September 2025

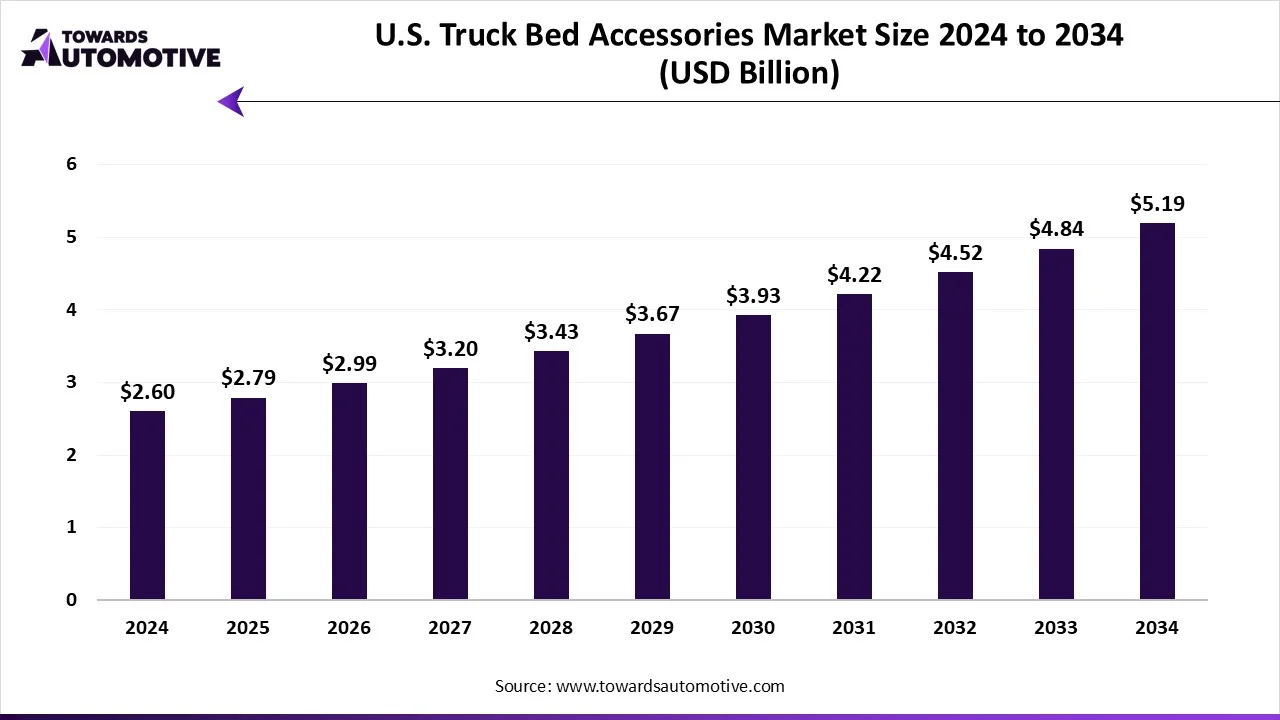

The U.S. truck bed accessories market is forecast to grow from USD 2.79 billion in 2025 to USD 5.19 billion by 2034, driven by a CAGR of 7.15% from 2025 to 2034. The growing emphasis of truck owners to modify their trucks for enhancing their overall looks coupled with rapid investment by market players for manufacturing a wide range of accessories for truck beds has boosted the market expansion.

Additionally, the increasing sales of light-duty trucks in the U.S. region along with availability of truck bed accessories in several online platforms such as Amazon, Ebay, Walmart and some others is playing a crucial role in shaping the industrial landscape. The rising use of eco-friendly materials for manufacturing automotive accessories is expected to create ample growth opportunities for the market players in the upcoming years to come.

