September 2025

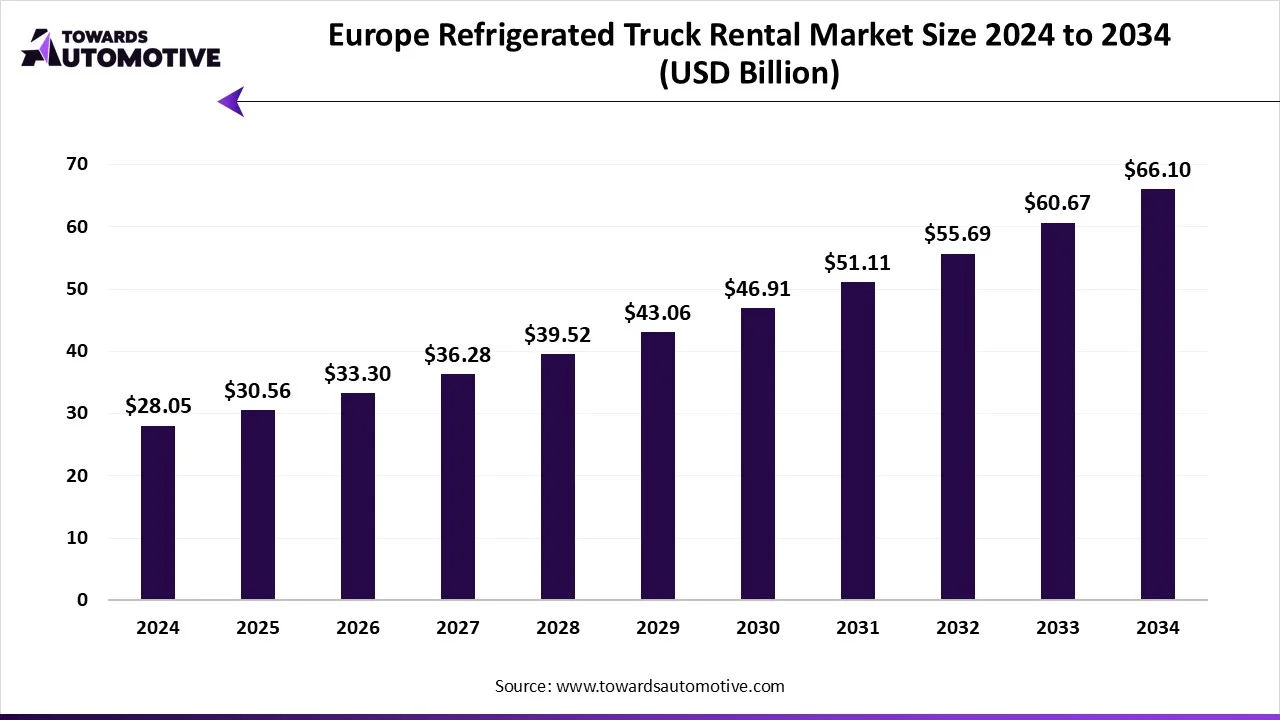

The Europe refrigerated truck rental market is expected to increase from USD 30.56 billion in 2025 to USD 66.10 billion by 2034, growing at a CAGR of 8.95% throughout the forecast period from 2025 to 2034. The growing focus of pharmaceuticals companies on deploying refrigerated trucks for transporting medicinal items along with technological advancements in refrigeration systems is playing a crucial role in shaping the industrial landscape.

Additionally, numerous government initiatives aimed at developing the logistics industry coupled with rising sales of electric trucks in the European region has bolstered the market expansion. The integration of advanced telematics and AI for efficient fleet management is expected to create ample growth opportunities for the market players in the upcoming days.

The Europe refrigerated truck rental market is a crucial branch of the logistics industry. This industry deals in providing refrigerated truck rental services across the European territory. There are several types of rental services delivered by this sector consisting of short-term rental, long-rental, full-service lease and some others. These services are operated using numerous types of vehicles comprising of LCVs, medium trucks, heavy trucks and some others. It finds application in different sectors including food & beverages, pharmaceuticals & healthcare, chemicals & industrial goods and some others. The end-users of this sector comprise of retail & e-commerce, foodservice & catering, logistics & transportation, healthcare & pharmaceuticals and some others. This market is expected to rise significantly with the growth of the automotive sector in the European region.

