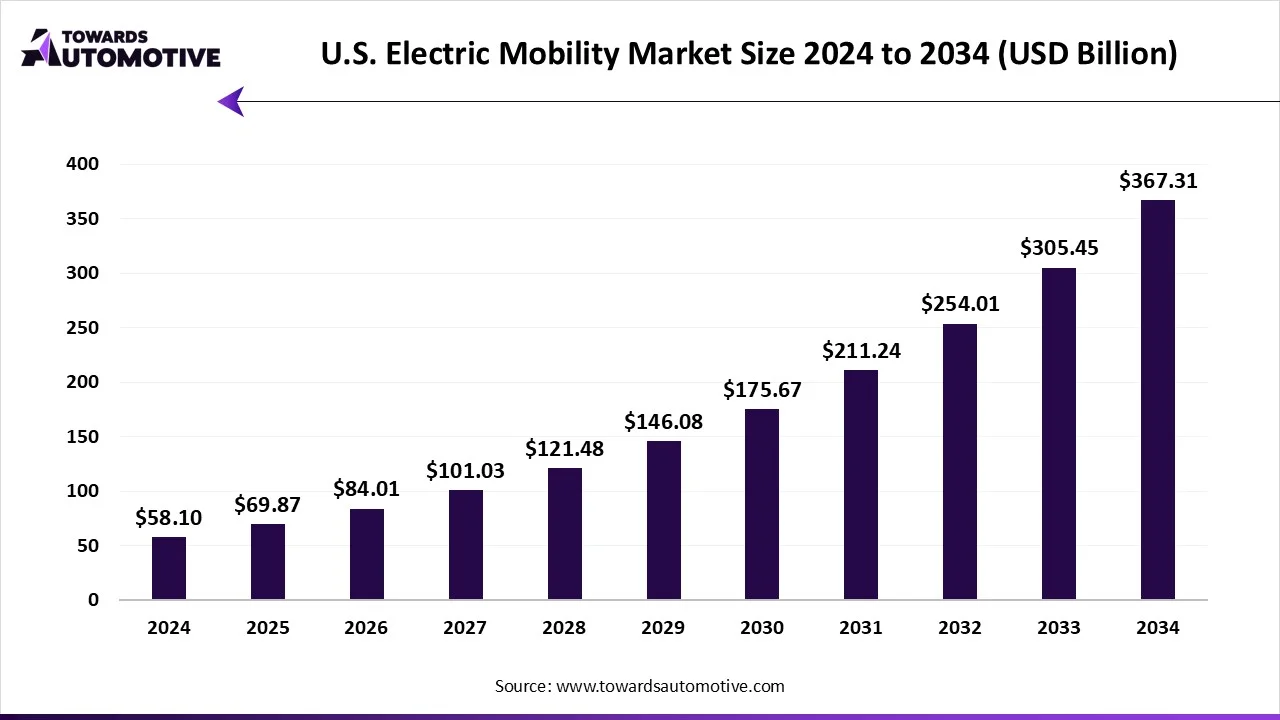

The U.S. electric mobility market is projected to reach USD 367.31 billion by 2034, expanding from USD 69.87 billion in 2025, at an annual growth rate of 20.25% during the forecast period from 2025 to 2034. The U.S. electric mobility market is growing rapidly due to government support in the form of federal tax credits for electric vehicles (EVs) and support for charging stations, as well as rising fuel prices and increased emissions regulations, leading people to select cleaner alternatives.

More automotive companies, such as Tesla, Ford, and GM, are investing in EVs that are also becoming more affordable and accessible. In addition, battery technology is also advancing, resulting in longer distances and shorter charge times. In summary, government policies, advanced technology, and consumer demand are driving the U.S. electric mobility market.

The U.S. Electric Mobility Market refers to the ecosystem of electric-powered vehicles and supporting infrastructure, including electric cars, buses, trucks, two-wheelers, micro-mobility solutions (e-scooters, e-bikes), and charging networks. It encompasses products, services, and technologies that enable the transition from internal combustion engine (ICE) vehicles to sustainable, low-emission transportation. Market growth is fueled by federal and state incentives, tightening emission regulations, rising fuel costs, advancements in battery technology, and increasing consumer awareness about sustainability. Key trends in the market include expansion of fast-charging networks, adoption of fleet electrification (logistics, ride-hailing, public transport), development of vehicle-to-grid (V2G) solutions, and growing investment in domestic battery manufacturing under U.S. government clean energy policies.