The truck bed accessories are a range of additional components that enhances the capability of truck beds. The truck bed accessories industry deals in the manufacturing and distribution of a wide range of accessories for the truck owners of the U.S. There are various types of products developed in this sector comprising of bed liners, tonneau covers, bed extenders, toolboxes, racks & carriers, tie-downs & anchors, cargo management systems, tailgate accessories, lighting & electrical accessories and some others. These accessories are manufactured using several types of materials including plastic & polymer, aluminum, steel, composite materials and some others. It is designed for different types of vehicles consisting of light-duty trucks and heavy-duty trucks. The end-users of these accessories comprise of individual/ personal use, commercial & fleet operators, recreational users and others. This market is expected to rise significantly with the growth of the commercial vehicle industry across the U.S.

| Metric | Details |

| Market Size in 2025 | USD 2.79 Billion |

| Projected Market Size in 2034 | USD 5.19 Billion |

| CAGR (2025 - 2034) | 7.15% |

| Market Segmentation | By Product Type, By Material, By Vehicle Type, By Distribution Channel, By End User and By Region |

| Top Key Players | CURT Manufacturing LLC., DECKED, BAK Industries, TruXedo, Dee Zee, Inc., DU-HA, Inc., TruckVault Inc., Worksport Ltd, Rockland Custom Products, CargoGlide |

The major trends in this market consists of product launches, increasing sales of electric trucks, partnerships, surging demand for bedliners and popularity of solar tonneau cover.

The bed liners segment dominated the U.S. truck bed accessories market with a share of around 30%. The rising application of bed liners in trucks for providing protection to truck beds from several issues such as dents, rust, scratches, weather impacts and some others has boosted the market growth. Additionally, the growing use of polyurethane and polyurea for manufacturing spray-on bed liners coupled with increasing focus of market players for developing eco-friendly bed liners for truck owners is playing a vital role in shaping the industry in a positive direction. Moreover, the increasing adoption of bed mats by light-duty trucks owners along with the availability of wide range of bed liners in several e-commerce platforms such as Ebay, Amazon, Walmart, Autozone and some others is expected to propel the growth of the U.S. truck bed accessories market.

The tonneau covers segment is expected to expand with the highest CAGR during the forecast period. The growing use of tonneau covers in pickup trucks for protecting the truck bed and cargo from weather and theft has driven the market expansion. Also, rapid investment by accessories companies for developing eco-friendly tonneau covers along with the rising popularity of folding and retractable tonneau covers among the U.S. consumers is playing a prominent role in shaping the industrial landscape. Moreover, the increasing sales of light-duty electric trucks coupled with numerous benefits of tonneau covers is expected to foster the growth of the U.S. truck bed accessories market.

The plastic & polymer segment led the U.S. truck bed accessories market with a share of around 40%. The increasing use of hard plastics to manufacturing folding tonneau covers for light-duty electric trucks has boosted the market expansion. Also, the growing application of polymers substrates in the production of tailgate accessories of electric trucks coupled with rapid investment in the polymer industry by public sector entities is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of plastics accessories including enhanced durability, lightweight, cost-effectiveness, insulating properties, reduced waste, recyclability and some others is expected to foster the growth of the U.S. truck bed accessories market.

The composite materials segment is expected to rise with the fastest CAGR during the forecast period. The growing use of composite materials for manufacturing corrosion-resistant truck bed accessories has driven the market expansion. Additionally, rapid investment by automotive companies for using composite materials to manufacture accessories coupled with the increasing demand for composite bedliners from the pickup truck owners is contributing to the industry in a positive manner. Moreover, various advantages of composite accessories such as high strength-to-weight ratio, design flexibility for complex shapes, and superior chemical stability, enhanced durability and some others is expected to propel the growth of the U.S. truck bed accessories market.

The light-duty trucks segment led the U.S. truck bed accessories market with a share of around 70%. The increasing application of light-duty trucks in several industries such as logistics, e-commerce, agriculture, furniture and some others has driven the market expansion. Also, rapid investment by automotive brands for opening up new manufacturing plants to increase the production of light-duty trucks coupled with rising demand for electric light-duty trucks from adventure travelers is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among automotive brands and accessories manufacturers to develop bedliners for light-duty trucks is expected to drive the growth of the U.S. truck bed accessories market.

The heavy-duty trucks segment is expected to rise with the highest CAGR during the forecast period. The growing use of heavy-duty trucks in various industries such as construction, mining, food and beverage and some others has boosted the market growth. Additionally, rising emphasis of truck manufacturers to develop FCEV trucks along with the surging application of ladder racks, bike racks, cargo racks and some others in heavy-duty trucks is playing a significant role in shaping the industry in a positive direction. Moreover, joint ventures among e-commerce brands and automotive companies to deploy heavy-duty electric trucks for delivering goods in different parts of the U.S. is expected to propel the growth of the U.S. truck bed accessories market.