The major trends in this market consists of partnerships, government initiatives and rapid expansion of the e-commerce sector.

| Scheme | Initiatives |

| EV Leasing Scheme | In July 2025, the government of France announced to invest around 700 million euros. This investment is done for leasing EVs across the France region. |

| Electric Truck Funding Scheme | In July 2025, the government of Denmark made an investment of around 425 million DKK. This investment is done for leasing electric trucks in this nation. |

| Power to the Road | In July 2024, the government of Germany launched an initiative. This initiative aims at deploying 350 fast-charging sites in this country. |

| Climate Premium Plan | In February 2024, the government of Sweden announced to invest around 4400 Euros. This investment is done for purchasing light electric trucks across this nation. |

|

National Recovery and Resilience Plan |

In August 2025, the government of Italy announced to invest around 700 million euros. This investment is done for enhancing the adoption of EVs in Italy. |

The medium trucks (3.5–16 tons) segment dominated the Europe refrigerated truck rental market with a share of around 40%. The growing demand for medium trucks with a wading capacity ranging from 3.5 tons to 16 tons from the pharmaceutical sector has boosted the market expansion. Additionally, the rapid expansion of the logistics sector in several countries such as Germany, France, Italy, and some others is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among automotive brands and engine manufacturers to develop high-performance engines for medium-sized refrigerated trucks is expected to boost the growth of the Europe refrigerated truck rental market.

The light commercial vehicles segment is expected to expand with the highest CAGR during the forecast period. The rising adoption of light commercial vehicles in the food and beverage sector for transporting numerous items such as dairy, meat, seafood and some others has boosted the market expansion. Additionally, the rapid focus of fleet operators for purchasing LCVs to enhance logistics capabilities in the European region is contributing to the industry in a positive manner. Moreover, rapid investment by automotive brands for opening new production facilities to increase the production of light refrigerated trucks is expected to propel the growth of the Europe refrigerated truck rental market.

The long-term rental segment held the largest share of the Europe refrigerated truck rental market with a share of around 55%. The growing adoption of long-term rental truck rental services by large businesses to transport perishable goods from one region to another has driven the market expansion. Additionally, rapid investment by truck operators to deploy electric refrigerated trucks in the logistics sector for long-term basis is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of long-term rental services including stable income, low management effort, reduced cost, tax benefits, predictable cost and some others is expected to foster the growth of the Europe refrigerated truck rental market.

The short-term rental segment is expected to rise with the highest CAGR during the forecast period. The rising adoption of short-term truck rental services by MSMEs to operate their daily tasks at low cost has boosted the market growth. Also, partnerships among truck manufacturers and catering brands for deploying refrigerated trucks on short-term basis is contributing to the industry in a positive manner. Moreover, several benefits of short-term rental services including flexibility, high income, tax benefits, flexible pricing, easy management and some others is expected to drive the growth of the Europe refrigerated truck rental market.

The frozen (-18°C and below) segment dominated the Europe refrigerated truck rental market with a share of around 45%. The growing demand for refrigerated trucks that supports -18’c temperature from the ice cream manufacturers to transport their products in their retail outlets has driven the market expansion. Additionally, the rapid expansion of the food and beverage industry has increased the demand for these trucks, thereby fostering the industrial growth. Moreover, the growing preference of consumers to adopt ready-to-eat products is expected to propel the growth of the Europe refrigerated truck rental market.

The multi-temperature trucks segment is expected to rise with the fastest CAGR during the forecast period. The increasing focus of truck manufacturers such as Volvo, Scania, Tata Motors, SAIC, RAM and some others for developing heavy-duty multi-temperature trucks has boosted the market growth. Additionally, the growing demand for these vehicles from the pharma & healthcare sector to transport wide variety of medicinal items is playing a prominent role in shaping the industrial landscape. Moreover, rapid investment by fleet operators to purchase electric-based multi-temperature trucks for earning maximum profit margins is expected to drive the growth of the Europe refrigerated truck rental market.

The food & beverages segment held the largest share of the Europe refrigerated truck rental market with a share of around 60%. The growing adoption of electric trucks in the food and beverage sector for lowering emission has bolstered the market expansion. Also, the increasing emphasis of people to purchase frozen food items coupled with rise in number of restaurant chains in several countries such as Italy, Denmark, France and some others is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among fleet operators and packaged food companies along with numerous government initiatives aimed at developing the foods and beverage industry is expected to boost the growth of the Europe refrigerated truck rental market.

The pharmaceuticals & healthcare segment is expected to grow with the highest CAGR during the forecast period. The rising development in the pharmaceutical sector in several countries including UK, France, Germany and some others has driven the market expansion. Additionally, rapid investment by healthcare companies for renting refrigerated trucks from fleet operators to enhance their delivery capabilities is playing a vital role in shaping the industrial landscape. Moreover, collaborations among truck rental companies and pharma brands to deploy electric refrigerated trucks for transporting medicines is expected to propel the growth of the Europe refrigerated truck rental market.