Moreover, strong collaboration in the market among automakers, energy providers, and tech companies to construct integrated mobility ecosystems supports the market growth. Digital solutions such as connected EV platforms, smart charging, and subscription ownership are gaining popularity among consumers in the U.S. Further, research within solid state batteries and recycling of used batteries is opening opportunities for reducing and utilizing resources more efficiently. With urban areas expanding along with sustainable logistics, the U.S. electric mobility market is poised for rapid and diverse growth.

The trends in the U.S. electric mobility market are strategic partnership, collaborations and product innovations.

Artificial Intelligence (AI) has made a positive impact on the U.S. electric mobility market by helping to make operations more efficient and reliable. AI has been adopted by manufacturers and charging providers to improve the locations of charging stations and predict the best areas to reduce drivers’ range anxiety. Moreover, fleet operators have benefitted from AI-augmented predictive maintenance, continuing to operate at reduced downtime and repair costs. AI-facilitated dynamic load management was implemented by many providers to optimize reductions in electrical consumption at peak rates, while allowing for the use of better renewable energy sources. In addition, AI has also been part of the mix as the robotaxi and to support connected autonomous electric vehicles. The growing involvement of automakers with autonomy will broaden the number of electric mobility options for all Americans and encourage further innovation across the U.S. electric mobility market.

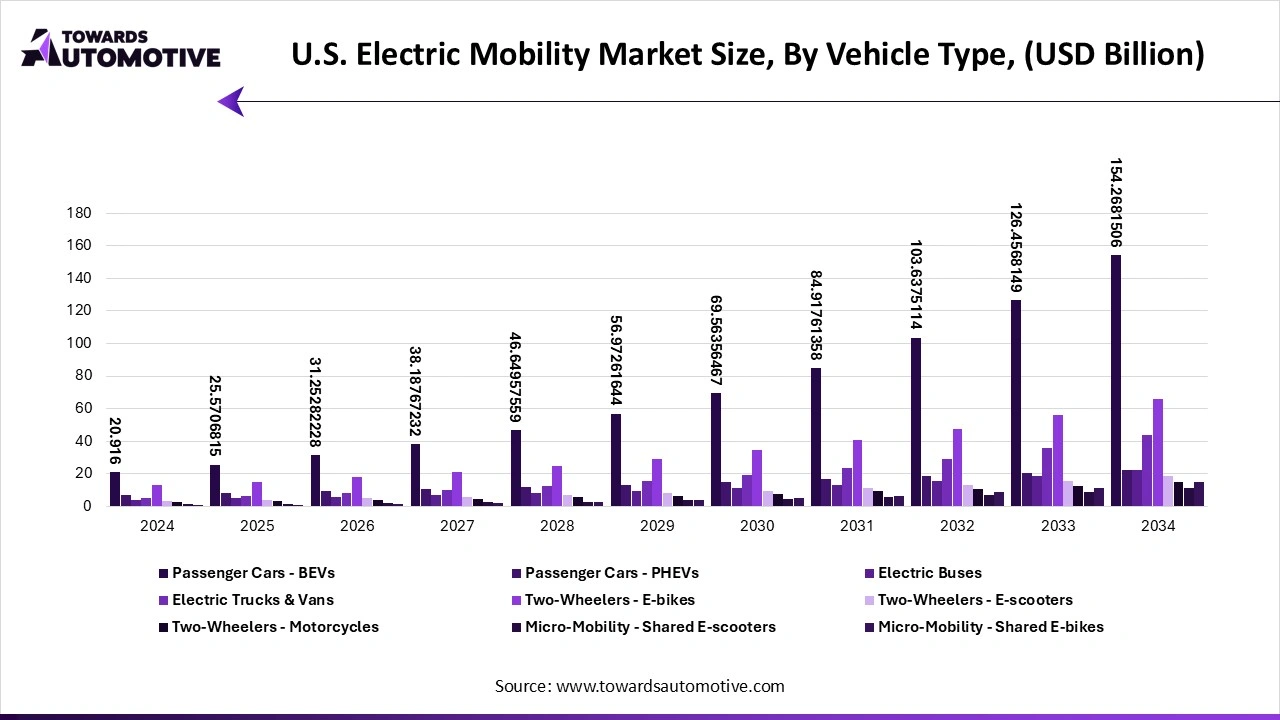

The electric passenger cars segment captured the largest market share of 55% in the U.S. electric mobility market due to a high rate of consumer adoption, widespread availability of model options, and incentives at both the federal and state levels. Automakers such as Ford, General Motors, and Tesla launched multiple EV models that appealed to both premium and mass-market consumers. Charging networks increased accessibility for consumers in cities and via highway travel, increasing the feasibility of driving an electric passenger vehicle every day. Also, with the increased awareness of the environment, coupled with high fuel prices, more households began to pivot to EV use. The dominance of the passenger vehicle segment was created through a combination of government support and the needs of consumers as they integrate this technology into their lifestyle.