The aftermarket segment led the U.S. truck bed accessories industry with a share of around 65%. The growing demand for low-price trucks accessories among truck owners of the U.S. region has boosted the market expansion. Also, rise in number of automotive aftermarket platforms along with rising consumer preference to purchase accessories from third-party e-commerce platforms is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of aftermarket platforms including diversified revenue streams, increased profit margins, and higher customer retention through improved service and loyalty is expected to boost the growth of the U.S. truck bed accessories market.

The OEM segment is expected to rise with the highest CAGR during the forecast period. The increasing emphasis of pickup truck owners to service their vehicles from OEM service centers has driven the market growth. Additionally, numerous offers and benefits provided by OEMs to gain maximum consumer attraction coupled with rapid investment by OEMs for opening up new outlets is contributing to the industry in a positive manner. Moreover, several benefits of OEM platforms such as cost-effectiveness, quality and reliability, scalability, improved customer experience and some others is expected to proliferate the growth of the U.S. truck bed accessories market.

The individual/personal use segment dominated the U.S. truck bed accessories market with a share of around 60%. The increasing emphasis of truck owners to integrate sustainable accessories in their vehicles to enhance their traveling experience has boosted the market expansion. Also, the growing adoption of light-duty electric trucks by individuals with an aim at reducing vehicular emission coupled with surging disposable income of the people is contributing to the industry in a positive manner. Moreover, collaborations among truck manufacturers and accessories companies to develop a wide range of truck bed accessories to the cater the needs of personal users is expected to foster the growth of the U.S. truck bed accessories market.

The recreational users segment is expected to expand with the fastest CAGR during the forecast period. The rising sales of pickup trucks in several U.S. states such as California, Washington, Oregon and some others for enhancing recreational experience has boosted the market expansion. Additionally, the increasing focus of adventure travelers to integrate high-quality accessories in their vehicles for improving their travelling experience is playing a crucial role in shaping the industrial landscape. Moreover, rapid investment by market players for designing high-quality truck accessories to cater the needs of recreational users is expected to propel the growth of the U.S. truck bed accessories market.

Northeast region led the U.S. truck bed accessories market. The increasing sales of electric trucks in various states such as New York, Massachusetts, New Jersey and some others has bolstered the market expansion. Additionally, rise in number of truck fleet owners coupled with rapid focus of government for developing the tourism sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as CURT Manufacturing LLC., DECKED, Reliable Engineered Products, LLC. and some others is expected to boost the growth of the U.S. truck bed accessories market in this region.

West region is expected to grow with the highest CAGR during the forecast period. The growing sales of hybrid trucks in several prominent states such as California, Washington, Oregon and other has driven the market growth. Also, rapid investment by market players for opening up new production facilities coupled with increasing preference of consumers to purchase pickup trucks to enhance recreation experience is adding to the industrial expansion. Moreover, the presence of numerous local accessories manufacturers such as Rockland Custom Products., TruckVault Inc., EZ STAK INC and some others is expected to accelerate the growth of the U.S. truck bed accessories market in this region.

Midwest held a significant share of the market. The growing demand for heavy duty trucks in numerous states such as Illinois, Michigan, Ohio and some others has driven the market expansion. Also, the growing emphasis of people to adopt eco-friendly accessories coupled with technological advancements in the automotive industry is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Dee Zee, Inc., DU-HA, Inc., Worksport Ltd. and some others is expected to proliferate the growth of the U.S. truck bed accessories market in this region.

South region is expected to rise with a considerable CAGR during the forecast period. The rising sales of light-duty electric trucks in various states such as Texas, Florida, Georgia and some others has boosted the industrial expansion. In addition, increasing emphasis of accessories manufacturers to enhance R &D activities coupled with rapid adoption of heavy-duty trucks in several industries such as construction, logistics, mining, e-commerce and some others is playing a prominent role in shaping the industrial landscape. Moreover, the presence of several accessories manufacturers such as Westin Automotive, GOOSE GEAR, INC, Highway Products and some others is expected to foster the growth of the U.S. truck bed accessories market in this region.