The retail & e-commerce segment led the Europe refrigerated truck rental industry with a share of around 35%. The popularity of online shopping has grown rapidly in various countries such as Germany, Italy, France, UK and some others, thereby driving the market expansion. Additionally, rapid focus of e-commerce companies such as Ebay, Amazon, Alibaba, and some others to rent electric refrigerated trucks for transporting perishable goods is playing a crucial role in shaping the industrial landscape. Moreover, the availability of e-commerce applications in Play Store and Apps Store coupled with partnerships among fleet operators and online shopping companies is expected to propel the growth of the Europe refrigerated truck rental market.

The healthcare & pharmaceuticals segment is expected to expand with the fastest CAGR during the forecast period. The growing adoption of refrigerated trucks in the pharma sector for transporting essentials goods such as medicines, injectables, biologics and some others has driven the market expansion. Also, the rapid expansion of the pharma & healthcare sector coupled with presence of numerous pharmaceutical companies such as Sanofi, AstraZeneca, Novo Nordisk, Bayer AG, GSK Plc and some others is playing a vital role in shaping the industrial landscape. Moreover, the increasing focus of pharma companies to launch numerous medicinal items is expected to drive the growth of the Europe refrigerated truck rental market.

Germany led the Europe refrigerated truck rental market with a share of around 25%. The growing adoption of electric rental refrigerated trucks in several industries such as food and beverage, chemicals, industrial goods and some others has driven the market expansion. Additionally, rapid investment by government for developing the EV charging infrastructure coupled with rise in number of fleet operators dealing in refrigerated trucks in Germany is playing a prominent role in shaping the industrial landscape. Moreover, the presence of various market players such as Auto Wichert GmbH, Jännert-Rental Service, Allround Car Rental and some others is expected to propel the growth of the Europe refrigerated truck rental market.

UK is expected to grow with a significant CAGR during the forecast period. The rapid development of the chemical industry in several cities including London, Manchester, Bristol, Liverpool and some others has driven the market growth. Also, numerous government initiatives aimed at developing the logistics sector coupled with increase in number of refrigerated truck rental companies is contributing to the industry in a positive direction. Moreover, the presence of various truck rental operators such as Enterprise Flex-E-Rent, FridgeXpress, Fenton Frost and some others is expected to boost the growth of the Europe refrigerated truck rental market.

France is expected to rise with the highest CAGR during the forecast period. The rapid expansion of the e-commerce sector in numerous cities such as Paris, Lyon, Bordeaux, Strasbourg and some others has boosted the industrial growth. Also, various government initiatives aimed at developing the EV sector coupled with technological advancements in the automotive industry is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of numerous refrigerated truck rental companies such as Petit Forestier, Europcar, Chereau and some others is expected to foster the growth of the Europe refrigerated truck rental market.

Spain held a significant share of the market. The growing adoption of hybrid refrigerated trucks in the logistics sector in various cities such as Barcelona, Seville, Madrid, Valencia and some others has driven the industrial expansion. Additionally, rapid investment by government for developing the food & beverage industry coupled with rise in number of healthcare companies is contributed to the industry in a positive manner. Moreover, the presence of various market players such as Easyfresh Logistics, Grupo Primafrio, Malco Rent a Car and some others is expected to proliferate the growth of the Europe refrigerated truck rental market.

Italy is expected to grow with a considerable CAGR during the forecast period. The increasing adoption of electric-propelled refrigerated trucks in the confectionary sector in several prominent cities such as Florence, Rome, Venice and some others has driven the market growth. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rapid expansion of the automotive industry is contributing to the industry in a positive direction. Moreover, the presence of several market players such as Morini Rent, Vrent, LAZIO TRASPORTI SRL and some others is expected to boost the growth of the Europe refrigerated truck rental market.

| August 2025 | Announcement |

| Ingmar Coppoolse, Manager Fleet, Claims & HESQ, DLG | DLG is thrilled to be a part of this exciting trial with TIP and Sunswap. We believe that pioneering technologies like Sunswap’s are key to unlocking a route to lower emissions throughout European FMCG transportation. Removing diesel powered refrigeration from the road haulage cold chain is a huge opportunity for lower emissions, and we look forward to our trial demonstrating to our peers in the road haulage industry that there are clear routes forward to cleaner technologies that will significantly reduce our emissions as a sector. |