The electric trucks & vans segment is expected to be the fastest-growing segment in the U.S. electric mobility market. Electric trucks and vans comprise the fastest-growing segment in the U.S. The expanding market for electric delivery vehicles is primarily driven by fast-growing logistics, delivery service, and e-commerce companies like Amazon, UPS, and FedEx, which are purchasing electric delivery vans to decrease operational costs and reach sustainability targets. Automakers are entering the marketplace as well, including new electric trucks from companies such as Rivian and Ford with higher towing capacity and range, as well as state and federal credits. There is additional support for electrifying commercial fleets through federal grants and other incentives by the government that will support the U.S. electric mobility market. Moreover, the rise in fuel prices and stricter emissions standards will also support commercial electric truck and van demand nationally.

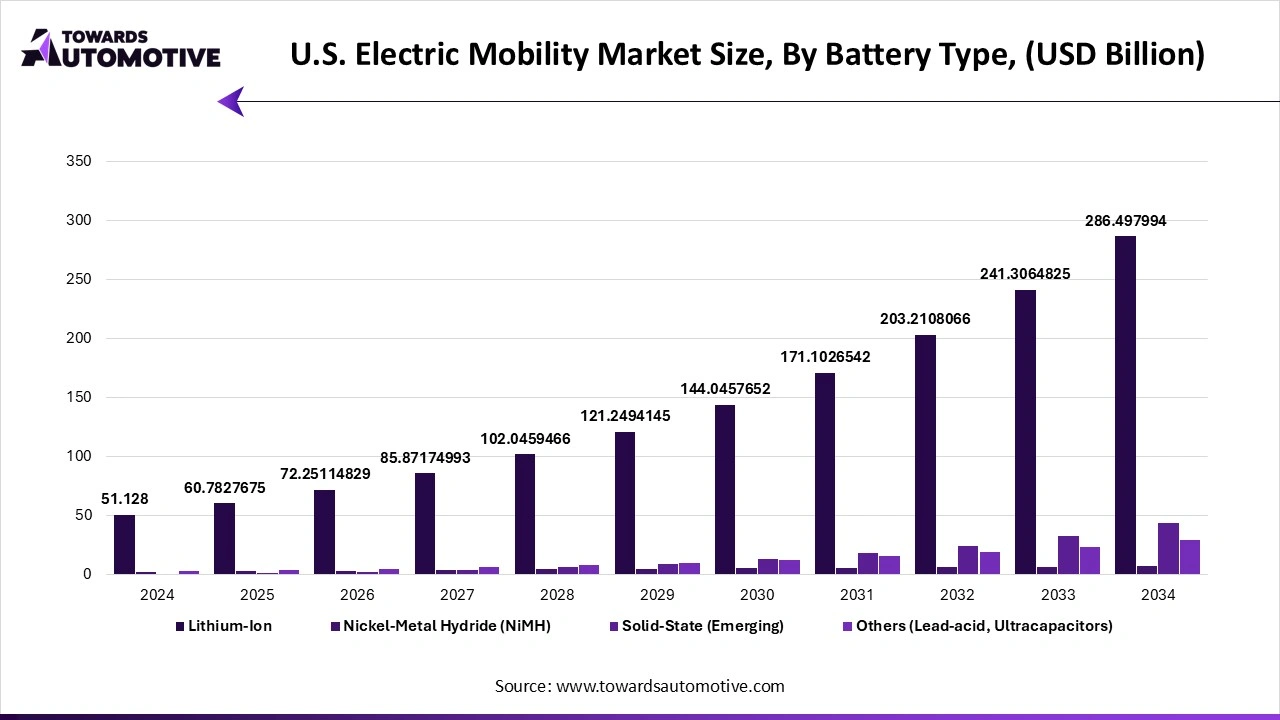

The lithium-ion batteries segment led the market with 80% of the total market share due to increased energy density, cycle life, and faster charge time when compared to older technologies such as lead-acid batteries. More specifically, battery manufacturers provided solutions to original equipment manufacturers (OEMs) who have built and relied on lithium-ion batteries for both passenger and commercial electric vehicles. Trends such as declining production costs and expanding supply chain development in the U.S. were development factors enabling the mass adoption of lithium-ion batteries. Lithium-ion battery status was also aided by measurable safety standards, manufacturing activity, energy density, and the ability to use a common battery for various vehicles.