The foundation of truck bed accessories production lies in the extraction and supply of essential materials such as Plastic & Polymer, Aluminium, Steel, Composite Materials and some others.

Fabrication of truck bed accessories is the process of cutting, shaping, bending, and joining raw materials to manufacture specialized truck add-ons and parts, such as custom toolboxes, or structural modifications, tailored to specific needs of truck owners.

Testing and quality control for truck bed accessories involves environmental exposure testing, visual inspections, mechanical tests, specialized lab tests and some others.

Truck bed accessories are distributed to dealers and original equipment manufacturers (OEMs) through a supply chain consisting of auto parts suppliers, manufacturers, and distributors.

Retail sales of truck bed accessories involve a multi-step process from inventory acquisition to customer sales by leveraging dealer-specific financing options and sales strategies for gaining maximum consumer attraction. It is incorporated by supplier relations, inventory management, financing options along with using advanced technologies for streamlining operations and improving the customer experience.

| March 2025 | Announcement |

| John Poindexter, CEO and Chairman of JBPCO | This company was founded on principles of long-term growth, innovation, and operational excellence, and those principles continue to guide us 40 years later, our proven past helps ensure we remain future driven – and that we always understand our success has largely been built on the trust we’ve earned from our customers, the dedication of our team members, and the strength of our partnerships. |

| March 2025 | Announcement |

| Tony Savasta, VP of Marketing at Westin Automotive | At Westin, we know truck owners want products that not only look good but are also durable, easy to use, and stylish, our new Tonneau Covers deliver on all fronts. They're strong, sleek, and will keep the goods in your bed secure, dry and out-of-sight. |

| October 2024 | Announcement |

| Andrew Camp, director of product management, accessories, Makita U.S.A., Inc | Users across the country told us about their many challenges with the vertical-first design-based modular storage systems that are ubiquitous in the market today, and we listened, driven by this clear user feedback, we designed and engineered a horizontal-first design-based modular storage system that addresses their challenges and brings to market a product range that we believe is a transformative solution that creates tremendous user value. Researched, designed, engineered, and manufactured in the U.S.A., MAKTRAK is the next generation in modular storage. |