| January 2025 | Announcement |

| Rogier Laan, Vice President Sales and Marketing at TIP Group | The SolarEdge e-Mobility e-reefer is the first of its kind to combine and test all three power sources battery, solar, and energy recuperation into a single solution. This unique set-up allows us to deliver proven, effective solutions directly to fleet operators. By testing and validating these technologies ourselves, we empower our customers to focus on their core business while taking a significant step towards reducing fuel consumption and operational costs, this collaboration brings together industry leaders to create a solution that not only reduces carbon emissions but also delivers exceptional cost savings. |

| August 2024 | Announcement |

| Thomas Delvaux Lefebvre, CEO of Flexter | We are thrilled to launch Flexter.com in the UK market with a network of trusted truck rental suppliers, allowing customers to compare rates, vehicle availability, and services all in real-time and in one place. This expansion underscores our commitment to providing customers with convenient and reliable solutions for their moving truck needs. |

| March 2024 | Announcement |

| Giuliano Baldassarri, Fleet Manager at LC3 | We see ourselves at the forefront of sustainability and want to continue to drive forward the electrification of freight transport in Italy with the all-electric refrigerated box bodies from Schmitz Cargobull. This makes us a trendsetter for the entire transport industry. The S.KOe COOL is part of this long-term sustainability strategy and we are delighted to be one of the first Italian hauliers to add this vehicle to our fleet |

| April 2025 | Announcement |

| Juan Sánchez, the general manager of Disfrimur | At Disfrimur, we continue to work in continuous development, with the aim of offering the most competitive transport services, with the highest quality, at the lowest cost and in the shortest possible time. Because innovation, together with effort and commitment to our environment, can create great projec |

The Europe refrigerated truck rental market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Petit Forestier; The Hertz Corporation; ALLROUND Car Rental; Polar Leasing, Inc.; FedEx, Enterprise Holdings, Inc.; Fraikin; Penske Corporation, Inc.; Ryder System, Inc.; Auto Wichert GmbH; and some others. These companies are constantly engaged in providing refrigerated rental truck services in the European region and adopting numerous strategies such as partnerships, business expansions, acquisitions, collaborations, launches, expansions, joint ventures and some others to maintain their dominance in this industry.

| Companies | Model |

| 1.Petit Forestier | Petit Forestier is a France-based rental company, founded in 1907. This company specializes in the rental of refrigerated vehicles, display units, and containers, operating across Africa, Europe, the Middle East, and the United States. This company aims at deploying different types of refrigerated trucks for transporting perishable items including such as frozen foods, fish, dairy products, ready meals, meat, fruits and vegetables. |

| 2. The Hertz Corporation | The Hertz Corporation has a significant presence in Europe, operating numerous locations and serving a large customer base across this continent. This company is engaged in deploying numerous types of refrigerated vans to cater the needs of the European consumers. Additionally, this company aims at deploying electric refrigerated vehicles for enhancing logistics operations in Europe. |

| 3. ALLROUND Car Rental | ALLROUND Car Rental is a German car rental company, likely based in Berlin, offering a range of vehicles. This company deals in providing refrigerated trucks for handling a broad range of temperature-sensitive goods, such as perishables, pharmaceuticals, and chemicals, across diverse supply chains. |

| 4. Enterprise Holdings, Inc. | Enterprise Holdings, Inc. is a private American holding company that is the parent of Enterprise Rent-A-Car, Alamo Rent A Car, and National Car Rental, and provides various other mobility and transportation services including fleet management, truck rental, carsharing, and used vehicle sales. This company provides refrigerated truck rental service that comes with a maximum payload capacity of around 4000 lbs. |

| 5. Fraikin | Fraikin is a leading European provider of commercial and industrial vehicle rental, management, and related services, offering solutions for long, short, and medium-term needs. This company has deployed Refrigerated HGV that comes provides a carrying capacity ranging from 7.2 tons to 26 tons. |

| 6. Auto Wichert GmbH | Auto Wichert GmbH is a German automotive retailer based in the Hamburg area, Germany that specializes in new and used vehicles. This company has recently moved into rental services. It is constantly providing rental truck rental services to transport several items including fresh, refrigerated and sensitive goods in Europe. |