The solid-state batteries segment is expected to grow at the fastest rate in the forecasted period. Solid-state batteries are the fastest-growing area in the U.S. since they promise energy density, shorter charging times, and safety improvements compared to lithium-ion. Automakers and technology start-ups like QuantumScape are putting considerable research funding into solid-state batteries or pilot test projects. They are considered the future of electric vehicle technology since they allow vehicles to achieve longer driving ranges and reduce safety risks like overheating. While only limited commercial availability currently exists, the push for next-generation battery solutions and large-scale investments from the U.S. government and private players support the solid-state battery segment as the fastest-growing in the U.S. electric mobility market.

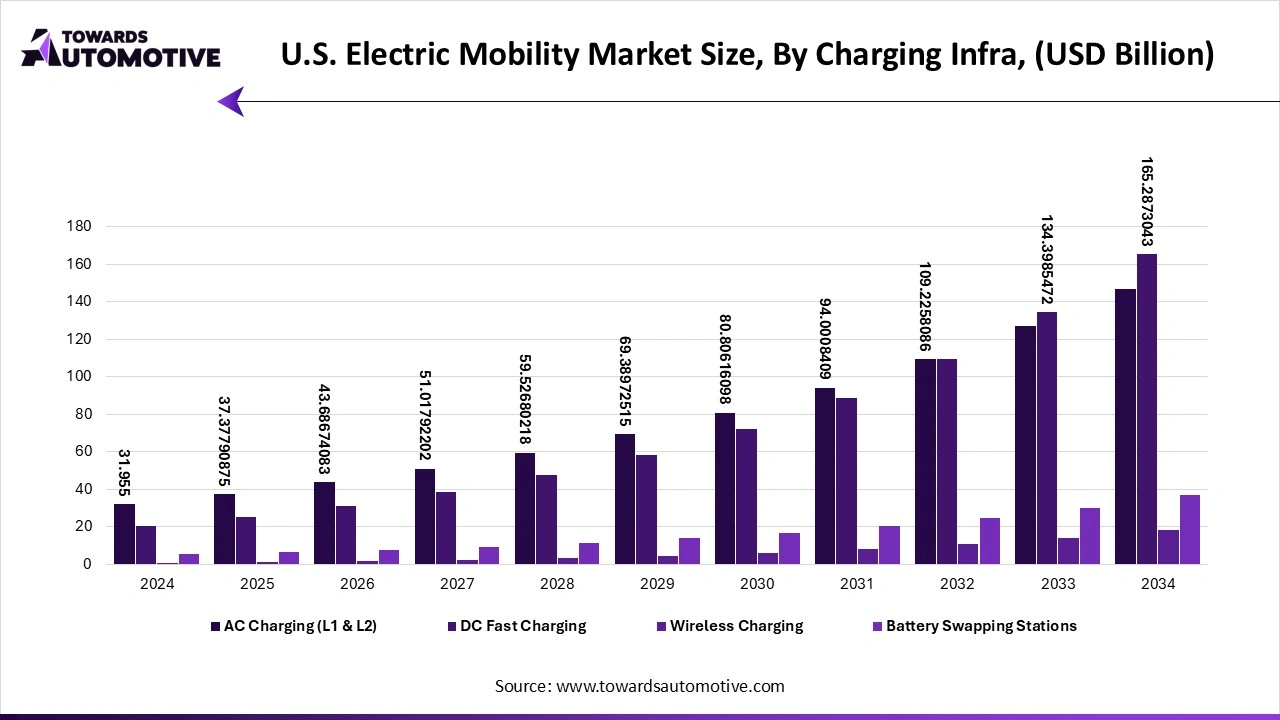

The AC charging segment dominated the market with 60% of the total market share as it was the most accessible and economical contender for charging, both at home and in public locations. Most EV owners installed Level 2 AC chargers at their houses, and the advantage of overnight charging was always available to these owners. Further, public AC charging stations were easily accessible and relatively low-cost compared to DC fast chargers for widespread deployment either in cities or in workplaces. Because passenger EVs made up the majority of the users of EVs operating, as well as their daily driving habits, AC charging worked perfectly well. In summary, higher accessibility and convenience made AC charging the obvious choice for infrastructure nationwide.