| January 2024 | Announcement |

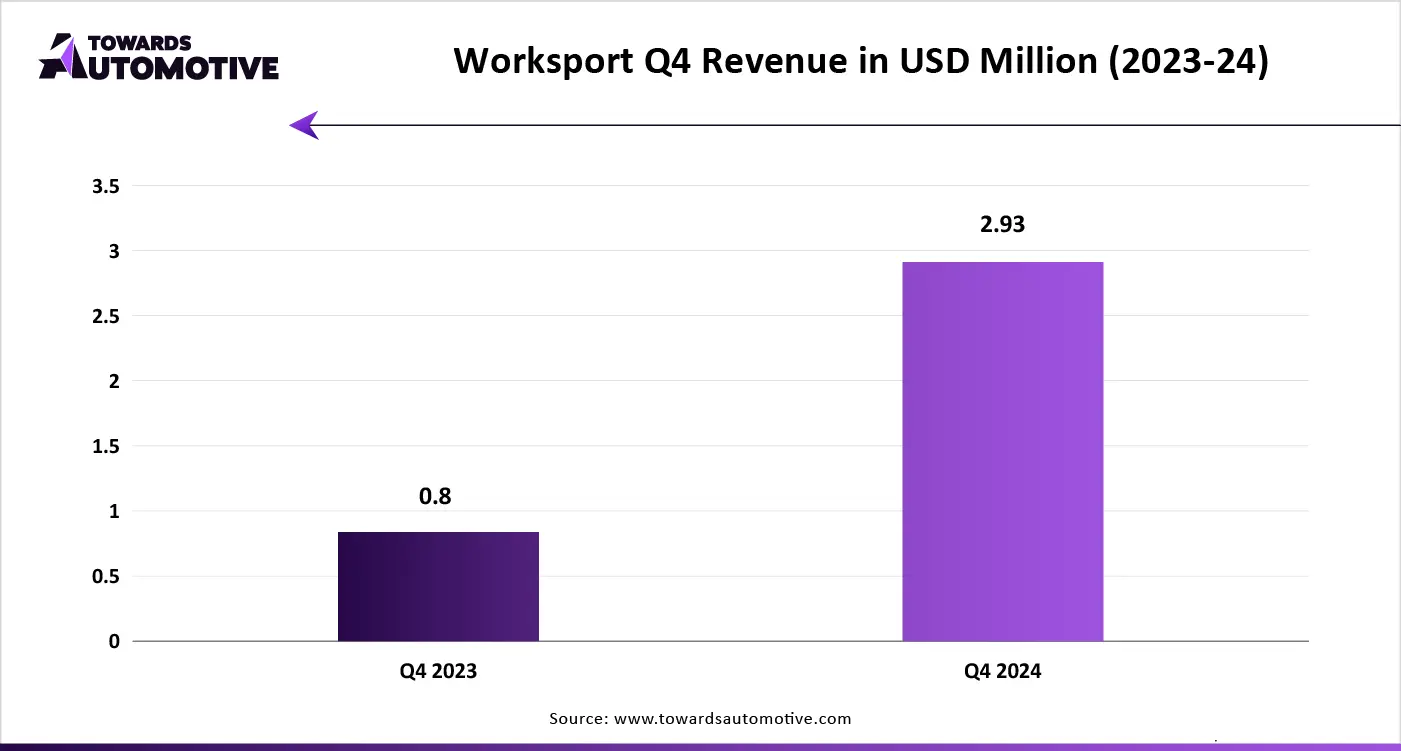

| Steven Rossi, CEO of Worksport | We are immensely proud to unveil the features of the AL3 PRO hard-folding tonneau cover. This American-made product reflects our commitment to quality, innovation, and the spirit of the American workforce. It’s not just a truck accessory. It’s a testament to our dedication to providing our customers with the best. We began by testing the product with Ford, General Motors models, and RAM by Stellantis models. Specifically, Chevrolet Silverado 1500, GMC Sierra 1500, Ford F150, and RAM Truck 1500. However, we quickly decided to expand our scope to also include compatibility with Jeep, Nissan, and Toyota models, along with the Honda Ridgeline soon. |

| January 2025 | Announcement |

| Steve Silverstein, Owner of Canyon State RV & Campershells | Our new website reflects our commitment to service and convenience with a clean design, intuitive navigation, and mobile-friendly features, making it easy for customers to connect with us anytime. |

| August 2025 | Announcement |

| Drew Schwartzhoff, Chief Commercial Officer at Wabash | Excel Trailer has been a trusted partner to Wabash for decades, and we’re excited to strengthen that relationship as we expand our network together into North and South Carolina. Our expert Wabash dealers are the backbone of our sales and aftermarket services, delivering the reliable support customers depend on to reduce downtime and keep operations running smoothly |

| October 2023 | Announcement |

| Greg Randolph, the VP of Marketing at DECKED | After ten years of listening to the feedback from our most rigorous testers and critics, and constantly improving the products we were selling, it was time to scrap the old playbook and start over from scratch. That meant redesigning the product the way we knew it needed to be built, this is a total redesign with new molds and tools as well as our very own in-house manufacturing. This is a huge leap forward for the customer and for DECKED. |

| March 2025 | Announcement |

| Brendan Church, chief marketing officer at Legend | while factory bed liners offer surface-level protection against scratches and abrasions, they leave truck beds vulnerable to dents and punctures when hauling heavy cargo. Additionally, factory tie-down points can be limited and inconveniently placed, restricting secure cargo storage |

The U.S. truck bed accessories market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of EZ STAK INC., GOOSE GEAR, INC, CURT Manufacturing LLC., DECKED, Reliable Engineered Products, LLC., Rockland Custom Products., TruckVault Inc., Worksport Ltd, Dee Zee, Inc., DU-HA, Inc., Highway Products and some others. These companies are constantly engaged in developing truck bed accessories in the U.S. and adopting numerous strategies such as joint ventures, collaborations, business expansions, product launches, acquisitions, partnerships, and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Product Type

By Material

By Vehicle Type

By Distribution Channel

By End User

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us