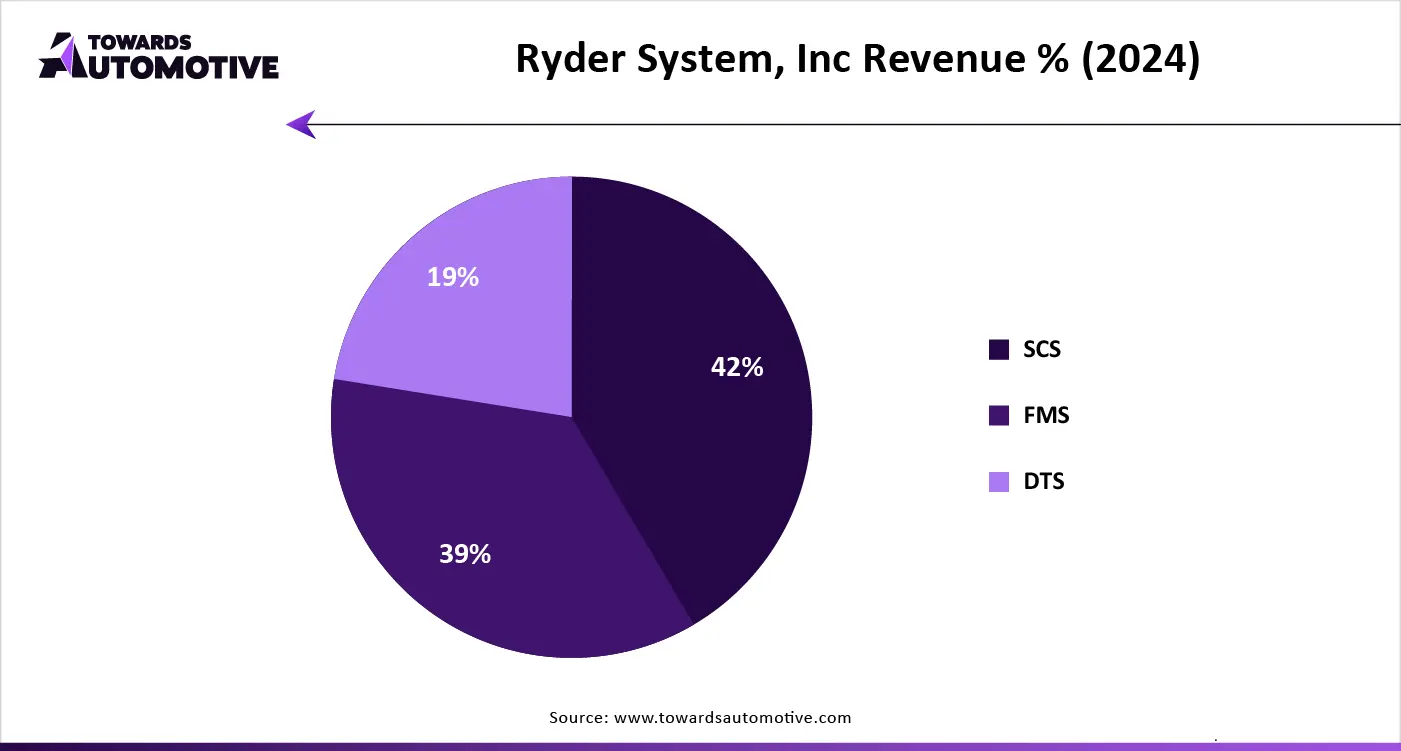

| 7. Ryder System, Inc. | Ryder System, Inc. is an American company of integrated logistics and transportation solutions that specializes in truck rental, leasing, and fleet management, alongside supply chain management, e-commerce fulfillment, and last-mile delivery services. This company has deployed reefer box truck that features a low cab-over design to support tight turning radius to offer improved handling and parking. This vehicle comes with 16 ft. of space and carrying capacity of around 7,000 lbs. This refrigerated box trucks can transport several types of perishable products and are equipped with automatic start-stop features and electric standby that helps in saving fuel along with reducing emissions. |

| 8. Polar Leasing, Inc. | Polar Leasing, Inc. is an American company founded in 1995, specializing in renting commercial walk-in coolers and freezers, mainly for outdoor, temporary use. This company is a major supplier of refrigerated truck in the European region. It is deploying a wide range of refrigerated trucks on rental basis to cater the needs of small and large businesses. |

| 9. FedEX | FedEx Corporation is a global logistics provider of transportation, e-commerce, and business services. It provides numerous types of vehicle rental services to transport various sensitive items including chemicals, medicines, frozen foods and some others across the European region. |

|

10. Penske Corporation, Inc. |

Penske Corporation, Inc. is a diversified American transportation services company founded by Roger Penske, with subsidiaries operating in automotive retail, truck leasing, logistics, and motorsports. This company is operating in European from late 19th century and engaged in providing truck rental services to different end-users. It offers a refrigerated truck that is equipped with several features including power steering, anti-lock brakes, AM/FM, automatic transmission, air conditioning, powered liftgates and some others. |

By Truck Type

By Rental Type

By Automation Level

By Temperature Range

By Application

By End-Use Industry

By Country

September 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us