The DC fast charging segment is expected to be the fastest-growing segment in the U.S. electric mobility market as it vastly reduces charging time and provides a more practical way to travel long distances with EVs. Some examples include the Tesla Supercharger network as well as the Federal NEVI program, which will fund rapid deployments of fast-charging stations at regular intervals on highways. Moreover, Commercial fleets and ride-sharing businesses are also scaling up rapidly, and they require short turnaround times to provide convenient services. With the growth of high-capacity electric vehicles coming to market that are being used for everyday consumer and business use, consumers will prefer DC fast charging, and thus this makes it the fastest-growing type of infrastructure.

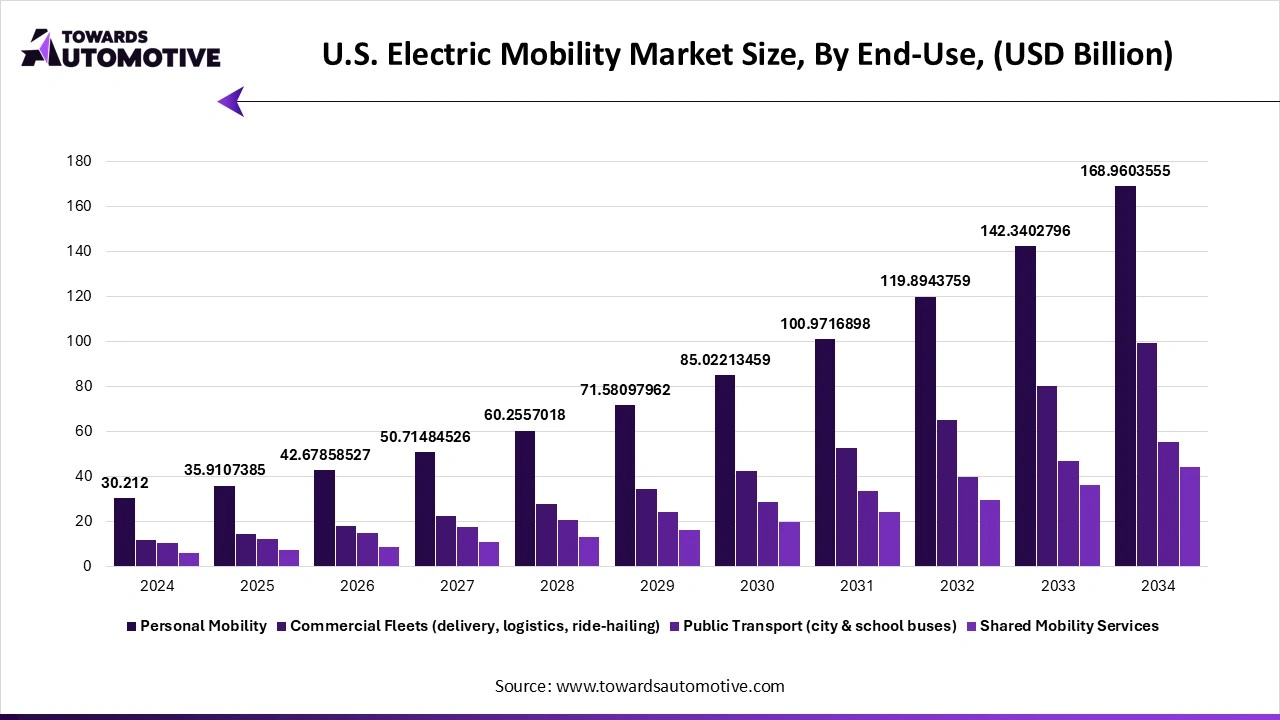

The personal mobility segment captured almost 50% of the total market share. Personal mobility dominated the U.S. electric mobility market as most EVs are bought by individuals or single consumers whose primary use for the vehicle is travelling alone or with family members from one location to another on a daily basis. Government incentives, including the federal tax credit and state rebates, provided many households with the financial motivation to purchase electric vehicles. Availability of passenger EV models for purchase in various price ranges served to supply and, therefore, further develop consumer demand. Moreover, the lifestyle shifts toward eco-friendly choices and the rising costs of gasoline in the U.S. also pushed American consumers toward electric cars as their primary mode of transport.

The commercial fleets segment is expected to grow at the fastest rate in the forecasted period as companies feel the need to reduce carbon emissions, coupled with reducing fuel and maintenance costs. Major companies, such as Amazon, UPS, and FedEx, are investing in thousands of electric delivery vans. Due to government grants and local subsidies, many companies have pursued options to electrify their fleet services as cities are enacting laws to help reduce air pollution emissions in urban areas. Electrification of commercial fleets represents the cheapest long-term operating cost, while even considering stricter emission policies at the individual state level. Thus, the commercial fleets segment is expected to grow rapidly in the U.S. electric mobility market.

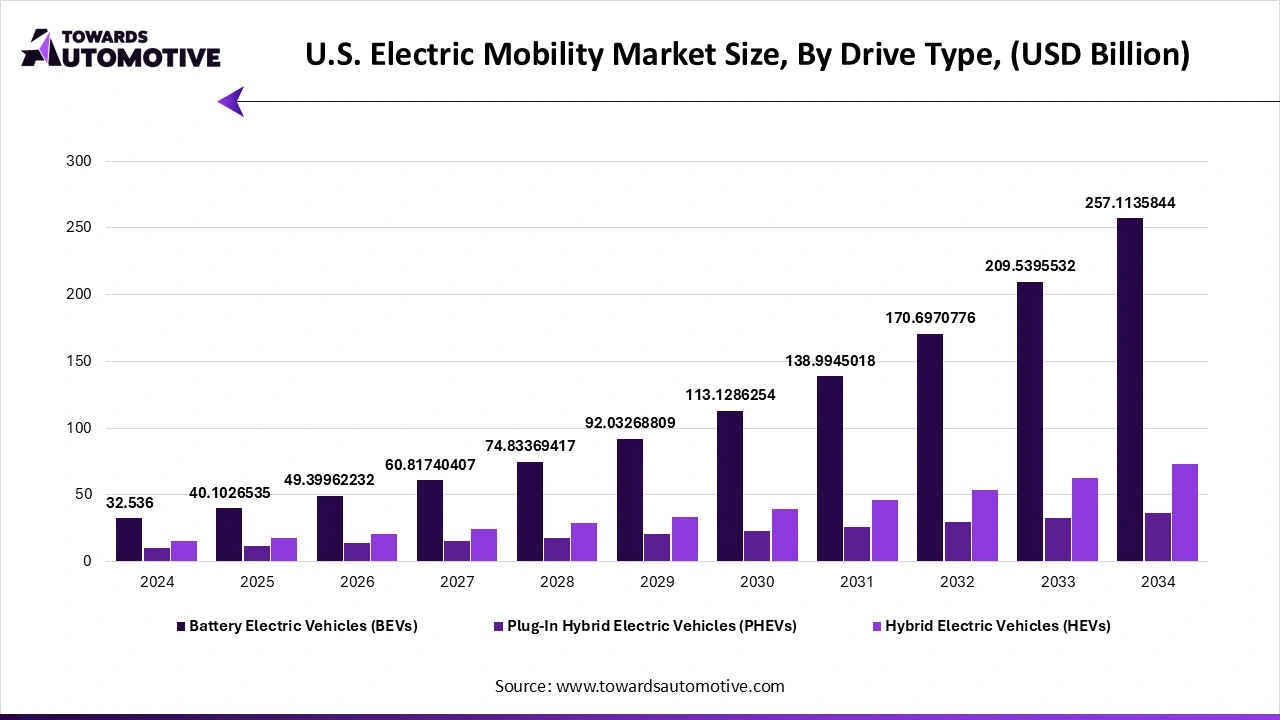

The BEVs segment captured around 65% of the total market share as they offer zero emissions, lower running costs, and have support from both the automakers and the government. Federal tax credits and other state incentives made them more affordable, and BEV production ramped up. Several companies increased consumer interest in the category by offering multiple models and a large charging network. Additionally, improvements to battery technology and driving range certainly satisfied many American buyers. Automakers are primarily focused on BEVs and are busy rolling out new models at many different price points to cater to all customers with different budgets. In summary, this combination of technology, favorable government policy, and increasing consumer interest, BEVs will lead the category.

The PHEVs segment is expected to be the fastest-growing segment in the U.S. electric mobility market due to their ability to provide both gasoline and electric options. PHEVs eliminate range anxiety in consumers who are interested in testing electric mobility but have not yet fully made the leap to rely on the entire range of charging infrastructure. Automakers are also building more PHEV models (often hybrids), especially in SUVs and trucks, which have a more significant appeal to U.S. buyers. Moreover, subsidies also contribute to the adoption of PHEVs. Their flexibility to go long distances with potentially lower emissions makes them the fastest-expanding drive-type segment in the market.

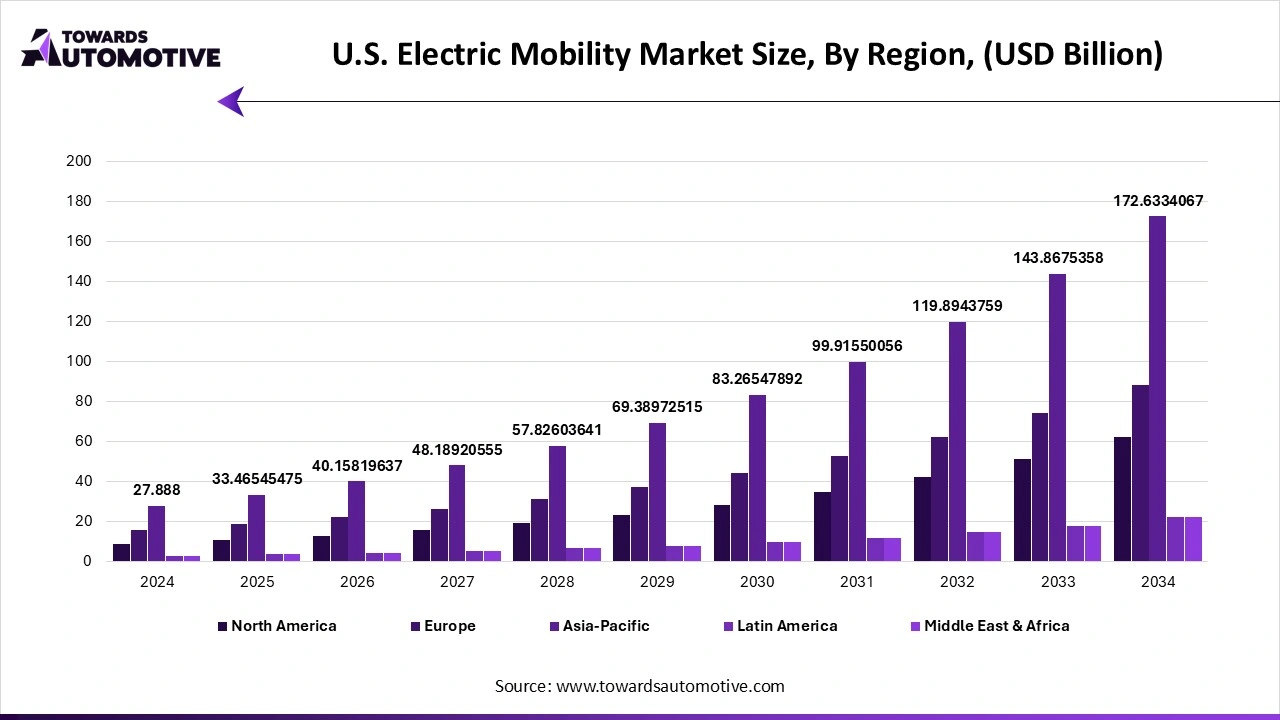

The Western region dominated the U.S. electric mobility market, capturing a total market share of 40%. California led the West and has driven demand in the U.S. electric mobility market from a combination of strong emission regulations and incentives, as well as developed charging infrastructure. The issuance of rebate amounts, carpool lane access, and mandates for zero-emission vehicle production by California led to the exponential adoption of electric vehicles in the state. Moreover, tech-savvy cities and conservation-minded American customers in all areas of the U.S. grew demand for electric vehicles. There is also significant upside in improving fast-charging networks, allowing for the seamless use of clean, renewable energy to power charging stations, as well as allowing for electric vehicles to integrate as a grid power management tool. In summary, ongoing government policies and consumer momentum keep the West driving electric mobility in the U.S.

Washington is expected to grow at a considerable rate in the West, driven by its clean energy policies and strong public commitment to sustainability. The Washington government provides sales tax exemptions for electric vehicles and grants for charging equipment through rebates and zero-emission vehicle standards. Seattle and its surrounding cities have strong support for public charging, including the establishment of corridors for DC fast charging along interstate highways. The growing charging infrastructure in Washington boosts the U.S. electric mobility market growth. Moreover, Washington is abundant in hydropower, helping to build a cleaner grid and reduce emissions from EVs. Furthermore, the establishment of new projects, electrifying private fleets, and local and state funding amounts provide even more assurance that Washington will grow considerably in the U.S. electric mobility market.

The southern area of the U.S. is growing the fastest in the electric mobility market, led by Texas and Florida. Growth in the South is fueled by extensive investments in charging infrastructure, increased demand for EV trucks and vans, and supportive state programs. Texas is emerging as a future hub for EV manufacturing and battery plants, while Florida is quickly growing its charging networks to support tourism and urban transport. Texas and Florida are both large, populated states with strong logistics sectors in the electric vehicles industry. There exist opportunities in the electrification of commercial fleets, expansion of fast-charging stations along major highways, and exploration of charging hubs that are powered by renewable energy sources, all of which contribute to making the South one of the key growth regions in the U.S. electric mobility market.

Georgia is growing at a considerable rate in the U.S. electric mobility market in the South due to support from investment in electric vehicle manufacturing. For instance, the state is home to Hyundai’s $7.6 billion electric vehicle and battery factory, while its developments provide a central location in Rivian’s growth plans, leading to an ecosystem of production in the state of Georgia. In addition, Georgia also has robust logistics networks and proximity to ports, which further boost the EV supply chains and logistics. Cities such as Atlanta are developing municipal plans for public charging stations, and private fleets are readily taking on EVs. Moreover, Georgia continues to develop a robust manufacturing platform, create jobs, and attract corporate investment in the electric vehicle and charging infrastructure, which will help the growth of the U.S. electric vehicle market.

The raw materials required in for building electric vehicles comprise lithium, cobalt, nickel, and graphite, for batteries & motors and copper, and aluminium for wiring and lightweight body parts.

Once raw materials are sourced, they are used in making components for electric vehicles such as battery cells, battery packs, motors, power electronics, and charging systems.

After components are manufactured, automakers in the U.S. combine these parts along with the frame to build electric cars, buses, trucks and more. This process involves fitting components, integrating energy management software, advanced driver-assistance and connectivity features in the vehicles.

| May 2025 | Announcement |

| Paul Ryan, General Manager, Energy Transition at Eaton. | Customers rely on Eaton to solve their toughest power management challenges. This game-changing partnership will help do just that for vehicle charging bringing together trusted power distribution and EV charging solutions to simplify electrification at scale. |

| April 2025 | Announcement |

| Gabe Klein, Executive Director of the Joint Office. | Building on the success of convenient public fast charging along highways, we need to address the real challenges that come with curb space and energy constraints, and a multifamily housing supply that encourages lower rates of car ownership and usage of other modes like shared mobility. This investment aims to expand transportation and energy infrastructure to meet the current and anticipated demands from how people charge and use shared vehicle fleets including e-bikes around transit hubs to a new model for more affordable multifamily housing charging advancing a more holistic energy and transportation ecosystem. |

| April 2025 | Announcement |

| Seung June (SJ) Oh, BTC POWER’s CRO. | BTC POWER is proud to partner with Chargie to address the growing demand for EV charging across government properties and fleets. This collaboration brings together BTC POWER’s industry-leading hardware with Chargie’s FedRAMP® authorized software to deliver reliable, scalable, and future-proofed charging solutions tailored to the unique needs of government agencies. As a software-agnostic provider, BTC POWER welcomes Chargie to our robust roster of trusted partners, ensuring that we offer diverse, best-in-class solutions to meet the evolving requirements of our customers and accelerate EV adoption and infrastructure deployment for a cleaner, more sustainable future. |

| December 2024 | Announcement |

| Nick Howe, head of Segway, e-bike department. | We’re committed to entering the e-bike market in a big way and doing it right. This means doing something new and different with both our products and our sales model. We see an opportunity to redefine the e-bike and micromobility product categories and return to a true dealer-centric sales model in the process. |

The U.S. electric mobility market is highly competitive. Some of the prominent players in the market are Accell Group, Airwheel Technology Holding (USA) Co., Ltd., Derby Bicycle, HARLEY-DAVIDSON, Honda Motor Co., Ltd., Invacare Holdings Corporation, SEGWAY INC., Lightning Motorcycles, Nissan Motor Co., Ltd, BMW AG, Tesla, General Motors, Rivian, Lucid Motors, and Ford. These companies are continuously developing innovative products, scaling production, expanding charging infrastructure, and reducing battery costs to gain dominance in the U.S. electric mobility market. Moreover, numerous companies are also investing in research and development to increase battery efficiency, charging speed, and driving range of vehicles. In addition, partnerships and collaboration with other electric mobility companies, energy providers, and governments help them expand their business immensely. Opportunities for the companies are in the development of solid-state batteries and the integration of renewable energy into charging networks.

By Vehicle Type

By Battery Type

By Charging Infrastructure

By End-Use Application

By Drive Type

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us